USA Space Technology Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD10744

November 2024

82

About the Report

USA Space Technology Market Overview

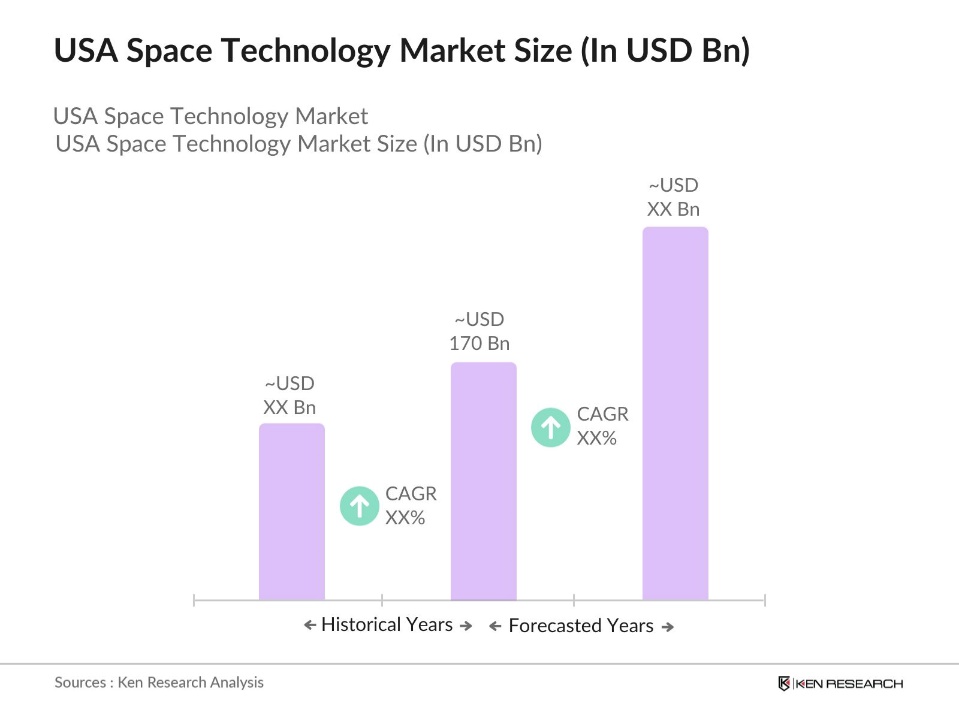

- The USA Space Technology Market, valued at USD 170 billion, is propelled by a combination of government funding, private sector investments, and advancements in satellite technology. This growth is underpinned by increased demand for satellite-based communication, Earth observation, and space exploration, all of which benefit from technological advancements in AI, IoT, and reusable launch vehicles.

- The USA dominates the space technology market globally, with leading cities like Los Angeles and Houston emerging as major centers due to their established aerospace industries and proximity to NASA facilities. Los Angeles is home to SpaceX and other pioneering companies, fostering an innovation ecosystem around commercial space exploration. Meanwhile, Washington D.C. is critical for policy and regulation, hosting governmental bodies like NASA, the FAA, and the DoD, which collectively shape the industry through policies and contracts.

- The U.S. Department of States ITAR compliance requirements ensure sensitive technologies are safeguarded. ITAR regulations are stringent, and in 2023, over 60% of U.S. space firms reported delays due to export compliance procedures. While necessary for national security, these policies create hurdles for firms attempting to expand globally, making export management a critical operational aspect in the space technology sector.

