USA Trench Shoring Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD6522

December 2024

87

About the Report

USA Trench Shoring Market Overview

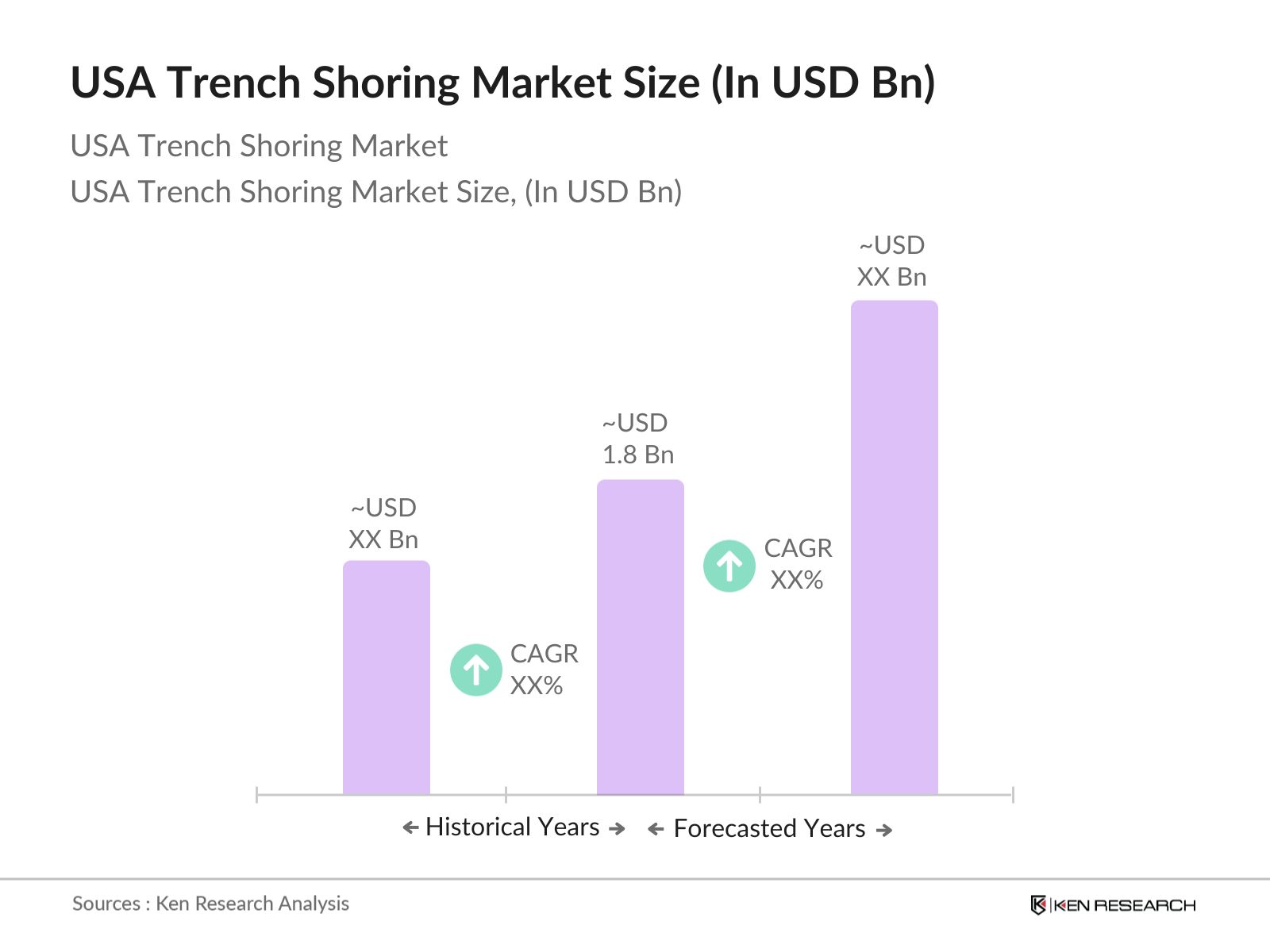

- The USA Trench Shoring market, based on a five-year historical analysis, is valued at USD 1.8 billion. This market is driven by an increase in large-scale infrastructure projects, such as roadways, utilities, and construction, which demand the use of trench shoring equipment to ensure safety and compliance with regulatory standards. Growth is fueled by stringent safety guidelines from agencies such as OSHA (Occupational Safety and Health Administration), which enforce regulations on excavation safety, encouraging companies to adopt advanced trench shoring solutions.

