USA Retail Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD3054

November 2024

80

About the Report

USA Retail Market Overview

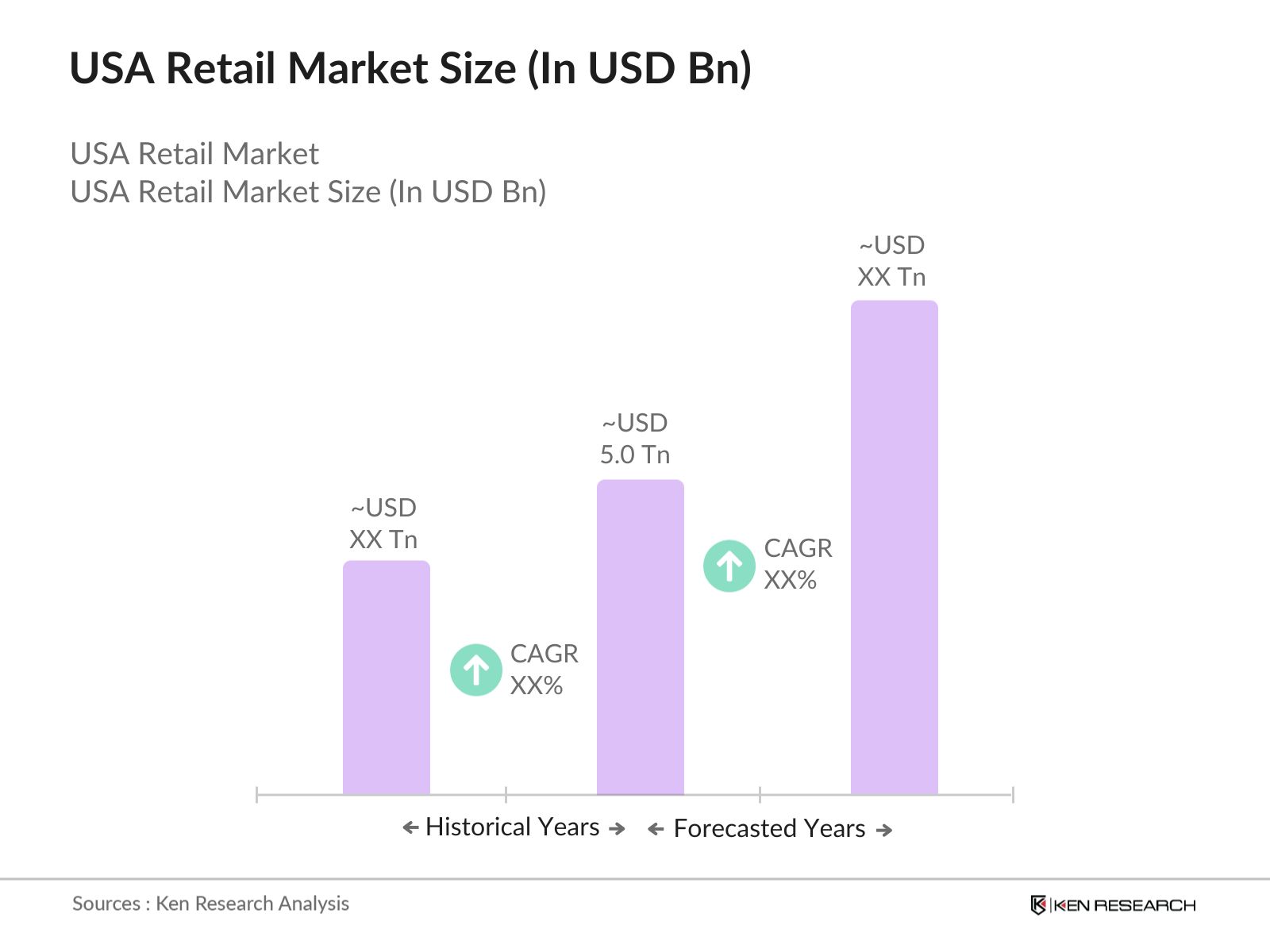

- The USA retail market, valued at USD 5.0 trillion, has been experiencing robust growth due to increasing consumer spending, technological advancements in retail, and the growth of e-commerce. The market is supported by the consistent demand for consumer goods, growing disposable incomes, and the evolution of omnichannel retailing, which integrates both online and offline shopping experiences. The retail industry is also benefiting from a shift in consumer preferences toward sustainable and ethical products, influencing product offerings across various categories.

