USA Smart Appliances Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD2362

December 2024

98

About the Report

USA Smart Appliances Market Overview

- The USA Smart Appliances market is valued at USD 10 billion, with continued growth driven by technological advancements in connected devices, IoT integration, and increased consumer demand for smart home solutions. The market has seen robust growth due to the adoption of smart refrigerators, washing machines, and HVAC systems, which offer convenience and energy efficiency. Consumers are increasingly seeking devices that seamlessly integrate with smart home ecosystems, enhancing the demand for smart appliances in both residential and commercial settings.

- The market is primarily dominated by cities such as New York, Los Angeles, and Chicago. These urban centers lead the market due to high consumer awareness, tech-savvy populations, and higher disposable incomes. Additionally, major metropolitan areas tend to be early adopters of innovative technologies, with the rapid development of smart homes and smart city projects driving demand for smart appliances. This urban concentration ensures a steady market for manufacturers and retailers operating in these regions.

- The U.S. Environmental Protection Agency (EPA) mandates strict energy efficiency standards for smart appliances through the Energy Star program. In 2021, over 300 million Energy Star certified products were purchased, indicating a strong market presence. The program provides guidelines on energy consumption and emissions, ensuring that manufacturers produce appliances that align with federal energy efficiency targets, ultimately lowering greenhouse gas emissions and reducing household energy bills.

