USA Stone Paper Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD5905

November 2024

83

About the Report

USA Stone Paper Market Overview

- The USA stone paper market is valued at USD 148 million, based on a five-year historical analysis. The market is driven by the increasing demand for eco-friendly alternatives to traditional paper and plastic. Stone paper, produced from calcium carbonate, is seen as a sustainable option with benefits such as water resistance and durability, making it attractive for various sectors such as packaging, printing, and labeling.

- Dominant regions in the market include California and New York, where sustainability initiatives are highly prioritized. These regions have seen significant growth in the packaging and publishing industries, driven by stringent environmental regulations and consumer preferences for sustainable products.

- The US Environmental Protection Agency (EPA) has rolled out initiatives encouraging the use of sustainable materials in packaging to minimize waste. The regulatory push targets reducing single-use plastics and traditional paper packaging that contribute heavily to landfill volumes (estimated at 18 million tons per year in 2024). Stone paper is positioned to benefit from these laws, as its sustainable nature aligns with the goals of such government initiatives.

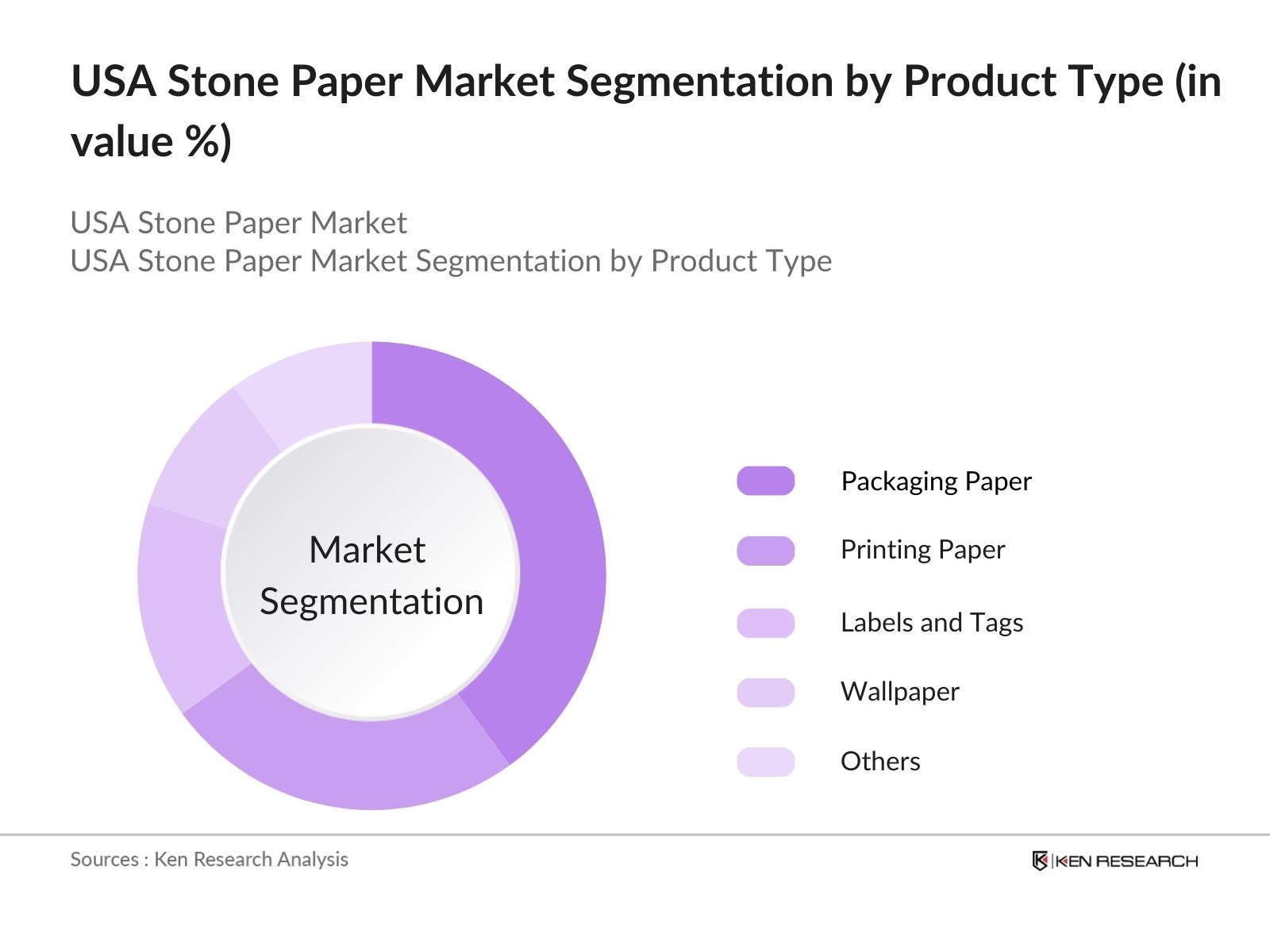

USA Stone Paper Market Segmentation

By Product Type: The market is segmented by product type into packaging paper, printing paper, labels and tags, wallpaper, and others. Packaging paper holds a dominant market share due to its increased use in industries looking for sustainable packaging solutions. The shift away from plastic packaging, especially in food and beverage and consumer goods sectors, has accelerated the demand for stone-based packaging materials. Companies seeking eco-friendly options benefit from stone paper's tear resistance and recyclability, making it the preferred choice in packaging.

