USA Specialty Food Ingredients Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD6275

December 2024

99

About the Report

USA Specialty Food Ingredients Market Overview

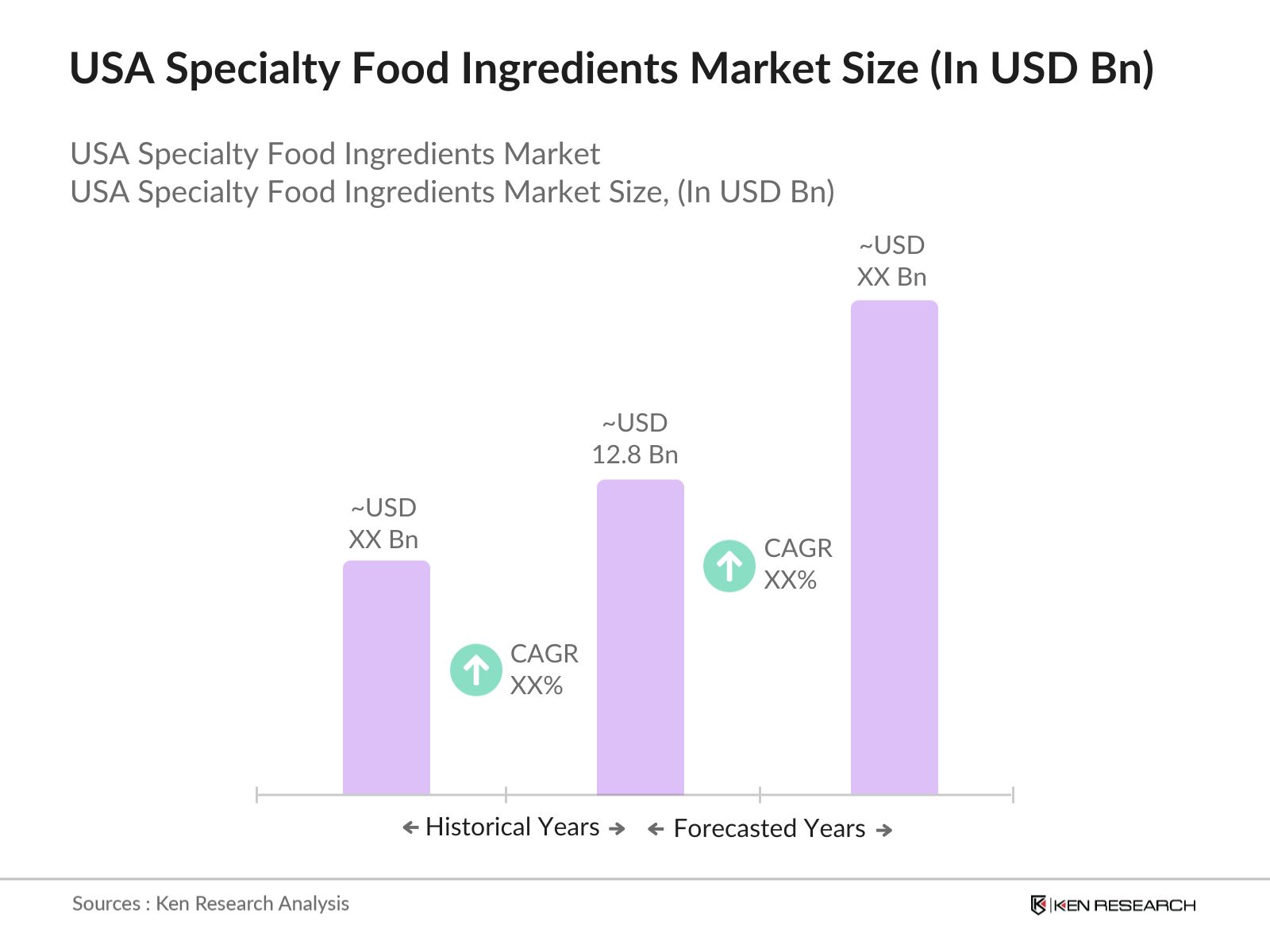

- The USA Specialty Food Ingredients market is valued at USD 12.8 billion, driven by the increasing consumer demand for healthier and natural food products. The market has witnessed robust growth due to a significant shift in dietary patterns, with consumers favoring organic, clean-label, and functional ingredients that contribute to better health outcomes. Growth is particularly driven by an increased preference for natural sweeteners, plant-based emulsifiers, and fortifying additives, which align with the demand for healthier alternatives in food products.