- The USA Trench Shoring market is dominated by cities with major infrastructure development projects, including New York, Los Angeles, and Houston. These cities lead due to the high volume of ongoing construction projects, particularly in transportation, water, and utility infrastructure. Additionally, the high level of government investment in urban development initiatives in these regions has contributed to their dominance in the market.

- OSHAs stringent regulations on trenching and excavation are major growth drivers for the trench shoring market. In 2024, OSHA increased the frequency of its inspections for trench-related projects, particularly after trenching fatalities rose in 2022. The average fine for trench safety violations now exceeds $70,000 per infraction, pushing companies to invest heavily in compliant shoring systems to avoid penalties. OSHAs regulatory framework ensures that trench shoring systems are mandatory for all major excavation projects, reinforcing the markets growth trajectory.

USA Trench Shoring Market Segmentation

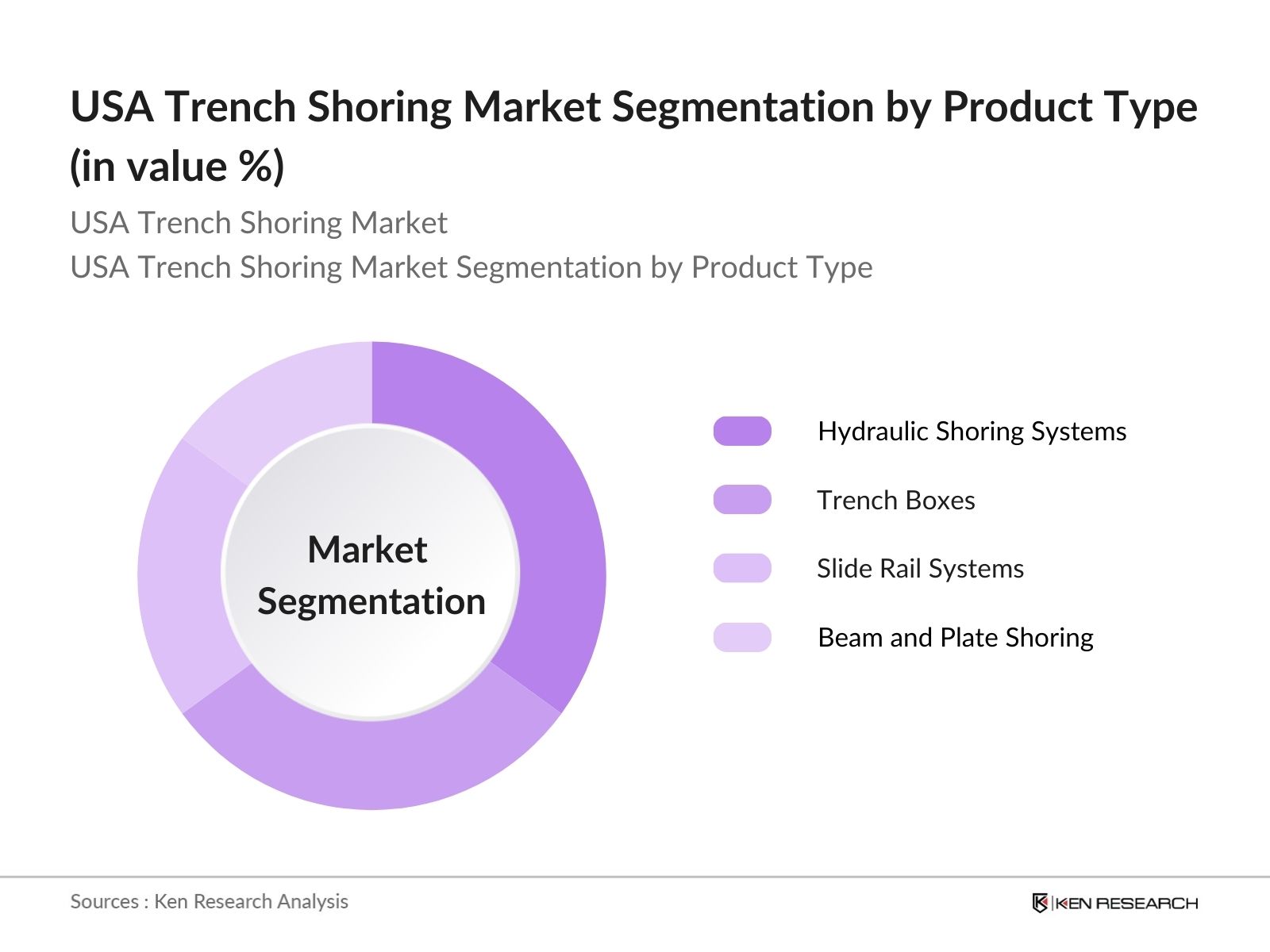

- By Product Type: The USA Trench Shoring market is segmented by product type into hydraulic shoring systems, trench boxes, slide rail systems, and beam and plate shoring. Hydraulic shoring systems hold a dominant market share due to their flexibility and ease of use across various trenching conditions. They are widely used in urban construction projects where quick setup and adjustments are critical. The ability of hydraulic systems to reduce excavation time while enhancing worker safety has made them popular, especially in densely populated areas with limited space for extended excavation work.

- By Application: The market is segmented by application into water and sewer systems, oil and gas pipeline construction, transportation infrastructure, and electrical utility projects. Water and sewer systems account for the largest market share due to the extensive replacement and rehabilitation efforts across the aging infrastructure in the USA. The need for trench shoring solutions in deep excavations for pipeline repair and installation drives this segment. The reliability of trench shoring equipment in preventing collapses and ensuring worker safety has further cemented its role in the water and sewer systems sector.

USA Trench Shoring Market Competitive Landscape

The USA Trench Shoring market is characterized by the presence of both domestic and international companies that dominate the market. Major players offer a variety of trench shoring solutions and rental services to meet the diverse needs of construction and utility companies. Many of these players focus on innovation, safety, and regulatory compliance, enabling them to maintain strong market positions.

