USA Thermoplastics Micro Molding Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD10971

November 2024

90

About the Report

USA Thermoplastics Micro Molding Market Overview

- The U.S. Thermoplastics Micro Molding market, valued at USD 207 million, has experienced steady growth, primarily driven by demand from industries requiring precision-engineered components. This demand is especially prominent in the medical and electronics sectors, where miniaturization trends continue to evolve. High-performance polymers, known for their durability and adaptability in extreme conditions, are becoming essential in these applications.

- The markets dominance is led by manufacturing hubs in states like California, Texas, and Illinois, driven by their established infrastructure for high-tech industries and skilled labor force. Californias significant presence in the medical device and electronics sectors has positioned it as a leader in thermoplastics micro molding. Texas and Illinois also contribute heavily, due to their thriving automotive and electronics sectors and the presence of large-scale facilities specializing in micro-precision manufacturing.

- In 2024, the U.S. government allocated $1.5 billion for the advancement of precision manufacturing, with a portion directed at micro molding technologies. This funding aims to foster innovation, improve manufacturing quality, and support small-to-medium enterprises (SMEs) in adopting micro molding capabilities.

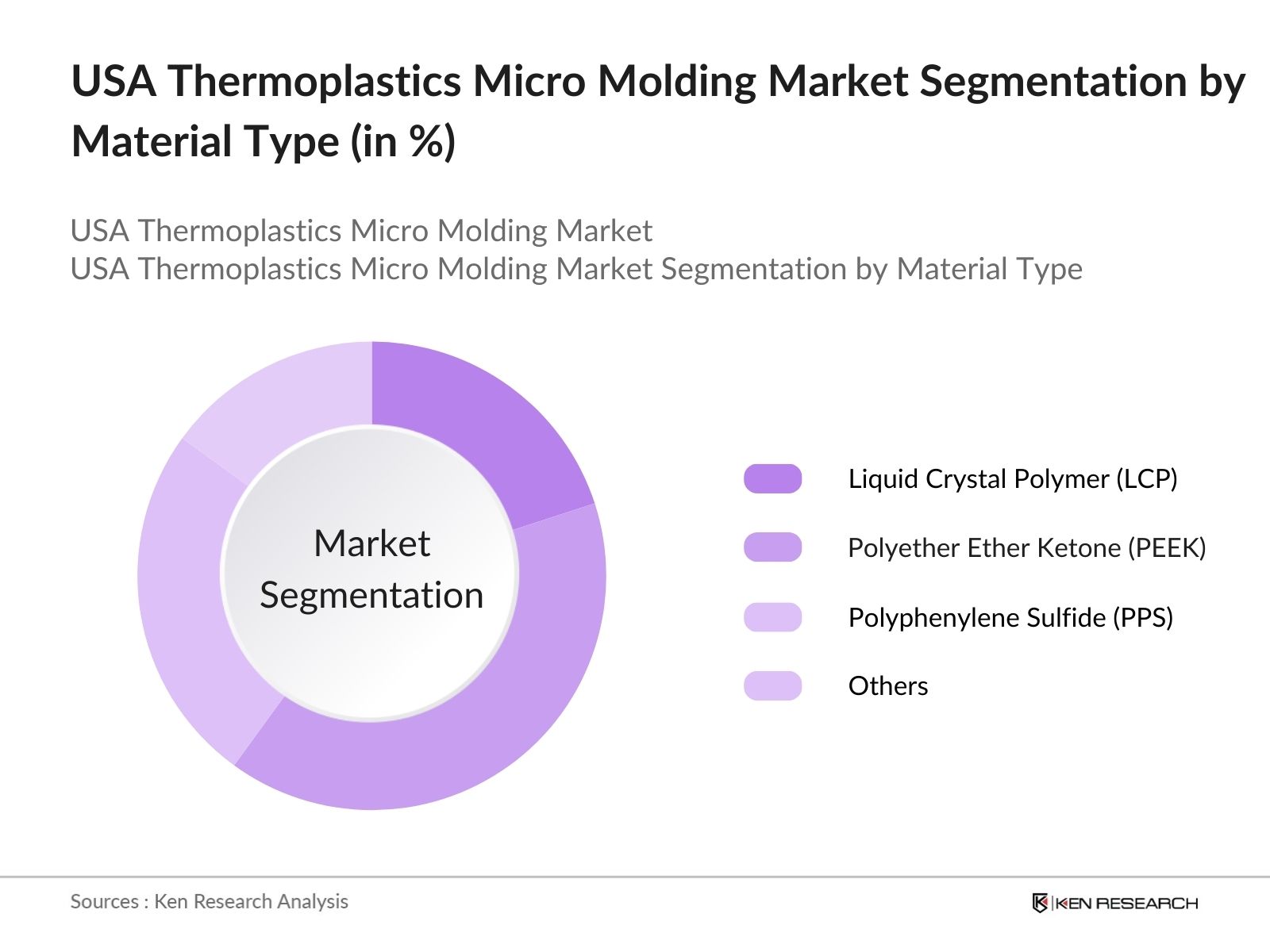

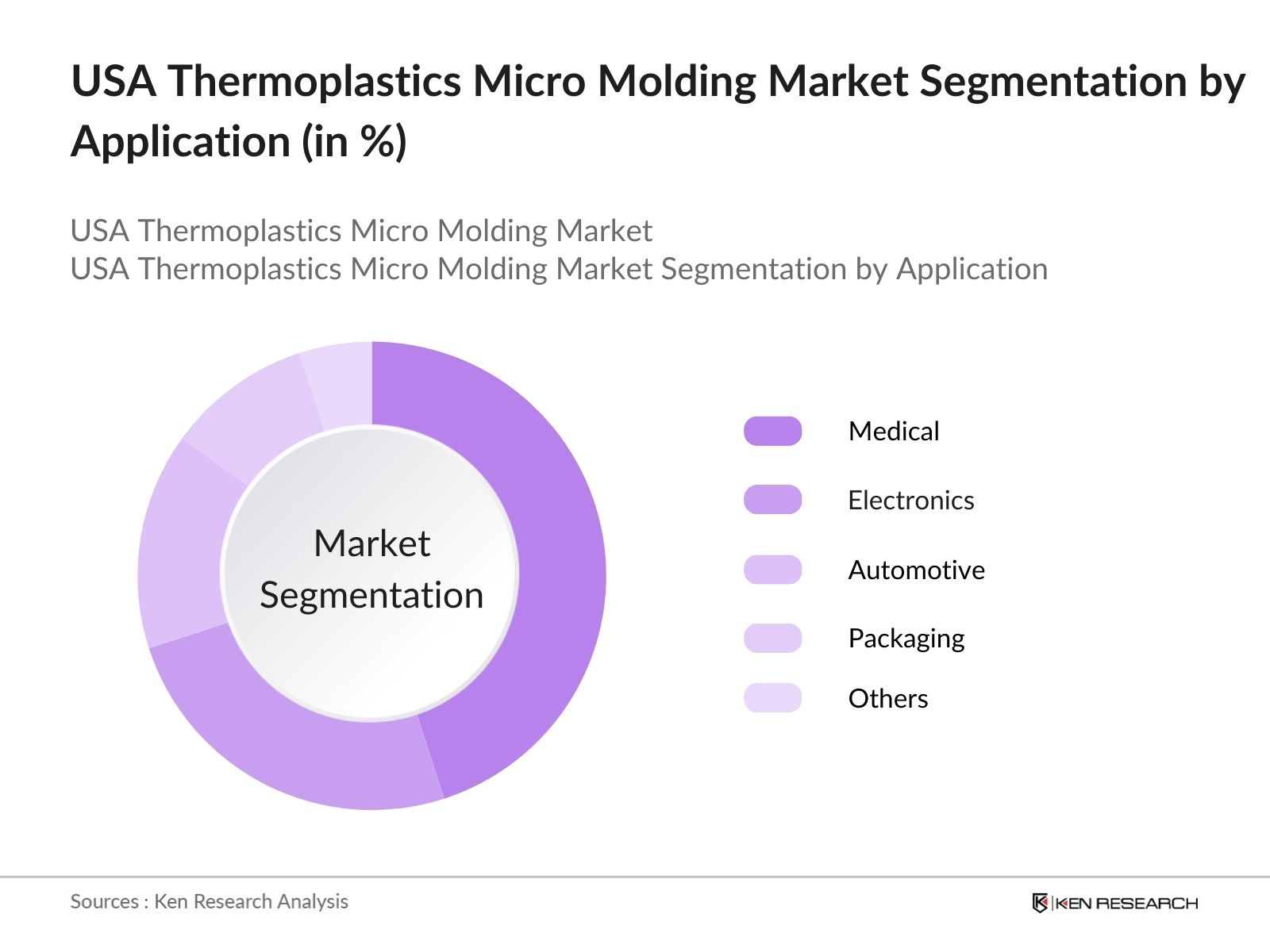

USA Thermoplastics Micro Molding Market Segmentation

By Material Type: The market is segmented by material type, which includes Liquid Crystal Polymer (LCP), Polyether Ether Ketone (PEEK), Polyphenylene Sulfide (PPS), and other high-performance thermoplastics. Among these, PEEK holds a dominant market share due to its high mechanical strength and resistance to chemical and thermal degradation, making it ideal for medical and aerospace applications.

