USA Satellite Internet Market Outlook to 2030

Region:North America

Author(s):Mukul Soni

Product Code:KROD4854

December 2024

84

About the Report

USA Satellite Internet Market Overview

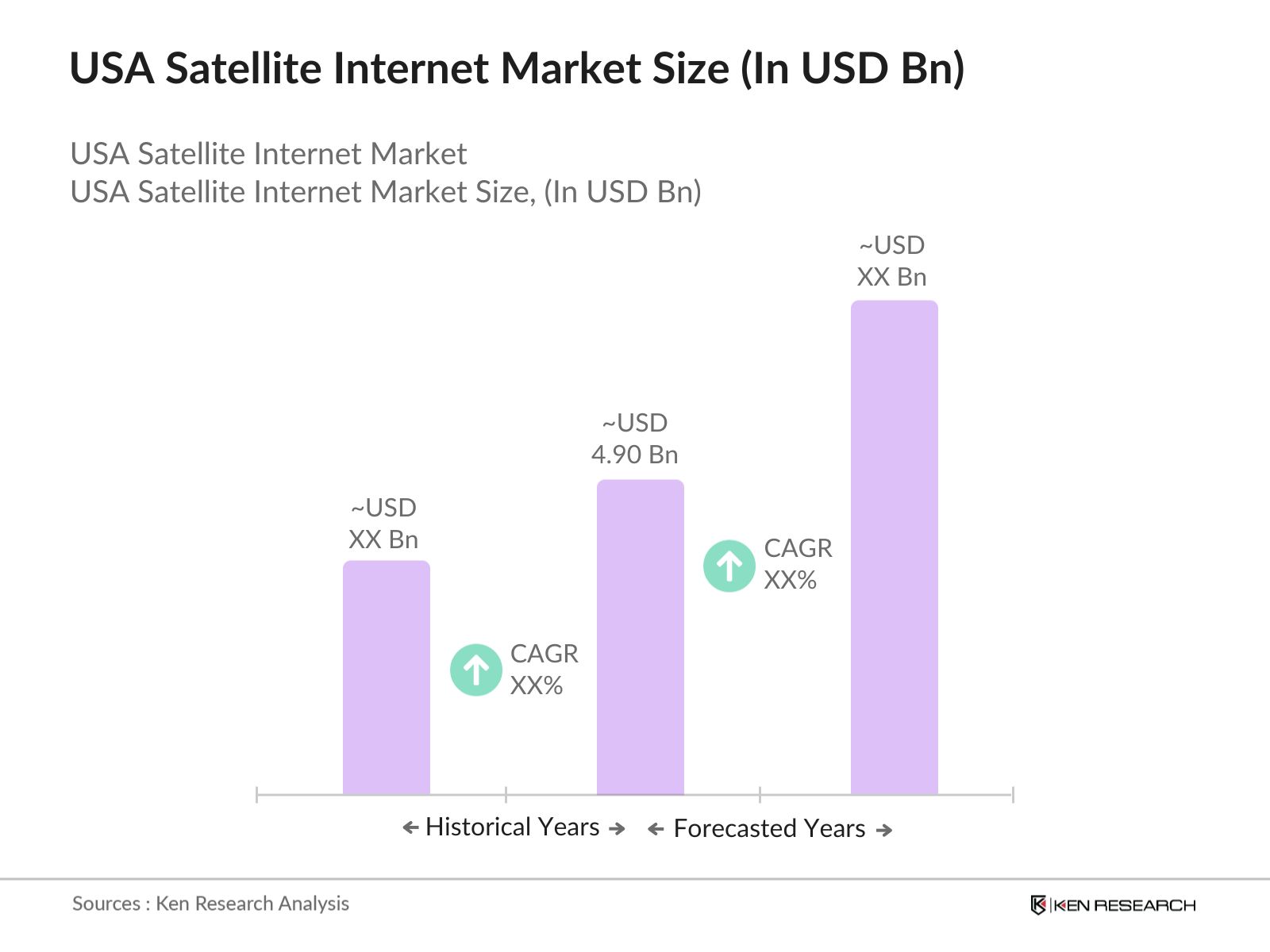

- The USA Satellite Internet market is valued at USD 4.90 billion, supported by robust infrastructure advancements and significant investment in satellite technology. The rapid development of Low Earth Orbit (LEO) satellite constellations by companies like SpaceXs Starlink and Amazons Project Kuiper has been a primary driver. These initiatives aim to provide high-speed internet access to underserved rural and remote areas. The combination of rising demand for broadband access and the increasing number of connected devices is fueling market expansion.