- Major metropolitan areas such as New York, Los Angeles, and Chicago lead the retail market expansion due to high population density and consumer spending power. The rise of suburban areas, driven by increasing residential development, is also contributing to the retail market's growth. Retail hubs in these areas are witnessing significant investment, particularly in grocery, apparel, and home improvement sectors. The shift towards e-commerce has enabled retailers to tap into rural and less densely populated regions, expanding their customer base.

- The U.S. Department of Commerce plays a critical role in regulating retail trade policies, ensuring fair competition, and promoting consumer protection. Recent regulatory developments have focused on e-commerce taxation, data privacy in digital retail, and consumer rights in online transactions, ensuring a balanced and transparent market for both consumers and retailers.

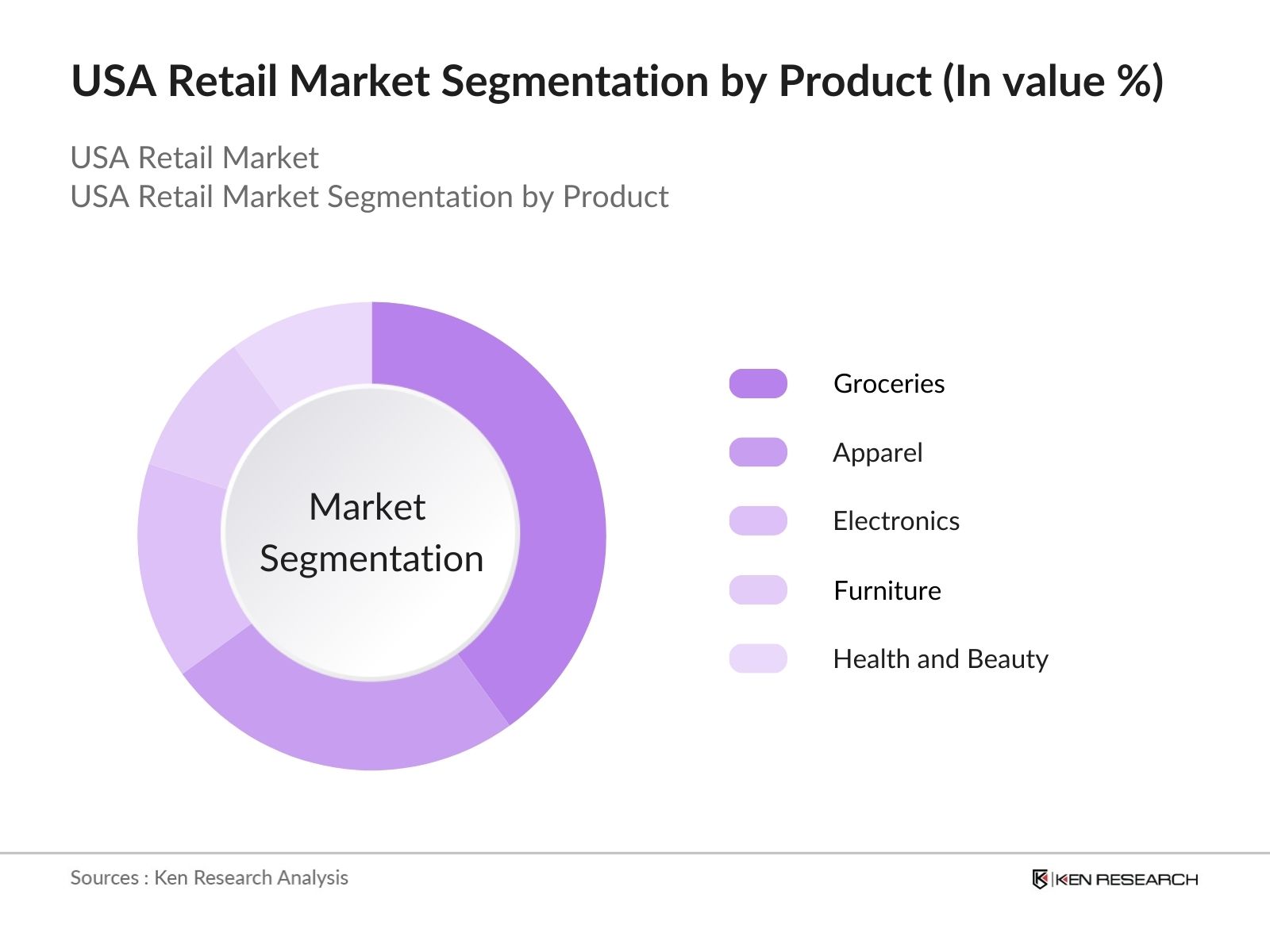

USA Retail Market Segmentation

- By Product Type: The retail market is segmented by product type into groceries, apparel, electronics, furniture, and health and beauty products. The grocery segment dominates the market due to the essential nature of food products and the increasing trend towards healthy eating and organic products. Apparel is the second-largest segment, driven by fast fashion and e-commerce platforms. Electronics are also experiencing significant demand, with a focus on smartphones, home entertainment, and smart devices. Furniture retail has been positively impacted by the surge in home renovations, while health and beauty products are seeing growth due to an increasing focus on personal wellness and self-care.

