USA Steel Silo Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD8514

December 2024

97

About the Report

USA Steel Silo Market Overview

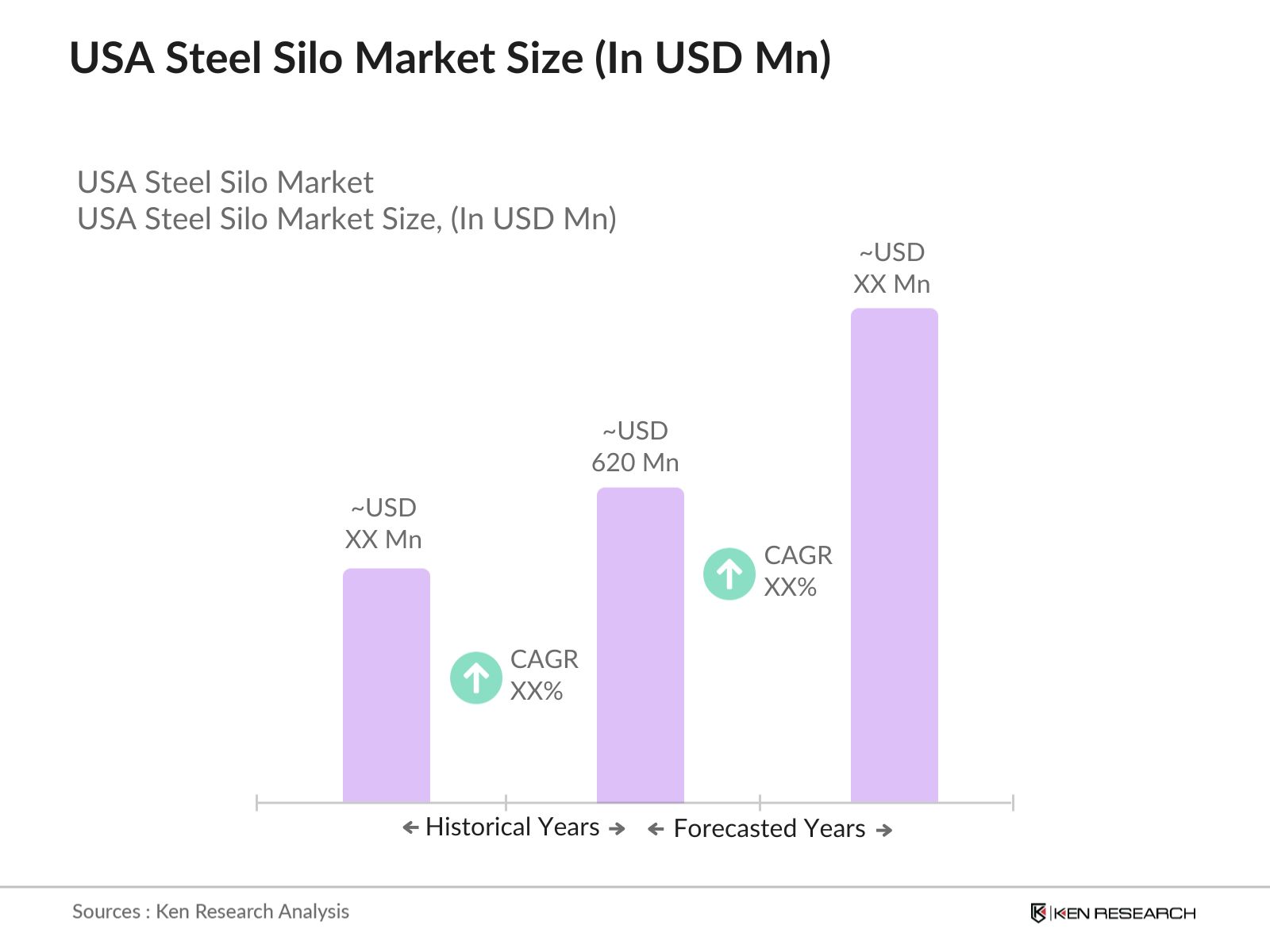

- The USA Steel Silo Market is valued at USD 620 million, based on a five-year historical analysis, driven by the rapid expansion in the agricultural and industrial sectors. Increasing needs for efficient storage solutions due to rising crop yields and the focus on minimizing wastage have underscored steel silos as vital infrastructure in agriculture and food processing. Additionally, technological advancements, including corrosion-resistant coatings and modular designs, further catalyze market adoption, enhancing durability and user flexibility.