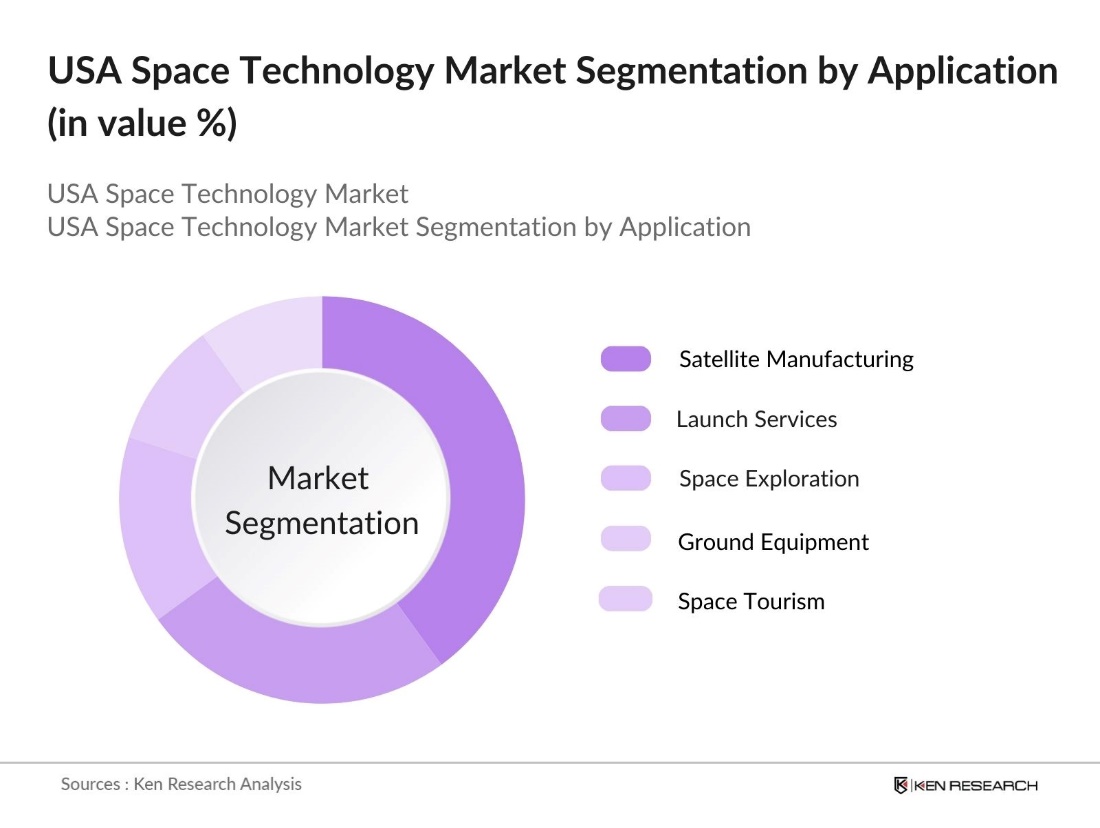

USA Space Technology Market Segmentation

By Application: The market is segmented by application into satellite manufacturing, launch services, space exploration, ground equipment, and space tourism. Satellite manufacturing currently holds a dominant market share due to the high demand for communication and Earth observation satellites. Companies like Boeing and Lockheed Martin have established strong manufacturing capabilities, catering to both governmental and private sector needs. Increased global demand for internet access and real-time environmental monitoring sustains the dominance of this segment.

