USA Sports Analytics Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD3875

December 2024

80

About the Report

USA Sports Analytics Market Overview

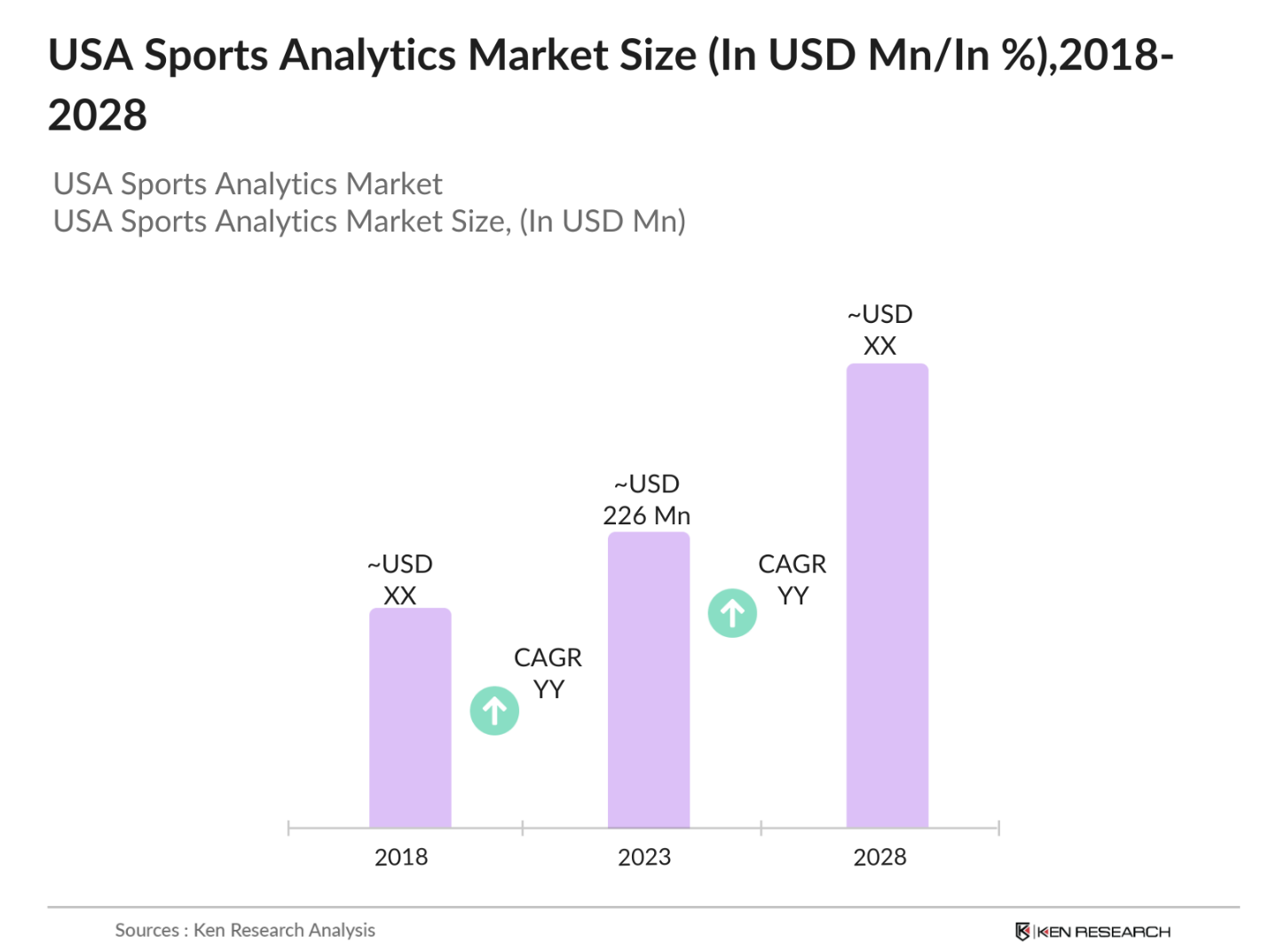

- The USA Sports Analytics market is valued at USD 226 million, based on a comprehensive five-year historical analysis. The market is driven by the growing integration of data analytics in professional sports, with teams utilizing performance and predictive analytics for enhanced decision-making. Wearable technology and real-time data collection are becoming essential components in sports, especially in high-revenue-generating sports like football and basketball. The ability to analyze player performance, optimize team strategies, and improve fan engagement has fueled the adoption of sports analytics, significantly driving market growth.