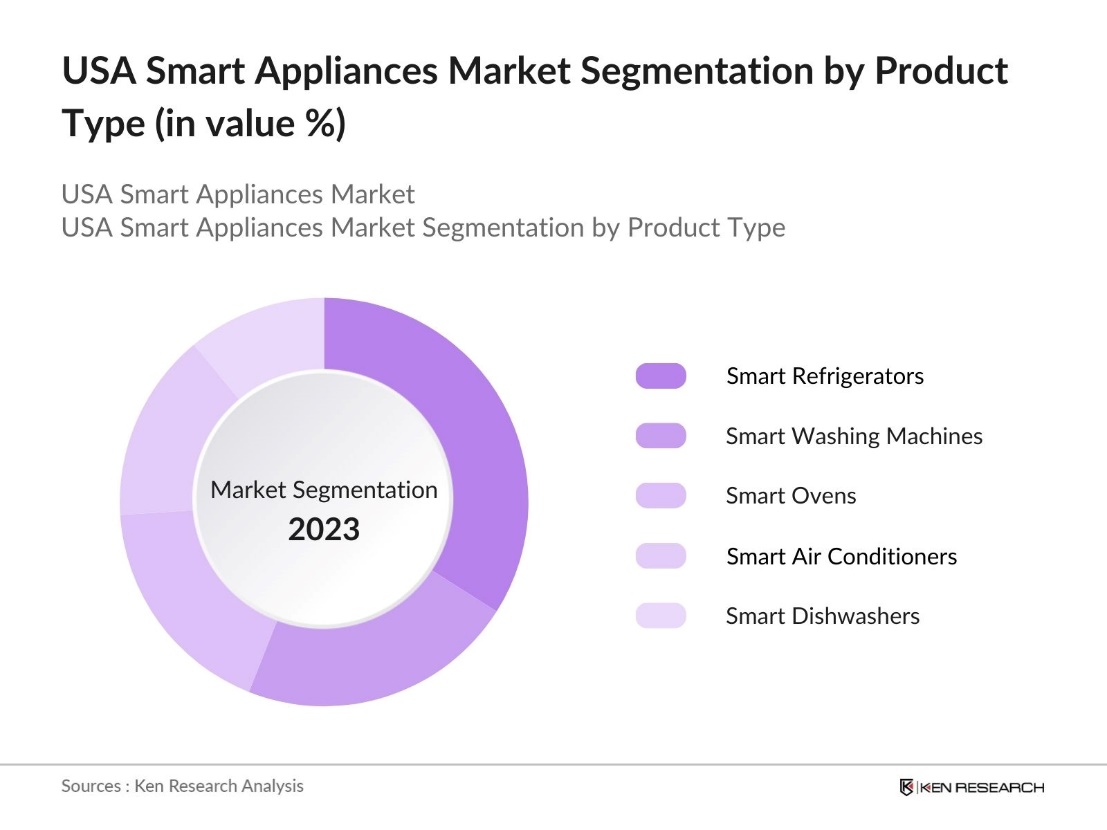

USA Smart Appliances Market Segmentation

By Product Type: The USA Smart Appliances market is segmented by product type into smart refrigerators, smart washing machines, smart ovens, smart air conditioners, and smart dishwashers. The smart refrigerators have held a dominant market share within this segmentation due to their widespread adoption in both households and commercial establishments. These refrigerators offer advanced features such as temperature regulation, energy consumption monitoring, and voice control integration. Companies like LG and Samsung have significantly invested in AI-based refrigerators that provide seamless connectivity and user-friendly interfaces, making this sub-segment particularly attractive to consumers seeking both convenience and innovation.

