USA Unmanned Ground Vehicle (UGV) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3049

November 2024

99

About the Report

USA Unmanned Ground Vehicle (UGV) Market Overview

- The USA Unmanned Ground Vehicle (UGV) market has reached a valuation of USD 580 million, primarily driven by the increasing adoption of UGVs across defense, industrial, and agricultural sectors. UGVs have found widespread application in the defense industry for explosive ordinance disposal (EOD), reconnaissance, and combat operations. Technological advancements, including AI-driven navigation systems and the rise of autonomous solutions, have accelerated market growth, contributing to the robust demand for UGVs across multiple industries.

- In terms of dominant regions, key areas such as California, Virginia, and Texas have emerged as major contributors to the market. California stands out due to its tech-centric ecosystem, allowing for rapid R&D and manufacturing. Virginia's proximity to defense and military facilities supports large-scale adoption of UGVs, particularly for military purposes. Texas, known for its expansive agricultural industry, has embraced UGVs to enhance agricultural productivity and operations.

- The Public-private partnerships have played a pivotal role in advancing UGV technologies. In 2023, the U.S. government partnered with over 30 private companies to accelerate UGV development, focusing on AI and sensor technologies. These collaborations have resulted in faster innovation cycles and the commercialization of UGV platforms across both military and civilian sectors.

