USA Secondhand Luxury Goods Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD10418

November 2024

95

About the Report

USA Secondhand Luxury Goods Market Overview

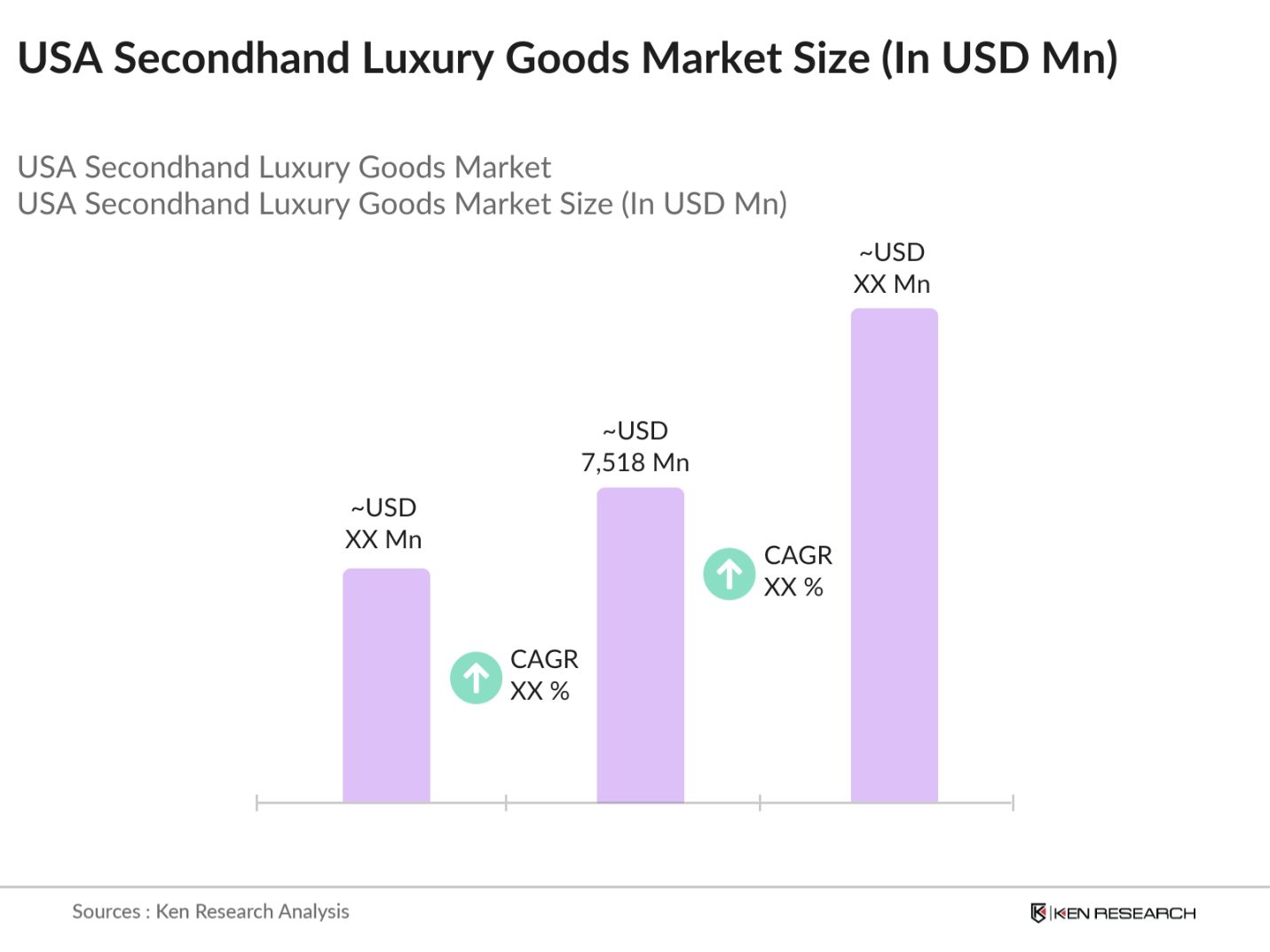

- The USA Secondhand Luxury Goods market is valued at USD 7,518 million, based on a five-year historical analysis. This markets growth is propelled by the rising consumer focus on sustainability, the affordability of pre-owned luxury items, and the increasing popularity of online resale platforms. The demand for authenticated, high-quality secondhand luxury products is particularly high in metropolitan areas, where consumers seek premium brands at accessible prices, making this market a central part of the circular economy within the luxury sector.

