USA Silk Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD2550

December 2024

96

About the Report

USA Silk Market Overview

- The USA silk market in 2023 is valued at USD 3 billion, driven by a combination of rising consumer demand for luxury fabrics and sustainable textiles. Silk, known for its luster, strength, and elegance, is increasingly utilized across multiple industries such as fashion, home dcor, and medical applications. The growing trend toward eco-friendly and ethically sourced products, such as Eri silk, also contributes to this markets expansion. In 2024, the market is expected to see a steady rise, supported by increasing technological innovations like bioengineered silk, as seen with companies such as Bolt Threads.

- The USA is one of the key players in the global silk market due to its established textile industry and high consumer purchasing power. Cities like New York and Los Angeles dominate the demand for silk, being hubs of the fashion and luxury industries. Additionally, these cities prominence in design and high-end retail ensures a continuous demand for silk-based products, which are often used in high-fashion apparel, accessories, and home textiles.

- The U.S. government is actively promoting sustainable textile production through various initiatives. The Sustainable Apparel Coalition, backed by the U.S. Environmental Protection Agency (EPA), has set guidelines for reducing the environmental impact of textile manufacturing. In 2023, the U.S. EPA reported that the textile industry accounted for 15.1 million tons of textile waste. To combat this, federal and state-level regulations are encouraging the adoption of sustainable materials, including organic and ethical silk, in textile production.

USA Silk Market Segmentation

By Silk Type: The USA silk market is segmented by silk type into Mulberry Silk, Eri Silk, Tussar Silk, and Spider Silk. Mulberry silk has a dominant share due to its widespread use in fashion and luxury textiles. Its fine texture and durability make it the most desirable silk type for high-end garments and accessories. Furthermore, its consistent quality and scalability of production have contributed to its dominance in the textile sector.

