USA Smart Manufacturing Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1883

October 2024

84

About the Report

USA Smart Manufacturing Market Overview

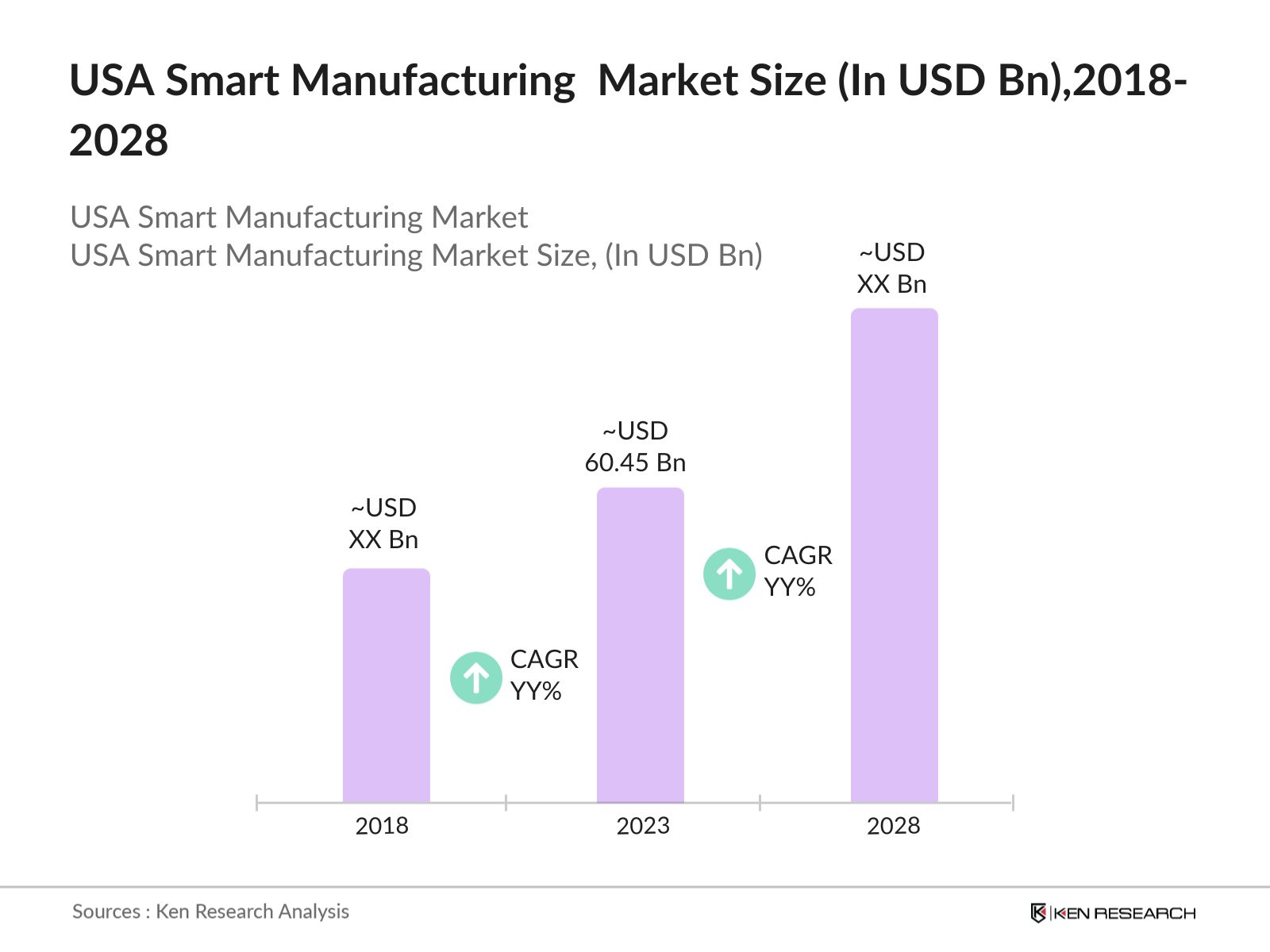

- The USA Smart Manufacturing Market was valued at USD 60.45 billion in 2023. The key drivers for this expansion include the increasing adoption of Industry 4.0 technologies, which integrate advanced manufacturing processes with the Internet of Things (IoT), big data analytics, and cloud computing.

- The market is dominated by several key players are Siemens AG, General Electric (GE), Rockwell Automation, Emerson Electric Co., and Honeywell International Inc. leading the industry. These companies are at the forefront of innovation, providing a range of smart manufacturing solutions including automation systems, control systems, and industrial IoT platforms.

