USA Soups Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD9229

November 2024

85

About the Report

USA Soups Market Overview

- The USA Soups Market, valued at USD 3.2 billion, is driven by a strong demand for convenient, ready-to-eat meals among busy consumers. A historical analysis reveals a consistent growth trajectory, spurred by an increasing preference for quick and easy meal options and a trend toward healthier ingredients. Major brands have responded by expanding their offerings to include organic, plant-based, and low-sodium soup varieties, catering to health-conscious consumers.

- Cities such as New York, Los Angeles, and Chicago dominate the market due to high population density, urban lifestyles, and a robust presence of supermarkets and convenience stores. The culture of convenience-driven eating in these urban hubs, combined with consumer awareness about health and wellness, has established these cities as significant consumption centers for packaged soups.

- To reduce dependence on imports, the U.S. Department of Agriculture (USDA) allocated around $2 billion in grants in 2024 to support domestic agriculture and food production. This initiative is designed to stabilize supply chains and mitigate costs, providing indirect benefits to soup manufacturers reliant on local ingredients. By supporting homegrown food sources, the government aims to make raw materials more accessible and affordable for manufacturers.

USA Soups Market Segmentation

By Product Type: The market is segmented by product type into canned soup, frozen soup, dry soup mix, and chilled soup. Currently, canned soup holds a dominant market share due to its extended shelf life and extensive distribution in both physical stores and online channels. Iconic brands like Campbells and Progresso have built strong consumer loyalty, particularly for canned soups, which are viewed as reliable, long-lasting pantry staples across the USA.

By Ingredients: The market is further segmented by ingredients into vegetarian and non-vegetarian soups. Vegetarian soups hold a significant share, largely due to the rise of plant-based diets and an increasing inclination toward meat-free meal options. Brands like Amys Kitchen and Pacific Foods cater to this demand by offering a wide variety of vegetarian and vegan soups, aligning with consumers' dietary preferences for more sustainable and cruelty-free products.

USA Soups Market Competitive Landscape

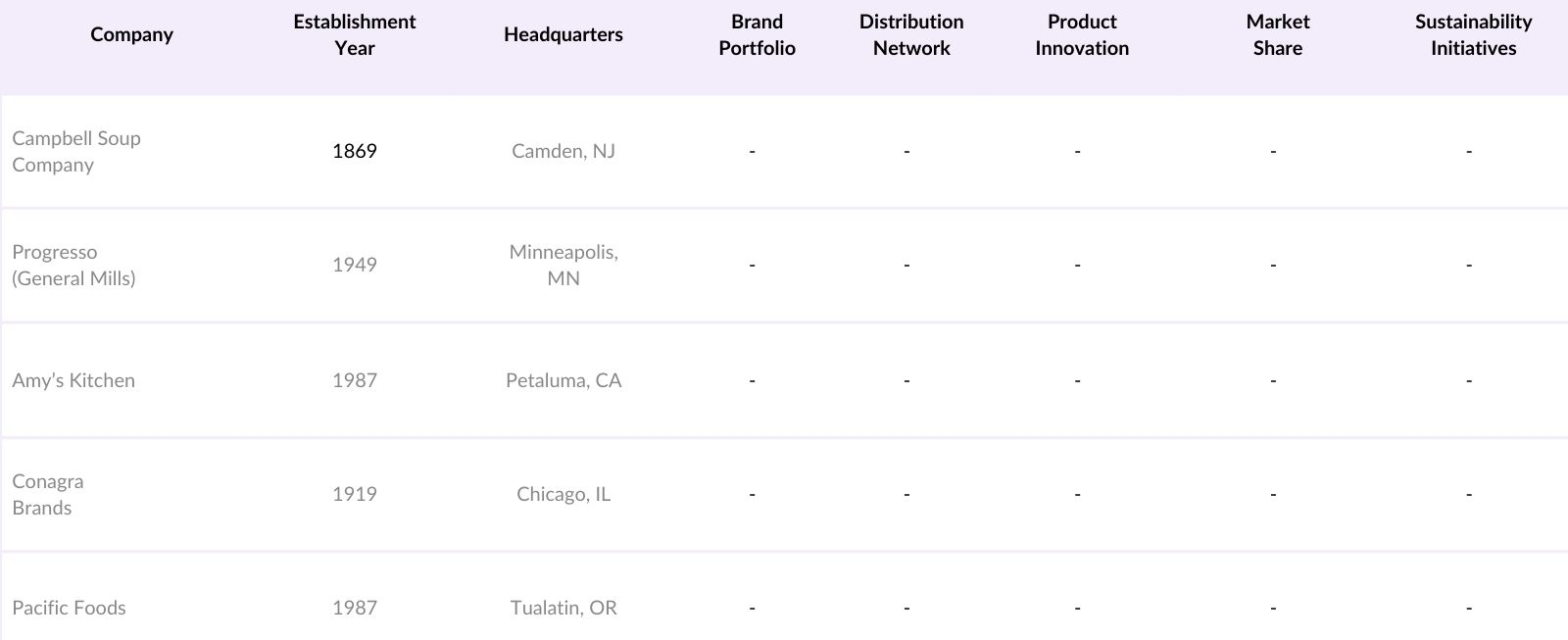

The market is dominated by a few major players, including well-established names like Campbell Soup Company and Progresso, alongside growing brands like Amys Kitchen. This competitive landscape is shaped by the diversity of offerings, innovation in flavors, and strong distribution networks, with each company continuously evolving to cater to consumer demands for healthier, convenient options.

