USA Tractor Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD5228

October 2024

86

About the Report

USA Tractor Market Overview

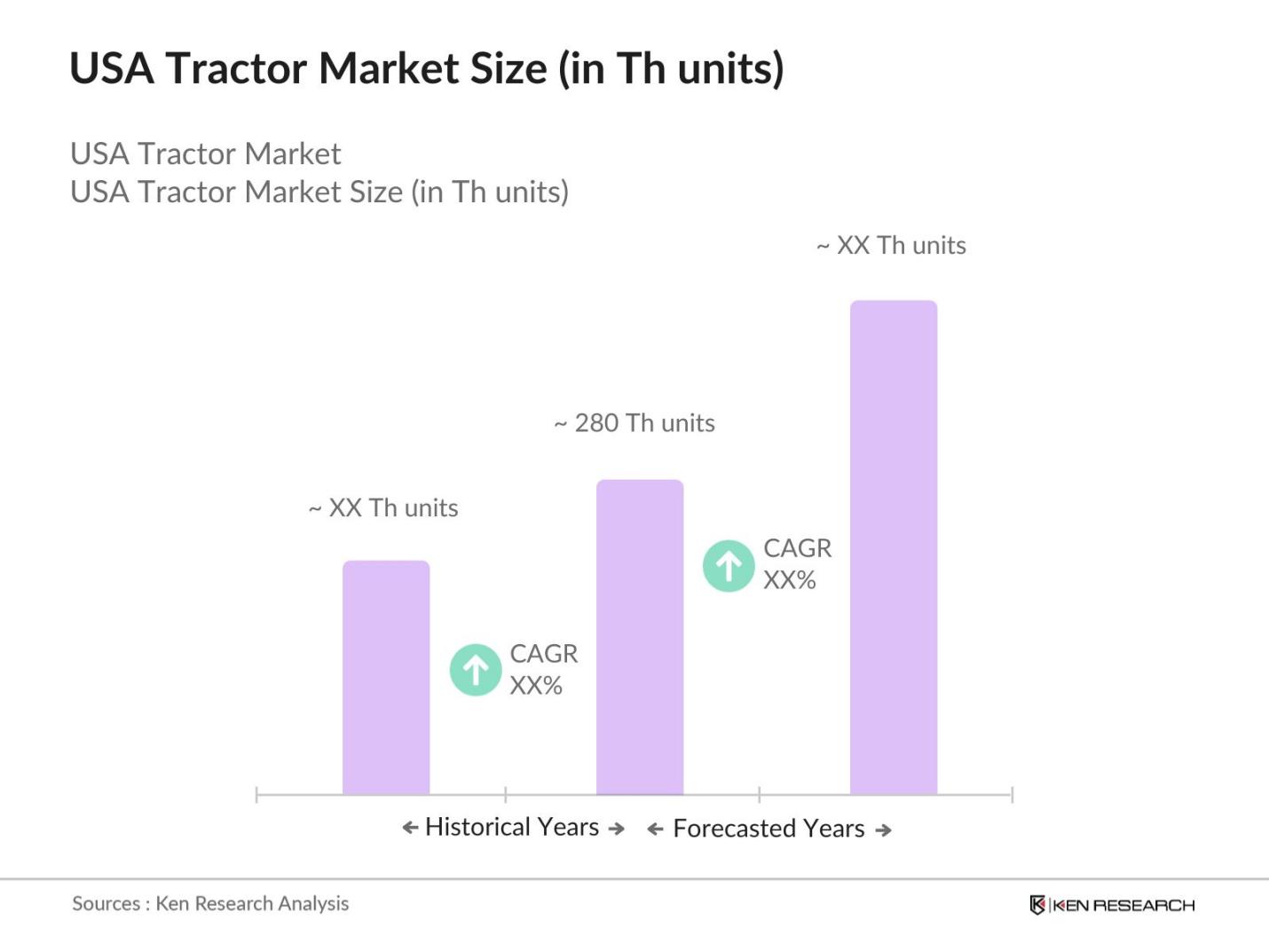

- The USA Tractor market is valued at USD 280 Th units, based on a five-year historical analysis. This market is driven by the rapid adoption of precision agriculture, government incentives supporting mechanization, and the increasing shift towards sustainable farming practices. The development of advanced technologies, including autonomous tractors and electric models, has further fueled the demand for tractors, especially among large-scale farmers who are increasingly reliant on machinery to increase productivity and reduce labor costs.