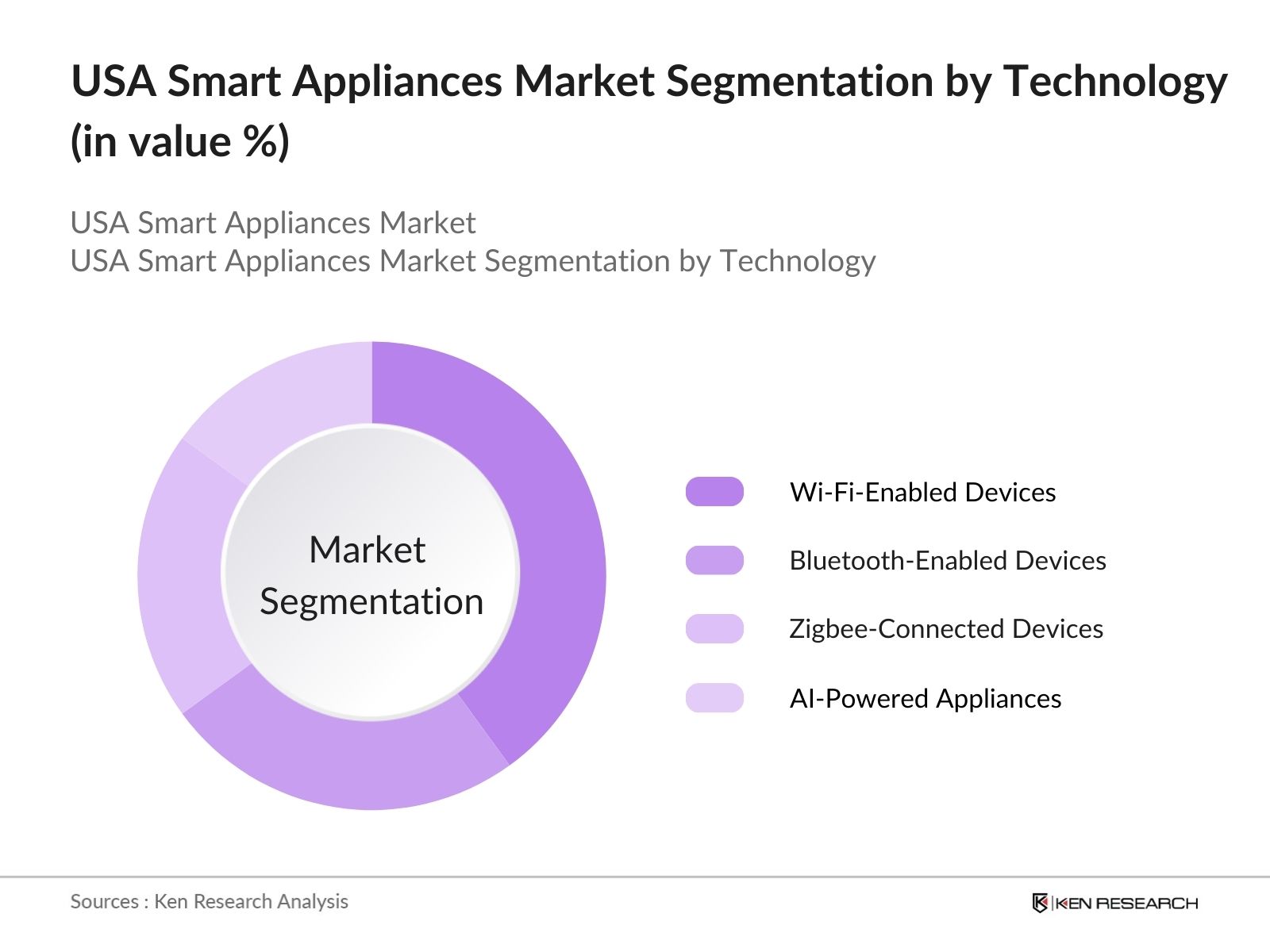

By Technology: The USA Smart Appliances market is segmented by technology into Wi-Fi-enabled appliances, Bluetooth-enabled appliances, Zigbee-connected devices, and AI-powered appliances. The Wi-Fi-enabled appliances dominate the market, accounting for the largest share of connected smart devices in U.S. households. The reason behind this dominance is their widespread availability and compatibility with existing smart home systems, such as Amazon Alexa and Google Home. Consumers find Wi-Fi connectivity essential for remote monitoring, energy efficiency management, and seamless integration with other smart home devices, which has contributed to the growing market share of this sub-segment.

USA Smart Appliances Market Competitive Landscape

The market is dominated by a few major global and local players who leverage their established distribution networks and technological expertise to capture a significant share of the market. These companies are at the forefront of innovation, integrating AI, voice control, and energy-saving technologies into their product lines, catering to the rising consumer demand for intelligent home solutions.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

No. of Employees |

Revenue (2023) |

Global Presence |

Strategic Alliances |

R&D Investment |

Sustainability Initiatives |

|---|---|---|---|---|---|---|---|---|---|

|

Whirlpool Corporation |

1911 |

Benton Harbor, MI |

|||||||

|

LG Electronics |

1958 |

Seoul, South Korea |

|||||||

|

Samsung Electronics |

1938 |

Suwon, South Korea |

|||||||

|

GE Appliances |

1907 |

Louisville, KY |

|||||||

|

Bosch Home Appliances |

1886 |

Gerlingen, Germany |

India Packaging Industry Analysis

Growth Drivers

- Rising Consumer Preference for Connected Devices: As of 2024, the45% of U.S. internet householdshave at least one smart home device, while18% own six or more devices. The integration of devices into a seamless ecosystem, including smart thermostats, lights, and security systems, is driving this trend. These connected devices are increasingly appealing to consumers looking to manage their homes more efficiently. The United States' internet penetration rate, at 92.1%, further boosts the adoption of these devices, supporting the integration of IoT-driven smart appliances across homes nationwide.

- Technological Advancements in IoT Integration: The U.S. smart appliance market is experiencing rapid growth due to advancements in IoT technology. The number of connected devices in the country reached 18.8 billion in 2024, driven by increased demand for interconnected home solutions, such as refrigerators, ovens, and washing machines, that can be controlled via smartphones or voice assistants. According to data from the Federal Communications Commission (FCC), improvements in wireless network infrastructure, including 5G deployment, are facilitating faster and more reliable connectivity, further enabling the integration of IoT in households.

- Shift Toward Smart Homes: The shift toward smart homes is gaining momentum, driven by the growing consumer awareness of the benefits these technologies offer, such as enhanced energy efficiency, security, and convenience. As more households seek to automate and optimize their living spaces, the demand for smart appliances like refrigerators, ovens, and HVAC systems is increasing. These appliances can seamlessly integrate with broader home automation systems, providing users with the ability to control and monitor their homes remotely. The trend is also supported by lifestyle changes and advancements in technology, making smart homes a key focus in modern living.

Market Restraints

- High Initial Costs and Maintenance: Despite the growing interest in smart appliances, the high upfront costs continue to be a significant barrier for many U.S. households. Smart appliances, such as refrigerators and washing machines, are often priced much higher than traditional models, making them less accessible to middle-income consumers. Additionally, ongoing maintenance costs, including software updates and occasional repairs, can add up over time. This challenge is particularly pronounced in homes that need to replace or upgrade devices to stay compatible with evolving technologies, further deterring widespread adoption.