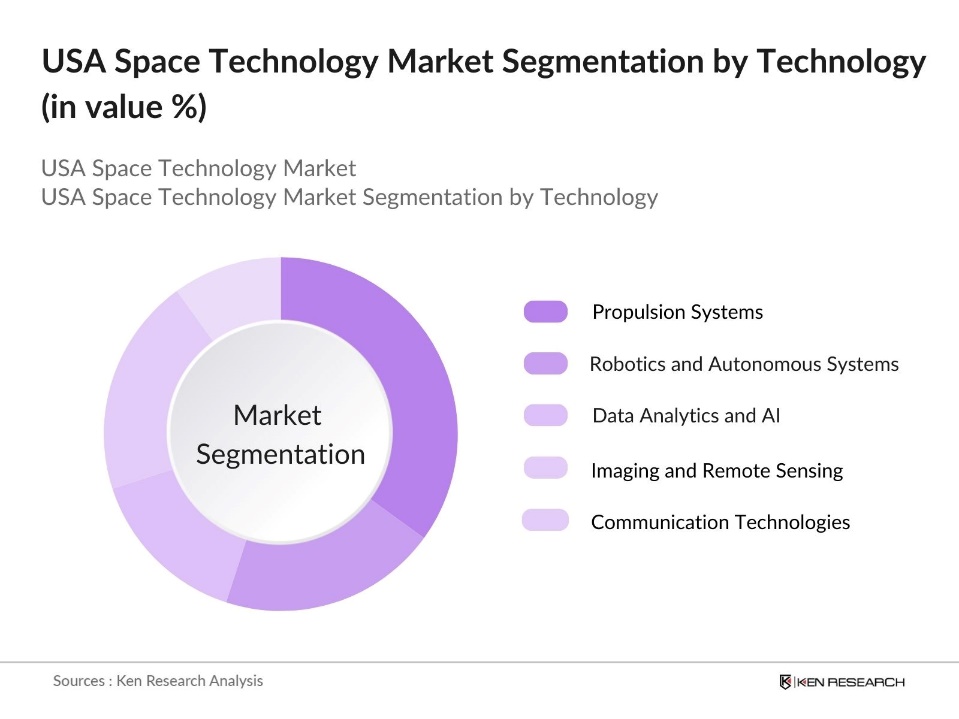

By Technology: The market is segmented by technology into propulsion systems, robotics and autonomous systems, data analytics and AI, imaging and remote sensing, and communication technologies. Propulsion systems dominate this segment, largely due to advancements in reusable rocket technologies by SpaceX and Blue Origin. The development of reliable and cost-efficient propulsion methods has made it feasible for both government agencies and private companies to embark on ambitious space exploration and satellite deployment missions.

USA Space Technology Market Competitive Landscape

The USA Space Technology Market is dominated by major players, both from the private sector and government contractors, such as SpaceX, Boeing, and Northrop Grumman. These companies lead the market with advanced technology, secured government contracts, and international collaboration agreements. The concentration of industry leaders underscores the influence of these companies in shaping the market.

USA Space Technology Industry Analysis

Growth Drivers

- Private Sector Advancements (Commercial Launch Providers): The private sector has dramatically transformed the U.S. space landscape, with commercial launches contributing to technological advancement. For instance, For instance, OneWeb's deployment of 16 satellites in May 2023 was part of their strategy to expand their constellation for better service coverage. The commercial sectors focus on cost-effective launch capabilities is not only accelerating satellite deployment but also driving development across space technology sub-segments, from satellite manufacturing to AI integration.

- International Collaborations (ISS, Artemis Accords): Collaborations on international projects are a key growth factor for the U.S. space sector. The Artemis Accords, signed by 29 countries as of 2023, promote partnerships in lunar exploration, including manned missions to the Moon by 2025. The International Space Station (ISS) also continues to foster joint missions, with recent contributions from Japan and Canada in funding and technology. Such collaborations open pathways for shared resources and talent, enabling the U.S. to expand its capabilities in human space exploration, which in turn benefits private sector partners engaged in complementary technologies like robotic arms and crew systems.

- Technological Innovations (AI, IoT Integration in Space Systems): Technological advancements in AI and IoT are enhancing U.S. space technology by improving satellite resilience and operational efficiency. AI enables predictive maintenance and autonomous navigation, while IoT supports continuous data transmission across satellite networks. Programs like NASAs Gateway use AI to monitor space systems, and IoT-integrated networks facilitate real-time Earth observation and data analytics for applications in agriculture, climate monitoring, and disaster response.

Market Challenges

- Regulatory and Policy Barriers (ITAR, Export Compliance): The International Traffic in Arms Regulations (ITAR) impose strict compliance requirements on U.S. space technology companies, particularly those exporting dual-use technologies. Compliance involves extensive documentation and regulatory approval, which can delay exports and increase operational costs. Additionally, the Export Administration Regulations (EAR) further complicate exports of sensitive technologies, making regulatory adherence both costly and time-intensive, impacting global competitiveness and posing challenges for international market expansion.

