USA Sugar Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD3243

December 2024

94

About the Report

USA Sugar Market Overview

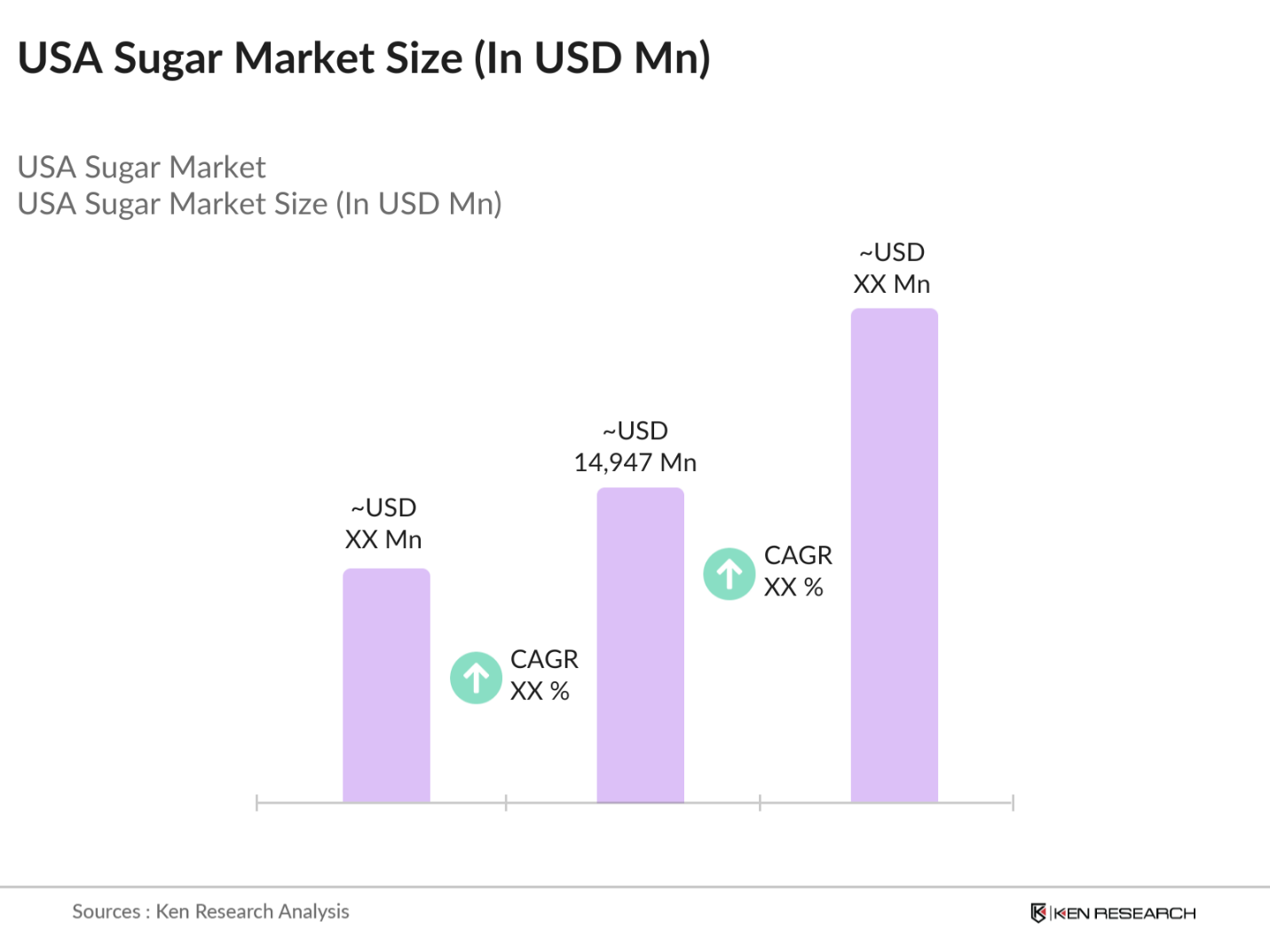

- The USA sugar market is valued at USD 14,947 million, driven by a five-year historical trend of steady growth. Key factors contributing to this market's size include the consistent demand for sugar in food and beverage manufacturing, particularly in the bakery, confectionery, and soft drink industries. Furthermore, government subsidies to domestic sugar producers through the U.S. Sugar Program have fostered growth, ensuring stability in pricing and production despite global volatility in the sugar trade.