USA Soups Market Analysis

Market Growth Drivers

- Health-Conscious Demand Surge: The growing awareness about health and nutrition has seen an increase in demand for soups, especially with a rising preference for low-sodium, organic, and gluten-free options. In 2024, over 12 million households in the USA reported a heightened focus on healthier dietary choices, significantly impacting soup selections. This trend is being fueled by the estimated 50 million Americans actively seeking to manage health conditions like hypertension and diabetes through diet.

- Increased Demand for Ready-to-Eat and Convenient Food Options: In 2024, the USA witnessed over 100 million employed individuals with demanding schedules who favored quick, convenient meals, further stimulating the market for ready-to-eat soups. The fast-paced lifestyle in metropolitan areas such as New York, Chicago, and Los Angeles has increased the demand for on-the-go meal solutions, making soups an appealing option. Additionally, an estimated 35% of American millennials report preferring ready-to-eat meal options, underscoring a shift towards convenient meals.

- Rising Elderly Population Driving Nutrient-Dense Soup Demand: By 2024, the elderly population in the USA reached around 56 million, spurring demand for easy-to-digest, nutrient-dense foods such as soups. This demographic shift has led soup companies to focus on creating specialized, nutrient-rich options that cater to the needs of seniors. Soups enriched with protein, vitamins, and other essential nutrients have become essential, contributing to market growth and product innovation as companies increasingly target this expanding customer base.

Market Challenges

- Rising Raw Material Costs: In 2024, the prices of essential ingredients like tomatoes, onions, and chicken reached unprecedented highs due to supply chain disruptions and unfavorable weather conditions in key agricultural regions. The USA imported over 7 million tons of vegetables, impacting the soup industry directly as costlier imports drive up production expenses.

- Intensified Competition from Alternatives: The USA ready-to-eat meal market has seen a 30% increase in alternative offerings such as ready-made salads and protein bowls, posing a competitive challenge to traditional soups. The 2024 surge in consumer interest toward plant-based and protein-rich snacks has diverted some demand away from soups, as newer products offer similar convenience with added health benefits.

USA Soups Market Future Outlook

Over the next five years, the USA Soups industry is expected to exhibit sustained growth, fueled by increased consumer awareness of health benefits and continuous innovation in product ingredients. Demand for plant-based and organic soup varieties is anticipated to rise, driven by a shift toward healthier lifestyles.

Future Market Opportunities

- Rising Demand for Plant-Based and Vegan Soups: By 2029, the demand for plant-based soups is expected to grow as more than 5 million American consumers are projected to transition to vegetarian and vegan diets over the next five years. This trend will drive soup companies to innovate with new plant-based recipes to cater to the increasing preference for animal-free products, positioning plant-based soups as a major growth area within the market.

- Increase in Direct-to-Consumer Sales Channels: With an estimated 50 million Americans expected to prefer direct-to-consumer purchases by 2029, the soup market will likely see substantial growth in direct online sales. Companies are projected to heavily invest in e-commerce platforms, enabling them to capture a larger portion of the digital retail market. This shift will streamline consumer access and drive brand loyalty through personalized marketing.

Scope of the Report

|

Type |

Canned Soup Frozen Soup Dry Soup Mix Chilled Soup |

|

Ingredients |

Vegetarian Non-Vegetarian |

|

Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

Consumer Group |

Household Consumers Institutional Buyers On-the-Go Consumers |

|

Packaging Type |

Cans Cartons Plastic Pouches Glass Containers |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Supermarket Chains and Grocery Stores

Quick-Service Restaurants (QSRs) and Cafes

Banks and Financial Institution

Private Equity Firms

Private Label Manufacturers

Food and Beverage Investment and Venture Capital Firms

Government and Regulatory Bodies (USDA, FDA)

E-commerce Platforms and Online Retailers

Companies

Campbell Soup Company

Progresso (General Mills)

Amys Kitchen

Conagra Brands (Healthy Choice)

Nestl (Maggi)

Heinz (Kraft Heinz)

Pacific Foods

Knorr (Unilever)

