USA Tea Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD1532

June 2025

80

About the Report

USA Tea Market Overview

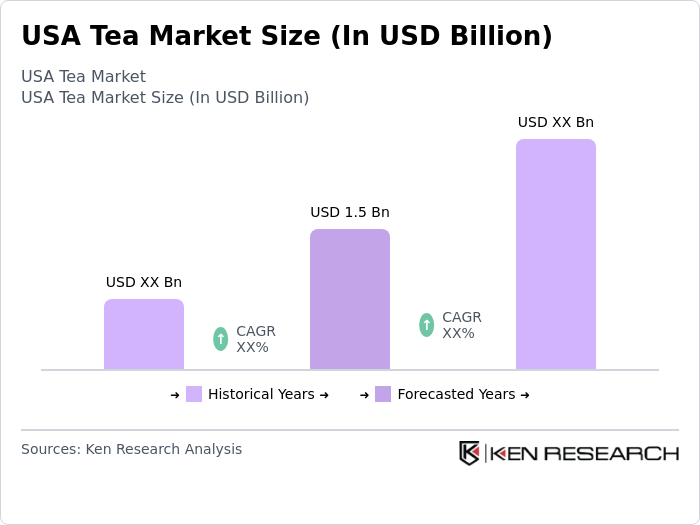

- The USA Tea Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness of health benefits associated with tea consumption, alongside a rising trend towards premium and specialty teas. The market has seen a shift towards organic and sustainably sourced products, reflecting changing consumer preferences and lifestyle choices.

- Key players in this market include cities like New York, Los Angeles, and Chicago, which dominate due to their large populations, diverse consumer bases, and strong retail infrastructures. These urban centers are also hubs for health-conscious consumers, driving demand for specialty and organic tea products.

- In recent years, the USA government implemented regulations to ensure the safety and quality of tea products. The Food and Drug Administration (FDA) established guidelines for labeling and health claims on tea products, requiring manufacturers to provide accurate information regarding the health benefits and ingredients of their products, thereby enhancing consumer trust and safety.

