USA Trona Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD4212

November 2024

85

About the Report

USA Trona Market Overview

- The USA Trona Market is valued at USD 2.5 billion, driven primarily by its key application in the production of soda ash, which is used in various industries like glass manufacturing, chemicals, and water treatment. The market is significantly influenced by the high-quality natural reserves in the Green River Basin, Wyoming, which holds the largest deposit of trona globally. These extensive reserves reduce reliance on synthetic alternatives and help the USA remain competitive on the global stage.

- The dominant players in the trona market are primarily located in the USA, with Wyoming leading the production due to its abundant natural reserves. Other significant contributors include smaller operations in Texas and California, though these regions hold a minor share compared to Wyoming. The USAs dominance is primarily due to these vast reserves and a well-established mining infrastructure, which ensures consistent supply and cost efficiency for soda ash production.

- The Clean Water Act and Clean Air Act mandate strict standards for reducing emissions and preventing water contamination from mining processes. In 2023, several trona mines in Wyoming were required to upgrade their water management systems to prevent harmful chemical runoff, reducing potential environmental damage. These upgrades have significantly increased operational costs, but they are necessary for meeting federal environmental standards, ensuring long-term sustainability in mining practices.

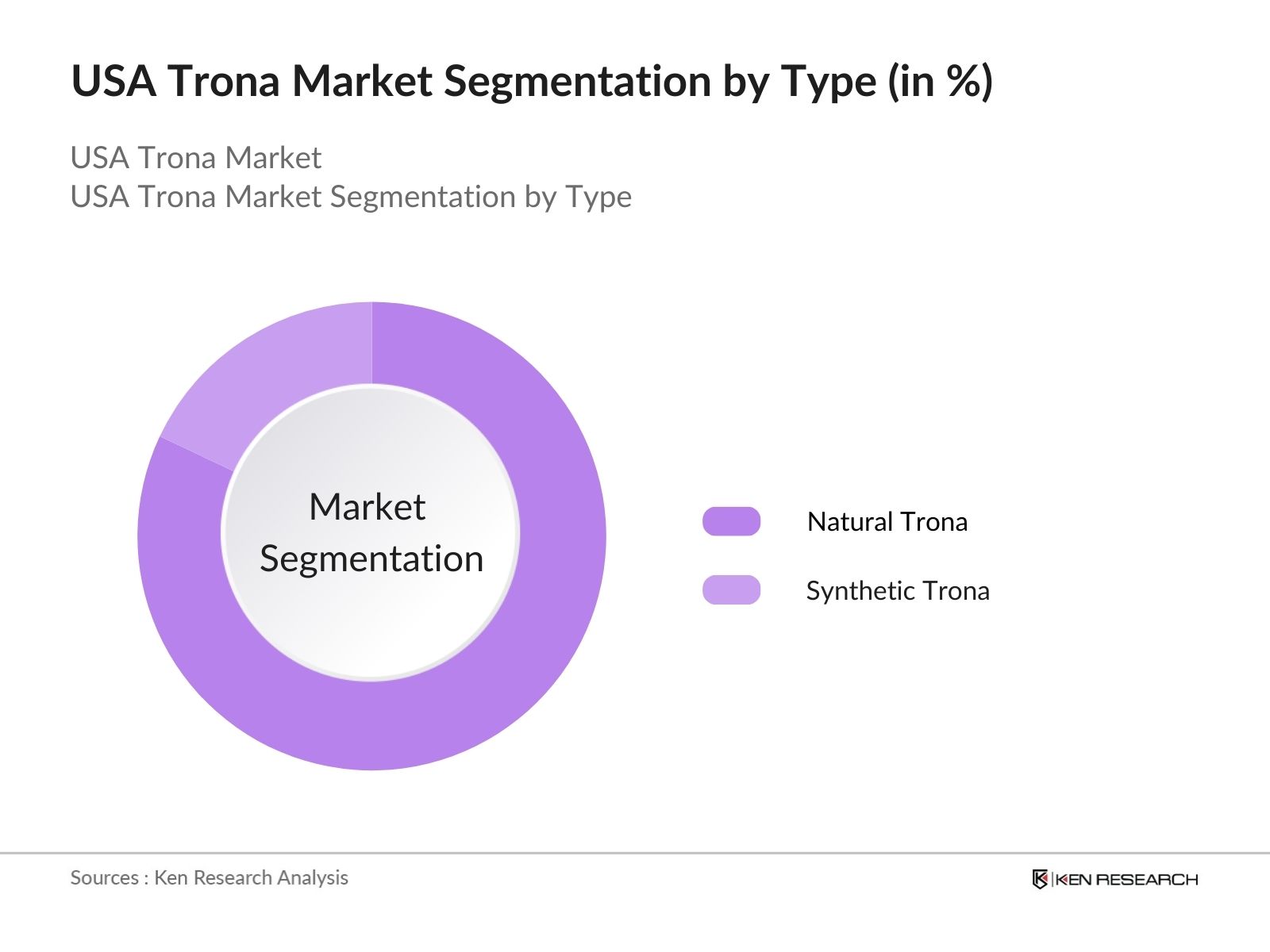

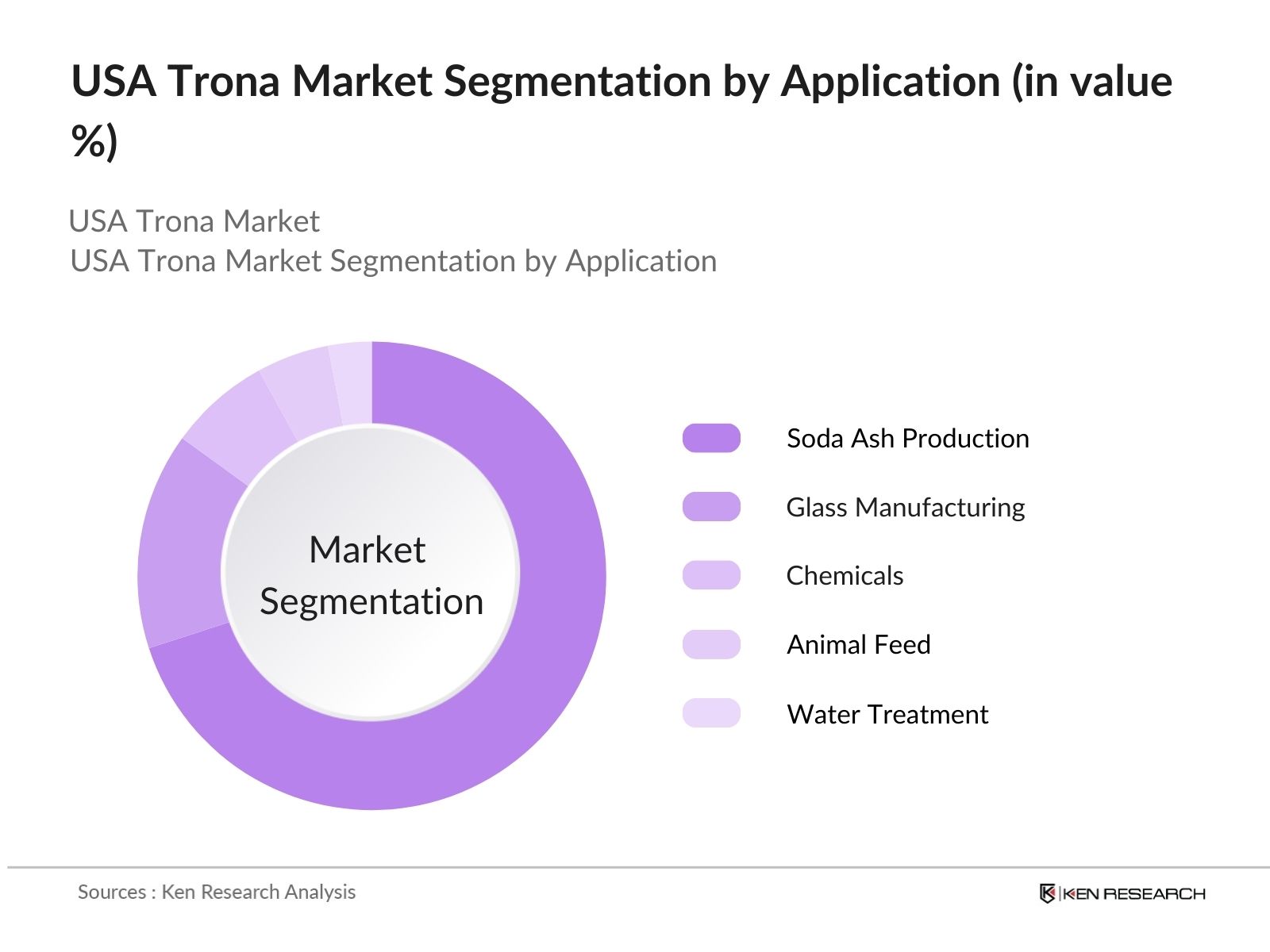

USA Trona Market Segmentation