- The market is dominated by cities like New York, Los Angeles, and Chicago, which are hubs for food innovation and home to a large population of health-conscious consumers. These regions host numerous food processing companies, have access to a wide range of natural resources, and benefit from strong infrastructure and logistics networks that support the supply chain of specialty ingredients. Additionally, the presence of large retail chains and food manufacturers in these areas further enhances their market dominance.

- The FDAs Food Safety Modernization Act (FSMA) has been pivotal in setting stringent safety standards for the specialty food ingredients market. By 2023, more than 80,000 food facilities in the U.S. had undergone FSMA compliance checks, ensuring that manufacturers meet the highest safety protocols. Non-compliance results in hefty fines and potential product recalls, making adherence critical for businesses in this sector.

USA Specialty Food Ingredients Market Segmentation

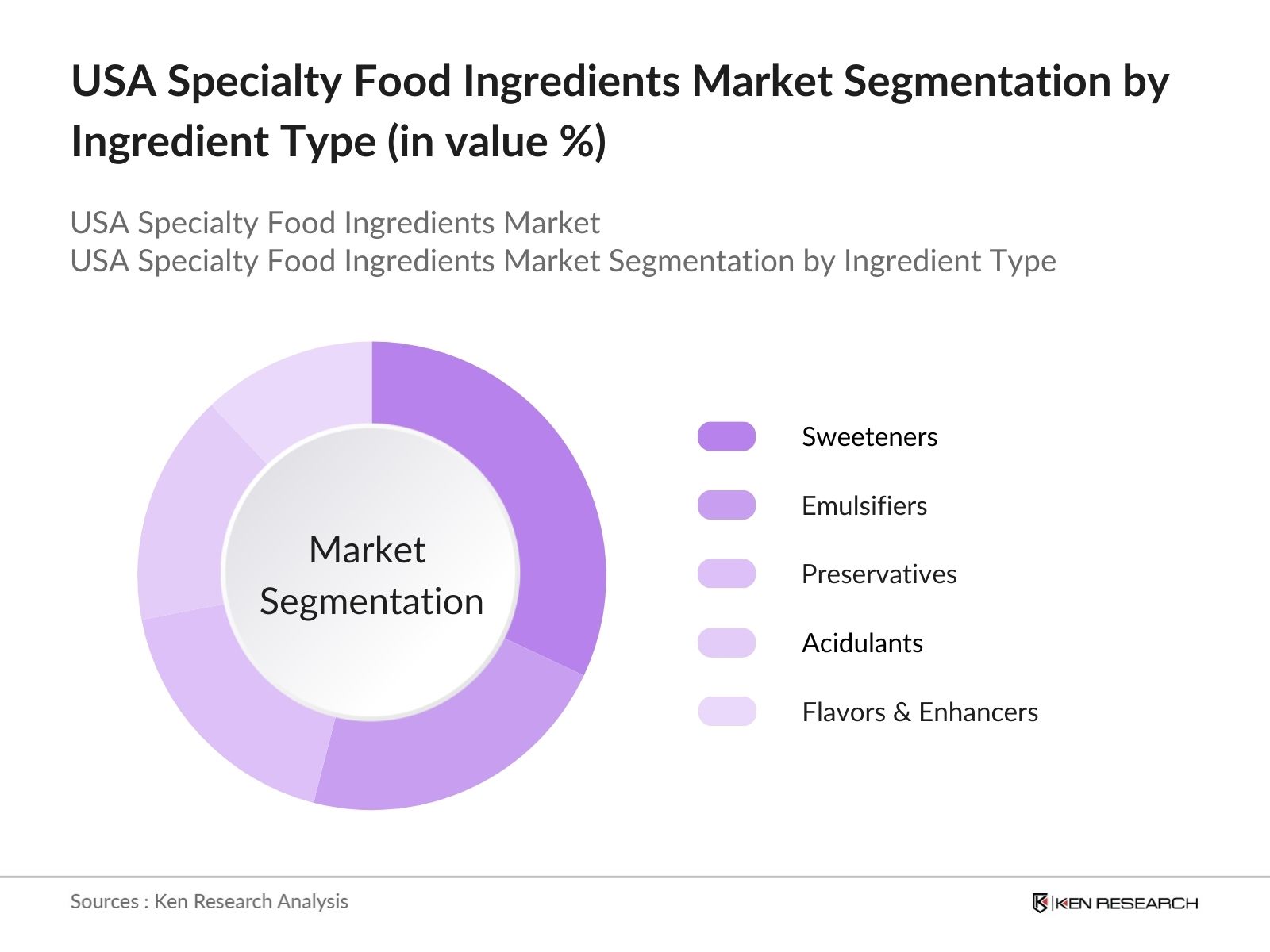

By Ingredient Type: The market is segmented by ingredient type into emulsifiers, sweeteners, preservatives, acidulants, and flavors & enhancers. Recently, sweeteners have dominated the market due to the growing consumer preference for low-calorie and natural alternatives to traditional sugars. With increasing health concerns surrounding obesity and diabetes, natural sweeteners such as stevia and monk fruit have gained popularity. These ingredients are widely used across food and beverage sectors, including bakery, confectionery, and dairy, contributing to their significant market share.

