USA Truck Market Outlook to 2029

Region:North America

Author(s):Rebecca Mary Reji

Product Code:KRO022

June 2025

90

About the Report

USA Truck Market Overview

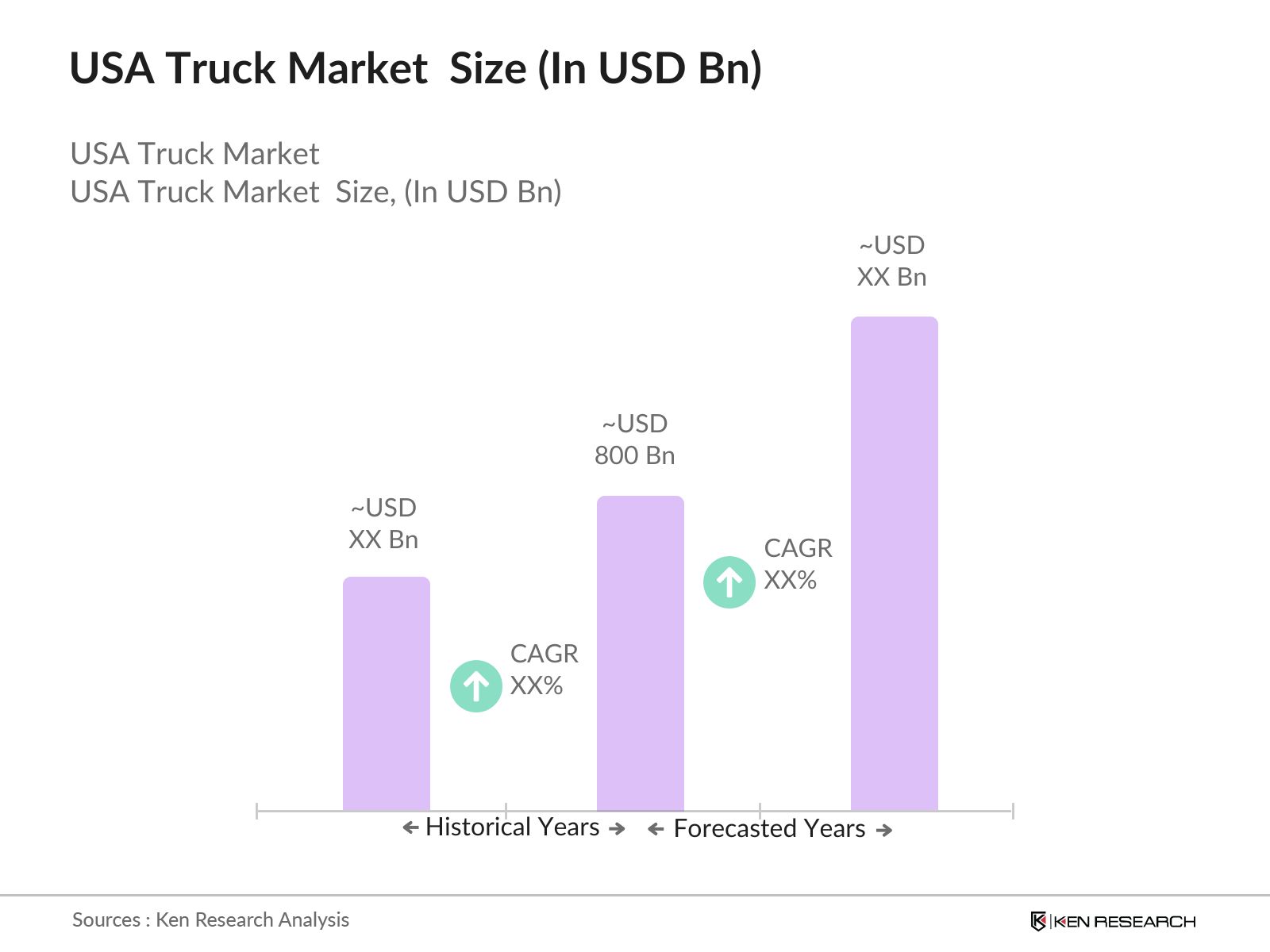

- The USA Truck Market was valued at USD 800 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for freight transportation, e-commerce expansion, and the need for efficient logistics solutions. The market has seen a surge in the adoption of advanced technologies, including telematics and automation, which enhance operational efficiency and reduce costs.

