USA Textile Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD3333

November 2024

86

About the Report

USA Textile Market Overview

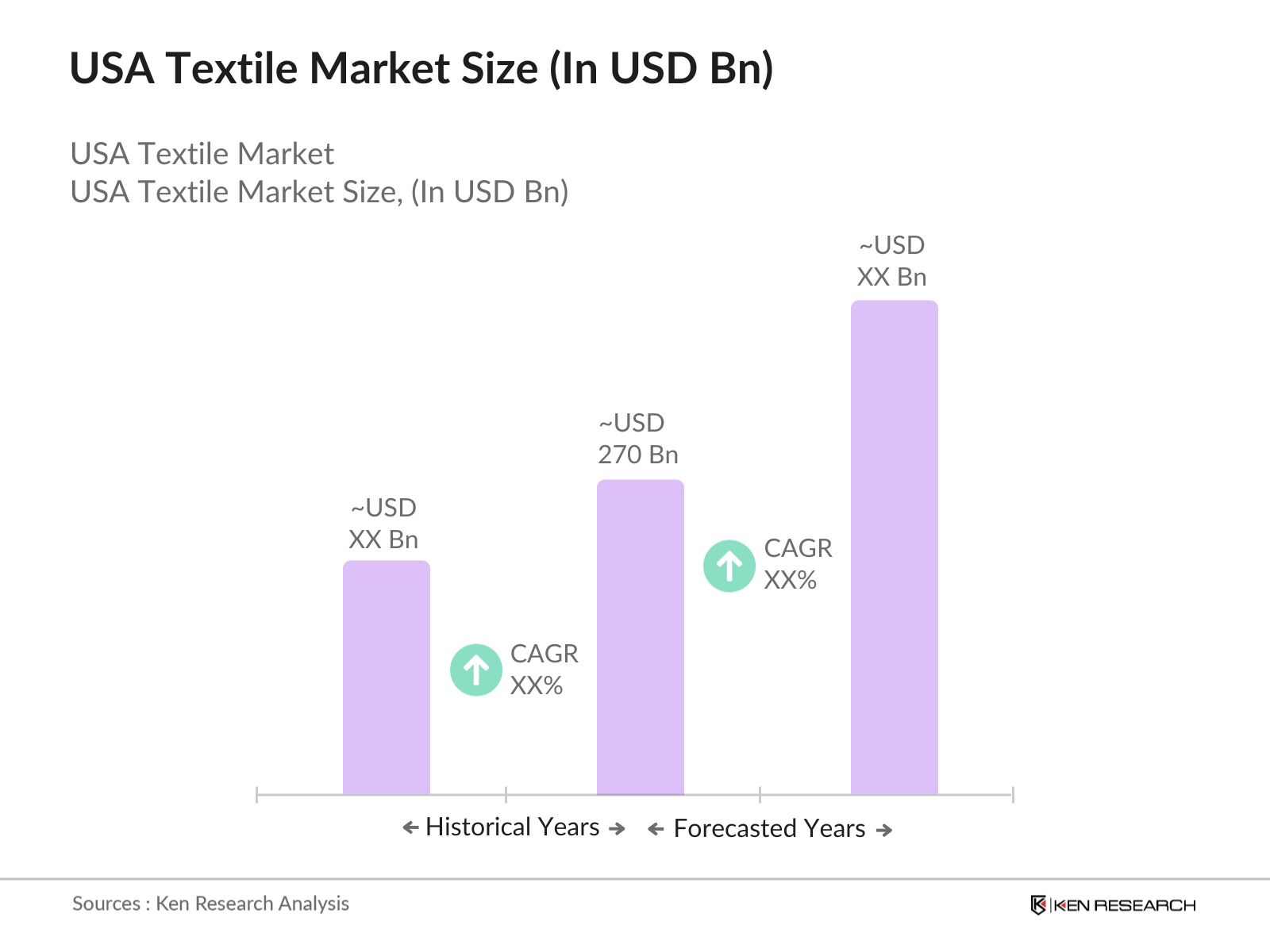

- The USA textile market is valued at USD 270 billion, based on a five-year historical analysis, largely driven by technological advancements in textile manufacturing and increasing demand for sustainable materials. Rapid innovation in textile technology, such as the integration of smart fabrics and wearable technology, along with growing awareness of environmental sustainability, has bolstered market growth. Demand for eco-friendly and organic textiles, driven by changing consumer preferences, further propels this market, positioning it as a dynamic sector within the U.S. economy.

