USA RPA Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD6026

November 2024

89

About the Report

USA RPA Market Overview

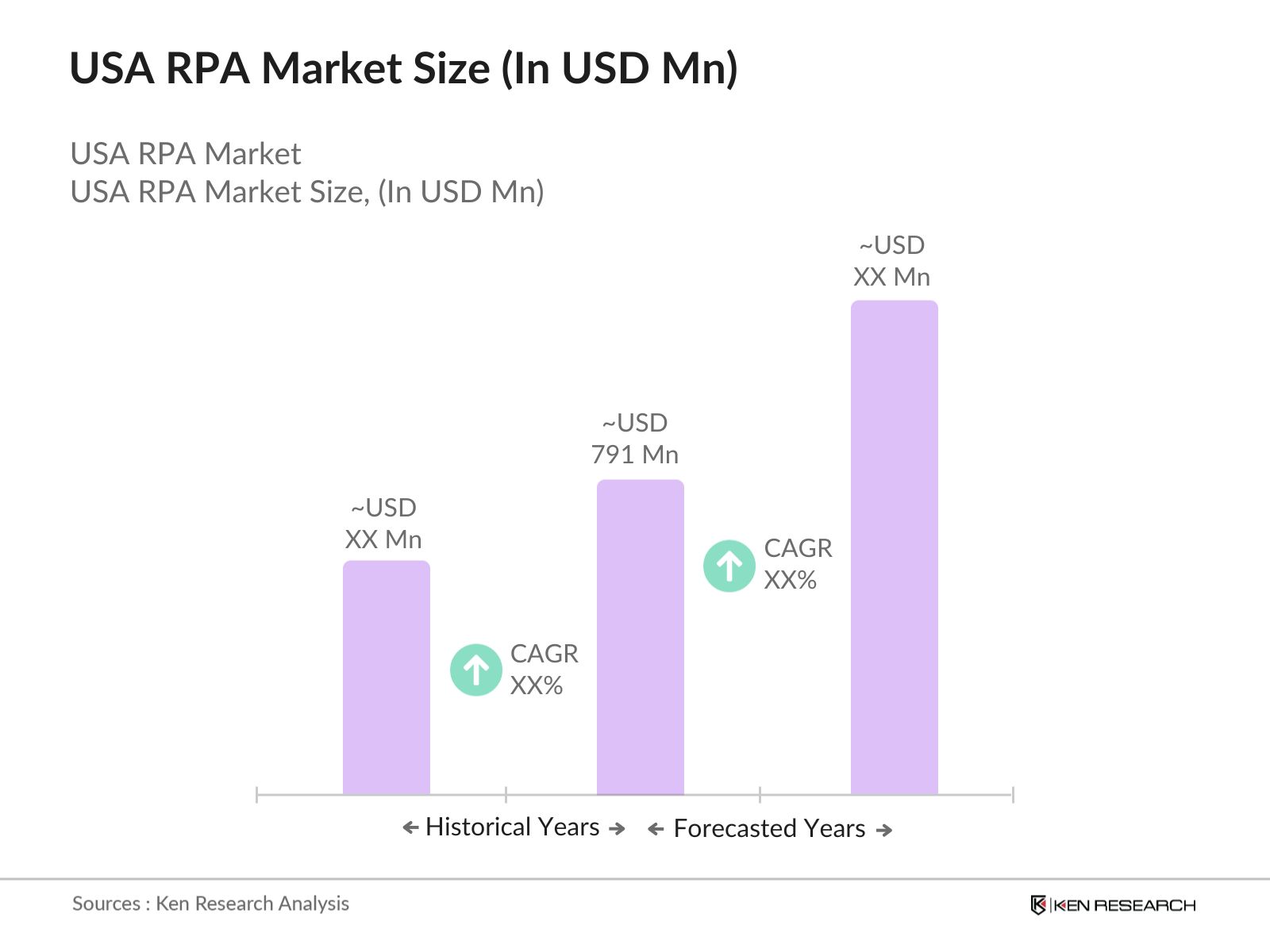

- The USA RPA Market is valued at USD 791 million, based on a comprehensive five-year historical analysis. The market has seen robust growth due to increased demand for workflow optimization across sectors such as banking, financial services, and insurance (BFSI), healthcare, and retail. Large enterprises have adopted RPA to reduce operational costs, enhance accuracy, and improve service quality.