- In October 2023, Siemens' Enlighted introduced AI-powered enhancements to its Location Services solution, achieving over 98% accuracy in tracking assets and badges within buildings. This improvement is integrated into existing intelligent lighting systems and benefits sectors like manufacturing and healthcare by optimizing operations and reducing costs. Enlighted also expanded its AI ecosystem by partnering with Tagnos and Zan Compute to enhance patient care and smart building management.

- The Midwest region, particularly states like Michigan and Ohio, has emerged as a dominant player in the market. This region's dominance is attributed to its strong manufacturing base, with companies in the automotive, aerospace, and heavy machinery sectors leading the adoption of smart manufacturing technologies.

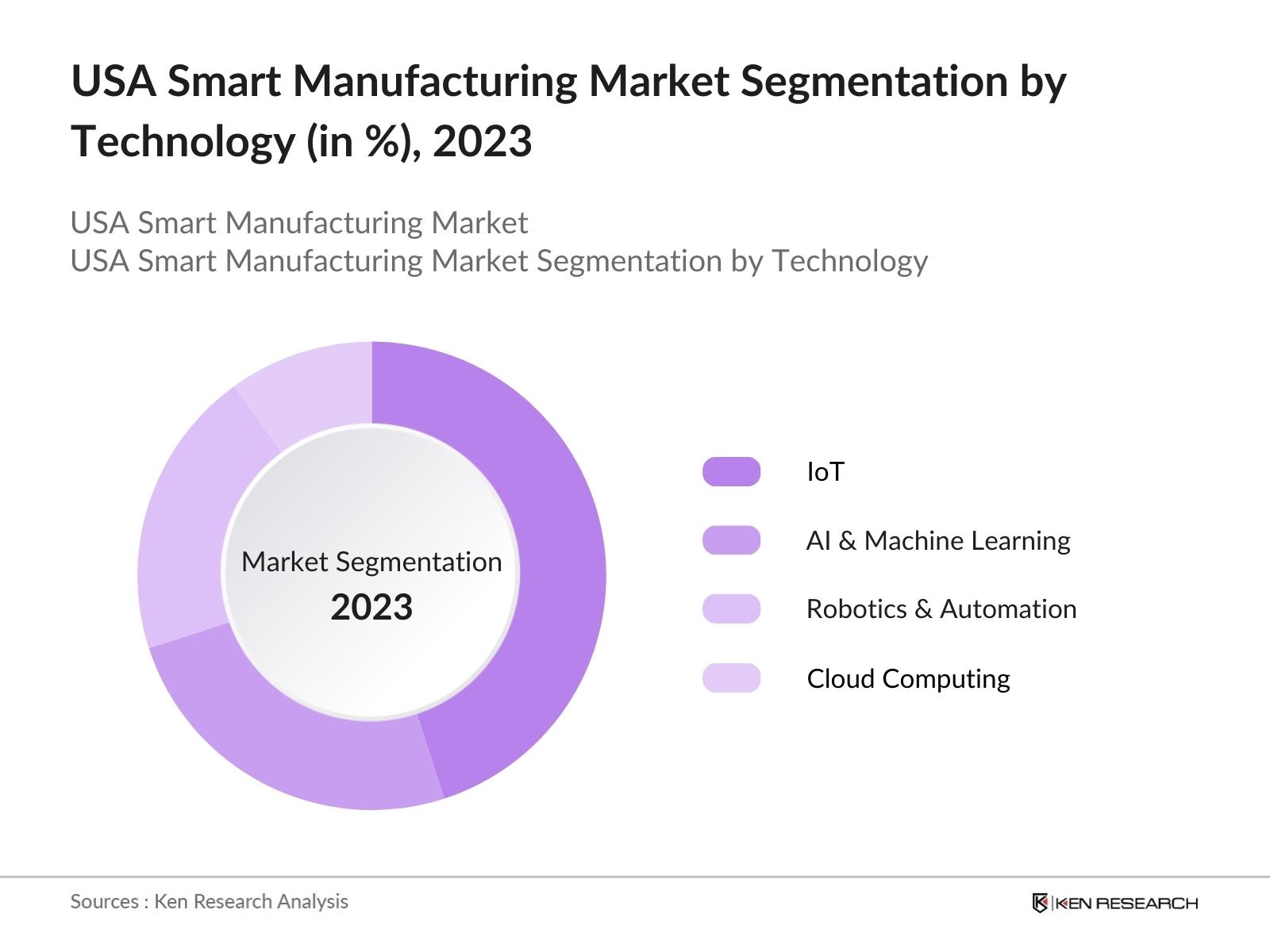

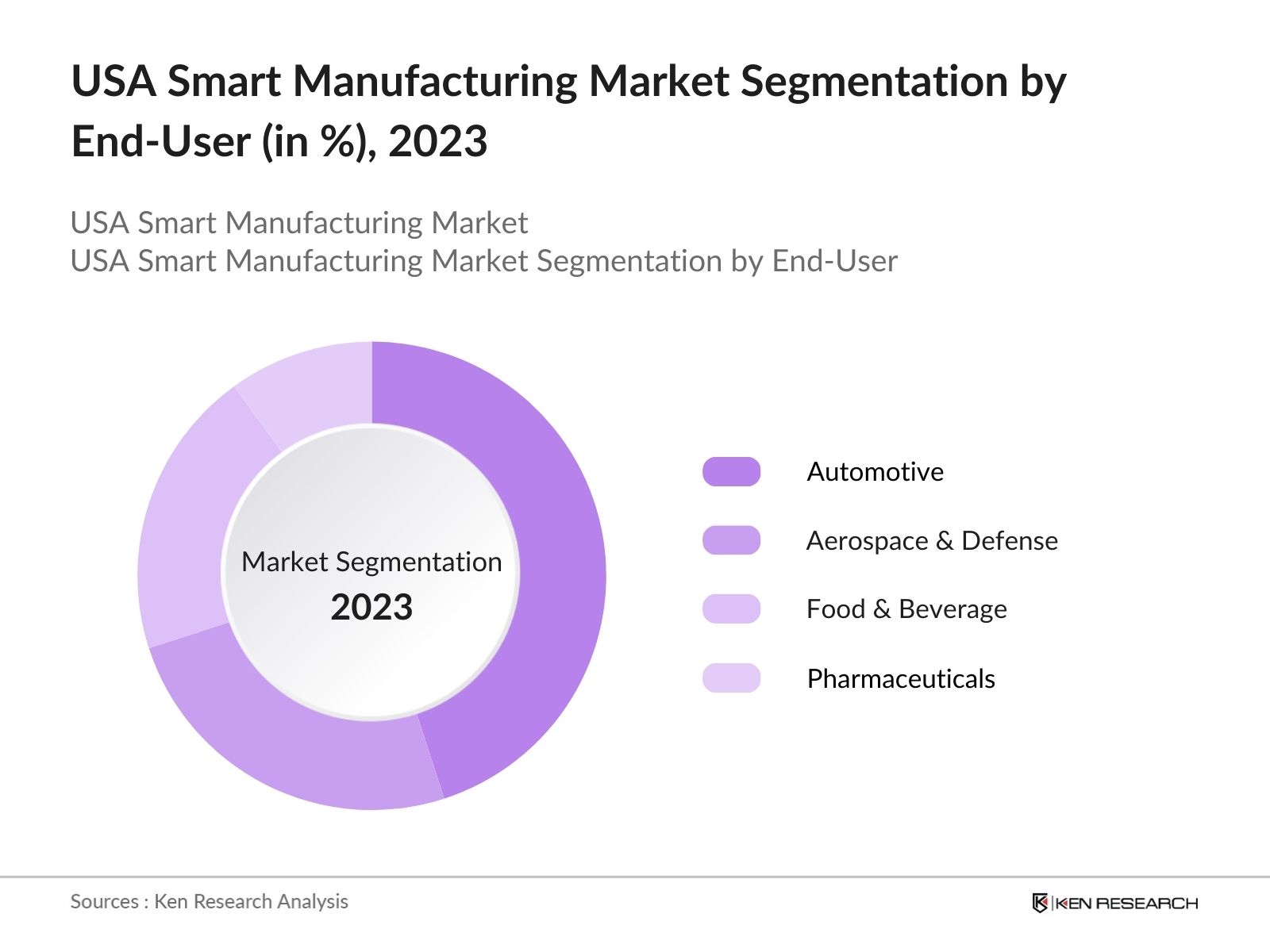

USA Smart Manufacturing Market Segmentation

The market is segmented into various factors like technology, end-user, and region.

By Technology: The market is segmented by technology into IoT, AI & Machine Learning, Robotics & Automation, and Cloud Computing. In 2023, IoT dominated the market, due to the widespread adoption of IoT devices and sensors in manufacturing processes, enabling real-time monitoring and data collection, which enhances operational efficiency and reduces downtime.