By Type: The USA Trona Market is segmented by type into natural trona and synthetic trona. Natural trona dominates the market due to its cost-effectiveness and abundance in key regions like the Green River Basin. The availability of natural deposits and the lower environmental impact associated with mining natural trona versus producing synthetic trona significantly bolster its market share. This segment caters to large-scale industries requiring soda ash for various applications such as glass production and water treatment.

By Application: The USA Trona Market is further segmented by application into soda ash production, glass manufacturing, chemicals, animal feed, and water treatment. Soda ash production dominates the application segment, driven by the extensive use of soda ash in the glass manufacturing industry. The demand for soda ash in various industrial processes, such as detergent and chemical manufacturing, further drives this segment. The soda ash produced from trona is vital for the global glass industry, and its importance keeps this sub-segment dominant in the market.

USA Trona Market Competitive Landscape

The USA Trona Market is highly consolidated, with a few major players dominating the market due to their control over key natural reserves and long-standing operations. These companies benefit from advanced mining technology and strong distribution networks that allow them to maintain cost efficiency and market control. The market is shaped by established players like Tata Chemicals North America and Genesis Alkali LLC, whose large-scale production and extensive resources provide them with a competitive advantage.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Revenue |

Employee Strength |

Key Products |

Key Markets |

|

Tata Chemicals North America |

1939 |

New York, USA |

- |

- |

- |

- |

- |

|

Genesis Alkali LLC |

1953 |

Wyoming, USA |

- |

- |

- |

- |

- |

|

Ciner Resources Corporation |