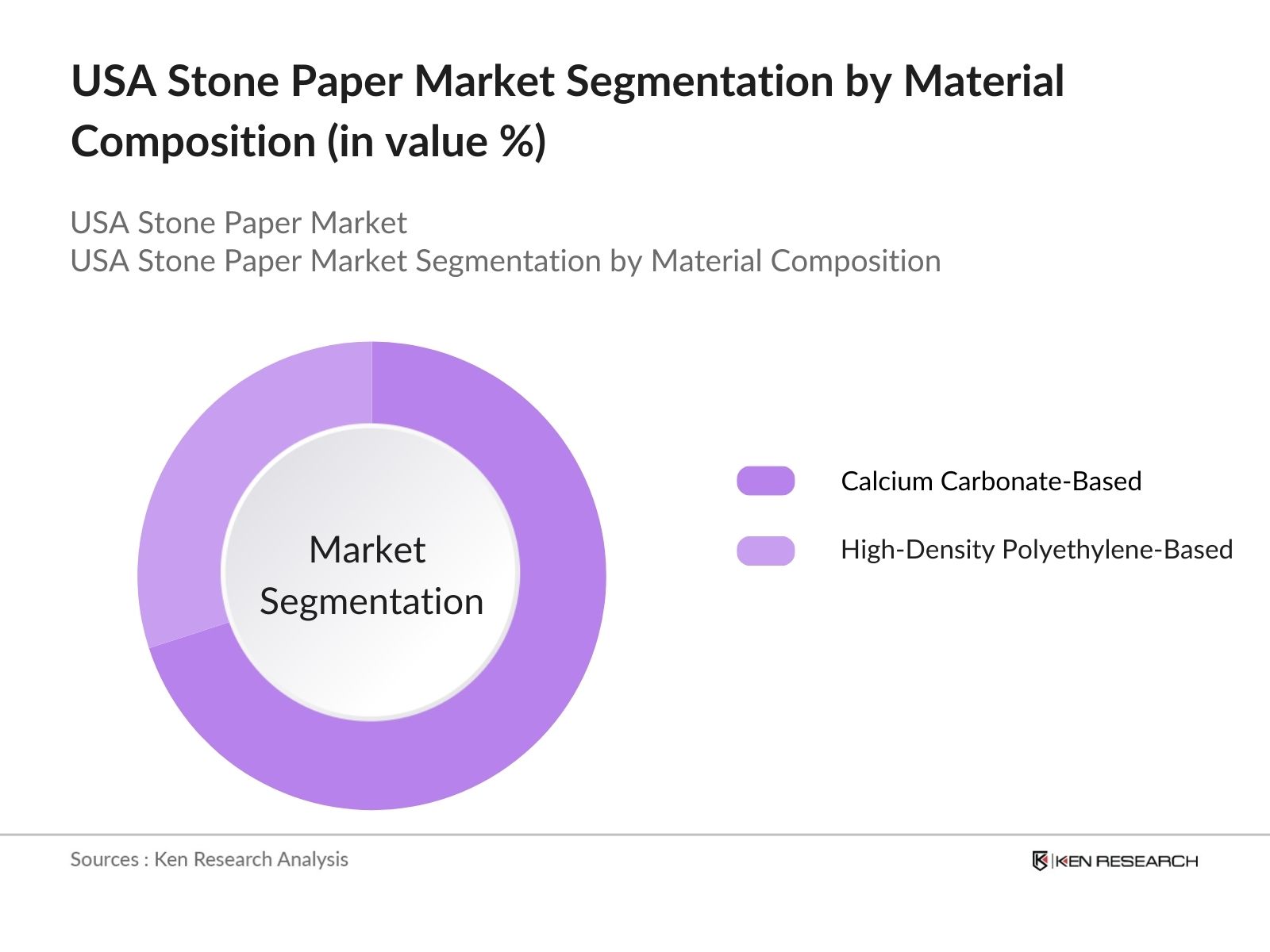

By Material Composition: The market is segmented into calcium carbonate-based and high-density polyethylene (HDPE)-based. The calcium carbonate-based segment dominates the market, owing to its cost-effectiveness and its role as the primary raw material for stone paper production. This material offers environmental benefits, including reduced CO2 emissions and resource consumption compared to traditional wood pulp-based paper, further solidifying its leading position.

USA Stone Paper Market Competitive Landscape

The market is dominated by both local and international companies that focus on sustainability, innovation, and large-scale production capabilities. The competitive landscape is influenced by technological advancements in stone paper production and increased consumer demand for environmentally friendly products.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Material Source |

Sustainability Initiatives |

Global Reach |

Patents Held |

Revenue (2023) |

Distribution Network |

|

Karst Stone Paper |

2017 |

Sydney, Australia |

|||||||

|

Taiwan Lung Meng Technology Co. |

1998 |

Taiwan |

|||||||

|

Pishgaman Sanat Sabz |

2010 |

Iran |

|||||||

|

Agood Company |

2018 |

Sweden |

|||||||

|

Soluz Stone Paper |

2015 |

Mexico |

USA Stone Paper Market Analysis

Market Growth Drivers