By End-User: The market is segmented by end-user into Automotive, Aerospace & Defense, Food & Beverage, and Pharmaceuticals. In 2023, the Automotive industry held the largest market share due to the industry's early adoption of smart manufacturing technologies to enhance production efficiency and meet the increasing demand for electric vehicles (EVs).

By Region: The market is segmented by region into North, South, East, and West. In 2023, the North region dominated the market due to the region's focus on innovation and adoption of smart technologies has made it a leader in the smart manufacturing market.

USA Smart Manufacturing Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Siemens AG |

1847 |

Munich, Germany |

|

General Electric |

1892 |

Boston, USA |

|

Honeywell International |

1906 |

Charlotte, USA |

|

Rockwell Automation |

1903 |

Milwaukee, USA |

|

Emerson Electric Co. |

1890 |

St. Louis, USA |

- General Electric: GE Aerospace is set to invest over $650 million in 2024 to enhance its manufacturing facilities and supply chain, with nearly $450 million allocated to 22 U.S. facilities across 14 states. This investment aims to boost production capacity and support both commercial and defense sectors, while also creating over 1,000 jobs.

- Honeywell International: Honeywell has introduced itsForge Performance+ for Buildings, enhancing predictive maintenance with real-time analytics and AI-driven insights. This solution aims to reduce downtime and improve asset performance across portfolios. It enables near real-time monitoring, allowing operators to address issues proactively and optimize maintenance strategies, ultimately extending asset lifecycles.

USA Smart Manufacturing Market Analysis

Market Growth Drivers

- Public Funding for Digital Transformation: In 2024, the US government allocated USD 1.1 trillion in funding across various sectors, with 17% directed toward manufacturing modernization. This significant financial support encourages manufacturers to adopt smart technologies, such as IoT and AI, by offsetting implementation costs, fostering digital transformation, and enhancing global competitiveness.

- AI-Driven Automation in Manufacturing: In 2024, AI-driven automation significantly enhanced manufacturing efficiency by reducing operational costs. Over 60% of manufacturers utilizing AI reported a reduction in energy consumption and an improvement in quality control. These improvements were driven by AIs ability to optimize production processes through real-time data analysis and predictive maintenance, allowing manufacturers to preemptively address issues, minimizing downtime and increasing overall output.

- Expansion of Smart Factory Investments: In 2024, U.S. manufacturers ramped up investments in smart factory initiatives, with over 2,000 new projects launched nationwide, representing a combined investment exceeding USD 100 billion. These initiatives are driven by the need for enhanced productivity, improved supply chain resilience, and the integration of advanced technologies like AI, IoT, and robotics.

Market Challenges

- Cybersecurity Risks and Vulnerabilities: The growing reliance on interconnected systems in smart manufacturing has led to heightened concerns about cybersecurity. In 2024, there were over 10,000 reported cybersecurity incidents in the manufacturing sector, resulting in estimated financial. These incidents highlight the vulnerabilities of smart manufacturing systems, particularly those involving IoT devices and cloud-based platforms.

- Skills Gap in the Manufacturing Workforce: Despite the growing demand for advanced manufacturing technologies, the industry faces a significant skills gap. In 2024, there were over 800,000 unfilled manufacturing jobs in the USA, many of which required expertise in smart manufacturing technologies. The lack of skilled workers capable of operating and maintaining advanced manufacturing systems is a critical challenge that could impede the sector's growth.

Government Initiatives

- Government Initiative on R&D and Innovation Funding: In 2024, the U.S. government proposed a budget of USD 210 billion for R&D and innovation, with a significant portion allocated to advanced manufacturing technologies. This funding aims to bolster AI, robotics, and smart manufacturing initiatives, driving the technological transformation of the U.S. industrial sector and enhancing global competitiveness.

- Tax Incentives for Smart Manufacturing Investments: In 2024, the U.S. government introduced tax incentives via the Inflation Reduction Act and CHIPS Act to boost smart manufacturing, focusing on clean energy, semiconductors, and EVs. These efforts led to 200 new clean tech facilities, $88 billion investment, and 75,000 jobs.

USA Smart Manufacturing Future Outlook

The future outlook is positive, with trends pointing towards the expansion of AI-powered systems, autonomous manufacturing, the growth of smart factory initiatives, and the integration of 5G networks into manufacturing operations.