- The USA market is primarily dominated by cities like New York, San Francisco, and Chicago. These cities have a high concentration of large enterprises, which are the primary adopters of RPA technologies. The significant presence of technology companies and financial institutions in these urban centers fosters faster adoption of automation technologies. Moreover, these cities serve as hubs for innovation, with access to skilled workforces and advanced infrastructure, further propelling the growth of the RPA market.

- The U.S. government has implemented stringent data protection laws that impact the adoption of RPA, particularly in industries like healthcare and finance. The Health Insurance Portability and Accountability Act (HIPAA) and the Gramm-Leach-Bliley Act (GLBA) require businesses to implement strict data security measures when automating processes that involve sensitive customer information. In 2024, U.S. businesses are expected to spend over $10 billion on compliance with these regulations, ensuring that their RPA systems are secure and meet the necessary legal requirements. These laws are driving the adoption of secure, compliant RPA solutions across industries.

USA RPA Market Segmentation

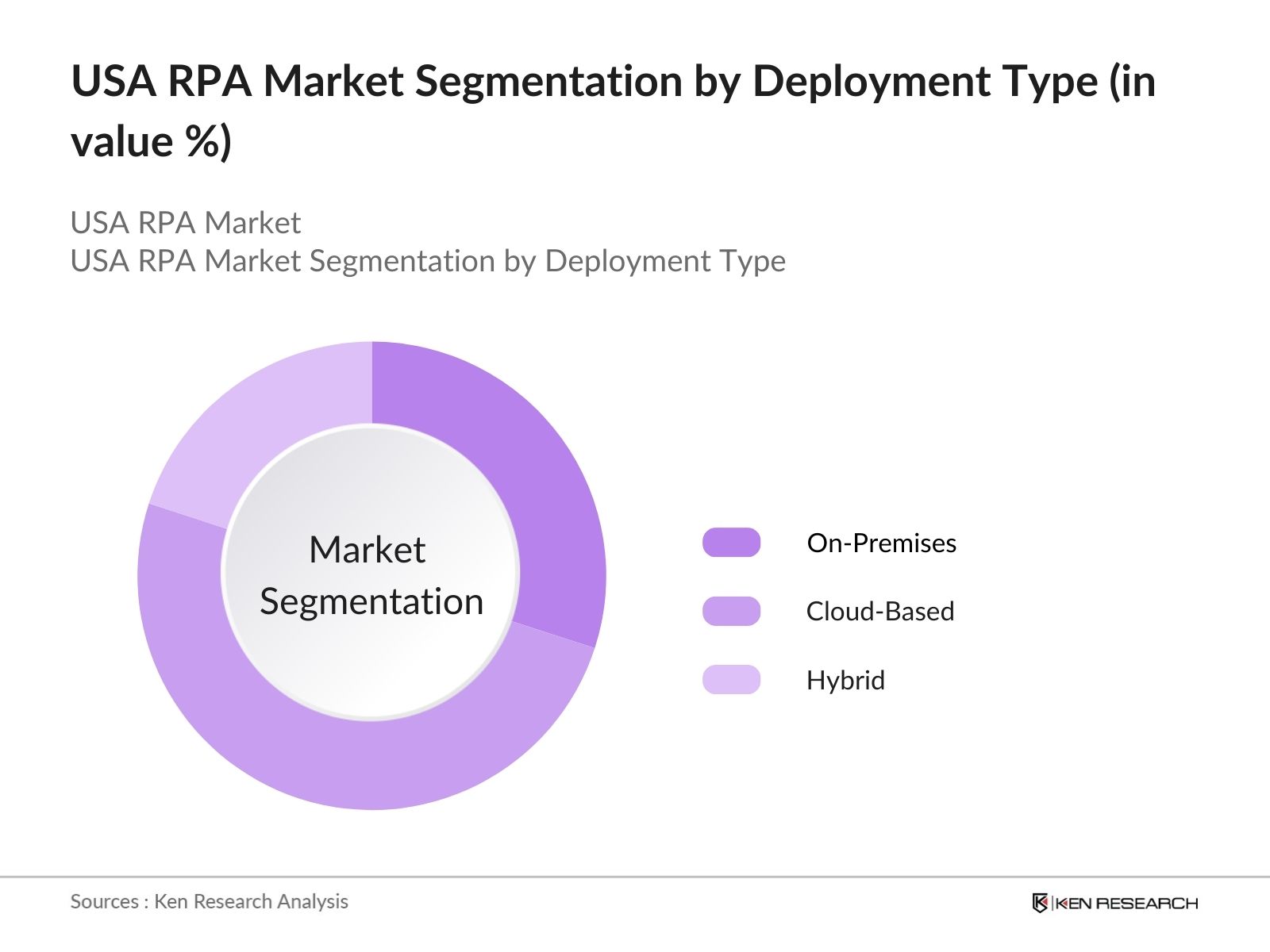

By Deployment Type: The USA RPA market is segmented by deployment type into on-premises, cloud-based, and hybrid solutions. Recently, cloud-based solutions have held a dominant market share in the USA RPA market due to their flexibility, scalability, and lower upfront costs compared to on-premises solutions. Cloud-based RPA enables companies to deploy automation tools quickly without the need for significant hardware investments, making it particularly attractive for small and medium-sized enterprises (SMEs). Additionally, cloud-based RPA solutions facilitate easier integration with other cloud-based services, such as customer relationship management (CRM) and enterprise resource planning (ERP) systems, contributing to their growing adoption.

