USA Sun Care Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD5449

December 2024

91

About the Report

USA Sun Care Market Overview

- The USA sun care market is valued at USD 14.3 billion, driven by increasing awareness around skin protection and the rising threat of skin-related diseases. Over the past five years, the market has consistently grown, supported by demand for products with high SPF ratings and the expansion of organic and mineral-based sunscreen offerings. Growth in the e-commerce sector has made these products more accessible to a broader audience, contributing significantly to the market's expansion. Sources such as industry reports confirm this valuation without estimations.

- Key cities in the USA like Los Angeles, Miami, and New York dominate the sun care market due to their high exposure to UV radiation, diverse demographic makeup, and robust tourism industries. Warm climates and beach-centric tourism significantly drive demand for sun care products in these areas. Additionally, the high concentration of skin-conscious consumers in urban areas ensures sustained demand for premium and specialized sun care products.

- The FDA's strict guidelines on sun protection product labeling have a significant impact on the market. In 2023, the FDA updated its sunscreen monograph to include more stringent testing requirements for broad-spectrum protection claims. Products must undergo rigorous testing to meet these standards, particularly for water resistance and UV radiation efficacy. These regulations have increased compliance costs for manufacturers, yet they also provide a level of consumer trust, ensuring the effectiveness of sun care products available on the U.S. market.

