USA System Integrator Market Outlook to 2030

Region:North America

Author(s):Rajat Galav

Product Code:KROD1238

May 2025

90

About the Report

USA System Integrator Market Overview

- The USA System Integrator Market was valued at USD XX billion, mirroring the broader Global System Integrator Market, which is valued at USD 45 billion. This growth is primarily driven by the increasing demand for automation and digital transformation across various industries, including manufacturing, healthcare, and telecommunications. The integration of advanced technologies such as IoT, AI, and cloud computing has further propelled the market, as businesses seek to enhance operational efficiency and reduce costs.

- Key cities dominating the market include New York, San Francisco, and Chicago. These urban centers are hubs for technology and innovation, housing numerous startups and established firms that drive the demand for system integration services. The concentration of skilled labor, access to venture capital, and a robust infrastructure contribute to their dominance in the market.

- In 2024, the U.S. government implemented regulations aimed at enhancing cybersecurity measures for critical infrastructure sectors. This regulation mandates that system integrators adhere to stringent security protocols to protect sensitive data and systems from cyber threats. The initiative is part of a broader strategy to bolster national security and ensure the resilience of essential services.

USA System Integrator Market Segmentation

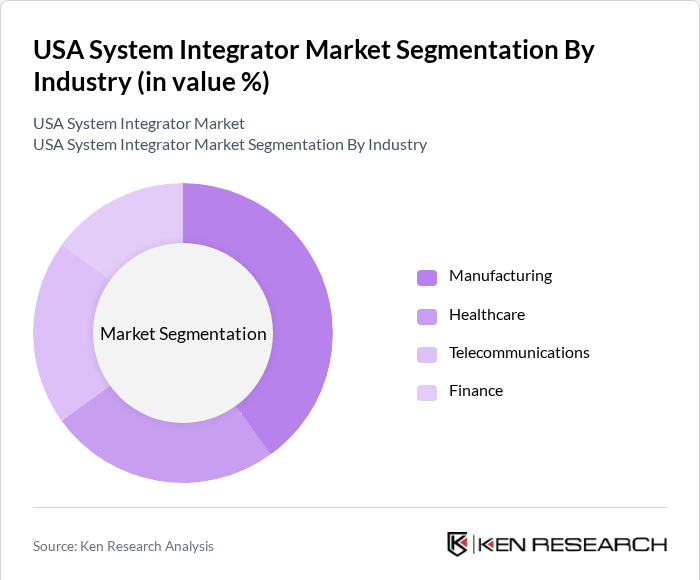

By Industry: The USA System Integrator Market is segmented by industry, with key sectors including manufacturing, healthcare, telecommunications, and finance. Among these, the manufacturing sector is the dominant sub-segment, driven by the increasing adoption of automation and smart manufacturing practices. Companies are investing in integrated systems to streamline operations, enhance productivity, and reduce downtime. The trend towards Industry 4.0, characterized by the use of IoT and AI technologies, is further propelling the demand for system integrators in this sector.

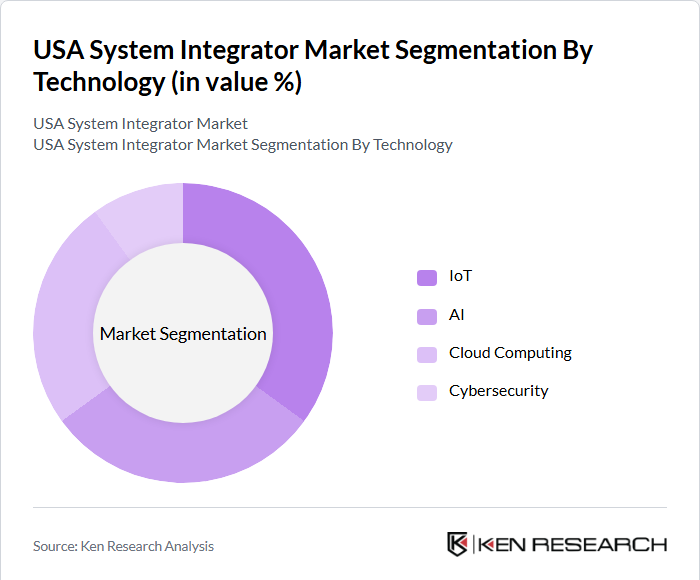

By Technology: The market is also segmented by technology, with key sub-segments including IoT, AI, cloud computing, and cybersecurity solutions. The IoT sub-segment is currently leading the market, as businesses increasingly seek to connect devices and systems for real-time data analysis and decision-making. The growing emphasis on data-driven insights and operational efficiency is driving the adoption of IoT solutions, making it a critical area for system integrators. Additionally, the rise of smart cities and connected infrastructure is further enhancing the demand for IoT integration services.