- The USA market is dominated by states like Florida, Louisiana, and Texas, which are the largest sugarcane producers in the country. Florida's dominance is due to its favorable climate, vast sugarcane farming areas, and proximity to major processing plants. Similarly, Louisiana benefits from its extensive infrastructure for sugar processing and a long history of sugarcane farming, while Texas capitalizes on its growing demand for locally sourced sugar in the southwestern region of the country.

- The U.S. Sugar Program plays a crucial role in stabilizing the domestic sugar market by setting import quotas and offering price support to sugar producers. In 2023, the program set an import quota of 1.17 million metric tons for sugar, limiting the volume of cheaper foreign sugar that can enter the U.S. market.

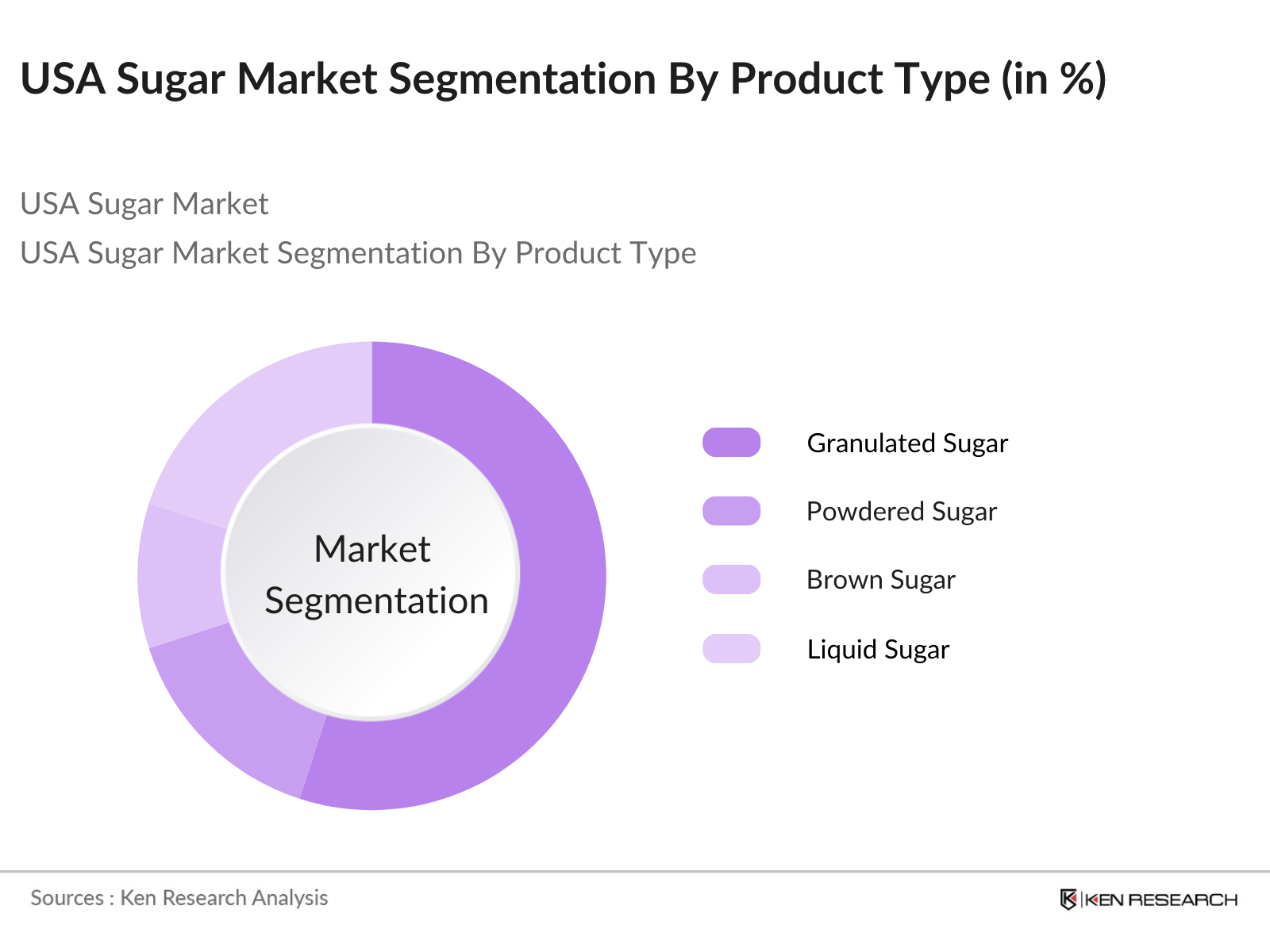

USA Sugar Market Segmentation

By Product Type: The USA sugar market is segmented by product type into granulated sugar, powdered sugar, brown sugar, liquid sugar, and organic sugar. Granulated sugar holds a dominant market share in this segment due to its widespread use in household cooking and large-scale food manufacturing. Its versatility and long shelf life make it the most preferred sugar type, contributing to its significant market presence in the USA.