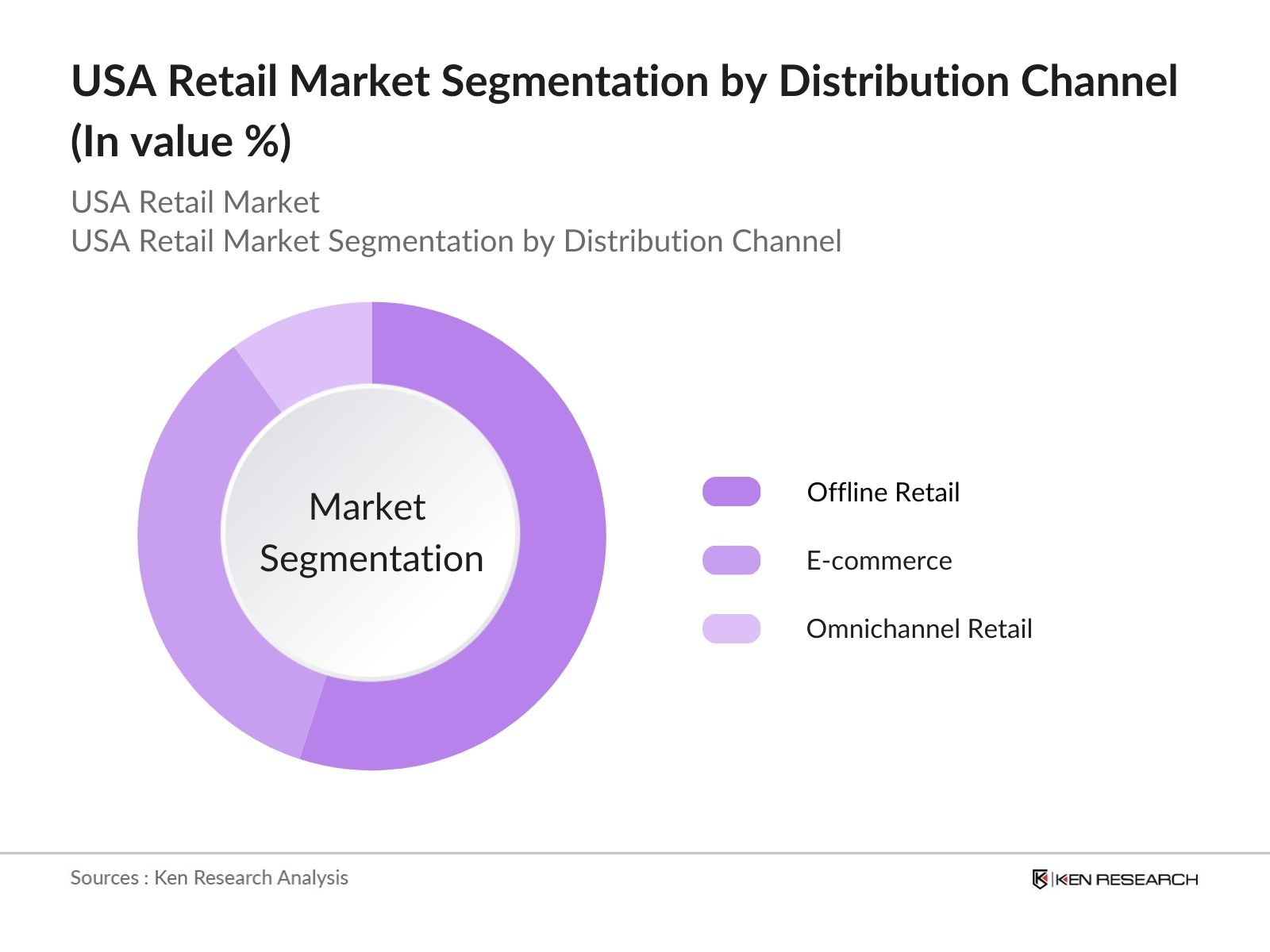

- By Distribution Channel: The market is segmented by distribution channel into offline retail, e-commerce, and omnichannel retail. Offline retail, including supermarkets, hypermarkets, and department stores, continues to be the largest channel, despite the rise of e-commerce. E-commerce, however, is growing rapidly, driven by convenience, extensive product offerings, and the COVID-19 pandemic's acceleration of online shopping habits. Omnichannel retail, which integrates both online and offline experiences, is gaining momentum as retailers focus on providing a seamless shopping experience across multiple touchpoints.

USA Retail Market Competitive Landscape

The USA retail market is highly competitive, with numerous national and international players dominating different segments. Major players include Walmart, Amazon, Costco, and Target, which lead in terms of market share and revenue. These companies are investing heavily in e-commerce, supply chain optimization, and customer experience enhancements to maintain their competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD) |

No. of Employees |

Key Products |

E-commerce Presence |

Physical Store Count |

Sustainability Initiatives |

Technology Investments |

|

Walmart |

1962 |

Bentonville, AR |

|||||||

|

Amazon |

1994 |

Seattle, WA |

|||||||

|

Costco |

1976 |

Issaquah, WA |

|||||||

|

Target |

1902 |

Minneapolis, MN |

|||||||

|

The Home Depot |

1978 |

Atlanta, GA |

USA Retail Industry Analysis

Growth Drivers

- Increasing E-commerce Adoption: The rise of e-commerce in the USA has been a major growth driver, with over 7.1 billion packages being delivered annually through USPS alone, supported by robust online shopping. E-commerce adoption surged as broadband access expanded to over 90% of U.S. households. This increase in high-speed internet access combined with more secure online payment systems led to a surge in retail sales, driven by convenience and wider product access. The U.S. Census Bureau reported that retail e-commerce sales were at USD 1.01 trillion in 2022, marking a 6.5% increase from the previous year.