USA Unmanned Ground Vehicle (UGV) Market Segmentation

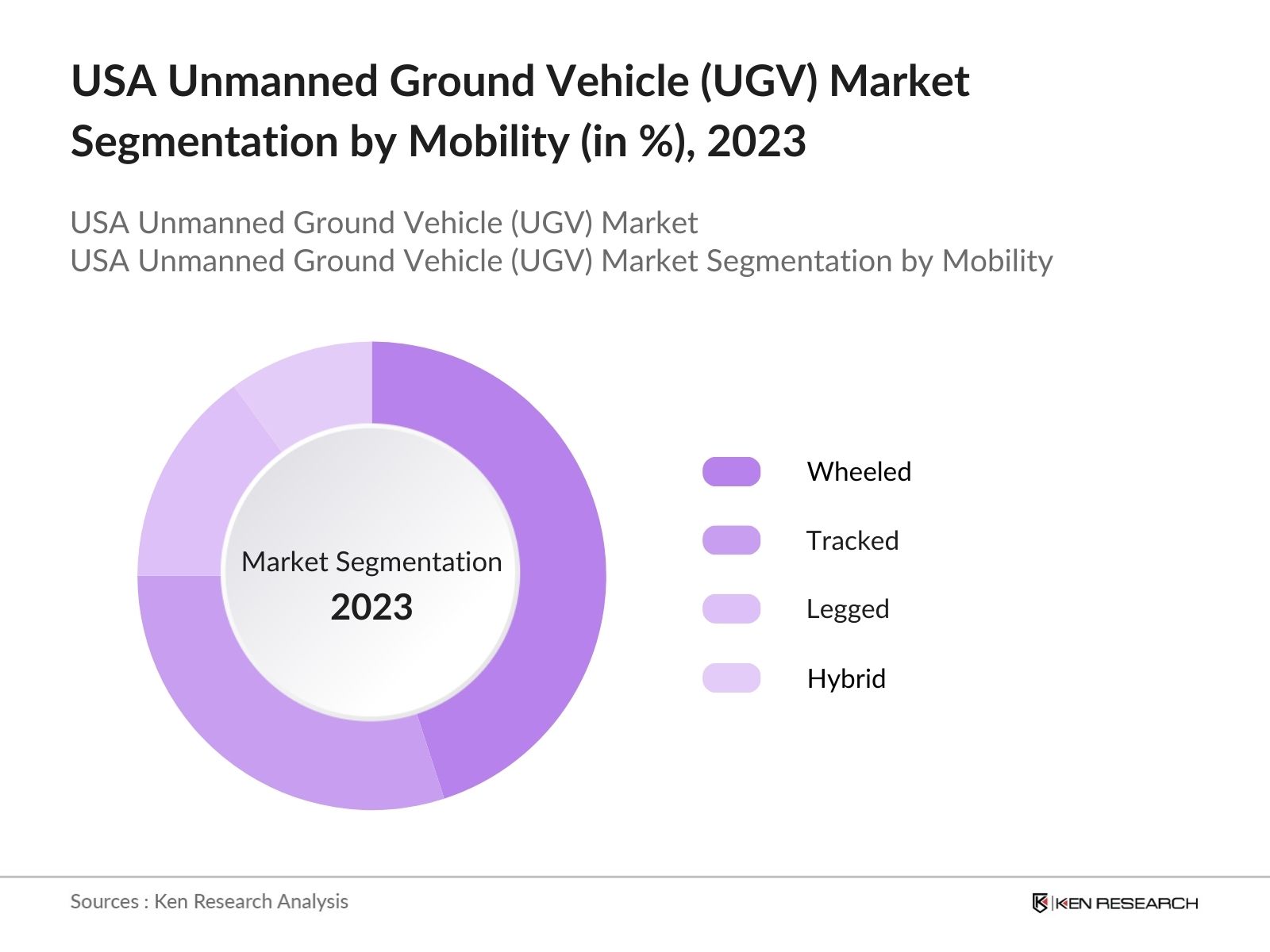

By Mobility: The market is segmented by mobility into wheeled, tracked, legged, and hybrid UGVs. Wheeled UGVs currently dominate the market due to their adaptability in a wide range of terrains, cost-efficiency, and ease of maintenance. Their applications in industries like defense, agriculture, and logistics are extensive. Wheeled UGVs are favored in the defense sector for patrol and logistics tasks, where reliability and speed are essential. Additionally, wheeled UGVs have a strong presence in the agricultural industry, where they are used for tasks such as soil analysis and crop monitoring.

