USA Sodium Benzoate Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4032

November 2024

92

About the Report

USA Sodium Benzoate Market Overview

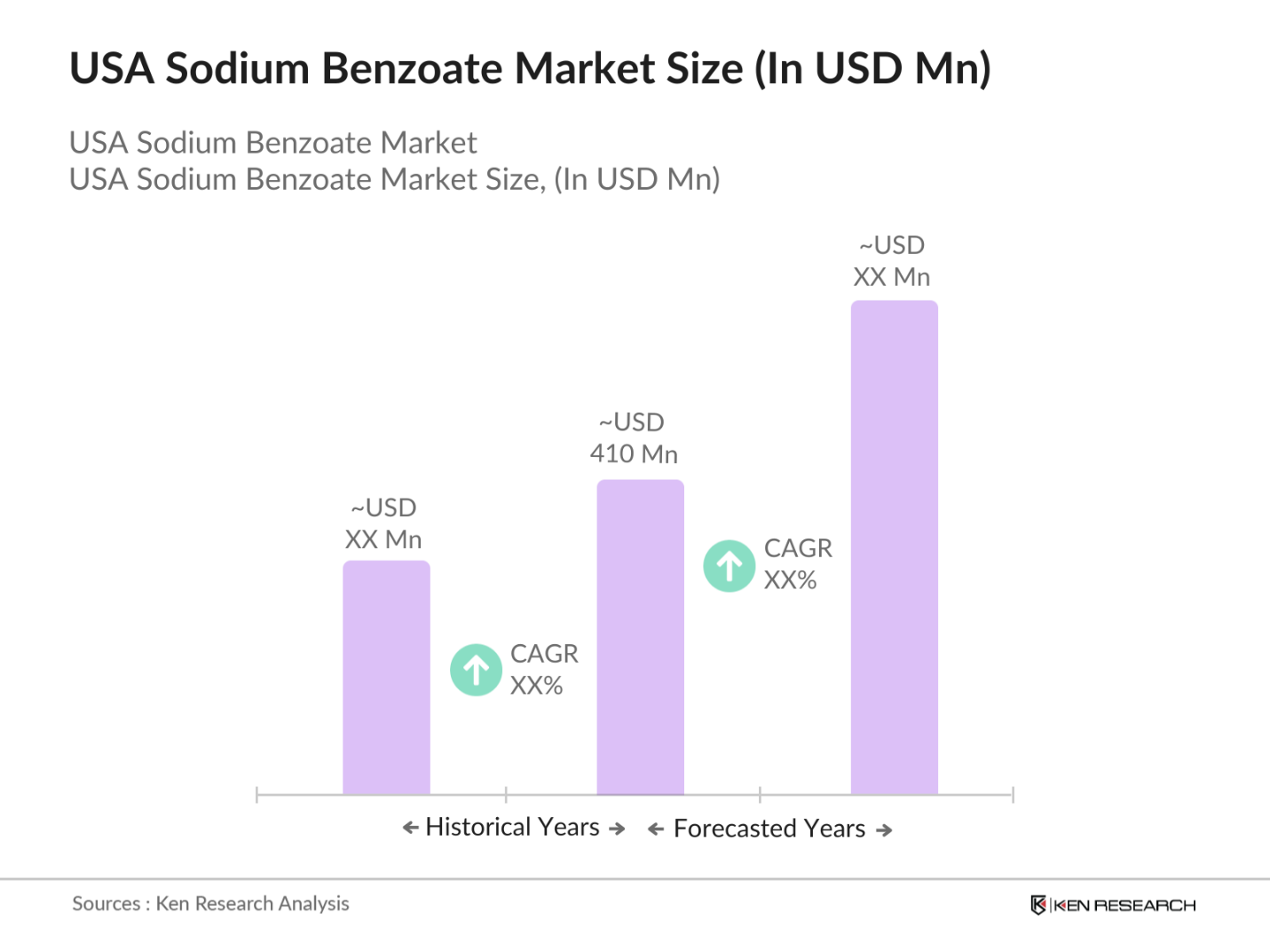

- The USA Sodium Benzoate market is valued at USD 410 million based on a five-year historical analysis. The demand is driven by its widespread usage as a preservative in the food and beverage industry, particularly in soft drinks, juices, and condiments. Sodium Benzoate's role in extending product shelf life and its status as an FDA-approved additive has strengthened its presence in the market. Additionally, its applications in pharmaceuticals and cosmetics contribute to steady market growth.

