USA Tunnel Boring Machine Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD10869

November 2024

86

About the Report

USA Tunnel Boring Machine Market Overview

- The USA Tunnel Boring Machine market, valued at USD 1.1 billion, is driven by infrastructure development across urban centers and the adoption of advanced tunneling technologies. Federal and state-level investments in expanding transportation networks, combined with private sector initiatives in energy projects, contribute heavily to the markets valuation. The markets growth is largely sustained by government funding and technological advances that support high-efficiency boring equipment.

- Major cities like New York, Los Angeles, and Seattle dominate the market in the USA. These cities prioritize tunneling projects due to their dense urban populations and growing need for efficient transit systems. Additionally, the geological challenges in these areas necessitate specialized machinery, which further supports their lead in this market.

- The Federal Highway Administration allocated $1.2 trillion in the 2024 Infrastructure Investment and Jobs Act to enhance national infrastructure, including transportation and water systems. This funding prioritizes TBM-enabled tunnel projects, like expanding interstate transportation networks, driving demand for advanced TBM technologies in projects expected to span over a decade.

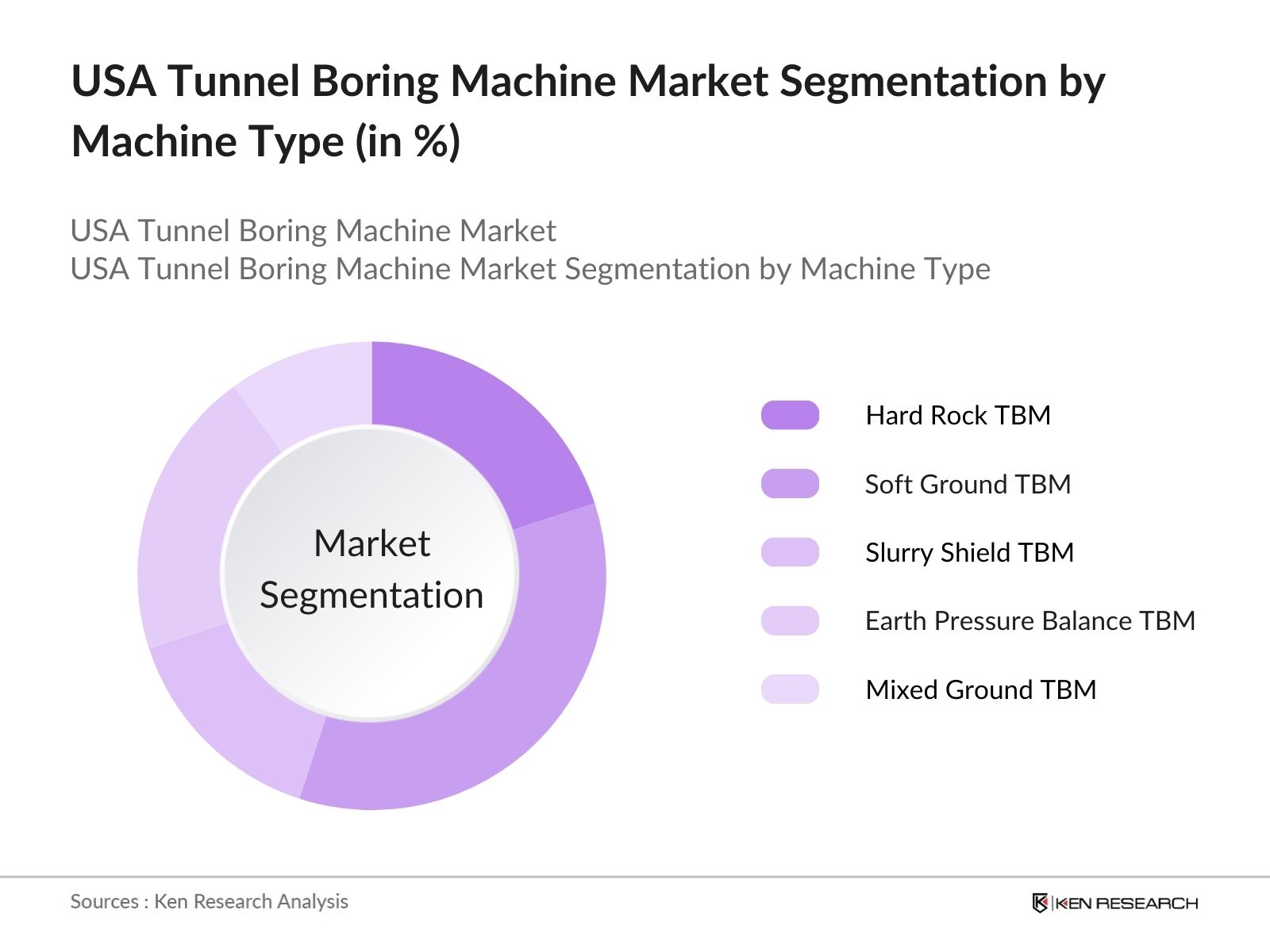

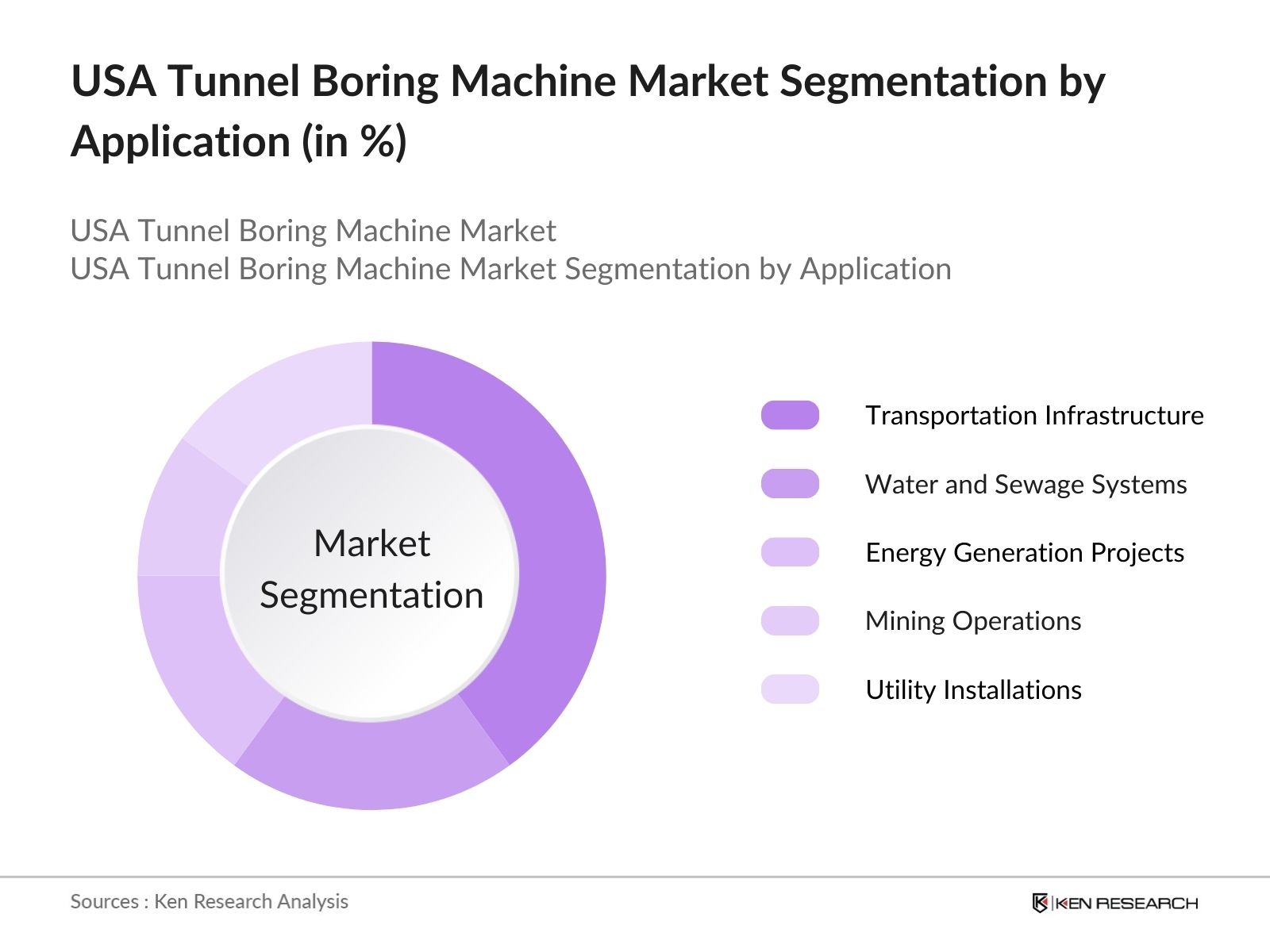

USA Tunnel Boring Machine Market Segmentation