- The key regions dominating the USA tractor market include the Midwest and Southern states. These regions are primarily agricultural hubs with vast tracts of land dedicated to farming activities, driving higher demand for tractors. The Midwest is known as the "Corn Belt" and "Grain Belt," while the Southern states have a strong tradition in livestock and mixed farming. These geographical advantages, combined with favorable government policies, make these regions crucial to the tractor market's growth.

- The shift towards low-emission tractors continues to accelerate due to stringent emission standards. According to the EPA, in 2023, around 60,000 Tier 4 tractors were sold, driven by the need to comply with the latest environmental regulations. Additionally, electric tractors are becoming increasingly popular in states like California, where strict emissions laws are in place. With tractor emissions accounting for a significant portion of US agricultural emissions, the market is moving toward solutions that reduce environmental impact while maintaining performance.

USA Tractor Market Segmentation

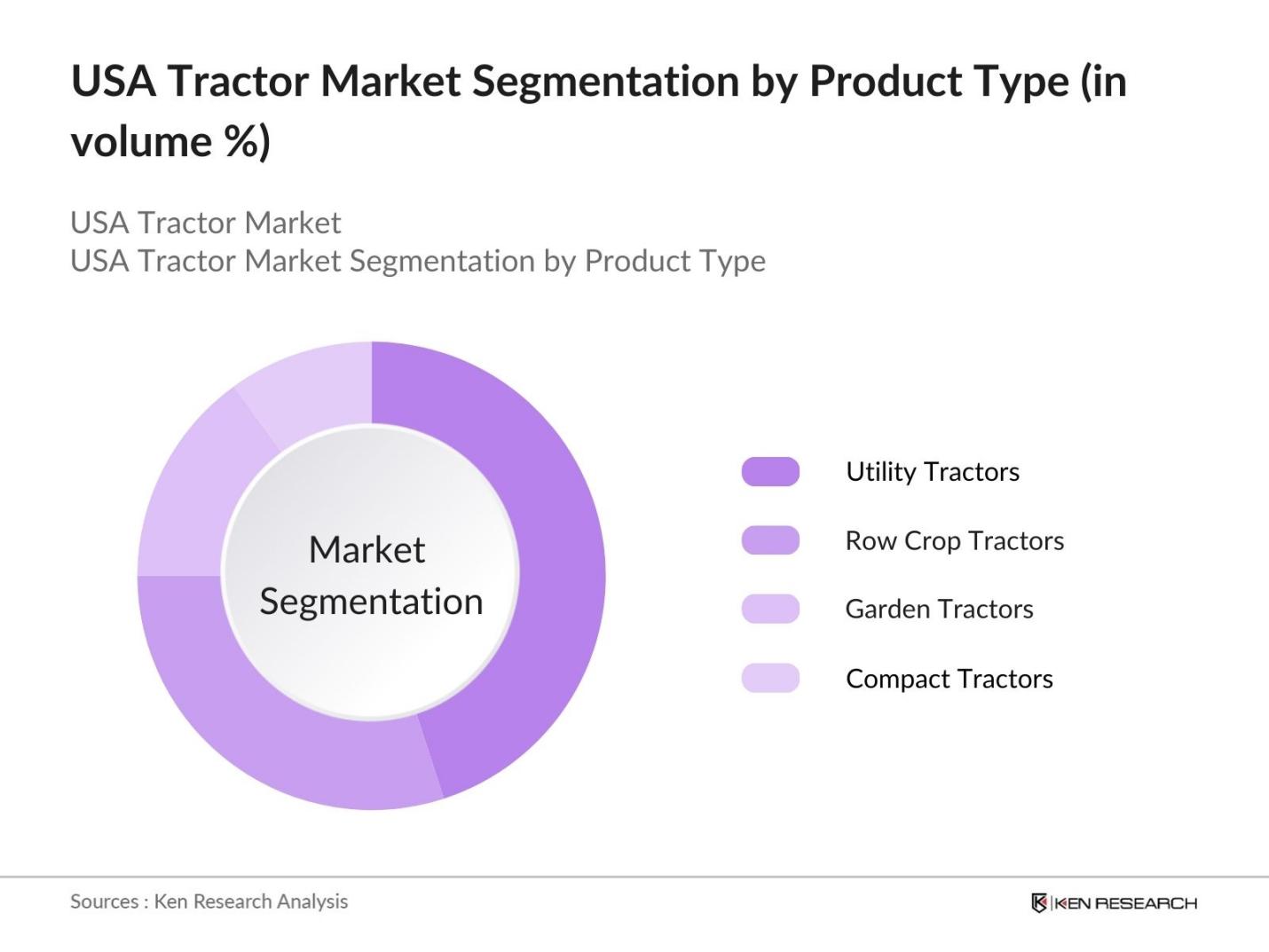

By Product Type: The market is segmented by product type into utility tractors, row crop tractors, garden tractors, and compact tractors. Utility tractors dominate this segmentation due to their versatility across various farming activities, from tilling and planting to harvesting. Farmers prefer utility tractors as they offer a balanced combination of power and affordability, making them suitable for small to medium-sized farms. The rising demand for mechanization and the ease of using utility tractors in multiple applications has solidified their position in the market.