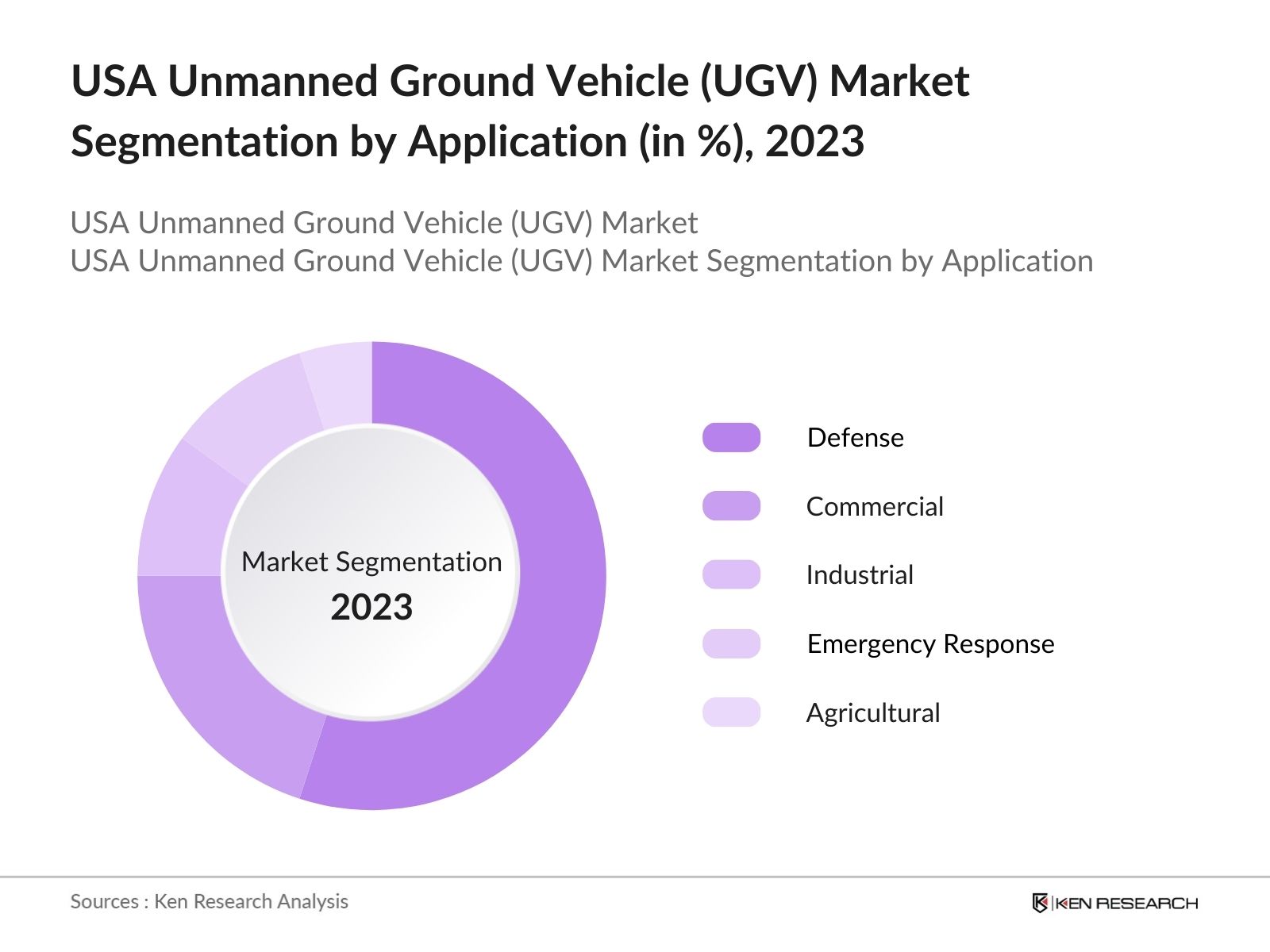

By Application: The market is also segmented by application into defense, commercial, industrial, emergency response, and agricultural UGVs. Defense UGVs are the dominant sub-segment due to the increasing focus on automation in military operations. UGVs in defense are used for a wide array of purposes including reconnaissance, logistics, and explosive ordinance disposal. Government investment in modernizing military technology and enhancing defense capabilities has propelled the growth of this segment. Additionally, emergency response UGVs have grown in significance due to their usage in disaster and rescue operations, where human intervention is either dangerous or impractical.

USA Unmanned Ground Vehicle (UGV) Market Competitive Landscape

USA Unmanned Ground Vehicle (UGV) Market Competitive Landscape

The market is dominated by several key players who focus on cutting-edge technology and maintaining strong partnerships with defense contractors. The landscape is competitive, with significant investments in R&D and innovation. Companies like Lockheed Martin and Northrop Grumman have solidified their positions through strategic defense contracts and large-scale government projects, while newer entrants like Clearpath Robotics are pushing the boundaries in industrial and commercial UGV applications.

|

USA Unmanned Ground Vehicle (UGV) Industry Analysis

Growth Drivers

- Increased Adoption in Military Applications: Unmanned Ground Vehicles (UGVs) are becoming integral to military operations due to their versatility in tasks like surveillance, reconnaissance, and logistics. In 2022, the U.S. Department of Defense invested $1.7 billion in UGV development, targeting areas such as border security and autonomous logistics. The U.S. Army, for example, deployed over 500 UGVs in operations focused on explosive ordnance disposal (EOD). These investments are expected to increase due to the need for autonomous solutions that minimize human risks in combat scenarios, especially in remote and hostile environments.

- Technological Advancements in AI and Machine Learning: Technological advancements in artificial intelligence (AI) and machine learning (ML) have significantly enhanced the autonomous navigation capabilities of UGVs. In 2023, the U.S. government allocated $800 million toward AI-enhanced military systems, enabling UGVs to operate independently and make real-time decisions in complex environments. The integration of AI has increased the deployment efficiency of UGVs in areas like mine detection and hazardous material handling, with over 200 AI-driven UGVs used by the military in 2022.

- Rising Demand for Disaster Response: UGVs are being increasingly utilized in disaster response operations, particularly in areas with extreme conditions like wildfires, floods, and earthquakes. In 2023, UGVs were deployed in over 50 disaster relief missions across the United States, assisting with tasks such as debris removal and victim search. Federal Emergency Management Agency (FEMA) reported that more than 200 UGVs were used for search-and-rescue missions in the aftermath of natural disasters, significantly reducing the time and risk for human responders.

Market Challenges

- High Development Costs: Developing UGV technologies requires substantial investment due to the need for high-end components like AI systems, sensors, and robotic platforms. In 2022, it was reported that the average development cost of a fully autonomous UGV for military use ranged between $1 million to $3 million, depending on the capabilities. The U.S. Army, which allocated over $600 million to UGV development in 2023, faces challenges in reducing these costs without compromising the efficiency and effectiveness of the vehicles.

- Technical Challenges in Remote Operations: One of the critical challenges facing UGVs is ensuring reliable remote operation, particularly in complex environments. Technical issues such as signal interference and difficulty in maintaining continuous communication pose limitations in the operational scope of these vehicles. In 2023, over 20% of UGV deployments in the military experienced operational disruptions due to technical failures. These challenges hinder their efficiency in missions that require extended operation without human intervention.

USA Unmanned Ground Vehicle (UGV) Market Future Outlook

Over the coming years, the USA UGV market is expected to grow significantly, driven by advancements in autonomous systems, artificial intelligence, and an increasing number of UGV applications in both defense and civilian sectors. The defense industry will continue to dominate, but there is growing interest in commercial applications, particularly in logistics and agriculture. The rise of automation and smart technologies will likely encourage further adoption of UGVs, with particular emphasis on reducing operational costs and improving safety in hazardous environments.