2013 |

Georgia, USA |

- |

- |

- |

- |

- |

|

FMC Corporation |

1883 |

Pennsylvania, USA |

- |

- |

- |

- |

- |

|

Solvay Chemicals Inc. |

1863 |

Brussels, Belgium |

- |

- |

- |

- |

- |

USA Trona Market Analysis

Growth Drivers

- Availability of Natural Reserves: The United States holds one of the largest natural reserves of trona in the world, specifically in the Green River Basin in Wyoming, which contains over 100 billion metric tons of trona deposits. These natural reserves provide the U.S. with a long-term strategic advantage in the global trona market. According to the U.S. Geological Survey (USGS), the U.S. produced approximately 11 million metric tons of trona in 2023, positioning it as the world leader in natural soda ash production. Trona mining supports industries ranging from glass manufacturing to chemicals.

- Industrial Demand for Soda Ash: Soda ash derived from trona is critical for the production of glass, detergents, and other industrial products. The United States consumes 4.1 million metric tons of soda ash annually for domestic use, with glass manufacturing being the largest consumer. Global glass demand, particularly from the construction and automotive sectors, continues to rise.

- Environmental Regulations Encouraging Sustainable Mining: Environmental regulations are pushing the trona industry toward sustainable mining practices. The U.S. Environmental Protection Agency (EPA) has mandated stricter emissions standards for mining operations, promoting the adoption of more energy-efficient technologies. For instance, the Clean Air Act is a driving force behind reducing harmful emissions from trona mining and processing. Such regulations have led companies to invest in technologies that lower their carbon footprints while meeting the growing industrial demand for soda ash.

