USA Teleradiology Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD10924

November 2024

95

About the Report

USA Teleradiology Market Overview

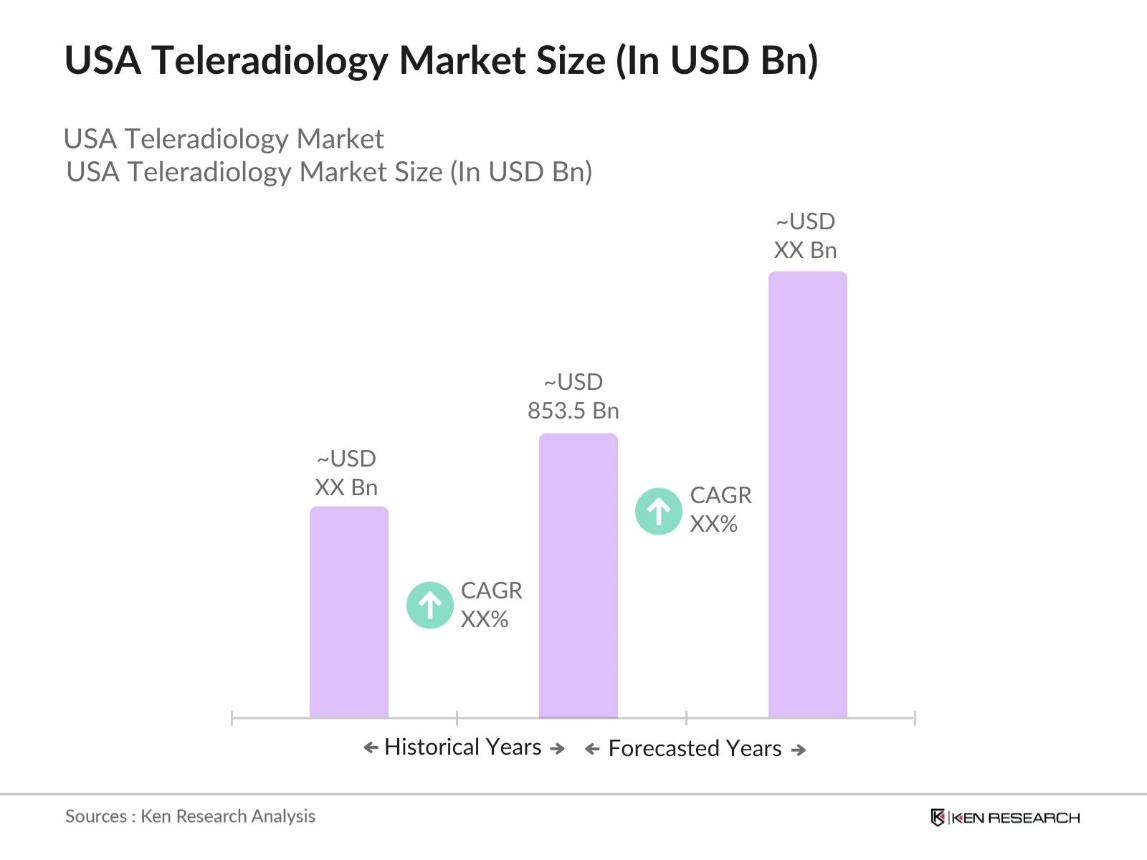

- The USA Teleradiology Market is valued at USD 853.5 million, with growth driven by advancements in telemedicine technology and the increasing need for remote diagnostic services. The rising demand for teleradiology is bolstered by the shortage of radiologists, especially in rural and underserved areas, where teleradiology services provide efficient diagnostic support.

- Key regions in the USA, such as California, Texas, and New York, dominate the teleradiology market due to their large population bases and advanced healthcare infrastructure. These regions also have a high concentration of major hospitals and diagnostic centers actively adopting telemedicine technologies to enhance service accessibility. The availability of high-speed internet and digital infrastructure in these regions has made teleradiology a viable option, reducing turnaround time for radiology reports and improving patient outcomes.