- Major metropolitan areas such as New York, Los Angeles, and Miami dominate the market. These cities have a high concentration of affluent consumers, robust retail infrastructures, and a strong cultural inclination towards luxury fashion, making them pivotal hubs for secondhand luxury transactions.

- Environmental policies are being tailored to address the impact of the luxury sector on ecological sustainability. The 2024 European Green Deal mandates that luxury brands maintain sustainable practices, including reducing waste and emissions. Countries like Japan and South Korea have also implemented policies promoting recycling and reuse within the luxury market, aligning with global sustainability goals.

USA Secondhand Luxury Goods Market Segmentation

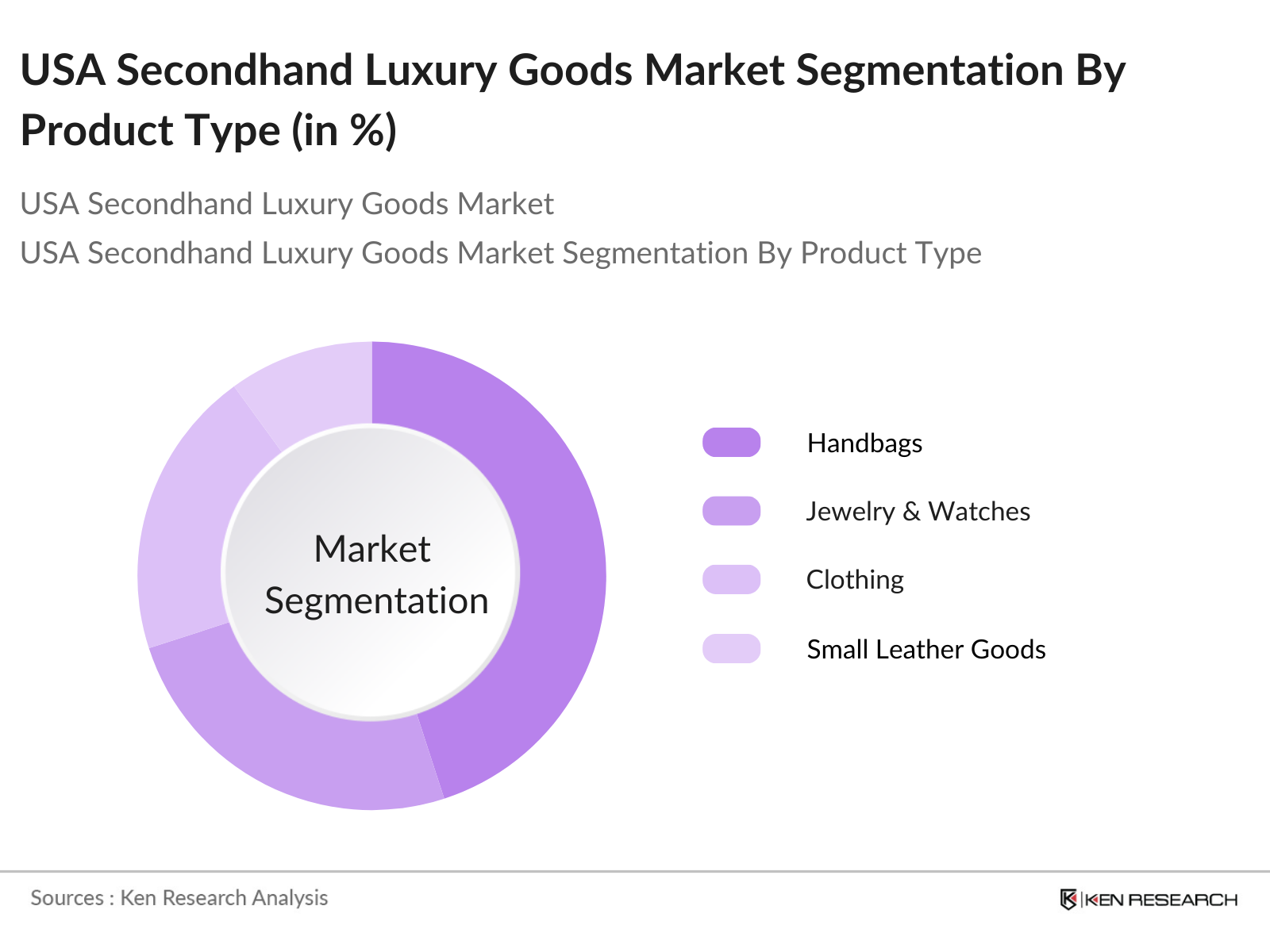

By Product Type: The U.S. secondhand luxury goods market is segmented by product type into handbags, jewelry & watches, clothing, small leather goods, footwear, accessories, and others. Handbags hold a dominant market share due to their enduring popularity and status as fashion statements. Brands like Louis Vuitton and Chanel have established strong brand loyalty, contributing to the dominance of this segment.

By Distribution Channel: The market is also segmented by distribution channel into offline and online platforms. Online channels have gained a significant market share, driven by the convenience of e-commerce and the rise of dedicated resale platforms. Consumers appreciate the wide selection and ease of access provided by online marketplaces, leading to their prominence in the market.

USA Secondhand Luxury Goods Market Competitive Landscape

The USA secondhand luxury goods market is dominated by key players that continuously innovate in authentication technologies, marketing strategies, and partnerships to strengthen their foothold. Companies like The RealReal and Fashionphile lead the market, focusing on rigorous authentication processes to ensure the quality and authenticity of their products. Other major players, such as Rebag and Vestiaire Collective, emphasize online platform development, enhancing accessibility and convenience for consumers.

USA Secondhand Luxury Goods Industry Analysis

Growth Drivers

- Sustainability Awareness: Increased sustainability awareness is impacting consumer behavior in the luxury goods market. According to the United Nations Environment Programme (UNEP), the fashion industry emits an estimated 2 billion metric tons of CO annually, driving demand for more sustainable options in 2024. Consumers are increasingly seeking eco-friendly, pre-owned luxury products. A 2024 report from the UN also indicates that over 90 million tons of waste are generated by the fashion sector yearly, prompting regulatory bodies in developed economies to enforce sustainability in luxury goods.