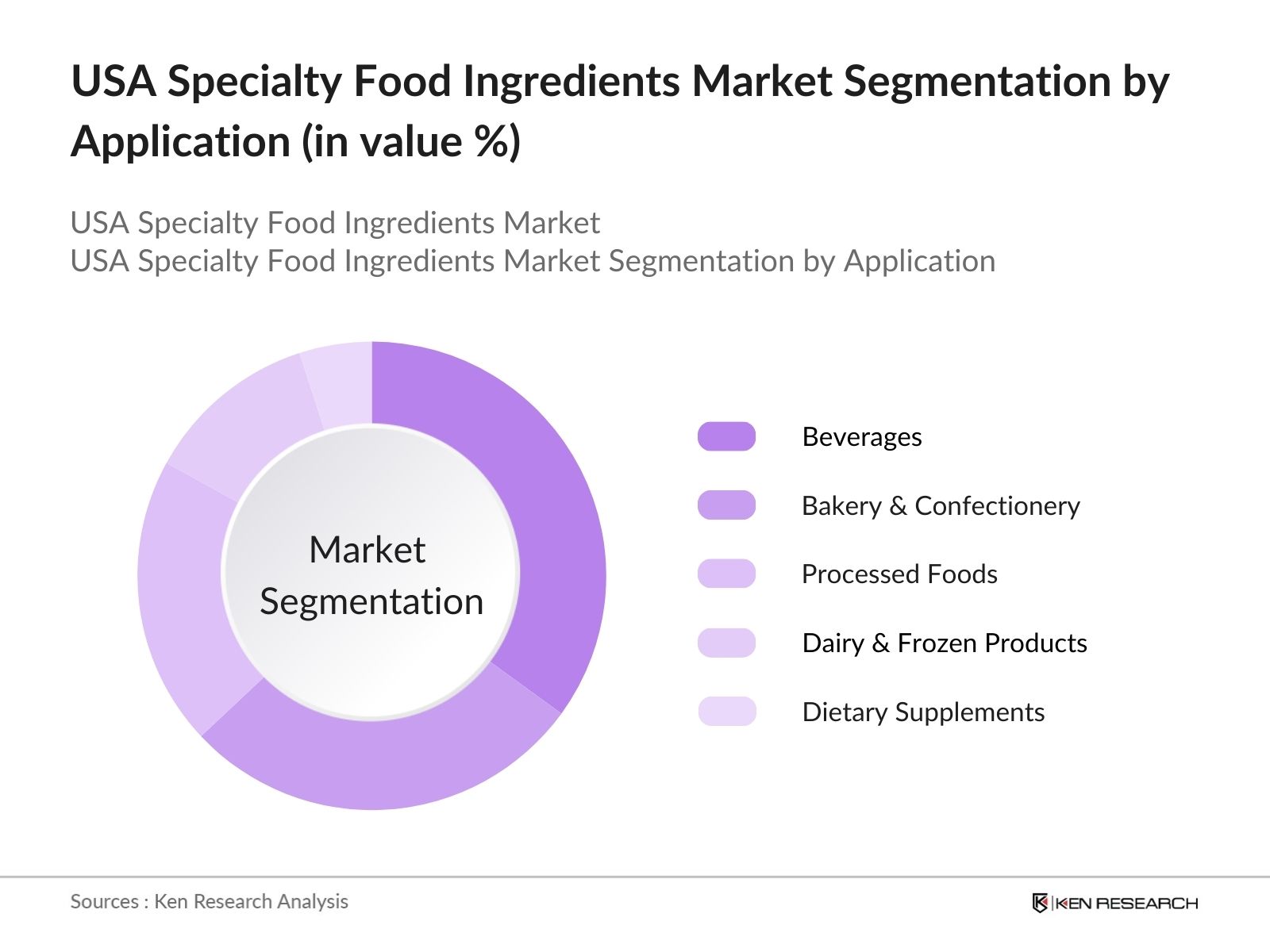

By Application: The market is also segmented by application into bakery & confectionery, dairy & frozen products, beverages, processed foods, and dietary supplements. The beverages segment is leading the market due to the rise in functional drinks and fortified beverages. Consumers are increasingly looking for added health benefits in their beverages, including probiotics, vitamins, and plant-based ingredients. This trend is particularly strong in energy drinks, plant-based milk alternatives, and health-focused beverages, where specialty ingredients play a critical role in formulation.

USA Specialty Food Ingredients Market Competitive Landscape

The USA Specialty Food Ingredients market is dominated by major global and domestic players that have established strong brand presence and extensive distribution networks. These players have focused on innovation, sustainability, and product diversification to meet the evolving demands of consumers. The competitive landscape is characterized by innovation in product development and ingredient sourcing, with companies investing in R&D to meet the growing demand for natural and organic ingredients. Sustainability has become a critical focus, as companies aim to enhance their eco-friendly practices and ensure a sustainable supply chain.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Product Portfolio |

Ingredient Sourcing |

R&D Investment |

Sustainability Initiatives |

Strategic Partnerships |

Market Reach |

|

Cargill |

1865 |

Wayzata, Minnesota |

|||||||

|

Archer Daniels Midland |

1902 |

Chicago, Illinois |

|||||||

|

DuPont de Nemours, Inc. |

1802 |

Wilmington, Delaware |

|||||||

|

Kerry Group |

1972 |

Tralee, Ireland |

|||||||

|

Ingredion Incorporated |

1906 |

Westchester, Illinois |

USA Specialty Food Ingredients Industry Analysis

Growth Drivers