- Federal telehealth regulations significantly shape the U.S. teleradiology landscape. The Federal Communications Commission (FCC) allocated funding to expand telehealth in rural and underserved areas, ensuring regulatory support for telehealth providers. In 2023, $1.6 billion was designated for rural telehealth infrastructure, creating opportunities for teleradiology providers to expand services. These regulations aim to improve healthcare access, particularly in remote areas, while maintaining a supportive regulatory environment for telehealth innovations.

USA Teleradiology Market Segmentation

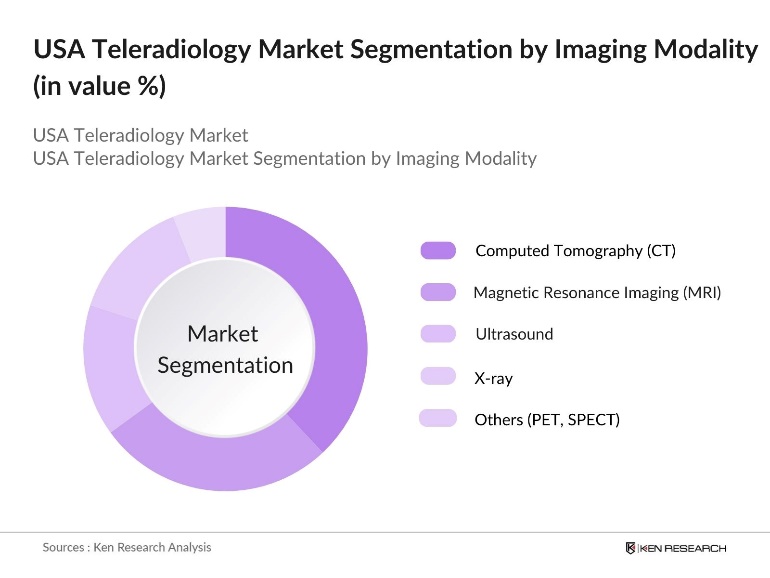

By Imaging Modality: The market is segmented by imaging modality into Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, X-ray, and others (e.g., PET, SPECT). CT imaging holds a dominant market share due to its crucial role in emergency and complex diagnostic imaging. The demand for remote CT analysis has grown significantly as CT scans are often required urgently, and teleradiology allows radiologists to interpret images and provide diagnoses quickly, regardless of location. With high-speed digital transmission of these images, hospitals can improve emergency response, a key factor driving CT's leading position.

