USA Steel Slag Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD9200

December 2024

86

About the Report

USA Steel Slag Market Overview

- The USA steel slag market is valued at USD 15.6 billion, driven primarily by its use in road construction and cement production. Rising construction activities and government infrastructure programs, coupled with environmental initiatives, have boosted demand for steel slag as a cost-effective, sustainable material. The market is supported by consistent demand from the cement industry, where steel slag serves as a substitute for natural aggregates, reducing the environmental impact of mining activities.

- The Midwest and Southern USA dominate the steel slag market due to high steel production in these regions, which ensures a steady supply of slag by-products. The prevalence of infrastructure projects in these areas also supports high slag consumption, particularly for road base and construction applications. The Midwests large steel industry and extensive manufacturing base create a robust demand for slag, while the South benefits from active investments in transportation and public works projects, making these regions leading consumers of steel slag.

- The Clean Air Act enforces strict emission standards that impact steel slag production. Compliance with these standards is mandatory, and failure to meet them results in penalties. The EPA noted that industrial emissions from cement and steel accounted for nearly 15% of total U.S. CO emissions in 2023. Compliance drives manufacturers to adopt cleaner production methods, aligning slag production with sustainable practices.

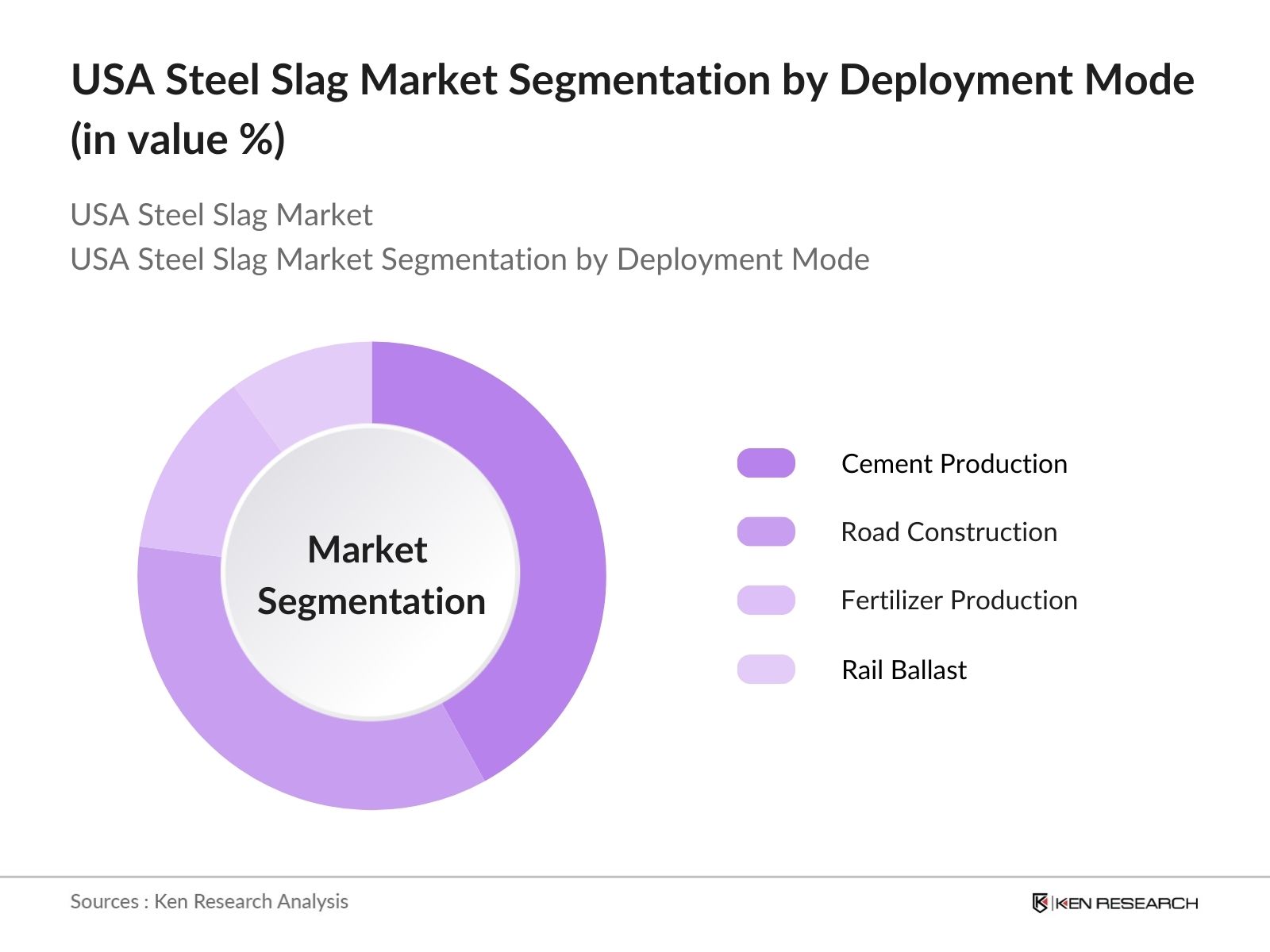

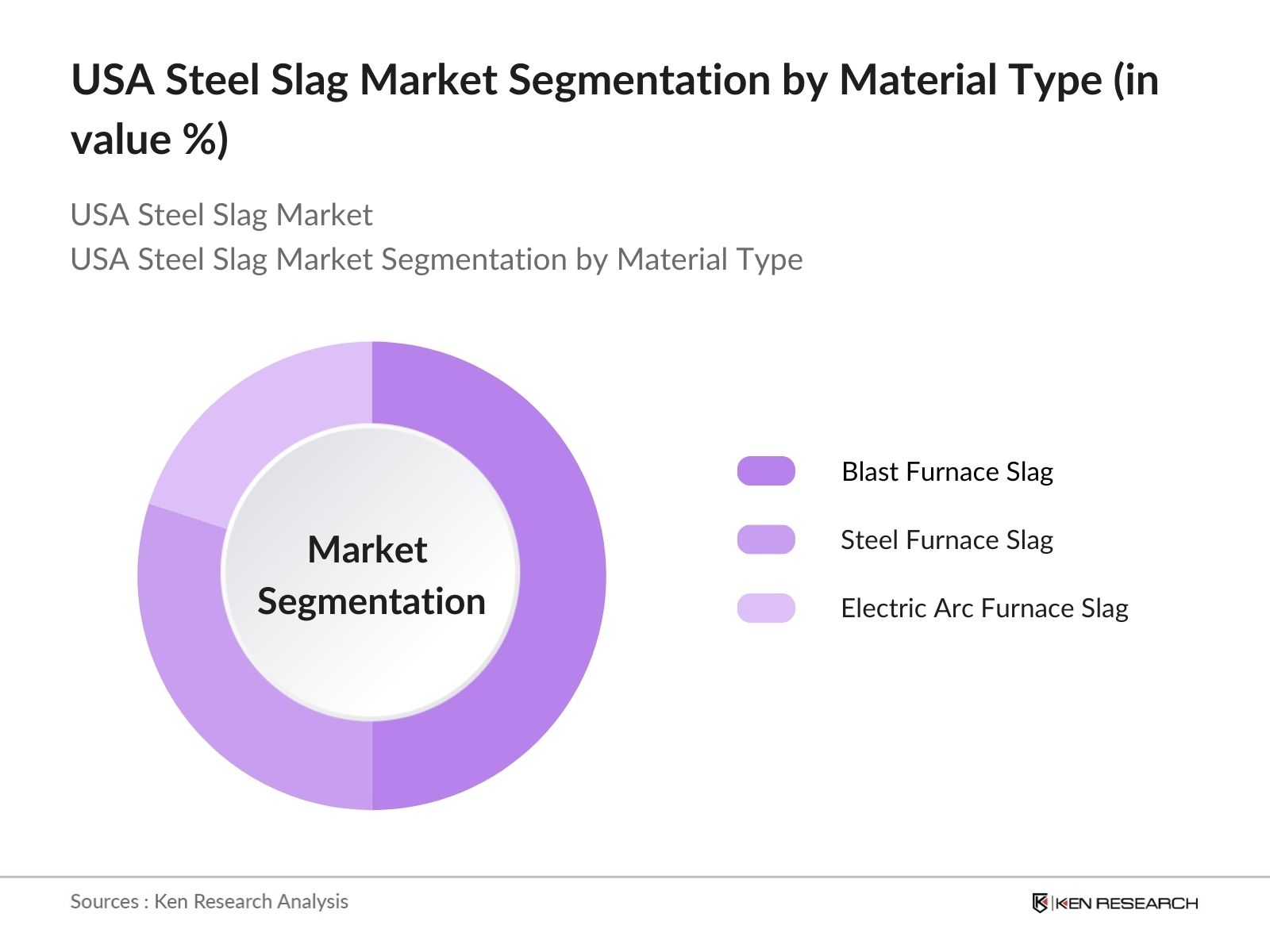

USA Steel Slag Market Segmentation

