USA Smart TV Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD904

July 2024

100

About the Report

USA Smart TV Market Overview

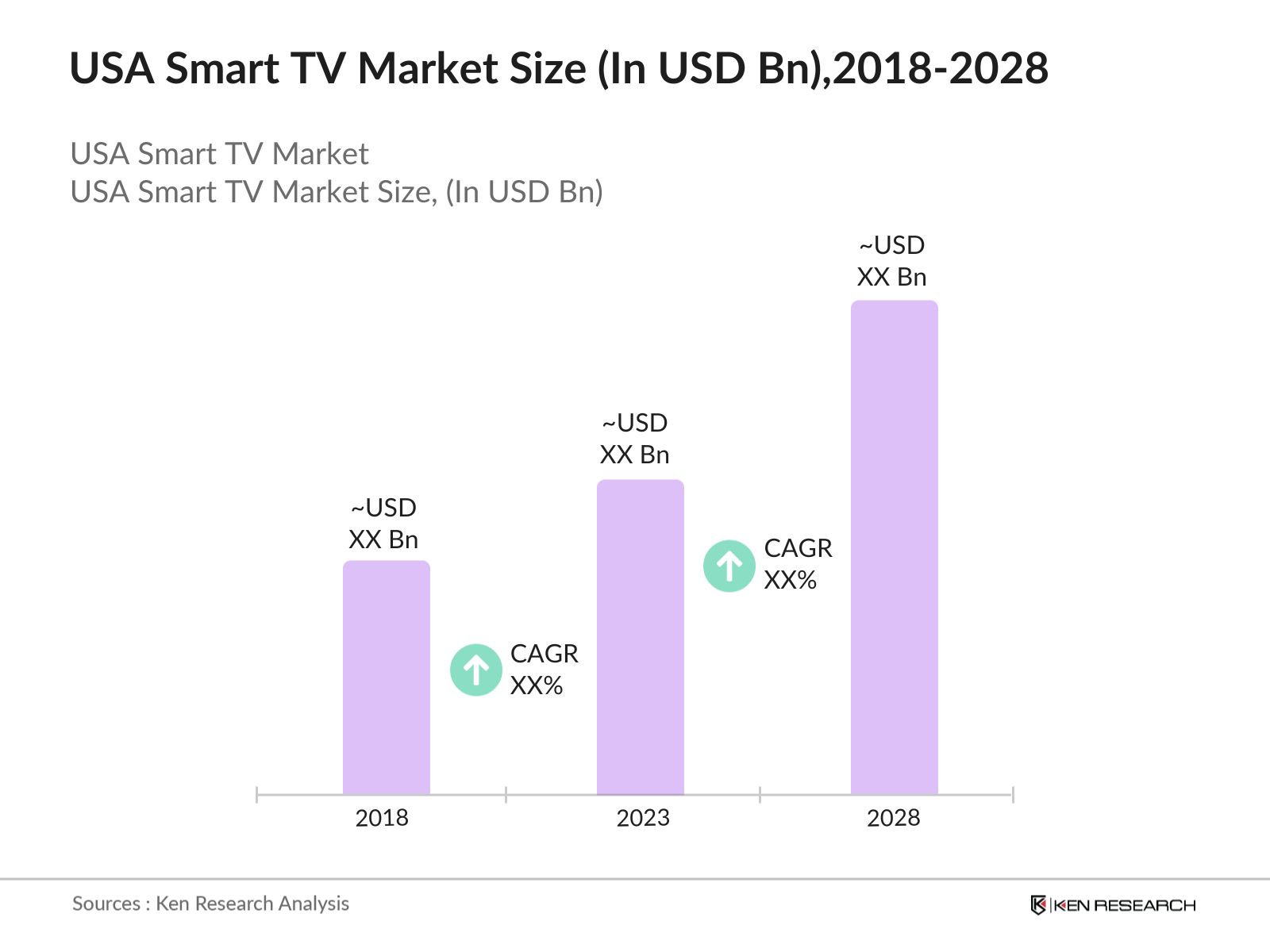

- USA Smart TV Market has shown significant growth over the past years. Meanwhile, in 2023, the size of Global Smart TV market was valued at USD 260 Bn. The growth is marked by various factors such as the rising penetration of high-speed internet, the proliferation of streaming services, and the growing popularity of smart home ecosystems.