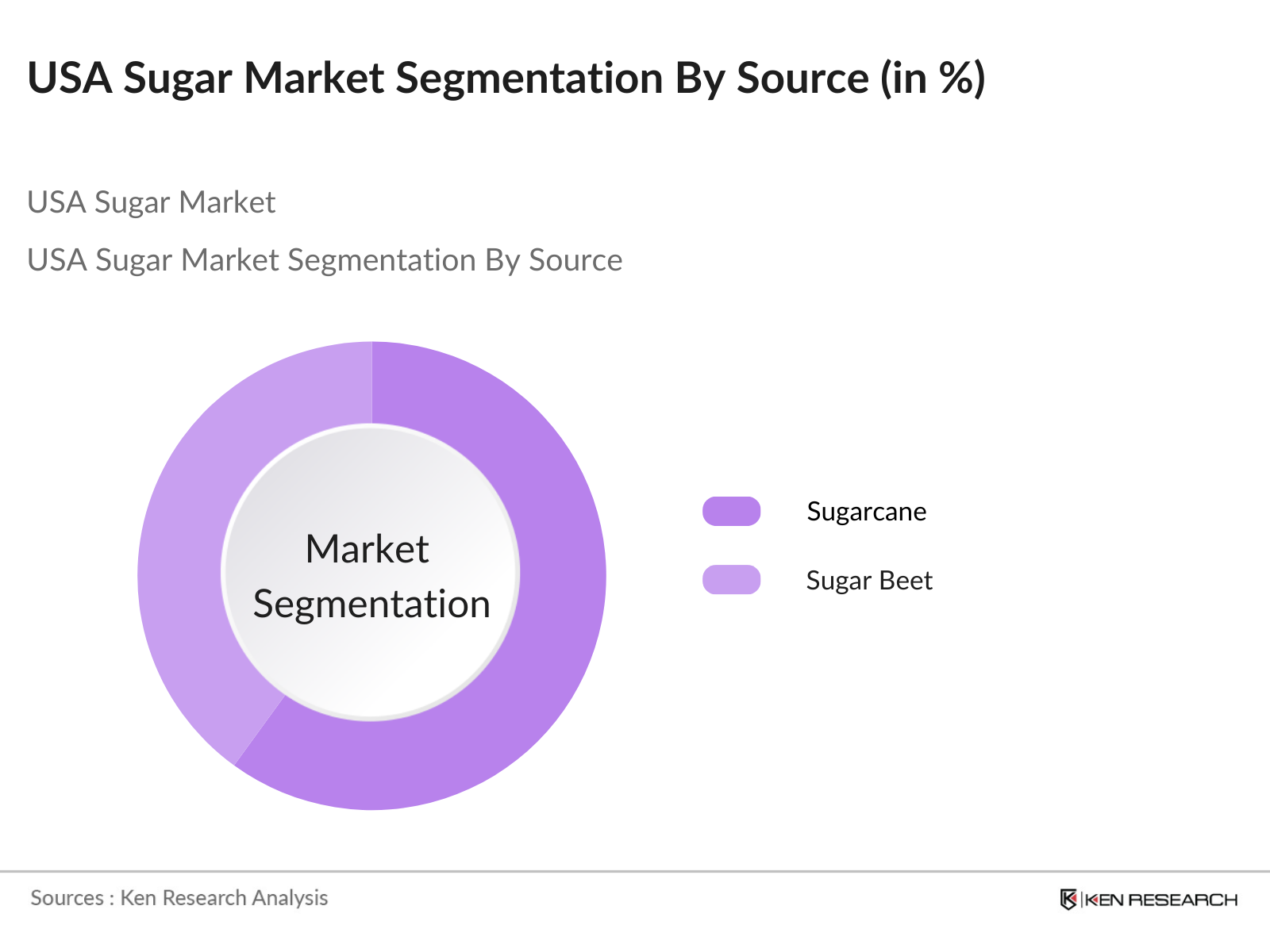

By Source: The market is further segmented by the source of sugar, namely sugarcane and sugar beet. Sugarcane accounts for the majority of sugar production in the USA. The dominance of sugarcane is due to its higher yield compared to sugar beet and the concentration of sugarcane cultivation in high-production states like Florida and Louisiana. These regions benefit from established infrastructure and expertise in sugarcane farming, driving their market share.