- Growth in Consumer Spending: Consumer spending in the U.S. continues to rise, with real disposable personal income reaching USD 16.78 trillion in mid-2023, an increase driven by wage growth, stimulus packages, and expanded credit access. Americans' personal consumption expenditures grew to USD 19.58 trillion in the same period, bolstered by lower unemployment at 3.5% and favorable economic policies. Expanded credit card offerings and lower interest rates helped fuel retail spending further, despite inflationary pressures on essentials. This reflects a strong retail environment, especially for non-essential goods like electronics and apparel.

- Urbanization and Population Growth: Urbanization is steadily transforming the retail landscape, with 83% of the U.S. population residing in urban areas as of 2023. Cities like Austin, Texas, saw population growth of over 2.7%, driving increased demand for retail outlets, especially in fast-growing urban centers. Population growth also resulted in a rise in per capita consumption, contributing to overall retail expansion. With population growth expected to continue, retail infrastructure investment is scaling up to meet urban demand, particularly for fashion, electronics, and groceries.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions continue to pose significant challenges in the U.S. retail market, with key issues including port congestion, labor shortages, and geopolitical tensions. West Coast port delays have led to extended shipping timelines, severely affecting inventory management. Additionally, shortages of critical raw materials, such as semiconductor chips vital to electronics, have created further bottlenecks. Retailers are also grappling with rising logistics costs, leading to stockouts and increasing pressure on profit margins, all of which complicate operational efficiency and business planning.

- Intense Market Competition: The U.S. retail market remains intensely competitive, with price wars between major players squeezing profit margins. Large retailers are competing to attract cost-sensitive consumers, driving down prices across the board. Discount retailers have also intensified the competition by appealing to lower-income customers with aggressive pricing. Traditional retailers are facing increasing pressure to balance affordability and profitability, as price competition continues to challenge business strategies, limiting the ability to maintain healthy profit margins.