- Environmental Sustainability Drive: The growing focus on reducing deforestation has led industries to explore eco-friendly alternatives like stone paper. In 2024, over 1.2 billion tons of conventional paper were consumed globally, a significant portion in the USA. Stone paper, made without trees or water, offers an attractive alternative in the environmentally conscious market, where an estimated 20 million tons of paper products are needed annually in sectors like packaging and printing.

- Reduction in Water Usage: Traditional paper production consumes vast quantities of waterestimated at 10 liters per sheet. In contrast, stone paper production does not require water, providing a solution to water scarcity issues in key industrial areas. With the USA's industrial water consumption around 40 billion cubic meters per year, the stone paper industry positions itself as a critical player in reducing industrial water usage.

- Plastic Substitution in Packaging: The USA produces over 35 million tons of plastic waste annually, with packaging accounting for a portion. Stone paper's unique composition of calcium carbonate and polymer resin offers a substitute for plastic in various packaging applications, appealing to companies looking to reduce plastic dependency. As a result, industries producing around 10 million tons of packaging materials are expected to adopt stone paper-based solutions.

Market Challenges

- High Production Costs: Although stone paper has environmental benefits, its production involves high initial costs due to advanced machinery and technology required to convert limestone into usable paper. This has led to stone paper being approximately 30% more expensive than traditional paper, making it less competitive for smaller companies in 2024 that are already facing increased raw material costs across sectors.