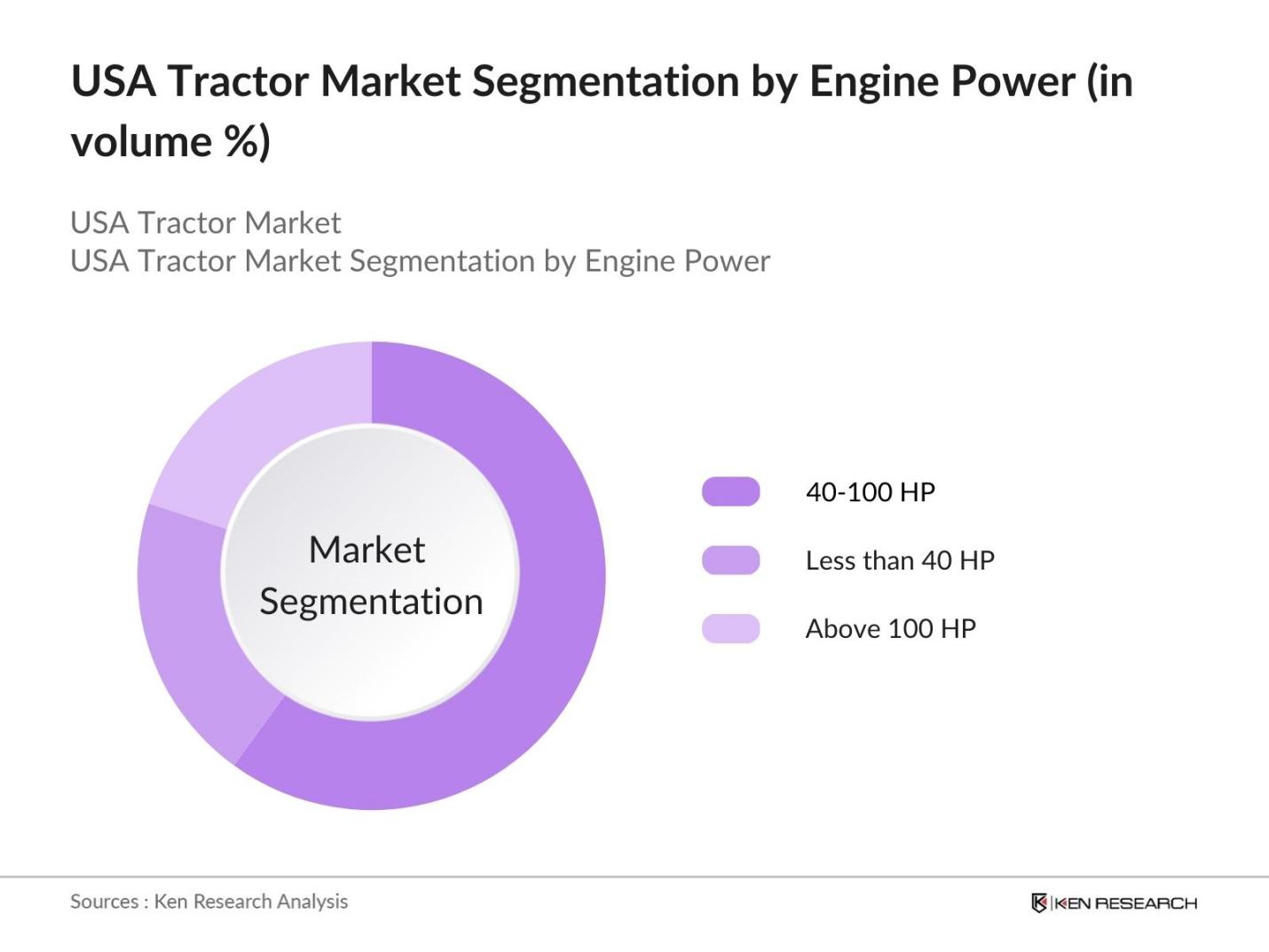

By Engine Power: The market is segmented by engine power into less than 40 HP, 40-100 HP, and above 100 HP. Tractors with engine power between 40-100 HP hold a dominant market share due to their suitability for diverse farming operations, from small-scale to commercial farming. This power range is ideal for row crop farming and more intensive applications, while also being cost-effective for farmers who need moderate power without the expense of high-powered models. The mid-range horsepower tractors are also widely available across dealerships, providing farmers with multiple choices.