- The dominant regions for sports analytics in the USA include major cities like New York, Los Angeles, and Chicago, where professional sports teams and major leagues are headquartered. These cities dominate the market due to the presence of well-funded teams, advanced technological infrastructure, and significant investments in analytics solutions. The combination of a large fan base, strategic partnerships with tech companies, and heavy media presence further solidifies their dominance in the market.

- The U.S. government has implemented stringent data privacy regulations that impact the sports analytics industry, particularly regarding the collection and storage of athlete data. In 2023, the CCPA imposes civil penalties ranging from $2,500 for unintentional violations to $7,500 for intentional violations. Sports teams are required to implement robust security measures to protect player data, ensuring compliance with federal and state regulations.

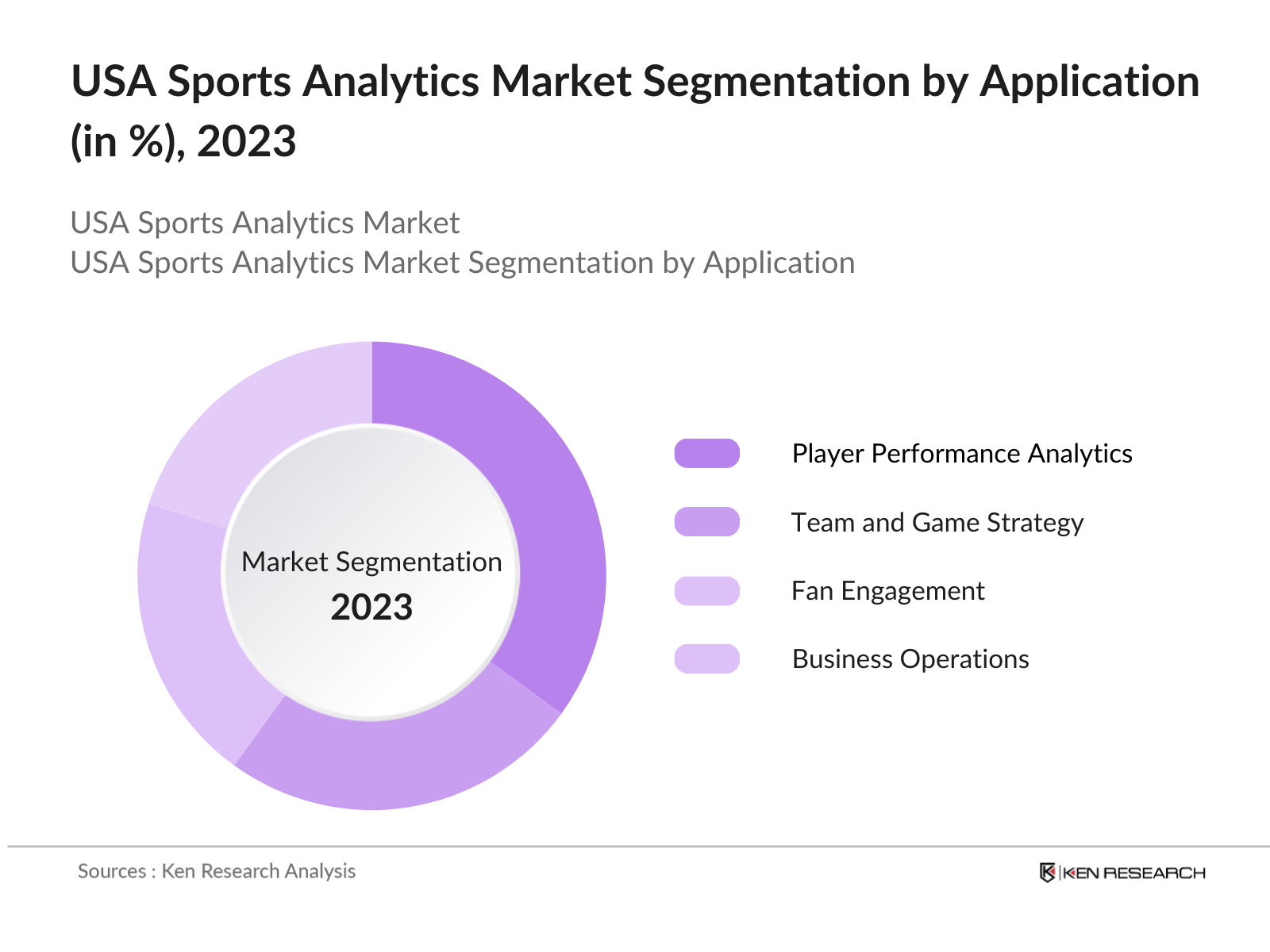

USA Sports Analytics Market Segmentation

By Application: The USA Sports Analytics market is segmented by application into Player Performance Analytics, Team and Game Strategy, Fan Engagement, and Business Operations. Within this segment, Player Performance Analytics holds a dominant market share due to the increasing focus on real-time monitoring of player health, fitness, and performance. The use of wearable devices and advanced data analytics helps teams reduce the risk of injury, optimize training, and improve overall team performance. This sub-segment has grown rapidly due to the use of predictive analytics in enhancing player longevity and career management.