- By Application: The USA steel slag market is segmented by application into Cement Production, Road Construction, Fertilizer Production, and Rail Ballast. Among these, Cement Production holds a dominant share due to its ability to replace natural aggregates in cement production. This use reduces the environmental impact of mining and provides a cost-effective raw material for manufacturers, driving demand in the cement sector. The increasing push towards eco-friendly materials and the rising focus on carbon reduction in construction further strengthen the position of the cement production segment within the steel slag market.

- By Material Type: The steel slag market is also segmented by material type into Blast Furnace Slag, Steel Furnace Slag, and Electric Arc Furnace Slag. Blast Furnace Slag leads in market share as it is extensively used in cement and concrete applications. Its favourable properties, such as high durability and reduced expansion, make it highly suitable for construction uses, including road bases and concrete aggregates. The chemical stability of blast furnace slag contributes to its high demand in cement, making it a preferred material for sustainable infrastructure projects.

USA Steel Slag Market Competitive Landscape

The USA steel slag market is dominated by major steel companies and dedicated slag processing firms. These players leverage advanced technologies for slag processing and recycling, contributing to the markets competitive nature.

USA Steel Slag Market Analysis

Market Growth Drivers

- Industrial Demand for Slag as Cement Substitute: The USA is witnessing an increasing industrial demand for steel slag as a cement substitute due to its properties, which enhance durability and reduce carbon emissions in construction. With a push for greener alternatives, the U.S. Environmental Protection Agency (EPA) promotes recycled materials, citing that using slag-based cement can reduce CO emissions from the traditional cement industry by up to 50%. Additionally, the U.S. cement sector emitted around 35 million metric tons of CO in 2023, further driving slag adoption to meet federal emission standards.

