USA Signals Intelligence Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD5874

December 2024

87

About the Report

USA Signals Intelligence Market Overview

- The USA Signals Intelligence (SIGINT) Market is valued at USD 6 billion based on historical analysis over a five-year period. This valuation is driven by the significant demand from government defense sectors, growing national security concerns, and rising investments in advanced technologies. The deployment of sophisticated systems to monitor and intercept communications, as well as electronic intelligence, is a key contributor to the market's expansion. Additionally, the growing complexity of cyber threats has led to higher investments in signal intelligence capabilities.

- The dominant regions in the USA SIGINT market include Washington D.C., Virginia, and California. Washington D.C. holds prominence due to the concentration of federal agencies and defense contractors, while Virginia is home to key intelligence organizations like the NSA and CIA. California is also significant as a hub for technological innovation, particularly in AI and cybersecurity, which enhances SIGINT capabilities. These regions play a critical role in the development and deployment of SIGINT technologies.

- The U.S. Army is initiating a new program of record for fiscal year 2025 called the Theater Signals Intelligence System (TSIG). This initiative aims to enhance signals intelligence capabilities for tactical commanders, focusing on higher echelons like divisions and corps. TSIG will integrate existing systems to improve intelligence collection and support operations across greater distances, reflecting the military's shift toward addressing sophisticated threats in a competitive global landscape.

