USA Stone Veneer Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD4135

November 2024

82

About the Report

USA Stone Veneer Market Overview

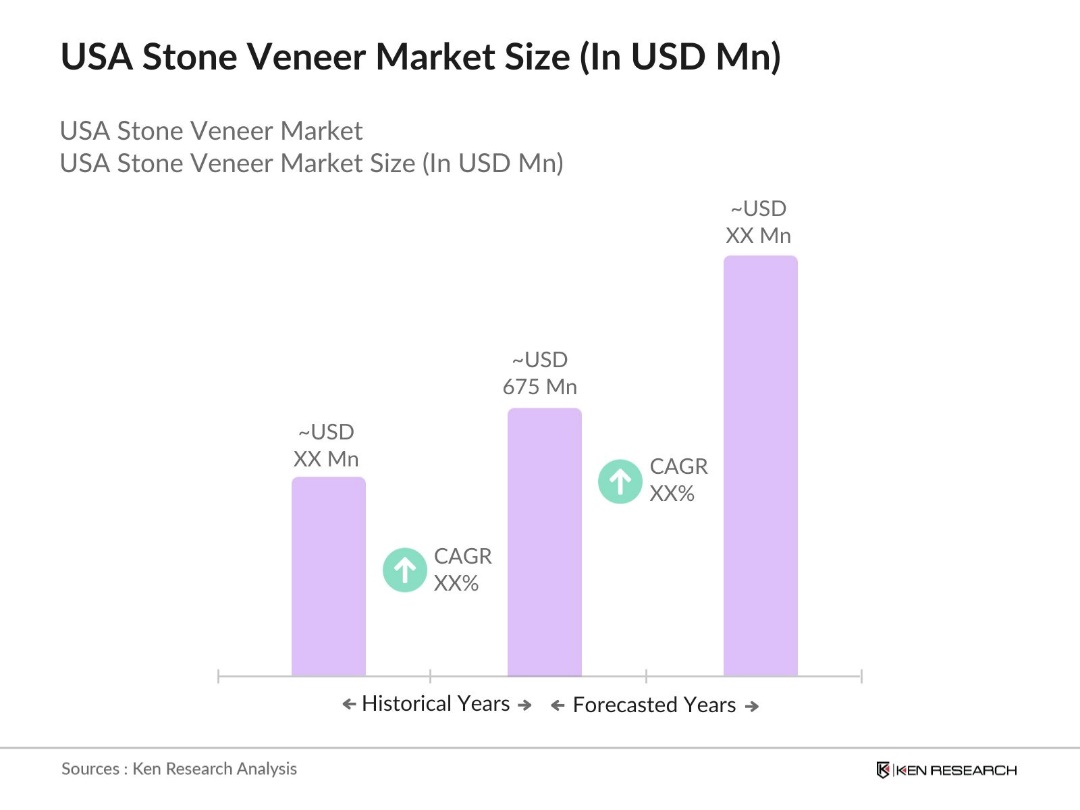

- The USA stone veneer market is valued at USD 675 million, supported by a five-year historical analysis of its growth. This market is primarily driven by increasing construction activities in both residential and commercial sectors. The demand for energy-efficient and aesthetically appealing exterior facades is further fueling market expansion. Consumers are increasingly opting for lightweight and durable alternatives like stone veneers due to their cost-effectiveness and ease of installation, making them a preferred choice over traditional stone materials.

- The market dominance can be observed in regions like California, Texas, and New York. These areas are hubs of construction, with growing urban populations and extensive commercial real estate developments. Additionally, Californias strong focus on eco-friendly and energy-efficient building solutions positions it as a leader in stone veneer adoption, particularly for green construction practices.

- Stone veneer must comply with stringent building codes and fire safety regulations in the U.S., particularly in states prone to wildfires like California. The U.S. Fire Administration reported that in 2023, over 40% of new homes in fire-prone areas were built using fire-resistant materials such as stone veneer. Stone veneer products are often tested for fire resistance to meet local safety codes, making them a preferred choice in regions where building standards prioritize fireproof materials.

