USA Rheumatoid Arthritis (RA) Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD2545

November 2024

90

About the Report

USA RA Market Overview

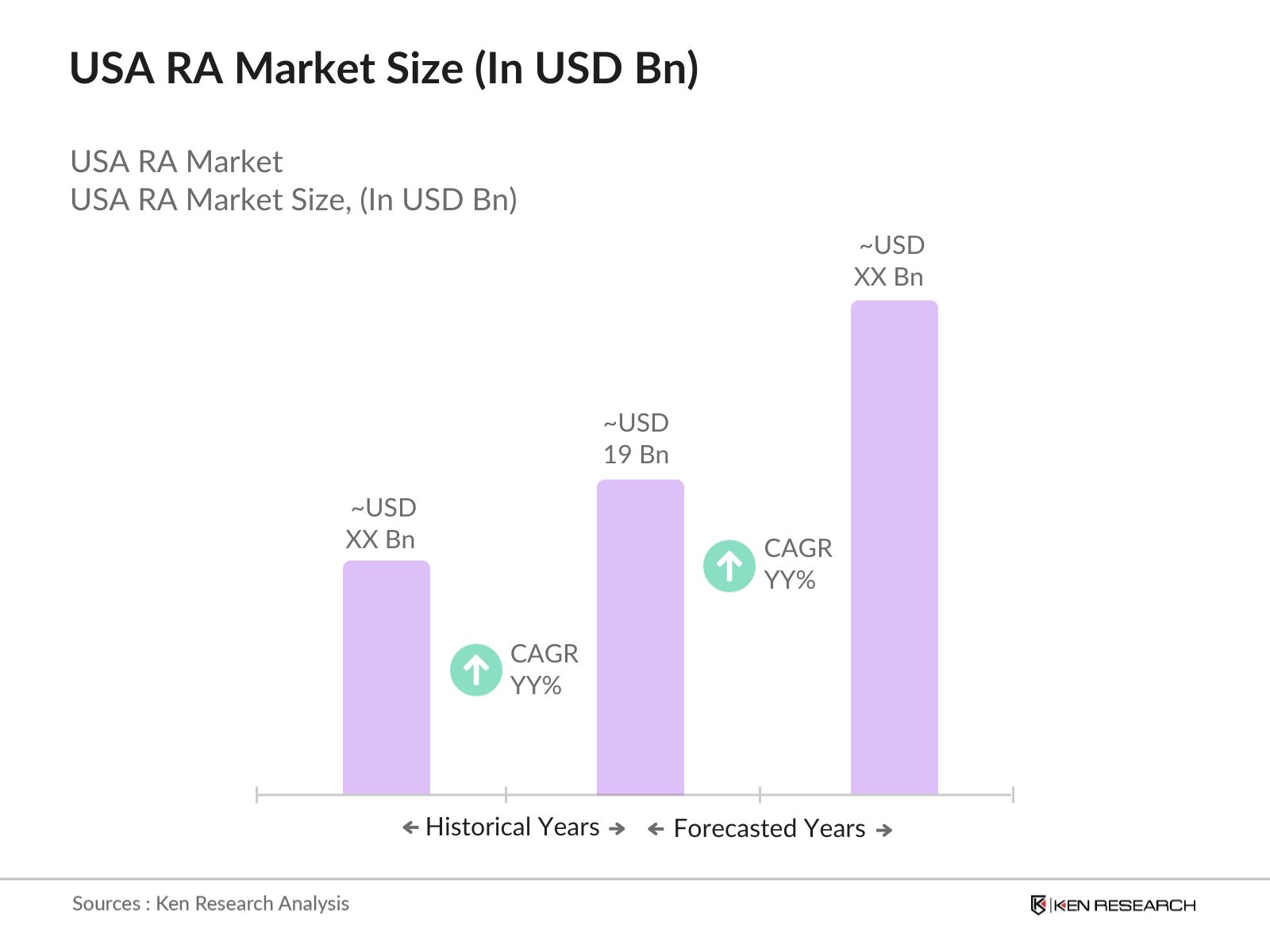

- The USA Rheumatoid Arthritis (RA) market was valued at USD 19 billion. This growth is driven by the increasing prevalence of RA, the rising elderly population, advancements in biological therapies, and government initiatives supporting RA awareness and treatment.

