USA Restaurant Management Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD10954

November 2024

92

About the Report

USA Restaurant Management Market Overview

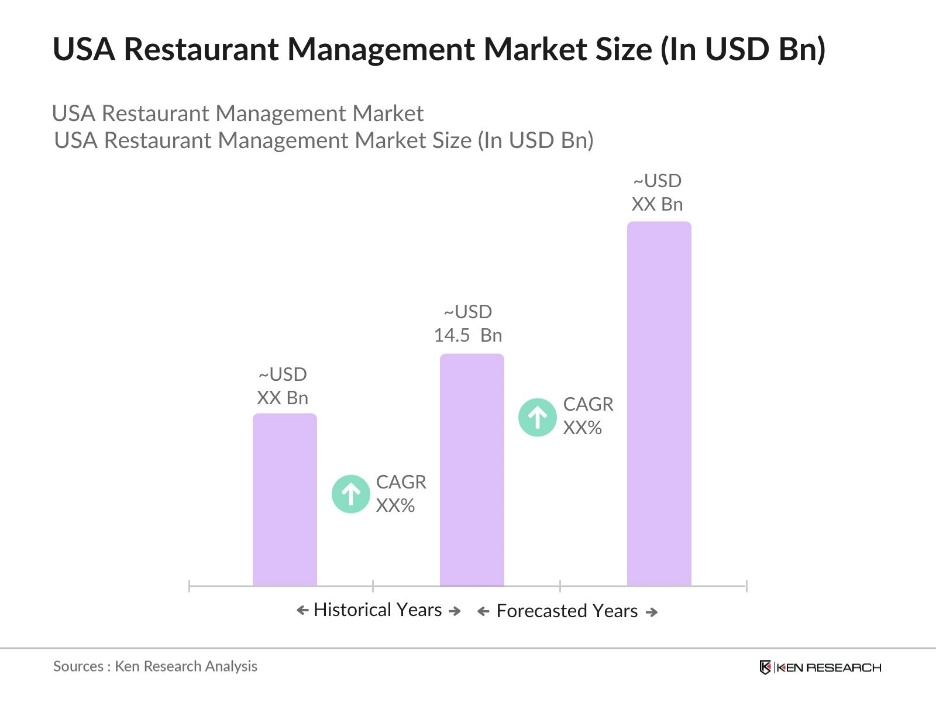

- The USA Restaurant Management Market is valued at USD 14.5 billion, reflecting steady growth propelled by rising consumer demand for dine-in, takeout, and delivery options across urban and suburban areas. The increased adoption of digital solutions for inventory management, employee scheduling, and customer engagement has further catalyzed this growth.

- Major cities such as New York, Los Angeles, and Chicago dominate the USA Restaurant Management market due to high population density, diverse consumer preferences, and a robust dining culture. These urban centers attract significant investments in both traditional and virtual restaurant spaces, leveraging advanced technologies to meet varied customer demands.

- Federal wage regulations, including the Fair Labor Standards Act, significantly impact the restaurant industry. Starting April 1, 2024, all fast food restaurant employees in California must be paid at least $20 per hour, which is significantly higher than the general state minimum wage of $16 per hour that will also be effective from January 1, 2024.