Future Market Trends

- Expansion of AI-Powered Predictive Maintenance: Over the next five years, the adoption of AI-powered predictive maintenance solutions is expected to grow rapidly across the USA Smart Manufacturing market. By 2028, it is projected that over 70,000 manufacturing facilities will utilize these systems to anticipate equipment failures and schedule maintenance proactively.

- Rise of Autonomous Manufacturing Systems: Autonomous manufacturing systems, powered by AI and robotics, are expected to become more prevalent in the USA by 2028. These systems will allow manufacturers to automate complex production processes with minimal human intervention, leading to significant gains in efficiency and productivity.

Scope of the Report

|

By Technology |

IoT AI & Machine Learning Robotics & Automation Cloud Computing |

|

By End-User |

Automotive Aerospace & Defense Food & Beverage Pharmaceuticals |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government Regulatory Bodies (e.g., Department of Commerce)

Manufacturing Companies

Technology Companies

Automation Solution Companies

AI & Machine Learning Companies

Robotics Manufacturers

Energy & Utility Companies

Industrial Equipment Manufacturers

Automotive Companies

Aerospace & Defense Companies

Pharmaceutical Companies

Venture Capitalist

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Siemens AG

General Electric

Honeywell International

Rockwell Automation

Emerson Electric Co.

ABB Ltd.

Schneider Electric

Mitsubishi Electric Corporation

IBM Corporation

Cisco Systems, Inc.

Bosch Rexroth AG

Yokogawa Electric Corporation

FANUC Corporation

Oracle Corporation

SAP SE

Table of Contents

1. USA Smart Manufacturing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Smart Manufacturing Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Smart Manufacturing Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of AI and IoT

3.1.2. Government Support and Funding

3.1.3. Expansion of Smart Factories

3.1.4. Increased Investment in Automation

3.2. Restraints

3.2.1. High Implementation Costs

3.2.2. Cybersecurity Concerns

3.2.3. Skills Gap in Workforce

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Strategic Partnerships

3.3.3. Regional Expansion

3.4. Trends

3.4.1. Integration of 5G Networks

3.4.2. Growth in Autonomous Systems

3.4.3. Adoption of Predictive Maintenance

3.5. Government Regulation

3.5.1. National AI and IoT Standards

3.5.2. Tax Incentives for Technology Adoption

3.5.3. Workforce Development Initiatives

3.5.4. Cybersecurity Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. USA Smart Manufacturing Market Segmentation, 2023

4.1. By Technology (in Value %)

4.1.1. IoT

4.1.2. AI & Machine Learning

4.1.3. Robotics & Automation

4.1.4. Cloud Computing

4.2. By End-User Industry (in Value %)

4.2.1. Automotive

4.2.2. Aerospace & Defense

4.2.3. Food & Beverages

4.2.4. Pharmaceuticals

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. USA Smart Manufacturing Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. General Electric

5.1.3. Honeywell International

5.1.4. Rockwell Automation

5.1.5. Emerson Electric Co.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Smart Manufacturing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Smart Manufacturing Market Regulatory Framework

7.1. National Manufacturing Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Smart Manufacturing Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Smart Manufacturing Market Future Segmentation, 2028

9.1. By Technology (in Value %)

9.2. By End-User Industry (in Value %)

9.3. By Region (in Value %)

10. USA Smart Manufacturing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on USA Smart Manufacturing industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Smart Manufacturing Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple smart manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such smart manufacturing companies.

Frequently Asked Questions

01 How big is the USA Smart Manufacturing market?

The USA Smart Manufacturing Market was valued at USD 60.45 billion in 2023. The key drivers for this expansion include the increasing adoption of Industry 4.0 technologies, which integrate advanced manufacturing processes with the Internet of Things (IoT), big data analytics, and cloud computing.

02 What are the challenges in USA Smart Manufacturing market?

The major challenges in the USA Smart Manufacturing market include cybersecurity risks, high implementation costs, a skills gap in the workforce, and the complexity of integrating new technologies with legacy systems in existing manufacturing setups.

03 Who are the major players in the USA Smart Manufacturing market?

Key players in the USA Smart Manufacturing market include Siemens AG, General Electric, Honeywell International, Rockwell Automation, and Emerson Electric Co., all of which are driving innovation and technological advancement in the sector.

04 What are the main growth drivers of the USA Smart Manufacturing market?

The growth of the USA Smart Manufacturing market includes adoption of IoT and AI technologies, government funding for advanced manufacturing, the push for operational efficiency, and the expansion of smart factory projects across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.