USA Shooting Range Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD6289

December 2024

86

About the Report

USA Shooting Range Market Overview

- The USA Shooting Range Market is valued at USD 570 million, based on a five-year historical analysis. This market is primarily driven by a rising demand for personal and professional firearm training, fueled by increased interest in self-defense and recreational shooting activities. Moreover, shooting sports are becoming increasingly popular, with more individuals engaging in competitive shooting events. Law enforcement agencies and military departments also contribute significantly to market demand by upgrading training facilities with modern equipment and technologies.

- Several regions in the USA, particularly Texas, California, and Florida, dominate the shooting range market. This is largely due to a combination of factors, including favorable gun laws, a strong culture of hunting and shooting sports, and the presence of large military bases. These states have the infrastructure to support both indoor and outdoor shooting ranges, catering to a wide array of customers ranging from recreational users to professionals.

- The demand for outdoor shooting ranges is expected to grow as more states invest in expanding their recreational shooting facilities. In 2023, the U.S. Fish and Wildlife Service (USFWS) allocated $100 million for outdoor shooting range development under the Wildlife and Sport Fish Restoration Program. This funding supports the construction and enhancement of ranges, especially in rural areas where land availability is greater. The increase in outdoor ranges also caters to recreational hunters and shooting sports enthusiasts who prefer open-air environments, providing a new growth segment for range operators.