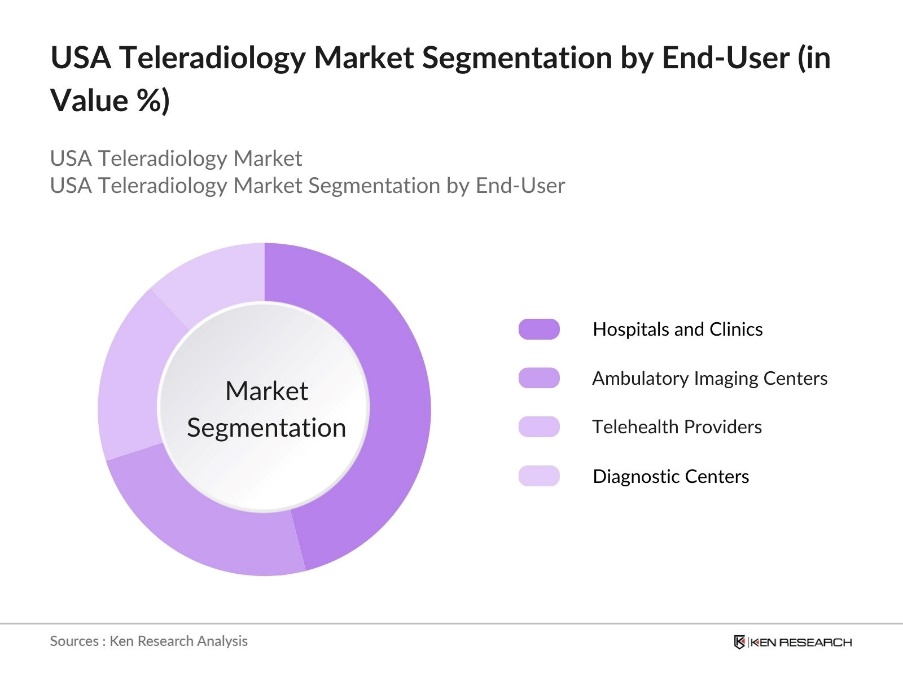

By End-User: The market is segmented by end-user into Hospitals and Clinics, Ambulatory Imaging Centers, Telehealth Providers, and Diagnostic Centers. Hospitals and Clinics account for the largest share due to the high volume of patients and the demand for comprehensive diagnostic capabilities. Teleradiology supports these healthcare institutions by providing access to radiology experts, especially in areas where radiologist availability is limited. Moreover, teleradiologys integration with hospital networks enables faster processing of radiology reports, essential in critical care and trauma cases.

USA Teleradiology Market Competitive Landscape

The USA Teleradiology market is shaped by major players who leverage strong digital capabilities and specialized imaging services. Companies like Philips Healthcare and Virtual Radiologic (vRad) are prominent, using extensive networks to serve a broad range of healthcare facilities. This market consolidation highlights the influence of these companies, as they bring innovative imaging solutions to the market.

USA Teleradiology Industry Analysis

Growth Drivers

- Rising Demand for Remote Diagnostic Services: The USA has witnessed an increased reliance on remote diagnostic services, largely attributed to the rise in telehealth utilization across regions. In 2024, the U.S. Department of Health and Human Services (HHS) reported that approximately 90 million Americans have accessed remote diagnostic and telehealth services due to its convenience and efficiency. This shift, further accelerated by the shortage of onsite medical professionals in rural areas, has made teleradiology indispensable, particularly for medical facilities struggling to meet patient demands.

- Increased Adoption of AI in Radiology: AI integration in radiology is on the rise, with the U.S. seeing significant investments aimed at improving image analysis and diagnostic accuracy. As of October 19, 2023, the FDA reported a total of 692 AI-enabled medical devices that had received marketing authorization, demonstrating a strong commitment to advancing medical imaging technology. The use of AI reduces diagnostic turnaround time, enhancing the teleradiology sectors ability to deliver timely diagnostics. This trend is driven by the efficiency AI brings to radiology, allowing quicker, more accurate analysis that aids underserved areas without immediate access to radiologists.

- Shortage of Radiologists in Rural Areas: Rural U.S. regions face a significant shortage of radiologists, leaving many areas without direct access to these essential specialists. Teleradiology helps fill this gap by providing remote diagnostic services to underserved hospitals and clinics, ensuring timely healthcare support. This approach not only addresses the lack of onsite radiologists but also enhances healthcare access and equity in these communities.

Market Challenges

- Regulatory Hurdles in Data Sharing (HIPAA Compliance): Navigating HIPAA compliance is complex in the teleradiology sector due to strict regulations around patient data privacy. These regulations impose rigorous data-sharing protocols, and non-compliance can result in penalties. This creates challenges in sharing information crucial for remote diagnostic services, especially in cases involving cross-border collaborations. Ensuring HIPAA-compliant solutions is essential for maintaining the viability of teleradiology practices within the regulatory landscape.

- Cybersecurity Concerns in Medical Imaging: Cybersecurity concerns are increasingly critical in medical imaging, with teleradiology systems particularly vulnerable due to their reliance on digital record transmission. Cyber threats targeting sensitive patient data have heightened the need for robust cybersecurity infrastructure. Protecting medical imaging data is essential for maintaining trust in teleradiology and safeguarding patient information amid growing digital threats in healthcare.