USA Sun Care Market Segmentation

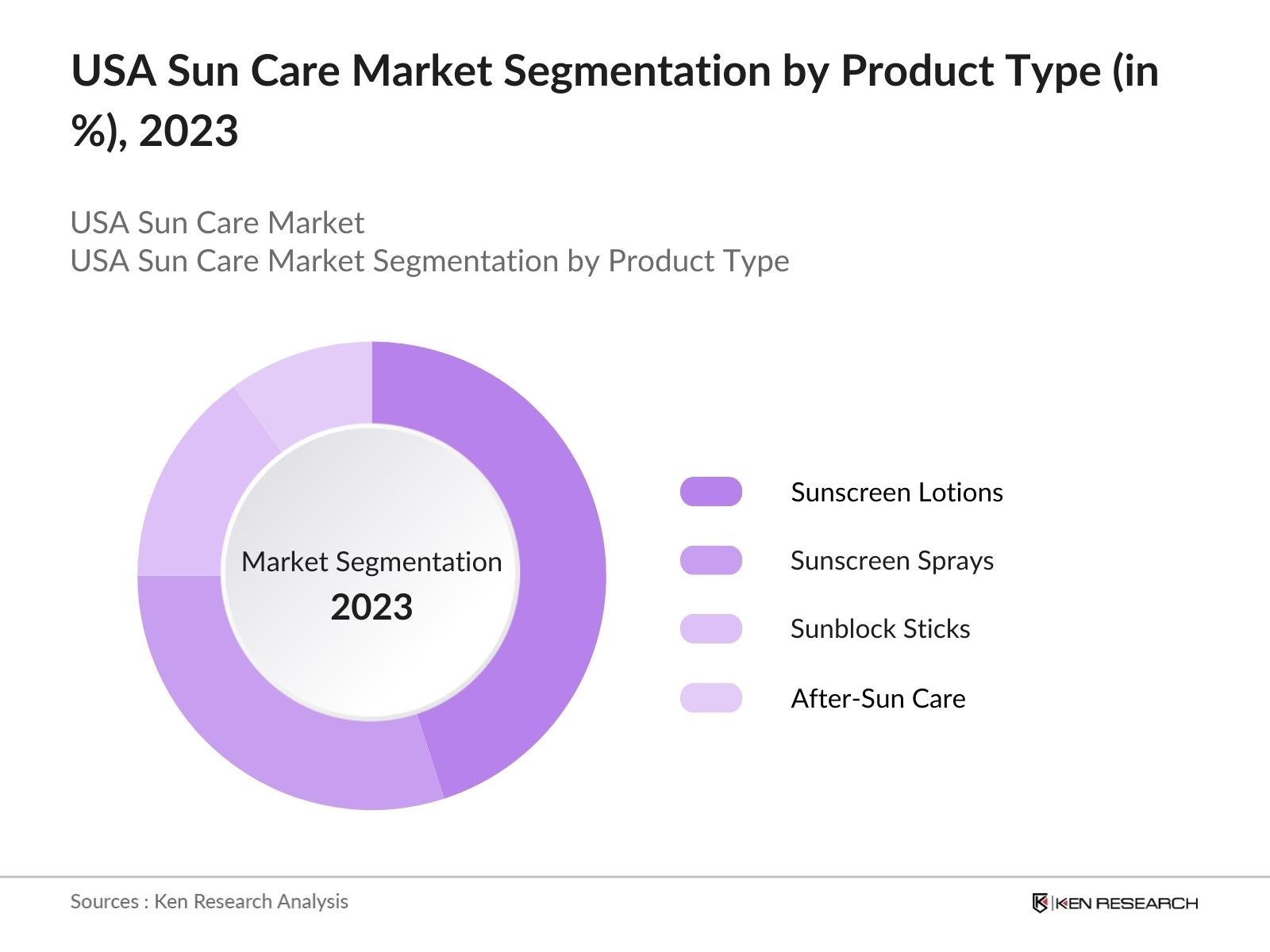

By Product Type: The market is segmented by product type into sunscreen lotions, sprays, sunblock sticks, and after-sun care products. Sunscreen lotions hold the dominant market share in 2023, attributed to their long-standing reputation and widespread consumer trust. Brands like Neutrogena and Coppertone have leveraged decades of research and consumer loyalty, particularly among individuals concerned with long-lasting skin protection. Lotion-based sunscreens are also favored for their easy application and versatility across different SPF ranges.