- Within the USA, states like California, North Carolina, and Texas dominate the textile market due to their established infrastructure and proximity to both raw materials and skilled labor. California leads in innovation and high-tech textile products, while North Carolina and Texas benefit from a strong legacy in textile manufacturing, abundant natural fibers, and advanced logistics networks that ensure streamlined production and distribution.

- Textile safety compliance remains critical in the U.S., with the Consumer Product Safety Commission enforcing stringent flammability standards. Data from 2024 confirms that nearly 2,500 textile products were tested for safety compliance, ensuring consumer protection against hazardous materials. Compliance with federal standards impacts production costs and supports industry competitiveness by maintaining quality benchmarks.

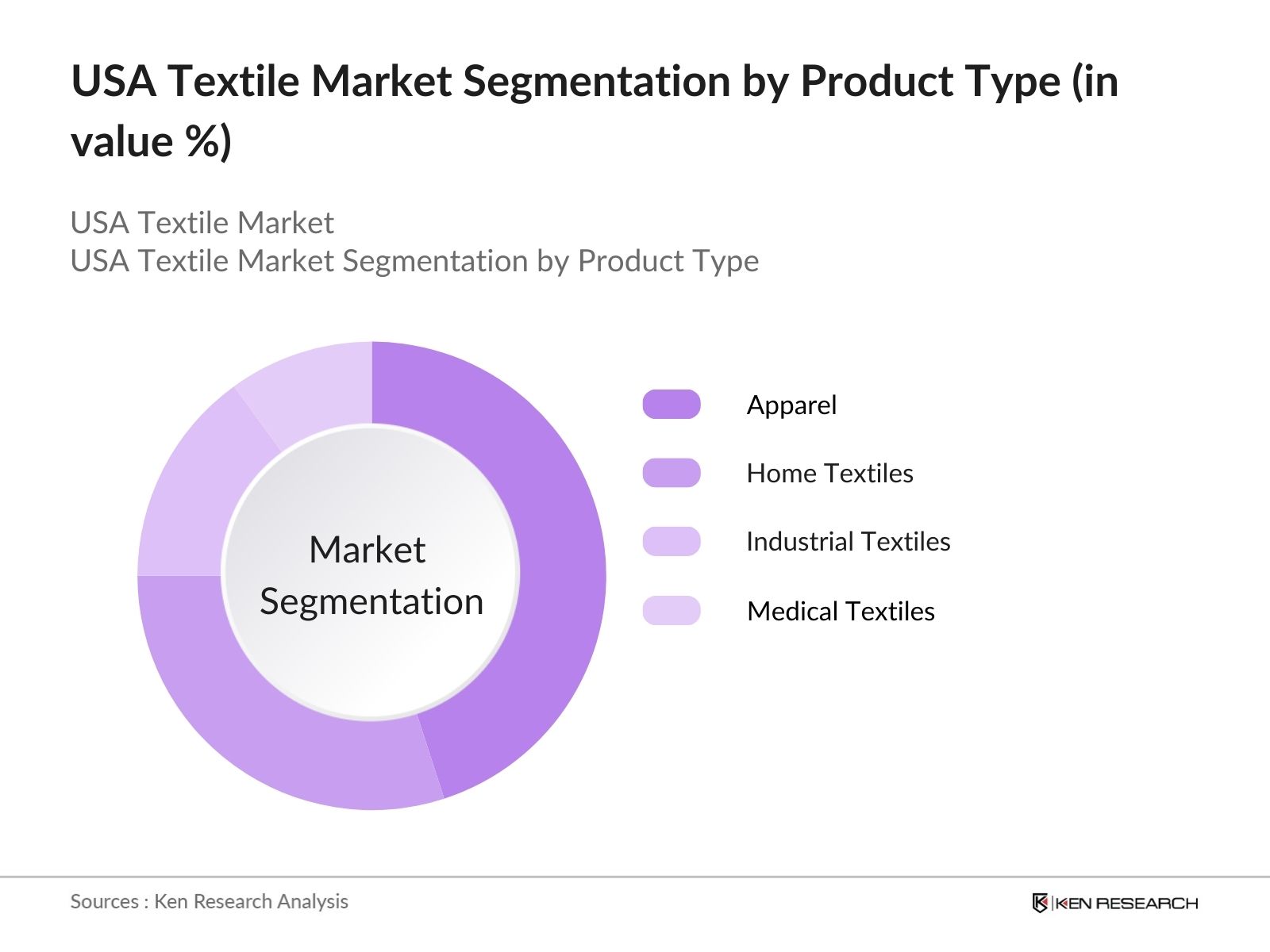

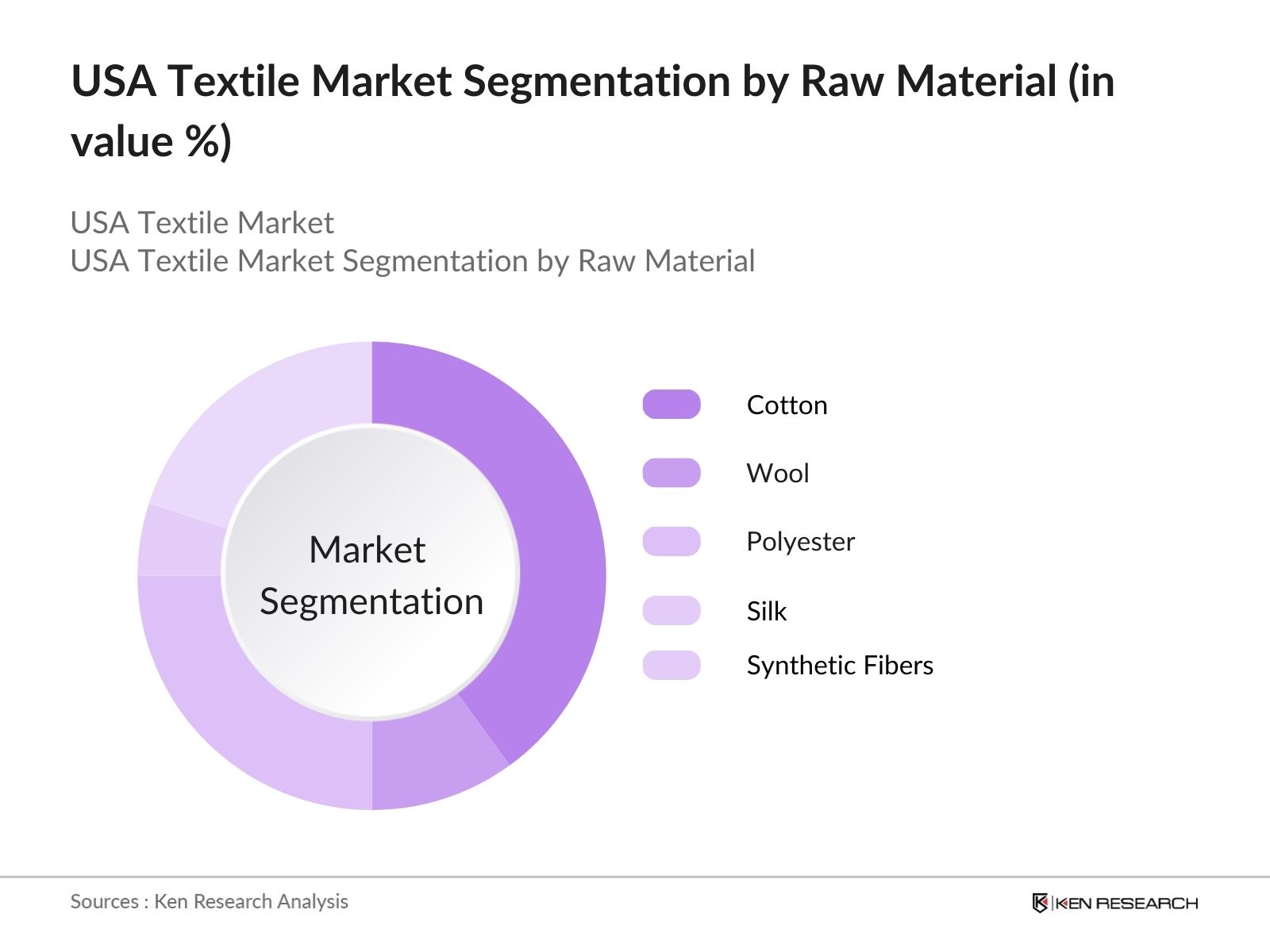

USA Textile Market Segmentation

The USA textile market is segmented by product type and by raw material.

- By Product Type: The USA textile market is segmented by product type into apparel, home textiles, industrial textiles, and medical textiles. Recently, apparel holds a dominant market share in the product type segment, fueled by the continuous demand for fast fashion and athleisure wear. Major brands and e-commerce channels have boosted apparel sales, while advancements in design and customization options cater to diverse consumer preferences. This segment also benefits from innovation in fabric types, including sustainable materials like organic cotton and recycled fibers.