- Health & Wellness Focus: The increasing awareness of health and wellness is driving demand for specialty food ingredients like organic, non-GMO, and natural ingredients in the USA. In 2023, approximately 39 million Americans were following diets prioritizing natural and organic foods, according to the U.S. Department of Agriculture (USDA). This shift is attributed to rising concerns over chronic illnesses, which now affect over 60% of American adults. A report from the World Bank noted that healthcare spending in the U.S. stood at $4.3 trillion in 2022, emphasizing the growing consumer focus on preventative health measures, including dietary changes.

- Clean Label Trend: Consumers are demanding transparency in ingredient sourcing, a major driver in the specialty food ingredients market. The "clean label" trend encourages food manufacturers to use fewer artificial ingredients and more recognizable, natural components. According to the FDA, over 52% of U.S. consumers read ingredient labels before making purchasing decisions in 2023, reflecting a sharp rise in demand for transparency. Additionally, the USDA reported that organic farming operations grew by over 4,000 between 2022 and 2023, as farmers responded to increasing consumer demand for clean labels and traceable sources. Source.

- Rising Popularity of Plant-Based Diets: The demand for plant-based food ingredients is growing rapidly, driven by dietary shifts towards veganism, vegetarianism, and flexitarianism. In 2023, the U.S. Department of Agriculture recorded a notable increase in plant-based ingredient imports, valued at over $2.2 billion. This trend has been amplified by health-conscious consumers and those seeking alternative protein sources due to rising concerns over the environmental impact of animal-based products. With over 10 million Americans now identifying as vegetarians, plant-based food ingredients are expected to dominate the specialty food segment. Source.