- Cities like New York, Los Angeles, and Chicago dominate the market due to their large food and beverage manufacturing hubs and higher consumption rates. These cities host numerous food processing and pharmaceutical companies that rely on Sodium Benzoate for product preservation. Moreover, the proximity to major shipping ports and distribution centers in these regions allows for efficient supply chain operations, reinforcing their dominance.

- The U.S. Food and Drug Administration (FDA) regulates the use of sodium benzoate, setting strict usage limits for its inclusion in foods and beverages. Sodium benzoate is generally recognized as safe (GRAS) when used in levels up to 0.1% in food. In 2022, FDAs guidelines further reinforced this rule to ensure consumer safety. These regulatory measures ensure the preservative is safely utilized without leading to health risks, which continues to affect how manufacturers implement sodium benzoate in their products.

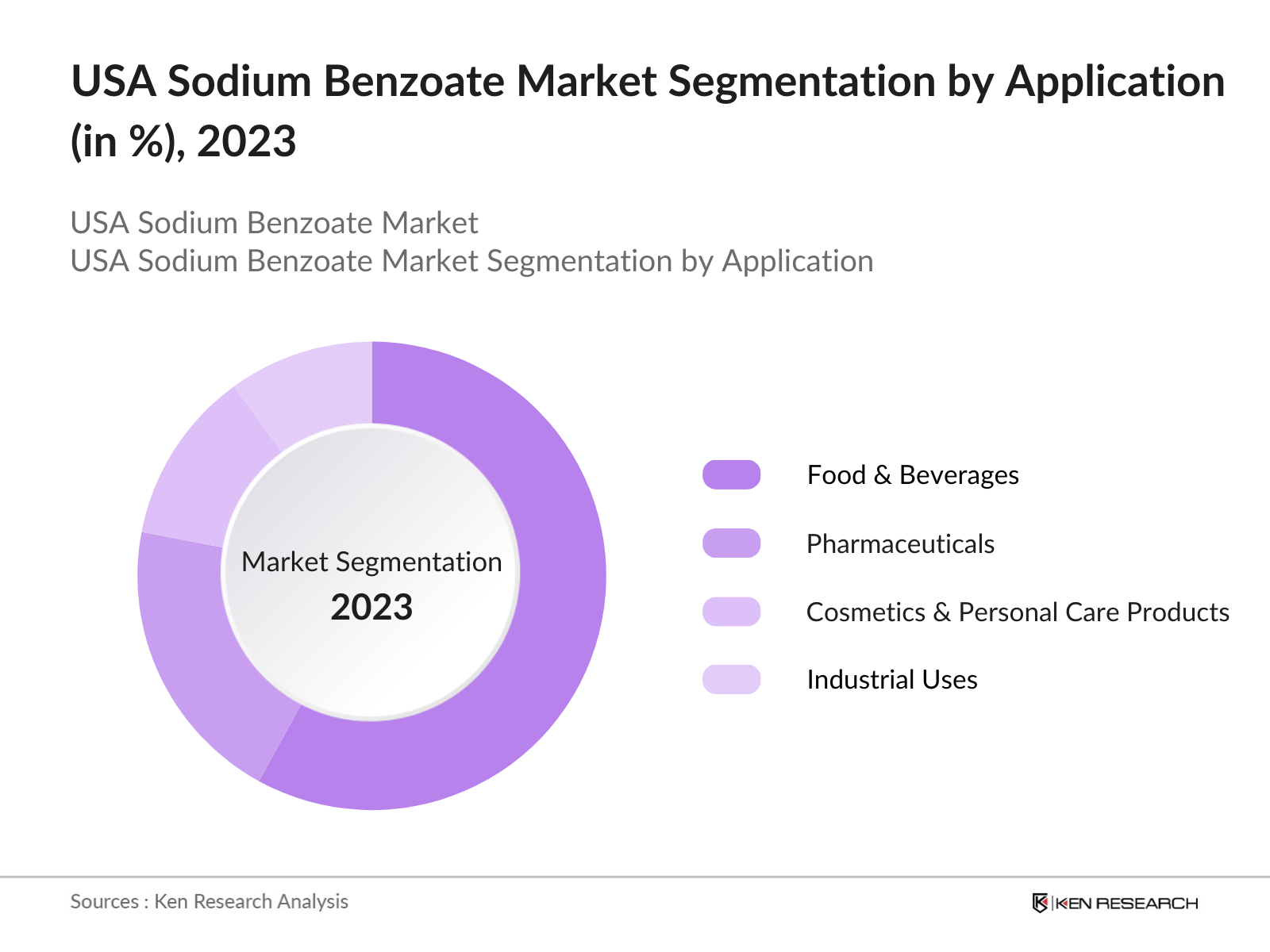

USA Sodium Benzoate Market Segmentation

By Application: The market is segmented by application into food and beverages, pharmaceuticals, cosmetics and personal care products, and industrial uses. Recently, food and beverages had a dominant market share due to the extensive use of Sodium Benzoate as a preservative in processed foods and drinks. This segment leads the market as manufacturers prioritize food safety and extend the shelf life of products, catering to the increasing demand for convenient, ready-to-eat food products in urban areas.

By Product Type: The market is segmented by product type into powdered, granular, and liquid Sodium Benzoate. Granular Sodium Benzoate holds the largest market share due to its superior solubility and ease of incorporation into food and beverage formulations. It is preferred by manufacturers for its consistent quality and ability to maintain product stability without altering taste or texture, making it the most commonly used form in food preservation.

USA Sodium Benzoate Market Competitive Landscape

The USA Sodium Benzoate market is dominated by a mix of local and global players, which includes both chemical manufacturers and food additive suppliers. Companies are focused on product innovation, regulatory compliance, and sustainability initiatives to maintain their market presence. Key market participants are investing in research and development to offer safer and more efficient preservative solutions. The market consolidation shows the influence of these key players, with several global companies leading in production capacity and innovation.

|

Company Name |

Establishment Year |

Headquarters |

Annual Revenue (USD Mn) |

Production Capacity (MT) |

No. of Employees |

Market Presence |

R&D Investment (USD Mn) |

Patent Count |

Sustainability Initiatives |

|---|---|---|---|---|---|---|---|---|---|