By Machine Type: The market is segmented by machine type into Hard Rock TBM, Soft Ground TBM, Slurry Shield TBM, Earth Pressure Balance TBM, and Mixed Ground TBM. Recently, Soft Ground TBMs hold a dominant market share within this segment due to their specialized use in urban underground developments. Their capacity to handle softer soil and prevent ground settlement has made them preferable in metropolitan areas like New York and Los Angeles.

By Application: The market in the USA is segmented by application into Transportation Infrastructure, Water and Sewage Systems, Energy Generation Projects, Mining Operations, and Utility Installations. Transportation Infrastructure dominates due to extensive investments in urban transit systems. City expansion projects and inter-state rail systems rely heavily on tunneling to address urban congestion and improve logistics.

USA Tunnel Boring Machine Market Competitive Landscape

The market is dominated by key players, showcasing a mix of domestic and global companies. This competitive landscape highlights technological advancements and alliances among top firms in tunneling and construction sectors.

USA Tunnel Boring Machine Market Analysis

Market Growth Drivers

- Increasing Demand for Infrastructure Development Projects: The USA has been investing heavily in infrastructure development, with a recent allocation of around $110 billion for various projects nationwide. This increased funding includes large-scale transit and subway expansions, where tunnel boring machines (TBMs) are critical.

- Rising Construction of Water Management Systems: Due to water scarcity and climate change-induced flooding, the U.S. government allocated $20 billion in 2024 for constructing new water management infrastructure, including reservoirs and flood mitigation systems. TBMs are essential in developing these underground structures, especially in urban areas where surface space is limited.