- High Capital Investment (Launch and R&D Costs): Significant capital investment required for space technology R&D and launches creates entry barriers. Developing and launching satellites and deep-space probes demands high funding levels, necessitating substantial support from public and private sectors. The extensive costs of these projects limit new entrants and slow market expansion, particularly in emerging technologies, as firms face high operational expenses and financial risk in the competitive space industry.

USA Space Technology Market Future Outlook

Over the coming years, the USA Space Technology Market is anticipated to continue on its growth trajectory, driven by ongoing government funding, private investments, and technological advancements. Developments in reusable launch systems, miniaturized satellites, and space tourism are expected to further boost market demand, with companies exploring opportunities for sustainable space operations and interplanetary exploration.

Market Opportunities

- Expanding Satellite Applications (Earth Observation, IoT Networks): Satellite applications in Earth observation and IoT networks present significant growth opportunities, as they enable real-time environmental monitoring and data collection across industries like agriculture, logistics, and disaster management. Small satellites, such as CubeSats and nanosats, enhance connectivity for IoT networks, supporting cost-effective data transfer and remote monitoring. These applications drive demand for advanced data analytics, specialized sensors, and satellite manufacturing, opening avenues for expansion within related services.

- Lunar and Mars Missions (Human and Robotic Exploration): The U.S. focus on lunar and Mars exploration is creating new demands for advanced technology and research. Programs such as Artemis, which aims to establish a sustainable human presence on the Moon, open opportunities for private-sector involvement in habitat modules, rovers, and surface systems. Similarly, Mars exploration initiatives boost demand for space robotics and autonomous navigation, encouraging innovation and partnerships in advanced exploration technologies.

Scope of the Report

|

By Application |

Satellite Manufacturing and Operations |

|

By End-User |

Government |

|

By Technology |

Propulsion Systems |

|

By Spacecraft Type |

Satellites |

|

By Region |

North America |

Products

Key Target Audience

Satellite Manufacturing Companies

Space Technology Component Manufacturers

Advanced Materials Manufacturers

Space Law and Policy Advisory Firms

Government and Regulatory Bodies (NASA, FAA, DoD)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

SpaceX

Boeing Defense, Space & Security

Lockheed Martin Space

Northrop Grumman Innovation Systems

Blue Origin

Virgin Galactic

Maxar Technologies

Raytheon Intelligence & Space

Sierra Nevada Corporation

Rocket Lab

Table of Contents

1. USA Space Technology Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate Analysis

1.4 Market Segmentation Overview

2. USA Space Technology Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Space Technology Market Analysis

3.1 Growth Drivers

3.1.1 Government Investments (NASA, DoD Funding)

3.1.2 Private Sector Advancements (Commercial Launch Providers)

3.1.3 International Collaborations (ISS, Artemis Accords)

3.1.4 Technological Innovations (AI, IoT Integration in Space Systems)

3.2 Market Challenges

3.2.1 Regulatory and Policy Barriers (ITAR, Export Compliance)

3.2.2 High Capital Investment (Launch and R&D Costs)

3.2.3 Talent Shortage (STEM Workforce Gaps)

3.3 Opportunities

3.3.1 Expanding Satellite Applications (Earth Observation, IoT Networks)

3.3.2 Lunar and Mars Missions (Human and Robotic Exploration)

3.3.3 Space Tourism and Habitats (Commercial Space Stations)

3.4 Trends

3.4.1 Rise of Small Satellites (CubeSats, Nanosats)

3.4.2 Growth in Space-as-a-Service Models

3.4.3 Private Funding Surge (Venture Capital, SPACs)

3.5 Government Regulation

3.5.1 FCC Spectrum Regulations

3.5.2 FAA Launch Licensing

3.5.3 ITAR Compliance for Exports

3.5.4 NASAs Technology Transfer Programs

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA Space Technology Market Segmentation