Company | Establishment Year | Headquarters | Revenue | Fleet Size | Geographic Reach | OSHA Compliance | Product Range | R&D Investment |

National Trench Safety | 2003 | Houston, TX | - | - | - | - | - | - |

United Rentals | 1997 | Stamford, CT | - | - | - | - | - | - |

Efficiency Production, Inc. | 1971 | Mason, MI | - | - | - | - | - | - |

Trench Shoring Services | 1980 | Los Angeles, CA | - | - | - | - | - | - |

Sunbelt Rentals | 1983 | Fort Mill, SC | - | - | - | - | - | - |

USA Trench Shoring Market Analysis

USA Trench Shoring Market Growth Drivers

- Infrastructure Development: The United States is undergoing infrastructure development, driven by the $1.2 trillion Infrastructure Investment and Jobs Act, which was passed in November 2021. This act allocated funding for repairing and expanding the nations aging infrastructure, including roads, bridges, and underground utilities, all of which require trench shoring equipment for safe excavation. By 2024, around $550 billion of this funding will be directed toward infrastructure projects that are expected to create demand for trench shoring solutions. This increase in public infrastructure development has amplified the need for advanced trench shoring techniques for ensuring safety.

- Urbanization and Construction Projects: Rapid urbanization in the U.S. continues to drive the need for robust construction practices, especially in densely populated cities like New York, Los Angeles, and Chicago. In 2024, nearly 83% of the U.S. population resides in urban areas, according to data from the U.S. Census Bureau, and this growth in urban density necessitates more complex construction techniques, including trench shoring. Urban construction projects require deep excavations for the installation of utilities, sewer lines, and underground electrical systems, all of which are critical applications for trench shoring solutions.

- Safety Regulations: Safety concerns in the construction industry, especially related to trench collapses, have heightened the demand for trench shoring solutions. According to the U.S. Occupational Safety and Health Administration (OSHA), there were 39 recorded trenching fatalities in 2022, and this has prompted stricter enforcement of safety regulations regarding trench safety. OSHA mandates require that trench shoring systems be used in any trench deeper than 5 feet to prevent cave-ins. Increased adherence to these regulations is driving the demand for reliable trench shoring equipment across various construction projects.

