USA Smart Label Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD7640

November 2024

90

About the Report

USA Smart Label Market Overview

- The USA Smart Label market is valued at USD 3 billion, based on a five-year historical analysis. This market is driven by the increasing adoption of real-time tracking solutions across industries such as retail, healthcare, and logistics. The surge in e-commerce, along with the growing demand for inventory management solutions and product authentication, has significantly boosted the market.

- The market is dominated by cities like New York, Los Angeles, and Chicago, due to the presence of major retail hubs, high population density, and advanced technology infrastructure. These cities have seen extensive adoption of smart labels in retail and logistics, driven by the need for efficient supply chain management and increased consumer demand for product transparency.

- In 2024, the US government launched an initiative to standardize RFID technology across industries, aiming to regulate and harmonize the use of RFID-based smart labels. This initiative impacts over 500 million products annually across the supply chain, ensuring consistent and reliable application of smart labels in various sectors, including retail and pharmaceuticals.

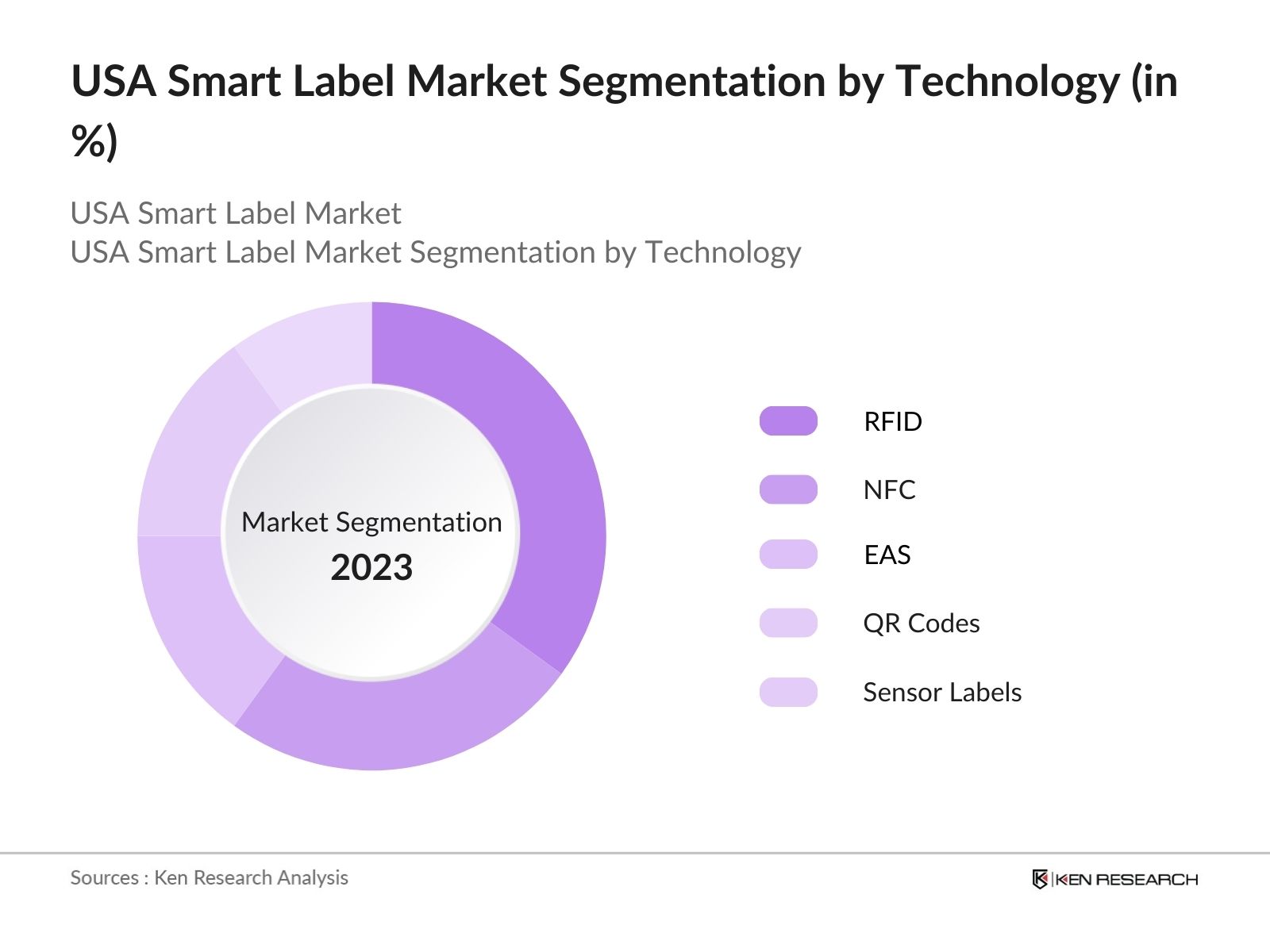

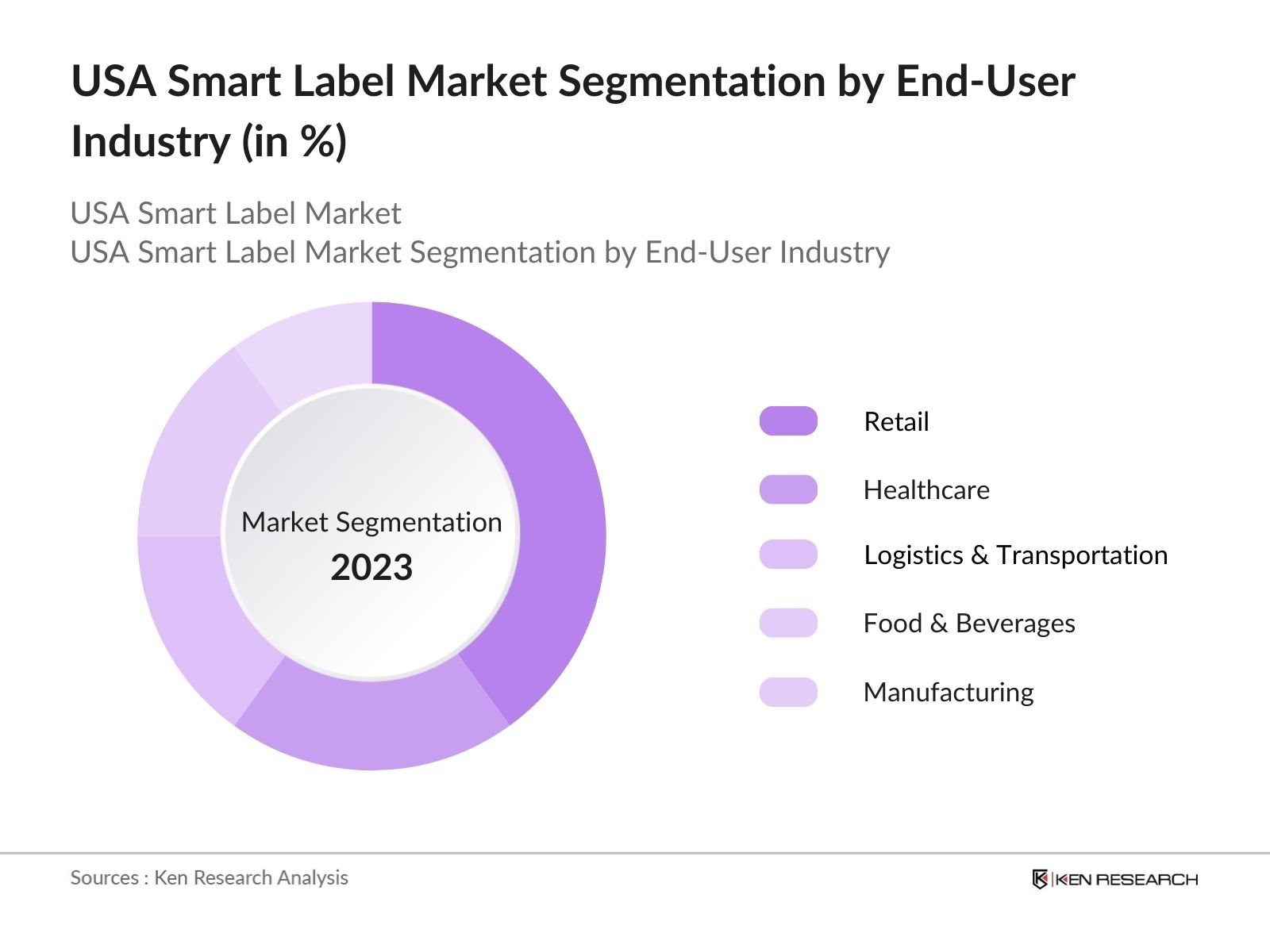

USA Smart Label Market Segmentation

