USA Steel Rebar Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD9244

December 2024

89

About the Report

USA Steel Rebar Market Overview

- The USA Steel Rebar Market is currently valued at USD 8.2 billion, based on an analysis of historical market performance over the last five years. This market is driven by the significant infrastructure development projects initiated under federal and state government initiatives. The rising demand for commercial and residential construction, combined with renovation and modernization efforts in various sectors, are some of the key factors propelling the demand for steel rebar in the USA.

- Cities such as New York, Los Angeles, and Houston are the dominant markets for steel rebar. These cities lead due to their rapid urbanization, large-scale infrastructure projects, and ongoing residential construction activities. Additionally, state-level government incentives in these regions are encouraging investment in the construction sector, further increasing the demand for steel rebar.

- Federal and state building codes in the U.S. have become more stringent, requiring the use of rebar in both commercial and residential construction to meet safety standards. In 2023, the International Building Code (IBC) was updated to include higher rebar requirements for structural integrity. States like California, New York, and Texas have adopted these codes, making rebar a mandatory component in all new construction projects. The U.S. government has allocated $10 billion for regulatory compliance in construction, ensuring that builders adhere to these updated safety standards.

USA Steel Rebar Market Segmentation

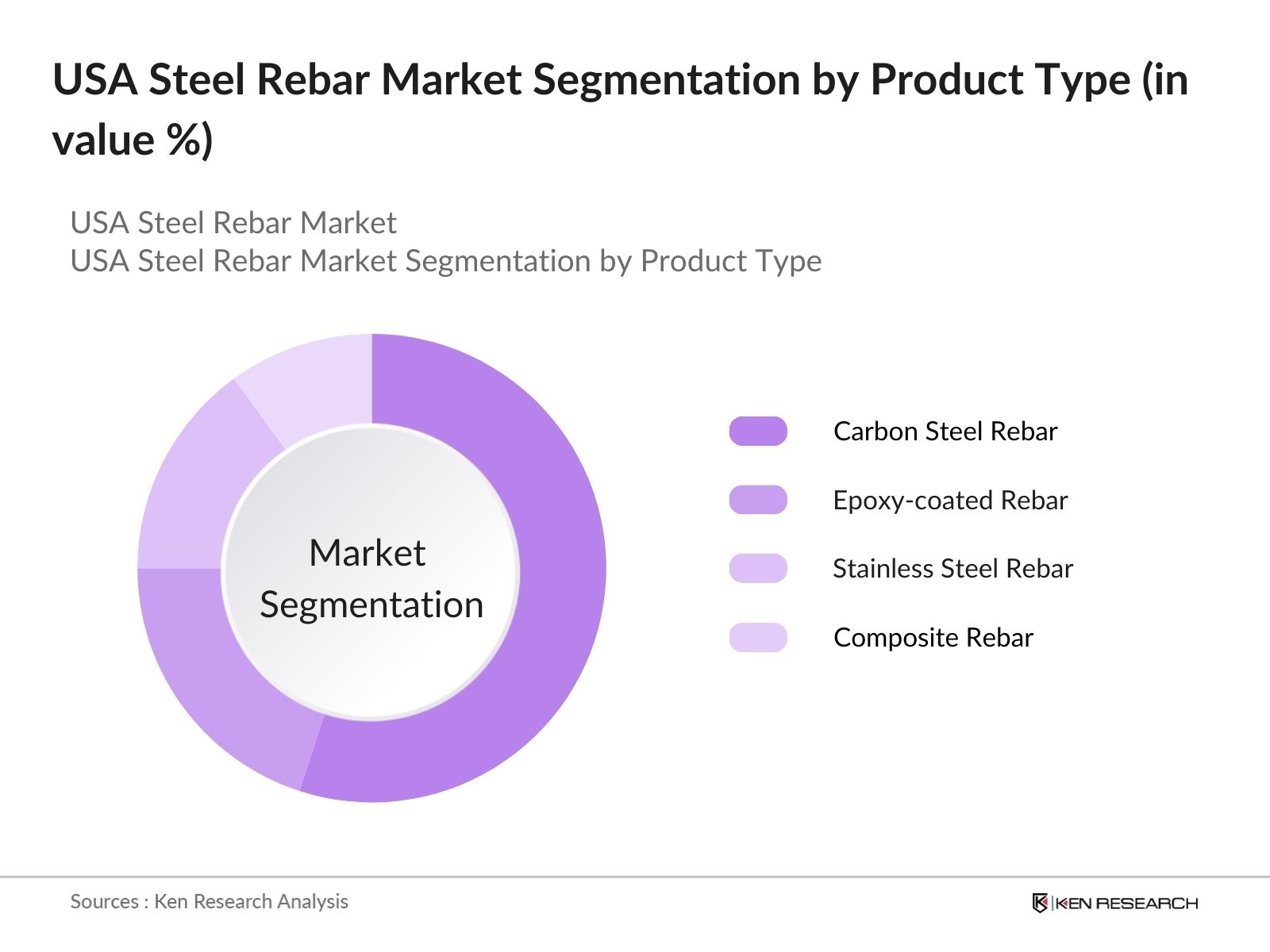

By Product Type: The USA steel rebar market is segmented by product type into carbon steel rebar, epoxy-coated rebar, stainless steel rebar, and composite rebar. Currently, carbon steel rebar dominates the market due to its cost-effectiveness and widespread application in both commercial and residential construction projects. Its versatility and ability to provide long-lasting strength make it a preferred choice among contractors and engineers for various infrastructure projects.

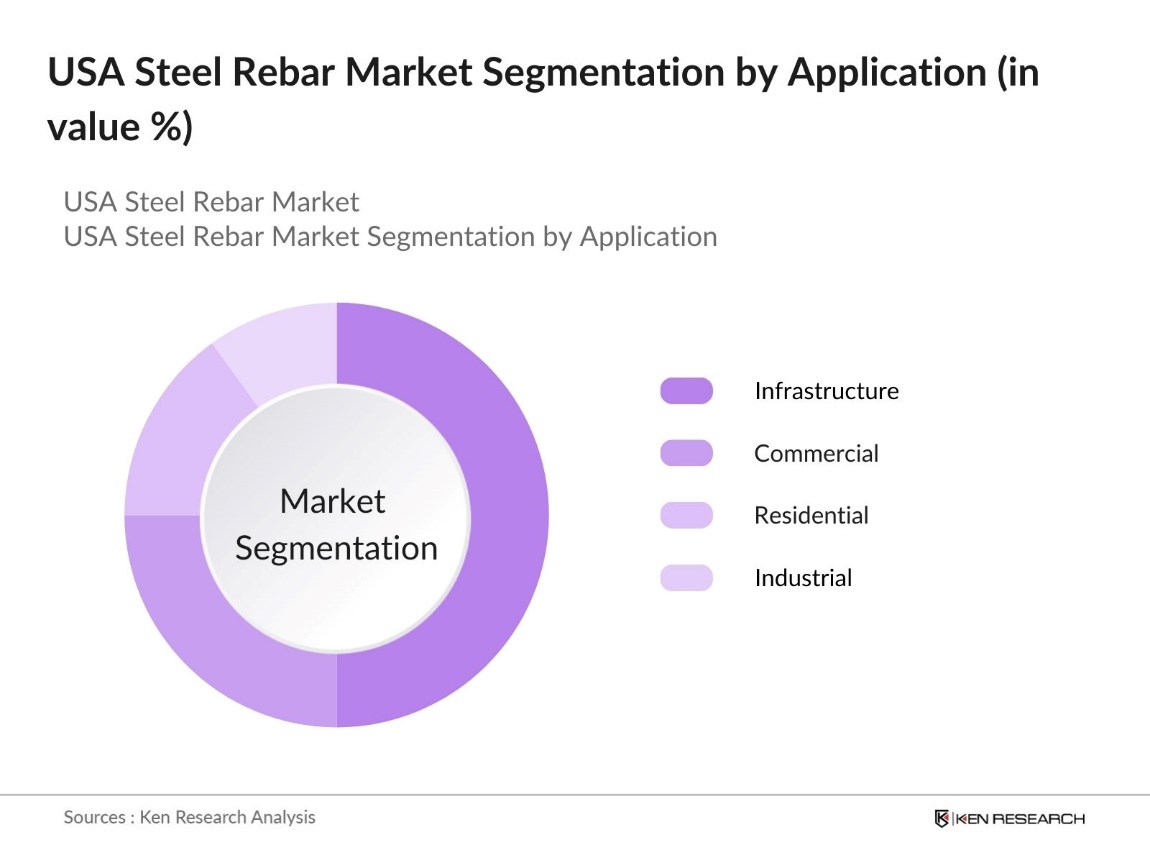

By Application: The USA steel rebar market is segmented by application into infrastructure (bridges, highways, airports), commercial (shopping malls, office buildings), residential (housing, apartment complexes), and industrial (power plants, factories). Infrastructure projects, particularly bridges and highways, hold the dominant market share. The US government's push for upgrading the nation's aging infrastructure, coupled with significant investments in transport systems, has driven demand in this sector.