Market Challenges

- Stringent Regulations: The U.S. specialty food ingredients market faces stringent regulatory frameworks set by the FDA and other agencies. Compliance with the Food Safety Modernization Act (FSMA) requires extensive testing and certification, significantly increasing operational complexity for manufacturers. In 2023, the FDA fined companies over $50 million for non-compliance with safety regulations. Manufacturers must meet these exacting standards to avoid penalties, delays, or product recalls, which can result in further financial strain.

- High Production Costs: Producing organic and natural ingredients involves high costs, partly due to certification processes and resource-intensive cultivation methods. The USDA reports that organic farming inputs cost 25-30% more than conventional farming, impacting the overall pricing of specialty food products. As of 2023, the U.S. organic farming sector required an estimated $60 billion in annual investments, largely due to stringent quality standards and the premium labor costs associated with sustainable practices.

USA Specialty Food Ingredients Market Future Outlook

Over the next five years, the USA Specialty Food Ingredients market is expected to witness significant growth driven by evolving consumer preferences for healthy and clean-label products. The demand for natural, plant-based ingredients and functional foods will continue to grow, influenced by rising health awareness and the increasing prevalence of chronic diseases like obesity and diabetes. Innovations in ingredient processing and sourcing will further contribute to the expansion of the market. Increased investment in sustainable ingredient sourcing, coupled with regulatory support for cleaner food labeling, will enhance growth opportunities for players in the market.

Future Market Opportunities

- Growth in E-commerce and Direct-to-Consumer Channels: The rise of e-commerce presents significant opportunities for the specialty food ingredients market. In 2023, online food and beverage sales in the U.S. surpassed $145 billion, according to the U.S. Census Bureau, with many specialty ingredient brands embracing direct-to-consumer (D2C) models to reach health-conscious buyers. E-commerce platforms allow manufacturers to bypass traditional retail channels and offer tailored products directly to consumers, reducing costs while increasing profit margins.

- Technological Advancements: Technological innovations in food processing and ingredient preservation are key growth drivers in the market. The USDA reported a 20% increase in the adoption of advanced food preservation technologies in 2023, which extended product shelf life and reduced waste. Innovations such as cold chain logistics, clean-label emulsifiers, and eco-friendly packaging methods further enhance the functionality and sustainability of specialty food ingredients.

Scope of the Report

|

By Ingredient Type |

Emulsifiers Sweeteners Preservatives Acidulants Flavors & Enhancers |

|

By Application |

Bakery & Confectionery Dairy & Frozen Products Beverages Processed Foods Dietary Supplements |

|

By Source |

Natural Synthetic Organic |

|

By Form |

Dry Ingredients Liquid Ingredients |

|

By Distribution Channel |

B2B Sales B2C (Retail, E-commerce) |

Products

Key Target Audience

Food & Beverage Manufacturers

Ingredient Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Organic Certification Agencies

Functional Food Product Developers

Natural Ingredient Retailers

Food Exporters

Companies

Major Players

Cargill

Archer Daniels Midland

DuPont de Nemours, Inc.

Kerry Group

Ingredion Incorporated

Givaudan

Sensient Technologies Corporation

Koninklijke DSM N.V.

Symrise AG

BASF SE

Corbion N.V.

Roquette Frres

Chr. Hansen Holding A/S

Firmenich SA

Tate & Lyle

Table of Contents

1. USA Specialty Food Ingredients Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Specialty Food Ingredients Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Specialty Food Ingredients Market Analysis

3.1. Growth Drivers

Health & Wellness Focus (Increase in demand for organic, non-GMO, and natural ingredients)

Clean Label Trend (Consumer demand for transparency in ingredient sourcing)

Rising Popularity of Plant-Based Diets

Functional Foods and Beverages (Incorporation of ingredients with health benefits)

3.2. Market Challenges

Stringent Regulations (FDA guidelines and compliance with food safety)

High Production Costs (Cost associated with organic and natural ingredients)

Supply Chain Disruptions (Impact of logistics and ingredient sourcing)