USA Teleradiology Market Future Outlook

The USA Teleradiology market is expected to grow significantly, driven by the continuous expansion of telehealth services and the need for accessible radiology in remote areas. Increasing investments in AI-enhanced diagnostics and advanced imaging technologies are likely to improve diagnostic accuracy, reduce costs, and make teleradiology services more efficient. Additionally, government policies favoring digital healthcare solutions will support market growth as healthcare providers focus on expanding remote healthcare infrastructure.

Market Opportunities

- Expansion of Telehealth Services: The expansion of telehealth services is driving growth opportunities for teleradiology, especially in underserved areas. By enhancing connectivity in remote regions, telehealth enables broader deployment of teleradiology, reducing geographic barriers to diagnostic services. This improved access helps healthcare providers reach more patients, addressing gaps in diagnostic availability and supporting healthcare equity across diverse locations.

- Integration with Machine Learning and Deep Learning Tools: Integrating machine learning and deep learning tools offers significant advancements for teleradiology. These technologies increase diagnostic speed and precision, allowing providers to deliver faster, more reliable results. This AI-driven shift enables teleradiology to expand its services efficiently, benefiting both remote and urban patients. The support for AI in teleradiology further enhances its role in improving diagnostic capabilities across the healthcare sector.

Scope of the Report

|

Imaging Modality |

Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound X-ray Others (e.g., PET, SPECT) |

|

Application |

Emergency Care Primary Diagnosis Consultation and Second Opinion Research and Training |

|

End-User |

Hospitals and Clinics Ambulatory Imaging Centers Telehealth Providers Diagnostic Centers |

|

Deployment Model |

Cloud-Based On-Premises Hybrid |

|

Region |

Northeast USA Midwest USA Southern USA Western USA |

Products

Key Target Audience

Telehealth Industry

Radiology Software Companies

Healthcare Cybersecurity Firms

Telemedicine Startups

Government and Regulatory Bodies (FDA, CMS)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Philips Healthcare

GE Healthcare

Siemens Healthineers

Virtual Radiologic (vRad)