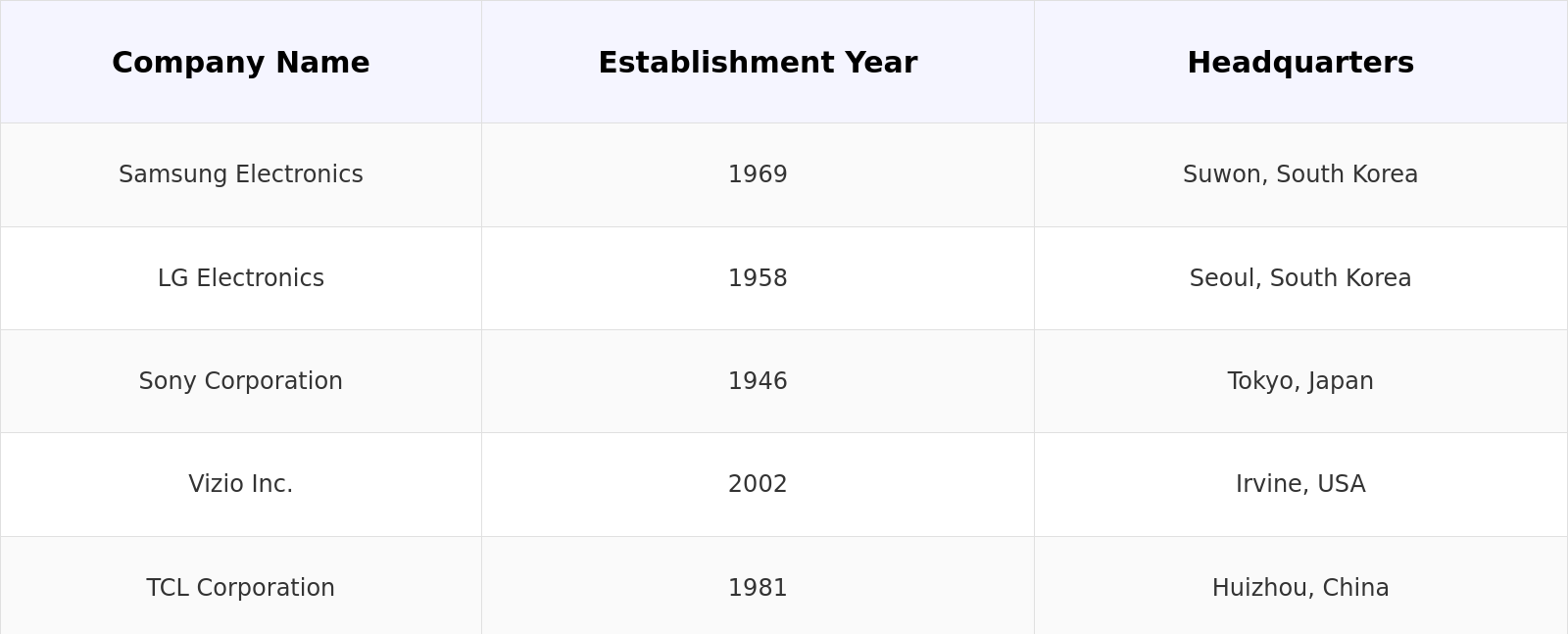

- The USA Smart TV market is dominated by several key players who have established a strong presence through innovation and strategic partnerships. Major companies are Samsung Electronics, LG Electronics, Sony Corporation, Vizio Inc. and TCL Corporation.

- In 2023, Samsung Electronics announced the launch of their latest Neo QLED 8K Smart TVs, featuring enhanced AI capabilities and the latest Quantum Mini LED technology. This development marks a significant leap in display technology, offering improved picture quality and energy efficiency.

USA Smart TV Current Market Analysis

- Innovations in display technology, such as OLED and QLED, as well as improvements in sound quality and user interfaces, are attracting consumers to upgrade their existing televisions

- The proliferation of smart TVs has transformed the way consumers access and consume content, shifting the focus from traditional broadcasting to on-demand streaming. This shift is driving significant changes in the entertainment industry, influencing content creation, distribution, and advertising strategies.