USA Sugar Market Competitive Landscape

The USA sugar market is highly competitive and features a mix of domestic and international players. Cargill Inc., American Sugar Refining, Inc., and Florida Crystals Corporation dominate due to their extensive distribution networks, large production capacity, and strategic partnerships with food and beverage manufacturers. Additionally, these companies benefit from their control over both raw material sourcing and final product manufacturing, providing them with significant advantages in cost management and market penetration.

USA Sugar Industry Analysis

Growth Drivers

- Rise in Domestic Sugar Consumption: Domestic sugar consumption in the USA has seen a consistent increase due to a growing demand for processed foods, beverages, and snacks. As of 2024, per capita sugar consumption in the United States has been estimated at around 68 kilograms annually, driven by higher consumption of soft drinks and confectionery items.

- Increase in Beverage and Confectionery Sectors: The beverage industry, valued at over USD 230 billion in 2023, is a significant driver of sugar consumption, with soft drink production in the U.S. relying heavily on sugar as a core ingredient. Confectionery production also contributes significantly, with U.S. confectionery sales topping USD 45 billion in 2022. This consistent demand supports higher production volumes from sugar processors and distributors.

- Expansion of Organic Sugar Products: There has been an increasing consumer shift towards organic sugar products in the U.S. market, with organic food sales reaching USD 67.6 billion in 2022. This growing trend has pushed sugar producers to expand their organic product offerings, particularly organic cane sugar, to meet consumer demand.

Market Challenges

- Volatile Global Sugar Prices: The volatility of global sugar prices continues to impact U.S. sugar producers and importers. As reported by the World Bank in 2023, the global price of raw sugar reached USD 0.20 per pound, driven by fluctuating weather conditions in key producing countries like Brazil and India. This price volatility creates challenges for U.S. manufacturers that rely on stable sugar prices for their cost structures.

- Trade Tariffs and Quotas: U.S. sugar imports are governed by the U.S. Sugar Program, which imposes strict quotas and tariffs on sugar imports to protect domestic producers. In 2023, the tariff-rate quota for sugar imports was set at 1.17 million metric tons, limiting the volume of lower-cost sugar that could be imported. These trade restrictions have led to higher domestic sugar prices, which are approximately 50% higher than global sugar prices.

USA Sugar Market Future Outlook

The USA sugar market is expected to experience continued growth over the next few years. Increasing demand from the food and beverage sector, coupled with a rising interest in sustainable and organic sugar products, is anticipated to drive this growth. Government subsidies and support for sugar producers are likely to remain in place, providing stability in production and pricing.

Market Opportunities

- Expansion of Sugar Alternatives (Stevia, Agave): The U.S. market for sugar alternatives has been expanding rapidly, with sales of stevia and agave-based products growing by over 12% annually, reaching USD 2.4 billion in 2023. These natural sweeteners are gaining traction as consumers seek healthier alternatives to traditional sugar, especially in light of rising obesity and diabetes rates.

- Technological Advancements in Sugarcane Processing: Recent technological advancements in sugarcane processing, such as the adoption of more efficient extraction and refining technologies, are driving improvements in production yields and cost efficiency. In 2023, the U.S. sugar industry invested over USD 350 million in modernization efforts, including automation and improved harvesting techniques. These innovations are helping to mitigate the impacts of rising labor and input costs, ensuring that U.S.

Scope of the Report

|

By Product Type |

Granulated Sugar Powdered Sugar Brown Sugar Liquid Sugar Organic Sugar |

|

By Source |

Sugarcane Sugar Beet |

|

By Application |

Food & Beverage Industry Pharmaceuticals Biofuel Production Household Consumption |

|

By Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales |

|

Region |

North-East USA Mid-West USA Southern USA Western USA |

Products

Key Target Audience

Sugar Manufacturers

Food & Beverage Producers

Confectionery and Bakery Industries

Biofuel Producers

Pharmaceutical Companies

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Agriculture, FDA)

Sustainable and Organic Food Distributors

Companies

Players Mentioned in the Report

Cargill Inc.

American Sugar Refining, Inc.

