USA Solar Lighting System Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD9905

November 2024

91

About the Report

U.S. Solar Lighting System Market Overview

- The U.S. Solar Lighting System market is valued at USD 3 billion. This valuation is driven by increasing demand for renewable energy solutions and rising adoption of energy-efficient technologies. Factors such as favorable government policies, technological advancements, and the growing need for sustainable urban development play a crucial role in boosting market demand.

- Cities like Los Angeles, New York, and Austin dominate the U.S. Solar Lighting System market due to their aggressive renewable energy initiatives, substantial government funding, and higher adoption rates. These urban areas invest heavily in smart city projects and infrastructure modernization, which rely on solar-powered systems to achieve energy efficiency and carbon neutrality goals.

- Several states have introduced mandates and incentives to accelerate the adoption of solar technologies. Californias Title 24 Building Energy Efficiency Standards, for example, require solar integration in new residential constructions. By 2023, over 25,000 new homes in California were equipped with solar lighting systems. Similarly, New York's NY-Sun Initiative has allocated $1.5 billion to expand solar projects, including lighting installations. These state-level efforts complement federal policies, driving market growth at the regional level.

U.S. Solar Lighting System Market Segmentation

By Product Type: The U.S. Solar Lighting System market is segmented by product type into standalone solar lighting systems and grid-connected solar lighting systems.

Standalone solar lighting systems dominate the market due to their suitability for off-grid applications and rural electrification projects. These systems operate independently of grid connectivity, making them ideal for remote areas and highways. Additionally, their cost-effectiveness and scalability contribute to their widespread adoption.

By Application: The market is further segmented by application into residential, commercial, industrial, highways and roadways, and others. The commercial segment holds a dominant share, driven by widespread use in office buildings, malls, and public infrastructure projects. Commercial establishments prioritize energy-efficient lighting to reduce operational costs and comply with sustainability mandates.