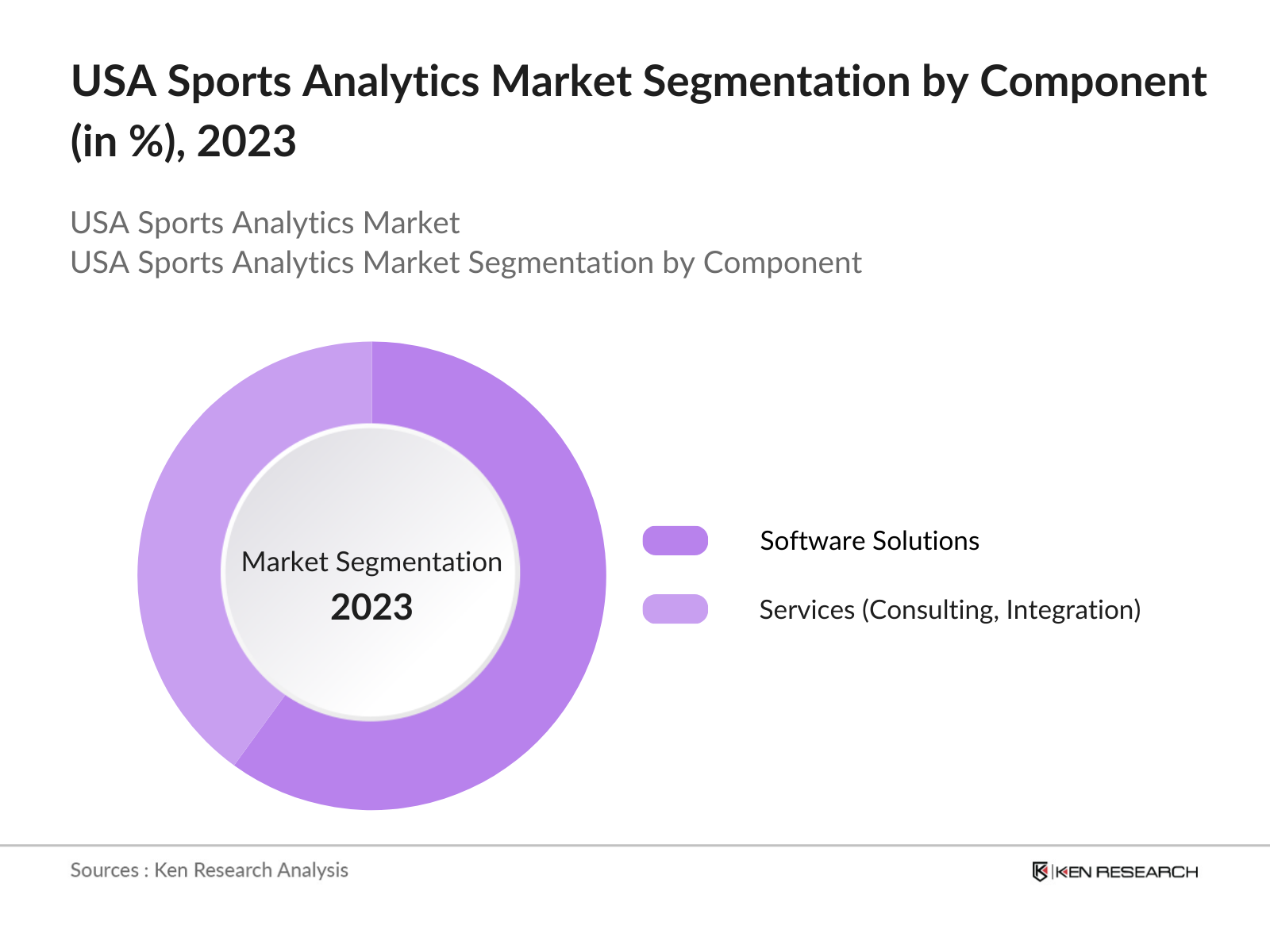

By Component

The market is also segmented by component into Software Solutions and Services. Software solutions dominate this segment, holding the majority share due to the increasing demand for customizable platforms that provide real-time data insights and predictive modeling. These platforms allow sports organizations to collect and process large amounts of data efficiently, enabling teams to analyze various performance metrics. Services such as consulting and integration, though essential, are secondary as teams prioritize investing in long-term, scalable software solutions.

USA Sports Analytics Market Competitive Landscape

The USA Sports Analytics market is highly competitive, with both global and local players contributing to the market's growth. Major companies in the market are leveraging partnerships with professional sports leagues, utilizing AI and machine learning to provide more advanced analytical insights. Established companies have a strong foothold due to their extensive portfolios and ability to provide end-to-end solutions, making it difficult for smaller companies to gain significant market share.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Employees |

Technology Platform |

Market Presence |

Innovation Capability |

Strategic Partnerships |

Customer Base |

|

IBM |

1911 |

Armonk, New York |

73.6 |

- |

- |

- |

- |

- |

- |

|

SAS |

1976 |

Cary, North Carolina |

3.2 |

- |

- |

- |

- |

- |

- |

|

Catapult Sports |

2006 |

Melbourne, Australia |

0.1 |

- |

- |

- |

- |

- |

- |

|

Hudl |

2006 |

Lincoln, Nebraska |

0.2 |

- |

- |

- |

- |

- |

- |

|

SAP |

1972 |

Walldorf, Germany |

32.7 |

- |

- |

- |

- |

- |

- |

USA Sports Analytics Industry Analysis

Market Growth Drivers

- Increasing Use of Wearable Devices: The increasing adoption of wearable devices in the USA sports industry has significantly transformed player performance tracking. In 2023, the U.S. wearable devices market was valued at approximately $19.92 billion, with a notable portion attributed to their use in sports and fitness These devices, integrated with advanced analytics, help teams to collect real-time data on player health and performance, aiding in injury prevention and training customization.