USA Stone Veneer Market Segmentation

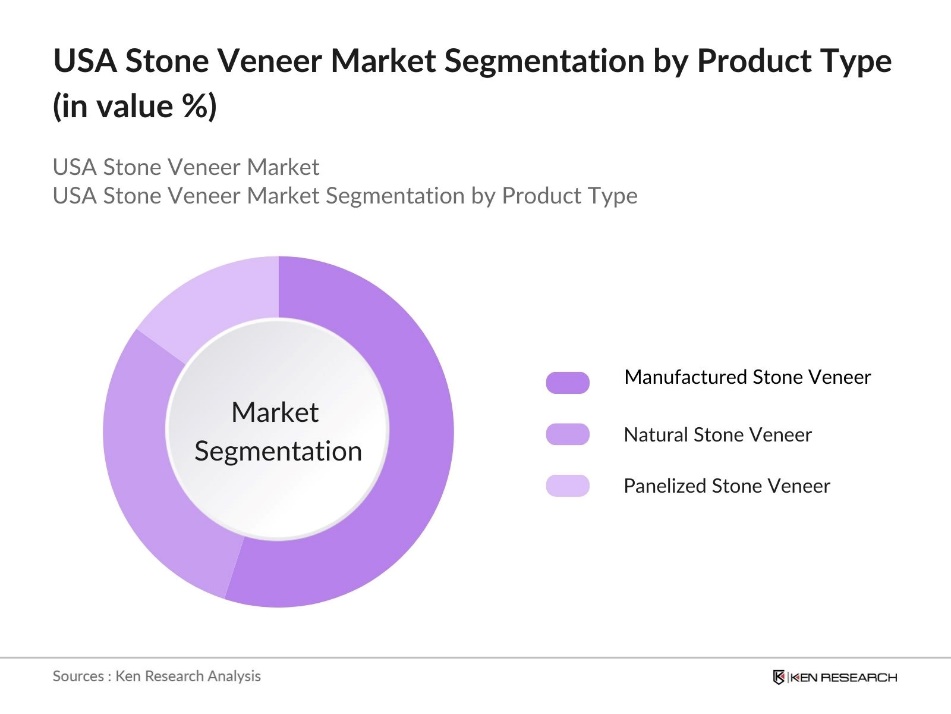

By Product Type: The USA market is segmented by product type into natural stone veneer, manufactured stone veneer, and panelized stone veneer. Manufactured stone veneer holds the dominant market share due to its cost advantages and availability in various textures and colors. The product is widely used in both residential and commercial buildings for its lightweight nature and the ability to mimic the appearance of real stone, while being easier to install and less expensive.

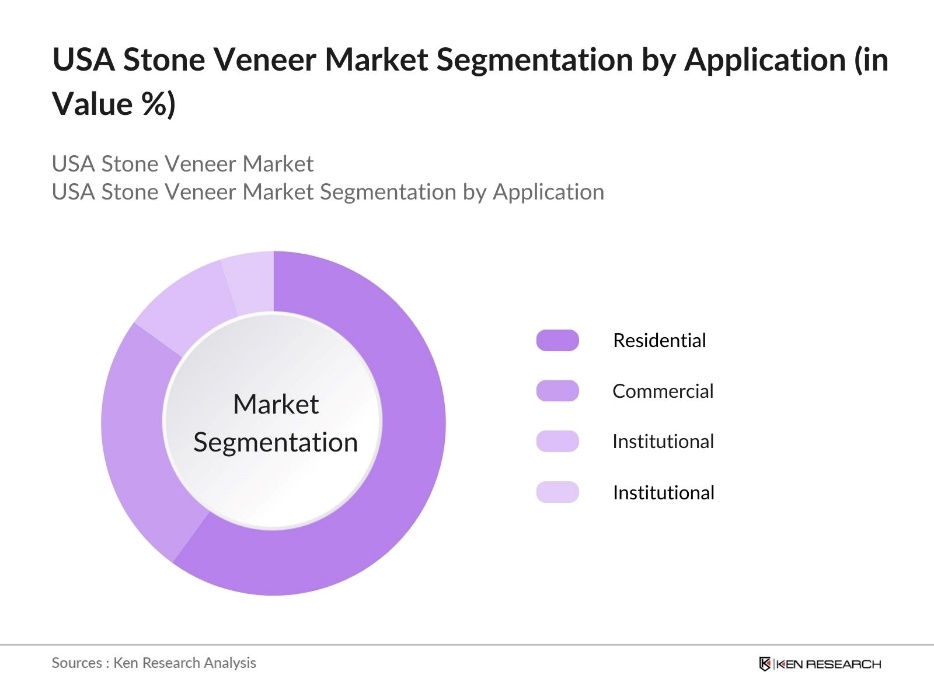

By Application: The market is segmented by application into residential, commercial, institutional, and industrial sectors. The residential segment dominates the market, driven by the increasing demand for modern home aesthetics and energy efficiency. Homeowners are opting for stone veneers to enhance the exterior appearance of their properties while improving insulation. Additionally, residential DIY projects, supported by prefabricated veneer systems, further boost demand in this segment.

