USA System Integration Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD9281

November 2024

85

About the Report

USA System Integration Market Overview

- The USA System Integration market is valued at USD 110 billion, based on a five-year historical analysis. This market is driven by the accelerating adoption of digital transformation strategies across sectors such as BFSI, healthcare, and government, which are increasingly relying on integrated solutions to enhance operational efficiency and data management. With rising investments in automation, cloud migration, and data integration, system integration solutions have become critical for organizations to streamline processes and support scalable infrastructure.

- Major cities and regions like New York, California, and Texas lead the USA System Integration market. These areas have high demand due to the presence of technology-driven industries, financial institutions, and government agencies requiring complex integration solutions. Their leadership in technological innovation, high digital adoption rates, and significant budgets contribute to their dominance in this sector.

- Data privacy acts such as the CCPA and HIPAA govern data handling in various sectors, enforcing strict compliance requirements. The FTCs enforcement has led to approximately $200 million in fines across industries for non-compliance, demonstrating the seriousness of data protection laws. These regulations are a crucial consideration for system integrators, who must develop solutions that adhere to privacy standards.

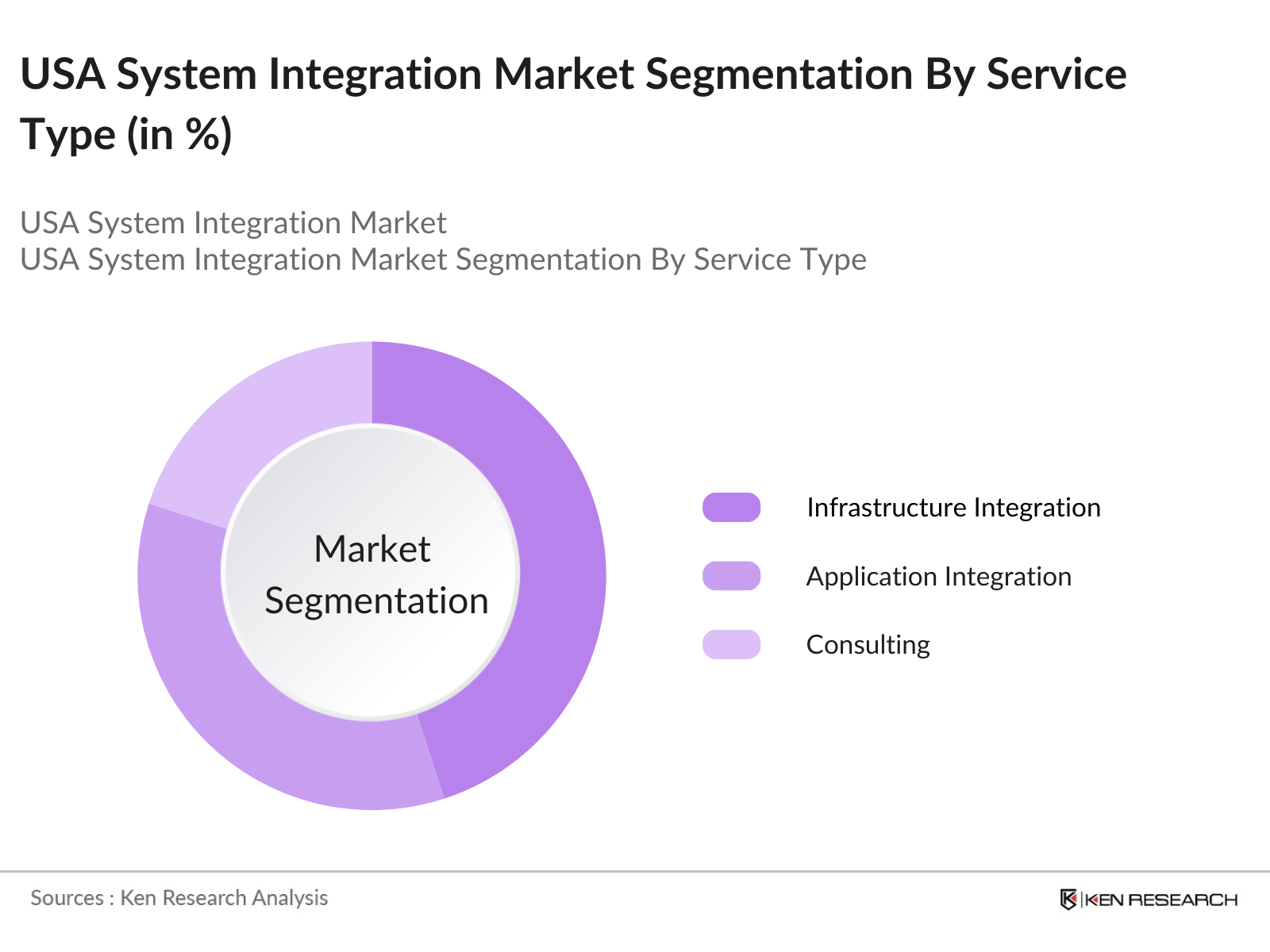

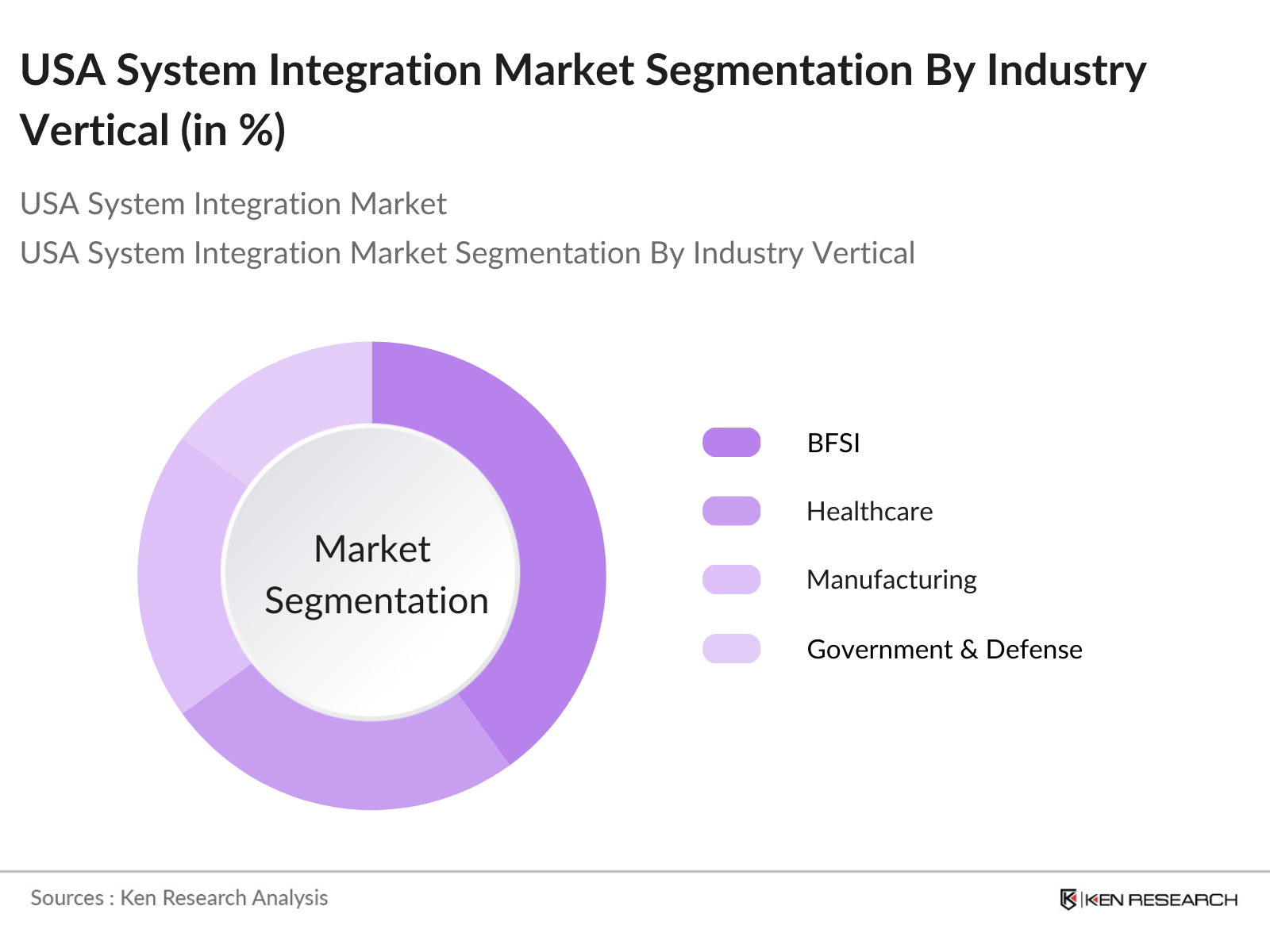

USA System Integration Market Segmentation

By Service Type: The market is segmented by service type into infrastructure integration, application integration, and consulting services. Infrastructure integration holds a dominant market share under the service type segment due to its critical role in establishing and maintaining enterprise infrastructure, especially as businesses migrate to hybrid and multi-cloud environments. The complexity of legacy systems and the need for secure, scalable infrastructures make infrastructure integration a priority for enterprises.