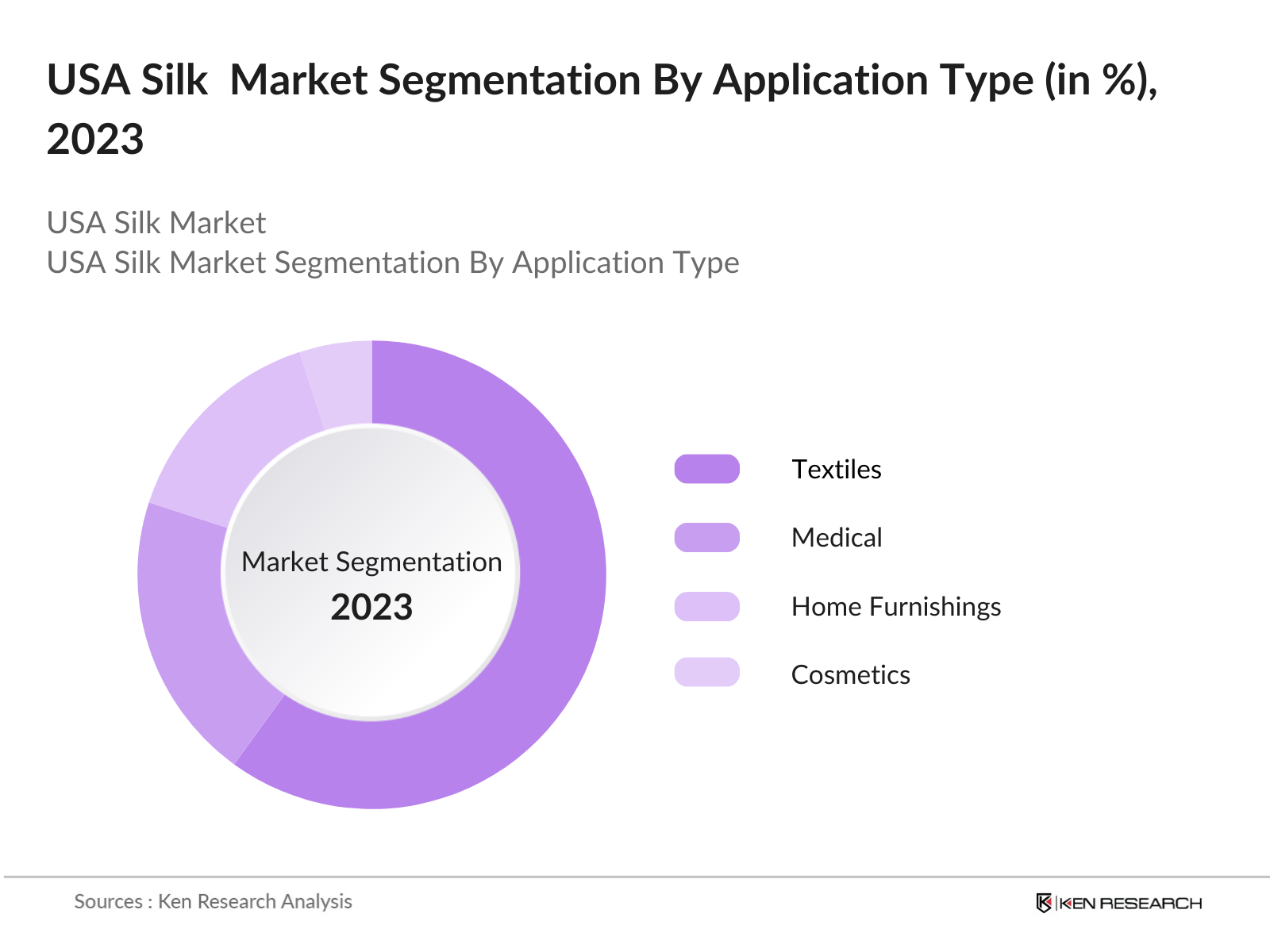

By Application: The market is segmented by application into Textiles, Medical, Home Furnishings, and Cosmetics. The textile segment holds the largest share, driven by the continued demand for luxury garments, bridal wear, and high-fashion accessories. The rising awareness of sustainability and demand for ethically sourced silk, particularly in the fashion industry, has also propelled the growth of this segment.

USA Silk Market Competitive Landscape

The USA silk market is characterized by several key players, ranging from traditional silk manufacturers to innovative firms utilizing bioengineered silk. Leading companies are focusing on sustainability, product diversification, and technological advancements to maintain their competitive edge. For instance, companies like Bolt Threads are pioneering the use of bioengineering to create synthetic spider silk, expanding the market's scope.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Sustainability Focus |

Global Presence |

Technological Innovation |

Partnerships/Collaborations |

Revenue |

|

Bolt Threads |

2010 |

Emeryville, CA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

AM Silk GmbH |

2008 |

Planegg, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Zhejiang Jiaxin Silk Co. |

1980 |

Jiaxing, China |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Kraig Biocraft Laboratories |

2006 |

Ann Arbor, MI |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Wensli Group Co. |

1975 |

Hangzhou, China |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

USA Silk Industry Analysis

Growth Drivers

- Demand for Sustainable and Luxury Textiles: The luxury textile segment, particularly for high-end silk products, is witnessing growth due to rising disposable incomes in the U.S. In 2024, the U.S. GDP per capita reached $76,600, which boosts the purchasing power of consumers seeking luxury goods such as silk textiles. According to World Bank data, the demand for sustainable fashion in the U.S. is also growing, as approximately 32 million Americans, or about 9.7% of the population, actively seek out eco-friendly products. This shift is driving up the demand for ethically sourced and luxury silk products in the market.

- Increasing Use in Medical Applications: The biomedical sector has increased the use of silk-based products due to silk's biocompatibility and non-toxicity. Medical-grade silk is now commonly used for sutures and tissue engineering. As of 2024, the U.S. healthcare expenditure is projected to exceed $4.5 trillion, according to the Centers for Medicare & Medicaid Services (CMS), highlighting the robust market for medical applications of silk. This expanding healthcare sector is fostering the integration of silk in advanced biomedical applications, such as drug delivery systems and surgical meshes.

- Innovation in Bioengineered Silk: Bioengineering companies in the U.S., like Bolt Threads, are driving innovation in sustainable silk alternatives through bioengineering technologies. In 2023, Bolt Threads developed bioengineered silk fibers using yeast, water, and sugar, leading to significant reductions in environmental impact compared to traditional silk production methods. This innovation aligns with the United States commitment to reducing carbon emissions, which were recorded at 5.1 gigatons of CO2 equivalent in 2022, according to the U.S. Environmental Protection Agency (EPA).