- Affordability of Luxury Goods: Economic shifts and rising income inequality, as reported by the World Bank, have led consumers to seek affordable luxury alternatives. The median household income in many developed economies has stagnated, making consumers more inclined to invest in pre-owned luxury items rather than new ones. In the U.S., average disposable income adjusted for inflation grew only by 0.7% in 2024, making pre-owned items a viable choice for aspirational buyers. This trend is supported by policies to promote affordability and accessibility in luxury consumption.

- Expansion of Online Platforms: The adoption of online luxury marketplaces has surged in response to increased internet penetration. Data from the International Telecommunication Union (ITU) shows global internet users reached 5.3 billion in 2024, significantly driving e-commerce for pre-owned luxury goods. Furthermore, mobile penetration has risen in emerging markets, with Africa reporting over 1 billion mobile users in 2024, thus expanding the consumer base for online platforms. Government policies encouraging digital transformation are further supporting this trend.

Market Challenges

- Counterfeit Products: The luxury market faces challenges with counterfeiting. Interpol estimates that over 1.3 million counterfeit luxury items are seized annually, with significant impacts on the markets credibility and consumer trust. Governments are enforcing stricter import regulations and authentication requirements to curb counterfeiting, which has cost the luxury market billions annually. In 2024, the European Union introduced stricter penalties for counterfeit production and distribution to address this issue.

- Quality and Condition Variability: Quality assurance is a persistent issue in the pre-owned luxury market. In 2024, the Bureau of Standards published findings that showed only 60% of pre-owned luxury items met original quality standards. The lack of consistent quality checks affects consumer trust, especially in high-income regions like North America and Europe, where demand for high-quality goods is significant. Government standards and stricter quality regulations have been proposed to address these inconsistencies.

USA Secondhand Luxury Goods Market Future Outlook

Over the next five years, the U.S. secondhand luxury goods market is expected to show significant growth, driven by continuous consumer interest in sustainable fashion, advancements in authentication technologies, and the expansion of online resale platforms. The market is projected to reach USD 15.16 billion, reflecting a compound annual growth rate (CAGR) of 7.9%.

Market Opportunities

- Technological Advancements in Authentication: Advancements in technology, including blockchain and AI, are helping the luxury market authenticate pre-owned items with higher precision. Blockchain verification initiatives are being adopted by over 300 luxury brands globally, as reported by the 2024 Blockchain Alliance. The technology enables traceability and authentication, thus increasing consumer confidence in pre-owned luxury items.