|

Emerald Kalama Chemical |

1967 |

Kalama, WA |

|||||||

|

Eastman Chemical Company |

1920 |

Kingsport, TN |

|||||||

|

LANXESS AG |

2004 |

Cologne, Germany |

|||||||

|

FBC Industries Inc. |

1993 |

Chicago, IL |

|||||||

|

A.M. Food Chemical Co. |

1997 |

New York, NY |

USA Sodium Benzoate Industry Analysis

Growth Drivers

- Increasing Demand for Food Preservatives: The market is seeing heightened demand driven by the food and beverage industry's growing need for food preservatives. Sodium benzoate is widely used in products like carbonated drinks, pickles, jams, and fruit juices. In 2022, the food and beverage industry in the USA contributed over $1.9 trillion to the GDP, with preservative demand expanding due to the increasing consumption of processed foods. Furthermore, sodium benzoate's ability to prevent microbial growth and extend shelf life is crucial for reducing food wastage, a $161 billion issue in the U.S.

- Rising Use in Pharmaceutical Formulations: Sodium benzoate is increasingly used in pharmaceuticals as an antifungal agent and to treat conditions like hyperammonemia. In 2023, the pharmaceutical sector in the USA grew to approximately $550 billion, enhancing demand for compounds like sodium benzoate for drug formulations. The healthcare industry, which accounted for 18% of the U.S. GDP in 2022, has continuously leveraged sodium benzoate in oral medications and syrups, where it ensures product stability over extended periods. This rising demand reflects the pharmaceutical sectors dependence on sodium benzoate.

- Expansion in the Cosmetics and Personal Care Industry: Sodium benzoate is a common preservative in the cosmetics and personal care industry. In 2023, the U.S. personal care sector generated $87.9 billion, with sodium benzoate used extensively in moisturizers, shampoos, and body washes to prevent microbial contamination. As consumer interest in health and hygiene increases, sodium benzoate is vital in maintaining the safety and longevity of cosmetic products. The expansion of this industry further bolsters sodium benzoates demand, especially as manufacturers focus on extending product shelf lif.

Market Challenges

- Health Concerns Related to Sodium Benzoate Usage: Health concerns around sodium benzoate, particularly its potential to form benzene, a known carcinogen, in combination with ascorbic acid (vitamin C), pose challenges to market growth. The FDA maintains strict regulations, allowing sodium benzoate levels of up to 0.1% in food and beverages. Despite this, consumer awareness about the potential risks, particularly in highly processed foods, has increased, and the global trend toward natural preservatives puts pressure on the market. The U.S. processed food sector, valued at $222.5 billion in 2022, may see shifts as health concerns influence consumer choices.