Florida Crystals Corporation

United Sugars Corporation

Michigan Sugar Company

Archer Daniels Midland (ADM)

Sudzucker AG

Louis Dreyfus Company

Sweet Harvest Foods

Redpath Sugar Ltd.

Table of Contents

1. USA Sugar Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Sugar Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Sugar Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Inclination Towards Confectionery, Bakeries, and Beverages

3.1.2. Rising Demand for Processed Foods

3.1.3. Expansion of the Food and Beverage Industry

3.2. Market Challenges

3.2.1. Shift Towards Healthier Alternatives

3.2.2. Regulatory Restrictions on Sugar Consumption

3.2.3. Volatility in Raw Material Prices

3.3. Opportunities

3.3.1. Development of Low-Calorie Sugar Products

3.3.2. Expansion into Emerging Markets

3.3.3. Technological Advancements in Sugar Processing

3.4. Trends

3.4.1. Increasing Use of Natural Sweeteners

3.4.2. Adoption of Sustainable Production Practices

3.4.3. Growth in Organic Sugar Demand

3.5. Government Regulation

3.5.1. Sugar Import and Export Policies

3.5.2. Subsidies and Support for Domestic Producers

3.5.3. Health Guidelines on Sugar Consumption

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Sugar Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. White Sugar

4.1.2. Brown Sugar

4.1.3. Liquid Sugar

4.2. By Form (In Value %)

4.2.1. Granulated Sugar

4.2.2. Powdered Sugar

4.2.3. Syrup Sugar

4.3. By Source (In Value %)

4.3.1. Sugarcane

4.3.2. Sugar Beet

4.4. By End-Use Sector (In Value %)

4.4.1. Food and Beverages

4.4.2. Pharmaceuticals

4.4.3. Personal Care

4.4.4. Household

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Sugar Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. United States Sugar Corporation

5.1.2. American Crystal Sugar Company

5.1.3. Imperial Sugar Company

5.1.4. Florida Crystals Corporation

5.1.5. Domino Foods, Inc.

5.1.6. Cargill, Incorporated

5.1.7. Archer Daniels Midland Company

5.1.8. Sdzucker AG

5.1.9. Tereos S.A.

5.1.10. Louis Dreyfus Company

5.1.11. Michigan Sugar Company

5.1.12. Amalgamated Sugar Company

5.1.13. ASR Group International, Inc.

5.1.14. Western Sugar Cooperative

5.1.15. Nordzucker AG

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Production Capacity, Market Share, Product Portfolio, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. USA Sugar Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Sugar Market Future Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Sugar Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Form (In Value %)

8.3. By Source (In Value %)

8.4. By End-Use Sector (In Value %)

8.5. By Region (In Value %)

9. USA Sugar Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves the creation of an ecosystem map that includes all key stakeholders in the USA Sugar Market. Extensive desk research is conducted using a combination of secondary and proprietary databases to gather comprehensive market data. The main objective is to identify and define the critical variables influencing the market's growth and trends.

Step 2: Market Analysis and Construction

In this step, historical data for the USA Sugar Market is analyzed, focusing on market penetration, production levels, and revenue generation. Further, an assessment of sugar consumption trends in various regions is conducted to ensure the reliability and accuracy of the revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts via computer-assisted telephone interviews (CATI). These interviews provide operational and financial insights directly from key players, ensuring the data is verified and robust.

Step 4: Research Synthesis and Final Output

The final stage involves consultations with sugar manufacturers to acquire detailed insights on product segments, sales performance, and consumer preferences. This interaction ensures that the data obtained through the bottom-up approach is validated, leading to an accurate and comprehensive analysis of the USA Sugar Market.

Frequently Asked Questions

01. How big is the USA Sugar Market?

The USA sugar market is valued at USD 14,947 million, driven by high demand from the food and beverage industry, along with government support for sugar production through subsidies.

02. What are the challenges in the USA Sugar Market?

Challenges in the USA sugar market include volatile global sugar prices, regulatory pressures to reduce sugar consumption due to health concerns, and high production costs in some regions.

03. Who are the major players in the USA Sugar Market?

The USA sugar market key players include Cargill Inc., American Sugar Refining, Inc., Florida Crystals Corporation, United Sugars Corporation, and Michigan Sugar Company. These companies dominate due to their extensive production capacities and strong distribution networks.

04. What are the growth drivers of the USA Sugar Market?

The USA sugar market is driven by high demand from the food and beverage industry, especially in the confectionery and soft drink sectors. Additionally, government subsidies and technological advancements in farming are contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.