- Key urban and industrial hubs like Texas, Illinois, and California dominate the steel silo market. These regions benefit from robust agricultural outputs and manufacturing facilities that necessitate extensive storage capacities. Furthermore, favorable policies that support storage infrastructure investments make these areas primary consumers of steel silos, leveraging both economic scale and established supply chains to drive consistent demand.

- The USDA provides specific guidelines on the safety of storage facilities, mandating periodic inspections and safety standards compliance for agricultural storage facilities. In 2023, the USDA invested $12 million in storage safety programs, emphasizing standards that steel silos must meet to ensure safe grain storage. These guidelines impact the steel silo market as companies must adhere to safety practices to qualify for USDA support programs

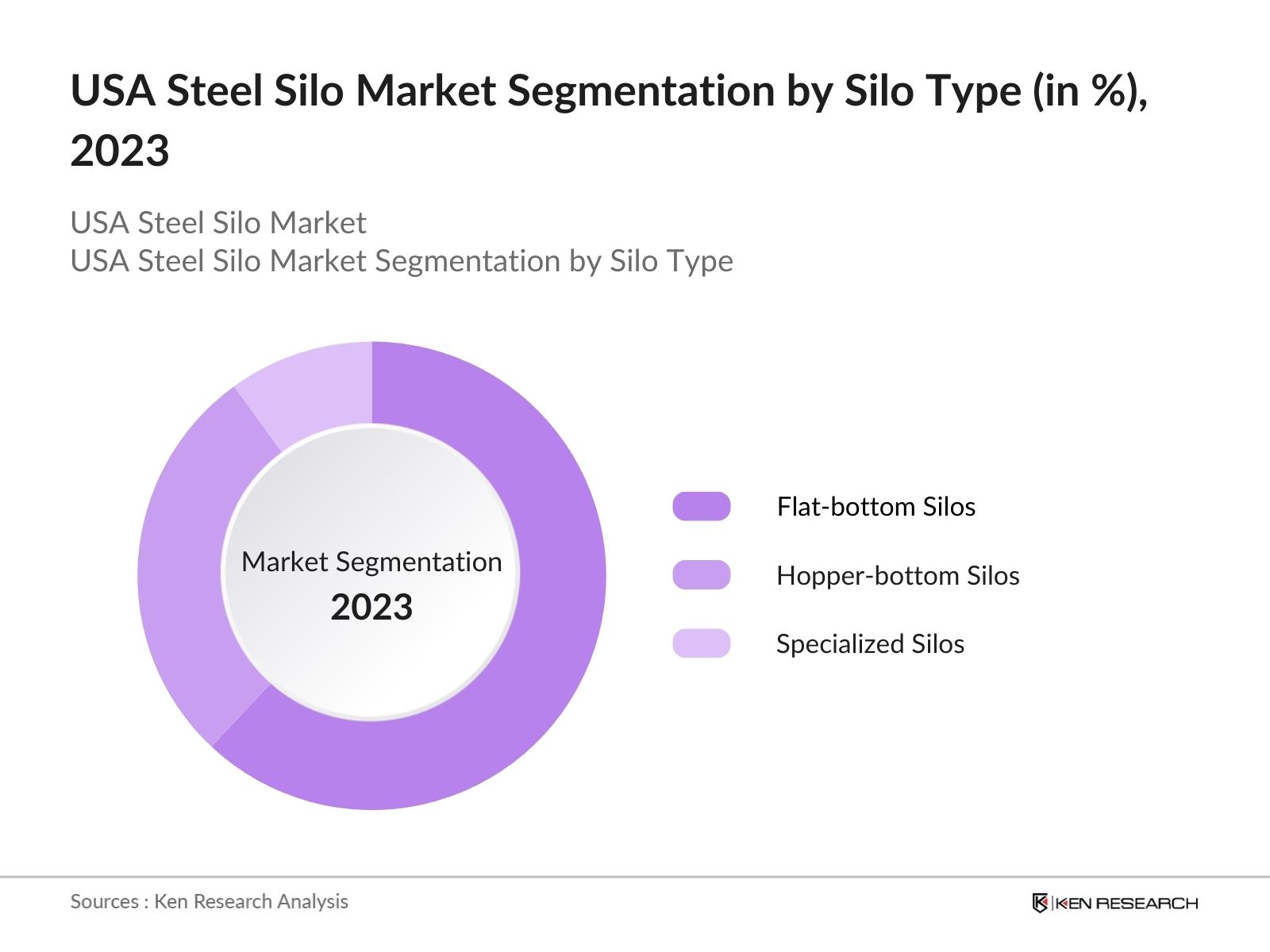

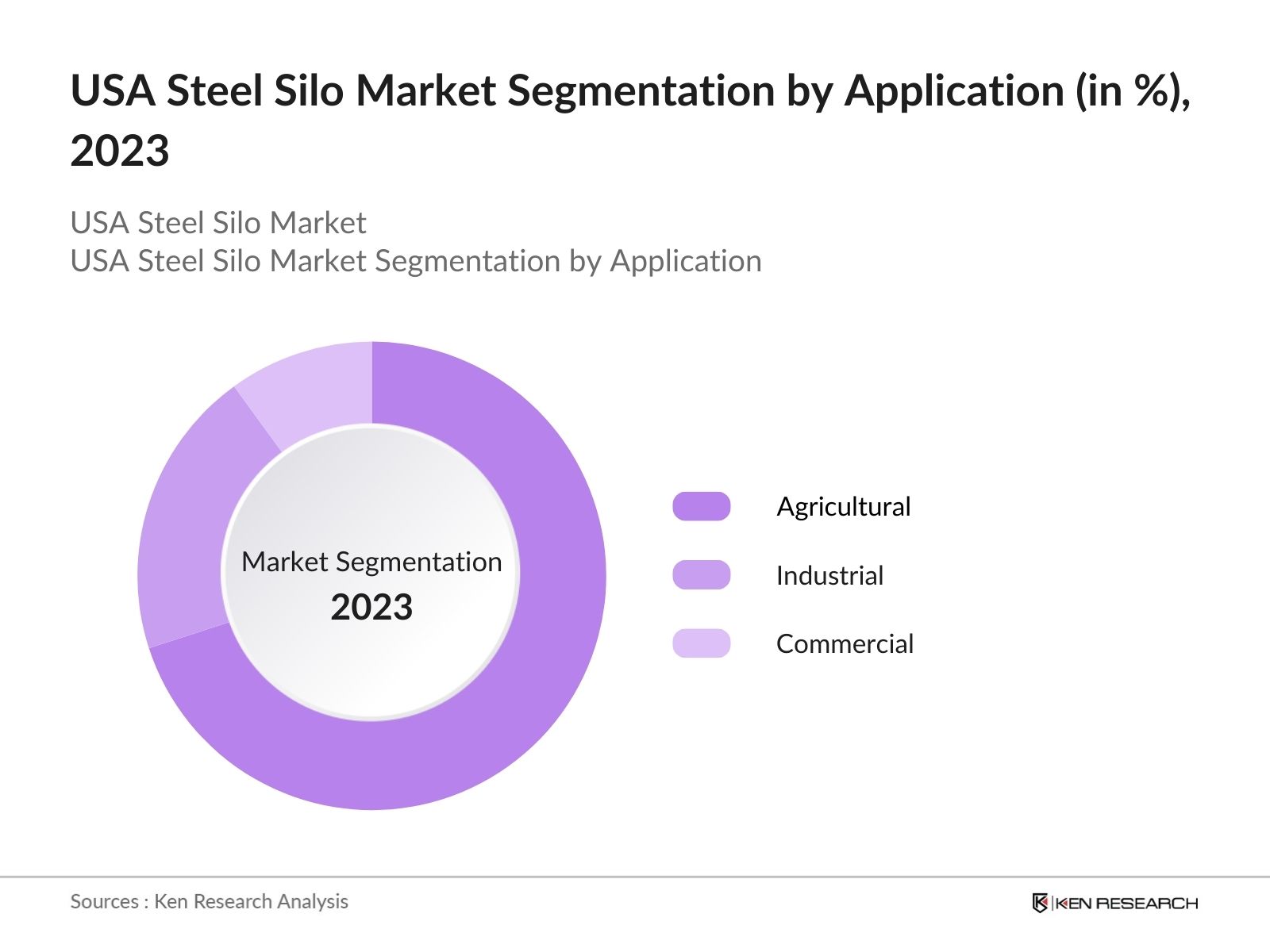

USA Steel Silo Market Segmentation

By Silo Type: The market is segmented by silo type into flat-bottom silos, hopper-bottom silos, and other specialized silos. Among these, flat-bottom silos hold a dominant share in the market due to their larger storage capacities and cost-effectiveness, especially for long-term storage needs. These silos are preferred by large agricultural enterprises and grain cooperatives because they are easier to install, provide ample storage, and minimize grain loss over time, which is essential for maintaining quality during extended periods.