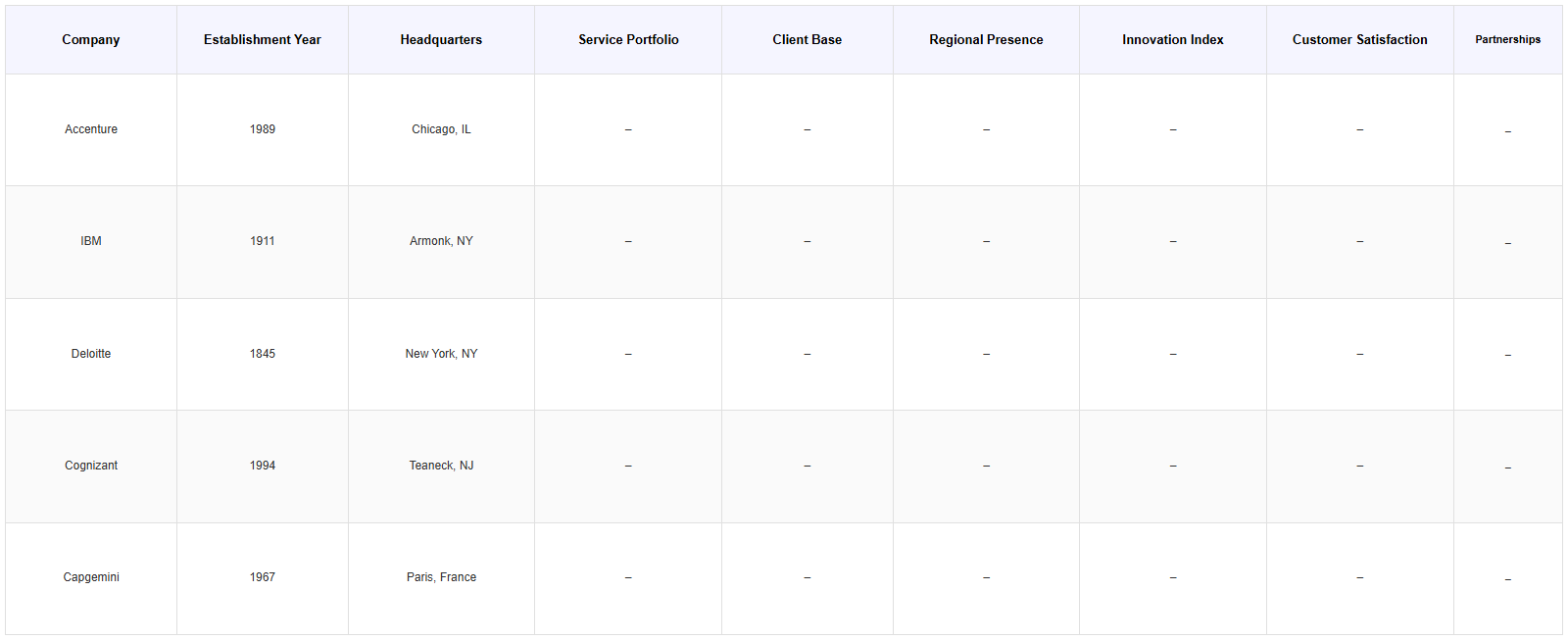

USA System Integrator Market Competitive Landscape

The USA System Integrator Market is characterized by a competitive landscape dominated by several key players, including both established firms and emerging companies. These players are focusing on technological advancements and strategic partnerships to enhance their service offerings and maintain a competitive edge. The market is witnessing a trend towards consolidation, with companies seeking to expand their capabilities and market reach through mergers and acquisitions.

USA System Integrator Market Industry Analysis

Growth Drivers

- Increasing Demand for Automation Solutions: The USA's manufacturing sector is projected to grow significantly, with automation technologies expected to enhance productivity. This surge in demand for automation is driven by the need for operational efficiency and cost reduction, as companies seek to remain competitive in a rapidly evolving market. The World Bank claims that the USA's industrial output reached USD 3 trillion in 2024, further fueling the need for system integrators to implement advanced automation solutions across various industries.

- Rising Adoption of Cloud Technologies: The U.S. system integrator market is witnessing a strong rise in cloud technology adoption, with 33% of organizations now spending over USD 12 million annually on public cloud services in 2025, up from 29% previously. In healthcare, 95% of organizations are projected to use cloud services for patient data management, while 80% of educational institutions rely on cloud-based systems.

- Need for Enhanced Operational Efficiency: Enhancing operational efficiency through advanced technologies and system integration is a top priority for the U.S. manufacturing sector, with 86% of industry leaders citing smart factory initiatives as critical to improving productivity and competitiveness over the next five years. As companies face rising operational costs, the demand for solutions that improve efficiency is paramount. System integrators play a vital role in implementing integrated systems that streamline operations, reduce waste, and enhance overall productivity.

Market Challenges

- High Initial Investment Costs: The upfront costs associated with implementing advanced system integration solutions can be a significant barrier for many businesses. With the average investment in automation technologies estimated at USD 1 million per facility, smaller enterprises may struggle to justify these expenses. The IMF reports that while the USA's economy is expected to grow, the disparity in capital availability could hinder the adoption of necessary technologies, particularly among SMEs, limiting their competitiveness in the market.