- Limited Consumer Awareness: Despite its benefits, stone paper remains relatively unknown among consumers and businesses alike. Surveys conducted in early 2024 showed that only 12% of American consumers are aware of stone paper's existence, posing a barrier to widespread adoption. Without significant marketing efforts, the material will struggle to penetrate broader markets dominated by traditional paper and plastic alternatives.

USA Stone Paper Maret Future Outlook

Over the next five years, the USA stone paper industry is expected to witness strong growth driven by increasing sustainability demands from both consumers and industries. The market will likely see advancements in stone paper production technologies, which will reduce production costs and improve product quality.

Future Market Opportunities

- Investment in R&D for Cost Reduction: Over the next five years, companies will increasingly invest in research and development to lower the production costs of stone paper, making it more competitive with traditional paper and plastic. With projected investments of over $200 million in R&D by 2029, the technology behind stone paper production is expected to become more efficient, driving down costs.

- Integration into Consumer Electronics: Stone papers durability, waterproof properties, and eco-friendliness will make it a prime candidate for packaging consumer electronics. By 2029, its estimated that over 30 million electronic devices in the USA will come packaged in stone paper, driven by sustainability initiatives from major tech companies.

Scope of the Report

|

Product Type |

Packaging Paper Printing Paper Labels and Tags Wall Paper Others |

|

Material Composition |

Calcium Carbonate-Based High-Density Polyethylene-Based |

|

Application |

Packaging Publishing Consumer Goods Industrial Applications |

|

Distribution Channel |

Direct Sales Retail Distribution E-Commerce |

|

Region |

North East South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Packaging Companies

Printing Industry Players

Consumer Goods Manufacturers

Banks and Financial Institution

Government and Regulatory Bodies (Environmental Protection Agency, U.S. Department of Commerce)

Investments and Venture Capitalist Firms

Private Equity Firms

Companies

Players Mentioned in the Report:

Karst Stone Paper

Taiwan Lung Meng Technology Co. Ltd.

Pishgaman Sanat Sabz

Agood Company

Soluz Stone Paper

Gaia Converter

Stone Paper Solutions Ltd.

Sluz Stone Paper

Gaiakraft GmbH

Shenzhen Stone Paper New Materials Co., Ltd.

Terraskin Stone Paper

Rockstock

Sphera International

Papelyco Stone Paper

Stone Paper Company Limited

Table of Contents

USA Stone Paper Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Growth Indicators

1.4. Key Market Segmentation Overview

USA Stone Paper Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Production Volume, Revenue, Installed Capacity)

2.3. Key Market Developments and Milestones

USA Stone Paper Market Analysis

3.1. Growth Drivers (Sustainability Demand, Plastic Ban Initiatives, Industrial Applications)

3.1.1. Rising Adoption in Packaging

3.1.2. Government Support for Eco-Friendly Materials

3.1.3. Increased Consumer Awareness on Environmental Impact

3.1.4. Innovation in Stone Paper Manufacturing Processes

3.2. Market Challenges (Cost of Production, Technological Barriers, Recycling Limitations)

3.2.1. High Initial Investment for Stone Paper Production

3.2.2. Competition with Traditional Paper and Plastic

3.2.3. Limited Recycling Infrastructure

3.2.4. Supply Chain Disruptions

3.3. Opportunities (Government Subsidies, Circular Economy Integration, Consumer Market Penetration)

3.3.1. Expansion into Non-Packaging Sectors (Education, Stationery)

3.3.2. Collaborative R&D for Improved Product Quality

3.3.3. International Trade Opportunities

3.3.4. Investment in Sustainable Production Technologies

3.4. Trends (Biodegradable Technologies, Shift to Zero-Waste Initiatives)

3.4.1. Increasing Use of Stone Paper in E-Commerce Packaging

3.4.2. Emergence of Stone Paper in Niche Applications (Maps, Posters)

3.4.3. Consumer-Driven Demand for Recycled Materials

3.4.4. Technological Advancements in Stone Paper Coating

3.5. Government Regulations (Environmental Policies, Recycling Laws, Sustainability Standards)

3.5.1. USA Sustainability Packaging Acts

3.5.2. Ban on Single-Use Plastics and its Impact on Paper Market

3.5.3. Import/Export Duties on Stone Paper Raw Materials

3.5.4. Certifications and Compliance Requirements for Eco-Friendly Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, Retailers, End-Users)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