- Key players in the USA RA market include AbbVie Inc., Pfizer Inc., Johnson & Johnson, Amgen Inc., and Bristol-Myers Squibb Company. These companies have a strong presence in the U.S., leveraging new therapies and biological drugs to meet the growing demand for effective RA treatments.

- AbbVie's RINVOQ (upadacitinib) is now indicated for treating pediatric patients 2 years and older with active polyarticular juvenile idiopathic arthritis (pJIA) and psoriatic arthritis (PsA) in the U.S., providing a new treatment option for these young patients.

- California emerged as the leading region in the USA RA market, driven by a high incidence of autoimmune diseases, a robust healthcare infrastructure, and active clinical trials that foster early adoption of new RA treatments.

USA RA Market Segmentation

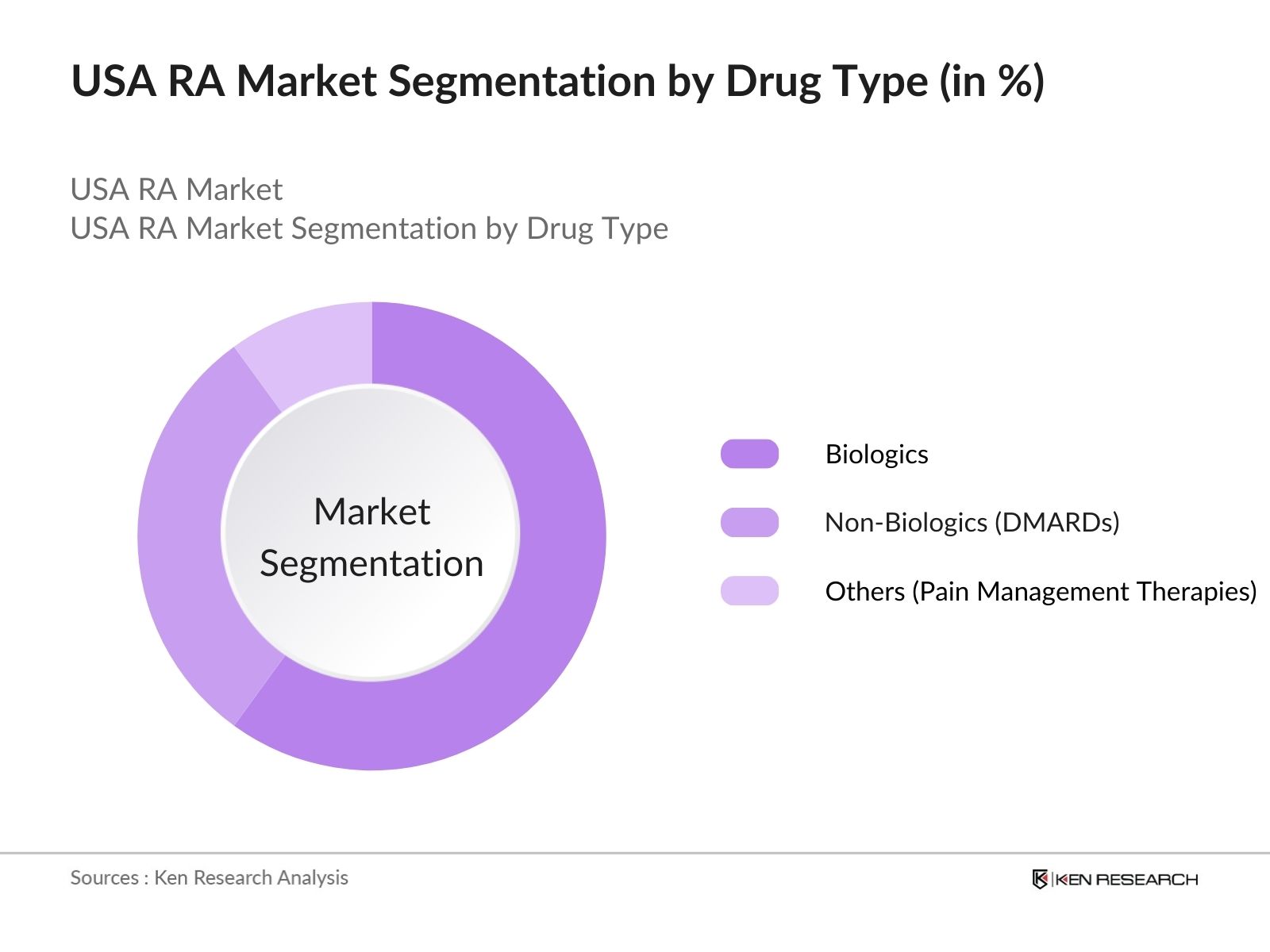

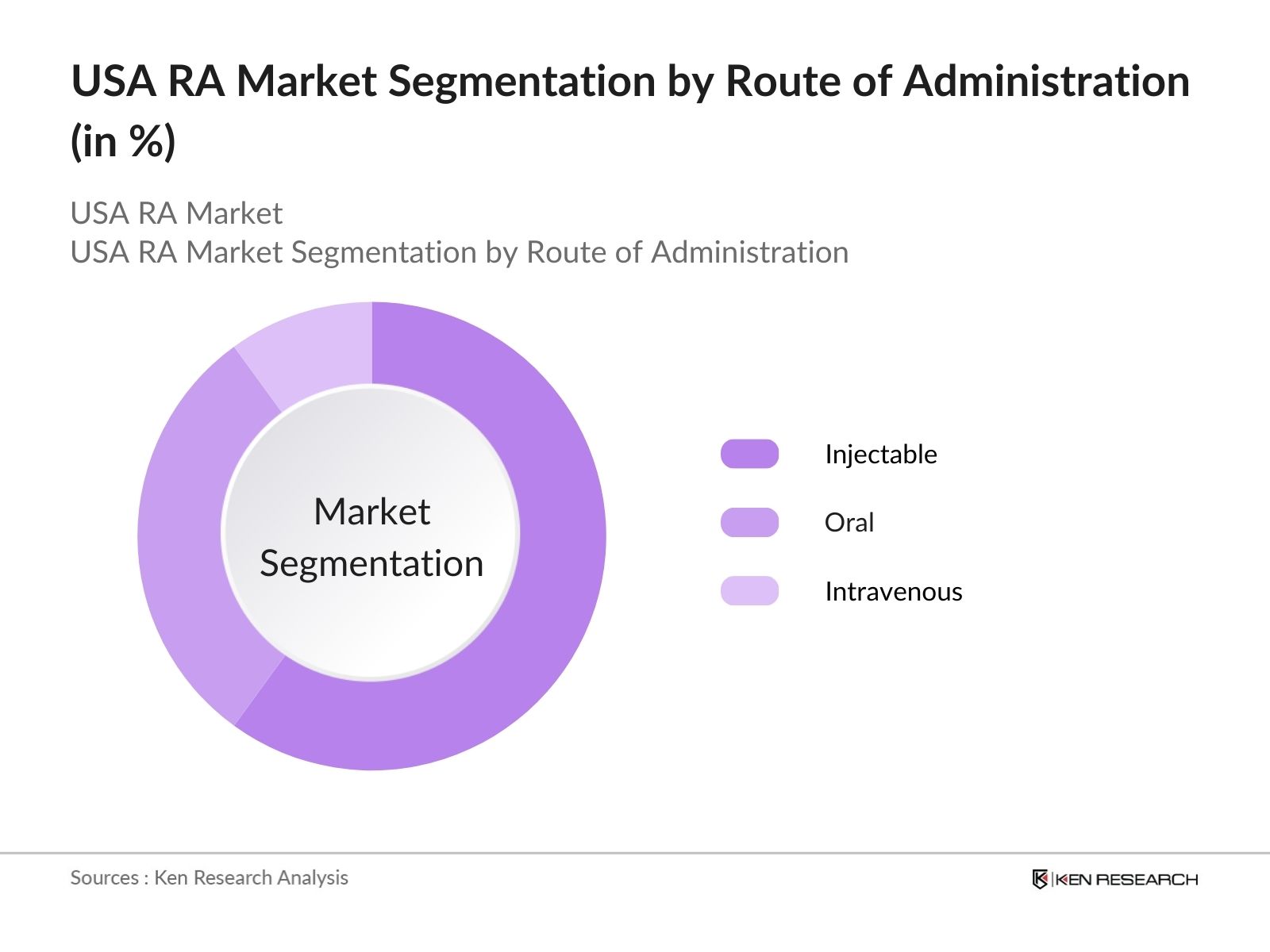

The USA RA Market is segmented by drug type, route of administration, and region.

- By Drug Type: The market is segmented into biologics, non-biologics (DMARDs), and others (pain management therapies). Biologics dominated the market due to their effectiveness in reducing inflammation and slowing disease progression.

- By Route of Administration: The market is segmented into oral, injectable, and intravenous. Injectable biologics held the largest market share due to their established use and proven efficacy in RA treatment.

