USA Toys Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD8984

December 2024

91

About the Report

USA Toys Market Overview

- The USA Toys Market is valued at USD 24.3 billion, as supported by a historical analysis of consumer demand trends and purchasing behaviors. The market has seen growth fueled by a combination of factors such as high consumer demand for educational and interactive toys, and a significant rise in the popularity of collectible toys. Furthermore, the rapid advancements in toy technology and the growing adoption of STEM (Science, Technology, Engineering, and Math) toys for skill development are key growth drivers.

- Major urban regions, including California and New York, dominate the USA Toys Market due to their high population density and elevated disposable income levels, which drive robust consumer spending on toys. These cities also lead in terms of toy retail outlets and e-commerce penetration, providing greater access to a wide range of products and fostering brand loyalty among consumers.

- Stringent safety regulations enforced by the CPSC ensure the safe production of childrens toys, requiring compliance with standards like the ASTM F963 for toy safety. As of 2024, compliance inspections increased by 10%, reflecting heightened oversight in response to safety concerns. These standards mitigate risks associated with small parts, toxic materials, and other hazards.

USA Toys Market Segmentation

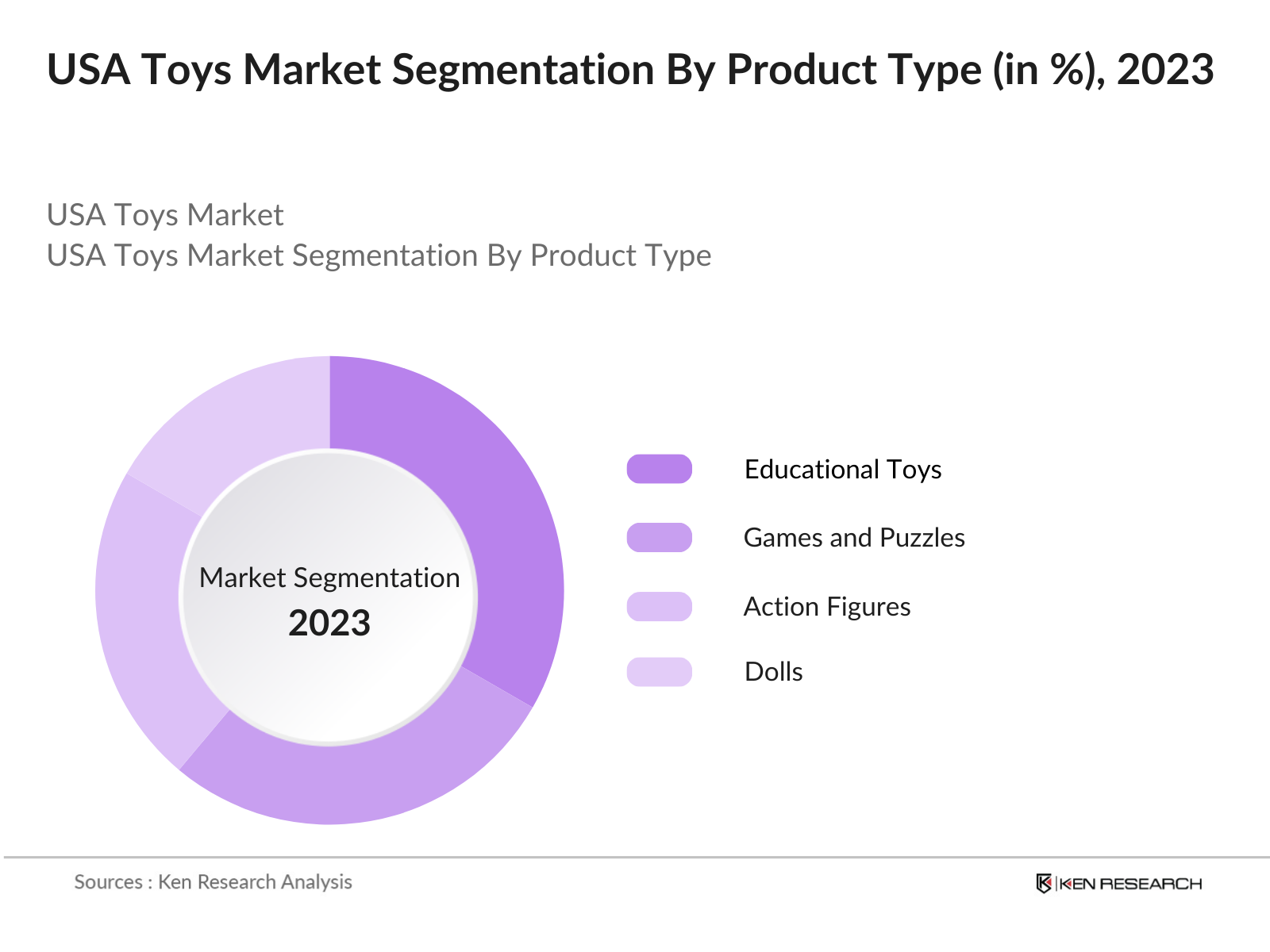

By Product Type: The USA Toys Market is segmented by product type into action figures, educational toys, dolls, games and puzzles, and outdoor toys. Recently, educational toys hold a dominant market share in the product type segment, as parents increasingly prioritize toys that foster cognitive development and problem-solving skills in children. Brands like LEGO and VTech have reinforced this segment's popularity by offering a variety of educational and STEM-focused products that engage children in learning through play.