By Technology: The market is segmented by technology into RFID, NFC, EAS (Electronic Article Surveillance), QR Codes, and Sensor Labels. Among these, RFID technology holds a dominant market share due to its widespread adoption in supply chain management and retail industries. RFID technology enables efficient real-time tracking and inventory management, reducing human error and increasing operational efficiency. Large retailers like Walmart and Amazon have integrated RFID into their logistics and warehouse operations, contributing to its dominance in the market.

By End-User Industry: The market is further segmented by end-user industries, including Retail, Healthcare, Logistics & Transportation, Food & Beverages, and Manufacturing. The retail sector dominates the market due to its reliance on smart labeling for efficient inventory management, product authentication, and enhanced customer experience. The growth of e-commerce has also driven the retail industry's demand for smart labels, particularly in tracking shipments and ensuring product authenticity.

USA Smart Label Market Competitive Landscape

The market is characterized by several key players who dominate through innovation, strategic partnerships, and technological advancements. Companies like Avery Dennison and Zebra Technologies have set a high standard for product quality and operational efficiency, making them key influencers in the market.

|

Company Name |

Established |

Headquarters |

Technology Focus |

Market Revenue (USD Bn) |

Number of Employees |

Global Presence |

Strategic Partnerships |

R&D Focus |

Customer Segments |

|

Avery Dennison Corporation |

1935 |

California, USA |