USA Steel Rebar Market Competitive Landscape

The market is dominated by several major players with established global and local market presences. These companies are characterized by their diverse production capacities, long-standing industry experience, and their commitment to sustainability and innovation in steel production. The competitive landscape is consolidated with leading players controlling a significant portion of the market.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Market Reach |

Sustainability Initiatives |

Technology Adoption |

Workforce |

Revenue |

|

Gerdau S.A. |

1901 |

Porto Alegre, Brazil |

5 million tons |

Global |

Green Steel Initiatives |

High |

30,000 |

$15 billion |

|

Nucor Corporation |

1940 |

Charlotte, NC, USA |

7 million tons |

North America |

Low Carbon Steel Production |

High |

28,000 |

$20 billion |

|

Commercial Metals Company |

1915 |

Irving, TX, USA |

3 million tons |

North America |

Energy-Efficient Processes |

Medium |

12,000 |

$6 billion |

|

Steel Dynamics, Inc. |

1993 |

Fort Wayne, IN, USA |

6 million tons |

North America |

Recycling in Steelmaking |

High |

10,000 |

$13 billion |

|

ArcelorMittal USA |

2006 |

Chicago, IL, USA |

4 million tons |

Global |

Carbon Neutral Initiatives |

High |

18,000 |

$12 billion |

USA Steel Rebar Industry Analysis

Growth Drivers

- Government Infrastructure Projects (Biden's Infrastructure Plan, Highway construction): The IIJA represents a historic investment of $1.2 trillion in various infrastructure projects, with $550 billion earmarked for new investments and programs. This surge in federal investment is expected to significantly boost the demand for steel rebar in construction, particularly for highways and bridge repairs. The plan also prioritizes $66 billion in railway investments, further amplifying the need for steel rebar to reinforce railway tracks and bridges.

- Commercial and Residential Construction Boom (Urbanization, Building codes) The new housing starts decreased by 18.3% compared to previous years, with single-family home construction down by 9.8% and multi-family units down by 31.1%, an indicator of ongoing residential construction growth. This uptrend in construction directly boosts the demand for steel rebar, as rebar is critical for structural integrity in high-rise buildings, bridges, and other infrastructural developments.

- Technological Advancements in Rebar Manufacturing (Green steel, Automation): Advancements in automation and green steel technologies are boosting growth in rebar manufacturing. The increasing use of Electric Arc Furnace (EAF) technology, which utilizes scrap steel, is helping reduce carbon emissions and environmental impact. This focus on sustainability is driving efficiency improvements, with rebar producers benefiting from streamlined production processes and reduced waste, aligning with the broader push toward eco-friendly industrial practices.

Market Challenges

- Volatile Raw Material Prices (Iron ore, Scrap steel): Fluctuations in the prices of raw materials like iron ore and scrap steel have created significant challenges for rebar manufacturers, impacting their cost structures. These price changes, driven by global supply chain disruptions and varying demand, have led to increased production costs, affecting profit margins. Additionally, supply chain issues, including geopolitical tensions, have further complicated the availability of essential raw materials, putting additional pressure on manufacturers to manage pricing and resources efficiently.

- Stringent Environmental Regulations (Carbon emissions, Waste disposal): Rebar manufacturers face increasing pressure to meet stringent environmental regulations, particularly regarding carbon emissions and waste management. Compliance with these regulations, which aim to significantly reduce industrial emissions, has raised operational costs for manufacturers, especially those using traditional production methods. As the steel industry is a major contributor to emissions, the adoption of greener practices has become a critical focus, prompting manufacturers to invest in more sustainable production technologies to align with environmental mandates.