Market Challenges

- High Production Costs: Silk production remains labor-intensive and resource-heavy, leading to high operational costs. In 2023, the U.S. Bureau of Labor Statistics reported that the average wage for textile workers was $42,500 annually, significantly higher than in major silk-producing countries like China or India, where labor costs are lower. This wage disparity increases the overall cost of silk production in the U.S. Additionally, energy costs, which averaged $0.13 per kilowatt-hour in 2023 for the industrial sector, further exacerbate production expenses, making it difficult for domestic silk producers

- Ethical Concerns: Conventional silk production involves killing silkworms, raising ethical concerns among animal rights groups and environmentally conscious consumers. According to a 2023 survey by the U.S. Department of Agriculture, there has been a 19% increase in awareness of ethical farming practices. This growing awareness has contributed to a shift toward non-violent silk alternatives, such as Eri and Peace Silk, which allow the silkworms to emerge from their cocoons naturally. Despite these alternatives, conventional silk harvesting methods still dominate the market, posing an ethical challenge.

USA Silk Market Future Outlook

Over the next five years, the USA silk market is expected to show significant growth, driven by the rising demand for luxury fabrics, the adoption of sustainable silk production techniques, and the development of bioengineered silk materials. The market is anticipated to benefit from increased research and innovation in silk applications across industries such as healthcare, where silk's biocompatibility and durability offer vast potential.

Opportunities

- Growth in Ethical Silk: Eri silk, which does not harm the silkworm during harvesting, is gaining popularity in the U.S. market. With the U.S. textile industry increasingly focusing on sustainable materials, Eri silk offers a cruelty-free alternative to conventional silk. According to a 2023 report by the U.S. Department of Commerce, the import of ethical silk products, including Eri silk, rose by 14% from the previous year. This shift is in line with the rising consumer demand for products aligned with ethical and environmental standards.

- Technological Advancements: Spider silk is being explored as the next frontier in the textile and biomedical fields due to its strength and elasticity. The U.S. Department of Defense (DoD) has been investing in spider silk research for potential applications in defense and healthcare. In 2023, the U.S. DoD allocated $75 million to R&D projects focused on spider silk, including partnerships with universities and biotech firms. These advancements in silk technology could open new avenues for high-performance textiles and medical materials in the near future.

Scope of the Report

|

By Type |

Mulberry Silk Eri Silk Tussar Silk Spider Silk |

|

By Application |

Fashion Medical Home Furnishings Cosmetics |

|

By Sales Channel |

Retail Stores E-Commerce Specialty Stores |

|

By End-Use |

Fashion Industry Home Decor Healthcare Automotive |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Luxury Fashion Companies

Textile Industries

Medical Device Companies

Home Furnishing Retailers

Cosmetic companies

Government and Regulatory Bodies (U.S. Department of Commerce, U.S. Environmental Protection Agency)

Investment and Venture Capitalist Firms

E-commerce Companies

Companies

Players Mentioned in the Report:

Bolt Threads

AM Silk GmbH

Kraig Biocraft Laboratories, Inc.

Zhejiang Jiaxin Silk Co.

Wujiang First Textile Co., Ltd.

ShengKun Silk Manufacturing Co. Ltd.

Wensli Group Co. Ltd.

China Silk Corporation

Entogenetics Inc.

Sichuan Nanchong Liuhe Group

Table of Contents

1. USUSA Silk Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USUSA Silk Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USUSA Silk Market Analysis