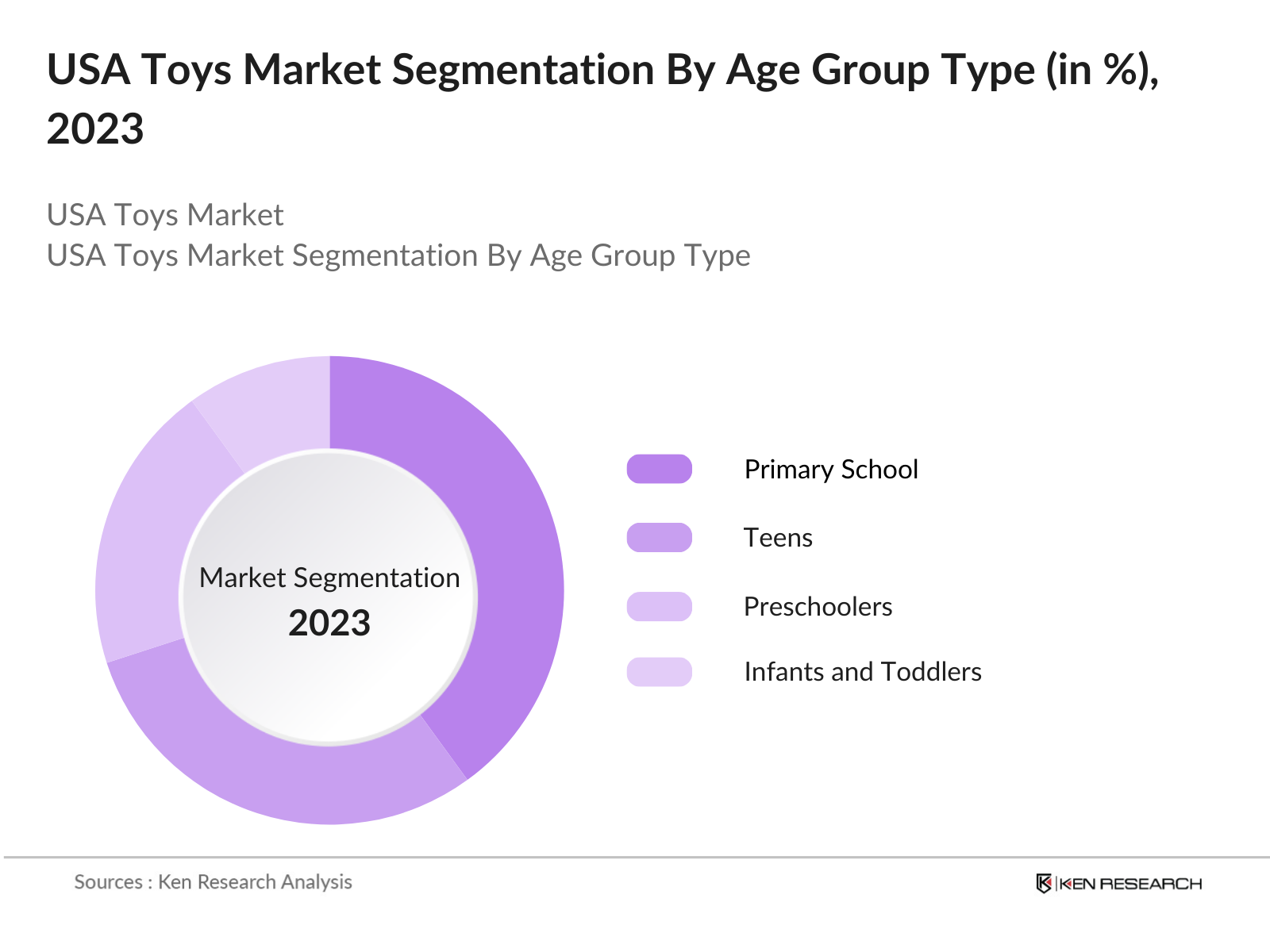

By Age Group: The USA Toys Market is also segmented by age group into infants and toddlers, preschoolers, primary school children, and teens. Toys for primary school children are currently the leading sub-segment in this category, as children in this age group show strong engagement with toys that promote creativity and social interaction. Brands such as Hasbro and Mattel cater to this age group with products that encourage play-based learning and social skills, which has led to sustained demand within this age demographic.

USA Toys Market Competitive Landscape

The USA Toys Market is characterized by a mix of established global players and emerging brands that focus on niche categories. Market leaders include well-known companies such as Mattel, Hasbro, and LEGO, whose longstanding market presence and diversified product portfolios allow them to maintain a competitive edge. The competition is intensified by continual product innovations and high brand loyalty among consumers.

USA Toys Industry Analysis

Growth Drivers

- Brand Loyalty and Product Recognition: Brand loyalty plays a significant role in the USA toy market, especially as iconic brands leverage strong consumer recall to retain market share. For example, licensed characters from popular media generate consistent demand, with brands like Disney, LEGO, and Hasbro experiencing substantial repeat sales. As of 2024, around 75% of American households with children purchase toys associated with popular brands or franchises at least once annually, underscoring the impact of brand loyalty on sales. The Bureau of Economic Analysis (BEA) notes a steady rise in consumer spending on branded items, driven by household disposable income trends.

- Demand for STEM and Educational Toys: The growing emphasis on STEM education has fueled a strong demand for educational toys. The National Center for Education Statistics (NCES) highlights that 30 million students in the U.S. are enrolled in STEM programs, supporting the trend of parents choosing toys that reinforce science and math skills. In 2024, STEM toys represented over 20% of U.S. toy industry sales, with popular items like coding kits and robotics kits being sought by parents seeking to supplement their children's learning experiences.

- Seasonal Demand Trends: The U.S. toy market experiences a significant spike during holiday seasons, driven by cultural trends and seasonal gifting habits. According to the U.S. Census Bureau, in 2023, over $30 billion was spent on toys and games during the fourth quarter alone, accounting for nearly half of the industrys annual revenue. This seasonal boost is supported by Black Friday and holiday promotions, which stimulate an uptick in consumer spending.

Market Challenges

- Safety and Regulatory Compliance Costs: Strict safety regulations, like those mandated by the Consumer Product Safety Commission (CPSC), significantly impact operational costs for toy manufacturers. Adhering to standards like lead content limitations and testing protocols has added compliance costs. In 2024, CPSC reported that regulatory compliance costs contributed to a 5% increase in the production costs of toys, especially those produced overseas.