By Application: The market is further divided by application into agricultural, industrial, and commercial storage. Agricultural storage emerges as the dominant application, driven by the need to preserve large quantities of grains and feedstock critical to food security and livestock production. The demand in agriculture is bolstered by increasing production levels and the critical role of silos in preventing crop loss and ensuring smooth supply chain operations.

USA Steel Silo Market Competitive Landscape

The USA Steel Silo market is led by prominent players whose market strategies and innovation are shaping the sector. This competitive environment is characterized by both domestic companies and international brands that provide a diverse range of silo solutions for various applications, showcasing a significant consolidation within the industry.

|

Company |

Establishment Year |

Headquarters |

Specialization |

Silo Capacity Range |

Technology Integration |

Client Base |

Global Reach |

|

AGI |

1996 |

Manitoba, Canada |

|||||

|

CST Industries |

1893 |

Kansas City, MO |

|||||

|

Brock Grain Systems |

1957 |

Milford, IN |

|||||

|

Sukup Manufacturing |

1963 |

Sheffield, IA |

|||||

|

Superior Grain Equipment |

1977 |

Kindred, ND |

USA Steel Silo Industry Analysis

Growth Drivers

- Expansion in Agriculture Sector: The growth of the U.S. agriculture sector significantly drives the demand for steel silos due to increased grain storage needs. The USDA reports that total grain production in the U.S. reached 408 million metric tons in 2023, emphasizing the need for efficient storage solutions to minimize post-harvest losses. Steel silos, with enhanced durability and airtight features, are critical for preserving grain quality, especially in regions with high production such as Iowa and Illinois. As agricultural outputs continue to rise, the demand for steel silos aligns closely with these storage requirements to optimize productivity and reduce waste.

- Demand from Food and Beverage Processing: The U.S. food and beverage industry has observed substantial growth, necessitating reliable bulk storage solutions like steel silos. The Bureau of Economic Analysis highlighted that food and beverage processing added $1.1 trillion to the U.S. GDP in 2023, creating a significant need for efficient raw material storage. With steel silos providing solutions to maintain hygiene standards and efficient space utilization, the sectors demand for high-capacity silos continues to rise. This infrastructure is particularly essential for sectors like grain milling and dairy processing, where bulk storage aligns with production volumes.

- Advancements in Silo Technology: Technological advancements in silo design have enabled higher storage efficiency and product preservation. The U.S. Department of Energy (DOE) reports that modern silos with improved insulation and ventilation can reduce energy consumption by up to 25%, an attractive feature for industries looking to optimize costs. These technological advancements in the U.S. steel silo market cater to industries focusing on sustainability and energy efficiency, supporting long-term operational savings and improved storage quality.