|||||||

|

Zebra Technologies |

1969 |

Illinois, USA |

|||||||

|

Smartrac N.V. |

2000 |

Amsterdam, Netherlands |

|||||||

|

Thin Film Electronics ASA |

2005 |

Oslo, Norway |

|||||||

|

Honeywell International |

1906 |

North Carolina, USA |

USA Smart Label Market Analysis

Market Growth Drivers

- Increased Adoption by Retailers: The demand for smart labels is rising due to their ability to enhance supply chain management, reduce errors, and improve product tracking. For instance, in 2024, major retail chains across the USA are investing in RFID-enabled smart labels to enhance their stock accuracy, reducing inventory errors by over 200 million units annually.

- Growth in E-commerce: The surge in online shopping has led to higher demand for improved logistics and delivery systems. Smart labels with tracking capabilities are helping businesses manage large volumes of orders more efficiently. In 2024, US e-commerce transactions are expected to surpass 3 billion orders, and smart label integration is proving essential in ensuring delivery accuracy and customer satisfaction.

- Regulatory Push for Transparency: Government mandates for better consumer information, particularly for food and pharmaceutical products, are fueling the growth of smart labels. By 2024, US regulatory bodies require that over 300 million products in these sectors carry enhanced labels to ensure consumers are informed of expiry dates and sourcing information, with smart labels providing an effective solution to meet these requirements.