3.3. Opportunities

Growth in E-commerce and Direct-to-Consumer Channels

Technological Advancements (Development in food processing and ingredient preservation)

Expansion into Emerging Markets (Opportunities in export and niche markets)

3.4. Trends

Rise of Plant-Based Protein Ingredients (Demand for alternatives to animal-based products)

Fortification of Products with Vitamins & Minerals

Sustainability in Sourcing (Focus on ethically sourced ingredients)

Consumer Demand for Functional Foods (Probiotics, prebiotics, and gut health-focused ingredients)

3.5. Government Regulation

FDA Food Safety Modernization Act

U.S. Department of Agriculture Organic Certification

Compliance with Food Additive Regulations

Labeling Standards and Nutritional Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. USA Specialty Food Ingredients Market Segmentation

4.1. By Ingredient Type (In Value %)

Emulsifiers

Sweeteners (Natural, Artificial)

Preservatives

Acidulants

Flavors & Enhancers

4.2. By Application (In Value %)

Bakery & Confectionery

Dairy & Frozen Products

Beverages (Functional Beverages, Energy Drinks)

Processed Foods (Snacks, Ready-to-Eat Meals)

Dietary Supplements

4.3. By Source (In Value %)

Natural

Synthetic

Organic

4.4. By Form (In Value %)

Dry Ingredients

Liquid Ingredients

4.5. By Distribution Channel (In Value %)

B2B Sales

B2C (Retail, E-commerce)

5. USA Specialty Food Ingredients Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

Cargill

Archer Daniels Midland (ADM)

DuPont de Nemours, Inc.

Ingredion Incorporated

Kerry Group

Tate & Lyle

Givaudan

Sensient Technologies Corporation

Koninklijke DSM N.V.

Symrise AG

BASF SE

Corbion N.V.

Roquette Frres

Chr. Hansen Holding A/S

Firmenich SA

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Product Portfolio, R&D Investment, Ingredient Sourcing, Product Innovation, Geographical Reach, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Specialty Food Ingredients Market Regulatory Framework

6.1 Food Safety Standards

6.2 Compliance with Additive Regulations

6.3 Labeling and Certification Requirements

6.4 Organic Certification and Standards

7. USA Specialty Food Ingredients Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Specialty Food Ingredients Future Market Segmentation

8.1 By Ingredient Type (In Value %)

8.2 By Application (In Value %)

8.3 By Source (In Value %)

8.4 By Form (In Value %)

8.5 By Distribution Channel (In Value %)

9. USA Specialty Food Ingredients Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves developing a comprehensive understanding of the USA Specialty Food Ingredients market by identifying key variables such as ingredient categories, sourcing regions, and consumer preferences. Data is collected from reliable secondary sources including industry reports and proprietary databases.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data on market performance, including key developments in the specialty food ingredients sector. Market penetration, product adoption rates, and ingredient sourcing patterns are also assessed during this stage.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are tested and validated through consultations with market experts and industry leaders. This feedback is gathered via direct interviews and surveys to ensure the accuracy and relevance of market insights.

Step 4: Research Synthesis and Final Output

The final phase of research involves synthesizing all data gathered through primary and secondary research. The final output includes verified data on market size, growth drivers, challenges, and competitive analysis.

Frequently Asked Questions

01. How big is the USA Specialty Food Ingredients Market?

The USA Specialty Food Ingredients market was valued at USD 12.8 billion, driven by the growing consumer preference for natural and organic ingredients.

02. What are the challenges in the USA Specialty Food Ingredients Market?

Challenges include stringent regulatory requirements, high production costs for organic ingredients, and supply chain disruptions impacting ingredient sourcing.

03. Who are the major players in the USA Specialty Food Ingredients Market?

Key players include Cargill, Archer Daniels Midland, DuPont de Nemours, Inc., Kerry Group, and Ingredion Incorporated, all of which dominate through extensive distribution networks and strong product portfolios.

04. What are the growth drivers of the USA Specialty Food Ingredients Market?

The market is driven by rising consumer demand for clean-label and functional foods, along with innovations in plant-based and natural ingredients.

05. What is the future outlook of the USA Specialty Food Ingredients Market?

The market is expected to grow significantly due to increased demand for natural and sustainable ingredients, along with innovations in functional food products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.