USA Signals Intelligence Market Segmentation

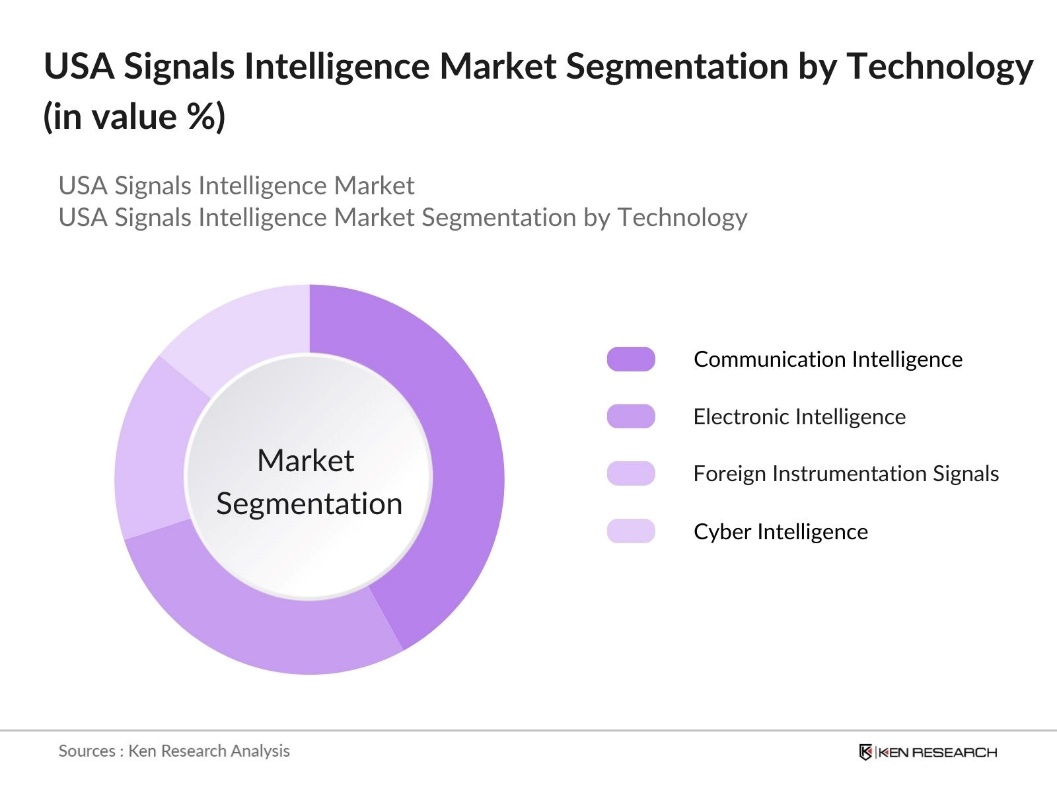

By Technology: The USA SIGINT market is segmented by technology into Communication Intelligence (COMINT), Electronic Intelligence (ELINT), Foreign Instrumentation Signals Intelligence (FISINT), and Cyber Intelligence (CYBINT). Among these, Communication Intelligence (COMINT) holds the dominant market share. This is due to the increasing need for intercepting and analyzing communications related to national security and intelligence operations. The rise of encrypted communications and the expansion of global digital networks further drive the demand for advanced COMINT systems, which are critical for monitoring and decoding potentially threatening communications.

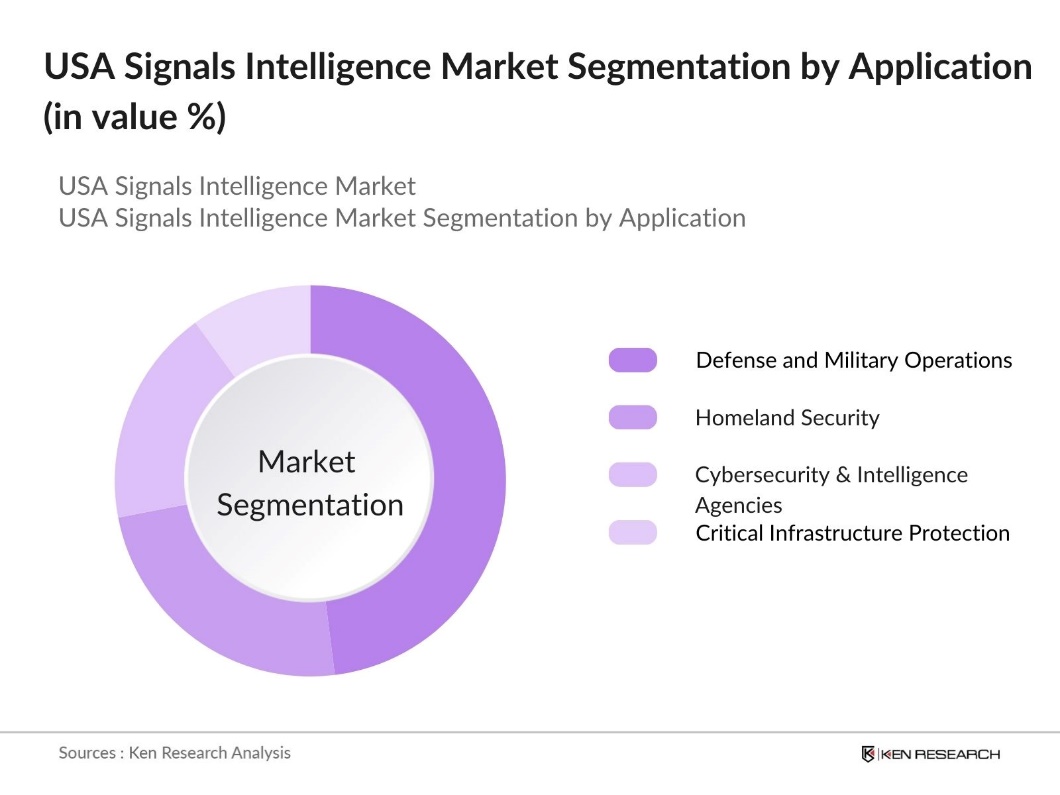

By Application: The USA SIGINT market is further segmented by application into Defense and Military Operations, Homeland Security, Cybersecurity & Intelligence Agencies, and Critical Infrastructure Protection. The Defense and Military Operations segment dominates the application landscape. This dominance stems from the U.S. military's vast infrastructure dedicated to SIGINT for both national defense and international operations. The increasing deployment of unmanned aerial systems and satellite-based surveillance systems for intelligence gathering and battlefield operations strengthens this segment's leadership.