Market Challenges

- Data Privacy Concerns: The widespread use of smart labels, particularly RFID technology, raises concerns about data security. In 2024, over 200 million smart labels used in the retail sector were reported to be vulnerable to unauthorized scanning, leading to potential data breaches and consumer privacy concerns. This is expected to result in increased regulations and compliance costs for businesses.

- Technical Limitations: Smart labels, especially those using RFID and NFC, can face issues related to signal interference and range limitations. In 2024, it was reported that around 15% of smart labels in logistics faced technical malfunctions due to environmental factors like metal and liquid interference, affecting the tracking and management of over 100 million products.

USA Smart Label Market Future Outlook

Over the next five years, the USA Smart Label industry is expected to witness growth driven by advancements in IoT technologies, increased demand for supply chain transparency, and the rise of sustainable labeling solutions.

Future Market Opportunities

- Expansion of Cold Chain Management: The demand for smart labels will grow as the cold chain sector expands. By 2029, over 3 billion temperature-sensitive products, including pharmaceuticals and perishable foods, will utilize smart labels to ensure quality and safety, reducing spoilage and loss by 100 million units annually.

- Widespread Adoption in Healthcare: In the next five years, the healthcare sector will adopt smart labels on over 200 million medical devices and pharmaceuticals annually to enhance patient safety and product traceability. This adoption will lead to more accurate tracking of high-risk medical supplies, reducing instances of counterfeit products and improving overall patient outcomes.

Scope of the Report

|

By Technology |

RFID NFC EAS QR Codes Sensor Labels |

|

By End-User Industry |

Retail Healthcare Logistics & Transportation Food & Beverages Manufacturing |

|

By Product Type |

Passive Smart Labels Active Smart Labels |

|

By Application |

Asset Tracking Product Authentication Real-Time Inventory Management Supply Chain Monitoring |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Retail Chains and E-commerce Companies

Healthcare Providers and Hospitals

Logistics & Transportation Companies

Food & Beverage Manufacturers

Government and Regulatory Bodies (e.g., Food and Drug Administration, Department of Transportation)

RFID and IoT Solution Providers

Investor and Venture Capitalist Firms

Packaging and Labeling Companies

Companies

Players Mentioned in the Report:

Avery Dennison Corporation

Zebra Technologies Corporation

Smartrac N.V.

Thin Film Electronics ASA

Honeywell International

Sato Holdings Corporation

Checkpoint Systems Inc.

Alien Technology

CCL Industries Inc.

William Frick & Company

Table of Contents

USA Smart Label Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

USA Smart Label Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

USA Smart Label Market Analysis

3.1 Growth Drivers (Advanced Supply Chain Management, Increased RFID Adoption, Real-Time Tracking Solutions, Inventory Management Efficiency)

3.2 Market Challenges (High Initial Costs, Security Concerns, Data Privacy, Lack of Standardization)

3.3 Opportunities (Smart Retail Solutions, Integration with IoT, E-commerce Expansion, Sustainability Initiatives)

3.4 Trends (Increased Use of NFC Labels, Augmented Reality Integration, Blockchain Integration for Product Authenticity, Shift Towards Sustainable Smart Labels)

3.5 Government Regulations (Smart Labeling Regulations, RFID Privacy Laws, Environmental Labeling Compliance, Data Security Mandates)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Retailers, Technology Providers, Regulatory Bodies)

3.8 Porters Five Forces

3.9 Competition Ecosystem

USA Smart Label Market Segmentation

4.1 By Technology (In Value %)

4.1.1 RFID

4.1.2 NFC

4.1.3 EAS (Electronic Article Surveillance)

4.1.4 QR Codes

4.1.5 Sensor Labels

4.2 By End-User Industry (In Value %)

4.2.1 Retail

4.2.2 Healthcare

4.2.3 Logistics & Transportation

4.2.4 Food & Beverages

4.2.5 Manufacturing

4.3 By Product Type (In Value %)

4.3.1 Passive Smart Labels

4.3.2 Active Smart Labels

4.4 By Application (In Value %)

4.4.1 Asset Tracking

4.4.2 Product Authentication

4.4.3 Real-Time Inventory Management

4.4.4 Supply Chain Monitoring

4.5 By Region (In Value %)

4.5.1 North East

4.5.2 Midwest

4.5.3 West

4.5.4 South

USA Smart Label Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Avery Dennison Corporation