- By Raw Material: The USA textile market is further segmented by raw material into cotton, wool, polyester, silk, and synthetic fibers. Cotton dominates the raw material segment, driven by its versatility, comfort, and sustainability. Despite the rise of synthetic materials, cotton remains preferred for both fashion and household textiles, especially with organic cotton gaining popularity due to its eco-friendly nature. Furthermore, initiatives promoting sustainable cotton production have strengthened the segment's foothold in the market.

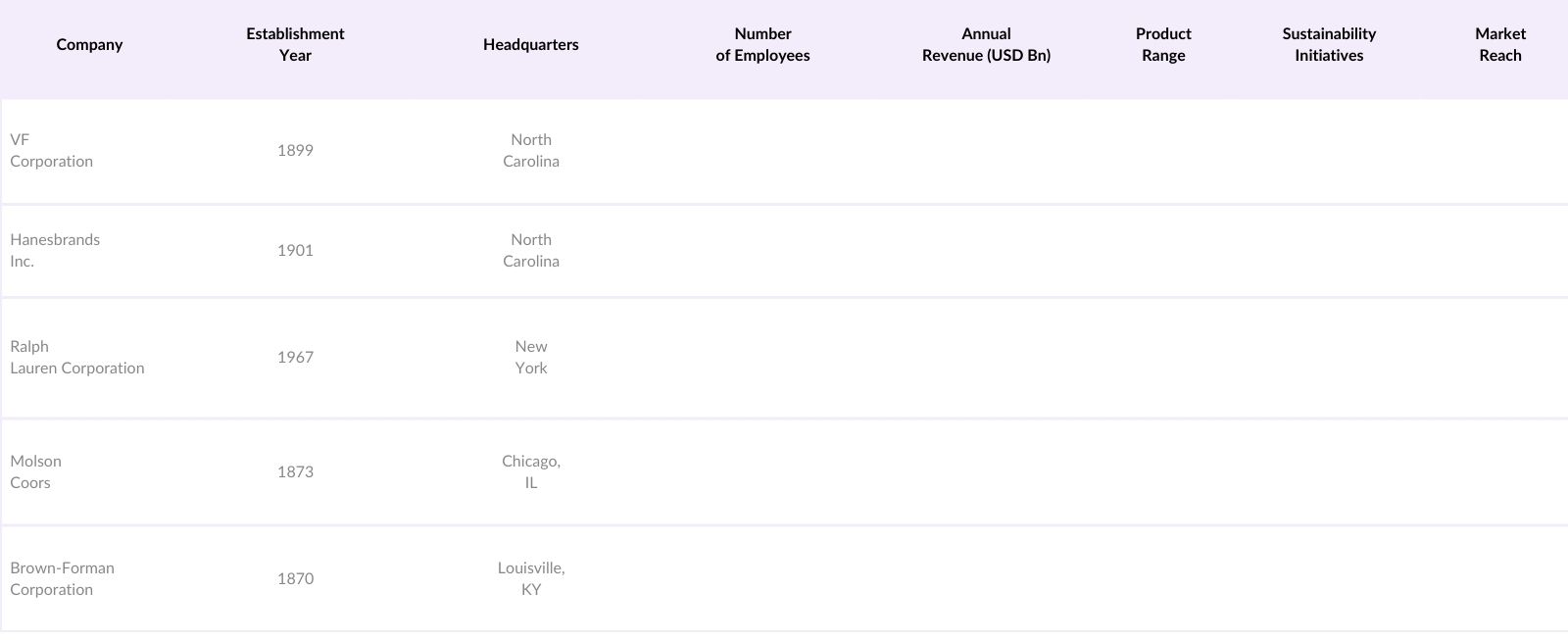

USA Textile Market Competitive Landscape

The USA textile market is dominated by several key players, each contributing unique strengths to the market. This consolidation highlights the considerable influence these companies wield, leveraging extensive distribution networks, advanced manufacturing capabilities, and continuous investments in research and innovation.

USA Textile Market Analysis

Growth Drivers

- Technological Advancements (e.g., Smart Fabrics, IoT): The U.S. textile industry has integrated advanced technologies like IoT and smart fabrics, with significant applications in sectors like healthcare, where wearable textiles monitor patient vitals. In 2024, the Department of Commerce reports that over 7,500 companies in the U.S. textile industry have integrated IoT for streamlined production and enhanced fabric functionality, contributing to $20 billion in value across wearable tech alone. Industry support from government-funded initiatives encourages IoT adoption, aiming to increase productivity in textile mills by 30% through automation advancements.