USA Restaurant Management Market Segmentation

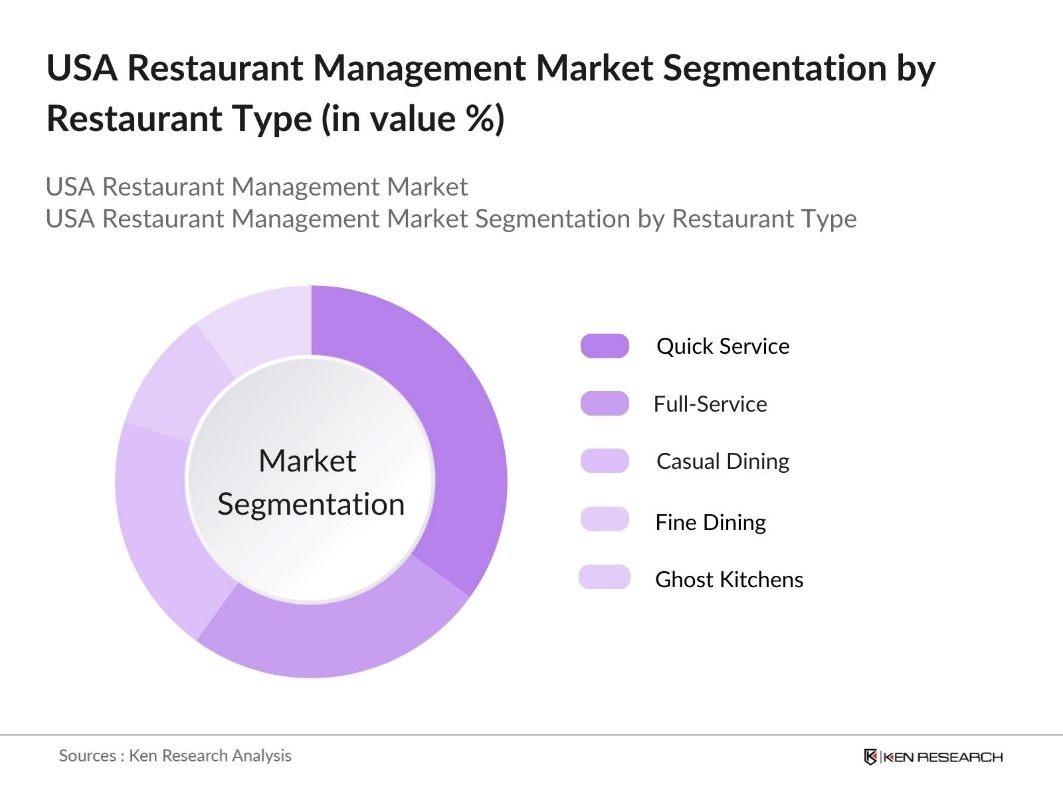

By Restaurant Type: The market is segmented by restaurant type into quick service restaurants (QSR), full-service restaurants, casual dining, fine dining, and ghost kitchens. Among these, quick service restaurants hold a dominant market share due to their fast-paced service and broad customer appeal, especially in urban areas where convenience is a significant factor. Chains like McDonald's and Subway have perfected the QSR model by implementing robust POS systems and streamlined kitchen workflows, which have become industry standards for efficient restaurant management.