- By Region: The market is segmented by region into North, South, East, and West. The West region led the market due to the higher prevalence of RA, advanced healthcare facilities, and greater patient access to innovative treatments.

USA RA Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

AbbVie Inc. |

2013 |

North Chicago, Illinois, USA |

|

Pfizer Inc. |

1849 |

New York City, New York, USA |

|

Johnson & Johnson |

1886 |

New Brunswick, New Jersey, USA |

|

Amgen Inc. |

1980 |

Thousand Oaks, California, USA |

|

Bristol-Myers Squibb Company |

1887 |

New York City, New York, USA |

- Johnson & Johnson: Johnson & Johnson (J&J) announced positive topline results for nipocalimab in two rare diseases: generalized myasthenia gravis (gMG) and Sjogren's disease. Both trials met primary endpoints, showing improvements over placebo, prompting J&J to seek regulatory approval for gMG.

- Pfizer Inc.: A recent study published in Nature examined the immune cell landscape in early rheumatoid arthritis (RA) patients and healthy vaccine recipients. Researchers profiled 267 RA patients and 52 vaccine recipients over 18 months, generating extensive multi-omic data to enhance understanding of RA pathogenesis and treatment responses.

USA RA Market Analysis

USA RA Market Growth Drivers:

- Increasing RA Prevalence: Rheumatoid arthritis affects about 17.6 million people globally, with a projected increase to 31.7 million by 2050. The age-standardized global prevalence rate is 208.8 cases per 100,000 population, representing a 14.1% increase since 1990, indicating a growing demand for effective treatments.

- Advancements in Biologic Therapies: The introduction of biologic therapies, including JAK inhibitors, has substantially transformed RA treatment. These medications have been shown to improve patient outcomes, with studies indicating that they can reduce disease activity by over 50% in many patients who do not respond to traditional DMARDs, thus driving market growth.

- Increased Awareness and Early Diagnosis Initiatives: Awareness campaigns and early diagnosis initiatives have led to increased diagnosis rates. Studies show that early intervention can reduce long-term disability by up to 40%, resulting in a higher treatment uptake. This shift is expected to further increase the demand for RA medications as more patients are diagnosed and treated early.

USA RA Market Challenges:

- High Treatment Costs: Rheumatoid arthritis therapies, particularly biologics, can exceed $30,000 annually, with monthly costs ranging from $1,300 to $3,000. This high expense creates barriers for patients, especially those lacking comprehensive insurance coverage, limiting access to necessary treatments for effective disease management.

- Biosimilar Competition: The introduction of biosimilars is exerting price pressure on the RA biologics market. These alternatives to original biologics, such as Humira and Enbrel, can drive down prices, benefiting patients. However, this increased competition poses revenue challenges for established pharmaceutical companies like AbbVie and Pfizer.