- In the USA, states such as California, Texas, and Florida, alongside other developed urban centers, dominate the satellite internet market. These areas benefit from well-established digital infrastructure, favorable government policies, and a high concentration of tech-savvy populations. Furthermore, rural states like Alaska and Montana are key areas of focus due to the high demand for reliable internet solutions in remote regions. The dominance of these regions is attributed to the strategic location for satellite infrastructure deployment and the presence of large consumer bases.

- The FCC plays a critical role in regulating spectrum allocations for satellite internet providers. In 2023, the FCC authorized several satellite operators to use Ka-band and V-band frequencies to meet the rising demand for satellite-based broadband. These allocations are essential for expanding satellite internet services, particularly in underserved rural areas. The FCC's spectrum policies aim to balance the needs of satellite operators, traditional telecommunications providers, and emerging technologies, ensuring that adequate bandwidth is available for all users.

USA Satellite Internet Market Segmentation

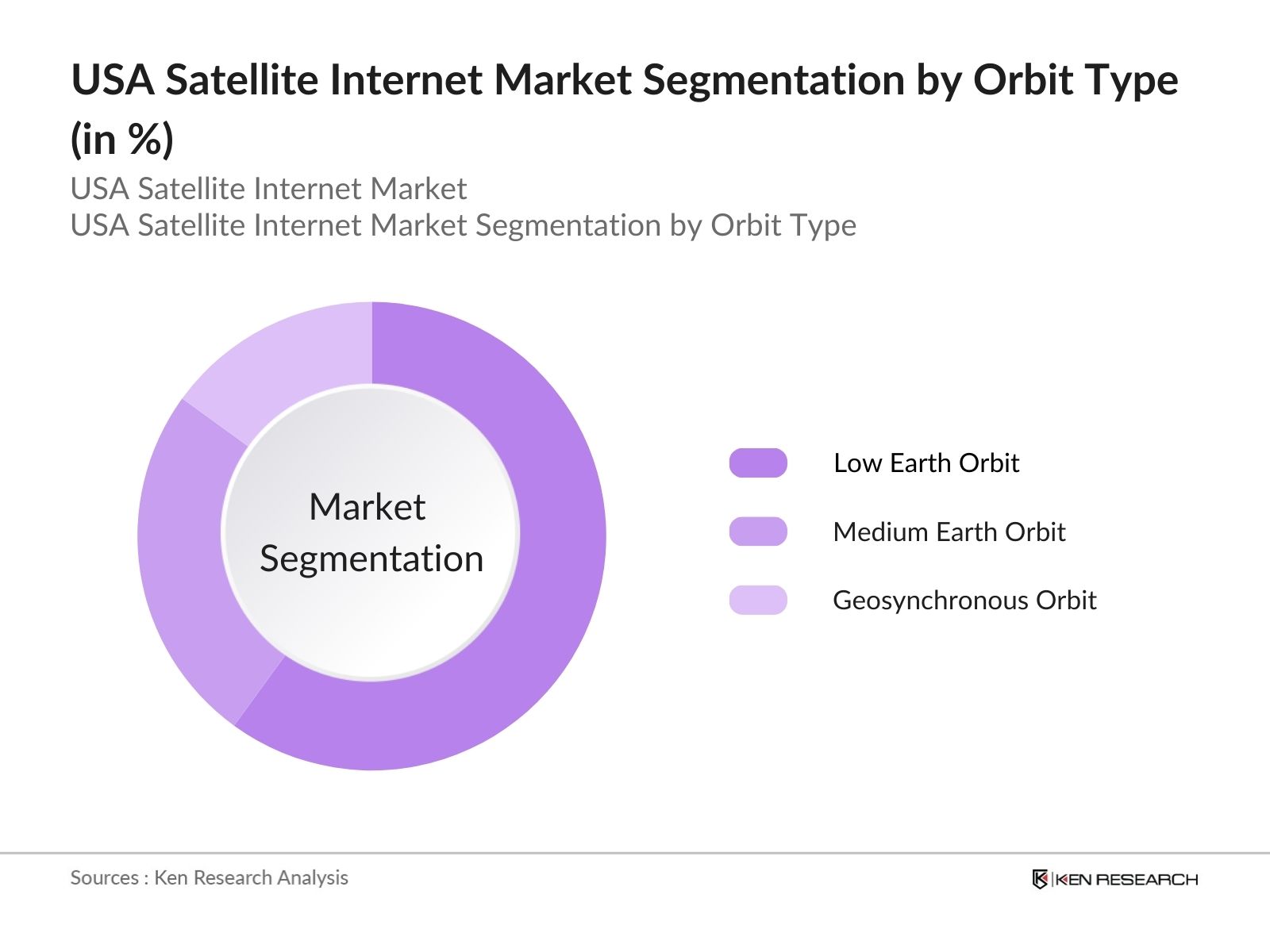

- By Orbit Type: The USA Satellite Internet market is segmented by orbit type into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geosynchronous Orbit (GEO). Currently, the LEO segment holds the dominant market share, driven by advancements in satellite technology and increasing investments by key players such as SpaceX and OneWeb. LEO satellites offer lower latency and higher speed, making them ideal for broadband applications. As a result, LEO satellites have gained popularity for providing internet to remote and underserved areas across the USA.