- Shortage of Skilled Workforce: The USA is currently facing a critical shortage of skilled workers in the manufacturing sector, with an estimated 2.1 million jobs expected to remain unfilled by 2030. This skills gap poses a significant challenge for system integrators, as the successful implementation of complex integration projects requires a highly skilled workforce. The World Bank highlights that addressing this skills shortage is essential for maintaining the USA's competitive edge in technology and innovation, making it imperative for companies to invest in training and development initiatives.

USA System Integrator Market Future Outlook

In the coming years, the USA system integrator market is poised for robust growth, driven by advancements in technology and increasing demand for integrated solutions across various industries. The ongoing digital transformation and the need for enhanced operational efficiency will continue to propel market expansion, with system integrators playing a crucial role in facilitating this transition.

Market Opportunities

- Expansion into Emerging Markets: As businesses look to expand their operations, system integrators have the opportunity to tap into emerging markets, where demand for automation and integration solutions is on the rise. The World Bank projects that emerging economies will contribute significantly to global GDP growth, creating new avenues for system integrators to offer tailored solutions that meet the unique needs of these markets.

- Integration of AI and Machine Learning: The increasing adoption of AI and machine learning technologies presents a significant opportunity for system integrators to enhance their service offerings. With the booming AI market, system integrators can leverage these technologies to provide innovative solutions that improve decision-making, optimize processes, and drive business growth.

Scope of the Report

| By Industry | Manufacturing Health Care Telecommunications Finance |

| By Technology | IoT AI Cloud Computing Cybersecurity Solutions |

| By Service Type | Consulting Implementation Support & Maintenance |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | Northeast Midwest South West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Communications Commission, Department of Defense)

Manufacturers and Producers

System Integrator Companies

Technology Providers

Industry Associations (e.g., Automation Federation, International Society of Automation)

Financial Institutions

Telecommunications Companies

Companies

Players Mentioned in the Report

Accenture

IBM

Siemens

Honeywell

Rockwell Automation

TechFusion Integrators

NexGen Systems Solutions

SynergyTech Integrations

Innovatech Systems Group

Apex Integration Partners

Table of Contents

1. USA System Integrator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA System Integrator Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA System Integrator Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Automation Solutions

3.1.2. Rising Adoption of Cloud Technologies

3.1.3. Need for Enhanced Operational Efficiency

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Rapid Technological Changes

3.2.3. Shortage of Skilled Workforce

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Integration of AI and Machine Learning

3.3.3. Development of Custom Solutions for Niche Industries

3.4. Trends

3.4.1. Shift Towards Digital Transformation

3.4.2. Increased Focus on Cybersecurity Measures

3.4.3. Growing Importance of Sustainability in Integration Solutions

3.5. Government Regulation

3.5.1. Compliance with Industry Standards

3.5.2. Data Protection Regulations

3.5.3. Environmental Impact Assessments

3.5.4. Safety and Quality Assurance Guidelines

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. USA System Integrator Market Segmentation

4.1. By Industry

4.1.1. Manufacturing

4.1.2. Health Care

4.1.3. Telecommunications

4.1.4. Finance

4.2. By Technology

4.2.1. IoT

4.2.2. AI

4.2.3. Cloud Computing

4.2.4. Cybersecurity Solutions

4.3. By Service Type

4.3.1. Consulting

4.3.2. Implementation

4.3.3. Support & Maintenance

4.4. By Deployment Model

4.4.1. On-Premises

4.4.2. Cloud-Based

4.4.3. Hybrid

4.5. By Region

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA System Integrator Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Accenture

5.1.2. IBM

5.1.3. Siemens

5.1.4. Honeywell

5.1.5. Rockwell Automation

5.1.6. TechFusion Integrators

5.1.7. NexGen Systems Solutions

5.1.8. SynergyTech Integrations

5.1.9. Innovatech Systems Group

5.1.10. Apex Integration Partners

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Index

5.2.4. Innovation Index

5.2.5. Service Portfolio Diversity

5.2.6. Geographic Reach

5.2.7. Partnership and Collaboration Strength

5.2.8. Brand Reputation

6. USA System Integrator Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA System Integrator Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA System Integrator Market Future Market Segmentation

8.1. By Industry

8.1.1. Manufacturing

8.1.2. Health Care

8.1.3. Telecommunications

8.1.4. Finance

8.2. By Technology

8.2.1. IoT

8.2.2. AI

8.2.3. Cloud Computing

8.2.4. Cybersecurity Solutions

8.3. By Service Type

8.3.1. Consulting

8.3.2. Implementation

8.3.3. Support & Maintenance

8.4. By Deployment Model

8.4.1. On-Premises

8.4.2. Cloud-Based

8.4.3. Hybrid

8.5. By Region

8.5.1. Northeast

8.5.2. Midwest

8.5.3. South

8.5.4. West

9. USA System Integrator Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA System Integrator Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA System Integrator Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA System Integrator Market.

Frequently Asked Questions

01. How big is the USA System Integrator Market?

The USA System Integrator Market is valued at USD XX billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the USA System Integrator Market?

Key challenges in the USA System Integrator Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the USA System Integrator Market?

Major players in the USA System Integrator Market include Accenture, IBM, Siemens, Honeywell, Rockwell Automation, among others.

04. What are the growth drivers for the USA System Integrator Market?

The primary growth drivers for the USA System Integrator Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.