USA Tractor Market Competitive Landscape

The USA tractor market is dominated by both domestic and international players, with Deere & Company, CNH Industrial, and Kubota Corporation leading the charge. These companies have established a strong presence due to their vast dealer networks, extensive product lines, and continuous innovation in technology. Deere & Company, for example, has invested significantly in precision agriculture solutions, enabling farmers to achieve higher yields while reducing resource consumption.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Product Range |

R&D Investment |

Market Focus |

Global Presence |

|

Deere & Company |

1837 |

Moline, Illinois, USA |

||||||

|

CNH Industrial N.V. |

2013 |

London, UK |

||||||

|

Kubota Corporation |

1890 |

Osaka, Japan |

||||||

|

AGCO Corporation |

1990 |

Duluth, Georgia, USA |

||||||

|

Mahindra & Mahindra |

1945 |

Mumbai, India |

USA Tractor Industry Analysis

Growth Drivers

- Precision Agriculture Adoption: The adoption of precision agriculture in the USA is rising due to increasing demand for higher crop yields and optimized resource usage. In 2024, the US Department of Agriculture (USDA) has noted an increase in farmers using GPS, sensors, and data analytics in tractor operations to improve efficiency. Precision farming equipment is allowing farmers to increase yields by over 15%, which in turn enhances the demand for tractors with smart technology integration. In the US, more than 10 million acres are currently managed using precision agriculture technologies, reflecting its growing role in boosting tractor adoption.

- Government Subsidies & Schemes: Government programs like the Farm Bill and Section 179 tax deductions are key drivers in the USA tractor market. The USDA allocated $867 billion for the Farm Bill, supporting agricultural investments including tractor purchases. Section 179 allows farmers to deduct up to $1.16 million for equipment costs, including tractors, boosting sales. With 98,000 American farms receiving subsidies annually, government support remains critical for enhancing farm mechanization. The recent increase in subsidies aimed at promoting renewable energy in agriculture is also driving the demand for sustainable tractor solutions.

- Sustainability and Energy-Efficient Equipment: Energy-efficient tractors are becoming a key driver in the USA due to increasing awareness of sustainability. The Environmental Protection Agency (EPA) noted that more than 20% of agricultural emissions come from farm machinery, prompting farmers to adopt lower-emission tractors. Government incentives and the push for sustainability are causing a shift towards tractors powered by clean energy solutions, including Tier 4 compliant engines. In 2023, more than 15,000 Tier 4 tractors were sold, showcasing the demand for energy-efficient farming equipment in line with stricter emissions standards.

Market Challenges

-

Supply Chain Disruptions: The COVID-19 pandemic and subsequent global disruptions have highlighted vulnerabilities in the tractor supply chain. A survey by the USDA in 2023 noted that 75% of farmers experienced delays in receiving agricultural machinery, including tractors, due to global supply chain disruptions. Additionally, the 2022 chip shortage further exacerbated these delays, affecting the availability of tractors with advanced technologies. These disruptions continue to challenge manufacturers and buyers, limiting market growth by causing supply-demand mismatches and driving up delivery lead times.

- Uncertainty in Farm Income: Unpredictable farm income due to volatile commodity prices and climate conditions impacts tractor investments. According to the USDA, net farm income in 2023 was estimated at $141.3 billion, fluctuating due to a 15% drop in crop prices following global trade tensions. Moreover, extreme weather events, such as droughts and floods, which have become more frequent, cost the agriculture sector over $20 billion annually. These economic uncertainties make farmers cautious about large investments in high-cost machinery like tractors.

USA Tractor Market Future Outlook

Over the next five years, the USA tractor market is expected to experience robust growth driven by several factors, including increased investments in precision agriculture technologies, rising demand for sustainable and low-emission farming equipment, and government initiatives supporting rural mechanization. Additionally, the trend toward electrification and automation in the agriculture sector will push manufacturers to innovate further. Farmers are increasingly adopting autonomous tractors and electric-powered models, which reduce operational costs and environmental impact, fostering future growth.