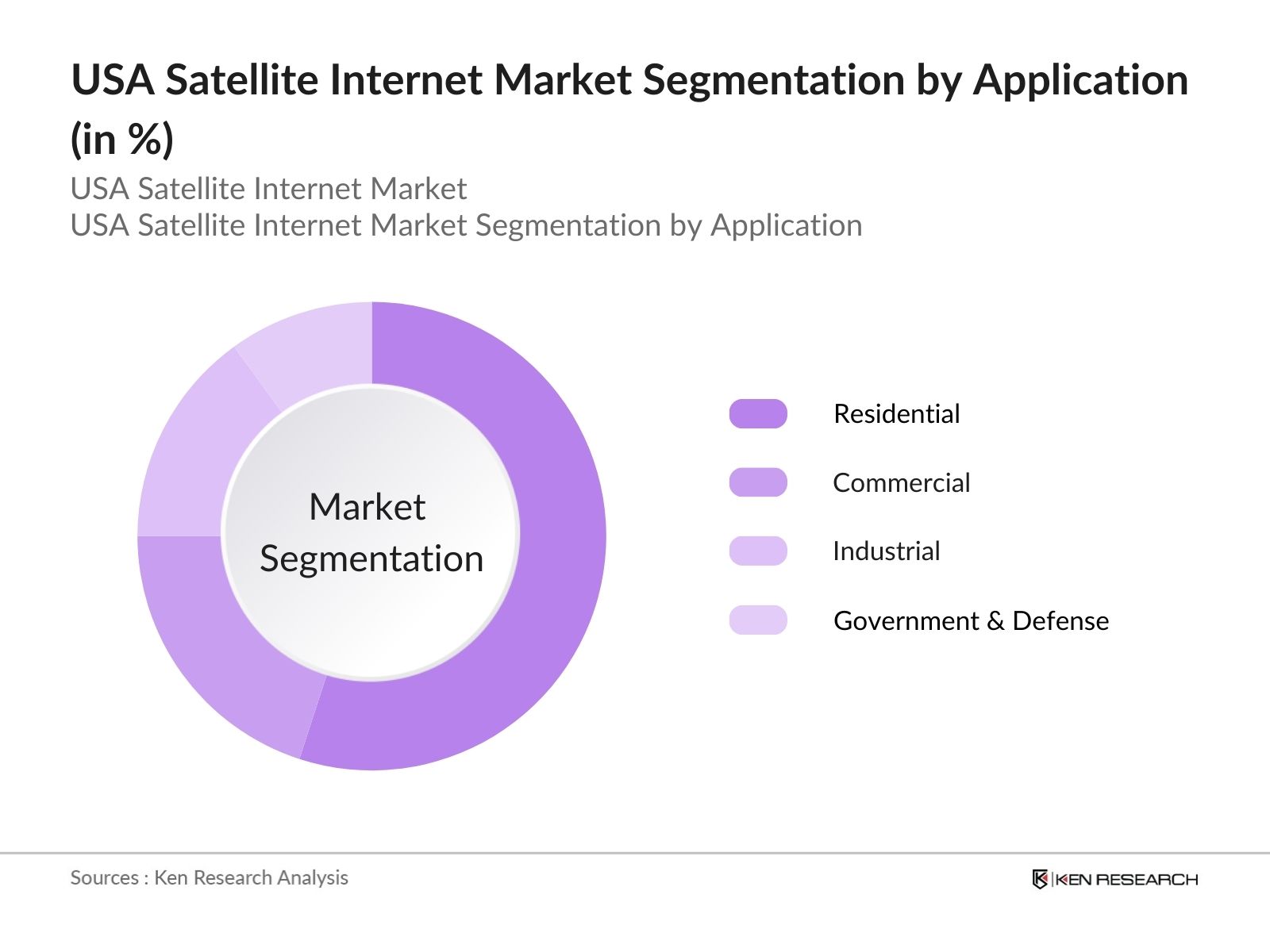

- By Application: The USA Satellite Internet market is segmented by application into Residential, Commercial, Industrial, and Government & Defense. The residential segment dominates the market due to the increasing demand for high-speed internet in remote and underserved areas. The expansion of satellite broadband services to rural regions and the growing need for reliable home internet connectivity post-pandemic have bolstered this segments growth. Consumers in these areas rely heavily on satellite internet for everyday connectivity, making it the largest sub-segment.

USA Satellite Internet Competitive Landscape

The USA Satellite Internet market is dominated by several major players, including both domestic and international companies. The leading companies include SpaceX (Starlink), Hughes Network Systems, and Amazons Project Kuiper. These players have built extensive satellite constellations to provide widespread internet coverage, particularly in remote and underserved areas. The market is consolidated, with key players focusing on expanding their satellite constellations and improving service reliability.

|

Company Name |

Establishment Year |

Headquarters |

Satellites Launched |

Frequency Band |

User Base (millions) |

Partnerships |

Services Offered |

Geographical Reach |

|

SpaceX (Starlink) |

2002 |

Hawthorne, CA |

- |

- |

- |

- |

- |

- |

|

Hughes Network Systems |

1971 |

Germantown, MD |

- |

- |

- |

- |

- |

- |

|

Amazon (Project Kuiper) |

2019 |

Seattle, WA |

- |

- |

- |

- |

- |

- |

|

OneWeb |

2012 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Viasat |

1986 |

Carlsbad, CA |

- |

- |

- |

- |

- |

- |

USA Satellite Internet Industry Analysis

Market Growth Drivers