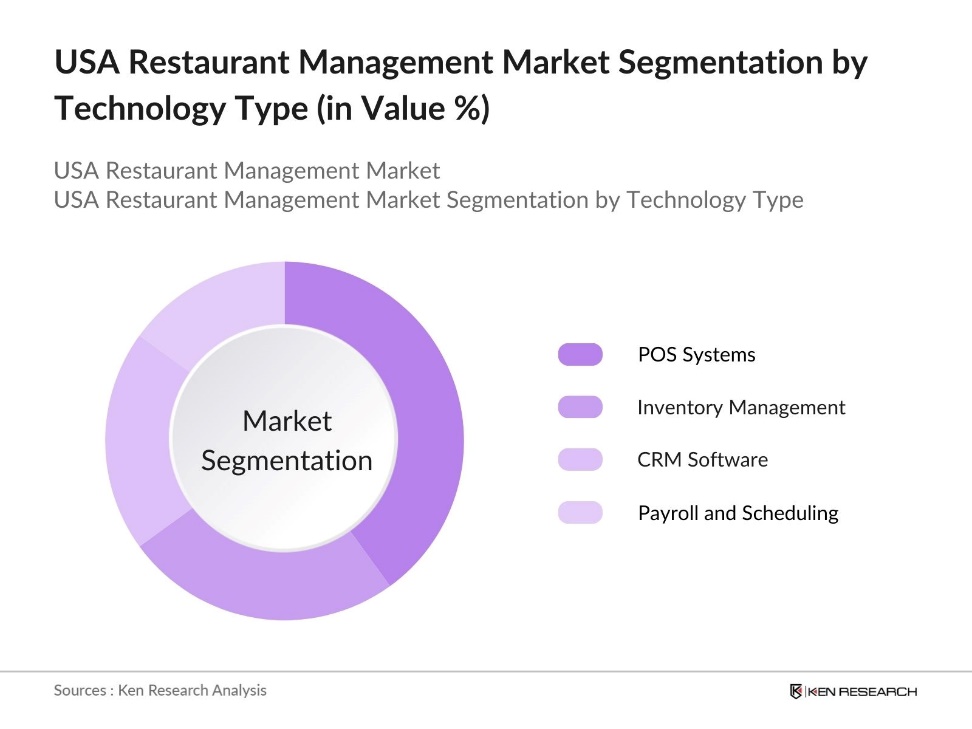

By Technology Type: The market is segmented by technology type, including POS systems, inventory management software, customer relationship management (CRM) software, and payroll and scheduling software. POS systems dominate this segment due to their crucial role in facilitating payment transactions, order management, and sales tracking. POS solutions like Square and Toast are widely adopted in the industry, offering real-time data analytics and inventory integration, which helps in effective resource management and enhances operational efficiency.

USA Restaurant Management Market Competitive Landscape

The USA Restaurant Management market is concentrated, with key players holding significant influence through strategic investments and product innovations. Companies in this market maintain a competitive edge by integrating digital solutions and focusing on customer-centric technology enhancements.

USA Restaurant Management Industry Analysis

Growth Drivers

- Rising Demand for Delivery Services: The U.S. restaurant management sector has seen rapid growth in demand for delivery services due to increased digital adoption and changing consumer preferences. For instance, 60% of U.S. consumers have ordered food delivery at least once a week. With cities like New York, Los Angeles, and Chicago leading in delivery volume, food delivery has become essential to restaurant operations. Digital platforms such as DoorDash and UberEats are common facilitators, which has reshaped restaurant management strategies.

- Increasing Technological Integration (POS, Inventory Management, Digital Payment Systems): The integration of Point of Sale (POS) systems, inventory tracking, and digital payments has revolutionized U.S. restaurants, improving efficiency and order accuracy. For instance, a report from the National Restaurant Association mentions that over 70% of U.S. restaurants have upgraded to cloud-based POS systems. Digital payment adoption is also high, as of orders paid via contactless or mobile payment, streamlining operations and improving customer experience.

- Shifting Consumer Preferences Toward Healthier Options: U.S. consumers are increasingly leaning towards health-conscious dining, prompting restaurants to expand menu options that emphasize locally sourced, organic ingredients. This shift includes offerings for specific dietary needs, such as vegan, low-fat, and gluten-free options, especially in trend-setting states like California. Restaurants are adapting to meet these changing preferences, reflecting a commitment to healthier, nutrition-focused choices that resonate with todays diners.

Market Challenges

- Labor Shortages and Rising Wages: The restaurant industry is grappling with significant labor shortages, compounded by rising wages that strain operating budgets. With higher wage requirements in several states, restaurant operators are increasingly turning to automation and more efficient workflows to alleviate staff dependency. These adjustments aim to balance workforce limitations and help manage the cost pressures stemming from labor scarcity.

- High Operational Costs and Narrow Profit Margins: U.S. restaurants are facing rising operational costs across rent, utilities, and raw materials, all of which tighten profit margins. The increased expense of ingredients further impacts profitability, pushing restaurants to adopt efficient cost-management practices. To diversify revenue, many are exploring delivery and off-premise dining options, which provide additional income streams amid these mounting financial pressures.

