USA Steel Merchant and Rebar Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD10849

November 2024

80

About the Report

USA Steel Merchant and Rebar Market Overview

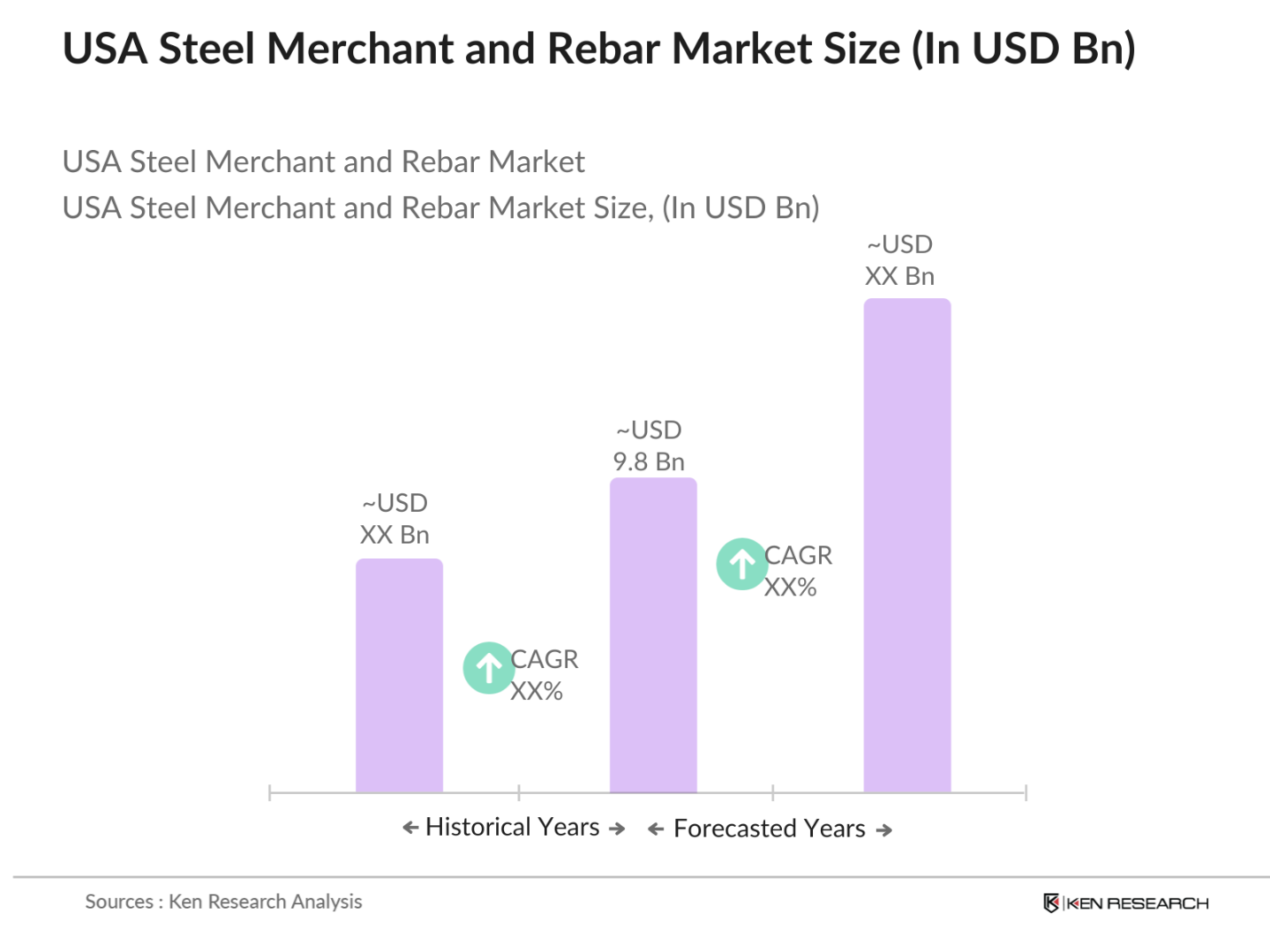

- The USA steel merchant and rebar market is valued at USD 9.8 billion, driven by robust demand from the construction and infrastructure sectors. Major government-backed infrastructure projects and urban development initiatives contribute significantly to this demand, especially with rising investments in public infrastructure and housing projects. Growth is further fueled by the increased adoption of high-strength rebar materials aimed at enhancing structural durability in both commercial and residential buildings.

- Leading regions in this market include Texas, California, and Florida, where construction and infrastructure projects have accelerated due to high population growth and industrial expansion. Texas, for instance, is a hub for commercial construction projects, while Californias focus on earthquake-resistant construction boosts demand for high-grade rebar. These regions dominate due to their significant investment in large-scale construction projects and supportive government regulations for infrastructure.

- The EPAs steel industry standards mandate emission reductions, requiring facilities to maintain CO2 emissions below specific thresholds. Non-compliance results in penalties, emphasizing eco-friendly practices among steel producers.