- Sustainability Initiatives (e.g., Recycled Fibers): Sustainable materials drive significant growth, with recycled fibers increasingly favored by U.S. manufacturers to reduce waste. Data from the Environmental Protection Agency (EPA) highlights that textile recycling programs diverted 4 million tons of textile waste from landfills in 2023, with new tax incentives encouraging manufacturers to adopt eco-friendly practices. The use of recycled polyester in textile manufacturing grew by 15% from 2022, and industry projections expect a further 20% adoption rate due to regulatory support for sustainable production.

- Expansion of E-commerce and Fast Fashion: The expansion of e-commerce platforms has fueled the fast fashion sector in the U.S., with textile exports for online retail reaching $5 billion in 2024. According to the U.S. Census Bureau, over 45% of textile sales were attributed to e-commerce in 2023, with strong contributions from apparel and home goods. Enhanced online shopping infrastructure and logistics have minimized delivery times, supporting market access for U.S. manufacturers and enabling small businesses to scale nationally.

Market Challenges

- Volatile Raw Material Prices: The textile sector in the U.S. faces price instability for cotton and synthetic fibers, impacted by global supply chain shifts. U.S. Department of Agriculture data shows that cotton prices surged by 25% in 2023 due to climate impacts and reduced global yields, increasing operational costs for textile producers. The fluctuating prices contribute to unstable profit margins, especially for small and medium textile companies reliant on steady raw material costs.

- High Labor Costs: Labor remains a primary cost driver for U.S. textile production, with average hourly wages for textile workers at $16.80 in 2024, as reported by the Bureau of Labor Statistics. Despite automation efforts, labor-intensive processes like sewing and finishing limit potential for wage reduction. High labor costs impact U.S. textile competitiveness globally, where Asian manufacturers operate with significantly lower labor expenses.

USA Textile Market Future Outlook

Over the next five years, the USA textile market is anticipated to experience robust growth driven by technological advancements, sustainability initiatives, and evolving consumer preferences. Increasing demand for functional textiles, such as smart fabrics and eco-friendly materials, alongside the adoption of digital manufacturing techniques, will likely boost market expansion. With support from government incentives and rising environmental awareness among consumers, the textile sector is positioned for continued innovation and transformation.

Market Opportunities

- Growth in Functional and Technical Textiles: Functional textiles, including high-performance and protective fabrics, have gained demand in U.S. industries like healthcare and automotive. The U.S. Department of Commerce estimates that technical textiles make up 40% of the textile output, with defense and medical applications driving the majority of this segment. Government grants for research in wearable health technology further incentivize growth, highlighting an expected demand surge for antimicrobial fabrics in 2024.

- Demand for Sustainable and Organic Fabrics: Consumer demand for organic and sustainable fabrics is rising, with U.S. imports of organic cotton products reaching 500 million units in 2023. Environmental Protection Agency data shows a steady decline in synthetic fiber usage, with organic cotton-based textiles favored for eco-conscious consumers. This demand presents significant growth opportunities for U.S. textile producers aiming to capture the green consumer segment in both domestic and international markets.

Scope of the Report

|

Apparel Home Textiles Industrial Textiles Medical Textiles |

|

|

By Raw Material |

Cotton Wool Polyester Silk Synthetic Fibers |

|

By Application |

Apparel and Fashion Home Furnishing Industrial and Technical Use Healthcare and Medical |

|

By Distribution Channel |

Online Offline Retail Wholesale |

|

By Region |

North East West South |

Products

Key Target Audience

Textile Manufacturers

Apparel Retailers

Industrial Textile Companies

Healthcare Facilities and Medical Textile Buyers

Home Furnishing Retailers

Banks and Financial Institutes

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency, U.S. Customs and Border Protection)

E-commerce Platforms

Companies

Players Mention in the Report:

VF Corporation

Hanesbrands Inc.

Ralph Lauren Corporation

PVH Corp.

Levi Strauss & Co.

Under Armour Inc.

Gildan Activewear Inc.

Nike Inc.

Fruit of the Loom, Inc.

Carter's Inc.

Columbia Sportswear Company

Lululemon Athletica Inc.

Kontoor Brands, Inc.