- Increasing Focus on Clean Energy and Transportation: With a $50 billion investment in clean energy projects in 2024, the USA aims to boost the number of underground power line networks, tunnels for renewable energy storage, and transportation networks to reduce urban carbon emissions. Tunnel boring machines are essential in constructing these underground storage and transportation systems, and the growth in renewable energy projects is directly increasing TBM demand.

Market Challenges

- High Cost of Tunnel Boring Machine Operations: Tunnel boring machines are capital-intensive, with each unit costing upwards of $15 million. Additionally, operational expenses, including maintenance and labor, drive up costs significantly. For instance, the Second Avenue Subway project in New York recorded operational costs exceeding $4 billion due to TBM maintenance and labor-intensive processes, posing financial challenges to smaller contractors and projects with tight budgets.

- Lengthy Approval and Permitting Processes: Tunnel projects face regulatory challenges, with average approval timelines extending over 12 months, adding costs and delays. A notable example is the Purple Line Extension in Los Angeles, which faced delays due to environmental impact assessments and local government approvals, impacting project timelines and budget planning for TBM operations.

USA Tunnel Boring Machine Market Future Outlook

The USA Tunnel Boring Machine industry is expected to witness robust growth driven by urban infrastructure expansion, technological advancements, and a shift towards sustainable tunneling methods.