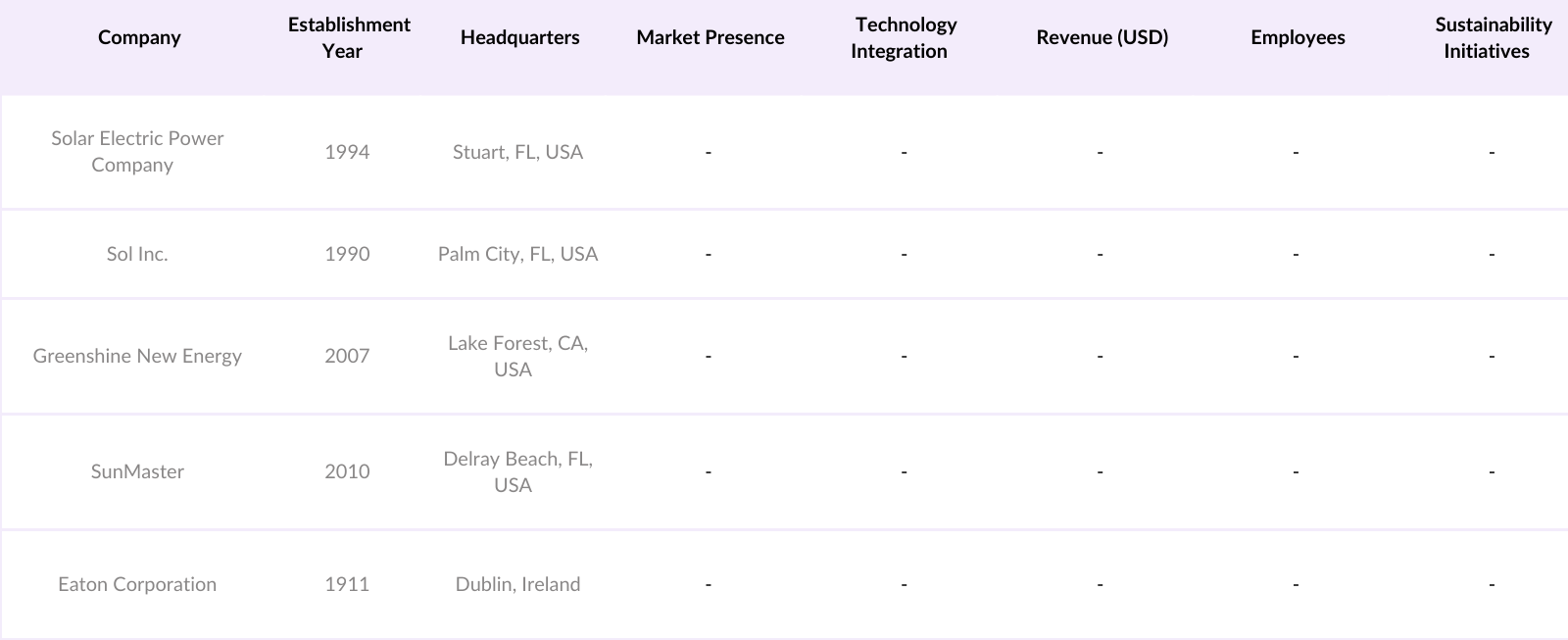

U.S. Solar Lighting System Market Competitive Landscape

The U.S. Solar Lighting System market is dominated by major players with strong technological capabilities and extensive distribution networks. Companies like Solar Electric Power Company, Sol Inc., and Greenshine New Energy leverage their advanced products and strategic partnerships to secure a significant market position. This consolidation demonstrates the impact of innovation and market outreach.

U.S. Solar Lighting System Market Analysis

Growth Drivers

- Increasing Demand for Energy-Efficient Lighting: The U.S. Department of Energy reports that lighting accounts for approximately 15% of the nation's electricity consumption. In 2024, the U.S. consumed about 3,800 billion kilowatt-hours (kWh) of electricity, indicating that lighting usage was around 570 billion kWh. The shift towards energy-efficient solutions, such as solar lighting systems, aims to reduce this substantial energy demand. The Energy Information Administration (EIA) notes that the adoption of energy-efficient lighting technologies could save up to 190 billion kWh annually, underscoring the significant impact of transitioning to solar lighting systems.

- Rising Adoption of Renewable Energy Sources: The U.S. Energy Information Administration (EIA) indicates that renewable energy sources contributed approximately 20% to the nation's electricity generation in 2023. Solar energy, in particular, has seen rapid growth, with utility-scale solar capacity reaching 97 gigawatts (GW) by the end of 2023. This trend reflects a national commitment to reducing reliance on fossil fuels and decreasing greenhouse gas emissions.

- Government Incentives and Subsidies: The U.S. government has implemented various incentives to promote renewable energy adoption. The Investment Tax Credit (ITC) offers a 26% tax credit for solar energy systems installed on residential and commercial properties. Additionally, the Department of Energy's Solar Energy Technologies Office (SETO) allocated $128 million in 2023 to support solar technology advancements. These financial incentives reduce the upfront costs associated with solar lighting systems, encouraging both individuals and businesses to invest in energy-efficient lighting solutions.

Challenges

- High Initial Installation Costs: The initial investment required for solar lighting systems remains a significant barrier to widespread adoption. According to the National Renewable Energy Laboratory (NREL), the average installed cost for commercial solar PV systems was approximately $1.50 per watt in 2023. For a typical 10-kilowatt (kW) system, this translates to an upfront cost of $15,000. While long-term savings are achievable through reduced energy bills, the substantial initial expenditure can deter potential users, particularly in residential and small business sectors.

- Dependence on Weather Conditions: Solar lighting systems rely on sunlight to generate power, making their performance susceptible to weather variability. The National Oceanic and Atmospheric Administration (NOAA) reports that certain regions in the U.S. experience over 100 cloudy days annually, which can significantly impact solar energy generation. This dependence on weather conditions necessitates the integration of efficient energy storage solutions to ensure consistent lighting, especially in areas with less predictable sunlight exposure.

U.S. Solar Lighting System Market Future Outlook

Over the next five years, the U.S. Solar Lighting System market is expected to experience robust growth driven by ongoing government support, advancements in solar panel efficiency, and rising consumer awareness of sustainable energy solutions. Increasing adoption in both urban and rural areas, combined with private sector investments in smart cities, will significantly enhance the market's trajectory.

Market Opportunities

- Expansion into Rural and Off-Grid Areas: Approximately 14% of the U.S. population resides in rural areas, many of which lack reliable access to the electrical grid. The U.S. Department of Agriculture (USDA) has identified over 1,000 rural communities that could benefit from renewable energy solutions. Solar lighting systems offer a viable alternative for these regions, providing dependable illumination without the need for extensive infrastructure. The deployment of solar lighting in these areas not only enhances quality of life but also supports sustainable development initiatives.

- Integration with Smart City Initiatives: The U.S. Department of Transportation (DOT) has invested over $350 million in smart city projects across various municipalities. These initiatives aim to enhance urban infrastructure through the integration of advanced technologies, including smart lighting systems. Solar lighting equipped with Internet of Things (IoT) capabilities can be integrated into these projects, offering benefits such as remote monitoring, adaptive lighting based on real-time conditions, and energy efficiency.

Scope of the Report

|

By Product Type |

- Standalone Solar Lighting Systems |

|

By Light Source |

- Light Emitting Diode (LED) |

|

By Application |

- Residential |

|

By Grid Type |

- Off-Grid |

|

By Region |

- Northeast |

Products

Key Target Audience

Solar Lighting Manufacturers

Urban Development Authorities

Smart City Solution Providers

Construction and Infrastructure Companies

Renewable Energy Organizations

Highway and Roadway Planning Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Energy, Environmental Protection Agency)

Companies

Players Mentioned in the Report

Solar Electric Power Company

Sol Inc.