The North Face

Wrangler

Table of Contents

1. USA Textile Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Growth Rate and Dynamics

1.4. Market Segmentation Overview

2. USA Textile Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Textile Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements (e.g., Smart Fabrics, IoT)

3.1.2. Sustainability Initiatives (e.g., Recycled Fibers)

3.1.3. Expansion of E-commerce and Fast Fashion

3.1.4. Trade Agreements Impacting Market Growth

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices

3.2.2. High Labor Costs

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Growth in Functional and Technical Textiles

3.3.2. Demand for Sustainable and Organic Fabrics

3.3.3. Digital Transformation in Textile Production

3.4. Trends

3.4.1. Increasing Use of Automation and AI

3.4.2. Rise of Textile Recycling Initiatives

3.4.3. Adoption of Eco-Friendly Dyeing Processes

3.5. Government Regulations

3.5.1. Textile Safety and Standards Compliance

3.5.2. Environmental Protection Mandates

3.5.3. Trade Policies and Tariffs

4. USA Textile Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Apparel

4.1.2. Home Textiles

4.1.3. Industrial Textiles

4.1.4. Medical Textiles

4.2. By Raw Material (In Value %)

4.2.1. Cotton

4.2.2. Wool

4.2.3. Polyester

4.2.4. Silk

4.2.5. Synthetic Fibers

4.3. By Application (In Value %)

4.3.1. Apparel and Fashion

4.3.2. Home Furnishing

4.3.3. Industrial and Technical Use

4.3.4. Healthcare and Medical Applications

4.4. By Distribution Channel (In Value %)

4.4.1. Online

4.4.2. Offline Retail

4.4.3. Wholesale

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Textile Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. VF Corporation

5.1.2. Hanesbrands Inc.

5.1.3. Ralph Lauren Corporation

5.1.4. PVH Corp.

5.1.5. Levi Strauss & Co.

5.1.6. Under Armour Inc.

5.1.7. Gildan Activewear Inc.

5.1.8. Nike Inc.

5.1.9. Fruit of the Loom, Inc.

5.1.10. Carter's Inc.

5.1.11. Columbia Sportswear Company

5.1.12. Lululemon Athletica Inc.

5.1.13. Kontoor Brands, Inc.

5.1.14. The North Face

5.1.15. Wrangler

5.2. Cross Comparison Parameters (Market Share, Revenue, Product Innovation, Sustainability Initiatives, Distribution Channels, Manufacturing Locations, R&D Expenditure, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Collaborations

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

6. USA Textile Market Regulatory Framework

6.1. Compliance Standards for Textile Manufacturing

6.2. Environmental Regulations

6.3. Import and Export Tariffs

7. USA Textile Market Future Size (In USD Billion)

7.1. Projected Market Size

7.2. Key Drivers for Future Market Growth

8. USA Textile Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Raw Material (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. USA Textile Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Targeting

9.3. Investment Prioritization

9.4. Growth Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the USA textile market ecosystem, identifying key stakeholders, trends, and demand drivers. Through extensive desk research, various variables influencing market dynamics were recognized, including product segments, material preferences, and technology adoption rates.

Step 2: Market Analysis and Construction

Historical data related to market size, growth rates, and segment penetration were compiled and analyzed. This step included evaluating market reach and identifying dominant regional hubs, which contributed to developing a comprehensive picture of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts, including textile manufacturers and retailers. These interactions provided qualitative insights into consumer preferences, production capabilities, and competitive strategies.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing data collected from primary and secondary sources. This ensured that the analysis was exhaustive and accurate, incorporating all major factors impacting the USA textile market.

Frequently Asked Questions

01. How big is the USA Textile Market?

The USA textile market was valued at USD 270 billion, driven by technological advancements in fabric production, sustainable material adoption, and rising demand for functional textiles.

02. What are the challenges in the USA Textile Market?

Challenges in this USA textile market include fluctuating raw material costs, high labor expenses, and complex regulatory requirements concerning environmental and safety standards.

03. Who are the major players in the USA Textile Market?

Major players in USA textile market include VF Corporation, Hanesbrands Inc., Ralph Lauren Corporation, and PVH Corp. These companies dominate due to their extensive distribution networks and innovation in textile technology.

04. What are the growth drivers of the USA Textile Market?

USA textile market Growth drivers encompass increasing demand for sustainable and functional textiles, technological innovations in textile production, and the expansion of e-commerce platforms that boost sales.

05. What types of textiles are dominant in the USA Textile Market?

Apparel and home textiles are the dominant categories, driven by a high demand for athleisure, fast fashion, and sustainable home furnishings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.