By Industry Vertical: In terms of industry vertical, the USA System Integration market is segmented into healthcare, BFSI (Banking, Financial Services, and Insurance), manufacturing, government and defense, and retail & e-commerce. The BFSI segment has the largest share within this vertical due to stringent regulatory requirements and the need for robust cybersecurity measures, data integration, and seamless customer service solutions.

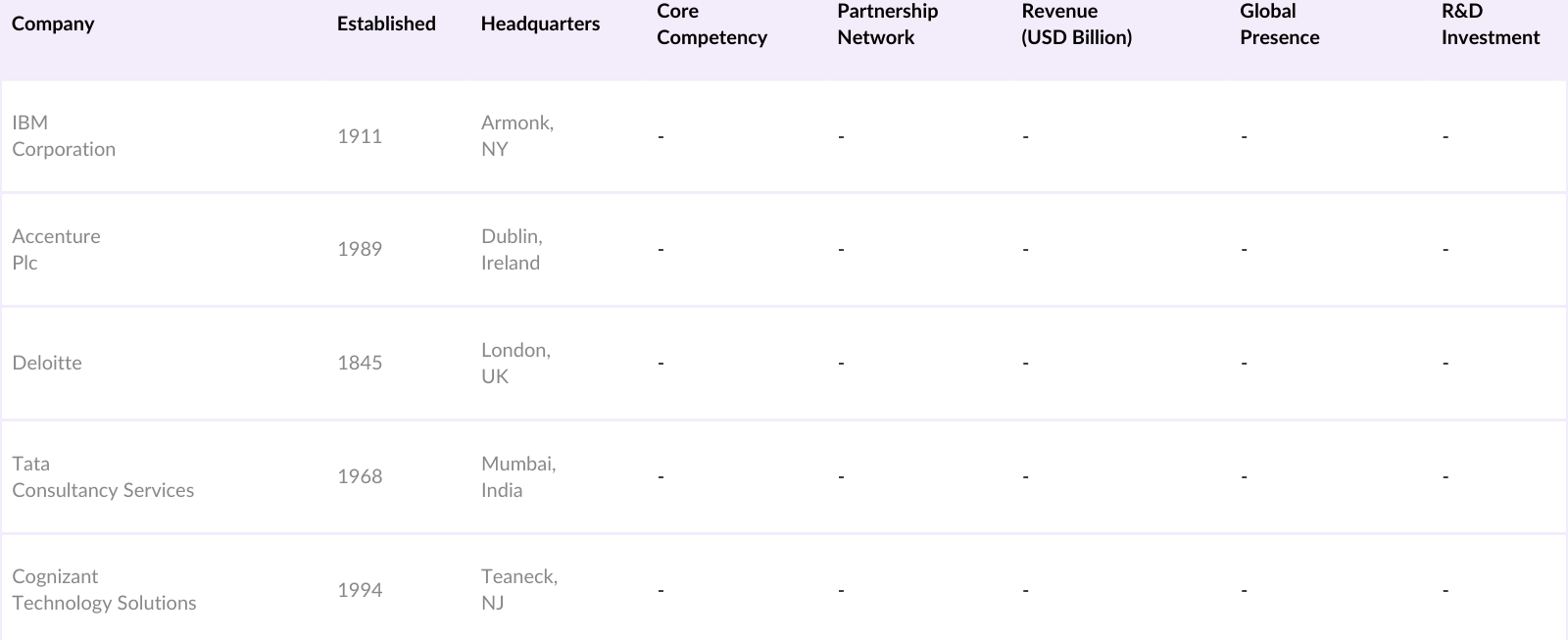

USA System Integration Market Competitive Landscape

The USA System Integration market is characterized by strong competition among key players, with major companies leveraging extensive technology expertise, strategic partnerships, and advanced infrastructure. Notable players include IBM Corporation, Accenture Plc, and Deloitte, each capitalizing on their robust service portfolios and high R&D investments to capture a larger market share. This competition is driven by increasing demand for customized solutions and end-to-end integration capabilities.