USA Restaurant Management Market Future Outlook

The USA Restaurant Management market is expected to continue expanding, driven by increasing consumer demand for convenience and dining experiences tailored to diverse preferences. Technological integration remains a significant growth factor, as restaurants across various formats adopt cloud-based management systems to streamline operations, improve customer engagement, and reduce costs. The rise of ghost kitchens and the continued popularity of takeout and delivery services further highlight the industry's adaptability to shifting consumer behaviors.

Market Opportunities

- Expansion of Franchising Models: Franchising has become a key growth avenue for the restaurant industry, particularly in suburban and rural areas. This model provides aspiring owners with lower startup costs and extensive operational support, making it an attractive, lower-risk entry into the market. The structured systems that franchises offer enable faster brand expansion and provide franchisees with a proven business model to boost revenue and streamline operations.

- Growth in Ghost Kitchens and Virtual Brands: Ghost kitchens and virtual brands have gained popularity as efficient, cost-effective options in the restaurant industry. Operating without a physical storefront, ghost kitchens focus solely on delivery, minimizing overhead costs associated with traditional dining spaces. This model provides flexibility and scalability, appealing to operators looking to focus exclusively on delivery services while reaching a wider, digitally savvy customer base.

Scope of the Report

|

By Restaurant Type |

Quick Service Restaurants |

|

By Technology |

POS Systems |

|

By Service Type |

Dine-In |

|

By Revenue Stream |

Food and Beverage Sales |

|

By Region |

North |

Products

Key Target Audience

Restaurant Technology

Food Delivery Platforms

Hospitality Management Companies

Investors and venture capital Firms

Government and Regulatory Bodies (FDA, OSHA)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Sysco Corporation

US Foods Holding Corp

Aramark Corporation

Performance Food Group

Bloomin Brands, Inc.

Darden Restaurants, Inc.

Chipotle Mexican Grill, Inc.

Yum! Brands, Inc.

The Cheesecake Factory Incorporated

McDonald's Corporation

Table of Contents

1. USA Restaurant Management Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Demand and Growth Rate (Average Check Size, Customer Traffic, Sales Per Square Foot)

1.4 Key Industry Drivers

2. USA Restaurant Management Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis (Operational Expenses, Labor Cost Percentage, Gross Margins)