By Application: The application segmentation for thermoplastics micro molding includes Medical, Electronics, Automotive, Packaging, and Others. The medical segment dominates due to the high demand for precision-molded components in surgical instruments, implantable devices, and diagnostic equipment. This dominance is attributed to stringent regulatory standards and the need for reliability in medical devices.

USA Thermoplastics Micro Molding Market Competitive Landscape

The market is concentrated with a few key players that control a significant share. Major players have developed specialized expertise in micro-scale manufacturing, supporting sectors like healthcare and electronics.

USA Thermoplastics Micro Molding Market

Market Growth Drivers

- Increased Demand for Precision Medical Components: The rise in demand for highly precise medical components has fueled growth in the USA thermoplastics micro molding market, driven by the increasing volume of minimally invasive surgeries and diagnostic devices. In 2024, over 1.2 million medical devices requiring micro-molded parts were manufactured in the U.S., with projections indicating continuous growth in this sector due to an aging population and advancements in healthcare technology.

- Expansion of the Electronics Industry: The electronics sector, especially the consumer electronics and semiconductor industries, has contributed significantly to the demand for thermoplastics micro molding. In 2024, the U.S. consumer electronics market produced around 550 million units with miniature components, many of which required thermoplastic micro molding due to their complex designs and durability needs, fueling growth in this niche.

- Automotive Sectors Need for Lightweight, Durable Components: With over 10 million vehicles produced in the U.S. in 2024, the automotive industrys demand for lightweight materials is driving the market. Thermoplastic components, particularly those used in automotive sensors, connectors, and micro switches, have become essential due to their high durability, which contributes to reduced overall vehicle weight and increased fuel efficiency.

Market Challenges

- High Costs of Micro Molding Equipment and Setup: The initial cost of micro molding machinery and tooling remains high, impacting smaller manufacturers. In 2024, U.S. companies in the thermoplastics micro molding industry spent an average of $750,000 per setup, posing a significant barrier for new entrants and limiting market expansion.

- Stringent Regulatory Compliance in Medical and Automotive Sectors: Regulatory compliance remains a challenge for thermoplastics micro molding manufacturers, particularly for medical and automotive applications. In 2024, FDA inspection reports showed that over 1,000 thermoplastics manufacturers faced delays or additional costs due to compliance issues, increasing production timelines and associated expenses.

USA Thermoplastics Micro Molding Market Future Outlook

The U.S. Thermoplastics Micro Molding industry is expected to experience robust growth over the coming years, driven by increasing demand for miniaturized components in medical and electronics applications.

Future Market Opportunities

- Adoption of Nano-Scale Molding Technologies: Over the next five years, the market will increasingly adopt nano-scale molding technologies to produce components with even greater precision for medical and electronics applications. This transition is estimated to support production volumes of up to 1.5 billion units annually by 2028, addressing the need for miniaturization across these sectors.

- Expansion in Bio-Compatible Micro-Molded Components for Healthcare: Demand for bio-compatible thermoplastic components for healthcare applications is expected to grow, with projected production of around 800 million components by 2028, as the medical industry shifts towards more patient-specific devices. This trend reflects ongoing advancements in personalized medicine, driving innovation in thermoplastics micro molding.

Scope of the Report

|

Material Type |

Liquid Crystal Polymer (LCP) |

|

Application |

Medical |

|

Process Type |

Injection Molding |

|

End-User Industry |

Healthcare |

|

Region |

Northeast |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Thermoplastic Manufacturers

Precision Component Suppliers

Medical Device Companies

Electronics and Semiconductor Manufacturers

Automotive OEMs

Government and Regulatory Bodies (FDA, Environmental Protection Agency)

Investor and Venture Capitalist Firms

Research and Development Institutions (Private)

Companies

Accumold

MTD Micro Molding

Makuta Technics Inc.

Stack Plastics

SMC Corporation

American Precision Products

Veejay Plastic Injection Molding Company

ALC Precision

Micro Molding Solutions Inc.

Advanced Plastiform Inc.