- The West Coast, particularly California, is a dominant region in the USA Smart TV market. This dominance is because of high concentration of tech-savvy consumers, higher disposable incomes, and the presence of major tech companies and innovation hubs.

USA Smart TV Market Segmentation

The USA Smart TV Market can be segmented based on several factors:

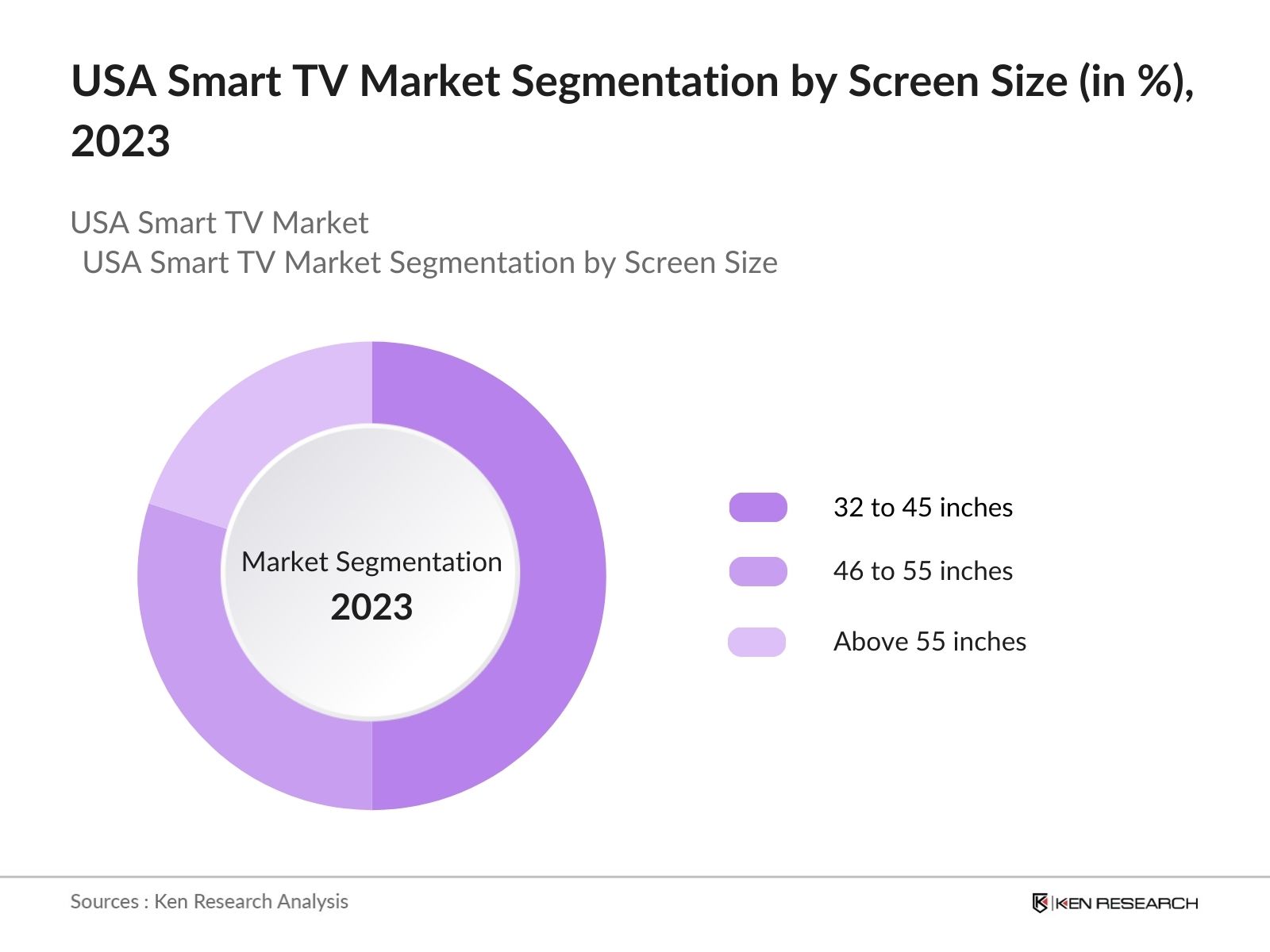

By Screen Size: USA Smart TV Market is segmented by Screen Size into 32-45 inches, 46 to 55 inches & more than 55 inches. In 2023, 32-45 inches reign as the most dominant sub-segment, holding a substantial market share for its suitability in small to medium-sized living spaces, balancing between affordability and enhanced viewing experience.