USA System Integration Industry Analysis

Growth Drivers

- Increasing Demand for Automation Solutions: As of 2024, the U.S. sees high adoption of automation solutions driven by manufacturing and logistics, both of which are pivotal to economic stability and growth. Recent data from the U.S. Bureau of Economic Analysis highlights that automation in these sectors contributed to nearly $2 trillion in economic output. The manufacturing sectors push for efficiency and productivity has resulted in automated systems becoming integral across operations, significantly influencing workforce dynamics and productivity output across industries. This increasing reliance on automation highlights its critical role in bolstering the U.S. economy.

- Rising Cloud Computing Adoption: The adoption of cloud computing across U.S. industries continues to soar, with government statistics revealing that 80% of federal agencies have integrated cloud-based services. Additionally, the U.S. Department of Commerce reports that cloud infrastructure underpins over $700 billion of economic activities in sectors such as finance and healthcare. Cloud integration is central to digital transformation, reducing dependency on physical infrastructure while enhancing data management, which directly aligns with the U.S. market's expansion in system integration.

- Advancements in AI and Machine Learning: In the U.S., advancements in AI and machine learning are redefining system integration. According to the U.S. Department of Energy, AI applications in industries such as energy optimization and manufacturing saved approximately 5 billion kilowatt-hours, enhancing productivity and sustainability. Additionally, the growth of AI has led to its incorporation into enterprise systems, where machine learning algorithms help in data processing, predictive maintenance, and operational efficiency.

Market Challenges

- High Costs of Integration Solutions: System integration costs remain a challenge for many U.S. businesses, as data from the U.S. Census Bureau shows that integration projects can account for up to 20% of a companys annual IT budget. These high costs are often attributed to the complexity of linking diverse systems, particularly in sectors like finance and healthcare. The costs are a barrier for small and medium enterprises (SMEs), limiting their access to advanced integration technologies that larger firms can afford.

- Limited Skilled Workforce for System Integration: The shortage of skilled professionals in system integration is another key challenge in the U.S. market. According to the U.S. Bureau of Labor Statistics, the demand for system integrators is expected to increase by 10% through 2025, but a significant gap in available skilled workers remains. This shortage strains project timelines and raises costs, impacting the overall efficiency of integration projects and slowing down technology adoption rates across industries.

USA System Integration Future Outlook

Over the next five years, the USA System Integration market is projected to experience steady growth, fueled by increased digital transformation initiatives across sectors and the expansion of hybrid cloud solutions. Enterprises are expected to continue investing in secure, scalable integration frameworks to address complex infrastructure requirements, paving the way for ongoing innovations in IoT, AI-driven integration, and cybersecurity solutions.

Market Opportunities

- Growing Smart City Initiatives: Smart city initiatives across the U.S. have accelerated, with recent government data showing that investments in smart infrastructure totaled over $160 billion. These projects span transportation, public safety, and utilities, requiring complex system integration for seamless operation. As smart cities evolve, the demand for integrative solutions that enable interoperable technologies continues to present lucrative opportunities for system integrators.

- Enhanced Use of IoT in Enterprises: IoT adoption in U.S. enterprises is on the rise, with the Department of Energy estimating that over 20 billion IoT devices are connected across industries, enhancing data collection and management. These devices are essential for operations in sectors like manufacturing and energy, requiring robust system integration solutions for effective real-time data exchange and monitoring.

Scope of the Report

|

Service Type |

Infrastructure Integration Application Integration Consulting |

|

Industry Vertical |

Healthcare BFSI Manufacturing Government and Defense Retail and E-commerce |

|

Technology Type |

On-premises Cloud-based Hybrid |

|

Organization Size |

SMEs Large Enterprises |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

CIOs and IT Managers

Chief Technology Officers

Operations and System Managers

System Integration Service Providers

Enterprise Resource Planning (ERP) Solution Providers

Government and Regulatory Bodies (e.g., U.S. Department of Commerce, National Institute of Standards and Technology)

Venture Capitalists and Investment Firms

Infrastructure and Cloud Service Providers

Companies

Players Mentioned in the Report

IBM Corporation

Accenture Plc

Deloitte Touche Tohmatsu Limited

Tata Consultancy Services

Infosys Limited

Wipro Limited

Capgemini SE

Cognizant Technology Solutions

Atos SE

Cisco Systems, Inc.