USA RA Market Government Initiatives:

- NIH Research Funding: The National Institutes of Health (NIH) has substantially increased funding for rheumatoid arthritis research, allocating over $500 million in 2021. This investment focuses on developing new treatment options, understanding the genetic basis of the disease, and advancing knowledge and therapeutic strategies.

- Affordable Care Act (ACA): The Affordable Care Act (ACA) has enhanced access to rheumatoid arthritis treatments by expanding insurance coverage for costly biologics. It prevents discrimination based on pre-existing conditions, ensuring that more patients can receive timely and necessary treatments, and improving overall health outcomes for those with RA.

USA RA Future Market Outlook

The USA RA market is expected to grow over the next five years, driven by the introduction of new biologics and biosimilars, advancements in personalized medicine, and increasing demand for more effective RA therapies. The adoption of innovative drug delivery systems and the rise of telemedicine are expected to shape the market's future trajectory.

USA RA Future Market Trends:

- Rise of Personalized Medicine: Over the next five years, the future of rheumatoid arthritis treatment will lean towards personalized medicine, tailoring therapies to individual genetic profiles. This approach will aim to enhance treatment efficacy and minimize side effects, moving away from traditional methods to more effective management strategies based on unique patient characteristics.

- Expansion of Biosimilars: Over the next five years, the biosimilars market will be poised for major growth as more biologics lose patent protection. This expansion will provide patients with affordable treatment options without compromising efficacy, increasing competition and improving access to necessary therapies for rheumatoid arthritis, ultimately benefiting a broader patient population.

Scope of the Report

|

By Drug Type |

Biologics Non-Biologics (DMARDs) Others (Pain Management) |

|

By Application |

Oral Injectable Intravenous |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Healthcare Companies

Biopharmaceutical Companies

Health Insurance Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Table of Contents