- Consumer Privacy Concerns: As smart appliances become more prevalent, concerns about privacy and data security are also rising. Many consumers are apprehensive about the personal data collected by these devices, including sensitive information like daily routines and preferences. The potential for cyberattacks on interconnected home devices adds to these concerns, as smart appliances can become vulnerable points of entry for hackers. Ensuring data protection and developing stronger security measures are crucial to addressing these challenges and maintaining consumer trust in smart home technologies.

USA Smart Appliances Market Future Outlook

Over the next five years, the USA Smart Appliances market is expected to experience significant growth, driven by technological advancements in the IoT sector, the increasing trend of smart homes, and greater consumer demand for automated and energy-efficient home appliances. With ongoing innovations in AI and machine learning, smart appliances will become more intuitive, offering customized solutions to consumers. The integration of renewable energy systems into smart appliances is likely to emerge as a key trend, contributing to sustainable development in the market.

Market Opportunities

- Increasing Adoption of AI-Powered Appliances: AI-powered appliances are becoming more popular, with innovations like predictive maintenance and autonomous cooking solutions leading the way. These appliances offer features such as personalized controls and energy optimization, enhancing convenience and efficiency in daily tasks. As consumers seek smarter solutions for their homes, AI-powered appliances present a significant opportunity for manufacturers to tap into the evolving smart home market by offering advanced, connected functionalities.

- Growth in Subscription-Based Models: Subscription-based models for smart appliances are gaining traction, offering consumers access to the latest technology without high upfront costs. These services typically include maintenance and software updates, providing flexibility and cost-effectiveness. For manufacturers, this model creates opportunities for recurring revenue streams and ongoing customer engagement through innovative service offerings.

Scope of the Report

|

By Product Type |

Smart Refrigerators Smart Washing Machines Smart Air Conditioners Smart Ovens Smart Dishwashers |

|

By Technology |

Wi-Fi Enabled Appliances Bluetooth-Enabled Appliances Zigbee and Z-Wave Connected Devices AI-Based Appliances |

|

By Distribution Channel |

Online Retail Offline Retail B2B Sales |

|

By Application |

Residential Commercial Industrial |

|

By Region |

Northeast Midwest Southern Western |

Products

Key Target Audience

Smart Appliance Manufacturers

Smart Home Solution Providers

Retailers and Distributors

Government and Regulatory Bodies (FCC, DOE)

Energy Efficiency Organizations

IoT Service Providers

Investment and Venture Capital Firms

Technology Innovators and AI Developers

Companies

Players Mentioned in the Report

Whirlpool Corporation

LG Electronics

Samsung Electronics

GE Appliances (Haier)

Bosch Home Appliances

Miele

Panasonic Corporation

Amazon (Alexa Smart Home Integration)

Google LLC (Nest Smart Devices)

BSH Home Appliances Corporation

Honeywell International Inc.