- Rising Competition from Digital Entertainment: The rising popularity of digital entertainment, such as gaming and streaming platforms, is a challenge for the traditional toy industry. According to the Federal Communications Commission (FCC), American children spend an average of 2.5 hours daily on digital media. This shift toward screen-based entertainment diverts spending from traditional toys, affecting their sales growth.

USA Toys Market Future Outlook

The USA Toys Market is anticipated to experience steady growth in the coming years, driven by technological advancements in interactive and smart toys, rising consumer interest in sustainable materials, and increased spending on educational toys. Market players are expected to expand their product lines to cater to a diverse demographic, including teens and adults, as interest in collectibles and board games remains strong. The shift toward eco-friendly and sustainable toy production also presents growth opportunities, as consumers increasingly seek environmentally responsible products.

Opportunities

- Sustainability in Toys: With increased environmental awareness, eco-friendly toys present a significant growth opportunity. In 2024, the Environmental Protection Agency (EPA) reported that 40% of American consumers prioritize sustainable products, including toys made from recycled or biodegradable materials. Manufacturers responding to this trend are likely to gain market share as consumer demand for green products rises.

- Expansion in Specialty Toy Markets: There is a growing interest in specialty toy markets, such as educational, sensory, and inclusive toys. Data from the National Retail Federation (NRF) indicates that specialty toy sales grew by 10% in 2023, driven by demand for products that cater to diverse learning needs. This segment is supported by schools and therapy centers, which increasingly seek tailored toys to support child development.

Scope of the Report

|

Product Type |

Action Figures Dolls and Plush Toys Educational and STEM Toys Electronic and Interactive Toys Games and Puzzles |

|

Age Group |

Infant and Toddler (0-2 years) Preschool (3-5 years) Primary School (6-12 years) Teens and Preteens (13+ years) |

|

Sales Channel |

Online Retail Offline Retail Specialty Stores Hypermarkets and Supermarkets |

|

Material Type |

Plastic Wood Fabric Others |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Toy Retail Companies

Wholesale and Distributor Industries

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Consumer Product Safety Commission, U.S. Department of Commerce)

E-commerce Platform Companies

Toy Manufacturing Industries

Trade Associations and Industry Bodies (e.g., Toy Association, National Retail Federation)

Environmental and Safety Advocacy Companies

Companies

Players Mentioned in the Report

Mattel Inc.

Hasbro, Inc.

LEGO Group

Spin Master Corp.

Funko, Inc.

Bandai Namco Holdings

VTech Holdings Ltd.

Jakks Pacific, Inc.

MGA Entertainment

Playmobil

Table of Contents

1. USA Toys Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics (Consumer Preferences, Technological Influence)

1.4 Market Segmentation Overview

2. USA Toys Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones (Product Innovations, Retail Expansion)

3. USA Toys Market Analysis

3.1 Growth Drivers

3.1.1 Brand Loyalty and Product Recognition

3.1.2 Demand for STEM and Educational Toys

3.1.3 Seasonal Demand Trends

3.1.4 Influence of Online Retail

3.2 Market Challenges

3.2.1 Safety and Regulatory Compliance Costs

3.2.2 Rising Competition from Digital Entertainment

3.2.3 Product Counterfeiting

3.2.4 Price Sensitivity of Consumers

3.3 Opportunities

3.3.1 Sustainability in Toys

3.3.2 Expansion in Specialty Toy Markets

3.3.3 Growth in Subscription-based Toy Services

3.3.4 Regional Brand Collaborations

3.4 Trends

3.4.1 Adoption of Eco-Friendly Materials

3.4.2 Growth of Interactive and AI Toys

3.4.3 Increase in Customization and Personalization

3.4.4 Rise in Collectibles and Limited Edition Toys

3.5 Government Regulations

3.5.1 Safety Standards for Childrens Products

3.5.2 Import Regulations and Tariffs

3.5.3 Environmental Regulations on Materials

3.5.4 Labor and Manufacturing Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Retailers, Distributors)

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. USA Toys Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Action Figures