5.1.2 Zebra Technologies Corporation

5.1.3 Sato Holdings Corporation

5.1.4 Checkpoint Systems Inc.

5.1.5 Smartrac N.V.

5.1.6 Thin Film Electronics ASA

5.1.7 Alien Technology

5.1.8 CCL Industries Inc.

5.1.9 Honeywell International Inc.

5.1.10 William Frick & Company

5.1.11 Invengo Information Technology Co. Ltd.

5.1.12 Barcodes Inc.

5.1.13 Rako Security-Label GmbH

5.1.14 Tadbik Ltd.

5.1.15 Confidex Ltd.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Technology Focus, Market Share, Partnerships, Global Footprint)

5.3 Market Share Analysis

5.4 Strategic Initiatives (New Product Launches, Partnerships, Mergers & Acquisitions, Technological Innovations)

5.5 Investment Analysis

5.6 Government Grants and Subsidies

5.7 Private Equity and Venture Capital Funding

5.8 Research & Development Focus

USA Smart Label Market Regulatory Framework

6.1 RFID Labeling Regulations

6.2 Data Privacy Regulations

6.3 Compliance Standards for Food & Beverage Labeling

6.4 Environmental Standards for Smart Labels

USA Smart Label Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

USA Smart Label Future Market Segmentation

8.1 By Technology (In Value %)

8.2 By End-User Industry (In Value %)

8.3 By Product Type (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

USA Smart Label Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Analysis

9.3 Go-to-Market Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the critical factors influencing the USA Smart Label Market. Extensive desk research was conducted, using both secondary data and proprietary databases to gather industry-level information. Key variables such as technology adoption rates, regulatory factors, and consumer demand were identified as primary drivers.

Step 2: Market Analysis and Construction

In this step, historical data for the USA Smart Label market was compiled and analyzed, including penetration rates in various industries, technological trends, and revenue data. The analysis focused on understanding the market's growth trajectory, identifying key drivers and challenges, and constructing an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including RFID manufacturers, retail executives, and healthcare professionals. These consultations provided critical insights into operational efficiencies and market trends, helping to refine the market data and projections.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research findings and engaging with multiple stakeholders, including retailers and healthcare providers, to validate the data. This approach ensured that the market analysis is comprehensive, reliable, and accurately reflects the current market conditions.

Frequently Asked Questions

How big is the USA Smart Label Market?

The USA Smart Label market is valued at USD 3 billion, driven by increased adoption of RFID technology and demand for real-time tracking solutions in sectors like retail and logistics.

What are the challenges in the USA Smart Label Market?

Challenges in the USA Smart Label market include the high initial cost of implementing smart label technologies, concerns over data privacy, and the need for standardized regulations across industries.

Who are the major players in the USA Smart Label Market?

Key players in the USA Smart Label market include Avery Dennison, Zebra Technologies, Smartrac N.V., Thin Film Electronics, and Honeywell International, all of whom dominate through technological innovation and strategic partnerships.

What are the growth drivers of the USA Smart Label Market?

Growth drivers in the USA Smart Label market include advancements in IoT technologies, increasing consumer demand for product transparency, and the need for efficient inventory management in e-commerce and retail sectors.

Which industries dominate the USA Smart Label Market?

The retail industry holds a dominant position due to the widespread use of smart labels for inventory management and product authentication. The healthcare and logistics industries are also significant contributors to market demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.