USA Shooting Range Market Segmentation

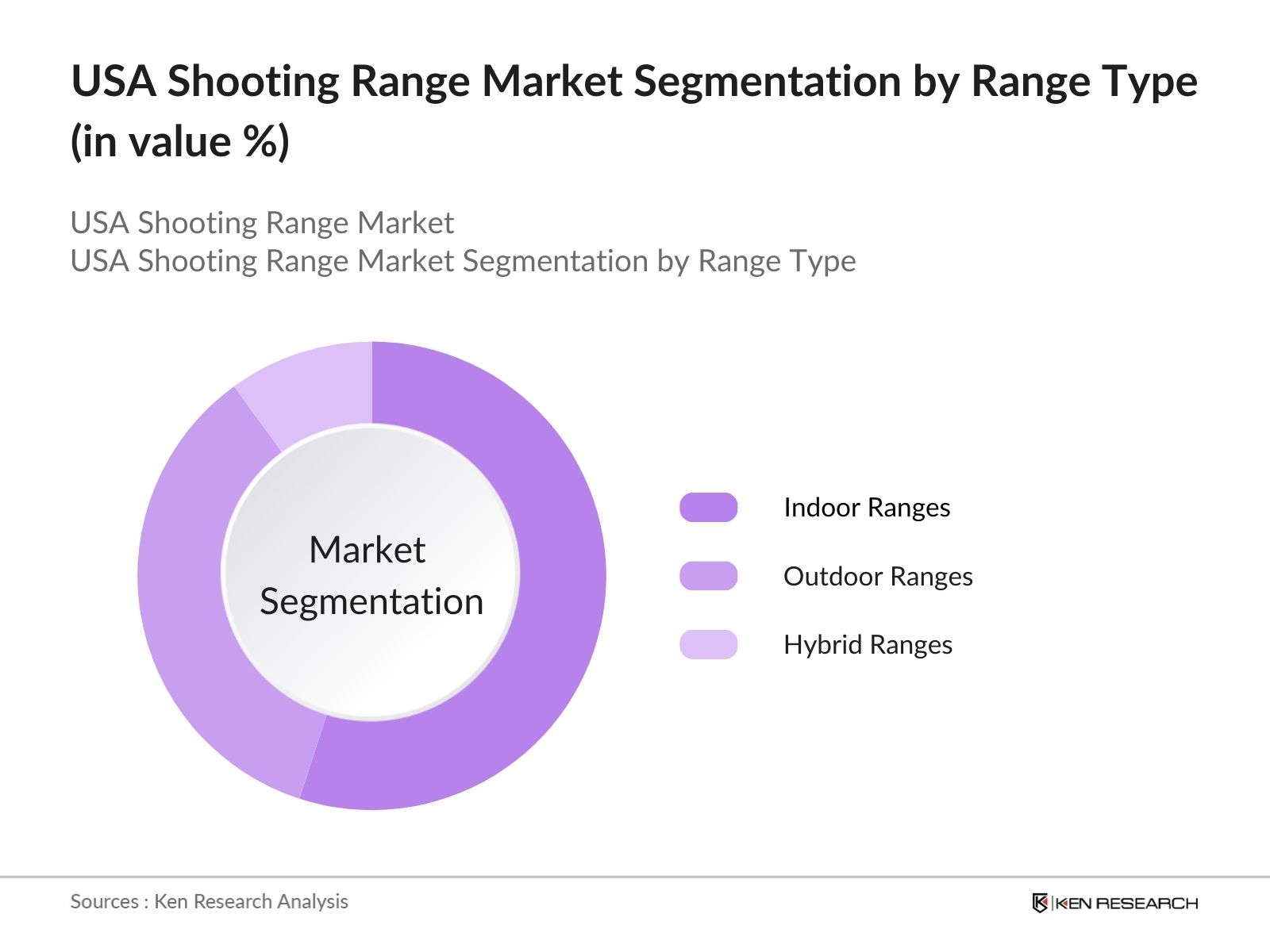

By Range Type: The Market is segmented by range type into Indoor Ranges, Outdoor Ranges, and Hybrid Ranges. Currently, Indoor Ranges hold a dominant market share due to their ability to operate year-round, regardless of weather conditions, and their growing presence in urban areas. These ranges are particularly popular among recreational users and law enforcement agencies, as they offer controlled environments for training and practice. The availability of advanced air filtration systems and noise-reduction technologies also makes indoor ranges more appealing to those in densely populated areas.