Philips Electronics

Xiaomi Corporation

Sharp Corporation

Electrolux AB

Table of Contents

1. USA Smart Appliances Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Smart Appliances Ecosystem Overview

2. USA Smart Appliances Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Milestones in Smart Appliances

3. USA Smart Appliances Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Consumer Preference for Connected Devices

3.1.2. Technological Advancements in IoT Integration

3.1.3. Government Incentives for Energy-Efficient Appliances

3.1.4. Shift Toward Smart Homes

3.2. Market Challenges

3.2.1. High Initial Costs and Maintenance

3.2.2. Consumer Privacy Concerns (data security and privacy issues)

3.2.3. Compatibility Issues Between Devices

3.3. Opportunities

3.3.1. Increasing Adoption of AI-Powered Appliances

3.3.2. Growth in Subscription-Based Models (servitization)

3.3.3. Integration with Renewable Energy Systems

3.4. Trends

3.4.1. Voice Control and Smart Assistants Integration

3.4.2. Demand for Smart Kitchen and Laundry Appliances

3.4.3. Sustainability and Green Technologies in Smart Appliances

3.5. Government Regulation

3.5.1. Energy Star Certifications and Standards

3.5.2. Data Protection Laws for Smart Devices

3.5.3. Federal Incentives for Smart Energy Solutions

3.6. Stakeholder Ecosystem

3.7. Porters Five Forces Analysis

3.8. USA Smart Appliances Competition Ecosystem

4. USA Smart Appliances Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Smart Refrigerators

4.1.2. Smart Washing Machines

4.1.3. Smart Air Conditioners

4.1.4. Smart Ovens

4.1.5. Smart Dishwashers

4.2. By Technology (In Value %)

4.2.1. Wi-Fi Enabled Appliances

4.2.2. Bluetooth-Enabled Appliances

4.2.3. Zigbee and Z-Wave Connected Devices

4.2.4. AI-Based Appliances

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail

4.3.3. B2B Sales

4.4. By Application (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.5. By Region (In Value %)

4.5.1. Northeast USA

4.5.2. Midwest USA

4.5.3. Southern USA

4.5.4. Western USA

5. USA Smart Appliances Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Whirlpool Corporation

5.1.2. LG Electronics

5.1.3. Samsung Electronics

5.1.4. GE Appliances (Haier)

5.1.5. Electrolux AB

5.1.6. Bosch Home Appliances

5.1.7. Miele

5.1.8. Panasonic Corporation

5.1.9. Honeywell International Inc.

5.1.10. Amazon (Alexa Smart Home Integration)

5.1.11. Google LLC (Nest Smart Devices)

5.1.12. BSH Home Appliances Corporation

5.1.13. Philips Electronics

5.1.14. Xiaomi Corporation

5.1.15. Sharp Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, Technological Expertise, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

5.8. Government Grants and Funding for Smart Appliances

6. USA Smart Appliances Market Regulatory Framework

6.1. Compliance with Energy Star Guidelines

6.2. Data Privacy and Protection Regulations (GDPR, CCPA)

6.3. Product Certification Requirements (UL Certification, FCC Compliance)

7. USA Smart Appliances Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Smart Appliances Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. USA Smart Appliances Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Demographic and Psychographic Profiling)

9.3. Marketing Strategies and Channels

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves identifying the major stakeholders within the USA Smart Appliances market. Using a combination of secondary and proprietary databases, the primary variables influencing market dynamics, including technological adoption, consumer trends, and product innovations, are identified.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical market data, assessing the penetration of smart appliances, and the influence of technological advancements on revenue generation. The goal is to ensure that market projections are aligned with historical performance metrics and current market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Through extensive consultation with industry experts using CATIS, we validate our research hypotheses and gather insights into operational challenges and financial strategies. These consultations are critical for refining market projections and understanding competitive positioning.

Step 4: Research Synthesis and Final Output

The final step integrates inputs from multiple stakeholders, including manufacturers, retailers, and consumers. The data collected through this bottom-up approach is synthesized into a comprehensive and accurate analysis of the USA Smart Appliances market.

Frequently Asked Questions

01 How big is the USA Smart Appliances Market?

Key challenges in USA Smart Appliances Market include high costs of smart appliances, consumer privacy concerns related to data sharing, and compatibility issues between devices from different manufacturers.

02 What are the challenges in the USA Smart Appliances Market?

Key challenges in USA Smart Appliances Market include high costs of smart appliances, consumer privacy concerns related to data sharing, and compatibility issues between devices from different manufacturers.

03 Who are the major players in the USA Smart Appliances Market?

Major players in USA Smart Appliances Market include Whirlpool Corporation, LG Electronics, Samsung Electronics, GE Appliances, and Bosch Home Appliances. These companies dominate due to their vast product portfolios, global presence, and continuous investments in R&D.

04 What are the growth drivers of the USA Smart Appliances Market?

The USA Smart Appliances Market is propelled by advancements in IoT integration, increasing consumer preference for energy-efficient appliances, and technological innovations such as voice control and AI-powered devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.