Future Market Opportunities

- Growth in Smart TBM Technology Integration: Over the next five years, TBM manufacturers are expected to invest in smart technologies, with projections indicating over 50,000 TBMs equipped with sensors and AI-driven controls by 2028. This shift will enhance operational accuracy and reduce downtime, streamlining project timelines and costs in large infrastructure projects, particularly in urban settings.

- Expansion in Underground Renewable Energy Storage: By 2029, underground tunnels for renewable energy storage will increase, with anticipated construction of over 20 energy storage tunnels nationwide. TBMs will play a crucial role in creating stable, secure storage environments, supporting the growth of the renewable energy sector in the U.S.

Scope of the Report

|

Machine Type |

Hard Rock TBM |

|

Soft Ground TBM |

|

|

Slurry Shield TBM |

|

|

Earth Pressure Balance TBM |

|

|

Mixed Ground TBM |

|

|

Application |

Transportation Infrastructure |

|

Water and Sewage Systems |

|

|

Energy Generation Projects |

|

|

Mining Operations |

|

|

Utility Installations |

|

|

Geology Type |

Hard Rock |

|

Soft Soil |

|

|

Mixed Geology |

|

|

Machine Diameter |

Small Diameter TBM (<4 meters) |

|

Medium Diameter TBM (4-8 meters) |

|

|

Large Diameter TBM (>8 meters) |

|

|

End-User |

Government Bodies |

|

Construction Contractors |

|

|

Private Developers |

|

|

Mining Companies |

|

|

Utility Providers |

|

|

Region |

North |

|

East |

|

|

West |

|

|

South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Transportation, Federal Highway Administration)

TBM Manufacturers and Suppliers

Urban Transit Authorities and Agencies

Construction and Infrastructure Development Companies

Utility Service Providers

Mining and Natural Resource Companies

Tunnel Maintenance and Service Contractors

Companies

Herrenknecht AG

Robbins Company

Hitachi Zosen Corporation

Caterpillar Inc.

China Railway Construction Heavy Industry

Akkerman Inc.

Komatsu Ltd.

Mitsubishi Heavy Industries, Ltd.

SANY Group

Terratec Ltd.

Table of Contents

1. USA Tunnel Boring Machine Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Growth Rate and Market Dynamics

1.4. Market Segmentation Overview

2. USA Tunnel Boring Machine Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Tunnel Boring Machine Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development Initiatives

3.1.2. Technological Advancements in TBM Design

3.1.3. Increasing Urbanization and Transit Expansion

3.1.4. Environmental Benefits and Sustainability

3.2. Market Challenges

3.2.1. High Initial Capital Investment

3.2.2. Geotechnical and Operational Challenges

3.2.3. Regulatory Constraints

3.3. Opportunities

3.3.1. Increased Application in Renewable Energy Projects

3.3.2. Private and Public Sector Collaborations

3.3.3. Digitalization and Automation in TBM Operations

3.4. Trends

3.4.1. Integration of AI and IoT in Tunnel Operations

3.4.2. Enhanced Safety and Monitoring Systems

3.4.3. Focus on Environmentally-Friendly Machinery

3.5. Government Regulations

3.5.1. Federal Infrastructure Funding Initiatives

3.5.2. Environmental Safety Standards

3.5.3. Compliance and Certification Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Tunnel Boring Machine Market Segmentation