Future Market Opportunities

-

Automation & Autonomous Tractors: The shift towards automation and autonomous tractors offers substantial opportunities for the market. According to the USDA, approximately 25% of large farms in the US have already adopted some form of autonomous machinery. Autonomous tractors, capable of operating without human intervention, are reducing labor costs and enhancing productivity. In 2024, the market saw an increasing interest in driverless tractors for large-scale farms. This trend is set to grow as labor shortages persist, with around 500,000 agricultural jobs remaining unfilled, propelling demand for autonomous solutions in farming.

- Electrification in Tractors: Electrification in the tractor market is gaining momentum, driven by the need for low-emission farming solutions. The EPA reported that agricultural machinery accounts for nearly 11% of greenhouse gas emissions in the US, prompting the shift toward electric and hybrid tractors. In 2023, more than 5,000 hybrid and electric tractors were sold in the US, signaling the growing trend toward cleaner energy solutions. This opportunity is amplified by government incentives for electric machinery and technological advancements that are making these tractors more accessible to larger farms.

Scope of the Report

|

By Product Type |

Utility Tractors Row Crop Tractors Compact Tractors Specialty Tractors Garden Tractors |

|

By Engine Power |

Less than 40 HP 40-100 HP Above 100 HP |

|

By Drive Type |

2WD (Two-Wheel Drive) 4WD (Four-Wheel Drive) |

|

By Application |

Agricultural Use Landscaping and Gardening Construction and Infrastructure Municipal and Utility Applications |

|

By Region |

North East Midwest South West |

Products

Key Target Audience

Agricultural Equipment Manufacturers

Large-scale Commercial Farmers

Small and Medium Farmers

Agricultural Cooperatives

Agricultural Trade Associations

Investment and Venture Capitalist Firms

Agricultural Machinery Dealerships

Banks and Financial Institutes

Government and Regulatory Bodies (USDA, EPA)

Companies

Players Mentioned in the Report:

Deere & Company

CNH Industrial N.V.

Kubota Corporation

AGCO Corporation

Mahindra & Mahindra Ltd.

CLAAS KGaA mbH

Yanmar Co., Ltd.

JCB

New Holland Agriculture

Massey Ferguson

Escorts Limited

LS Tractor USA

Fendt

SAME Deutz-Fahr

Kioti Tractor

Table of Contents

1. USA Tractor Market Overview

1.1. Definition and Scope (Power, Usage, Technology)

1.2. Market Taxonomy (Utility Tractors, Row Crop Tractors, Garden Tractors, Compact Tractors)

1.3. Market Growth Rate (CAGR, Unit Sales Growth, Revenue Growth)

1.4. Market Segmentation Overview (By Product Type, By Engine Power, By Drive Type, By Application, By Region)

2. USA Tractor Market Size (In Th units)

2.1. Historical Market Size (Units Sold, Revenue)

2.2. Year-On-Year Growth Analysis (Volume Growth, Value Growth)

2.3. Key Market Developments and Milestones (Technological Advancements, New Product Launches)

3. USA Tractor Market Dynamics

3.1. Growth Drivers

3.1.1. Precision Agriculture Adoption

3.1.2. Government Subsidies & Schemes (Farm Bill, Equipment Tax Deductions)

3.1.3. Increasing Farm Mechanization

3.1.4. Sustainability and Energy-Efficient Equipment

3.2. Market Restraints

3.2.1. High Equipment Costs

3.2.2. Uncertainty in Farm Income (Agricultural Commodity Prices, Weather)

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Automation & Autonomous Tractors

3.3.2. Electrification in Tractors (Hybrid and Electric Tractors)

3.3.3. Customization Based on Region-Specific Needs

3.4. Market Trends

3.4.1. Smart Farming and IoT Integration in Tractors

3.4.2. Shift Towards Low Emission Tractors (Tier 4 Engines, Electric Tractors)

3.4.3. Rental and Leasing Services for Tractors

3.5. Regulatory Landscape

3.5.1. Environmental Regulations (Emission Standards for Agricultural Equipment)

3.5.2. Import and Export Tariffs

3.5.3. Certification Standards for Tractor Safety

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Bargaining Power of Buyers, Threat of New Entrants, Threat of Substitutes, Industry Rivalry)