USA Stone Veneer Market Competitive Landscape

The USA stone veneer market is dominated by players like Eldorado Stone, Boral Limited, and Owens Corning Cultured Stone. These companies have established strong supply chains and distribution networks across the country, enabling them to maintain their positions as market leaders. Additionally, regional companies like StoneCraft Industries and Kafka Granite are emerging as strong competitors, particularly in local markets where customized solutions are in high demand.

|

Company Name |

Establishment Year |

Headquarters |

Market Focus |

Revenue (USD) |

Product Portfolio |

Employee Count |

Recent Developments |

Sustainability Initiatives |

Distribution Channels |

|

Eldorado Stone |

1969 |

San Marcos, California |

Residential, Commercial |

||||||

|

Boral Limited |

1946 |

Roswell, Georgia |

Infrastructure, Industrial |

||||||

|

Owens Corning Cultured Stone |

1938 |

Toledo, Ohio |

Residential, Institutional |

||||||

|

StoneCraft Industries |

1978 |

Nashville, Tennessee |

Residential, Industrial |

||||||

|

Kafka Granite |

1979 |

Mosinee, Wisconsin |

Commercial, Industrial |

USA Stone Veneer Industry Analysis

Growth Drivers

- Rising Popularity of Lightweight Building Materials: Lightweight building materials are gaining traction in the U.S. due to their ease of installation, durability, and reduced transportation costs. Stone veneer, made from engineered or natural stone, is often significantly lighter than traditional stone cladding. For instance, the weight of a typical stone veneer panel is about 15 pounds per square foot, which is half of what traditional masonry stone weighs. This popularity reflects broader trends in reducing building costs and time.

- Demand for Aesthetic and Durable Cladding Solutions: The demand for visually appealing and long-lasting building materials has fueled the growth of stone veneer in the U.S. construction market. Stone veneer offers the look of natural stone without the high cost or weight, making it an attractive option for homebuilders and property developers. According to the U.S. Environmental Protection Agency, materials like stone veneer are preferred in modern builds due to their resistance to weathering and minimal maintenance requirements, especially in regions prone to extreme weather conditions, thus increasing the demand for high-performance exterior finishes.

- Energy Efficiency and Sustainability Trends: Energy efficiency and sustainability play a crucial role in the growing demand for stone veneer products in the building materials industry. Modern stone veneer offers insulation benefits, helping to lower energy consumption for heating and cooling in buildings. These products also align with green building standards such as LEED (Leadership in Energy and Environmental Design), which encourages the use of sustainable materials. As more construction projects aim to meet stricter environmental standards, stone veneer has become a preferred choice for its ability to contribute to energy-efficient building designs and reduce environmental impact.

Market Challenges

- High Initial Installation Costs: Stone veneer installation offers long-term durability and aesthetic benefits, but it comes with higher initial costs compared to other cladding materials. The installation process is labor-intensive and requires specialized skills, which increases overall project expenses. This can be a barrier for small contractors and DIY homeowners, as the upfront costs are significantly higher than those for simpler cladding solutions.

- Limited Skilled Labor Availability (specific to stone veneer installation): The construction industry is experiencing a shortage of skilled labor, and this shortage extends to stone veneer installation. Stone veneer requires specialized knowledge and techniques, making it harder to find qualified installers. This shortage can lead to delays in construction projects, as builders struggle to find the necessary labor to complete installations efficiently. The lack of skilled workers also increases the cost of installation, as demand for these services exceeds supply, further complicating the use of stone veneer in larger or time-sensitive projects.

USA Stone Veneer Market Future Outlook

Over the next five years, the USA stone veneer market is expected to continue its upward trajectory, driven by increasing construction activities, government incentives for green building materials, and growing consumer demand for eco-friendly solutions. Technological advancements in manufacturing processes, including the integration of automation and 3D printing, are also expected to play a key role in shaping the markets future.

Market Opportunities

- Growing Use of Engineered Stone Products: Engineered stone products are gaining popularity due to their customizable design options, durability, and cost-efficiency compared to natural stone. They can mimic various stone textures and colors, offering more flexibility to architects and builders. Engineered stone is also more resistant to moisture and environmental damage, reducing maintenance costs and increasing its appeal for both residential and commercial projects.

- Technological Advancements in Manufacturing Processes: Advancements in manufacturing technology have improved stone veneer production by making it faster, more precise, and cost-efficient. Automated systems allow manufacturers to produce high-quality, customizable designs that cater to diverse architectural needs. These technologies help reduce production costs and enable greater flexibility, making stone veneer more accessible while meeting the increasing demand for efficient, high-performance materials.