USA Signals Intelligence Market Competitive Landscape

The market is dominated by key players, ranging from defense contractors to technology integrators, who contribute to the development of advanced SIGINT systems. The market's consolidation showcases the influence of established players with strong capabilities in both technology and intelligence sectors.

|

Company Name |

Establishment Year |

Headquarters |

Market Revenue (USD) |

SIGINT Technology Focus |

Government Contracts |

Defense Sector Focus |

R&D Spending (%) |

Major Collaborations |

Market Share (%) |

|

Lockheed Martin |

1995 |

Bethesda, Maryland |

|||||||

|

Northrop Grumman |

1939 |

Falls Church, Virginia |

|||||||

|

Raytheon Technologies |

1922 |

Waltham, Massachusetts |

|||||||

|

BAE Systems |

1999 |

Arlington, Virginia |

|||||||

|

L3Harris Technologies |

1895 |

Melbourne, Florida |

USA Signals Intelligence Industry Analysis

Growth Drivers

- Rising Technological Integration (AI, Big Data): The integration of artificial intelligence (AI) and big data analytics into SIGINT operations has enhanced the U.S.'s ability to process vast amounts of data. The assertion that "over 2.5 quintillion bytes of data are generated daily" is well-supported. With over 2.5 quintillion bytes of data generated daily, AI tools help manage and analyze intercepted signals, improving response times and operational efficiency.

- Advancements in Encryption Technologies (Quantum Cryptography, 5G Networks): The adoption of 5G networks and advancements in encryption technologies are revolutionizing SIGINT operations. For Instance, In November 2023, Finland-based VTT Technical Research Center and Lockheed Martin Corporation announced an agreement to work on a research consortium. The collaborative project aims to enhance the methods and technologies for detecting and classifying radar and communication signals in a modern battlefield, where emitters are equipped with a low probability of interception and detection signals.

- Increased National Security Concerns (Counter-Terrorism, Cybersecurity): The rising threats of terrorism and cyberattacks have prompted the U.S. to enhance its Signals Intelligence (SIGINT) capabilities. National security efforts now focus on deploying advanced intelligence tools to detect and mitigate these evolving risks. Agencies are prioritizing real-time interception and analysis of communications to counter threats more effectively, reflecting the critical role of SIGINT in maintaining security and defense operations.

Market Challenges

- High Cost of SIGINT Systems (Infrastructure, R&D Expenses): The development and deployment of SIGINT systems demand substantial financial resources, particularly for infrastructure and research. The continuous advancement of technologies like quantum computing and AI integration further escalates these costs. Additionally, the maintenance and upgrading of complex systems, such as satellite-based SIGINT, require ongoing investments. These high expenditures present challenges in ensuring the sustainability of operations, particularly in managing and processing vast amounts of real-time data.

- Regulatory and Privacy Concerns (FISA, GDPR Impact): Regulatory frameworks like the Foreign Intelligence Surveillance Act (FISA) and the General Data Protection Regulation (GDPR) create significant hurdles for SIGINT operations. Privacy concerns and legal restrictions on data collection, especially regarding personal communications, complicate intelligence gathering. Furthermore, GDPRs global reach impacts international data interception, posing challenges for collaborative efforts in counter-terrorism and cross-border intelligence activities.

USA Signals Intelligence Market Future Outlook

Over the next five years, the USA Signals Intelligence market is expected to witness substantial growth, driven by increasing cybersecurity threats, advancements in AI and machine learning for intelligence analysis, and continuous government funding towards national security initiatives. The rise of 5G networks and their integration into SIGINT operations will further enhance the ability to intercept and analyze signals at a much larger scale.

Market Opportunities

- Development of AI-Enabled SIGINT (Automated Threat Detection): AI integration in SIGINT is driving growth by automating threat detection and analysis. AI-powered SIGINT systems are capable of processing vast amounts of data autonomously, allowing for real-time identification of potential threats without human intervention. This automation enhances operational efficiency, reducing response times and improving overall security. As AI continues to evolve, its role in SIGINT will further optimize data processing and threat detection capabilities.