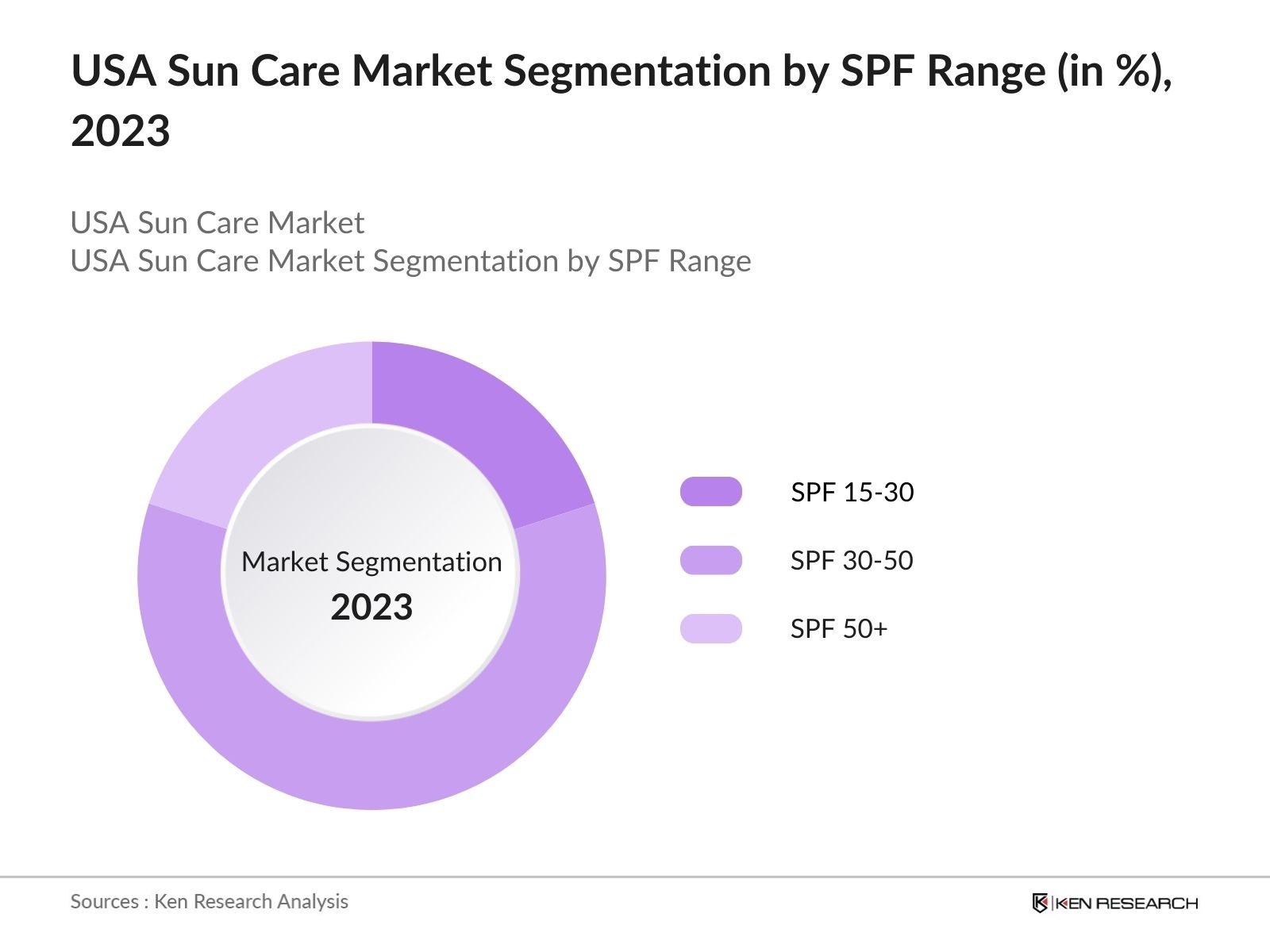

By SPF Range: The SPF range segmentation includes SPF 15-30, SPF 30-50, and SPF 50+. Products in the SPF 30-50 range dominate the market, accounting for a substantial share in 2023. This range balances protection with consumer preference for daily use, offering strong defense against harmful UV rays without feeling too heavy on the skin. Increased awareness of the risks associated with prolonged sun exposure has bolstered the demand for products in this category.

USA Sun Care Market Competitive Landscape

The USA sun care market is highly competitive, with both multinational corporations and smaller, niche brands competing for consumer attention. The major players, including global giants like Johnson & Johnson and LOral USA, dominate with their extensive distribution networks and established brand presence. These companies continue to innovate in product formulations, focusing on mineral-based and reef-safe products to cater to environmentally conscious consumers.

|

Company |

Establishment Year |

Headquarters |

Product Innovation |

Environmental Compliance |

Market Penetration |

R&D Spending |

Global Reach |

Revenue Growth |

|

Johnson & Johnson |

1886 |

New Brunswick, NJ |

||||||

|

LOral USA |

1909 |

New York, NY |

||||||

|

Neutrogena Corporation |

1930 |

Los Angeles, CA |

||||||

|

Procter & Gamble |

1837 |

Cincinnati, OH |

||||||

|

Beiersdorf AG |

1882 |

Hamburg, Germany |

USA Sun Care Industry Analysis

Growth Drivers

- Rising Skin Cancer Awareness: The rising incidence of skin cancer in the USA has significantly increased awareness about sun care products. According to the National Cancer Institute, there were approximately 99,780 new cases of melanoma in 2023. This heightened awareness is fueling consumer demand for effective sun care products as skin cancer is the most commonly diagnosed cancer in the country. Government health campaigns have promoted UV protection, further driving the market growth. The American Cancer Society indicates that more individuals are taking preventive measures, contributing to higher sales of sunscreen products.

- Increasing Consumer Focus on UV Protection: Consumer awareness regarding the harmful effects of ultraviolet (UV) radiation is increasing significantly. In 2023, studies from the Skin Cancer Foundation showed that approximately 1 in 5 Americans will develop skin cancer in their lifetime, intensifying the need for sun protection. With a rise in outdoor recreational activities, the demand for sun care products offering higher UV protection, like SPF 50+ formulas, has surged. Market players are capitalizing on this shift by enhancing product offerings to include broad-spectrum protection, ensuring defense against both UVA and UVB rays.

- Expanding Range of Organic & Mineral-Based Products: The shift towards organic and mineral-based sun care products is driven by increasing consumer concerns about chemical ingredients. Data from the Environmental Working Group (EWG) indicates a rise in consumer preference for zinc oxide and titanium dioxide-based formulations. In 2023, over 60% of new sunscreen product launches in the U.S. contained organic or mineral-based ingredients. This shift is influencing market leaders to focus more on innovation in non-chemical, reef-safe formulations to meet evolving consumer demand while adhering to stricter environmental and health standards.

Market Challenges

- Stringent Regulatory Compliance: The sun care industry in the USA faces stringent regulatory hurdles, primarily enforced by the Food and Drug Administration (FDA). The FDA's sunscreen monograph sets specific guidelines for UV protection labeling, ingredient safety, and efficacy claims. In 2023, these regulations became more stringent, limiting the inclusion of certain chemical compounds such as oxybenzone and octinoxate. The process of complying with these regulations can be expensive and time-consuming for manufacturers. Consequently, product reformulations and delays in product launches pose significant challenges for industry players.