- Availability of Substitutes and Natural Preservatives: The increasing availability of natural preservatives like vinegar and rosemary extract is a significant challenge for sodium benzoate manufacturers. The clean-label movement is pushing manufacturers to use alternatives perceived as healthier by consumers. In 2023, the natural food preservatives market in the U.S. grew substantially, challenging synthetic preservatives like sodium benzoate. For example, clean-label products saw a rise in retail sales, contributing to the $100 billion organic food sector in the U.S., potentially reducing the demand for sodium benzoate.

USA Sodium Benzoate Market Future Outlook

Over the next five years, the USA Sodium Benzoate market is expected to experience steady growth, driven by rising demand for preservatives in food and beverages, pharmaceutical, and cosmetic applications. The shift toward clean-label products and natural preservatives could challenge the market, but the consistent use of Sodium Benzoate in processed foods will sustain its importance. Additionally, advancements in food safety standards and growing awareness of shelf-life extension technologies will drive innovation in this market.

Future Market Opportunities

- Technological Advancements in Food Preservation: Technological innovations in food preservation techniques provide significant opportunities for sodium benzoate in the U.S. market. Advanced packaging solutions, such as modified atmosphere packaging, in combination with sodium benzoate, help extend product shelf life without compromising food quality. This aligns with efforts to reduce food waste, which costs the U.S. economy $165 billion annually. As a cost-effective preservative, sodium benzoate will likely benefit from these advancements, particularly within processed food and beverage production.

- Increased Adoption in Emerging Industrial Applications: Sodium benzoate's usage is expanding into industrial applications, such as corrosion inhibition in the automotive and aviation industries. In 2022, the U.S. automotive manufacturing industry was valued at approximately $82 billion, offering opportunities for sodium benzoate in formulations like coolant systems. As industries look for multifunctional additives that extend the life of their products, sodium benzoate's role as a preservative and corrosion inhibitor could boost its demand in various sectors beyond food and pharmaceuticals.

Scope of the Report

|

Application |

Food & Beverages Pharmaceuticals Cosmetics Industrial Others |

|

Product Type |

Powder Granular Liquid |

|

End-User |

Food & Beverage Pharmaceuticals Cosmetics Industrial |

|

Distribution Channel |

Direct Sales Distributors Online |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Food & Beverage Manufacturers

Pharmaceutical Companies

Cosmetics and Personal Care Product Manufacturers

Industrial Chemical Suppliers

Food Additive Distributors

Banks and Financial Institutes

Government and Regulatory Bodies (FDA, EPA)

Investment and Venture Capitalist Firms

Packaging and Logistics Companies

Companies

Major Players

Emerald Kalama Chemical

Eastman Chemical Company

FBC Industries Inc.

LANXESS AG

A.M. Food Chemical Co.

Dr. Paul Lohmann GmbH

Jarchem Industries Inc.

AkzoNobel N.V.

Profood International Corporation

American International Chemical, LLC

Tianjin Dongda Chemical Group Co., Ltd.

Zancheng Co., Ltd.

Zhengzhou Lifeng Chemical Co., Ltd.

Weifang Hongyuan Chemical Co., Ltd.

Fancheng International Trade Co., Ltd.

Table of Contents

USA Sodium Benzoate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Market Demand for Preservatives, Industrial Applications, Food and Beverage Usage)

1.4. Market Segmentation Overview

USA Sodium Benzoate Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Regulatory Approvals, Innovation in Preservation Techniques)

USA Sodium Benzoate Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Food Preservatives

3.1.2. Rising Use in Pharmaceutical Formulations

3.1.3. Expansion in the Cosmetics and Personal Care Industry

3.2. Market Challenges

3.2.1. Health Concerns Related to Sodium Benzoate Usage

3.2.2. Regulatory Restrictions on Usage Limits (FDA, EPA Compliance)

3.2.3. Availability of Substitutes and Natural Preservatives

3.3. Opportunities

3.3.1. Technological Advancements in Food Preservation

3.3.2. Increased Adoption in Emerging Industrial Applications

3.3.3. Growth of Clean-Label Products

3.4. Trends

3.4.1. Shift Towards Natural Preservatives

3.4.2. Increased R&D in Food Safety and Shelf-Life Extension

3.4.3. Collaborative Innovations in the Cosmetic Industry

3.5. Government Regulations

3.5.1. FDA Guidelines on Sodium Benzoate

3.5.2. Environmental Compliance and Waste Management

3.5.3. Impact of Trade Tariffs on Imports and Exports

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, Distributors)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Threat of Substitutes, etc.)