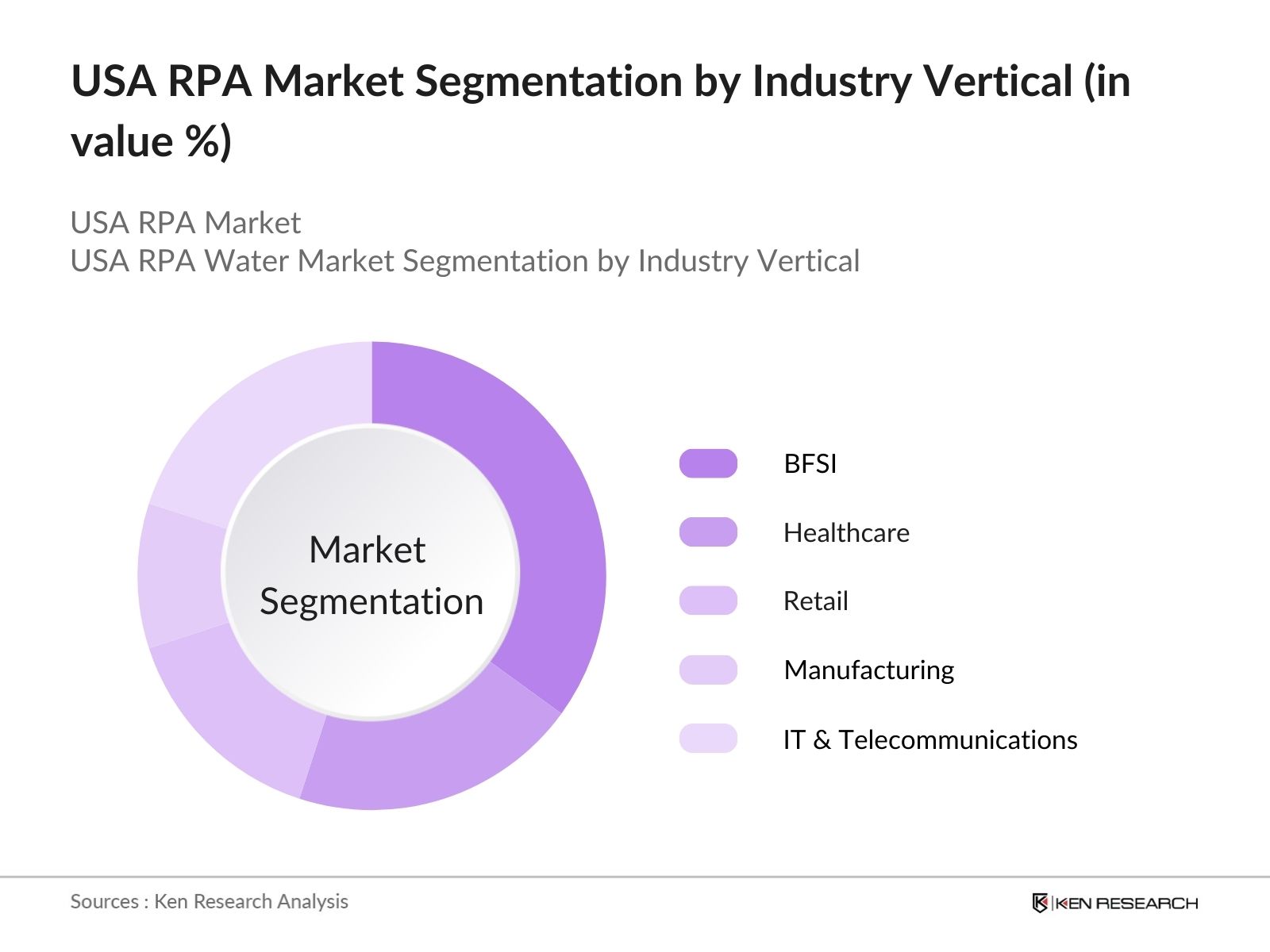

By Industry Vertical: The USA RPA market is segmented by industry vertical into BFSI, healthcare, retail, manufacturing, and IT & telecommunications. BFSI holds the largest share of the market owing to its heavy reliance on automation for functions such as fraud detection, customer onboarding, and compliance reporting. Automation in BFSI has become critical in reducing operational costs and minimizing errors in repetitive tasks like data entry and document processing. Banks and financial institutions have increasingly adopted RPA to enhance the efficiency of back-office operations and to ensure regulatory compliance, making BFSI a dominant industry vertical in the RPA space.

By Industry Vertical: The USA RPA market is segmented by industry vertical into BFSI, healthcare, retail, manufacturing, and IT & telecommunications. BFSI holds the largest share of the market owing to its heavy reliance on automation for functions such as fraud detection, customer onboarding, and compliance reporting. Automation in BFSI has become critical in reducing operational costs and minimizing errors in repetitive tasks like data entry and document processing. Banks and financial institutions have increasingly adopted RPA to enhance the efficiency of back-office operations and to ensure regulatory compliance, making BFSI a dominant industry vertical in the RPA space.

USA RPA Market Competitive Landscape

USA RPA Market Competitive Landscape

The USA RPA market is dominated by a few key players, including UiPath, Blue Prism, and Automation Anywhere, which have a significant share of the market due to their extensive R&D efforts and strong partnerships with major enterprises across various industries. These companies have developed robust automation platforms that are highly customizable and scalable, catering to both SMEs and large enterprises. The consolidation in the market indicates the competitive advantage these companies hold, driven by their innovation in AI-integrated RPA solutions and strong client support systems.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Global Presence |