USA Retail Market Future Outlook

The USA retail market is expected to continue its growth trajectory over the next five years, driven by increasing consumer spending, the e-commerce boom, and technological advancements. Retailers are likely to focus on enhancing their omnichannel strategies, improving customer experiences, and adopting new technologies such as AI, AR, and VR to stay competitive in a rapidly evolving market. Sustainability and ethical consumerism will also play a significant role in shaping product offerings and retail strategies moving forward.

Future Market Opportunities

- Expansion in Suburban and Rural Markets: Retailers are increasingly turning their attention to suburban and rural markets, where infrastructure development and e-commerce growth have unlocked new consumer bases. With 27 % of the U.S. population living in rural areas, and suburban migration rising due to post-pandemic preferences for space, retail chains like Walmart and Amazon are expanding last-mile delivery and pickup services in these regions. This expansion is expected to unlock considerable growth opportunities, with median household incomes in suburban areas rising to USD 81,000 in 2023, up from USD 78,000 in 2020.

- Growth of Sustainable and Ethical Retail: Sustainable retail is on the rise, with consumer demand for eco-friendly products driving change. In 2023, 50% of U.S. consumers stated a preference for sustainable brands, up from 30% in 2020, according to a World Bank study. This trend is pushing retailers to stock more ethically produced goods, reduce plastic packaging, and invest in renewable energy sources for stores. As the U.S. shifts towards carbon neutrality goals, more retailers are investing in solar power, eco-friendly materials, and carbon offsets, creating a growing niche for sustainable retail products.

Scope of the Report

|

By Product Type |

Groceries Apparel Electronics Furniture Health and Beauty |

|

By Distribution Channel |

Offline Retail (Supermarkets, Department Stores, Specialty Stores) E-commerce (B2C, D2C) Omnichannel (Integration of Online & Physical Stores) |

|

By Payment Method |

Cash Credit/Debit Cards Digital Payments BNPL Services |

|

By Consumer Age Group |

Generation Z Millennials Generation X Baby Boomers |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Retailers and Supermarket Chains

E-commerce Platforms

Technology Providers (AI, Cloud Computing, AR/VR Solutions)

Logistics and Supply Chain Companies

Payments Solution Providers (Fintech)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Commerce, Federal Trade Commission)

Banks and Financial Institutes

Private Equity Investors

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Walmart

Amazon

Costco

Target

The Home Depot

Best Buy

Kroger

Walgreens Boots Alliance

CVS Health

Macys

Nordstrom

Lowes

Kohls

Aldi

Dollar General

Table of Contents

1. USA Retail Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Retail Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Retail Market Analysis

3.1 Growth Drivers

3.1.1 Increasing E-commerce Adoption

3.1.2 Growth in Consumer Spending (Disposable Income, Credit Expansion)

3.1.3 Urbanization and Population Growth

3.1.4 Advancements in Omnichannel Retailing (Integration of Online & Offline)

3.2 Market Challenges

3.2.1 Supply Chain Disruptions (Logistics, Import Delays, Raw Material Shortages)

3.2.2 Intense Market Competition (Price Wars, Profit Margins)

3.2.3 Inflationary Pressures (Rising Costs of Goods, Shipping)

3.3 Opportunities

3.3.1 Expansion in Suburban and Rural Markets

3.3.2 Growth of Sustainable and Ethical Retail (Eco-Friendly Products)

3.3.3 Technological Innovations (AI, AR, VR in Retail)

3.4 Trends

3.4.1 Rise of "Buy Now, Pay Later" (BNPL) Solutions

3.4.2 Subscription-Based Retail Models (Monthly Delivery Services)

3.4.3 Hyper-Personalization and Data-Driven Marketing (Customer Insights)

3.5 Government Regulations

3.5.1 E-Commerce Taxation and Digital Sales Policies

3.5.2 Data Privacy and Security Regulations (GDPR, CCPA)

3.5.3 Consumer Protection Laws (Warranty, Returns, Refunds)

3.6 SWOT Analysis

3.7 Stake Ecosystem (Retailers, Suppliers, Payment Processors, Logistics)

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem (National & International Retailers)