Wolfgang Puck Soups

Imagine Foods

Table of Contents

1. USA Soups Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate Analysis

1.4 Market Segmentation Overview

2. USA Soups Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Soups Market Analysis

3.1 Growth Drivers

3.1.1 Rising Consumer Preference for Ready-to-Eat Meals

3.1.2 Expansion in Retail Channels (supermarkets, online platforms)

3.1.3 Innovation in Flavors and Ingredients

3.2 Market Challenges

3.2.1 Health Concerns around Processed Foods

3.2.2 Intense Competition from Local and Imported Brands

3.2.3 Regulatory Compliance on Food Safety

3.3 Opportunities

3.3.1 Demand for Organic and Health-Oriented Soups

3.3.2 Expansion into Emerging Markets

3.3.3 Growth in Plant-Based Soup Offerings

3.4 Trends

3.4.1 Premiumization of Soup Products

3.4.2 Increasing Demand for Sustainable Packaging

3.4.3 Rise of Clean Label and Non-GMO Options

3.5 Regulatory Environment

3.5.1 USDA and FDA Compliance

3.5.2 Labeling and Packaging Standards

3.5.3 Food Safety Modernization Act Implications

3.6 SWOT Analysis

3.7 Industry Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Overview

4. USA Soups Market Segmentation

4.1 By Type (In Value %)

4.1.1 Canned Soup

4.1.2 Frozen Soup

4.1.3 Dry Soup Mix

4.1.4 Chilled Soup

4.2 By Ingredients (In Value %)

4.2.1 Vegetarian

4.2.2 Non-Vegetarian

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarkets & Hypermarkets

4.3.2 Convenience Stores

4.3.3 Online Retail

4.3.4 Specialty Stores

4.4 By Consumer Group (In Value %)

4.4.1 Household Consumers

4.4.2 Institutional Buyers (restaurants, hospitals)

4.4.3 On-the-Go Consumers

4.5 By Packaging Type (In Value %)

4.5.1 Cans

4.5.2 Cartons

4.5.3 Plastic Pouches

4.5.4 Glass Containers

4.6 By Region (In Value %)

4.6.1 North

4.6.2 East

4.6.3 West

4.6.4 South

5. USA Soups Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Campbell Soup Company

5.1.2 Progresso (General Mills)

5.1.3 Amy's Kitchen

5.1.4 Conagra Brands (Healthy Choice)

5.1.5 Nestl (Maggi)

5.1.6 Heinz (Kraft Heinz)

5.1.7 Pacific Foods

5.1.8 Knorr (Unilever)

5.1.9 Wolfgang Puck Soups

5.1.10 Imagine Foods

5.1.11 Trader Joe's Soups

5.1.12 Kroger Private Label

5.1.13 Walmart Great Value

5.1.14 Whole Foods 365

5.1.15 Lipton (PepsiCo)

5.2 Cross Comparison Parameters (Market Share, Product Range, Brand Reputation, Supply Chain Network, Innovation Capacity, Sustainability Initiatives, Customer Satisfaction, Pricing Strategies)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Investments

5.8 Funding in Product Development

6. USA Soups Market Regulatory Framework

6.1 Food Labeling Regulations

6.2 Safety and Quality Standards

6.3 Health Claims and Nutritional Guidelines

7. USA Soups Future Market Size (In USD Mn)

7.1 Forecasted Market Size Projections

7.2 Key Drivers for Future Market Growth

8. USA Soups Future Market Segmentation

8.1 By Type (Projected Value %)

8.2 By Ingredients (Projected Value %)

8.3 By Distribution Channel (Projected Value %)

8.4 By Consumer Group (Projected Value %)

8.5 By Packaging Type (Projected Value %)

8.5 By Region (Projected Value %)

9. USA Soups Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Serviceable Addressable Market (SAM) Analysis

9.3 Product Innovation and Marketing Strategies

9.4 Identifying White Space Opportunities

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the primary stakeholders in the USA Soups Market through comprehensive desk research, using secondary databases and industry sources. Critical variables, including product type, ingredients, and regional demand patterns, are identified to frame the market dynamics.

Step 2: Market Analysis and Data Compilation

In this phase, historical market data is collected and analyzed, focusing on production volumes, distribution trends, and consumer behavior. A detailed examination of market drivers and restraints is conducted to ensure accurate revenue estimates and segment growth analysis.

Step 3: Hypothesis Testing and Expert Validation

Hypotheses concerning growth potential, dominant segments, and future trends are formulated and validated through interviews with industry experts and company representatives. This step ensures data accuracy and offers insight into market trends from professionals within the sector.

Step 4: Data Synthesis and Final Report Preparation

The final step synthesizes insights from all prior stages, integrating expert feedback and market trends to develop a validated, comprehensive analysis of the USA Soups Market. Final output includes segment-wise projections, competitive analysis, and a future outlook, presenting a reliable market overview.

Frequently Asked Questions

01. How big is the USA Soups Market?

The USA Soups Market is valued at USD 3.2 billion, driven by increasing consumer demand for convenience foods and a shift towards healthier, organic options.

02. What are the challenges in the USA Soups Market?

Challenges in the USA Soups Market include stringent regulatory standards on food safety, growing competition, and the need for continuous innovation to meet consumer preferences for low-sodium and organic products.

03. Who are the major players in the USA Soups Market?

Key players in the USA Soups Market include Campbell Soup Company, Progresso (General Mills), Amys Kitchen, Heinz (Kraft Heinz), and Pacific Foods, which lead due to their wide product ranges and strong market presence.

04. What drives growth in the USA Soups Market?

Growth in the USA Soups Market is driven by factors like the demand for ready-to-eat meals, a rise in plant-based and organic options, and product innovation catering to health-conscious consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.