Product Range |

Revenue |

Key Partnerships |

Innovation Focus |

Key Clients |

|

UiPath |

2005 |

New York, USA |

- |

- |

- |

- |

- |

- |

- |

|

Blue Prism |

2001 |

Warrington, UK |

- |

- |

- |

- |

- |

- |

- |

|

Automation Anywhere |

2003 |

San Jose, USA |

- |

- |

- |

- |

- |

- |

- |

|

Pegasystems |

1983 |

Cambridge, USA |

- |

- |

- |

- |

- |

- |

- |

|

WorkFusion |

2010 |

New York, USA |

- |

- |

- |

- |

- |

- |

- |

USA RPA Market Analysis

Growth Drivers

- Adoption in Banking, Financial Services, and Insurance (BFSI): The adoption of Robotic Process Automation (RPA) in the BFSI sector is driven by its ability to automate routine and time-consuming tasks like account reconciliation, transaction processing, and customer onboarding. In 2024, the U.S. financial sector is projected to manage around $4 trillion in assets, creating an urgent need for RPA to enhance operational efficiency and minimize manual errors. The BFSI sector accounts for nearly 30% of the total automation spending in the country, with an increased investment in RPA to streamline processes, reduce operational risks, and improve compliance management.

- Demand for Workflow Optimization: In 2024, the U.S. logistics industry alone manages goods worth over $10 trillion annually, pushing for optimized workflows to handle large volumes of transactions. RPA implementations in logistics are reducing process cycle times by as much as 50%. Retail operations, managing over 25 million employees in 2024, increasingly leverage RPA to reduce operational bottlenecks in inventory management, customer support, and order fulfillment. The need to handle high transaction volumes and enhance customer experience is fueling this trend.