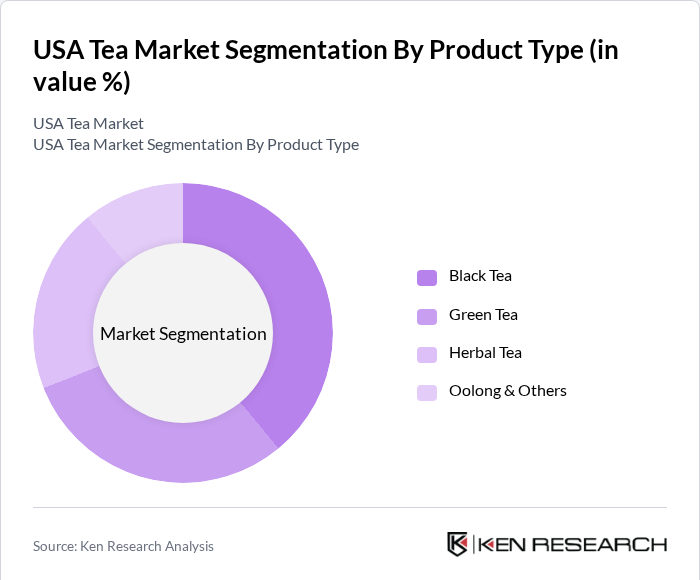

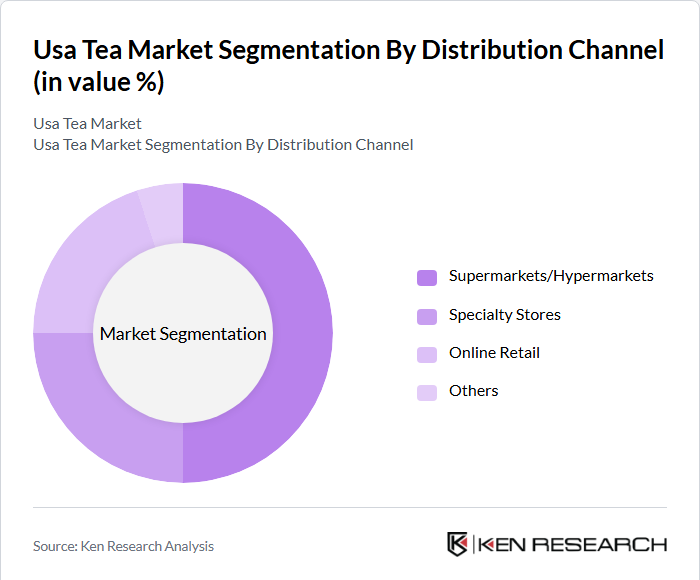

USA Tea Market Segmentation

By Product Type: The market is segmented into black tea, green tea, oolong tea, and herbal tea. Black tea holds the largest share of the market, driven by its widespread popularity and versatility, especially in iced tea and chai beverages. Green tea is the fastest-growing segment, favored by health-conscious consumers for its perceived health benefits. Herbal and oolong teas are also gaining traction, particularly among consumers seeking unique flavors and wellness-oriented blends.

By Distribution Channel: The market is segmented into supermarkets/hypermarkets, online retail, specialty stores, and others. Supermarkets and hypermarkets continue to dominate, due to their broad reach and variety of offerings. Online retail is rapidly expanding, fueled by the growth of e-commerce and consumer preference for convenience. Specialty stores cater to niche markets, offering premium and artisanal teas.