4.1.2 Dolls and Plush Toys

4.1.3 Educational and STEM Toys

4.1.4 Electronic and Interactive Toys

4.1.5 Games and Puzzles

4.2 By Age Group (in Value %)

4.2.1 Infant and Toddler (0-2 years)

4.2.2 Preschool (3-5 years)

4.2.3 Primary School (6-12 years)

4.2.4 Teens and Preteens (13+ years)

4.3 By Sales Channel (in Value %)

4.3.1 Online Retail

4.3.2 Offline Retail

4.3.3 Specialty Stores

4.3.4 Hypermarkets and Supermarkets

4.4 By Material Type (in Value %)

4.4.1 Plastic

4.4.2 Wood

4.4.3 Fabric

4.4.4 Others (Eco-friendly materials)

4.5 By Region (in Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Toys Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mattel Inc.

5.1.2 Hasbro, Inc.

5.1.3 LEGO Group

5.1.4 Spin Master Corp.

5.1.5 Bandai Namco Holdings

5.1.6 VTech Holdings Ltd.

5.1.7 Funko, Inc.

5.1.8 Jakks Pacific, Inc.

5.1.9 MGA Entertainment

5.1.10 Ravensburger AG

5.1.11 TOMY Company, Ltd.

5.1.12 Basic Fun!

5.1.13 Melissa & Doug

5.1.14 Playmobil

5.1.15 Fisher-Price

5.2 Cross-Comparison Parameters

(Brand Strength, Product Variety, Market Presence, Revenue Growth Rate, Employee Count, Headquarters Location, Distribution Network, New Product Launch Frequency)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Toys Market Regulatory Framework

6.1 Safety Compliance Standards (ASTM, CPSIA)

6.2 Import and Export Regulations

6.3 Certification Processes

6.4 Environmental Standards on Manufacturing

7. USA Toys Market Future Size (in USD Mn)

7.1 Market Projections

7.2 Key Factors Driving Future Growth

8. USA Toys Market Future Segmentation

8.1 By Product Type

8.2 By Age Group

8.3 By Sales Channel

8.4 By Material Type

8.5 By Region

9. USA Toys Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involves mapping the entire USA Toys Market ecosystem, identifying major stakeholders, and understanding the demand dynamics and regulatory environment. Secondary databases and proprietary industry reports are leveraged to define critical variables, such as consumer trends and purchasing behavior.

Step 2: Market Analysis and Construction

This phase entails compiling historical data for market sizing and segmentation analysis. The research focuses on toy categories, age-specific preferences, and sales channel distribution, which helps determine the market share and growth rate of various segments.

Step 3: Hypothesis Validation and Expert Consultation

A structured approach is taken to validate market hypotheses by conducting interviews with industry experts and key executives from leading toy manufacturers. This qualitative insight complements quantitative data, ensuring that the analysis reflects accurate and recent market trends.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the collected data to form a comprehensive report, incorporating insights from manufacturers, retailers, and distributors. The analysis is verified for accuracy through a bottom-up approach, enabling a detailed and reliable assessment of the USA Toys Market.

Frequently Asked Questions

01. How big is the USA Toys Market?

The USA Toys Market is valued at USD 24.3 billion, driven by rising consumer interest in educational and STEM toys, as well as collectible figures that cater to older demographics.

02. What are the key growth drivers in the USA Toys Market?

Key drivers include increased consumer demand for educational toys, advancements in interactive technologies, and the influence of digital media on childrens preferences.

03. Who are the major players in the USA Toys Market?

Prominent companies include Mattel, Hasbro, LEGO Group, Spin Master, and Funko. These players dominate due to their extensive product lines, global reach, and strong brand loyalty.

04. What challenges does the USA Toys Market face?

Challenges include regulatory compliance with safety standards, competition from digital entertainment options, and the need for eco-friendly production practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.