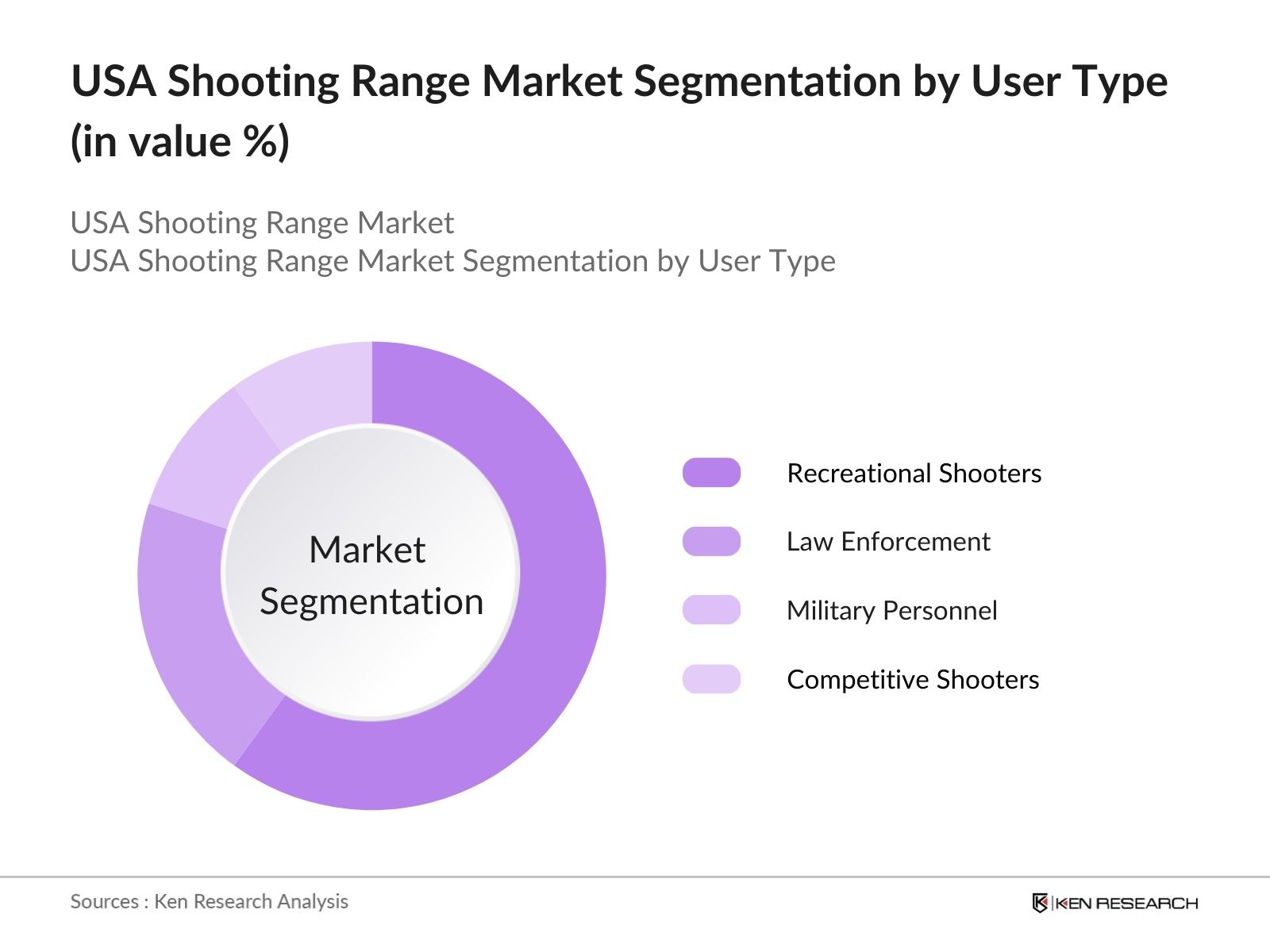

By User Type: The Market is also segmented by user type into Recreational Shooters, Law Enforcement, Military Personnel, and Competitive Shooters. Recreational Shooters dominate the market due to the growing interest in shooting as a leisure activity, coupled with the increasing number of shooting clubs and private memberships across the country. The rise of firearm ownership for personal safety and hobby shooting has further accelerated the growth of this segment, especially in states with permissive gun laws.

USA Shooting Range Market Competitive Landscape

The USA Shooting Range Market is dominated by a mix of local and national players, ranging from private shooting range operators to equipment manufacturers. The landscape is highly fragmented, with key players offering a range of services, from high-tech indoor ranges to expansive outdoor facilities. Additionally, partnerships with law enforcement agencies and military institutions give some companies a competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

Market Segment Focus |

No. of Ranges |

Key Technologies |

Revenue (USD Bn) |

Geographic Reach |

Equipment Offerings |

R&D Expenditure |

|

Action Target Inc. |

1986 |

Provo, Utah |

|||||||

|

Range Systems Inc. |

1994 |

Minneapolis, MN |

|||||||

|

Savage Range Systems |

1991 |

Westfield, MA |

|||||||

|

Meggitt Training Systems |

1920 |

Suwanee, GA |

|||||||

|

Shoot Point Blank |

2012 |

Cincinnati, OH |

USA Shooting Range Industry Analysis

Growth Drivers

- Increased Demand for Training Facilities: The rise in the number of individuals seeking firearm training across the USA has spurred demand for shooting range facilities. In 2022, the Federal Bureau of Investigation (FBI) processed over 31 million firearm background checks, reflecting heightened interest in firearm ownership. Training programs for beginners and experienced shooters, particularly in urban areas, are in demand. Additionally, the National Shooting Sports Foundation (NSSF) reported that nearly 5.4 million first-time gun buyers were added to the market in 2023, requiring access to safe and regulated training environments. This supports shooting range growth as more people seek professional training.

- Rising Popularity of Competitive Shooting Sports: Competitive shooting sports are on the rise in the U.S., driven by both professional and amateur interest. The National Rifle Association (NRA) reported an increase in the number of registered competitive shooting events, with over 13,000 events in 2023. Furthermore, shooting disciplines such as skeet and trap shooting have seen growing participation, with over 4 million athletes actively competing in these sports. This has led to the development of shooting ranges to cater specifically to competitive training and tournaments, thereby creating new revenue opportunities for range operators.

- Growth in Self-Defense and Safety Courses: With self-defense training becoming a priority for many Americans, shooting ranges have seen a notable increase in demand for safety and defensive shooting courses. In 2023, it was estimated that nearly 5 million people participated in courses designed to improve their proficiency in handling firearms for self-defense purposes. Law enforcement bodies have also emphasized the importance of such training, with local police departments offering subsidized safety courses in partnership with shooting ranges. This surge in course participation highlights the growing need for accessible and well-maintained shooting facilities across the country.

Market Challenges

- High Cost of Setup and Maintenance: Setting up a shooting range requires substantial capital investment, with costs varying based on the type of facility. For indoor ranges, construction costs can range from $500,000 to $3 million depending on location, size, and amenities, according to industry estimates from 2023. Maintenance costs, particularly for lead cleanup, HVAC systems, and ballistic containment structures, add an additional operational expense that ranges between $50,000 and $150,000 annually. These high costs limit the number of new ranges being established and put financial strain on small to mid-sized operators, slowing market expansion.