3.1. Growth Drivers

3.1.1. Expansion in Sustainable Fashion (Key Trend: Sustainability)

3.1.2. Rising Consumer Demand for Premium Textiles (Consumer Preferences)

3.1.3. Government Initiatives Supporting Silk Industry (Government Policies)

3.1.4. Technological Advancements in Silk Production (Innovation and Automation)

3.2. Market Challenges

3.2.1. High Production Costs (Cost Efficiency)

3.2.2. Volatility in Raw Material Prices (Price Fluctuations)

3.2.3. Competition from Synthetic Fabrics (Market Competition)

3.2.4. Lack of Skilled Workforce (Labor Challenges)

3.3. Opportunities

3.3.1. Increasing Demand in Luxury Fashion (Premium Market Expansion)

3.3.2. Growth in Export Markets (International Trade)

3.3.3. Innovations in Silk Blending Technologies (Product Innovation)

3.3.4. Expansion of E-commerce Channels (Digital Commerce)

3.4. Trends

3.4.1. Integration of Ethical Silk Certifications (Sustainability Certifications)

3.4.2. Adoption of Eco-Friendly Dyeing Techniques (Green Manufacturing)

3.4.3. Growth in Customization Demand (Personalization Trends)

3.4.4. Partnership with Fashion Designers and Luxury Brands (Collaborations)

3.5. Government Regulations

3.5.1. USUSA Silk Export Regulations (Export Policies)

3.5.2. Silk Industry Subsidies (Government Support)

3.5.3. Silk Certification Standards (Regulatory Standards)

3.5.4. Tariffs and Import-Export Laws (Trade Policies)

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.7.1. Silk Farmers

3.7.2. Manufacturers

3.7.3. Retailers

3.7.4. Exporters

3.8. Porter’s Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competitive Landscape

3.9.1. Competitor Analysis (Competitive Landscape Overview)

3.9.2. Market Share Analysis (Percentage Analysis by Competitor)

3.9.3. Key Market Strategies (Strategic Approaches of Major Players)

4. USUSA Silk Market Segmentation

4.1. By Silk Type (In Value %)

4.1.1. Mulberry Silk

4.1.2. Eri Silk

4.1.3. Tussar Silk

4.1.4. Muga Silk

4.1.5. Spider Silk (Innovative Substitutes)

4.2. By Application (In Value %)

4.2.1. Apparel

4.2.2. Home Textiles

4.2.3. Medical (Biomedical Uses)

4.2.4. Industrial (Technical Textiles)

4.2..5. Personal Care

4.3. By Distribution Channel (In Value %)

4.3.1. Offline Retail

4.3.2. Online Retail

4.3.3. Wholesale

4.3.4. Direct Sales

4.3.4. Fashion Houses

4.4. By End-User (In Value %)

4.4.1. Fashion Industry

4.4.2. Healthcare

4.4.3. Textile Industry

4.4.5. Hospitality

4.4.6. Automotive

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. USUSA Silk Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Panda Silk Corp.

5.1.2. Mulberry Haven Textiles

5.1.3. LuxeSilk USA

5.1.4. SilkenCraft Industries

5.1.5. EriSustainable Corp.

5.1.6. Tussar Innovations Ltd.

5.1.7. PureSilk Fabrics Inc.

5.1.8. GreenWeave Silk Co.

5.1.9. Spider Silk Technologies

5.1.10. American Silk Farms

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Revenue

5.2.4. Export Volume

5.2.5.Product Portfolio

5.2.6. Sustainability Initiatives

5.2.7. Market Penetration

5.2.8. Innovation Score

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

5.9. Venture Capital Funding

6. USUSA Silk Market Regulatory Framework

6.1. Environmental Standards for Silk Production

6.2. Compliance Requirements for Silk Export

6.3. Certification Processes for Ethical Silk

7. USUSA Silk Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USUSA Silk Future Market Segmentation

8.1. By Silk Type (In Value %)

8.1.1. Mulberry Silk

8.1.2. Eri Silk

8.1.3. Tussar Silk

8.1.4. Muga Silk

8.1.5. Spider Silk

8.2. By Application (In Value %)

8.2.1. Apparel

8.2.2. Home Textiles

8.2.3. Medical

8.2.4. Industrial

8.2.5. Personal Care

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USUSA Silk Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategy

9.3. White Space Opportunity Analysis

9.4. Strategic Partnerships & Alliances

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying the major stakeholders in the USA silk market. This involves thorough desk research using secondary sources, proprietary databases, and industry reports to understand the key factors driving market growth.

Step 2: Market Analysis and Construction

The historical data from 2018-2023 is compiled to assess market dynamics such as penetration rates and revenue generation. This data is then used to forecast future market conditions, taking into account current industry trends and technological advancements

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with key players in the silk industry, including manufacturers, suppliers, and retailers. These consultations provide valuable insights into industry operations and confirm the accuracy of the data.

Step 4: Research Synthesis and Final Output

The final step involves combining primary and secondary research findings to produce a comprehensive market analysis. This is followed by validation of data through direct engagement with silk producers and experts, ensuring accuracy and reliability in the final report.

Frequently Asked Questions

01. How big is the USA Silk Market?

The USA silk market is valued at USD 3 billion, driven by increasing consumer demand for luxury textiles, sustainable materials, and bioengineered silk technologies.

02. What are the key challenges in the USA Silk Market?

Challenges include high production costs, ethical concerns regarding conventional silk harvesting, and competition from synthetic fibers. However, innovations in sustainable silk production are helping to mitigate these challenges.

03. Who are the major players in the USA Silk Market?

Key players in the market include Bolt Threads, AM Silk GmbH, Kraig Biocraft Laboratories, Zhejiang Jiaxin Silk Co., and Wensli Group Co. Ltd., among others.

04. What drives the growth of the USA Silk Market?

The market is driven by growing demand for luxury fashion, eco-friendly textiles, and advancements in bioengineered silk technologies. The rise in consumer awareness around sustainability also boosts demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.