- Rising Fan Engagement through Digital Platforms: Digital platforms have enhanced fan engagement in sports, with over 180 million U.S. sports fans utilizing social media platforms like Twitter and Instagram for real-time updates, live interactions, and personalized content. These platforms leverage sports analytics to tailor user experiences, driving deeper fan loyalty. Streaming services incorporating data-driven content, such as player statistics and real-time predictions, significantly increase engagement. This trend is supported by macroeconomic factors, such as the growing internet penetration rate of 92% in the U.S.

- Enhanced Player Performance Tracking and Injury Prevention: Sports analytics have revolutionized player performance tracking, with teams using advanced analytics platforms to monitor over 200 metrics per player during games. In 2024, around 85% of NBA teams are actively using performance-tracking solutions to reduce injury rates by 30%, optimizing player availability. This data-driven approach is bolstered by government regulations, such as HIPAA-compliant health monitoring, ensuring player data security. These innovations provide critical insights for real-time decision-making in training and game strategies.

Market Challenges

- Data Privacy and Security Issues: As wearable devices and real-time analytics become ubiquitous, data privacy concerns remain a significant challenge in the USA sports analytics market. In 2023, over 50 million athlete data points were stored in cloud systems, with growing concerns about breaches and unauthorized use. Strict regulations under the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) require sports organizations to ensure compliance, but many struggle to implement adequate protections, leading to over 1,000 reported security incidents in 2023 alone.