Challenges

- Environmental Concerns Regarding Mining Practices: Despite technological advancements, trona mining remains associated with environmental concerns, particularly regarding land degradation and water usage. Mining operations in Wyoming consume millions of gallons of water annually, leading to local concerns about water table depletion. Additionally, tailings from mining operations contribute to landfills, raising

- Fluctuations in Global Demand: The U.S. trona market is highly dependent on global demand for soda ash, which can fluctuate based on industrial needs. In 2023, global soda ash demand slowed slightly due to economic uncertainties, especially in key markets like China and India. Export figures show that U.S. soda ash exports dropped to 6 million metric tons in 2023 from 7 million in 2022, reflecting the volatility in demand. Such fluctuations present challenges for U.S. producers reliant on export markets.

USA Trona Future Market Outlook

The USA Trona Market is expected to experience steady growth, driven by increasing global demand for soda ash and continued technological advancements in trona extraction. With the ongoing trend toward sustainability, efforts to improve energy efficiency in mining and processing are likely to contribute positively to market growth. Furthermore, export opportunities are anticipated to rise as countries with limited natural resources look to import soda ash from the USA.

Market Opportunities

- Technological Advancements in Mining and Processing: Technological innovations, including automation and AI-driven equipment, are transforming the trona mining sector. Smart mining technologies that enhance resource extraction efficiency while minimizing environmental impact are gaining traction. For instance, the use of AI in equipment has improved yield extraction by 10% in Wyomings trona mines. These advancements reduce costs and increase production efficiency, positioning U.S. producers to capitalize on growing global demand.

- Export Potential to Global Markets: The U.S. has immense potential to expand its trona exports, particularly to emerging markets in Southeast Asia and Africa. In 2023, the U.S. exported around 6 million metric tons of soda ash, primarily to countries in Europe, Latin America, and Asia. As global industrialization trends continue, demand for soda ash in developing economies is expected to grow. The U.S. is well-positioned to capitalize on this, thanks to its vast trona reserves and established export infrastructure.

Scope of the Report

|

Segments |

Sub-segments |

|

By Type |

Natural Trona |

|

By Application |

Soda Ash Production |

|

By End-User Industry |

Industrial Manufacturing |

|

By Region |

Western USA Eastern USA |

|

By Process Type |

Room and Pillar Mining Solution Mining |

Products

Key Target Audience

Trona Mining Companies

Soda Ash Manufacturers

Glass Manufacturing Companies

Chemical Producers

Water Treatment Companies

Animal Feed Producers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of the Interior, Environmental Protection Agency)

Companies

Major Players

Tata Chemicals North America Inc.

Genesis Alkali LLC

Ciner Resources Corporation

FMC Corporation

Solvay Chemicals Inc.

Searles Valley Minerals

American Natural Soda Ash Corporation (ANSAC)

Tronox Limited

Natural Soda Inc.

OCI Wyoming LP

Tata Chemicals Europe Ltd.

Kazan Soda Elektrik

JSC "Bashkir Soda Company"

Eti Soda AS

Weifang Soda Ash Co. Ltd.

Table of Contents

1. USA Trona Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Trona Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Trona Market Analysis

3.1 Growth Drivers

3.1.1 Availability of Natural Reserves

3.1.2 Industrial Demand for Soda Ash

3.1.3 Environmental Regulations Encouraging Sustainable Mining

3.1.4 Global Demand for Soda Ash in Glass Manufacturing

3.2 Market Challenges

3.2.1 Environmental Concerns Regarding Mining Practices

3.2.2 Fluctuations in Global Demand

3.2.3 Energy-Intensive Production Processes

3.2.4 Increasing Regulatory Stringency

3.3 Opportunities

3.3.1 Technological Advancements in Mining and Processing

3.3.2 Export Potential to Global Markets

3.3.3 Expansion of Trona Production Capacity

3.3.4 Growth in Emerging Applications such as Environmental Solutions

3.4 Trends

3.4.1 Sustainability and Energy Efficiency Initiatives

3.4.2 Focus on Reducing Carbon Footprint

3.4.3 Adoption of Smart Mining Technologies

3.5 Government Regulations

3.5.1 Mining Laws and Permits

3.5.2 Environmental Compliance Requirements

3.5.3 Trade Agreements Impacting Export

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. USA Trona Market Segmentation