1. USA RA Market Overview

1.1 Definition and Scope of the USA RA Market

1.2 Market Taxonomy (Drug Type, Route of Administration, Region)

1.3 Market Growth Rate and Trends

1.4 Market Drivers (RA Prevalence, Biologic Therapies, Government Initiatives)

1.5 Market Restraints (High Treatment Costs, Biosimilar Competition)

2. USA RA Market Size (in USD Billion)

2.1 Historical Market Size Analysis (2018-2023)

2.2 Year-on-Year Growth Analysis

2.3 Forecast Market Size and Growth Projections (2023-2028)

2.4 Key Market Milestones and Developments

3. USA RA Market Analysis

3.1 Growth Drivers

3.1.1 Increasing RA Prevalence

3.1.2 Advancements in Biologic Therapies

3.1.3 Early Diagnosis Initiatives

3.2 Market Challenges

3.2.1 High Treatment Costs for Biologics

3.2.2 Growing Biosimilar Competition

3.2.3 Access Barriers for Uninsured Patients

3.3 Opportunities

3.3.1 Growth of Biosimilars Market

3.3.2 Development of Personalized Medicine

3.3.3 Telemedicine Adoption in RA Management

3.4 Market Trends

3.4.1 Increasing Focus on Personalized RA Treatments

3.4.2 Rise of Biosimilars for Cost-Effective RA Treatment

4. USA RA Market Segmentation

4.1 By Drug Type (in Value %)

4.1.1 Biologics

4.1.2 Non-Biologics (DMARDs)

4.1.3 Others (Pain Management)

4.2 By Route of Administration (in Value %)

4.2.1 Oral

4.2.2 Injectable

4.2.3 Intravenous

4.3 By Region (in Value %)

4.3.1 North

4.3.2 South

4.3.3 East

4.3.4 West

5. USA RA Competitive Landscape

5.1 Competitive Market Share Analysis

5.2 Company Profiles

5.2.1 AbbVie Inc. (Established 2013, Headquarters: North Chicago, Illinois, USA)

5.2.2 Pfizer Inc. (Established 1849, Headquarters: New York City, New York, USA)

5.2.3 Johnson & Johnson (Established 1886, Headquarters: New Brunswick, New Jersey, USA)

5.2.4 Amgen Inc. (Established 1980, Headquarters: Thousand Oaks, California, USA)

5.2.5 Bristol-Myers Squibb Company (Established 1887, Headquarters: New York City, New York, USA)

5.2.6 Eli Lilly and Co. (Established 1876, Headquarters: Indianapolis, Indiana, USA)

5.2.7 Sanofi (Established 1973, Headquarters: Paris, France)

5.2.8 UCB S.A. (Established 1928, Headquarters: Brussels, Belgium)

5.2.9 Regeneron Pharmaceuticals Inc. (Established 1988, Headquarters: Tarrytown, New York, USA)

5.2.10 Biogen Inc. (Established 1978, Headquarters: Cambridge, Massachusetts, USA)

5.2.11 Roche Holding AG (Established 1896, Headquarters: Basel, Switzerland)

5.2.12 Gilead Sciences Inc. (Established 1987, Headquarters: Foster City, California, USA)

5.2.13 Novartis AG (Established 1996, Headquarters: Basel, Switzerland)

5.2.14 Merck & Co. Inc. (Established 1891, Headquarters: Kenilworth, New Jersey, USA)

5.2.15 Teva Pharmaceuticals (Established 1901, Headquarters: Petah Tikva, Israel)

5.3 Strategic Initiatives and Investments

5.4 Recent Mergers and Acquisitions

5.5 Technological Innovations and R&D Investments

6. USA RA Market Government Regulations and Initiatives

6.1 NIH Funding for RA Research

6.2 Affordable Care Act and Its Impact on RA Treatment Access

6.3 Government Initiatives for RA Awareness and Early Diagnosis

7. USA RA Market Future Market Size and Segmentation

7.1 Market Segmentation by Drug Type (2023-2028)

7.2 Market Segmentation by Route of Administration (2023-2028)

7.3 Market Segmentation by Region (2023-2028)

7.4 Future Market Trends (Biosimilars, Personalized Medicine)

8. USA RA Market Technological Advancements

8.1 Advancements in Biologic Therapies

8.2 Development of Biosimilars for RA Treatment

8.3 Use of AI and Machine Learning in RA Diagnosis and Management

9. USA RA Market Investment and Funding Landscape

9.1 Key Investments in RA Therapies

9.2 Mergers and Acquisitions in the RA Market

9.3 Government Grants and Incentives for RA Treatment Development

9.4 Private Equity and Venture Capital Funding in RA Biologics

10. USA RA Market SWOT Analysis

10.1 Strengths (Strong Pharmaceutical Industry, Technological Advancements)

10.2 Weaknesses (High Treatment Costs, Complex Regulatory Approvals)

10.3 Opportunities (Growth in Biosimilars, Personalized Treatment Approaches)

10.4 Threats (Biosimilar Competition, Rising Healthcare Costs)

11. Analysts Recommendations

11.1 Strategic Market Entry and Expansion Opportunities

11.2 Collaboration with Healthcare Providers and Insurers

11.3 Innovative Product Development (Biosimilars, Personalized Medicine)

11.4 Market Positioning Strategies for Key Players

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the USA RA market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple manufacturers of biologics and DMARDs, and healthcare providers to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these manufacturers of biologics and DMARDs, and healthcare providers.

Frequently Asked Questions

01. How big is the USA RA Market?

The USA RA Market was valued at USD 19 billion in 2023. It is expected to witness growth driven by new drug approvals, the rising prevalence of RA, and the increasing adoption of biological treatments.

02. Who are the major players in the USA RA market?

Major players in the USA RA market include AbbVie Inc., Pfizer Inc., Johnson & Johnson, Amgen Inc., and Bristol-Myers Squibb Company.

03. What are the growth drivers of the USA RA market?

The USA RA Market is driven by the rising elderly population, advancements in biologic therapies, and government support for RA treatment.

04. What are the USA RA market challenges?

Challenges in the USA RA Market include the high cost of biologics and biosimilars, and the complex nature of RA treatment, which requires personalized approaches for effective management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.