USA Steel Merchant and Rebar Market Segmentation

By Product Type: The USA steel merchant and rebar market is segmented by product type into rebar, structural sections, merchant bars, and steel wire rods. Rebar holds a dominant market share in the USA under the product type segment due to its widespread application in concrete reinforcement in construction projects. The durability and strength of rebar make it essential in both residential and commercial construction, contributing to its strong position within this segment.

By Application: In terms of application, the USA steel merchant and rebar market is categorized into residential construction, commercial construction, industrial applications, and public infrastructure. Commercial construction has a dominant market share due to the surge in high-rise building projects, particularly in metropolitan areas. The demand for durable and high-strength steel products for commercial construction projects supports this sub-segment's leading position.

USA Steel Merchant and Rebar Market Competitive Landscape

The USA steel merchant and rebar market is primarily shaped by major domestic manufacturers and a few multinational corporations. Companies like Nucor Corporation and Commercial Metals Company are leading players, leveraging their extensive manufacturing capabilities and distribution networks to maintain a competitive edge.

USA Steel Merchant and Rebar Industry Analysis

Growth Drivers

-

Infrastructure Development: The USA has prioritized infrastructure development with an allocation of $1.2 trillion in the Infrastructure Investment and Jobs Act (IIJA), supporting upgrades in roads, bridges, and railways. Steel is a primary material in these projects, driving demand for steel merchant and rebar products. For instance, as of 2024, over 20,000 miles of highways and 10,000 bridges are planned for renovation, requiring high volumes of reinforced steel.

- Increasing Urbanization: As of 2024, the U.S. urban population reached approximately 275 million, emphasizing the need for expanded housing, transportation, and commercial facilities. This population growth is spurring demand for steel and rebar in urban projects. Cities like Houston and Phoenix have allocated funding for new residential complexes and public infrastructure to accommodate an influx of residents.

- Demand from Construction Sector: In 2024, the U.S. construction sector has maintained steady demand for steel, driven by a $500 billion investment in residential and commercial projects nationwide. Steel rebar is essential for structural stability in high-rise buildings and large complexes, accounting for a significant portion of material costs in commercial projects. This growing sector ensures sustained demand for steel products.

Market Challenges

-

Volatile Raw Material Prices: Fluctuations in steel and iron ore prices impact the cost structure of steel merchants and rebar manufacturers. In 2024, iron ore prices peaked at $120 per ton due to supply chain disruptions and mining output limitations, pressuring margins for steel suppliers. This price volatility adds risk to operational costs.

- Environmental Regulations: The U.S. Environmental Protection Agency (EPA) has implemented stringent emissions standards for steel manufacturing, limiting carbon dioxide emissions to 1.5 tons per ton of steel. Compliance with these standards requires significant investment in cleaner production technologies, increasing costs for steel producers.

USA Steel Merchant and Rebar Market Future Outlook

The USA steel merchant and rebar market is expected to grow in the coming years, driven by ongoing infrastructure development and increased urbanization. Government-led projects for roads, bridges, and public infrastructure will support growth, alongside demand from private sector construction. Innovations in high-strength and eco-friendly steel products are anticipated to further boost market adoption, positioning the industry for steady expansion.

Opportunities

- Green Building Initiatives: Sustainable building practices, promoted through U.S. Green Building Council initiatives, drive demand for recycled and low-carbon steel. In 2024, green-certified projects have surpassed 100 million square feet, creating an opportunity for eco-friendly rebar and steel products.

- Technological Advancements: High-strength rebar, with tensile strengths above 100,000 psi, is increasingly adopted in high-rise and industrial applications due to its durability and reduced material needs. This advancement supports projects in earthquake-prone zones, expanding its market demand.

Scope of the Report

|

Product Type |

Merchant Bar Rebar Structural Sections Flat Products Steel Wire Rods |

|

Application |

Residential Construction Commercial Construction Industrial Fabrication Infrastructure Mining and Metals |

|

Material Grade |

Carbon Steel Alloy Steel Stainless Steel High-Strength Steel TMT Steel |

|

End-User Industry |

Construction Transportation and Automotive Energy and Utilities Manufacturing and Fabrication Agricultural Equipment |

|

Distribution Channel |

Direct Sales Distributors and Wholesalers Online Platforms |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency, Federal Highway Administration)

Construction Companies

Infrastructure Development Industries

Steel Fabrication Companies

Public Infrastructure Inducstries

Real Estate Development Companies

Industrial Equipment Manufacturing Companies

Companies

Players Mentioned in the Report

Nucor Corporation

Commercial Metals Company

Steel Dynamics Inc.