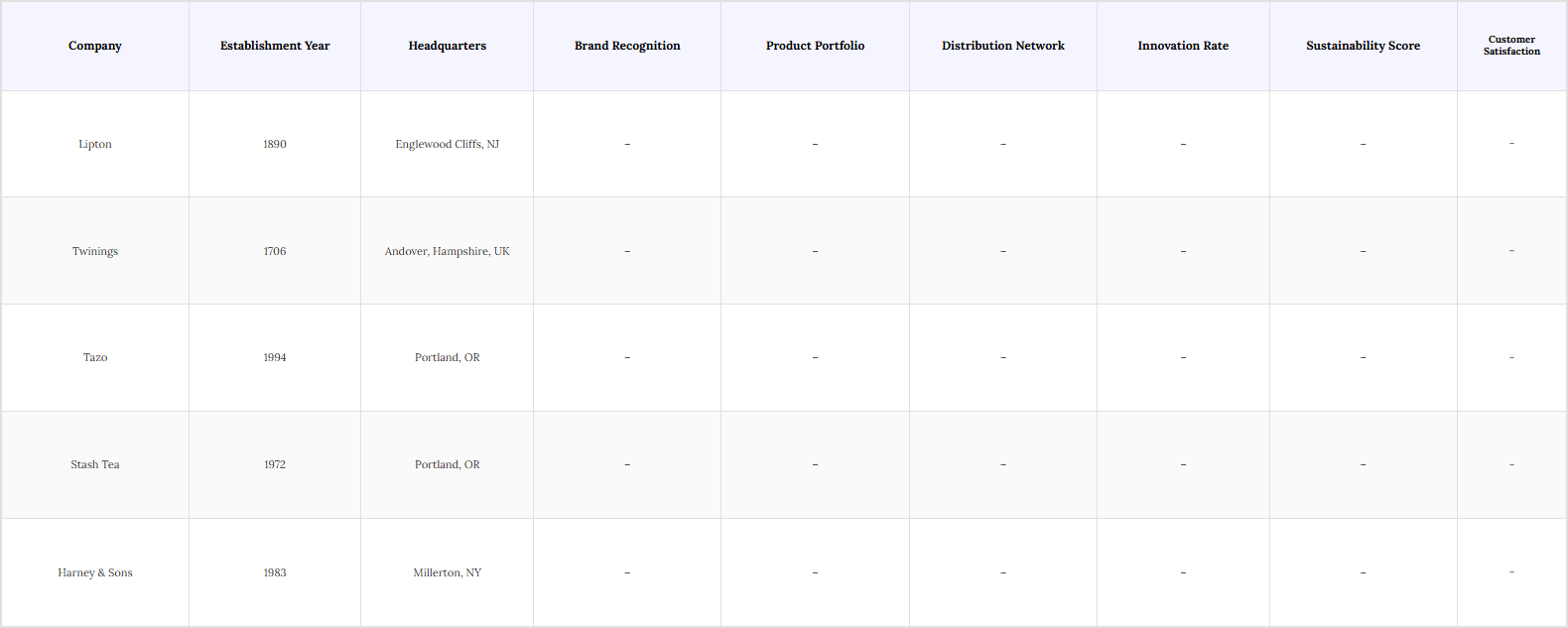

USA Tea Market Competitive Landscape

The USA Tea Market is characterized by a competitive landscape with several key players, including established brands and emerging companies. Prominent players such as Lipton, Twinings, and Celestial Seasonings dominate the market, leveraging their strong brand recognition and extensive distribution networks. The market is also witnessing the entry of niche brands focusing on organic and specialty teas, which cater to the growing health-conscious consumer segment.

USA Tea Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness Among Consumers: The USA tea market is growing due to rising health consciousness, with many consumers prioritizing beverages offering health benefits like relaxation and immunity support. Demand for antioxidant-rich teas, such as green and herbal varieties, is increasing, driven by their proven roles in reducing chronic disease risks. Scientific studies and health organizations highlight tea’s benefits in lowering cardiovascular and cancer risks, boosting market growth. Additionally, organic and functional teas are gaining popularity as consumers seek natural, health-promoting options.

- Rising Popularity of Specialty and Premium Teas: The specialty and premium tea segment in the USA is gaining momentum, accounting for nearly 30% of total tea sales, driven by consumers seeking unique flavors and high-quality products. Specialty tea sales have increased by about 20% recently, reflecting growing interest in artisanal and gourmet tea experiences. This trend aligns with reports from the National Tea Association highlighting consumer shifts toward premiumization, supported by innovations, social media influence, and greater accessibility through e-commerce platforms.

- Expansion of Distribution Channels: The expansion of distribution channels, particularly online retail, is significantly contributing to market growth. E-commerce sales of tea products surged substantially in 2024, reaching approximately $1 billion. This shift is driven by the convenience of online shopping and the increasing number of consumers preferring home delivery options. Retailers are investing in digital platforms to enhance customer reach, aligning with the broader trend of digital transformation in the beverage industry.

Market Challenges

- Intense Competition Among Brands: The USA tea market is characterized by intense competition, with over 200 brands vying for market share. This saturation leads to price wars, impacting profit margins. Major players like Lipton and Twinings dominate, holding majority of the market share, while smaller brands struggle to differentiate themselves. The competitive landscape necessitates continuous innovation and marketing efforts to maintain consumer interest and loyalty.

- Fluctuating Raw Material Prices: Fluctuating prices of raw materials, particularly tea leaves, pose a significant challenge for manufacturers. In 2023, the price of high-quality tea leaves increased substantially due to adverse weather conditions affecting production in key regions. This volatility can lead to increased production costs, which may be passed on to consumers, potentially reducing demand. Companies must develop strategies to mitigate these risks and stabilize their supply chains.

USA Tea Market Future Outlook

The USA tea market is poised for continued growth, driven by evolving consumer preferences towards healthier beverage options and innovative product offerings. The increasing demand for organic and sustainably sourced teas is expected to shape market dynamics, with consumers willing to pay a premium for quality. Additionally, the rise of ready-to-drink tea products is anticipated to attract younger demographics, further expanding the market. Companies that adapt to these trends will likely capture significant market share in the coming years.

Market Opportunities

- Growth of E-commerce Platforms: The rapid growth of e-commerce platforms presents a significant opportunity for tea brands to reach a broader audience. With online tea sales projected to reach all time high in 2025, companies can leverage digital marketing strategies to enhance visibility and customer engagement, tapping into the convenience-driven shopping trend.

- Innovations in Tea Products and Flavors: There is a growing opportunity for innovation in tea products, particularly in flavor profiles and functional blends. The introduction of unique flavors and health-focused blends can attract health-conscious consumers. Companies that invest in research and development to create novel products are likely to gain a competitive edge and capture emerging market segments.