- Increased Focus on Operational Efficiency: Companies in the U.S. have been focusing on improving operational efficiency due to increasing competition and rising operational costs. In 2024, U.S. manufacturing output exceeds $2.4 trillion, and sectors like manufacturing and logistics are adopting RPA to cut costs associated with manual errors and delays. RPA solutions in manufacturing help streamline production workflows, reducing processing times by up to 60%. Furthermore, businesses that have integrated RPA have experienced cost savings in operational budgets ranging from $30 billion to $50 billion annually, significantly enhancing their bottom line.

Challenges

- Integration with Legacy Systems: Over 60% of U.S. enterprises in industries such as healthcare, utilities, and finance rely on outdated IT infrastructure, creating barriers to seamless RPA deployment. In 2024, the cost of maintaining legacy systems in the U.S. is projected to reach $25 billion, which often exceeds the budget allocated for modernization. As a result, companies face high costs and delays when attempting to integrate RPA with older technologies, limiting the effectiveness of automation initiatives.

- Data Security Concerns: Data security remains a critical concern for companies implementing RPA, especially in sectors handling sensitive information like healthcare and finance. In 2024, the U.S. healthcare industry alone processes over 1 billion electronic health records annually, posing significant risks for data breaches. RPA systems, if not adequately secured, can become vulnerable to cyberattacks, potentially leading to millions in financial losses. The U.S. financial sector has seen a rise in cybersecurity budgets by $500 million, as businesses invest in safeguarding automated systems from data breaches and unauthorized access.

USA RPA Market Future Outlook

USA RPA Marketis expected to witness significant growth driven by increased adoption across small and medium-sized enterprises (SMEs) and advancements in AI and machine learning integrated RPA tools. As businesses increasingly look to optimize operations and reduce costs, the demand for RPA solutions is projected to expand across industries such as healthcare, retail, and logistics. Additionally, government initiatives to support digital transformation and automation in key sectors like BFSI and healthcare are expected to further fuel market growth.

Market Opportunities

- AI-Driven RPA: AI-driven RPA systems can handle more complex tasks, such as data analysis and decision-making, which were previously beyond the scope of traditional RPA solutions. In 2024, the U.S. AI market is valued at over $300 billion, and businesses in sectors like healthcare, finance, and retail are leveraging AI-enhanced RPA to improve efficiency and reduce operational errors. Companies investing in AI-driven RPA are expected to achieve cost savings of over $10 billion annually.

- Integration with Cloud Computing: The increasing adoption of cloud computing in the U.S. presents a significant opportunity for RPA providers. Cloud-based RPA solutions offer greater scalability, flexibility, and cost-efficiency compared to traditional on-premise deployments. In 2024, the U.S. cloud services market is expected to manage over $1.2 trillion in enterprise data, and businesses across industries are moving their RPA operations to the cloud. Cloud-based RPA solutions reduce infrastructure costs and improve deployment speed, allowing companies to scale their automation efforts more effectively.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Deployment |

On-Premises |

|

Cloud-Based |

|

|

Hybrid |

|

|

By Industry Vertical |

BFSI |

|

Healthcare |

|

|

Retail |

|

|

Manufacturing |

|

|

IT & Telecommunications |

|

|

By Organization Size |

Small and Medium Enterprises (SMEs) |

|

Large Enterprises |

|

|

By Solution Type |

Software |

|

Services |

|

|

Tools & Platforms |

|

|

By Process Type |

Attended Automation |

|

Unattended Automation |

|

|

Hybrid Automation |

Products

Key Target Audience

Automation Technology Vendors

IT Consulting Firms

Financial Services Institutions

Healthcare Service Providers

Large Enterprises

Small and Medium Enterprises (SMEs)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Trade Commission, Securities and Exchange Commission)

Companies

Players Mentioned in the Report

UiPath

Blue Prism

Automation Anywhere

Pegasystems

WorkFusion

NICE Systems

Kofax

AntWorks

EdgeVerve Systems

Kryon Systems

Table of Contents

1. USA RPA MarketOverview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA RPA MarketSize (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA RPA MarketAnalysis