- High Implementation Costs for Smaller Teams: Smaller sports teams face substantial financial barriers in adopting advanced sports analytics solutions, with implementation costs ranging between $500,000 and $1.5 million annually. These high costs hinder broader adoption, particularly in lower-budget leagues and amateur sports, where the returns on investment are more limited. Financial assistance programs from the U.S. governments Small Business Innovation Research (SBIR) have helped some teams, but many still find the costs prohibitive.

USA Sports Analytics Market Future Outlook

Over the next five years, the USA Sports Analytics market is expected to experience robust growth, driven by advancements in wearable technologies, increased use of artificial intelligence, and the growing importance of fan engagement solutions. The proliferation of cloud-based analytics platforms will provide teams and sports organizations with scalable solutions, helping to streamline operations and decision-making processes. As teams continue to adopt more data-driven strategies, the sports analytics landscape is likely to expand beyond major leagues to include amateur and collegiate sports.

Market Opportunities

- Growing Demand for AI-based Analytics Solutions: AI-based analytics solutions are seeing growing demand across U.S. sports leagues. By 2024, over 30 professional teams in the NFL and NBA are expected to fully integrate AI-driven analytics platforms for game strategy and player management. These platforms provide teams with real-time simulations and predictive models to improve performance. Government incentives for AI research and development are also spurring advancements in this field, with over $2 billion allocated by federal programs to boost AI innovation.

- Increasing Use of Cloud-Based Platforms for Scalability: Cloud-based platforms are providing scalable solutions for sports analytics, offering teams the flexibility to manage vast amounts of player and performance data. In 2023, over 70% of U.S. sports teams had shifted their analytics infrastructure to cloud-based platforms, benefiting from improved scalability and data management. The U.S. governments investment in cloud infrastructure, with $9 billion allocated for cloud computing advancements in 2023, supports the broader adoption of cloud analytics across industries, including sports.

Scope of the Report

|

By Application |

Player Performance Analytics Team Strategy Fan Engagement Business Operations |

|

By Component |

Software Solutions Services |

|

By Deployment Mode |

On-Premise Cloud-Based |

|

By End User |

Professional Teams Leagues, Media Individual Athletes |

|

By Region |

North-East West Mid-West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Professional Sports Companies

Leagues and Associations

Media and Broadcasting Companies

Wearable Technology Companies

AI and Machine Learning Companies

Government and Regulatory Bodies (Federal Trade Commission, U.S. Department of Commerce)

Investment and Venture Capital Firms

Sports Infrastructure and Stadium Industries

Companies

Players Mentioned in the Report:

IBM

SAS

Catapult Sports

Hudl

SAP

Tableau

Zebra Technologies

Opta Sports

HPE

Sportsradar

Table of Contents

1. USA Sports Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Sports Analytics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Sports Analytics Market Analysis

3.1. Growth Drivers (Real-time Data Analytics, Wearable Technology Adoption, Fan Engagement Solutions, Performance Optimization Platforms)

3.1.1. Increasing Use of Wearable Devices

3.1.2. Rising Fan Engagement through Digital Platforms

3.1.3. Enhanced Player Performance Tracking and Injury Prevention

3.1.4. Strategic Decision-Making via Predictive Analytics

3.2.Market Challenges (Data Privacy Concerns, High Initial Costs, Integration with Legacy Systems, Limited Adoption in Amateur Sports)

3.2.1. Data Privacy and Security Issues

3.2.2. High Implementation Costs for Smaller Teams

3.2.3. Integration Challenges with Legacy Systems

3.2.4. Limited Use of Analytics in Non-Professional Sports

3.3.Opportunities (Cloud-based Analytics, AI-Driven Insights, Expansion into Amateur Sports, Partnerships with Media and Entertainment)

3.3.1. Growing Demand for AI-based Analytics Solutions

3.3.2. Increasing Use of Cloud-Based Platforms for Scalability

3.3.3. Expanding Adoption in College and Amateur Sports

3.3.4. Opportunities with Media Rights and Broadcast Analytics

3.4.Trends (AI and ML Integration, Gamification of Sports, Fan-Centric Analytics, Performance Data Monetization)