- Liability and Safety Concerns: Operating a shooting range involves significant liability risks due to the inherent dangers associated with firearms. According to data from the Insurance Information Institute (III), shooting ranges in 2023 faced liability premiums ranging from $10,000 to $100,000 annually, depending on their size and clientele. Safety concerns, including accidental discharges and improper firearm handling, have led to increased scrutiny, making it essential for range operators to implement stringent safety measures and maintain adequate insurance coverage. The high cost of liability insurance and safety equipment can be prohibitive, especially for smaller ranges.

USA Shooting Range Market Future Outlook

Over the next five years, the USA Shooting Range Market is expected to show steady growth driven by increasing consumer demand for recreational shooting, advancements in range safety technology, and strong government support for law enforcement and military training programs. The expansion of virtual and augmented reality-based shooting simulators is likely to further enhance user experiences and attract more customers. Additionally, rising awareness of firearm safety and the importance of professional training will continue to drive demand for both indoor and outdoor ranges.

Future Market Opportunities

- Growth in Outdoor Range Infrastructure: The demand for outdoor shooting ranges is expected to grow as more states invest in expanding their recreational shooting facilities. In 2023, the U.S. Fish and Wildlife Service (USFWS) allocated $100 million for outdoor shooting range development under the Wildlife and Sport Fish Restoration Program. This funding supports the construction and enhancement of ranges, especially in rural areas where land availability is greater. The increase in outdoor ranges also caters to recreational hunters and shooting sports enthusiasts who prefer open-air environments, providing a new growth segment for range operators.

- Partnerships with Law Enforcement and Military: Collaborations between shooting ranges and law enforcement agencies present significant market opportunities. In 2023, over 1,000 shooting ranges across the U.S. partnered with local police departments and military units for specialized training programs. These partnerships provide a steady revenue stream for range operators and ensure consistent use of facilities during non-peak hours. Moreover, military programs such as the U.S. Armys Train as You Fight initiative, which emphasizes realistic combat training scenarios, have increased the demand for advanced, simulation-capable ranges, further boosting opportunities in this sector.

Scope of the Report

|

Range Type |

Indoor Ranges Outdoor Ranges Hybrid Ranges |

|

User Type |

Recreational Shooters Law Enforcement Military Personnel Competitive Shooters |

|

Equipment |

Firearms Targets & Target Systems Range Safety Equipment Ammunition |

|

Technology |

Electronic Target Systems Simulation-Based Training Mobile App Integration Range Management Systems |

|

Region |

West Coast Midwest East Coast South Southwest |

Products

Key Target Audience

Shooting Range Operators

Law Enforcement Agencies (FBI, Homeland Security)

Military Training Institutions (US Army, US Marine Corps)

Firearm Equipment Manufacturers

Recreational Shooters Associations

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (ATF - Bureau of Alcohol, Tobacco, Firearms and Explosives)

Safety Equipment Suppliers

Companies

Major Players

Action Target Inc.

Range Systems Inc.