3.9. Competitive Ecosystem

USA Sodium Benzoate Market Segmentation

4.1. By Application (In Value %)

4.1.1. Food and Beverages (Processed Foods, Beverages, Condiments)

4.1.2. Pharmaceuticals (Formulations, OTC Medicines)

4.1.3. Cosmetics and Personal Care Products (Skincare, Haircare)

4.1.4. Industrial Uses (Plastics, Paints)

4.1.5. Other Applications (Animal Feed, Tobacco Products)

4.2. By Product Type (In Value %)

4.2.1. Powdered Sodium Benzoate

4.2.2. Granular Sodium Benzoate

4.2.3. Liquid Sodium Benzoate

4.3. By End-User (In Value %)

4.3.1. Food and Beverage Industry

4.3.2. Pharmaceutical Industry

4.3.3. Cosmetics and Personal Care Industry

4.3.4. Industrial Manufacturing

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Distributors and Wholesalers

4.4.3. Online Channels

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

USA Sodium Benzoate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Emerald Kalama Chemical

5.1.2. Eastman Chemical Company

5.1.3. FBC Industries Inc.

5.1.4. LANXESS AG

5.1.5. A.M. Food Chemical Co. Ltd.

5.1.6. Dr. Paul Lohmann GmbH

5.1.7. Jarchem Industries Inc.

5.1.8. AkzoNobel N.V.

5.1.9. Profood International Corporation

5.1.10. American International Chemical, LLC

5.1.11. Tianjin Dongda Chemical Group Co., Ltd.

5.1.12. Zancheng Co., Ltd.

5.1.13. Zhengzhou Lifeng Chemical Co. Ltd.

5.1.14. Weifang Hongyuan Chemical Co. Ltd.

5.1.15. Fancheng International Trade Co., Ltd.

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Geographical Reach, R&D Investment, No. of Patents, Export Volume, Market Penetration, Innovation Pipeline)

5.3. Market Share Analysis (By Major Players)

5.4. Strategic Initiatives (Joint Ventures, Product Launches, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Private Equity Investments

USA Sodium Benzoate Market Regulatory Framework

6.1. FDA Regulations for Sodium Benzoate in Food and Beverage Products

6.2. Compliance Requirements for Sodium Benzoate in Pharmaceuticals

6.3. Environmental Regulations and Guidelines for Industrial Use

6.4. Certification Processes (GMP, ISO Standards)

USA Sodium Benzoate Future Market Size (In USD Mn

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Sodium Benzoate Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Product Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

USA Sodium Benzoate Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involved constructing an ecosystem map encompassing all major stakeholders in the USA Sodium Benzoate Market. Extensive desk research was conducted, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The objective was to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data pertaining to the Sodium Benzoate market was compiled and analyzed, including market penetration and revenue generation. Additionally, the performance of major players and suppliers was assessed to evaluate service quality and ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts via telephone interviews (CATIS). These consultations provided operational and financial insights directly from industry practitioners, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with Sodium Benzoate manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction served to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis.

Frequently Asked Questions

01 How big is the USA Sodium Benzoate Market?

The USA Sodium Benzoate market is valued at USD 410 million, based on a five-year historical analysis. It is driven by strong demand in food and beverage preservation and expanding pharmaceutical and cosmetics applications.

02 What are the challenges in the USA Sodium Benzoate Market?

Key challenges in the USA Sodium Benzoate market include health concerns associated with Sodium Benzoate's long-term usage and increasing regulatory restrictions on its allowable concentration in products. Furthermore, the rise of natural preservatives is creating competition.

03 Who are the major players in the USA Sodium Benzoate Market?

Major players in the USA Sodium Benzoate market include Emerald Kalama Chemical, Eastman Chemical Company, FBC Industries Inc., LANXESS AG, and A.M. Food Chemical Co., which lead the market due to their large production capacities and extensive product portfolios.

04 What drives the USA Sodium Benzoate Market?

The USA Sodium Benzoate market is propelled by the food and beverage industry's need for preservatives, alongside growing applications in pharmaceuticals and personal care products. The FDA's approval of Sodium Benzoate further supports its widespread use in consumable products.

05 What is the future outlook of the USA Sodium Benzoate Market?

The future of the Sodium Benzoate market looks promising, with steady growth expected due to rising demand for extended shelf-life solutions and innovations in preservation technologies, although natural preservatives may provide competition in specific segments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.