- Environmental Regulations Promoting Recycling: Environmental regulations are key drivers of steel slag recycling, particularly under federal guidelines like the Resource Conservation and Recovery Act. In 2023, nearly 80 million tons of steel slag were produced globally, with the U.S. contributing about 10 million tons. The EPAs recycling mandates encourage its use in construction to mitigate waste. The U.S. Department of Transportation also supports recycled materials in infrastructure, promoting steel slag in highway projects due to its high load-bearing capacity and sustainable appeal.

- Urbanization and Infrastructure Projects: The U.S. infrastructure sector is experiencing growth fueled by urbanization, with projects funded under the Infrastructure Investment and Jobs Act. The act allocates $1.2 trillion for projects across transportation and renewable energy, driving demand for durable materials like steel slag. By 2024, urban centers across the country are expected to require large volumes of construction materials that reduce emissions, making slag a preferred choice due to its durability and low environmental footprint.

Market Challenges

- High Processing and Transport Costs: Processing and transport costs are high for steel slag, especially for distribution across regions with limited industrial facilities. Transporting slag over long distances increases costs significantly, with the U.S. Department of Transportation indicating that freight costs in 2023 accounted for around 30% of the slags final price. Processing complexities add to these costs, as slag must undergo treatments for purification and safe disposal of residual metals.

- Competition from Natural Aggregates: Natural aggregates present competition for steel slag, particularly in regions where aggregates are more accessible and cost-effective. In 2023, the U.S. Geological Survey reported that natural aggregates comprised over 70% of the construction materials market. This strong presence of aggregates hinders steel slag adoption, especially when companies weigh costs over sustainability, making market penetration challenging for slag-based products.