MEDNAX Radiology Solutions

Radiology Partners

Envision Healthcare

Teleradiology Solutions

Everlight Radiology

Aris Radiology

Table of Contents

1. USA Teleradiology Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Penetration Rate

1.4 Market Segmentation Overview

2. USA Teleradiology Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Technological Milestones and Innovations

3. USA Teleradiology Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Remote Diagnostic Services

3.1.2 Increased Adoption of AI in Radiology

3.1.3 Shortage of Radiologists in Rural Areas

3.1.4 Growing Focus on Cost-Effective Solutions

3.2 Market Challenges

3.2.1 Regulatory Hurdles in Data Sharing (HIPAA Compliance)

3.2.2 Cybersecurity Concerns in Medical Imaging

3.2.3 Limited Reimbursement Framework

3.3 Opportunities

3.3.1 Expansion of Telehealth Services

3.3.2 Integration with Machine Learning and Deep Learning Tools

3.3.3 Increased Accessibility to Advanced Imaging in Underserved Areas

3.4 Market Trends

3.4.1 Adoption of Cloud-Based Platforms for Image Storage

3.4.2 Collaborative Partnerships with Hospital Networks

3.4.3 Rising Use of Mobile Radiology Units

3.5 Government Regulations

3.5.1 Health Insurance Portability and Accountability Act (HIPAA)

3.5.2 Medicare and Medicaid Services Reimbursement Policies

3.5.3 Federal Telehealth Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. USA Teleradiology Market Segmentation

4.1 By Imaging Modality (In Value %)

4.1.1 Computed Tomography (CT)

4.1.2 Magnetic Resonance Imaging (MRI)

4.1.3 Ultrasound

4.1.4 X-ray

4.1.5 Others (e.g., PET, SPECT)

4.2 By Application (In Value %)

4.2.1 Emergency Care

4.2.2 Primary Diagnosis

4.2.3 Consultation and Second Opinion

4.2.4 Research and Training

4.3 By End-User (In Value %)

4.3.1 Hospitals and Clinics

4.3.2 Ambulatory Imaging Centers

4.3.3 Telehealth Providers

4.3.4 Diagnostic Centers

4.4 By Deployment Model (In Value %)

4.4.1 Cloud-Based

4.4.2 On-Premises

4.4.3 Hybrid

4.5 By Region (In Value %)

4.5.1 North

4.5.2 East

4.5.3 South

4.5.4 West

5. USA Teleradiology Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Philips Healthcare

5.1.2 GE Healthcare

5.1.3 Siemens Healthineers

5.1.4 Teleradiology Solutions

5.1.5 MEDNAX Services

5.1.6 Radiology Partners

5.1.7 Envision Healthcare

5.1.8 USARAD Holdings, Inc.

5.1.9 4ways Healthcare Ltd.

5.1.10 Everlight Radiology

5.1.11 Life Image

5.1.12 Virtual Radiologic (vRad)

5.1.13 Aris Radiology

5.1.14 RamSoft Inc.

5.1.15 Nucleus Health

5.2 Cross-Comparison Parameters (Revenue, Technological Integration, Imaging Modality Specialization, Regional Presence, Client Base, Innovation in AI Tools, Cybersecurity Protocols, Telehealth Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Teleradiology Market Regulatory Framework

6.1 Data Privacy Standards (HIPAA)

6.2 Compliance with Federal Communication Commission (FCC)

6.3 Accreditation Requirements (e.g., ACR Accreditation)

6.4 Cross-State Licensing Regulations

7. USA Teleradiology Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Teleradiology Future Market Segmentation

8.1 By Imaging Modality (In Value %)

8.2 By Application (In Value %)

8.3 By End-User (In Value %)

8.4 By Deployment Model (In Value %)

8.5 By Region (In Value %)

9. USA Teleradiology Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Strategies for New Market Entrants

9.4 White Space Opportunity Identification

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all major stakeholders within the USA Teleradiology Market. This step includes gathering comprehensive data on the industrys structure using reliable secondary and proprietary sources, aiming to identify the critical variables influencing market dynamics.

Step 2: Market Analysis and Data Collection

In this phase, historical data is compiled to evaluate trends in market segments and identify leading segments. Key metrics such as modality adoption rates and geographic distribution are analyzed, ensuring a comprehensive understanding of market performance.

Step 3: Hypothesis Validation and Expert Interviews

Market hypotheses are formulated and validated through expert consultations with industry insiders from major teleradiology companies. These interviews provide operational and financial insights, which refine the research findings and enhance data reliability.

Step 4: Synthesis and Final Report Compilation

The final phase involves synthesizing all gathered data, followed by validation against market trends. The report is finalized with verified data on product segments, key players, and strategic trends, ensuring a thorough market overview for stakeholders.

Frequently Asked Questions

01. How big is the USA Teleradiology Market?

The USA Teleradiology Market is valued at USD 853.5 million, with growth attributed to increasing demand for remote radiology solutions and significant advancements in telemedicine technology.

02. What are the major challenges in the USA Teleradiology Market?

Challenges in USA Teleradiology Market include regulatory compliance, especially concerning HIPAA regulations, cybersecurity concerns in data transmission, and limitations in reimbursement frameworks, which impact market adoption rates.

03. Who are the major players in the USA Teleradiology Market?

Major players in USA Teleradiology Market include Philips Healthcare, Virtual Radiologic (vRad), MEDNAX Radiology Solutions, and Siemens Healthineers, all of whom dominate through advanced imaging technologies and extensive partnerships with healthcare providers.

04. What are the key growth drivers in the USA Teleradiology Market?

The USA Teleradiology Market growth is driven by the increased adoption of telehealth, the shortage of radiologists in underserved areas, and continuous advancements in imaging technology, especially those integrating AI for enhanced diagnostic accuracy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.