2.3 Key Market Developments and Milestones

3. USA Restaurant Management Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Delivery Services

3.1.2 Increasing Technological Integration (POS, Inventory Management, Digital Payment Systems)

3.1.3 Shifting Consumer Preferences Toward Healthier Options

3.1.4 High Urbanization Rate and New Restaurant Openings

3.2 Market Challenges

3.2.1 Labor Shortages and Rising Wages

3.2.2 High Operational Costs and Narrow Profit Margins

3.2.3 Regulatory Compliance Burden (Food Safety Standards, Wage Regulations)

3.3 Opportunities

3.3.1 Expansion of Franchising Models

3.3.2 Growth in Ghost Kitchens and Virtual Brands

3.3.3 Investment in Sustainability and Local Sourcing

3.4 Trends

3.4.1 Adoption of Contactless Technologies (Digital Ordering, Self-Service Kiosks)

3.4.2 Growth of Omni-Channel Experiences (In-store, Online, and Third-Party Delivery Integration)

3.4.3 Increased Focus on Customer Loyalty Programs

3.5 Regulatory Framework

3.5.1 Food and Drug Administration (FDA) Regulations

3.5.2 Occupational Safety and Health Administration (OSHA) Standards

3.5.3 Federal Wage and Hour Regulations

3.5.4 Licensing and Health Code Compliance

3.6 Competitive Landscape Overview

3.7 SWOT Analysis

3.8 Ecosystem Mapping (Suppliers, Technology Providers, Distribution Channels)

3.9 Porters Five Forces

4. USA Restaurant Management Market Segmentation

4.1 By Restaurant Type (In Value %)

4.1.1 Quick Service Restaurants

4.1.2 Full-Service Restaurants

4.1.3 Casual Dining

4.1.4 Fine Dining

4.1.5 Ghost Kitchens

4.2 By Technology (In Value %)

4.2.1 POS Systems

4.2.2 Inventory Management Software

4.2.3 Customer Relationship Management (CRM) Software

4.2.4 Payroll and Scheduling Software

4.3 By Service Type (In Value %)

4.3.1 Dine-In

4.3.2 Takeout

4.3.3 Delivery

4.3.4 Drive-Thru

4.4 By Revenue Stream (In Value %)

4.4.1 Food and Beverage Sales

4.4.2 Alcohol Sales

4.4.3 Merchandise Sales

4.4.4 Event Hosting

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 East

4.5.3 South

4.5.4 West

5. USA Restaurant Management Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Sysco Corporation

5.1.2 US Foods Holding Corp

5.1.3 Aramark Corporation

5.1.4 Performance Food Group Company

5.1.5 Bloomin' Brands

5.1.6 Darden Restaurants, Inc.

5.1.7 Chipotle Mexican Grill, Inc.

5.1.8 Yum! Brands, Inc.

5.1.9 The Cheesecake Factory Incorporated

5.1.10 McDonalds Corporation

5.1.11 Inspire Brands

5.1.12 Shake Shack Inc.

5.1.13 Starbucks Corporation

5.1.14 Brinker International, Inc.

5.1.15 Dominos Pizza, Inc.

5.2 Cross Comparison Parameters (Revenue, Number of Locations, Customer Satisfaction Scores, Technology Adoption, Market Share, Employee Retention Rate, Digital Sales Percentage, Average Check Size)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Partnerships

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Private Equity Investments

5.8 Government Subsidies and Grants

6. USA Restaurant Management Market Regulatory Framework

6.1 Health and Safety Standards

6.2 Compliance Requirements (Labor Regulations, Food Handling)

6.3 Licensing and Certification Processes

7. USA Restaurant Management Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Impacting Future Market Growth

8. USA Restaurant Management Future Market Segmentation

8.1. By Restaurant Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Service Type (In Value %)

8.4. By Revenue Stream (In Value %)

8.5. By Region (In Value %)

9. USA Restaurant Management Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Recommended Marketing Strategies

9.4 White Space Opportunity Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping all primary stakeholders in the USA Restaurant Management market using desk research and secondary data sources. The objective is to isolate essential variables influencing the market's dynamics, such as technology adoption rates and customer preferences.

Step 2: Market Analysis and Construction

Data from historical records, industry-specific reports, and financial statements are compiled to assess revenue generation trends and restaurant segment performance. This analysis provides foundational insights into the operational frameworks driving the market.

Step 3: Hypothesis Validation and Expert Consultation

Insights from primary interviews with industry professionals (executives in top restaurant chains and technology providers) are used to validate hypotheses around market growth trends, competitive strategies, and consumer behavior patterns.

Step 4: Research Synthesis and Final Output

Findings from quantitative data analysis are synthesized with qualitative inputs to generate a validated market overview, enabling accurate segmentation and providing actionable insights for stakeholders.

Frequently Asked Questions

01. How big is the USA Restaurant Management Market?

The USA Restaurant Management Market is valued at USD 14.5 billion, driven by increasing demand for efficient restaurant operations and customer-centric dining solutions.

02. What are the main challenges in the USA Restaurant Management Market?

Challenges in USA Restaurant Management Market include labor shortages, high operational costs, and the need for compliance with stringent health and safety regulations, which add complexity to restaurant management.

03. Who are the key players in the USA Restaurant Management Market?

The USA Restaurant Management Market includes prominent players such as Sysco Corporation, US Foods Holding Corp, Darden Restaurants, and Starbucks Corporation, recognized for their innovative solutions and market influence.

04. What drives the growth of the USA Restaurant Management Market?

Growth drivers in USA Restaurant Management Market include technological advancements like POS integration, the rise of ghost kitchens, and increased consumer preference for online food ordering and delivery services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.