4.1 By Application (In Value %)

4.1.1 Satellite Manufacturing and Operations

4.1.2 Launch Services

4.1.3 Space Exploration

4.1.4 Ground Equipment

4.1.5 Space Tourism

4.2 By End-User (In Value %)

4.2.1 Government

4.2.2 Commercial Enterprises

4.2.3 Defense and Security Agencies

4.2.4 Research and Academic Institutions

4.2.5 Non-Governmental Organizations

4.3 By Technology (In Value %)

4.3.1 Propulsion Systems

4.3.2 Robotics and Autonomous Systems

4.3.3 Data Analytics and AI

4.3.4 Imaging and Remote Sensing

4.3.5 Communication Technologies

4.4 By Spacecraft Type (In Value %)

4.4.1 Satellites

4.4.2 Space Probes

4.4.3 Space Habitats

4.4.4 Rovers and Landers

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East and Africa

4.5.5 Latin America

5. USA Space Technology Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 SpaceX

5.1.2 Boeing Defense, Space & Security

5.1.3 Lockheed Martin Space

5.1.4 Northrop Grumman Innovation Systems

5.1.5 Blue Origin

5.1.6 Virgin Galactic

5.1.7 Maxar Technologies

5.1.8 Raytheon Intelligence & Space

5.1.9 Sierra Nevada Corporation

5.1.10 Rocket Lab

5.1.11 Relativity Space

5.1.12 United Launch Alliance (ULA)

5.1.13 Planet Labs

5.1.14 Ball Aerospace

5.1.15 Firefly Aerospace

5.2 Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Patents, Spacecraft Type, Funding, R&D Spending, Technological Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Space Technology Market Regulatory Framework

6.1 Export Control (ITAR, EAR Regulations)

6.2 Licensing Requirements (FAA, FCC)

6.3 Compliance Standards (ISO, AS9100)

6.4 Certification Processes (NASA Standards, MIL-SPEC)

7. USA Space Technology Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Space Technology Future Market Segmentation

8.1 By Application (In Value %)

8.2 By End-User (In Value %)

8.3 By Technology (In Value %)

8.4 By Spacecraft Type (In Value %)

8.5 By Region (In Value %)

9. USA Space Technology Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase includes identifying critical variables such as demand drivers, market restraints, and regulatory influences. A comprehensive ecosystem map is developed, outlining major stakeholders in the USA Space Technology Market and mapping out the dynamic relationships.

Step 2: Market Analysis and Construction

In this phase, historical data on industry growth, government investments, and technological advancements are analyzed. Proprietary databases and government reports are utilized to construct a detailed market analysis that covers market segments, application areas, and technology trends.

Step 3: Hypothesis Validation and Expert Consultation

Market insights are validated through consultations with industry experts and stakeholders, including executives from leading space technology companies. Interviews and surveys are conducted to gain perspectives on market potential, technological trends, and investment strategies.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data and expert insights into a cohesive market analysis report. This step ensures a holistic view of the market, backed by both primary and secondary research, to provide an accurate assessment of the USA Space Technology Market.

Frequently Asked Questions

01. How big is the USA Space Technology Market?

The USA Space Technology Market is valued at USD 170 billion, driven by government funding, commercial space exploration, and increasing satellite deployments.

02. What are the main challenges in the USA Space Technology Market?

Key challenges in USA Space Technology Market include high capital costs, regulatory barriers, and talent shortages in STEM fields, which impact the pace of innovation and project completion.

03. Who are the major players in the USA Space Technology Market?

The USA Space Technology Market is led by SpaceX, Boeing, Lockheed Martin, Northrop Grumman, and Blue Origin, who dominate due to their technological expertise, government contracts, and private sector investments.

04. What are the growth drivers in the USA Space Technology Market?

The USA Space Technology Market is driven by government investments, advancements in satellite technology, and the expansion of space tourism, alongside international collaborations in space exploration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.