USA Steel Slag Market Future Outlook

The USA steel slag market is set to expand as industries increasingly prioritize sustainable construction and waste management practices. Federal infrastructure investment programs and rising environmental awareness are expected to encourage higher steel slag utilization across road construction, cement production, and even agricultural applications. The sector is also likely to benefit from emerging technologies aimed at improving the recycling and processing efficiency of steel slag, creating potential for cost savings and broader adoption across industries.

Market Opportunities

- Carbon-Neutral Construction Initiatives: The U.S. steel slag market is presented with opportunities from carbon-neutral construction initiatives, especially as federal agencies push for sustainable infrastructure. By replacing conventional materials with steel slag, carbon footprints in construction are significantly reduced. The National Renewable Energy Laboratory reports that substituting slag for cement reduces emissions by up to 50%. Such data reinforces the material's utility in eco-friendly projects, offering substantial growth potential for slag applications.

- Expansion in the Cement and Asphalt Industries: Steel slag usage in cement and asphalt has seen a steady increase, particularly with the demand for high-performance, durable materials. The Federal Highway Administration (FHWA) promotes the use of recycled materials in pavements, with slag-based asphalt showing enhanced durability. Data from the FHWA in 2023 indicated that recycled materials, including slag, were used in 30% of new pavements, presenting ample opportunity for growth as sustainable alternatives gain acceptance in federal and state-level projects.

Scope of the Report

|

Application |

Cement Production Road Construction Fertilizer Production Rail Ballast |

|

Material Type |

Blast Furnace Slag Steel Furnace Slag Electric Arc Furnace Slag |

|

End-user Industry |

Construction Agriculture Industrial Waste Management |

|

Geography |

Northeast USA Midwest USA Southern USA Western USA |

|

Processing Method |

Crushing and Grinding Screening and Magnetic Separation Leaching and Chemical Treatment |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, Department of Transportation)

Construction and Infrastructure Companies

Cement Manufacturers

Banks and Financial Institutions

Fertilizer Producers

Recycling and Waste Management Firms

Environmental Non-Profit Organizations

Steel Manufacturing and Processing Firms

Companies

Players Mentioned in the Report

ArcelorMittal

Nucor Corporation

Tata Steel USA

Harsco Corporation

Sims Metal Management

Phoenix Services LLC

Levy Company

Steel Dynamics Inc.