Table of Contents

1. USA Thermoplastics Micro Molding Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Thermoplastics Micro Molding Market Size (USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Thermoplastics Micro Molding Market Analysis

3.1 Growth Drivers

3.1.1 Advancements in Medical Device Manufacturing

3.1.2 Increasing Demand for Miniaturized Electronic Components

3.1.3 Automotive Industry's Shift Towards Lightweight Components

3.1.4 Expansion of Micro-Optics Applications

3.2 Market Challenges

3.2.1 High Initial Tooling and Production Costs

3.2.2 Technical Complexity in Micro Molding Processes

3.2.3 Limited Availability of Skilled Workforce

3.3 Opportunities

3.3.1 Technological Innovations in Micro Molding Equipment

3.3.2 Growing Adoption in the Medical and Electronics Sectors

3.3.3 Expansion into Emerging Applications

3.4 Trends

3.4.1 Integration of Automation and Robotics

3.4.2 Use of Bioabsorbable Polymers in Medical Applications

3.4.3 Development of Sustainable and Eco-friendly Materials

3.5 Government Regulations

3.5.1 FDA Guidelines for Medical Device Components

3.5.2 Environmental Regulations on Plastic Usage

3.5.3 Trade Policies Affecting Raw Material Supply

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. USA Thermoplastics Micro Molding Market Segmentation

4.1 By Material Type (Value %)

4.1.1 Liquid Crystal Polymer (LCP)

4.1.2 Polyether Ether Ketone (PEEK)

4.1.3 Polyphenylene Sulfide (PPS)

4.1.4 Others

4.2 By Application (Value %)

4.2.1 Medical

4.2.2 Electronics

4.2.3 Automotive

4.2.4 Packaging

4.2.5 Others

4.3 By Process Type (Value %)

4.3.1 Injection Molding

4.3.2 Micro Insert Molding

4.3.3 Micro Overmolding

4.4 By End-User Industry (Value %)

4.4.1 Healthcare

4.4.2 Consumer Electronics

4.4.3 Automotive

4.4.4 Telecommunications

4.4.5 Others

4.5 By Region (Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Thermoplastics Micro Molding Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Accumold

5.1.2 MTD Micro Molding

5.1.3 Isometric Micro Molding Inc.

5.1.4 Makuta Technics Inc.

5.1.5 Stack Plastics

5.1.6 SMC Corporation

5.1.7 American Precision Products

5.1.8 Veejay Plastic Injection Molding Company

5.1.9 ALC Precision (American Laubsher Corp) NY

5.1.10 Micro Molding Solutions Inc.

5.1.11 Advanced Plastiform Inc.

5.1.12 EPTAM Precision

5.1.13 Natech Plastics Inc.

5.1.14 Scientific Molding Corp. Ltd.

5.1.15 Sovrin Plastics

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Key Clients, Market Share, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Thermoplastics Micro Molding Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. USA Thermoplastics Micro Molding Future Market Size (USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Thermoplastics Micro Molding Future Market Segmentation

8.1 By Material Type (Value %)

8.2 By Application (Value %)

8.3 By Process Type (Value %)

8.4 By End-User Industry (Value %)

8.5 By Region (Value %)

9. USA Thermoplastics Micro Molding Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage entails mapping out all major stakeholders within the U.S. Thermoplastics Micro Molding Market. Extensive desk research and database usage provide a foundation for identifying critical market variables, which are crucial in understanding market dynamics.

Step 2: Market Analysis and Data Compilation

This phase involves aggregating historical data to understand penetration, supplier landscape, and revenue trends in thermoplastics micro molding. Analysis focuses on service quality metrics, ensuring precise revenue estimation.

Step 3: Hypothesis Development and Industry Validation

Market hypotheses are developed and validated through expert interviews with professionals from leading companies in the thermoplastics industry. This step allows for deeper insights and the refinement of quantitative data.

Step 4: Report Synthesis and Finalization

The final phase includes discussions with thermoplastic manufacturers and stakeholders to verify data accuracy and refine market segmentation. These interactions help synthesize findings, ensuring the report delivers comprehensive market insights.

Frequently Asked Questions

01. How big is the U.S. Thermoplastics Micro Molding Market?

The U.S. Thermoplastics Micro Molding market is valued at USD 207 million, driven by growth in miniaturized medical and electronic applications.

02. What are the primary challenges in the U.S. Thermoplastics Micro Molding Market?

Key challenges in the U.S. Thermoplastics Micro Molding market include the high initial cost of tooling, the need for advanced technical expertise, and strict regulatory compliance, particularly in medical applications.

03. Who are the major players in the U.S. Thermoplastics Micro Molding Market?

Prominent players in the U.S. Thermoplastics Micro Molding market include Accumold, MTD Micro Molding, Makuta Technics Inc., Stack Plastics, and SMC Corporation, each specializing in various precision molding applications.

04. What are the growth drivers of the U.S. Thermoplastics Micro Molding Market?

The U.S. Thermoplastics Micro Molding market is primarily driven by demand from medical and electronics sectors, advancements in micro-molding technology, and increasing automation in manufacturing processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.