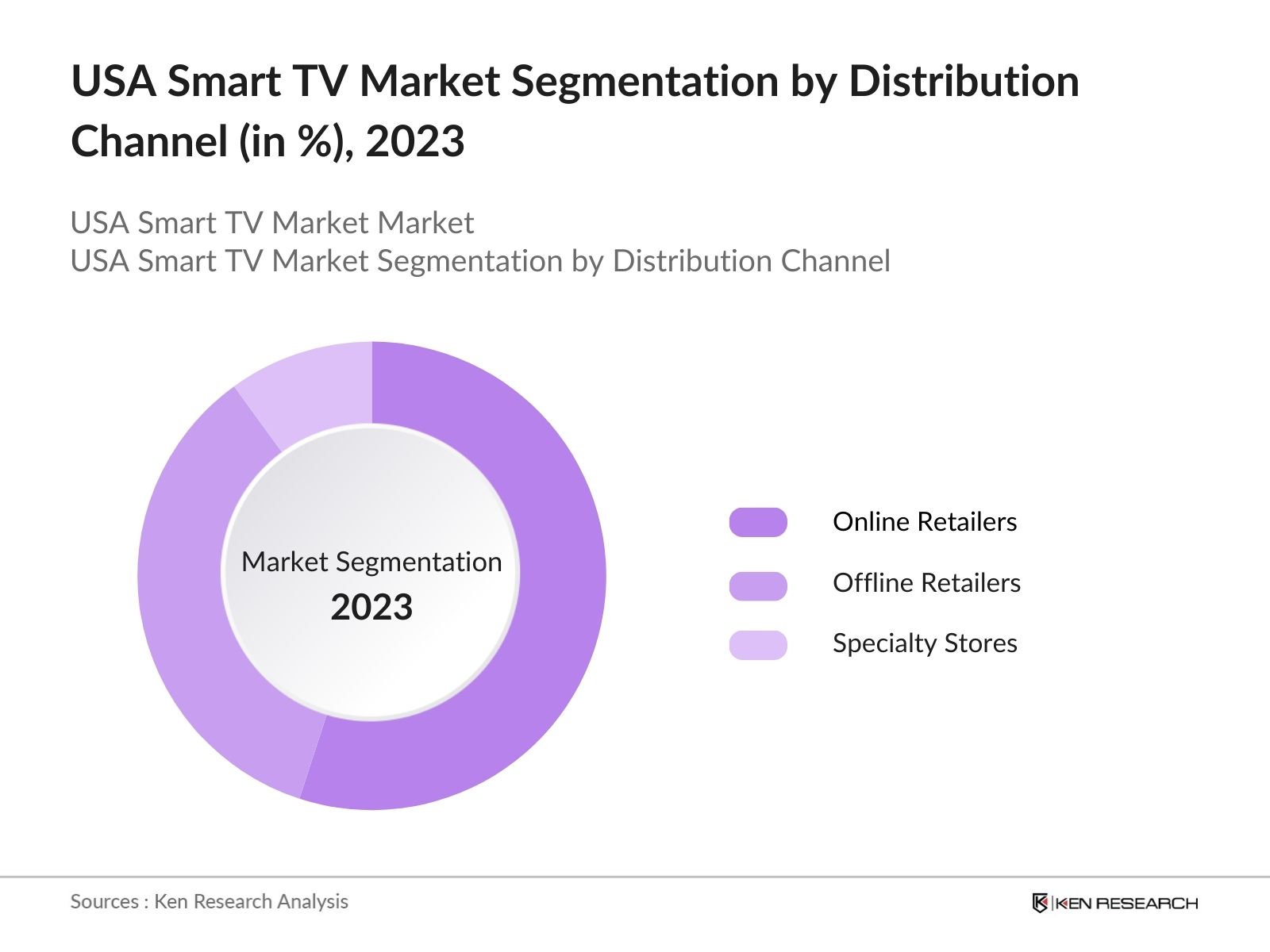

By Distribution Channel: USA Smart TV Market is segmented by End User into Online Retailers, Offline Retailers & Specialty Stores. In 2023, online retailers emerge as the most dominant sub-segment, commanding a significant percentage of the market share, due to the convenience of home delivery, competitive pricing, and a wide range of product options available to consumers.