U.S. Steel Corporation

Schnitzer Steel Industries

Cascade Steel Rolling Mills

Evraz North America

Gerdau North America

Macsteel International

Republic Steel

Table of Contents

1. USA Steel Merchant and Rebar Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Market Segmentation Overview

2. USA Steel Merchant and Rebar Market Size (in USD Million)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Developments and Milestones

3. USA Steel Merchant and Rebar Market Analysis

3.1 Growth Drivers

3.1.1 Infrastructure Development

3.1.2 Increasing Urbanization

3.1.3 Demand from Construction Sector

3.1.4 Industrial Development

3.2 Market Challenges

3.2.1 Volatile Raw Material Prices

3.2.2 Environmental Regulations

3.2.3 Competition from Substitute Materials

3.2.4 Trade Restrictions and Tariffs

3.3 Opportunities

3.3.1 Green Building Initiatives

3.3.2 Technological Advancements

3.3.3 Public-Private Partnerships

3.3.4 Focus on Safety Standards

3.4 Market Trends

3.4.1 Adoption of Recycled Steel

3.4.2 Use of High-Strength Steel

3.4.3 Automation in Manufacturing

3.4.4 Increasing Investments in Infrastructure

3.5 Regulatory Overview

3.5.1 EPA Standards

3.5.2 Federal Infrastructure Policies

3.5.3 Building Codes and Safety Standards

3.5.4 Steel Industry Trade Regulations

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. USA Steel Merchant and Rebar Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Merchant Bar

4.1.2 Rebar

4.1.3 Structural Sections

4.1.4 Flat Products

4.1.5 Steel Wire Rods

4.2 By Application (in Value %)

4.2.1 Residential Construction

4.2.2 Commercial Construction

4.2.3 Industrial Fabrication

4.2.4 Infrastructure (Bridges, Roads)

4.2.5 Mining and Metals

4.3 By Material Grade (in Value %)

4.3.1 Carbon Steel

4.3.2 Alloy Steel

4.3.3 Stainless Steel

4.3.4 High-Strength Steel

4.3.5 TMT (Thermo-Mechanically Treated) Steel

4.4 By End-User Industry (in Value %)

4.4.1 Construction

4.4.2 Transportation and Automotive

4.4.3 Energy and Utilities

4.4.4 Manufacturing and Fabrication

4.4.5 Agricultural Equipment

4.5 By Distribution Channel (in Value %)

4.5.1 Direct Sales

4.5.2 Distributors and Wholesalers

4.5.3 Online Platforms

5. USA Steel Merchant and Rebar Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nucor Corporation

5.1.2 ArcelorMittal USA

5.1.3 Gerdau North America

5.1.4 Commercial Metals Company

5.1.5 Steel Dynamics Inc.

5.1.6 U.S. Steel Corporation

5.1.7 Cascade Steel Rolling Mills

5.1.8 Evraz North America

5.1.9 Schnitzer Steel Industries Inc.

5.1.10 CMC Steel Fabricators Inc.

5.1.11 Charter Steel

5.1.12 SDI La Farga

5.1.13 Bayou Steel Group

5.1.14 Macsteel International

5.1.15 Republic Steel

5.2 Cross Comparison Parameters (Production Capacity, Employee Count, Global Presence, Steel Grade Offering, Revenue, Market Share, Sustainability Initiatives, Distribution Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Incentives

5.9 Private Equity Investments

6. USA Steel Merchant and Rebar Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance and Certification Processes

6.3 Trade Tariffs and Import Duties

6.4 Local Content Regulations

7. USA Steel Merchant and Rebar Future Market Size (in USD Million)

7.1 Future Market Size Projections

7.2 Key Growth Drivers for Future Market

8. USA Steel Merchant and Rebar Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Application (in Value %)

8.3 By Material Grade (in Value %)

8.4 By End-User Industry (in Value %)

8.5 By Distribution Channel (in Value %)

9. USA Steel Merchant and Rebar Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Analysis

9.3 Market Positioning Strategies

9.4 Emerging Market Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping out all critical stakeholders in the USA steel merchant and rebar market, supported by thorough desk research. This stage focused on identifying core factors impacting market trends, including construction activity and material preferences.

Step 2: Market Analysis and Construction

In this phase, historical data on market growth, construction projects, and infrastructure investments were compiled and analyzed. This data set was validated to ensure accuracy in estimating market demand and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Key industry hypotheses were validated through expert interviews and consultations with industry professionals. These insights provided deeper understanding into operational strategies and market challenges directly from practitioners.

Step 4: Research Synthesis and Final Output

Engagements with multiple steel manufacturers and construction firms enabled a comprehensive synthesis of market trends, revenue streams, and consumer preferences. This approach ensured a validated, data-driven analysis for the USA steel merchant and rebar market report.

Frequently Asked Questions

1. How big is the USA Steel Merchant and Rebar Market?

The USA steel merchant and rebar market is valued at USD 9.8 billion, driven by significant demand from the construction and infrastructure sectors.

2. What factors drive the USA Steel Merchant and Rebar Market?

Key drivers include government-led infrastructure projects, urbanization, and the adoption of high-strength rebar in construction.

3. Who are the major players in the USA Steel Merchant and Rebar Market?

The market is led by major companies such as Nucor Corporation, U.S. Steel Corporation, and Commercial Metals Company, known for their strong manufacturing and distribution networks.

4. What are the challenges faced by the USA Steel Merchant and Rebar Market?

Challenges include fluctuating raw material prices, stringent environmental regulations, and competition from alternative materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.