- Increasing Broadband Demand (Urban and Rural Accessibility): The demand for broadband access continues to grow in the U.S. due to the increasing reliance on high-speed internet in both urban and rural areas. As of 2023, the FCC reports that over 14 million Americans in rural areas still lack access to broadband internet services, creating a strong demand for satellite-based solutions to bridge the gap. This demand is further intensified by the growing reliance on remote work, online education, and telemedicine, particularly in underserved rural regions. The Biden administration's Infrastructure Investment and Jobs Act allocates $65 billion to expand broadband access across the country, bolstering satellite internet infrastructure.

- Advancements in Low Earth Orbit (LEO) Satellites: The development and deployment of LEO satellites have revolutionized satellite internet. Companies like SpaceX's Starlink and Amazon's Project Kuiper are deploying thousands of LEO satellites to provide faster internet with reduced latency. NASA reports that LEO satellite constellations could deliver global internet coverage, benefiting areas with limited fiber infrastructure. By 2023, over 3,500 Starlink satellites were operational, providing internet to more than a million users globally, including remote U.S. regions. LEO satellites offer significantly lower latency (25-50 milliseconds) compared to traditional geostationary satellites, making satellite internet a competitive option in underserved areas.

- Government Subsidies for Rural Internet Infrastructure: The U.S. government has increased subsidies for expanding internet access in rural areas through programs like the Rural Digital Opportunity Fund (RDOF). In 2023, RDOF awarded $9.2 billion to service providers, enabling infrastructure expansion in rural America. These funds are designed to improve access to high-speed internet in remote areas through satellite technology. The goal is to deliver broadband speeds of at least 25 Mbps to underserved rural regions, with satellite internet playing a pivotal role in achieving this. This initiative aims to reduce the digital divide, enhancing economic opportunities for rural communities.