Market Challenges

- High Initial Investment: Steel silos, while durable and efficient, involve a high initial investment, which can be a barrier, especially for small to medium enterprises. Data from the U.S. Small Business Administration indicates that smaller enterprises often struggle with high capital investments, with only 47% able to access sufficient financing in 2023. The requirement of high upfront costs for steel silos can limit adoption rates, as smaller companies prioritize investments with shorter payback periods.

- Cost of Maintenance: Maintenance costs for steel silos, especially in highly corrosive environments, present a significant challenge. A USDA study highlighted that periodic maintenance, including rust prevention and structural reinforcements, adds around $5,000 annually per silo on average. For enterprises relying on multiple silos, maintenance costs can accumulate, impacting operational budgets and potentially reducing the appeal of steel silos as a long-term storage solution.

USA Steel Silo Market Future Outlook

Over the next five years, the USA Steel Silo Market is positioned to experience considerable growth due to ongoing technological advancements and increased awareness of the need for efficient storage systems. The convergence of industrial automation and storage technologies is expected to drive silo demand, along with expanded adoption across the bioenergy and renewable sectors.

Future Market Opportunities

- Expansion of Grain Export Capacities: The U.S. is one of the worlds largest grain exporters, and increased demand for American grain globally has underscored the need for expanded storage facilities at ports. In 2023, U.S. grain exports totaled approximately 117 million metric tons, indicating a growing need for optimized storage infrastructure to handle these volumes efficiently. Steel silos, with their high capacity and durability, support the logistical demands of grain export facilities, especially at major export hubs like the Port of New Orleans.

- Technological Innovations in Silo Construction: Innovations in steel silo construction, such as modular designs and corrosion-resistant materials, provide opportunities for efficient storage solutions. The U.S. Department of Commerce reports that materials innovation in 2023 resulted in 15% lower corrosion rates for steel silos, enhancing their longevity and reducing maintenance costs. Such advancements attract industries with high storage requirements, like food processing and bioenergy, as these sectors look to invest in durable and sustainable storage infrastructure.

Scope of the Report

|

By Material Type |

Carbon Steel Stainless Steel Galvanized Steel |

|

By Application |

Grain and Feed Storage Chemical Storage Cement and Aggregates Plastic and Polymer Storage |

|

By End-User Industry |

Agriculture Manufacturing Food Processing Wastewater Treatment |

|

By Capacity |

Less than 50 Tons 50-100 Tons Above 100 Tons |

|

By Region |

Midwest South West Northeast |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, EPA)

Agricultural Cooperatives

Food Processing Companies

Industrial Manufacturing Plants

Construction and Engineering Firms

Wastewater Treatment Facilities

Technology Integrators for Smart Silo Systems

Companies

Major Players

CST Industries

GSI Group

Silos Crdoba

Brock Grain Systems

Meridian Manufacturing Inc.

Sioux Steel Company

Superior Grain Equipment

Symaga

Ahrens Group

Bentall Rowlands Storage Systems

Sukup Manufacturing Co.

Behlen Mfg. Co.

Scafco Grain Systems

Lorrich Industries

Ag Growth International (AGI)

Table of Contents

USA Steel Silo Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Supply Chain Analysis (Material Flow, Supplier Network, Logistics)

USA Steel Silo Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Market Growth Analysis (Volume & Value %)

2.3. Key Market Developments and Milestones

USA Steel Silo Market Analysis

3.1. Growth Drivers

3.1.1. Expansion in Agriculture Sector

3.1.2. Demand from Food and Beverage Processing

3.1.3. Advancements in Silo Technology

3.1.4. Government Initiatives for Storage Efficiency

3.2. Market Challenges

3.2.1. High Initial Investment

3.2.2. Cost of Maintenance

3.2.3. Limited Awareness in Small Enterprises

3.3. Opportunities

3.3.1. Expansion of Grain Export Capacities

3.3.2. Technological Innovations in Silo Construction

3.3.3. Growth in Bioenergy Storage Applications

3.4. Trends

3.4.1. Shift to Modular Silos

3.4.2. Integration with IoT and Smart Sensing

3.4.3. Increased Demand for Corrosion-Resistant Coatings

3.5. Regulatory Framework

3.5.1. USDA Guidelines on Storage Safety

3.5.2. EPA Environmental Regulations

3.5.3. Compliance with Local Zoning Laws

3.5.4. OSHA Standards for Silo Operations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (End Users, Distributors, Manufacturers)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