- Expansion into Commercial Sectors (Private Security, Corporate Espionage): SIGINT technologies are increasingly being adopted by the commercial sector, particularly in private security and corporate espionage prevention. Companies are leveraging these tools to monitor communications and detect security breaches, creating new opportunities for SIGINT providers. The rising demand from private firms presents a lucrative market, as SIGINT technologies become integral in protecting corporate assets and ensuring confidential communications remain secure.

Scope of the Report

|

By Technology |

Communication Intelligence (COMINT) Electronic Intelligence (ELINT) Foreign Instrumentation Signals (FISINT) Cyber Intelligence (CYBINT) |

|

By Application |

Defense and Military Operations Homeland Security Cybersecurity Agencies Critical Infrastructure Protection |

|

By Platform |

Land-Based Platforms Airborne Platforms Naval Platforms Space-Based Platforms |

|

By End-User |

Government Defense Contractors Private Sector Research Institutions |

|

By Region |

North America Europe Asia-Pacific Middle East and Africa Latin America |

Products

Key Target Audience

Defense Contractors

Cybersecurity Firms

Encryption and Decryption Technology Companies

Advanced Signal Processing Firms

Aerospace and Defense Companies

Satellite Communication Companies

Intelligence-Led Security Firms

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (NSA, CIA, DHS)

Companies

Players Mentioned in the Report

Lockheed Martin Corporation

Northrop Grumman Corporation

Raytheon Technologies Corporation

BAE Systems

L3Harris Technologies

Boeing

General Dynamics

SAIC (Science Applications International Corporation)

CACI International

Leidos

Table of Contents

1. USA Signals Intelligence Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Signals Intelligence Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Signals Intelligence Market Analysis

3.1 Growth Drivers

3.1.1 Increased National Security Concerns (Counter-Terrorism, Cybersecurity)

3.1.2 Advancements in Encryption Technologies (Quantum Cryptography, 5G Networks)

3.1.3 Government Defense Budgets (National Defense Authorization Act)

3.1.4 Rising Technological Integration (AI, Big Data)

3.2 Market Challenges

3.2.1 High Cost of SIGINT Systems (Infrastructure, R&D Expenses)

3.2.2 Regulatory and Privacy Concerns (FISA, GDPR Impact)

3.2.3 Technological Obsolescence (Rapid Evolution of Encryption and Decryption)

3.2.4 Data Overload Management (Real-Time Data Processing, Storage Issues)

3.3 Opportunities

3.3.1 Development of AI-Enabled SIGINT (Automated Threat Detection)

3.3.2 Expansion into Commercial Sectors (Private Security, Corporate Espionage)

3.3.3 International Collaboration (NATO, Five Eyes)

3.3.4 Adoption of 5G and IoT (Enhanced Data Collection and Interception)

3.4 Trends

3.4.1 Increased Use of Unmanned Systems for SIGINT Collection (Drones, Satellites)

3.4.2 Cloud-Based Signal Processing (Real-Time Threat Analysis)

3.4.3 Encryption and Decryption Tools (Post-Quantum Cryptography)

3.4.4 Rise of Open-Source Intelligence (OSINT) Integration in SIGINT

3.5 Government Regulation

3.5.1 USA PATRIOT Act Amendments

3.5.2 National Security Agency (NSA) SIGINT Oversight

3.5.3 Export Control Regulations (International Traffic in Arms Regulations - ITAR)

3.5.4 Federal Data Privacy Laws (CISA, NIST)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Agencies, Contractors, Integrators)