- High Cost of Premium Sun Care Products: The rising cost of premium sun care products has emerged as a notable challenge for consumers, particularly those from low-income households. According to a study by the U.S. Bureau of Labor Statistics, the price of personal care products, including sun care, increased by 5.6% year-on-year in 2023 due to inflation and higher production costs. Premium organic and mineral-based sunscreens are often priced significantly higher than conventional products, which can limit their accessibility to a wider audience, restricting market growth.

USA Sun Care Market Future Outlook

Over the next five years, the USA sun care market is expected to witness steady growth, driven by increased awareness of skin protection and innovations in sun care formulations. A growing trend toward clean beauty and environmental consciousness will likely lead to a rise in demand for mineral-based and reef-safe sunscreens. Furthermore, expanding e-commerce platforms will make sun care products more accessible to a wider demographic, while the men's grooming segment shows potential for increased market penetration.

Future Market Opportunities

- Increasing Demand for Anti-Aging Solutions: The growing demand for anti-aging solutions presents a significant opportunity for the sun care market. Data from the American Academy of Dermatology shows that 90% of skin aging is caused by UV exposure. As a result, there has been an increased focus on developing sun care products that not only protect against UV damage but also offer anti-aging benefits. In 2023, sales of anti-aging sun care products grew by 7.3%, with brands emphasizing the inclusion of ingredients like antioxidants and hyaluronic acid to combat premature aging.

- Expansion of Men's Grooming Segment: The male grooming segment is an emerging growth area within the sun care market. Data from the U.S. Census Bureau highlights that men aged 25-44 are increasingly investing in skincare products, including sun care items. In 2023, male-focused sun care products accounted for 12% of the total market sales, up from 9% in 2020. This growth can be attributed to increased awareness of skin health among men, coupled with targeted marketing campaigns from major brands.

Scope of the Report

|

Product Type |

Sunscreen Lotions Sunscreen Sprays Sunblock Sticks After-Sun Care Products |

|

SPF Range |

SPF 15-30 SPF 30-50 SPF 50+ |

|

Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores |

|

Consumer Demographic |

Women Men Children |

|

Formulation Type |

Organic Sunscreens Chemical Sunscreens Mineral-Based Sunscreens |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA)

Dermatologists and Skincare Professionals

Beauty Retailers and Distributors

Online Retailers and E-commerce Platforms

Sun Care Product Manufacturers

Health and Wellness Brands

Environmental Protection Agencies

Banks and Financial Institutions

Companies

Major Players

Johnson & Johnson

LOral USA

Neutrogena Corporation

Procter & Gamble

Beiersdorf AG

Coty Inc.

Shiseido Company, Ltd.

The Este Lauder Companies Inc.

Unilever (Sun Bum)

Blue Lizard

Banana Boat

Hawaiian Tropic

Edgewell Personal Care

La Roche-Posay

Coppertone

Table of Contents

USA Sun Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Y-o-Y growth)

1.4. Market Segmentation Overview

USA Sun Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Sun Care Market Analysis

3.1. Growth Drivers

3.1.1. Rising Skin Cancer Awareness [Health Impact]

3.1.2. Increasing Consumer Focus on UV Protection [Consumer Behavior]

3.1.3. Expanding Range of Organic & Mineral-Based Products [Product Innovation]

3.1.4. Influence of E-commerce and Digital Marketing [Distribution Channels]

3.2. Market Challenges

3.2.1. Stringent Regulatory Compliance [FDA Regulations]

3.2.2. High Cost of Premium Sun Care Products [Pricing Structure]

3.2.3. Availability of Substitute Products [Competitive Landscape]

3.3. Opportunities

3.3.1. Increasing Demand for Anti-Aging Solutions [Product Development]

3.3.2. Expansion of Men's Grooming Segment [Consumer Demographics]

3.3.3. Rising Awareness about Reef-Safe Sunscreens [Environmental Impact]

3.4. Trends

3.4.1. Innovation in SPF Technologies [R&D and Patents]

3.4.2. Growth of Multi-functional Sun Care Products [Product Diversification]

3.4.3. Growing Preference for Vegan & Cruelty-Free Products [Consumer Ethics]

3.5. Government Regulation

3.5.1. FDA Sun Protection Guidelines [Product Labeling Standards]

3.5.2. Environmental Legislation on Sunscreen Ingredients [Reef-Safe Compliance]

3.5.3. Import and Export Duties [Global Trade Regulations]

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis [Industry Structure]