Scope of the Report

| By Product Type |

Black Tea Green Tea Herbal Tea Oolong & Others |

| By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Specialty Stores Others |

| By Packaging Type |

Loose Leaf Tea Bags Ready-to-Drink |

| By Region |

North America Europe Asia-Pacific Latin America |

| By Consumer Age Group |

Millennials Generation X Baby Boomers |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Agriculture, Food and Drug Administration)

Manufacturers and Producers

Distributors and Retailers

Importers and Exporters

Industry Associations (e.g., Tea Association of the USA)

Financial Institutions

Market Analysts and Economic Research Organizations

Companies

Players Mentioned in the Report:

Lipton

Twinings

Tazo

Stash Tea

Harney & Sons

Brewed Awakening Teas

Leaf & Blossom

Steeped Serenity

Urban Infusions

Harmony Herbal Teas

Table of Contents

1. USA Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Tea Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Tea Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness Among Consumers

3.1.2. Rising Popularity of Specialty and Premium Teas

3.1.3. Expansion of Distribution Channels

3.2. Market Challenges

3.2.1. Intense Competition Among Brands

3.2.2. Fluctuating Raw Material Prices

3.2.3. Changing Consumer Preferences

3.3. Opportunities

3.3.1. Growth of E-commerce Platforms

3.3.2. Innovations in Tea Products and Flavors

3.3.3. Increasing Demand for Organic and Natural Products

3.4. Trends

3.4.1. Rise of Ready-to-Drink Tea Products

3.4.2. Popularity of Tea-Based Beverages

3.4.3. Focus on Sustainable and Eco-Friendly Packaging

3.5. Government Regulation

3.5.1. Food Safety Standards and Compliance

3.5.2. Labeling and Advertising Regulations

3.5.3. Import and Export Regulations

3.5.4. Environmental Regulations Affecting Production

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. USA Tea Market Segmentation

4.1. By Product Type

4.1.1. Black Tea

4.1.2. Green Tea

4.1.3. Herbal Tea

4.1.4. Oolong Tea & Others

4.2. By Distribution Channel

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online Retail

4.2.3. Specialty Stores

4.2.4. Others

4.3. By Packaging Type

4.3.1. Loose Leaf

4.3.2. Tea Bags

4.3.3. Ready-to-Drink

4.4. By Region

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.5. By Consumer Age Group

4.5.1. Millennials

4.5.2. Generation X

4.5.3. Baby Boomers

5. USA Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lipton

5.1.2. Twinings

5.1.3. Tazo

5.1.4. Stash Tea

5.1.5. Harney & Sons

5.1.6. Brewed Awakening Teas

5.1.7. Leaf & Blossom

5.1.8. Steeped Serenity

5.1.9. Urban Infusions

5.1.10. Harmony Herbal Teas

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Product Range and Innovation

5.2.3. Pricing Strategies

5.2.4. Distribution Network Efficiency

5.2.5. Brand Loyalty and Customer Retention

5.2.6. Marketing and Advertising Spend

5.2.7. Sustainability Practices

5.2.8. Customer Satisfaction Ratings

6. USA Tea Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Tea Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Tea Market Future Market Segmentation

8.1. By Product Type

8.1.1. Black Tea

8.1.2. Green Tea

8.1.3. Herbal Tea

8.1.4. Oolong Tea 7 Others

8.2. By Distribution Channel

8.2.1. Supermarkets/Hypermarkets

8.2.2. Online Retail

8.2.3. Specialty Stores

8.2.4. Others

8.3. By Packaging Type

8.3.1. Loose Leaf

8.3.2. Tea Bags

8.3.3. Ready-to-Drink

8.4. By Region

8.4.1. North America

8.4.2. Europe

8.4.3. Asia-Pacific

8.4.4. Latin America

8.5. By Consumer Age Group

8.5.1. Millennials

8.5.2. Generation X

8.5.3. Baby Boomers

9. USA Tea Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Tea Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Tea Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Tea Market.

Frequently Asked Questions

01. How big is the USA Tea Market?

The USA Tea Market is valued at USD 1.5 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the USA Tea Market?

Key challenges in the USA Tea Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the USA Tea Market?

Major players in the USA Tea Market include Lipton, Twinings, Celestial Seasonings, Stash Tea, Harney & Sons, among others.

04. What are the growth drivers for the USA Tea Market?

The primary growth drivers for the USA Tea Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.