3.1. Growth Drivers

3.1.1. Adoption in Banking, Financial Services, and Insurance (BFSI)

3.1.2. Demand for Workflow Optimization

3.1.3. Increased Focus on Operational Efficiency

3.1.4. Government Support for Automation

3.2. Market Challenges

3.2.1. Integration with Legacy Systems

3.2.2. Data Security Concerns

3.2.3. High Implementation Costs

3.2.4. Skill Shortages

3.3. Opportunities

3.3.1. AI-Driven RPA

3.3.2. Integration with Cloud Computing

3.3.3. Expansion into SMEs

3.3.4. Increased Use of Low-Code Platforms

3.4. Trends

3.4.1. AI-Enhanced RPA Systems

3.4.2. Hyperautomation

3.4.3. Cognitive Automation

3.4.4. Increased Focus on Scalability

3.5. Government Regulation

3.5.1. Data Protection Laws

3.5.2. Compliance Requirements in Finance and Healthcare

3.5.3. Automation Standardization Initiatives

3.5.4. Federal Funding for AI and Automation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA RPA MarketSegmentation

4.1. By Deployment (In Value %)

4.1.1. On-Premises

4.1.2. Cloud-Based

4.1.3. Hybrid

4.2. By Industry Vertical (In Value %)

4.2.1. BFSI

4.2.2. Healthcare

4.2.3. Retail

4.2.4. Manufacturing

4.2.5. IT & Telecommunications

4.3. By Organization Size (In Value %)

4.3.1. Small and Medium Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By Solution Type (In Value %)

4.4.1. Software

4.4.2. Services

4.4.3. Tools & Platforms

4.5. By Process Type (In Value %)

4.5.1. Attended Automation

4.5.2. Unattended Automation

4.5.3. Hybrid Automation

5. USA RPA MarketCompetitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. UiPath

5.1.2. Blue Prism

5.1.3. Automation Anywhere

5.1.4. Pegasystems

5.1.5. WorkFusion

5.1.6. NICE Systems

5.1.7. Kofax

5.1.8. EdgeVerve Systems

5.1.9. AntWorks

5.1.10. Kryon Systems

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Funding for RPA

5.8. Private Equity Investments in RPA Startups

6. USA RPA MarketRegulatory Framework

6.1. Data Privacy Regulations

6.2. Industry-Specific Compliance

6.3. Automation and Labor Laws

6.4. Certification and Standardization for Automation Tools

7. USA Robotic Process Automation Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Robotic Process Automation Future Market Segmentation

8.1. By Deployment (In Value %)

8.2. By Industry Vertical (In Value %)

8.3. By Organization Size (In Value %)

8.4. By Solution Type (In Value %)

8.5. By Process Type (In Value %)

9. USA RPA MarketAnalysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Targeting

9.3. White Space Opportunity Analysis

9.4. Future Business Models in RPA

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA RPA Market. This step is underpinned by extensive desk research, utilizing secondary sources like industry reports and proprietary databases. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data pertaining to the USA RPA market. This includes evaluating market adoption rates, industry penetration, and revenue generation patterns across various sectors. We also assessed the impact of emerging technologies on market dynamics to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with industry experts representing a diverse array of companies. These consultations provided valuable operational and financial insights directly from market practitioners, aiding in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved engaging with multiple RPA solution providers to acquire detailed insights into product segments, sales performance, and market trends. This interaction verified and complemented the statistics derived from our bottom-up approach, ensuring a comprehensive and validated analysis of the USA RPA market.

Frequently Asked Questions

1. How big is the USA Robotic Process Automation Market?

The USA RPA Marketis valued at USD 791 million, driven by widespread adoption in sectors such as BFSI, healthcare, and retail.

2. What are the challenges in the USA Robotic Process Automation Market?

Challenges in USA RPA Marketinclude high implementation costs, integration issues with legacy systems, and data security concerns, especially in highly regulated sectors like finance and healthcare.

3. Who are the major players in the USA Robotic Process Automation Market?

Key players in USA RPA Marketinclude UiPath, Blue Prism, Automation Anywhere, Pegasystems, and WorkFusion, with these companies dominating due to their innovative AI-driven solutions and strategic partnerships.

4. What are the growth drivers of the USA Robotic Process Automation Market?

Growth in USA RPA Marketis driven by the increasing demand for automation to optimize workflows, reduce operational costs, and enhance efficiency in key sectors like BFSI and healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.