By Region: USA Smart TV Market is segmented into North, South, East & West regions. In 2023, the Western region was dominating the market, driven by its status as a tech innovation hub, high disposable incomes, and a strong preference for digital entertainment and streaming services.

USA Smart TV Market Competitive Landscape

- In 2023, LG introduced its Rollable OLED TV, an advanced innovation that combined cutting-edge display technology with flexible design, capturing consumer interest and driving premium market growth. The cost of the Rollable TV was $100,000 in USA.

- In 2022, Sony has released soundbars like the HT-A5000 and HT-A3000 that deliver an "advanced and revolutionary multi-dimensional sound experience" when paired with compatible BRAVIA TVs. These products aim to take home cinema experiences to new heights.

- In 2023, TCL introduced smart TVs integrated with advanced AI features, enhancing voice control and personalized content recommendations. TCL's 2023 smart TV lineup offers expanded screen sizes, with models ranging from 43 inches up to a massive 98-inch display, which provides an immersive experience.

USA Smart TV Industry Analysis

USA Smart TV Market Growth Drivers:

- High-Speed Internet Penetration: In 2023, 331 million households had internet access, up from 281 million in 2018. This increase in internet access has also enabled the growth of other smart home devices, creating a more interconnected and convenient living environment.

- Rising Disposable Incomes: Increased disposable incomes have enabled consumers to invest in advanced home entertainment systems. Personal income in the USA grew by 21.64%, rising from $53,786 in 2018 to $65,423 in 2022, allowing more consumers to afford high-quality smart TVs.

- Increase in Streaming Services: The growth of streaming services like Netflix, Hulu, and Disney+ has been a significant driver for smart TV sales. In 2022, Subscription-based streaming services like Netflix, Amazon Prime Video, and Hulu dominate the US SVoD market. The demand for seamless access to these services has driven consumers to purchase smart TVs.

USA Smart TV Market Challenges:

- High Competition and Price Sensitivity: The smart TV market is highly competitive, with numerous players offering similar features at varying price points. This competition pressures profit margins and drives companies to continuously innovate to maintain market share.

- Cybersecurity Concerns: According to a report by the Federal Trade Commission in 2023, there were 4 million complaints related to identity theft and fraud, some of which were linked to smart devices, including smart TVs. Concerns over data privacy and potential hacking incidents can deter consumers from adopting smart TVs, impacting market growth.

- Rapid Technological Obsolescence: The rapid pace of technological advancements leads to quick obsolescence of smart TV models, making it challenging for consumers to keep up with the latest features. This can result in lower consumer satisfaction and increased returns.

USA Smart TV Market Government Initiatives:

- Energy Star Program: The Energy Star program, run by the US Environmental Protection Agency, encourages manufacturers to produce energy-efficient smart TVs, reducing environmental impact and promoting sustainable consumption. In 2023, the program reported that energy-efficient smart TVs saved consumers’ energy costs.

- Affordable Connectivity Program (2021): Launched as part of the Consolidated Appropriations Act, this program provides subsidies to low-income households to help them afford broadband internet services. By reducing the cost of internet access for eligible households, the program encourages the adoption of smart TVs, enabling a broader audience to benefit from streaming services and smart home integration.

- The Broadband DATA Act (2020): The Broadband Deployment Accuracy and Technological Availability (DATA) Act mandates the FCC to collect and publish detailed maps of broadband availability across the USA. By reducing the cost of internet access for eligible households, the program encourages the adoption of smart TVs, enabling a broader audience to benefit from.

USA Smart TV Future Market Outlook

The USA Smart TV market is expected to grow exponentially, driven by advancements in display technology, increased integration with smart home devices, and the proliferation of streaming services.

Future Trends

-

- Integration with Smart Home Ecosystems: By 2025, over 60% of households in the USA are projected to have smart home devices, up from 46% in 2022, driving demand for smart TVs as central hubs for IoT control. This trend will enhance the functionality and appeal of smart TVs as they integrate with other smart home technologies.