- Key players in this market include major cities such as Los Angeles, Chicago, and Dallas, which serve as critical logistics hubs due to their strategic locations, extensive transportation networks, and proximity to major ports. These cities facilitate the movement of goods across the country, making them vital to the overall growth of the truck market.

- In 2024, the U.S. EPA finalized stricter greenhouse gas emissions standards for heavy-duty trucks, known as Phase 3, effective for model years 2027–2032. These performance-based, technology-neutral regulations aim to cut emissions by about 1 billion metric tons by 2055 and encourage cleaner technologies, but do not mandate specific solutions or immediate compliance for 2023

USA Truck Market Segmentation

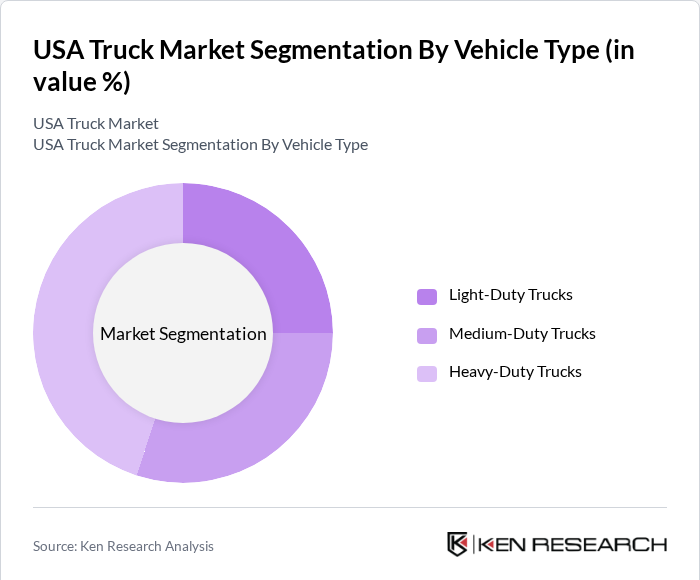

By Vehicle Type: The truck market is segmented into light-duty trucks, medium-duty trucks, and heavy-duty trucks. Among these, heavy-duty trucks dominate the market due to their essential role in long-haul transportation and freight logistics. The increasing demand for goods and the rise of e-commerce have led to a higher reliance on heavy-duty trucks for transporting large volumes over long distances. Additionally, advancements in fuel efficiency and technology have made heavy-duty trucks more appealing to fleet operators, further solidifying their market position.

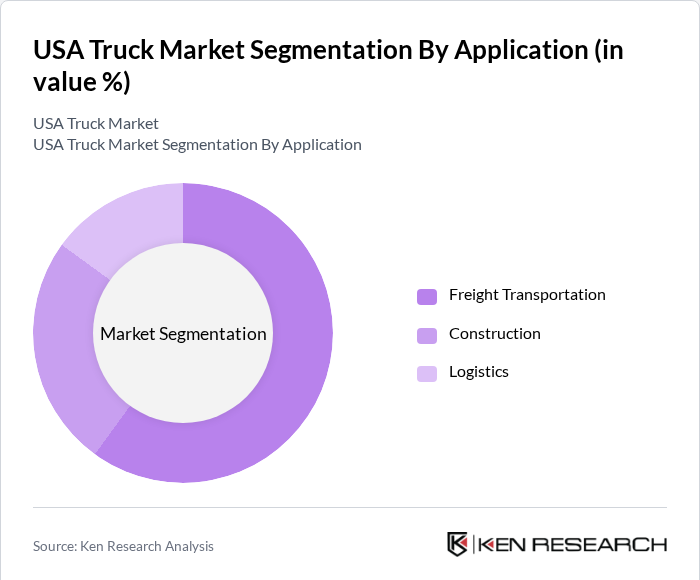

By Application: The truck market is further segmented into freight transportation, construction, and logistics. The freight transportation segment holds the largest share, driven by the booming e-commerce sector and the need for efficient supply chain solutions. Companies are increasingly investing in logistics to ensure timely deliveries, which has led to a surge in demand for trucks specifically designed for freight. This trend is supported by the growing consumer preference for online shopping, necessitating robust logistics networks.