3.8. Competition Ecosystem [Competitive Dynamics]

USA Sun Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Sunscreen Lotions

4.1.2. Sunscreen Sprays

4.1.3. Sunblock Sticks

4.1.4. After-Sun Care Products

4.2. By SPF Range (In Value %)

4.2.1. SPF 15-30

4.2.2. SPF 30-50

4.2.3. SPF 50+

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Supermarkets/Hypermarkets

4.3.3. Specialty Stores

4.4. By Consumer Demographic (In Value %)

4.4.1. Women

4.4.2. Men

4.4.3. Children

4.5. By Formulation Type (In Value %)

4.5.1. Organic Sunscreens

4.5.2. Chemical Sunscreens

4.5.3. Mineral-Based Sunscreens

USA Sun Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson

5.1.2. LOral USA

5.1.3. Neutrogena Corporation

5.1.4. Shiseido Company, Ltd.

5.1.5. Procter & Gamble

5.1.6. Beiersdorf AG

5.1.7. Coty Inc.

5.1.8. The Este Lauder Companies Inc.

5.1.9. Banana Boat

5.1.10. Hawaiian Tropic

5.1.11. La Roche-Posay

5.1.12. Blue Lizard

5.1.13. Unilever (Sun Bum)

5.1.14. Edgewell Personal Care

5.1.15. Coppertone

5.2. Cross Comparison Parameters (Revenue, Market Share, Innovation Index, R&D Spending, Environmental Compliance, Product Diversification, Distribution Network, Employee Base)

5.3. Market Share Analysis [Competitive Landscape]

5.4. Strategic Initiatives [Mergers, Acquisitions, Product Launches]

5.5. Investment and Partnership Analysis [Venture Capital, Private Equity]

5.6. Government Support Programs [Subsidies, Grants]

5.7. Marketing and Branding Strategies [Influencer Marketing, Sustainability Initiatives]

USA Sun Care Market Regulatory Framework

6.1. FDA Regulations for Sun Care Products [Compliance Guidelines]

6.2. Environmental and Sustainability Regulations [Chemical Restrictions]

6.3. Certification Processes [USDA Organic, Cruelty-Free]

USA Sun Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections [Forecasted Growth]

7.2. Key Factors Driving Future Growth [Rising Skin Health Awareness, Expansion in Emerging Markets]

USA Sun Care Market Analysts' Recommendations

8.1. TAM/SAM/SOM Analysis [Total Addressable Market, Serviceable Available Market]

8.2. White Space Opportunity Analysis [Untapped Markets]

8.3. Consumer Engagement Strategies [Brand Loyalty Programs]

8. USA Sun Care Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By SPF Rating (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the ecosystem of the USA sun care market, focusing on product types, consumer preferences, and regulatory frameworks. Extensive desk research is conducted using secondary sources to identify critical factors influencing market dynamics.

Step 2: Market Analysis and Construction

In this step, historical data on market penetration and revenue generation is compiled, assessing factors such as consumer behavior, product demand, and market competition. Key statistical data is derived from industry reports and validated through multiple sources.

Step 3: Hypothesis Validation and Expert Consultation

The research hypotheses are validated through consultations with dermatologists, product developers, and sun care manufacturers. These interviews provide firsthand insights into the market's current state, product innovation, and future trends.

Step 4: Research Synthesis and Final Output

The final analysis integrates qualitative insights with quantitative data to create a comprehensive report. The report is reviewed by industry experts and adjusted for accuracy, ensuring a detailed and factual representation of the USA sun care market.

Frequently Asked Questions

01 How big is the USA Sun Care Market?

The USA sun care market is valued at USD 14.3 billion, driven by rising skin cancer awareness and increasing consumer demand for high-SPF and mineral-based sunscreens.

02 What are the challenges in the USA Sun Care Market?

Challenges in the USA sun care market include stringent regulatory requirements from the FDA, the high cost of premium sun care products, and rising competition from emerging eco-friendly brands offering mineral-based sunscreens.

03 Who are the major players in the USA Sun Care Market?

Key players in the USA sun care market include Johnson & Johnson, LOral USA, Neutrogena Corporation, Procter & Gamble, and Beiersdorf AG. These companies dominate due to their strong brand presence, wide distribution networks, and continual product innovation.

04 What are the growth drivers of the USA Sun Care Market?

The growth in the USA sun care market is primarily driven by increasing awareness of skin protection, the expansion of organic and mineral-based products, and the influence of e-commerce platforms making these products more accessible.

05 Which product types are leading in the USA Sun Care Market?

Sunscreen lotions are the dominant product type in the USA sun care market, favored for their versatility, ease of use, and availability across a wide range of SPF levels in the USA sun care market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.