USA Trench Shoring Market Challenges

- High Equipment Costs: The cost of acquiring trench shoring equipment remains a challenge for small and mid-sized construction companies. According to the U.S. Bureau of Labor Statistics, the cost of heavy machinery, including shoring equipment, has increased by 6% from 2022 to 2024 due to inflationary pressures and supply chain disruptions. This rise in equipment costs affects companies ability to invest in modern shoring systems, making it more difficult for smaller contractors to comply with stringent safety regulations.

- Skilled Labor Shortage: The U.S. construction industry faces an ongoing skilled labor shortage, with a shortfall of 430,000 workers in 2023, as reported by the Associated Builders and Contractors. This shortage is particularly acute for specialized roles like excavation and trench safety, which require trained personnel. The lack of skilled labor complicates the deployment of trench shoring systems, as fewer workers possess the necessary expertise to operate and manage these systems safely.

USA Trench Shoring Market Future Outlook

Over the next five years, the USA Trench Shoring market is expected to experience moderate growth driven by ongoing infrastructure development projects, particularly in urban and suburban areas. Continued investment in transportation, water management, and oil and gas pipelines is projected to sustain demand for trench shoring equipment. In addition, advancements in safety technologies and the adoption of digital solutions for site management are likely to play a major role in shaping the future of this market. The growing rental market, driven by cost-conscious contractors, will also fuel market expansion.

USA Trench Shoring Market Opportunities

- Technological Advancements in Shoring Equipment: Technological innovations are transforming the trench shoring equipment market. Advanced systems such as hydraulic shoring and slide rail systems have increased operational efficiency and safety. In 2024, automated trench shoring systems, which integrate sensors and AI for real-time monitoring, have begun to gain traction. These advancements are reducing manual labor and increasing safety compliance, opening opportunities for companies to invest in smarter, more efficient shoring solutions. These systems are particularly relevant for large-scale projects, where precision and safety are paramount.

- Expansion into Rural and Suburban Areas: The construction boom is no longer confined to major metropolitan areas. In 2024, over $400 billion in infrastructure investment has been allocated to rural and suburban regions under the Infrastructure Investment and Jobs Act. These areas require substantial improvements in utility infrastructure, including water pipelines and underground electric grids, which drive the demand for trench shoring equipment. Expansion into these regions presents a growth opportunity for shoring companies, particularly as rural and suburban areas catch up to urban infrastructure standards. Source.

Scope of the Report

By Product Type | Hydraulic Shoring Systems Trench Boxes Slide Rail Systems Beam and Plate Shoring |

By Application | Water and Sewer Systems Oil and Gas Pipeline Construction Transportation Infrastructure Electrical Utility Projects |

By End User | Construction Contractors Utility Providers Government Bodies Rental Companies |

By Material Type | Steel Aluminum Composite Materials |

By Region | Northeast Midwest South West |

Products

Key Target Audience

Government and Regulatory Bodies (OSHA, EPA)

Infrastructure Development Firms

Construction Contractors

Banks and Financial Institutions

Utility Providers (Water, Gas, Electric)

Trench Shoring Equipment Manufacturers

Rental Equipment Companies

Investor and Venture Capitalist Firms

Public-Private Partnership Firms

Companies

Players Mentioned in the Report

National Trench Safety

United Rentals

Efficiency Production, Inc.

Trench Shoring Services

Sunbelt Rentals

GME (Groundforce Shoring)

Rain for Rent

TrenchTech, Inc.

Mabey Inc.

Shore Hire

Table of Contents

1. USA Trench Shoring Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Trench Shoring Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Trench Shoring Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development

3.1.2. Urbanization and Construction Projects

3.1.3. Safety Regulations

3.1.4. Environmental Concerns (Soil Stabilization, Erosion Control)

3.2. Market Challenges

3.2.1. High Equipment Costs

3.2.2. Skilled Labor Shortage

3.2.3. Regulatory Complexity (OSHA Compliance)

3.3. Opportunities

3.3.1. Technological Advancements in Shoring Equipment

3.3.2. Expansion into Rural and Suburban Areas

3.3.3. Increasing Demand for Modular Shoring Systems

3.4. Trends

3.4.1. Adoption of Digital Solutions for Project Management

3.4.2. Integration with Smart City Initiatives

3.4.3. Growing Rental Market for Trench Shoring Equipment

3.5. Government Regulation

3.5.1. Occupational Safety and Health Administration (OSHA) Regulations

3.5.2. Environmental Protection Standards

3.5.3. Public-Private Partnerships in Infrastructure Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Trench Shoring Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Hydraulic Shoring Systems