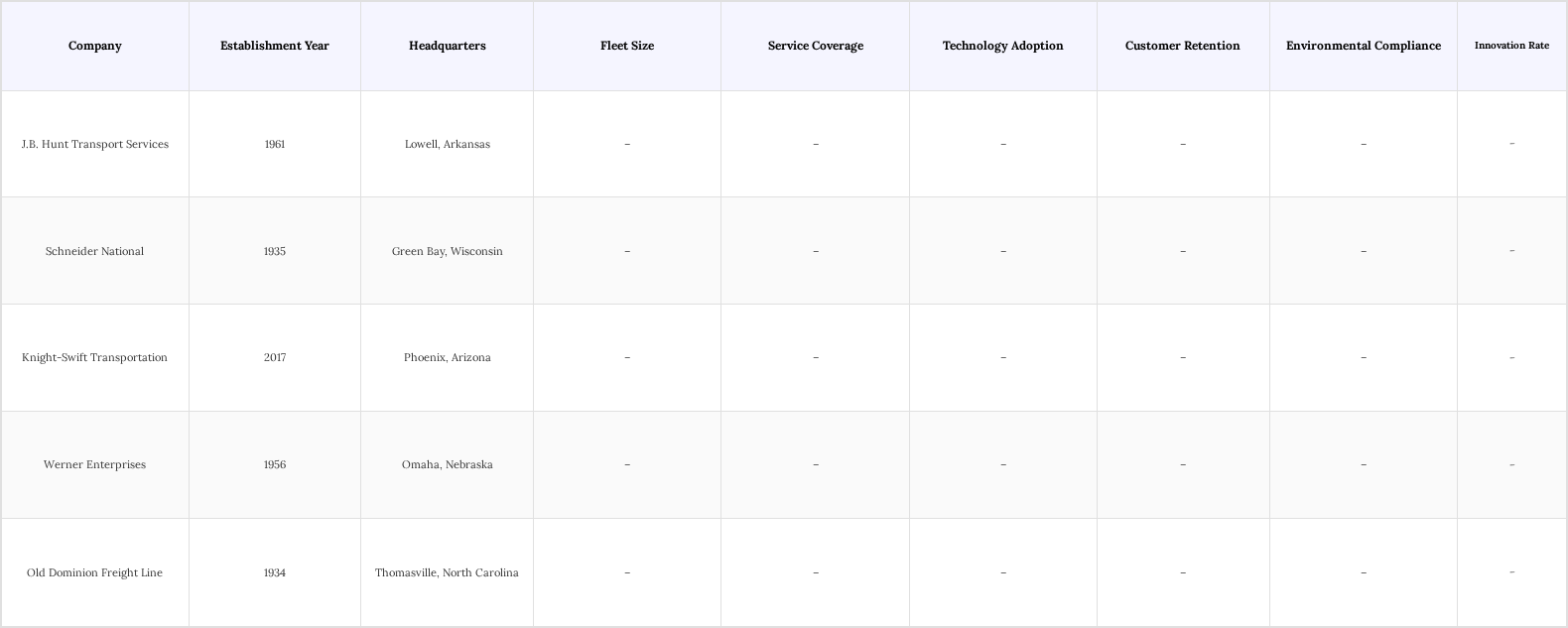

USA Truck Market Competitive Landscape

The USA Truck Market is characterized by intense competition among several key players, including companies like J.B. Hunt Transport Services, Schneider National, and Knight-Swift Transportation. These companies leverage advanced technologies and extensive logistics networks to maintain their market positions. The market is moderately concentrated, with a mix of large national carriers and smaller regional players, all striving to enhance service quality and operational efficiency.

USA Truck Market Industry Analysis

Growth Drivers

- Increasing Demand for E-commerce: The surge in e-commerce has significantly boosted the demand for trucking services, with online sales. This growth necessitates efficient last-mile delivery solutions, driving the need for light and medium-duty trucks. The U.S. Census Bureau reported a 15% increase in e-commerce sales in 2023, highlighting the critical role of trucking in meeting consumer expectations for rapid delivery.