Scope of the Report

|

Product Type |

Natural Stone Veneer Manufactured Stone Veneer Panelized Stone Veneer |

|

Application |

Residential Commercial Institutional Industrial |

|

Installation Type |

Field-Applied Installation Prefabricated Installation |

|

Material Type |

Cement-Based Polymer-Based Natural Stone |

|

Region |

Northeast Midwest Southern Western |

Products

Key Target Audience

Stone Veneer Manufacturers

Property Management Firms

Landscape Architecture Firms

Eco-Friendly Construction Companies

Government and Regulatory Bodies (e.g., U.S. Department of Energy, Environmental Protection Agency)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Eldorado Stone

Boral Limited

Owens Corning Cultured Stone

StoneCraft Industries

Kafka Granite

Coronado Stone Products

Environmental Stoneworks

Mutual Materials

ProVia

Glen-Gery Corporation

Table of Contents

1. USA Stone Veneer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Stone Veneer Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Stone Veneer Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Residential and Commercial Construction

3.1.2. Rising Popularity of Lightweight Building Materials

3.1.3. Demand for Aesthetic and Durable Cladding Solutions

3.1.4. Energy Efficiency and Sustainability Trends

3.2. Market Challenges

3.2.1. High Initial Installation Costs

3.2.2. Limited Skilled Labor Availability (specific to stone veneer installation)

3.2.3. Price Volatility in Raw Materials (natural stone and resin components)

3.3. Opportunities

3.3.1. Growing Use of Engineered Stone Products

3.3.2. Technological Advancements in Manufacturing Processes

3.3.3. Expansion in DIY Home Improvement Segment

3.4. Trends

3.4.1. Integration of 3D Printing and Customization Technologies

3.4.2. Adoption of Prefabricated Stone Veneer Systems

3.4.3. Demand for Low-Maintenance Siding Materials

3.5. Government Regulation

3.5.1. Building Codes and Fire Safety Regulations

3.5.2. LEED Certifications and Green Building Standards

3.5.3. Tax Incentives for Sustainable Building Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Stone Veneer Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Natural Stone Veneer

4.1.2. Manufactured Stone Veneer

4.1.3. Panelized Stone Veneer

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Institutional

4.2.4. Industrial

4.3. By Installation Type (In Value %)

4.3.1. Field-Applied Installation

4.3.2. Prefabricated Installation

4.4. By Material Type (In Value %)

4.4.1. Cement-Based

4.4.2. Polymer-Based

4.4.3. Natural Stone

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. Southern

4.5.4. Western

5. USA Stone Veneer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Eldorado Stone

5.1.2. Coronado Stone Products

5.1.3. Boral Limited

5.1.4. Owens Corning Cultured Stone

5.1.5. Ply Gem Stone

5.1.6. Environmental Stoneworks

5.1.7. Mutual Materials

5.1.8. StoneCraft Industries

5.1.9. ProVia

5.1.10. Kafka Granite

5.1.11. Acker-Stone Industries

5.1.12. Stone Veneer Systems

5.1.13. Tando Building Products

5.1.14. Dutch Quality Stone

5.1.15. Glen-Gery Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Portfolio, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Stone Veneer Market Regulatory Framework

6.1. Building Material Standards (ASTM and ICC Codes)

6.2. Compliance Requirements for Fire Resistance and Durability

6.3. Certification Processes for Sustainable Materials

7. USA Stone Veneer Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Stone Veneer Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Installation Type (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. USA Stone Veneer Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, the key stakeholders within the USA Stone Veneer Market are mapped. Secondary research is conducted using government databases and industry reports to identify the critical variables that shape market dynamics, including demand drivers, supply chains, and market constraints.

Step 2: Market Analysis and Construction

Historical data on market size, sales volumes, and revenue generation is collected and analyzed. This includes the segmentation of the market into various product types and applications, as well as assessing market penetration in different regions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including manufacturers, distributors, and installers. These consultations provide insights into the operational aspects of the market, helping refine the analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all data collected and conducting final validation through engagement with manufacturers. This ensures the accuracy and reliability of the data presented in the report, offering a comprehensive view of the USA Stone Veneer Market.

Frequently Asked Questions

01. How big is the USA Stone Veneer Market?

The USA stone veneer market is valued at USD 675 million, supported by increased construction activity and the demand for energy-efficient, durable building materials.

02. What are the key challenges in the USA Stone Veneer Market?

Challenges in USA stone veneer market include high installation costs, the price volatility of raw materials, and the availability of skilled labor, which limits the rapid adoption of stone veneers in certain regions.

03. Who are the major players in the USA Stone Veneer Market?

Major players in USA stone veneer market include Eldorado Stone, Boral Limited, Owens Corning Cultured Stone, StoneCraft Industries, and Kafka Granite. These companies dominate due to their wide product portfolios and strong distribution networks.

04. What drives growth in the USA Stone Veneer Market?

The USA stone veneer market growth is driven by the demand for modern aesthetics, energy efficiency, and lightweight building materials. Home renovation trends and increasing commercial construction also contribute to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.