USA Steel Rebar Market Future Outlook

Over the next five years, the USA steel rebar market is expected to witness substantial growth, primarily driven by the federal governments renewed focus on infrastructure development and the rise of urbanization across major US cities. The ongoing shift towards sustainable building materials, along with technological advancements in the steel manufacturing process, will play a key role in shaping the future of this market.

Market Opportunities

- Sustainability Initiatives (Low-carbon steel, Recycled rebar): The U.S. rebar market is placing increasing emphasis on sustainability, with investments in low-carbon steel production and the adoption of greener technologies. Manufacturers are focusing on reducing carbon emissions through advanced production methods, such as incorporating recycled steel into their processes. These efforts are aligning with growing demand from environmentally conscious builders, as sustainability becomes a key priority across the construction sector. This shift supports broader environmental goals, as the industry moves towards more eco-friendly practices.

- Expanding Manufacturing Capacities (New production plants, Partnerships): To address rising demand, U.S. steel manufacturers are expanding their production capacities by building new facilities and forming strategic partnerships. These expansions are aimed at increasing domestic production, reducing reliance on imports, and boosting the availability of rebar in the market. Support from local governments, in the form of incentives and grants, is helping to facilitate these developments, while also creating new jobs and enhancing regional economic growth. This trend underscores the industry's commitment to meeting both current and future market needs.

Scope of the Report

|

Product Type |

Carbon Steel Rebar |

|

Epoxy-coated Rebar |

|

|

Stainless Steel Rebar |

|

|

Composite Rebar |

|

|

Application |

Infrastructure (Bridges, Highways, Airports) |

|

Commercial (Shopping Malls, Office Buildings) |

|

|

Residential (Housing, Apartment Complexes) |

|

|

Industrial (Power Plants, Factories) |

|

|

Process Type |

Hot Rolled |

|

Cold Rolled |

|

|

Thermo-Mechanical Treatment (TMT) |

|

|

Diameter |

Up to 10 mm |

|

10-20 mm |

|

|

Above 20 mm |

|

|

Region |

Northeast USA |

|

Midwest USA |

|

|

Southern USA |

|

|

Western USA |

Products

Key Target Audience

Infrastructure Development Companies

Steel Manufacturers

Architectural and Engineering Firms

Industrial Manufacturing Companies

Government and Regulatory Bodies (U.S. Department of Transportation, Environmental Protection Agency)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Gerdau S.A.

Nucor Corporation

Commercial Metals Company

Steel Dynamics, Inc.

ArcelorMittal USA

EVRAZ North America

Cascade Steel Rolling Mills

Byer Steel

Harris Supply Solutions

SDI La Farga LLC

Table of Contents

1. USA Steel Rebar Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Steel Rebar Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Steel Rebar Market Analysis

3.1 Growth Drivers (Steel demand, Infrastructure spending, Commercial construction)

3.1.1 Government Infrastructure Projects (Biden's Infrastructure Plan, Highway construction)

3.1.2 Commercial and Residential Construction Boom (Urbanization, Building codes)

3.1.3 Technological Advancements in Rebar Manufacturing (Green steel, Automation)

3.1.4 Increase in Renovation and Retrofit Projects

3.2 Market Challenges (Supply chain disruptions, Environmental concerns)

3.2.1 Volatile Raw Material Prices (Iron ore, Scrap steel)

3.2.2 Stringent Environmental Regulations (Carbon emissions, Waste disposal)

3.2.3 Labor Shortages in Manufacturing Sector

3.2.4 Import Dependence (Trade tariffs, Foreign competition)

3.3 Opportunities (R&D investments, Green steel innovations)

3.3.1 Sustainability Initiatives (Low-carbon steel, Recycled rebar)

3.3.2 Expanding Manufacturing Capacities (New production plants, Partnerships)

3.3.3 Increasing Demand from Non-Construction Industries (Automotive, Energy)

3.4 Trends (Smart rebar, Digital tracking technologies)

3.4.1 Adoption of Smart Rebar Technologies

3.4.2 Use of AI and IoT for Monitoring and Tracking Rebar Quality

3.4.3 Rise in Rebar Reinforcement for Earthquake-Resistant Structures

3.5 Government Regulations (Safety standards, Environmental compliance)

3.5.1 US Federal and State Building Codes for Rebar Usage

3.5.2 Environmental Protection Agency (EPA) Regulations on Steel Production

3.5.3 Trade and Tariff Policies Affecting Steel Imports

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis (Supplier Power, Buyer Power, Substitutes, New Entrants, Competition)