3.9. Competition Ecosystem (Domestic vs International Players)

4. USA Tractor Market Segmentation

4.1. By Product Type (In Volume)

4.1.1. Utility Tractors

4.1.2. Row Crop Tractors

4.1.3. Compact Tractors

4.1.4. Specialty Tractors

4.1.5. Garden Tractors

4.2. By Engine Power (In Volume)

4.2.1. Less than 40 HP

4.2.2. 40-100 HP

4.2.3. Above 100 HP

4.3. By Drive Type (In Volume)

4.3.1. 2WD (Two-Wheel Drive)

4.3.2. 4WD (Four-Wheel Drive)

4.4. By Application (In Volume)

4.4.1. Agricultural Use

4.4.2. Landscaping and Gardening

4.4.3. Construction and Infrastructure

4.4.4. Municipal and Utility Applications

4.5. By Region (In Volume)

4.5.1. North East

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Tractor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Deere & Company

5.1.2. CNH Industrial N.V.

5.1.3. Kubota Corporation

5.1.4. AGCO Corporation

5.1.5. Mahindra & Mahindra Ltd.

5.1.6. CLAAS KGaA mbH

5.1.7. Yanmar Co., Ltd.

5.1.8. JCB

5.1.9. New Holland Agriculture

5.1.10. Massey Ferguson

5.1.11. Escorts Limited

5.1.12. LS Tractor USA

5.1.13. Fendt

5.1.14. SAME Deutz-Fahr

5.1.15. Kioti Tractor

5.2. Cross Comparison Parameters (Engine Power, Product Portfolio, R&D Investments, Regional Presence, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Technology Collaborations, New Product Launches)

5.5. Mergers And Acquisitions (Recent Deals, Key Strategic Movements)

5.6. Investment Analysis (Private Investments, Venture Capital Funding)

5.7. Government Grants and Incentives

5.8. Private Equity Investments

6. USA Tractor Market Regulatory Framework

6.1. Agricultural Equipment Safety Standards

6.2. Compliance with Emission Standards (EPA Tier 4, CARB Regulations)

6.3. Certification Processes (ANSI Standards, ISO Certifications)

7. USA Tractor Market Future Outlook

7.1. Market Size Projections (In Value & Units Sold)

7.2. Key Factors Driving Future Growth (Electrification, Automation, Government Initiatives)

8. USA Tractor Market Future Segmentation

8.1. By Product Type (In Volume)

8.2. By Engine Power (In Volume)

8.3. By Drive Type (In Volume)

8.4. By Application (In Volume)

8.5. By Region (In Volume)

9. USA Tractor Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Market Entry Recommendations

9.3. Marketing Initiatives and Expansion Opportunities

9.4. White Space Opportunity Analysis (Product Customization, Regional Gaps)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the ecosystem of the USA tractor market, which includes all major stakeholders such as manufacturers, dealers, and end-users. We conduct extensive desk research and use proprietary databases to gather information. Key variables such as market demand, equipment costs, and regulatory frameworks are identified to assess their impact on market dynamics.

Step 2: Market Analysis and Construction

This step focuses on compiling and analyzing historical data on the USA tractor market. We examine factors such as market penetration, product performance, and dealership networks. A thorough evaluation of sales volumes and consumer adoption trends helps to construct reliable revenue estimates for the market.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we validate our market hypotheses through consultations with industry experts. Interviews with senior executives from leading tractor manufacturers and industry associations provide critical insights that help to refine our market projections.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with tractor manufacturers and dealers to validate our findings. This data is cross-verified with secondary sources to ensure that our final market projections and analysis are accurate and comprehensive.

Frequently Asked Questions

01. How big is the USA Tractor Market?

The USA tractor market is valued at USD 280 Th units, driven by technological advancements, increased farm mechanization, and supportive government initiatives for agriculture.

02. What are the challenges in the USA Tractor Market?

Challenges in USA tractor market include the high cost of advanced tractors, fluctuating farm incomes due to volatile commodity prices, and increasing regulatory pressures around emissions. Additionally, supply chain disruptions pose hurdles in equipment manufacturing.

03. Who are the major players in the USA Tractor Market?

Key players in USA tractor market include Deere & Company, CNH Industrial, Kubota Corporation, Mahindra & Mahindra, and AGCO Corporation. These companies dominate the market due to their extensive dealer networks, strong product portfolios, and investments in technology.

04. What are the growth drivers of the USA Tractor Market?

The USA tractor market is driven by the adoption of precision farming techniques, government incentives supporting agricultural mechanization, and rising demand for energy-efficient and autonomous tractors. Additionally, the shift towards electrification of tractors is expected to boost market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.