- Infrastructure Development: The U.S. government’s $1.2 trillion Infrastructure Investment and Jobs Act, enacted in 2021 and still in effect, continues to drive upgrades to roads, bridges, and freight corridors. Ongoing improvements aim to reduce congestion, lower transit times, and cut operational costs for trucking companies. This sustained investment is boosting efficiency and capacity, strengthening the overall competitiveness of the U.S. trucking sector.

- Technological Advancements: The adoption of telematics, route optimization, and real-time tracking is revolutionizing fleet management in the trucking industry. According to industry reports, these technologies can reduce fuel consumption and maintenance costs by 10–15%. Enhanced efficiency and service reliability make trucking more attractive for logistics providers, supporting growth and competitiveness in the sector.

Market Challenges

- Rising Fuel Prices: Fuel costs remain a significant challenge for the trucking industry, as increases in diesel prices drive up operational expenses. This rise in costs pressures trucking companies to find ways to maintain profitability while managing expenses. The volatility of fuel prices can lead to unpredictable budgeting and financial planning for fleet operators.

- Driver Shortages: The trucking industry faces a critical shortage of drivers, with persistent vacancies across the sector. Factors contributing to this issue include an aging workforce and challenging working conditions, which hinder recruitment and retention efforts in the sector. If unaddressed, this shortage could significantly disrupt supply chains and the industry's ability to meet freight demand.

USA Truck Market Future Outlook

The USA Truck Market is poised for significant transformation driven by technological innovations and evolving consumer demands. As electric and alternative fuel trucks gain traction, the industry is expected to see a shift towards more sustainable practices. Additionally, the integration of autonomous technologies will likely enhance operational efficiency. With ongoing investments in infrastructure and logistics, the market is set to adapt to new challenges while capitalizing on emerging opportunities in the coming years.

Market Opportunities

- Growth of Electric Trucks: The U.S. electric truck market is projected to see rapid growth, with electric trucks expected to account for a small but rising share of total truck sales by 2025. By 2025, over 54,000 electric trucks are expected on U.S. roads, driven by federal and state incentives, but this remains a fraction of total truck sales

- Expansion of Logistics Solutions: The rise of e-commerce is driving the demand for innovative logistics solutions. Companies that invest in advanced supply chain technologies, such as AI-driven analytics and real-time tracking, can enhance their service offerings. This trend is expected to create new revenue streams and improve customer satisfaction, positioning logistics firms for growth in a competitive market.

Scope of the Report

| By Vehicle Type |

Light-Duty Trucks Medium-Duty Trucks Heavy-Duty Trucks |

| By Application |

Freight Transportation Construction Logistics |

| By Fuel Type |

Diesel Gasoline Electric Hybrid |

| By Region |

Northeast Midwest South West |

| By End-User |

Private Fleet Operators Public Fleet Operators Logistics Companies |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Motor Carrier Safety Administration, Department of Transportation)

Manufacturers and Producers

Logistics and Supply Chain Companies

Freight Brokers and Third-Party Logistics Providers

Technology Providers (e.g., Fleet Management Software Companies)

Industry Associations (e.g., American Trucking Associations)

Financial Institutions (e.g., Banks and Investment Firms specializing in Transportation)

Companies

Players Mentioned in the Report:

J.B. Hunt Transport Services

Schneider National

Knight-Swift Transportation

Werner Enterprises

Old Dominion Freight Line

USA Freight Solutions

Apex Logistics Group

Titan Trucking Services

Horizon Transport Network

Velocity Freight Carriers

Table of Contents

1. USA Truck Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Truck Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Truck Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for E-commerce and Last-Mile Delivery