4.1 By Type (In Value %)

4.1.1 Natural Trona

4.1.2 Synthetic Trona

4.2 By Application (In Value %)

4.2.1 Soda Ash Production

4.2.2 Glass Manufacturing

4.2.3 Chemicals

4.2.4 Animal Feed

4.2.5 Water Treatment

4.3 By End-User Industry (In Value %)

4.3.1 Industrial Manufacturing

4.3.2 Automotive

4.3.3 Construction

4.3.4 Environmental Solutions

4.4 By Region (In Value %)

4.4.1 Western USA

4.4.2 Midwest USA

4.4.3 Southern USA

4.4.4 Eastern USA

4.5 By Process Type (In Value %)

4.5.1 Room and Pillar Mining

4.5.2 Solution Mining

5. USA Trona Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Tata Chemicals North America Inc.

5.1.2 Genesis Alkali LLC

5.1.3 Ciner Resources Corporation

5.1.4 FMC Corporation

5.1.5 OCI Wyoming LP

5.1.6 Solvay Chemicals Inc.

5.1.7 Searles Valley Minerals

5.1.8 American Natural Soda Ash Corporation (ANSAC)

5.1.9 Tronox Limited

5.1.10 Natural Soda Inc.

5.1.11 Tata Chemicals Europe Ltd.

5.1.12 Kazan Soda Elektrik

5.1.13 JSC "Bashkir Soda Company"

5.1.14 Eti Soda AS

5.1.15 Weifang Soda Ash Co. Ltd.

5.2 Cross Comparison Parameters (Revenue, Headquarters, Number of Employees, Global Production Capacity, Market Share, Product Portfolio, Strategic Initiatives, Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Joint Ventures, Acquisitions, Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Trona Market Regulatory Framework

6.1 Mining Regulations

6.2 Environmental Compliance (Permitting, Emissions, Waste Management)

6.3 Trade and Export Policies

6.4 Safety Standards (OSHA, MSHA Compliance)

6.5 Certification Processes (ISO Certifications, Energy Management Standards)

7. USA Trona Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Export Opportunities, New Applications, Technological Advancements)

8. USA Trona Market Future Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Region (In Value %)

8.5 By Process Type (In Value %)

9. USA Trona Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 White Space Opportunity Analysis

9.4 Market Entry Strategy

9.5 Competitive Benchmarking

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step in the research involved mapping out all major stakeholders in the USA Trona Market, using extensive desk research and proprietary databases. The primary goal was to identify variables such as production capacity, geographical advantages, and market demand.

Step 2: Market Analysis and Construction

This step involved analyzing historical market data to assess market penetration and revenue generation trends. We evaluated key data points such as production efficiency and the ratio of trona consumption to soda ash production to ensure reliability in our projections.

Step 3: Hypothesis Validation and Expert Consultation

We engaged with industry experts from the top trona mining companies and conducted interviews through computer-assisted telephone interviews (CATI). These consultations helped us validate key hypotheses and provided valuable insights into market dynamics and production trends.

Step 4: Research Synthesis and Final Output

The final stage involved consolidating all the data collected from desk research, expert consultations, and bottom-up analysis. This data was verified through engagement with multiple mining companies and soda ash manufacturers to ensure accurate and comprehensive insights for the USA Trona Market.

Frequently Asked Questions

01. How big is the USA Trona Market?

The USA Trona Market is valued at USD 2.5 billion, primarily driven by the use of trona in soda ash production, which supports industries such as glass manufacturing and water treatment.

02. What are the challenges in the USA Trona Market?

Key challenges include fluctuating global demand, environmental concerns regarding mining processes, and the energy-intensive nature of trona extraction and processing.

03. Who are the major players in the USA Trona Market?

The major players include Tata Chemicals North America, Genesis Alkali LLC, Ciner Resources Corporation, FMC Corporation, and Solvay Chemicals Inc., dominating due to their control over natural reserves and established mining operations.

04. What are the growth drivers of the USA Trona Market?

The market is driven by global demand for soda ash, which is essential for glass production and various chemical processes. The sustainability efforts in mining operations and the demand for environmental solutions also propel growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.