- Collaborations with Traditional Retailers: Collaborations between online platforms and brick-and-mortar luxury retailers are expanding the reach of pre-owned luxury goods. According to the National Retail Federation (NRF), nearly 150 major retail brands partnered with online resale platforms in 2024. This integration helps increase accessibility and trust by leveraging physical retail networks, especially in developed markets like the U.S.

Scope of the Report

|

Product Type |

Handbags |

|

Demography |

Women |

|

Distribution Channel |

Offline |

|

Region |

Northeast |

Products

Key Target Audience

Luxury Brand Manufacturers

Online Resale Platforms

Brick-and-Mortar Retailers

Authentication Service Providers

Logistics and Supply Chain Companies

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Trade Commission)

Consumer Advocacy Groups

Companies

Players Mentioned in the Report

The RealReal

Fashionphile

Rebag

Vestiaire Collective

Tradesy

Poshmark

ThredUp

Grailed

StockX

Luxury Garage Sale

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Sustainability Awareness

3.1.2 Affordability of Luxury Goods

3.1.3 Expansion of Online Platforms

3.1.4 Influence of Social Media and Influencers

3.2 Market Challenges

3.2.1 Counterfeit Products

3.2.2 Quality and Condition Variability

3.2.3 Limited Warranty and Returns

3.3 Opportunities

3.3.1 Technological Advancements in Authentication

3.3.2 Collaborations with Traditional Retailers

3.3.3 Expansion into Emerging Markets

3.4 Trends

3.4.1 Growth of Circular Fashion Economy

3.4.2 Increased Consumer Trust in Pre-owned Goods

3.4.3 Rise of Luxury Rental Services

3.5 Government Regulations

3.5.1 Import and Export Policies

3.5.2 Consumer Protection Laws

3.5.3 Environmental Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Handbags

4.1.2 Jewelry & Watches

4.1.3 Clothing

4.1.4 Small Leather Goods

4.1.5 Footwear

4.1.6 Accessories

4.1.7 Others

4.2 By Demography (Value %)

4.2.1 Women

4.2.2 Men

4.2.3 Unisex

4.3 By Distribution Channel (Value %)

4.3.1 Offline

4.3.2 Online

4.4 By Region (Value %)

4.4.1 Northeast

4.4.2 Midwest

4.4.3 South

4.4.4 West

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 The RealReal Inc.

5.1.2 Vestiaire Collective

5.1.3 Fashionphile Group LLC

5.1.4 Rebag

5.1.5 The Luxury Closet

5.1.6 Chrono24

5.1.7 Yoogi's Closet

5.1.8 StockX

5.1.9 Hardly Ever Worn It

5.1.10 LuxeDH

5.1.11 Tradesy

5.1.12 Poshmark

5.1.13 Grailed

5.1.14 ThredUp

5.1.15 Luxury Garage Sale

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, Online Presence, Customer Reviews)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Future Market Size (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By Demography (Value %)

8.3 By Distribution Channel (Value %)

8.4 By Region (Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. secondhand luxury goods market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. secondhand luxury goods market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple secondhand luxury goods platforms to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. secondhand luxury goods market.

Frequently Asked Questions

01. How big is the U.S. secondhand luxury goods market?

The USA Secondhand Luxury Goods market is valued at USD 7,518 million, based on a five-year historical analysis. This markets growth is propelled by the rising consumer focus on sustainability, the affordability of pre-owned luxury items, and the increasing popularity of online resale platforms.

02. What are the challenges in the U.S. secondhand luxury goods market?

The U.S. secondhand luxury goods market faces challenges such as the presence of counterfeit goods, quality variability, and limited warranty options. Additionally, ensuring authentication remains critical to build consumer trust in the resale segment.

03. Who are the major players in the U.S. secondhand luxury goods market?

Key players in the market include The RealReal, Fashionphile, Rebag, Vestiaire Collective, and Tradesy. These companies lead due to their strong authentication processes, expansive online presence, and loyal customer base.

04. What are the growth drivers of the U.S. secondhand luxury goods market?

Growth drivers include increased consumer interest in sustainable fashion, the affordability of pre-owned luxury products, and the rise of specialized resale platforms. The digital shift has also made secondhand luxury goods more accessible to a wider audience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.