Table of Contents

1. USA System Integration Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA System Integration Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA System Integration Market Analysis

3.1 Growth Drivers (Digital Transformation, Cloud Adoption, Automation Demand)

3.1.1 Increasing Demand for Automation Solutions

3.1.2 Rising Cloud Computing Adoption

3.1.3 Advancements in AI and Machine Learning

3.1.4 Demand for Data Integration in Enterprises

3.2 Market Challenges (Integration Complexity, Cybersecurity Concerns)

3.2.1 High Costs of Integration Solutions

3.2.2 Limited Skilled Workforce for System Integration

3.2.3 Data Privacy Regulations

3.2.4 Complexity in Legacy System Integration

3.3 Opportunities (Expansion of Smart Cities, IoT Integration)

3.3.1 Growing Smart City Initiatives

3.3.2 Enhanced Use of IoT in Enterprises

3.3.3 Increased Government Investments

3.3.4 Collaborations and Strategic Partnerships

3.4 Trends (AI in System Integration, Hybrid Cloud Solutions)

3.4.1 Hybrid Cloud Integration Demand

3.4.2 Rise in Managed Services Adoption

3.4.3 IoT and Edge Computing Adoption

3.4.4 Cybersecurity Solutions within Integration

3.5 Government Regulation (Cybersecurity Policies, Privacy Standards)

3.5.1 U.S. Data Privacy Acts

3.5.2 Cybersecurity Compliance Requirements

3.5.3 Standards for IT Infrastructure

3.5.4 Federal Investments in Digital Infrastructure

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. USA System Integration Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Infrastructure Integration

4.1.2 Application Integration

4.1.3 Consulting

4.2 By Industry Vertical (In Value %)

4.2.1 Healthcare

4.2.2 BFSI

4.2.3 Manufacturing

4.2.4 Government and Defense

4.2.5 Retail and E-commerce

4.3 By Technology Type (In Value %)

4.3.1 On-premises

4.3.2 Cloud-based

4.3.3 Hybrid

4.4 By Organization Size (In Value %)

4.4.1 SMEs

4.4.2 Large Enterprises

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA System Integration Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Accenture Plc

5.1.2 IBM Corporation

5.1.3 Deloitte Touche Tohmatsu Limited

5.1.4 Tata Consultancy Services

5.1.5 Infosys Limited

5.1.6 Wipro Limited

5.1.7 Capgemini SE

5.1.8 Cognizant Technology Solutions

5.1.9 Atos SE

5.1.10 Cisco Systems, Inc.

5.1.11 HCL Technologies

5.1.12 Fujitsu Ltd.

5.1.13 Hitachi Systems Ltd.

5.1.14 DXC Technology

5.1.15 Tech Mahindra

5.2 Cross Comparison Parameters (Revenue, Service Portfolio, Geographic Presence, Number of Employees, Core Technology Competency, Partnership Network, Inception Year, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Funding

5.8 Government Grants

5.9 Research and Development (R&D) Expenditures

6. USA System Integration Market Regulatory Framework

6.1 Data Protection Laws

6.2 Compliance Requirements

6.3 Certification Processes

6.4 Cybersecurity and Data Privacy Standards

7. USA System Integration Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA System Integration Future Market Segmentation

8.1 By Service Type (In Value %)

8.2 By Industry Vertical (In Value %)

8.3 By Technology Type (In Value %)

8.4 By Organization Size (In Value %)

8.5 By Region (In Value %)

9. USA System Integration Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders within the USA System Integration market. Through comprehensive desk research, data from secondary sources, such as proprietary databases, are gathered to define the critical variables impacting market growth.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to assess the market penetration and structure of service providers. Revenue estimates are derived by evaluating service offerings, adoption trends, and growth patterns across different verticals.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through computer-assisted telephone interviews (CATIs) to validate market hypotheses. These insights aid in refining operational and financial data to enhance data accuracy.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with integration solution providers to obtain insights on product segments, customer preferences, and sales performance, ensuring a validated and comprehensive analysis of the market.

Frequently Asked Questions

1. How big is the USA System Integration Market?

The USA System Integration market is valued at USD 110 billion, based on a five-year historical analysis. This market is driven by the accelerating adoption of digital transformation strategies across sectors such as BFSI, healthcare, and government, which are increasingly relying on integrated solutions to enhance operational efficiency and data management.

2. What are the challenges in the USA System Integration Market?

Key challenges include high integration costs, complexities in managing legacy systems, and growing cybersecurity threats as systems become more interconnected.

3. Who are the major players in the USA System Integration Market?

Major players include IBM Corporation, Accenture, Deloitte, Tata Consultancy Services, and Cognizant Technology Solutions, each known for their extensive integration portfolios and global reach.

4. What are the growth drivers of the USA System Integration Market?

Growth is propelled by increased digital transformation initiatives across industries, especially in BFSI and healthcare, with a focus on cloud adoption, IoT, and data analytics integration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.