- 5G Technology Adoption: The rollout of 5G technology will enhance streaming capabilities, enabling ultra-high-definition content and reducing latency. By 2025, 5G networks are expected to cover most urban areas in the USA, boosting smart TV experiences and driving consumer interest in higher quality, faster streaming services.

- AI and Machine Learning: By 2026, most new smart TV models are expected to feature AI-driven functionalities, transforming user interaction with personalized content recommendations and advanced features like voice control. These advancements will drive market growth as consumers seek more intelligent and responsive home entertainment systems.

Scope of the Report

|

By Screen Size |

32-45 inches 46 to 55 inches More than 55 inches |

|

By Distribution Channel |

Online Retailers Offline Retailers Specialty Stores |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by subscribing this report:

Smart TV Manufacturers and supplier

Smart TV Component Manufacturer and supplier

Streaming Service Providers

IoT and Smart Home Solution Providers

Banks & Financial Institutions

Government & Regulatory Bodies (FTC, CPSC etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Samsung Electronics

LG Electronics

Sony Corporation

Vizio Inc.

TCL Corporation

Hisense

Panasonic Corporation

Sharp Corporation

Philips (TP Vision)

Insignia (Best Buy)

Toshiba Corporation

Sceptre Inc.

Skyworth Digital Holdings

Haier Group

Element Electronics

Funai Electric Co., Ltd.

Westinghouse Electronics

JVC (Japan Victor Company)

Hitachi, Ltd.

RCA (Radio Corporation of America

Â

Table of Contents

1. USA Smart TV Market Overview

1.1 USA Smart TV Market Taxonomy

2. USA Smart TV Market Size (in USD Bn), 2018-2023

3. USA Smart TV Market Analysis

3.1 USA Smart TV Market Growth Drivers

3.2 USA Smart TV Market Challenges and Issues

3.3 USA Smart TV Market Trends and Development

3.4 USA Smart TV Market Government Regulation

3.5 USA Smart TV Market SWOT Analysis

3.6 USA Smart TV Market Stake Ecosystem

3.7 USA Smart TV Market Competition Ecosystem

4. USA Smart TV Market Segmentation, 2023

4.1 USA Smart TV Market Segmentation by Screen Size (in value %), 2023

4.2 USA Smart TV Market Segmentation by Distribution Channel (in value %), 2023

4.3 USA Smart TV Market Segmentation by Region (in value %), 2023

5. USA Smart TV Market Competition Benchmarking

5.1 USA Smart TV Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. USA Smart TV Future Market Size (in USD Bn), 2023-2028

7. USA Smart TV Future Market Segmentation, 2028

7.1 USA Smart TV Market Segmentation by Screen Size (in value %), 2028

7.2 USA Smart TV Market Segmentation by Distribution Channel (in value %), 2028

7.3 USA Smart TV Market Segmentation by Region (in value %), 2028

8. USA Smart TV Market Analysts’ Recommendations

8.1 USA Smart TV Market TAM/SAM/SOM Analysis

8.2 USA Smart TV Market Customer Cohort Analysis

8.3 USA Smart TV Market Marketing Initiatives

8.4 USA Smart TV Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2: Market Building:

Collating statistics on USA Smart TV Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Smart TV Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4: Research Output:

Our team will approach multiple smart TV suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from suppliers and distributors companies.

Frequently Asked Questions

01 How big is USA Smart TV Market?

The Global Smart TV Market was valued at USD 260 Bn in 2023, rising penetration of high-speed internet, the proliferation of streaming services, and the growing popularity of smart home ecosystems

02 What factors drive USA Smart TV Market?

Factors like high-speed internet penetration, rise in disposable income & rise in streaming services are driving the market. Â This increase in internet access has also enabled the growth of other smart home devices.

03 What are challenges in USA Smart TV Market?

The key challenges faced by the USA Smart TV Market are high competition and cybersecurity concerns. The smart TV market is highly competitive, with numerous players offering similar features at varying price points.

04 Who are the major players in the USA Smart TV Market?

Some of the major players in the USA Smart TV Market include Samsung TV, LG and Sony Corporation. These companies are at the forefront of developing cutting-edge smart TV technologies, enhancing user experience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.