3.1.2. Infrastructure Development and Investment in Transportation

3.1.3. Technological Advancements in Trucking and Fleet Management

3.2. Market Challenges

3.2.1. Rising Fuel Prices and Operational Costs

3.2.2. Driver Shortages and Workforce Management Issues

3.2.3. Regulatory Compliance and Environmental Standards

3.3. Opportunities

3.3.1. Growth of Electric and Alternative Fuel Trucks

3.3.2. Expansion of Logistics and Supply Chain Solutions

3.3.3. Adoption of Autonomous Trucking Technologies

3.4. Trends

3.4.1. Increasing Focus on Sustainability and Green Logistics

3.4.2. Integration of IoT and Smart Technologies in Fleet Operations

3.4.3. Shift Towards Digital Platforms for Freight Matching and Management

3.5. Government Regulation

3.5.1. Federal Motor Carrier Safety Administration (FMCSA) Regulations

3.5.2. Environmental Protection Agency (EPA) Emission Standards

3.5.3. State-Level Transportation Policies and Incentives

3.5.4. Compliance with Hours of Service (HOS) Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. USA Truck Market Segmentation

4.1. By Vehicle Type

4.1.1. Light-Duty Trucks

4.1.2. Medium-Duty Trucks

4.1.3. Heavy-Duty Trucks

4.2. By Application

4.2.1. Freight Transportation

4.2.2. Construction

4.2.3. Logistics

4.3. By Fuel Type

4.3.1. Diesel

4.3.2. Gasoline

4.3.3. Electric

4.3.4. Hybrid

4.4. By Region

4.4.1. Northeast

4.4.2. Midwest

4.4.3. South

4.4.4. West

4.5. By End-User

4.5.1. Private Fleet Operators

4.5.2. Public Fleet Operators

4.5.3. Logistics Companies

5. USA Truck Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. J.B. Hunt Transport Services

5.1.2. Schneider National

5.1.3. Knight-Swift Transportation

5.1.4. Werner Enterprises

5.1.5. Old Dominion Freight Line

5.1.6. USA Freight Solutions

5.1.7. Apex Logistics Group

5.1.8. Titan Trucking Services

5.1.9. Horizon Transport Network

5.1.10. Velocity Freight Carriers

5.2. Cross-Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Fleet Size

5.2.4. Geographic Reach

5.2.5. Customer Satisfaction Ratings

5.2.6. Technology Adoption Level

5.2.7. Environmental Compliance

5.2.8. Innovation Index

6. USA Truck Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Truck Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Truck Market Future Market Segmentation

8.1. By Vehicle Type

8.1.1. Light-Duty Trucks

8.1.2. Medium-Duty Trucks

8.1.3. Heavy-Duty Trucks

8.2. By Application

8.2.1. Freight Transportation

8.2.2. Construction

8.2.3. Logistics

8.3. By Fuel Type

8.3.1. Diesel

8.3.2. Gasoline

8.3.3. Electric

8.3.4. Hybrid

8.4. By Region

8.4.1. Northeast

8.4.2. Midwest

8.4.3. South

8.4.4. West

8.5. By End-User

8.5.1. Private Fleet Operators

8.5.2. Public Fleet Operators

8.5.3. Logistics Companies

9. USA Truck Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the critical components of the USA Truck Market, including key players, market segments, and regulatory factors. This step relies on extensive desk research, utilizing secondary data sources such as industry reports, government publications, and market studies to identify the variables that significantly impact market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze quantitative data related to the USA Truck Market, focusing on historical trends, market size, and growth rates. This analysis will include evaluating the competitive landscape, market share distribution among key players, and identifying emerging trends that could influence future market developments.

Step 3: Hypothesis Validation and Expert Consultation

To validate the formulated hypotheses, we will conduct interviews with industry experts and stakeholders, including manufacturers, logistics companies, and regulatory bodies. These consultations will provide qualitative insights that complement the quantitative data, helping to refine our understanding of market dynamics and consumer behavior.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing all collected data and insights into a cohesive report. This will include cross-referencing findings from both quantitative and qualitative analyses, ensuring that the final output presents a well-rounded view of the USA Truck Market, complete with actionable recommendations for stakeholders.

Frequently Asked Questions

01. How big is the USA Truck Market?

The USA Truck Market is valued at USD 800 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the USA Truck Market?

Key challenges in the USA Truck Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the USA Truck Market?

Major players in the USA Truck Market include J.B. Hunt Transport Services, Schneider National, Knight-Swift Transportation, Werner Enterprises, Old Dominion Freight Line, among others.

04. What are the growth drivers for the USA Truck Market?

The primary growth drivers for the USA Truck Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.