3.4.1. Integration of AI and Machine Learning in Sports Analytics

3.4.2. Gamification to Boost Audience Engagement

3.4.3. Use of Fan-Centric Data Analytics for Personalization

3.4.4. Monetization of Performance Data through Partnerships

3.5.Government Regulation (Data Protection Laws, Athlete Data Usage Regulations, Compliance Requirements for Technology Implementation)

3.5.1. Data Privacy and Security Regulations

3.5.2. Athlete Rights in Data Usage

3.5.3. Compliance with Sports Governing Bodies

3.5.4. Regulations on Wearable Technology in Sports

3.6. SWOT Analysis

3.7. Stake Ecosystem (Leagues, Teams, Technology Providers, Fans)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitution, Threat of New Entrants)

3.9. Competition Ecosystem

4. USA Sports Analytics Market Segmentation

4.1. By Application (In Value %) 4.1.1. Player Performance Analytics

4.1.2. Team and Game Strategy

4.1.3. Fan Engagement and Experience

4.1.4. Business Operations (Ticketing, Sponsorship, Marketing)

4.2. By Component (In Value %)

4.2.1. Software Solutions

4.2.2. Services (Consulting, Integration, Support)

4.3. By Deployment Mode (In Value %)

4.3.1. On-Premise

4.3.2. Cloud-Based

4.4. By End User (In Value %)

4.4.1. Professional Sports Teams

4.4.2. Leagues and Associations

4.4.3. Media and Broadcasting Companies

4.4.4. Individual Athletes

4.5. By Region (In Value %) 4.5.1. North-East

4.5.2. West

4.5.3. Mid-West

4.5.4. South

5. USA Sports Analytics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM

5.1.2. SAS

5.1.3. Catapult Sports

5.1.4. Tableau

5.1.5. Hudl

5.1.6. SAP

5.1.7. Sportradar

5.1.8. STATSports

5.1.9. Krossover

5.1.10. Opta Sports

5.1.11. Zebra Technologies

5.1.12. HPE

5.1.13. Sportsradar

5.1.14. Microsoft

5.1.15. Oracle

5.2.Cross Comparison Parameters (Market Presence, Revenue, Service Offerings, Technology Platform, Innovation Capability, Strategic Partnerships, Market Penetration, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Sports Analytics Market Regulatory Framework

6.1. Data Privacy Regulations

6.2. Compliance with Sports League Regulations

6.3. Ethical Considerations in Data Usage

7. USA Sports Analytics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Sports Analytics Future Market Segmentation

8.1. By Application

8.2. By Component

8.3. By Deployment Mode

8.4. By End User

8.5. By Region

9. USA Sports Analytics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the key stakeholders in the USA Sports Analytics Market, including sports organizations, software providers, and regulatory bodies. Secondary research sources such as government reports, proprietary databases, and industry publications are used to define the key variables that drive market growth.

Step 2: Market Analysis and Construction

This step involves gathering and analyzing historical data on market size, application of analytics, and technological adoption in the sports industry. The analysis will include revenue trends, adoption rates, and the impact of AI on predictive analytics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from major sports organizations and technology firms are consulted through CATI interviews to validate hypotheses. These discussions help refine market estimates and provide insights into future growth trends.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing the findings and verifying them through direct consultations with sports teams and software providers. This ensures a comprehensive and validated analysis of the market, enabling accurate projections and strategies.

Frequently Asked Questions

01. How big is the USA Sports Analytics Market?

The USA Sports Analytics market is valued at USD 226 million, driven by the adoption of data-driven strategies among professional sports teams and the increasing use of wearable technology.

02. What are the key challenges in the USA Sports Analytics Market?

The market faces challenges such as data privacy concerns, high implementation costs for smaller teams, and the integration of advanced analytics platforms with existing legacy systems.

03. Who are the major players in the USA Sports Analytics Market?

Key players in the market include IBM, SAS, Catapult Sports, Hudl, and SAP. These companies dominate due to their comprehensive platforms, strategic partnerships, and innovative capabilities.

04. What drives the growth of the USA Sports Analytics Market?

The market is propelled by the rising use of real-time data analytics, wearable technologies, and AI-driven platforms that enable teams to optimize player performance and game strategy.

05. What is the future outlook for the USA Sports Analytics Market?

The market is expected to grow significantly, fueled by technological advancements and increasing investments in cloud-based analytics solutions, expanding beyond professional teams to include amateur and collegiate sports.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.