4. USA Retail Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Groceries

4.1.2 Apparel

4.1.3 Electronics

4.1.4 Furniture

4.1.5 Health and Beauty

4.2 By Distribution Channel (In Value %)

4.2.1 Offline Retail (Supermarkets, Department Stores, Specialty Stores)

4.2.2 E-commerce (B2C, D2C)

4.2.3 Omnichannel (Integration of Online & Physical Stores)

4.3 By Region (In Value %)

4.3.1 North-East

4.3.2 Mid-West

4.3.3 South

4.3.4 West

4.4 By Payment Method (In Value %)

4.4.1 Cash

4.4.2 Credit/Debit Cards

4.4.3 Digital Payments (Mobile Wallets, Contactless Payments)

4.4.4 "Buy Now, Pay Later" (BNPL) Services

4.5 By Consumer Age Group (In Value %)

4.5.1 Generation Z

4.5.2 Millennials

4.5.3 Generation X

4.5.4 Baby Boomers

5. USA Retail Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Walmart

5.1.2 Amazon

5.1.3 Costco

5.1.4 Target

5.1.5 The Home Depot

5.1.6 Best Buy

5.1.7 Kroger

5.1.8 Walgreens Boots Alliance

5.1.9 CVS Health

5.1.10 Macys

5.1.11 Nordstrom

5.1.12 Lowes

5.1.13 Kohls

5.1.14 Aldi

5.1.15 Dollar General

5.2 Cross Comparison Parameters (Revenue, Employee Count, R&D Investments, E-commerce Presence, Physical Store Count, Sustainability Initiatives, Technology Adoption, Market Share)

5.3 Market Share Analysis (Retail Giants vs. Mid-Size Retailers)

5.4 Strategic Initiatives (Omnichannel Expansion, Tech Innovation, M&A)

5.5 Mergers and Acquisitions (Key Deals in Retail Sector)

5.6 Investment Analysis (Capex, Opex, Technology Spend)

5.7 Venture Capital Funding in Retail Startups (Disruptive Business Models)

5.8 Government Grants for Retail Innovation (Tech, Logistics, Sustainability)

5.9 Private Equity Investments in Retail (Growth Sectors, Buyouts)

6. USA Retail Market Regulatory Framework

6.1 Retail-Specific Environmental Regulations (Waste Management, Packaging)

6.2 Compliance Requirements for E-commerce (Taxation, Data Privacy)

6.3 Certification Processes for Sustainable Retail Products (Eco Labels)

7. USA Retail Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Retail Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Region (In Value %)

8.4 By Payment Method (In Value %)

8.5 By Consumer Age Group (In Value %)

9. USA Retail Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Spending Behavior, Product Preferences)

9.3 Marketing Initiatives (Digital Marketing, In-store Promotions)

9.4 White Space Opportunity Analysis (Underserved Regions, Untapped Consumer Segments)

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves mapping the USA retail market, focusing on key stakeholders such as retailers, e-commerce platforms, and logistics providers. This is conducted through desk research, utilizing both secondary and proprietary data sources to understand the markets key driving factors.

Step 2: Market Analysis and Construction

In this phase, historical data on retail sales, consumer behavior, and technological trends are compiled and analyzed. The analysis will include market penetration data for both offline and online retail, evaluating how different distribution channels generate revenue. Service quality metrics are also reviewed to ensure accurate market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in the previous step will be validated through expert consultations via computer-assisted telephone interviews (CATI). These interviews will provide insights into market operations, technological adoption, and future trends, refining the data collected in the previous stages.

Step 4: Research Synthesis and Final Output

In the final phase, direct consultations with major retailers and e-commerce players will be conducted to verify and complement the market estimates derived from previous steps. This ensures a comprehensive and reliable analysis of the USA retail market.

Frequently Asked Questions

01 How big is the USA Retail Market?

The USA retail market is valued at USD 5.0 trillion, supported by consumer spending, e-commerce growth, and technological advancements.

02 What are the challenges in the USA Retail Market?

Challenges in the USA retail market include supply chain disruptions, increasing competition from e-commerce platforms, and rising inflation, which impacts product prices and profit margins.

03 Who are the major players in the USA Retail Market?

Major players in the USA retail market include Walmart, Amazon, Costco, Target, and The Home Depot, which dominate through their expansive reach, innovative retail models, and strong brand loyalty.

04 What are the growth drivers of the USA Retail Market?

Growth drivers in the USA retail market include increasing disposable income, advancements in technology (such as AI and AR), and the rapid expansion of e-commerce platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.