Schnitzer Steel

SSAB Americas

Table of Contents

1. USA Steel Slag Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Material Composition

1.4. Market Segmentation Overview

2. USA Steel Slag Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Milestones and Industry Benchmarks

3. USA Steel Slag Market Analysis

3.1. Growth Drivers (Policy Incentives, Industry Demand)

3.1.1. Industrial Demand for Slag as Cement Substitute

3.1.2. Environmental Regulations Promoting Recycling

3.1.3. Technological Advancements in Processing

3.1.4. Urbanization and Infrastructure Projects

3.2. Market Challenges (Logistics, Competition, and Sustainability)

3.2.1. High Processing and Transport Costs

3.2.2. Competition from Natural Aggregates

3.2.3. Environmental Sustainability Challenges

3.3. Opportunities (Innovative Applications and Green Initiatives)

3.3.1. Carbon-Neutral Construction Initiatives

3.3.2. Expansion in the Cement and Asphalt Industries

3.3.3. Rising Demand for Eco-friendly Materials

3.4. Trends (Technology Integration, Market Preferences)

3.4.1. Smart Production Techniques in Steel Slag Processing

3.4.2. Adoption of Slag in Asphalt Roads

3.4.3. Steel Slag in Carbon-Sequestration Efforts

3.5. Regulatory Framework (Environmental Standards and Compliance)

3.5.1. Clean Air Act and Impacts on Production Standards

3.5.2. Waste Management Compliance and Certification

3.5.3. State-Level Regulations on Industrial By-products

3.6. Stakeholder Ecosystem (Key Market Players and Influencers)

3.7. Porters Five Forces Analysis

3.8. SWOT Analysis

4. USA Steel Slag Market Segmentation

4.1. By Application (In Value %)

4.1.1. Cement Production

4.1.2. Road Construction

4.1.3. Fertilizer Production

4.1.4. Rail Ballast

4.2. By Material Type (In Value %)

4.2.1. Blast Furnace Slag

4.2.2. Steel Furnace Slag

4.2.3. Electric Arc Furnace Slag

4.3. By End-user Industry (In Value %)

4.3.1. Construction

4.3.2. Agriculture

4.3.3. Industrial Waste Management

4.4. By Geography (In Value %)

4.4.1. Northeast USA

4.4.2. Midwest USA

4.4.3. Southern USA

4.4.4. Western USA

4.5. By Processing Method (In Value %)

4.5.1. Crushing and Grinding

4.5.2. Screening and Magnetic Separation

4.5.3. Leaching and Chemical Treatment

5. USA Steel Slag Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. ArcelorMittal

5.1.2. Nucor Corporation

5.1.3. Tata Steel USA

5.1.4. Steel Dynamics Inc.

5.1.5. Schnitzer Steel

5.1.6. Phoenix Services LLC

5.1.7. Harsco Corporation

5.1.8. Levy Company

5.1.9. TMS International

5.1.10. Sims Metal Management

5.1.11. Gerdau

5.1.12. CRH

5.1.13. SSAB

5.1.14. Lafarge North America

5.1.15. AK Steel Corporation

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Slag Processing Technology, Market Reach, Environmental Certifications, Key Product Lines, R&D Investment, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Venture Capital and Private Equity Investments

5.7. Government Funding and Incentives

6. USA Steel Slag Market Regulatory Framework

6.1. Environmental Standards for Slag Recycling

6.2. Compliance and Licensing Requirements

6.3. Certification Processes in the Steel Slag Market

7. USA Steel Slag Market Future Prospects (In USD Mn)

7.1. Market Potential Assessment

7.2. Key Factors Impacting Future Market Growth

7.3. Emerging Applications of Steel Slag

8. USA Steel Slag Market Segmentation in Future Scope

8.1. By Application (In Value %)

8.2. By Material Type (In Value %)

8.3. By End-user Industry (In Value %)

8.4. By Region (In Value %)

8.5. By Processing Method (In Value %)

9. USA Steel Slag Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Cost Optimization Opportunities

9.3. Product Diversification Strategy

9.4. Market Penetration Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase focuses on mapping the ecosystem of the USA Steel Slag Market, identifying key stakeholders across the production, consumption, and recycling spectrums. A combination of secondary and proprietary sources is employed to define critical market variables influencing growth.

Step 2: Market Analysis and Data Compilation

Historical data from industry sources is compiled to analyze trends in the steel slag market, covering production volumes, applications, and usage patterns. This includes data verification to ensure comprehensive, industry-relevant insights.

Step 3: Hypothesis Testing and Validation

Expert consultations are conducted with market participants to validate the findings and assumptions. Insights gathered from these consultations offer real-time perspectives on market shifts and operational trends.

Step 4: Report Finalization and Review

All insights are synthesized to prepare a final report, verified through cross-referencing with industry publications and proprietary databases, ensuring accuracy and reliability for business professionals.

Frequently Asked Questions

01. How big is the USA Steel Slag Market?

The USA steel slag market is valued at USD 15.6 billion, driven by its diverse applications in construction and sustainable materials, particularly in road construction and cement production.

02. Who are the major players in the USA Steel Slag Market?

Key players include ArcelorMittal, Nucor Corporation, Tata Steel USA, Harsco Corporation, and Sims Metal Management, each leveraging advanced slag processing technologies to cater to regional and national demands.

03. What drives the demand for steel slag in the USA?

The market is driven by sustainable construction practices, government infrastructure projects, and environmental mandates encouraging the recycling and reuse of industrial by-products like steel slag.

04. What challenges exist in the USA Steel Slag Market?

Challenges include high transportation and processing costs, competition from natural aggregates, and the need for sustainable practices to reduce the environmental impact associated with slag production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.