4.1.2. Trench Boxes

4.1.3. Slide Rail Systems

4.1.4. Beam and Plate Shoring

4.2. By Application (In Value %)

4.2.1. Water and Sewer Systems

4.2.2. Oil and Gas Pipeline Construction

4.2.3. Transportation Infrastructure

4.2.4. Electrical Utility Projects

4.3. By End User (In Value %)

4.3.1. Construction Contractors

4.3.2. Utility Providers

4.3.3. Government Bodies

4.3.4. Rental Companies

4.4. By Material Type (In Value %)

4.4.1. Steel

4.4.2. Aluminum

4.4.3. Composite Materials

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Trench Shoring Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. National Trench Safety

5.1.2. Efficiency Production, Inc.

5.1.3. Trench Shoring Services

5.1.4. United Rentals

5.1.5. GME (Groundforce Shoring)

5.1.6. Rain for Rent

5.1.7. TrenchTech, Inc.

5.1.8. Mabey Inc.

5.1.9. Shore Hire

5.1.10. ICON Equipment

5.1.11. Speed Shore Corporation

5.1.12. Sunbelt Rentals

5.1.13. Kundel Industries

5.1.14. Acrow Bridge

5.1.15. Pro-Tec Equipment

5.2. Cross Comparison Parameters (Market Share, Revenue, Number of Projects Completed, Equipment Fleet Size, Geographic Presence, Investment in R&D, Strategic Partnerships, Innovation in Equipment Design)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Investments

6. USA Trench Shoring Market Regulatory Framework

6.1. Occupational Safety Standards

6.2. Environmental Compliance

6.3. Certification Requirements

7. USA Trench Shoring Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Trench Shoring Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End User (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. USA Trench Shoring Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

In this initial step, an ecosystem map was constructed to encompass all the major stakeholders in the USA Trench Shoring market. Extensive desk research, combined with secondary and proprietary databases, was employed to gather industry-level information. The objective of this step was to identify critical variables influencing the market, such as regulatory compliance, technological advancements, and infrastructure spending.

Step 2: Market Analysis and Construction

This phase focused on compiling and analyzing historical data, including market penetration rates and service provider-to-market ratios. Furthermore, data on project completions and the number of active construction contracts in the USA were evaluated to ensure the reliability of the market size and growth estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts and contractors in the field of trench safety and construction. These interviews provided first-hand insights into the operational and financial aspects of the trench shoring market, helping to refine market estimates.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the findings from multiple construction and equipment companies. The data from the bottom-up approach was verified through direct engagement with manufacturers and rental companies, ensuring an accurate and comprehensive analysis of the USA Trench Shoring market.

Frequently Asked Questions

01. How big is the USA Trench Shoring Market?

The USA Trench Shoring market is valued at USD 1.8 billion, driven by large-scale infrastructure projects and stringent safety regulations from OSHA. The increasing demand for excavation and trench safety equipment is also contributing to the market's expansion.

02. What are the key challenges in the USA Trench Shoring Market?

Challenges in the USA Trench Shoring market include high initial costs of shoring equipment, a shortage of skilled labor, and navigating complex regulatory requirements. Compliance with safety standards like OSHA is a critical but costly aspect for companies in this market.

03. Who are the major players in the USA Trench Shoring Market?

Key players in the USA Trench Shoring market include National Trench Safety, United Rentals, Efficiency Production, Inc., Trench Shoring Services, and Sunbelt Rentals. These companies dominate due to their extensive equipment fleets, strong market presence, and compliance with safety regulations.

04. What is driving growth in the USA Trench Shoring Market?

Growth in the USA Trench Shoring market is driven by ongoing infrastructure development, increasing urbanization, and the need for safety in excavation projects. The adoption of advanced shoring technologies and the growing rental equipment market also contribute to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.