USA Stone Paper Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Packaging Paper

4.1.2. Printing Paper

4.1.3. Labels and Tags

4.1.4. Wall Paper

4.1.5. Others

4.2. By Material Composition (In Value %)

4.2.1. Calcium Carbonate-Based

4.2.2. High-Density Polyethylene-Based

4.3. By Application (In Value %)

4.3.1. Packaging

4.3.2. Publishing

4.3.3. Consumer Goods

4.3.4. Industrial Applications

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Retail Distribution

4.4.3. E-Commerce

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

USA Stone Paper Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Karst Stone Paper

5.1.2. Taiwan Lung Meng Technology Co. Ltd.

5.1.3. Pishgaman Sanat Sabz

5.1.4. Sluz Stone Paper

5.1.5. STP Stone Paper Products GmbH

5.1.6. Stone Paper Solutions Ltd.

5.1.7. Gaia Converter (Division of Taiwan Lung Meng)

5.1.8. Agood Company

5.1.9. Gaiakraft GmbH

5.1.10. Shenzhen Stone Paper New Materials Co., Ltd.

5.1.11. Terraskin Stone Paper

5.1.12. Rockstock

5.1.13. Sphera International

5.1.14. Stone Paper Company Limited

5.1.15. Papelyco Stone Paper

5.2. Cross Comparison Parameters (Revenue, Material Source, Production Volume, Market Penetration, Sustainability Initiatives, Product Innovation, Pricing Strategy, Global Footprint)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Stone Paper Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

USA Stone Paper Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Stone Paper Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Composition (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

USA Stone Paper Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began with the identification of major stakeholders within the USA Stone Paper Market. Through extensive desk research, secondary databases were used to map out these stakeholders and define the variables influencing market dynamics, such as production volume and material sources.

Step 2: Market Analysis and Construction

Historical data on the USA stone paper market was analyzed, focusing on production capacity, revenue generation, and product penetration across different segments. This analysis provided key insights into the markets growth trajectory over the past five years.

Step 3: Hypothesis Validation and Expert Consultation

Initial market hypotheses were validated through interviews with industry experts, including manufacturers and suppliers. These consultations provided detailed insights into market dynamics and allowed us to refine the analysis with real-time data from stakeholders.

Step 4: Research Synthesis and Final Output

The final phase of research involved engaging with stone paper manufacturers to acquire in-depth insights on product segments, consumer demand, and revenue streams. This was used to cross-validate data and ensure the reliability of the final report.

Frequently Asked Questions

01. How big is the USA Stone Paper Market?

The USA stone paper market is valued at USD 148 million, primarily driven by its application in eco-friendly packaging solutions and growing demand in the publishing and printing sectors.

02. What are the challenges in the USA Stone Paper Market?

Challenges in the USA stone paper market include high production costs, limited recycling infrastructure, and competition from traditional paper and plastic materials.

03. Who are the major players in the USA Stone Paper Market?

Key players in the USA stone paper market include Karst Stone Paper, Taiwan Lung Meng Technology Co. Ltd., and Agood Company, among others, who dominate through sustainable practices and technological innovation.

04. What are the growth drivers of the USA Stone Paper Market?

Growth in the USA stone paper market is primarily driven by the increasing demand for sustainable packaging solutions, stringent environmental regulations, and innovations in stone paper manufacturing processes.

05. What is the future outlook of the USA Stone Paper Market?

The future outlook of the USA stone paper market is positive, with expected growth driven by advancements in stone paper production technologies, increasing demand for eco-friendly materials, and expanding applications in multiple sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.