4.1. By Machine Type (in Value %)

4.1.1. Hard Rock TBM

4.1.2. Soft Ground TBM

4.1.3. Slurry Shield TBM

4.1.4. Earth Pressure Balance TBM

4.1.5. Mixed Ground TBM

4.2. By Application (in Value %)

4.2.1. Transportation Infrastructure

4.2.2. Water and Sewage Systems

4.2.3. Energy Generation Projects

4.2.4. Mining Operations

4.2.5. Utility Installations

4.3. By Geology Type (in Value %)

4.3.1. Hard Rock

4.3.2. Soft Soil

4.3.3. Mixed Geology

4.4. By Machine Diameter (in Value %)

4.4.1. Small Diameter TBM (<4 meters)

4.4.2. Medium Diameter TBM (4-8 meters)

4.4.3. Large Diameter TBM (>8 meters)

4.5. By End-User (in Value %)

4.5.1. Government Bodies

4.5.2. Construction Contractors

4.5.3. Private Developers

4.5.4. Mining Companies

4.5.5. Utility Providers

4.6. By Region (in Value %)

North

East

West

South

5. USA Tunnel Boring Machine Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Herrenknecht AG

5.1.2. Robbins Company

5.1.3. Hitachi Zosen Corporation

5.1.4. Caterpillar Inc.

5.1.5. China Railway Construction Heavy Industry

5.1.6. Akkerman Inc.

5.1.7. Komatsu Ltd.

5.1.8. Mitsubishi Heavy Industries, Ltd.

5.1.9. SANY Group

5.1.10. Terratec Ltd.

5.1.11. Tianhe Mechanical Equipment Manufacturing Co., Ltd.

5.1.12. JIM Technology Corporation

5.1.13. STEC Shanghai Tunnel Engineering Co., Ltd.

5.1.14. Herrenknecht Tunneling Systems

5.1.15. American Augers, Inc.

5.2. Cross-Comparison Parameters (Machine Production Capacity, Market Presence, Technology Partnerships, Revenue, Product Innovations, Geographic Reach, Customer Base, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Landscape

5.7. Venture Capital and Private Equity Involvement

6. USA Tunnel Boring Machine Market Regulatory Framework

6.1. Environmental Compliance Standards

6.2. Certification Processes

6.3. Construction Safety Regulations

7. USA Tunnel Boring Machine Future Market Size (USD Billion)

7.1. Market Size Projections

7.2. Key Growth Drivers

8. USA Tunnel Boring Machine Future Market Segmentation

8.1. By Machine Type (in Value %)

8.2. By Application (in Value %)

8.3. By Geology Type (in Value %)

8.4. By Machine Diameter (in Value %)

8.5. By End-User (in Value %)

8.6. By Region (in Value %)

9. USA Tunnel Boring Machine Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Insights

9.3. Strategic Marketing Initiatives

9.4. White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase includes identifying the primary factors shaping the USA Tunnel Boring Machine market. Extensive desk research is conducted to pinpoint critical industry-level variables, with support from secondary databases and proprietary resources.

Step 2: Market Analysis and Construction

This step involves assembling and analyzing historical data on the USA Tunnel Boring Machine market, focusing on penetration rates, end-user profiles, and geographical adoption levels. Additionally, a comparative assessment is performed to verify accuracy.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, consultations are conducted with industry experts through structured interviews. These insights refine data accuracy and clarify operational factors relevant to the market.

Step 4: Research Synthesis and Final Output

In the final stage, data from primary interviews is synthesized with findings from secondary research. A bottom-up approach is employed to confirm comprehensive, data-backed analysis of the USA Tunnel Boring Machine market.

Frequently Asked Questions

1. How big is the USA Tunnel Boring Machine market?

The USA Tunnel Boring Machine market is valued at USD 1.1 billion, largely driven by federal investments in urban transit infrastructure and high-demand in metropolitan areas.

2. What challenges does the USA Tunnel Boring Machine market face?

Challenges in the USA Tunnel Boring Machine market include high initial capital requirements, complex regulatory standards, and limited skilled labor availability for operating advanced TBMs.

3. Who are the major players in the USA Tunnel Boring Machine market?

Key players in this USA Tunnel Boring Machine market include Herrenknecht AG, Robbins Company, Caterpillar Inc., Hitachi Zosen Corporation, and SANY Group, all influential through their technology and strategic partnerships.

4. What drives the USA Tunnel Boring Machine market growth?

Growth in the USA Tunnel Boring Machine market is driven by urbanization, federal and private sector investment in infrastructure, and the demand for high-efficiency boring solutions in geologically diverse regions

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.