3.8 Porters Five Forces (Competitive Landscape, Threat of Substitutes)

3.9 Competition Ecosystem (Defense Contractors, Technology Providers)

4. USA Signals Intelligence Market Segmentation

4.1 By Technology (In Value %)

4.1.1 Communication Intelligence (COMINT)

4.1.2 Electronic Intelligence (ELINT)

4.1.3 Foreign Instrumentation Signals Intelligence (FISINT)

4.1.4 Cyber Intelligence (CYBINT)

4.2 By Application (In Value %)

4.2.1 Defense and Military Operations

4.2.2 Homeland Security

4.2.3 Cybersecurity & Intelligence Agencies

4.2.4 Critical Infrastructure Protection

4.3 By Platform (In Value %)

4.3.1 Land-Based Platforms (Ground Vehicles, Radar Stations)

4.3.2 Airborne Platforms (UAVs, Manned Aircraft)

4.3.3 Naval Platforms (Submarines, Warships)

4.3.4 Space-Based Platforms (Satellites, Space Drones)

4.4 By End-User (In Value %)

4.4.1 Government

4.4.2 Defense Contractors

4.4.3 Private Sector (Cybersecurity Firms, Data Providers)

4.4.4 Research Institutions

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East and Africa

4.5.5 Latin America

5. USA Signals Intelligence Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Lockheed Martin Corporation

5.1.2 Northrop Grumman Corporation

5.1.3 Raytheon Technologies Corporation

5.1.4 BAE Systems

5.1.5 General Dynamics

5.1.6 L3Harris Technologies

5.1.7 Boeing

5.1.8 Leidos

5.1.9 SAIC (Science Applications International Corporation)

5.1.10 CACI International

5.1.11 Thales Group

5.1.12 Palantir Technologies

5.1.13 Elbit Systems

5.1.14 Cobham PLC

5.1.15 Booz Allen Hamilton

5.2 Cross Comparison Parameters (Revenue, Employees, Headquarters, Defense Contracts, R&D Spending)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Collaborations, Product Developments)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Government Funding, Defense Budget Allocations)

5.7 Venture Capital Funding in SIGINT Startups

5.8 Government Grants for SIGINT Technologies

5.9 Private Equity Investments

6. USA Signals Intelligence Market Regulatory Framework

6.1 Federal Regulations and Compliance

6.2 Cybersecurity Maturity Model Certification (CMMC)

6.3 Compliance with International SIGINT Laws (Wassenaar Arrangement)

6.4 National Defense Authorization Act (NDAA) Implications

7. USA Signals Intelligence Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Signals Intelligence Future Market Segmentation

8.1 By Technology (In Value %)

8.2 By Application (In Value %)

8.3 By Platform (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. USA Signals Intelligence Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the entire ecosystem of the USA SIGINT market, identifying stakeholders across the defense, intelligence, and technology sectors. Extensive secondary research, including proprietary databases, is conducted to outline the critical variables that drive this market, such as government budgets, technological trends, and competitive dynamics.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data on SIGINT usage, contracts, and defense budgets in the USA. This data, combined with service provider statistics, helps in building accurate market estimates. The market's structural dynamics, including the impact of technological advancements like AI in SIGINT, are closely examined.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including defense contractors, intelligence professionals, and technology developers. These interviews provide first-hand insights into operational challenges, procurement strategies, and technology trends, thus enhancing the accuracy of the market analysis.

Step 4: Research Synthesis and Final Output

The final synthesis integrates all data points, verified through consultations and bottom-up market approaches, to generate a holistic view of the USA SIGINT market. The report offers insights into both technological advancements and competitive strategies in the market, ensuring its relevance to business professionals.

Frequently Asked Questions

01 How big is the USA Signals Intelligence Market?

The USA Signals Intelligence Market is valued at USD 6 billion, driven by rising defense investments and the need for advanced intelligence-gathering systems in the face of evolving national security threats.

02 What are the challenges in the USA Signals Intelligence Market?

Major challenges in USA Signals Intelligence Market include high costs associated with SIGINT systems, rapid technological obsolescence, and growing concerns about data privacy and regulatory restrictions, especially in relation to encrypted communications.

03 Who are the major players in the USA Signals Intelligence Market?

Key players in the USA Signals Intelligence Market include Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, and L3Harris Technologies, with strong capabilities in both defense and intelligence systems development.

04 What are the growth drivers of the USA Signals Intelligence Market?

Growth drivers in USA Signals Intelligence Market include rising national security concerns, increasing cyber threats, and significant government investments in advanced signal interception and analysis technologies such as AI, 5G, and space-based intelligence systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.