3.9 Competitive Landscape

4. USA Steel Rebar Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Carbon Steel Rebar

4.1.2 Epoxy-coated Rebar

4.1.3 Stainless Steel Rebar

4.1.4 Composite Rebar

4.2 By Application (In Value %)

4.2.1 Infrastructure (Bridges, Highways, Airports)

4.2.2 Commercial (Shopping Malls, Office Buildings)

4.2.3 Residential (Housing, Apartment Complexes)

4.2.4 Industrial (Power Plants, Factories)

4.3 By Process Type (In Value %)

4.3.1 Hot Rolled

4.3.2 Cold Rolled

4.3.3 Thermo-Mechanical Treatment (TMT)

4.4 By Diameter (In Value %)

4.4.1 Up to 10 mm

4.4.2 10-20 mm

4.4.3 Above 20 mm

4.5 By Region (In Value %)

4.5.1 Northeast USA

4.5.2 Midwest USA

4.5.3 Southern USA

4.5.4 Western USA

5. USA Steel Rebar Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Gerdau S.A.

5.1.2 Nucor Corporation

5.1.3 Commercial Metals Company

5.1.4 Steel Dynamics, Inc.

5.1.5 ArcelorMittal USA

5.1.6 EVRAZ North America

5.1.7 Cascade Steel Rolling Mills

5.1.8 Byer Steel

5.1.9 Harris Supply Solutions

5.1.10 SDI La Farga LLC

5.1.11 Pacific Steel & Recycling

5.1.12 CMC Rebar

5.1.13 Re-Steel Supply Co.

5.1.14 Steel Ventures LLC

5.1.15 TAMCO Steel

5.2 Cross Comparison Parameters (Production Capacity, Market Presence, Geographical Reach, Sustainability Practices, Technology Adoption, Workforce, Customer Base, Revenue)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, New Product Launches, Expansion Plans)

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Steel Rebar Market Regulatory Framework

6.1 US Federal Standards for Rebar Production

6.2 Compliance with Environmental Regulations

6.3 Certification Processes for Rebar Manufacturers

7. USA Steel Rebar Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Steel Rebar Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Process Type (In Value %)

8.4 By Diameter (In Value %)

8.5 By Region (In Value %)

9. USA Steel Rebar Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the key factors influencing the USA steel rebar market. Through comprehensive desk research and consultations with industry experts, we identify variables such as production capacity, regulatory compliance, market demand, and pricing trends to map out the market ecosystem.

Step 2: Market Analysis and Construction

In this phase, historical data related to production, sales volumes, and demand patterns are compiled to understand market performance. Data sources include government databases, company financials, and steel industry reports. Analysis also focuses on shifts in regulatory standards and the impact of infrastructure projects on market growth.

Step 3: Hypothesis Validation and Expert Consultation

We conduct expert interviews through Computer-Assisted Telephone Interviews (CATI) with professionals in the steel manufacturing and construction sectors. These interviews validate market hypotheses, provide real-world insights, and confirm trends identified in earlier phases of the research.

Step 4: Research Synthesis and Final Output

The final stage of research integrates all collected data and insights into a cohesive market report. This synthesis ensures that the market estimates, trends, and forecasts are accurate, reliable, and aligned with industry developments.

Frequently Asked Questions

01. How big is the USA steel rebar market?

The USA Steel Rebar Market is valued at USD 8.2 billion, driven by the growing demand for steel in infrastructure projects and the modernization of the nations transport systems.

02. What are the challenges in the USA steel rebar market?

The USA Steel Rebar Market faces challenges such as fluctuating raw material prices, labor shortages, and stringent environmental regulations. Additionally, trade tariffs and foreign competition pose risks to domestic manufacturers.

03. Who are the major players in the USA steel rebar market?

Key players in USA Steel Rebar Market include Gerdau S.A., Nucor Corporation, Commercial Metals Company, Steel Dynamics, Inc., and ArcelorMittal USA. These companies dominate the market due to their vast production capacities and strategic focus on sustainable steel production.

04. What are the growth drivers of the USA steel rebar market?

The USA Steel Rebar Market is driven by increased government investment in infrastructure, the growth of urbanization, and the rise in commercial construction activities. Technological advancements in steel production also contribute to the market's growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.