Greenshine New Energy

SunMaster

Eaton Corporation

Clear Blue Technologies

Signify Holding

Su-Kam Power Systems

FlexSol Solutions

Jinhua SunMaster Solar Lighting Co., Ltd.

Table of Contents

1. U.S. Solar Lighting System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Solar Lighting System Market Size (USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Solar Lighting System Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Energy-Efficient Lighting

3.1.2. Rising Adoption of Renewable Energy Sources

3.1.3. Government Incentives and Subsidies

3.1.4. Technological Advancements in Solar Lighting

3.2. Market Challenges

3.2.1. High Initial Installation Costs

3.2.2. Dependence on Weather Conditions

3.2.3. Competition from Conventional Lighting Systems

3.3. Opportunities

3.3.1. Expansion into Rural and Off-Grid Areas

3.3.2. Integration with Smart City Initiatives

3.3.3. Development of Hybrid Solar Lighting Systems

3.4. Trends

3.4.1. Adoption of LED Technology

3.4.2. Use of IoT in Solar Lighting Systems

3.4.3. Growth in Solar Street Lighting Projects

3.5. Government Regulations

3.5.1. Federal Renewable Energy Policies

3.5.2. State-Level Incentives and Mandates

3.5.3. Environmental Standards and Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. U.S. Solar Lighting System Market Segmentation

4.1. By Product Type (Value %)

4.1.1. Standalone Solar Lighting Systems

4.1.2. Grid-Connected Solar Lighting Systems

4.2. By Light Source (Value %)

4.2.1. Light Emitting Diode (LED)

4.2.2. Compact Fluorescent Lamps (CFL)

4.2.3. Others

4.3. By Application (Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Highways and Roadways

4.3.5. Others

4.4. By Grid Type (Value %)

4.4.1. Off-Grid

4.4.2. Hybrid

4.5. By Region (Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. Solar Lighting System Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Solar Electric Power Company

5.1.2. Sol Inc.

5.1.3. SunMaster

5.1.4. FlexSol Solutions

5.1.5. Signify Holding

5.1.6. Eaton Corporation

5.1.7. Su-Kam Power Systems

5.1.8. Clear Blue Technologies

5.1.9. Jinhua SunMaster Solar Lighting Co., Ltd.

5.1.10. Greenshine New Energy

5.2. Cross Comparison Parameters

Number of Employees

Headquarters

Inception Year

Revenue

Product Portfolio

Market Share

R&D Investment

Regional Presence

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. U.S. Solar Lighting System Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. U.S. Solar Lighting System Future Market Size (USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Solar Lighting System Future Market Segmentation

8.1. By Product Type (Value %)

8.2. By Light Source (Value %)

8.3. By Application (Value %)

8.4. By Grid Type (Value %)

8.5. By Region (Value %)

9. U.S. Solar Lighting System Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

An initial map of stakeholders within the U.S. Solar Lighting System market was created using desk research and database analysis. This step involved identifying the main factors driving demand, including urbanization and renewable energy initiatives.

Step 2: Market Analysis and Construction

Historical data was compiled to assess penetration levels, product uptake, and operational efficiencies in the solar lighting sector. Comparative analyses of regions were conducted to pinpoint growth areas.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from desk research were validated through interviews with industry stakeholders, including manufacturers and policymakers. These consultations provided insights into regulatory impacts and market trends.

Step 4: Research Synthesis and Final Output

Data was synthesized to create actionable insights. Input from manufacturers and policymakers complemented quantitative findings, ensuring the analysis reflects real-world market conditions accurately.

Frequently Asked Questions

01. How big is the U.S. Solar Lighting System Market?

The U.S. Solar Lighting System market is valued at USD 3 billion, driven by rising renewable energy adoption, technological innovation, and supportive government policies.

02. What are the challenges in the U.S. Solar Lighting System Market?

Challenges in U.S. Solar Lighting System market include high initial setup costs, dependence on weather conditions, and competition from conventional lighting systems.

03. Who are the major players in the U.S. Solar Lighting System Market?

Key players in U.S. Solar Lighting System market include Solar Electric Power Company, Sol Inc., Greenshine New Energy, SunMaster, and Eaton Corporation. The U.S. Solar Lighting System market is dominated by major players with strong technological capabilities and extensive distribution networks

04. What are the growth drivers of the U.S. Solar Lighting System Market?

Growth drivers in US. Solar Lighting System market include government incentives for renewable energy, advancements in solar panel efficiency, and increasing adoption in smart city projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.