Market Restraints

- Limited Bandwidth and Latency Issues: Although satellite internet technology has advanced, bandwidth limitations and latency remain challenges, particularly in high-demand areas. The FCC notes that signal interference from weather conditions like heavy rain and snow can degrade satellite internet performance, resulting in slower speeds and higher latency. For example, geostationary satellites, positioned over 22,000 miles from Earth, suffer from latency times of 600-800 milliseconds, which can hinder real-time applications like online gaming or video conferencing. LEO satellites have improved latency, but atmospheric conditions and congestion in certain frequency bands can still cause bandwidth constraints.

- Geopolitical Challenges: Geopolitical tensions and regulatory barriers present significant challenges for satellite internet providers. Spectrum allocation, managed by the International Telecommunication Union (ITU), is a critical issue as countries compete for bandwidth in the radio frequency spectrum. Cross-border licensing agreements are also complex, particularly for LEO satellite constellations that require coordination across multiple jurisdictions. The ITU's 2023 guidelines emphasize the need for global cooperation to ensure equitable spectrum allocation, but political disagreements among major powers like the U.S., China, and Russia complicate these efforts.

USA Satellite Internet Market Future Outlook

Over the next five years, the USA Satellite Internet market is expected to witness substantial growth, driven by increasing government support, the rapid deployment of satellite constellations, and the rising demand for high-speed internet in remote regions. The expansion of LEO satellites by companies like SpaceX, OneWeb, and Amazon is expected to significantly enhance internet coverage, offering high-speed broadband services in areas previously lacking connectivity. The continued development of 5G technology and its integration with satellite services will further boost the market's expansion.

Market Opportunities

- Expansion of LEO and MEO Constellations: The expansion of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations represents a major opportunity for the U.S. satellite internet market. By 2023, companies such as SpaceX and OneWeb had launched over 4,500 LEO satellites collectively, with plans to expand these networks to tens of thousands of satellites by 2025. The FCC has granted approval for several new constellations, ensuring that LEO and MEO satellites will play an increasingly critical role in providing global internet coverage, particularly in underserved rural regions where terrestrial infrastructure is lacking.

- Partnerships with Telecommunications Companies: Partnerships between satellite internet providers and traditional telecommunications companies offer promising opportunities to create hybrid solutions combining fiber-optic and satellite networks. In 2023, the FCC reported a surge in such collaborations, particularly in remote regions where extending fiber-optic networks alone is cost-prohibitive. Hybrid networks can provide more reliable and faster internet services by using fiber for high-demand urban areas and satellites for rural or hard-to-reach locations. These partnerships are likely to drive the next phase of satellite internet expansion in the U.S., especially in regions where traditional infrastructure development has lagged.

Scope of the Report

|

Orbit Type |

Low Earth Orbit (LEO) Medium Earth Orbit (MEO) Geosynchronous Orbit (GEO) |

|

Application |

Residential Commercial Industrial Government & Defense |

|

Frequency Band |

Ka-Band Ku-Band C-Band V-Band |

|

Service Type |

Direct-to-Home (DTH) VSAT Broadband Satellite Services |

|

End-User |

Maritime Aviation Enterprise Networks Government and Military |

Products

Key Target Audience

Internet Service Providers (ISPs)

Satellite Operators

Telecommunications Companies

Government and Regulatory Bodies (FCC, ITU)

Defense Contractors

Maritime and Aviation Companies

Investments and Venture Capital Firms

Equipment Manufacturers

Companies

Players Mentioned in the Report:

SpaceX (Starlink)

Hughes Network Systems

Amazon (Project Kuiper)

OneWeb

Viasat

Globalstar

SES S.A.

Telesat

Eutelsat

Inmarsat

Iridium Communications

AST SpaceMobile

Skylo Technologies

Kepler Communications

Swarm Technologies

Table of Contents

1. USA Satellite Internet Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Satellite Internet Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Satellite Internet Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Broadband Demand (Urban and Rural Accessibility)