USA Steel Silo Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Carbon Steel

4.1.2. Stainless Steel

4.1.3. Galvanized Steel

4.2. By Application (In Value %)

4.2.1. Grain and Feed Storage

4.2.2. Chemical Storage

4.2.3. Cement and Aggregates

4.2.4. Plastic and Polymer Storage

4.3. By End-User Industry (In Value %)

4.3.1. Agriculture

4.3.2. Manufacturing

4.3.3. Food Processing

4.3.4. Wastewater Treatment

4.4. By Capacity (In Value %)

4.4.1. Less than 50 Tons

4.4.2. 50-100 Tons

4.4.3. Above 100 Tons

4.5. By Region (In Value %)

4.5.1. Midwest

4.5.2. South

4.5.3. West

4.5.4. Northeast

USA Steel Silo Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. CST Industries

5.1.2. GSI Group

5.1.3. Silos Crdoba

5.1.4. AGCO Corporation

5.1.5. Brock Grain Systems

5.1.6. Meridian Manufacturing Inc.

5.1.7. Sioux Steel Company

5.1.8. Superior Grain Equipment

5.1.9. Symaga

5.1.10. Ahrens Group

5.1.11. Bentall Rowlands Storage Systems

5.1.12. Sukup Manufacturing Co.

5.1.13. Behlen Mfg. Co.

5.1.14. Scafco Grain Systems

5.1.15. Lorrich Industries

5.2. Cross Comparison Parameters (Number of Silo Installations, Inception Year, Revenue, Market Share, Product Customization Options, After-Sales Support, Certifications, Regional Coverage)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Expansion Plans)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Steel Silo Market Regulatory Framework

6.1. Construction and Safety Standards

6.2. Storage Quality Control Standards

6.3. Certification Processes

6.4. Environmental Regulations

USA Steel Silo Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Steel Silo Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Capacity (In Value %)

8.5. By Region (In Value %)

USA Steel Silo Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involved identifying crucial market variables, including material types, applications, and end-user industries for steel silos. Comprehensive desk research and stakeholder mapping helped ensure a robust analysis framework.

Step 2: Market Analysis and Construction

Historical data were gathered for the USA Steel Silo Market, focusing on segment-specific market penetration and revenue trends. This phase assessed market concentration and structural dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry practitioners validated market hypotheses, providing insights on recent technology advancements and market trends. Expert consultations refined the data points and confirmed industry perspectives.

Step 4: Research Synthesis and Final Output

The final phase synthesized insights from primary and secondary data sources, offering a cohesive view of the market. Bottom-up and top-down approaches were used to cross-verify and finalize the findings.

Frequently Asked Questions

01. How big is the USA Steel Silo Market?

The USA Steel Silo Market is valued at USD 620 million, with growth driven by demand from agriculture, industrial manufacturing, and the need for advanced storage solutions across the country.

02. What challenges face the USA Steel Silo Market?

Challenges in the USA Steel Silo Market include high upfront costs, complex maintenance requirements, and compliance with rigorous safety standards, impacting smaller enterprises.

03. Who are the major players in the USA Steel Silo Market?

Major players in the USA Steel Silo Market include CST Industries, GSI Group, and Meridian Manufacturing Inc., renowned for their diverse product ranges and technological advancements.

04. What drives the growth of the USA Steel Silo Market?

Key drivers in the USA Steel Silo Market include rising agricultural output, industrial storage needs, and technological enhancements like corrosion resistance and smart monitoring capabilities.

05. What applications are most common in the USA Steel Silo Market?

Common applications in the USA Steel Silo Market include grain storage, cement and aggregates, and chemical storage, with grain storage dominating due to its critical role in the agricultural supply chain.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.