Savage Range Systems

Meggitt Training Systems

Shoot Point Blank

The Target Barn

Range USA

U.S. Shooting Academy

Winchester Safes

Xpert Range Systems

Rogue Shooting Targets

Kriss USA

Simunition

Black Rifle Range

Delta Defense

Table of Contents

1. USA Shooting Range Market Overview

1.1. Definition and Scope (Shooting Range Types, Indoor & Outdoor Ranges)

1.2. Market Taxonomy (Recreational, Military, Law Enforcement, Competitive Shooting)

1.3. Market Growth Rate (Expansion of Training Programs, Rising Recreational Users)

1.4. Market Segmentation Overview (By User Type, Range Type, Equipment, Technology)

2. USA Shooting Range Market Size (In USD Bn)

2.1. Historical Market Size (Training, Recreation, Professional Use)

2.2. Year-On-Year Growth Analysis (Customer Demographics, Safety Regulations)

2.3. Key Market Developments and Milestones (Advancements in Target Systems, New Regulations)

3. USA Shooting Range Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Training Facilities

3.1.2. Rising Popularity of Competitive Shooting Sports

3.1.3. Growth in Self-Defense and Safety Courses

3.1.4. Government and Military Spending on Shooting Ranges

3.2. Market Challenges

3.2.1. Stringent Environmental Regulations (Lead Pollution, Noise Control)

3.2.2. High Cost of Setup and Maintenance

3.2.3. Liability and Safety Concerns

3.2.4. Regional Disparities in Accessibility

3.3. Opportunities

3.3.1. Integration of Smart Technologies (Simulators, Remote Targeting)

3.3.2. Growth in Outdoor Range Infrastructure

3.3.3. Partnerships with Law Enforcement and Military

3.3.4. Expansion of Membership-Based Shooting Ranges

3.4. Trends

3.4.1. Use of Virtual Reality (VR) and Augmented Reality (AR) in Training

3.4.2. Adoption of Environmentally Friendly Range Designs

3.4.3. Increase in Female and Youth Participation

3.4.4. Customizable Range Targets and Experiences

3.5. Government Regulations

3.5.1. Federal Firearms Laws and Range Safety Requirements

3.5.2. Environmental Standards for Shooting Ranges (Lead Mitigation, Noise)

3.5.3. Local Zoning and Facility Construction Rules

3.5.4. Grant and Support Programs for Range Development

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.7.1. Shooting Range Operators

3.7.2. Equipment Suppliers

3.7.3. Law Enforcement and Military Partners

3.7.4. Environmental Compliance Agencies

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Competitor Differentiation, Range Features, Pricing)

4. USA Shooting Range Market Segmentation

4.1. By Range Type (In Value %)

4.1.1. Indoor Ranges

4.1.2. Outdoor Ranges

4.1.3. Hybrid Ranges

4.2. By User Type (In Value %)

4.2.1. Recreational Shooters

4.2.2. Law Enforcement

4.2.3. Military Personnel

4.2.4. Competitive Shooters

4.3. By Equipment (In Value %)

4.3.1. Firearms

4.3.2. Targets & Target Systems

4.3.3. Range Safety Equipment

4.3.4. Ammunition

4.4. By Technology (In Value %)

4.4.1. Electronic Target Systems

4.4.2. Simulation-Based Training

4.4.3. Mobile App Integration

4.4.4. Range Management Systems

4.5. By Region (In Value %)

4.5.1. West Coast

4.5.2. Midwest

4.5.3. East Coast

4.5.4. South

4.5.5. Southwest

5. USA Shooting Range Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Action Target Inc.

5.1.2. Range Systems Inc.

5.1.3. Savage Range Systems

5.1.4. Meggitt Training Systems

5.1.5. The Target Barn

5.1.6. Shoot Point Blank

5.1.7. Range USA

5.1.8. U.S. Shooting Academy

5.1.9. Winchester Safes

5.1.10. Xpert Range Systems

5.1.11. Rogue Shooting Targets

5.1.12. Kriss USA

5.1.13. Simunition

5.1.14. Black Rifle Range

5.1.15. Delta Defense

5.2 Cross Comparison Parameters (Revenue, Range Capacity, No. of Employees, Equipment Offerings, R&D Investment, Technology Integration, Geographic Coverage, Safety Standards)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Shooting Range Market Regulatory Framework

6.1. Federal Safety Standards

6.2. Environmental Compliance

6.3. Firearm Use and Handling Laws

7. USA Shooting Range Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Shooting Range Future Market Segmentation

8.1. By Range Type (In Value %)

8.2. By User Type (In Value %)

8.3. By Equipment (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. USA Shooting Range Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Shooting Range Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Shooting Range Market. This includes assessing market penetration, range utilization rates, and revenue generation. Furthermore, an evaluation of equipment quality and safety statistics is conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through interviews with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple range operators and equipment suppliers to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction verifies and complements the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Shooting Range Market.

Frequently Asked Questions

01. How big is the USA Shooting Range Market?

The USA Shooting Range Market is valued at USD 570 million, driven by rising interest in recreational shooting and increased demand from law enforcement and military institutions.

02. What are the challenges in the USA Shooting Range Market?

Challenges in the USA Shooting Range Market include stringent environmental regulations, high maintenance costs, and safety concerns related to liability. Noise control and lead pollution mitigation also present regulatory hurdles.

03. Who are the major players in the USA Shooting Range Market?

Key players in the USA Shooting Range Market include Action Target Inc., Range Systems Inc., Savage Range Systems, Meggitt Training Systems, and Shoot Point Blank. These companies dominate due to their technological advancements and partnerships with law enforcement and military institutions.

04. What are the growth drivers of the USA Shooting Range Market?

Growth drivers in the USA Shooting Range Market include the increasing popularity of recreational shooting, the expansion of competitive shooting events, and growing investments in law enforcement and military training facilities. Technological advancements such as virtual training systems also play a significant role.

05. How is the government involved in the USA Shooting Range Market?

The government plays a key role through regulations enforced by agencies such as the ATF and by providing grants for the development of new shooting ranges. Additionally, government-funded law enforcement and military training programs heavily utilize shooting ranges in the USA Shooting Range Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.