3.1.2. Advancements in Low Earth Orbit (LEO) Satellites

3.1.3. Government Subsidies for Rural Internet Infrastructure

3.1.4. Rising Number of Internet-Enabled Devices (IoT Proliferation)

3.2. Market Challenges

3.2.1. High Operational Costs (Satellite Launch Costs, Maintenance)

3.2.2. Limited Bandwidth and Latency Issues (Signal Interference, Atmospheric Conditions)

3.2.3. Geopolitical Challenges (Spectrum Regulation, Cross-border Licensing)

3.3. Opportunities

3.3.1. Expansion of LEO and MEO Constellations

3.3.2. Partnerships with Telecommunications Companies (Fiber-Satellite Hybrid Solutions)

3.3.3. Growing Demand for Commercial and Maritime Applications

3.4. Trends

3.4.1. Adoption of Ka-Band and V-Band Frequencies

3.4.2. Integration of Artificial Intelligence (AI) for Network Optimization

3.4.3. Usage of Satellite Internet in Disaster Recovery Scenarios

3.4.4. Shift towards Low Latency Communication

3.5. Government Regulations

3.5.1. Federal Communications Commission (FCC) Spectrum Allocations

3.5.2. Rural Digital Opportunity Fund (RDOF)

3.5.3. International Telecommunication Union (ITU) Guidelines on Satellite Coordination

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Satellite Operators, Service Providers, Consumers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Satellite Internet Market Segmentation

4.1. By Orbit Type (In Value %)

4.1.1. Low Earth Orbit (LEO) Satellites

4.1.2. Medium Earth Orbit (MEO) Satellites

4.1.3. Geosynchronous Orbit (GEO) Satellites

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Government & Defense

4.3. By Frequency Band (In Value %)

4.3.1. Ka-Band

4.3.2. Ku-Band

4.3.3. C-Band

4.3.4. V-Band

4.4. By Service Type (In Value %)

4.4.1. Direct-to-Home (DTH)

4.4.2. VSAT (Very Small Aperture Terminal)

4.4.3. Broadband Satellite Services

4.5. By End-User (In Value %)

4.5.1. Maritime

4.5.2. Aviation

4.5.3. Enterprise Networks

4.5.4. Government and Military

5. USA Satellite Internet Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SpaceX (Starlink)

5.1.2. OneWeb

5.1.3. Amazon (Project Kuiper)

5.1.4. Hughes Network Systems

5.1.5. Viasat

5.1.6. Globalstar

5.1.7. SES S.A.

5.1.8. Telesat

5.1.9. Eutelsat

5.1.10. Inmarsat

5.1.11. Iridium Communications

5.1.12. AST SpaceMobile

5.1.13. Skylo Technologies

5.1.14. Kepler Communications

5.1.15. Swarm Technologies

5.2. Cross Comparison Parameters (No. of Satellites Launched, Satellite Constellation, Frequency Band Usage, Service Offering, Revenue, No. of Users, Partnership Networks, Geographical Coverage)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Satellite Internet Market Regulatory Framework

6.1. Spectrum Allocation and Licensing Procedures

6.2. Satellite Launch Regulations

6.3. Data Privacy and Security Standards

6.4. Certification Processes

7. USA Satellite Internet Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Satellite Internet Future Market Segmentation

8.1. By Orbit Type (In Value %)

8.2. By Application (In Value %)

8.3. By Frequency Band (In Value %)

8.4. By Service Type (In Value %)

8.5. By End-User (In Value %)

9. USA Satellite Internet Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Satellite Internet Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Satellite Internet Market. This includes assessing market penetration, the ratio of marketplace offerings to service providers, and the resultant revenue generation. An evaluation of network performance metrics will also be conducted to ensure the accuracy of revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple satellite operators and internet service providers to acquire detailed insights into their network operations, product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from a bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the USA Satellite Internet market.

Frequently Asked Questions

01. How big is the USA Satellite Internet Market?

The USA Satellite Internet market is valued at USD 4.90 billion, driven by increasing demand for high-speed broadband services in rural and remote areas. Major players like SpaceX and OneWeb are expanding their satellite constellations to meet this demand.

02. What are the challenges in the USA Satellite Internet Market?

Challenges include high satellite deployment costs, limited bandwidth in densely populated areas, and the complexity of managing satellite constellations. Additionally, there are regulatory challenges related to spectrum allocation and cross-border satellite coordination.

03. Who are the major players in the USA Satellite Internet Market?

Key players in the USA Satellite Internet market include SpaceX (Starlink), Hughes Network Systems, Amazon (Project Kuiper), OneWeb, and Viasat. These companies dominate due to their extensive satellite networks and partnerships with government agencies and telecommunications firms.

04. What are the growth drivers of the USA Satellite Internet Market?

The market is driven by increasing demand for broadband access in rural areas, technological advancements in satellite infrastructure, and government initiatives like the Rural Digital Opportunity Fund, which aims to expand internet coverage across underserved regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.