Future Market Opportunities

- Expansion in Civilian Applications: UGVs are increasingly finding applications outside military use, particularly in industries like mining and agriculture. In 2023, over 300 UGVs were used in mining operations across North America, automating tasks such as material transport and exploration. Similarly, agricultural operations adopted around 150 UGVs to perform activities like crop monitoring and soil analysis. These applications show the potential for civilian UGV use to grow rapidly as the technology becomes more cost-effective and scalable.

- Potential for Customizable and Modular UGV Platforms: The growing demand for customizable UGV platforms has spurred innovation in modular designs, allowing users to modify UGVs for specific missions. In 2023, more than 50% of UGVs developed for military applications had modular components, enabling the integration of new tools and sensors. This trend is particularly significant for industries like agriculture and logistics, where flexibility is crucial for different operational needs.

Scope of the Report

|

By Mobility |

Wheeled Tracked Legged Hybrid |

|

By Application |

Defense Commercial Industrial Emergency Response Agricultural |

|

By Payload Type |

Sensors Cameras Manipulators Others |

|

By Operation Mode |

Teleoperated Autonomous Semi-autonomous |

|

By End-User |

Military Civil Commercial |

Products

Key Target Audience

Defense Contractors

Government and Regulatory Bodies (U.S. Department of Defense, Federal Aviation Administration)

Technology Providers

Autonomous Vehicle Manufacturers

Banks and Financial Institutes

Agricultural Machinery Manufacturers

Emergency Response Organizations

Investments and Venture Capitalist Firms

Industrial Equipment Suppliers

Companies

Major Players

Lockheed Martin Corporation

Northrop Grumman Corporation

General Dynamics

Clearpath Robotics

FLIR Systems

BAE Systems

iRobot Corporation

AeroVironment, Inc.

QinetiQ Group

Thales Group

Rheinmetall AG

G-NIUS Unmanned Ground Systems

Oshkosh Corporation

Kongsberg Gruppen

Milrem Robotics

Table of Contents

USA Unmanned Ground Vehicle (UGV) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Unmanned Ground Vehicle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA UGV Market Analysis

3.1. Growth Drivers (Technological Innovation, Defense Modernization, Autonomous Navigation Capabilities)

3.1.1. Increased Adoption in Military Applications

3.1.2. Technological Advancements in AI and Machine Learning

3.1.3. Rising Demand for Disaster Response

3.1.4. Government and Military Investments

3.2. Market Challenges (Operational Limitations, Cost Constraints, Regulatory Issues)

3.2.1. High Development Costs

3.2.2. Technical Challenges in Remote Operations

3.2.3. Regulatory Hurdles and Safety Concerns

3.3. Opportunities (Dual-Use Technologies, Commercial Integration)

3.3.1. Expansion in Civilian Applications (Mining, Agriculture, etc.)

3.3.2. Collaboration with Autonomous Vehicle Technologies

3.3.3. Potential for Customizable and Modular UGV Platforms

3.4. Trends (AI Integration, Fleet Management, Robotics-as-a-Service)

3.4.1. Increasing Use of AI and Robotics

3.4.2. UGVs in Border Security and Surveillance

3.4.3. Adoption of UGVs in Hazardous Industrial Applications

3.5. Government Regulation (DoD Standards, Safety Protocols, Certification Requirements)

3.5.1. Federal Investment in Defense UGV Technologies

3.5.2. Safety and Certification Standards

3.5.3. Public-Private Partnerships for Innovation

USA UGV Market Segmentation

4.1. By Mobility (In Value %)

4.1.1. Wheeled

4.1.2. Tracked

4.1.3. Legged

4.1.4. Hybrid

4.2. By Application (In Value %)

4.2.1. Defense

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Emergency Response

4.2.5. Agricultural

4.3. By Payload Type (In Value %)

4.3.1. Sensors

4.3.2. Cameras

4.3.3. Manipulators

4.3.4. Others

4.4. By Operation Mode (In Value %)

4.4.1. Teleoperated

4.4.2. Autonomous

4.4.3. Semi-autonomous

4.5. By End-User (In Value %)

4.5.1. Military

4.5.2. Civil

4.5.3. Commercial

USA UGV Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Lockheed Martin Corporation

5.1.2. Northrop Grumman Corporation

5.1.3. QinetiQ Group

5.1.4. General Dynamics Mission Systems

5.1.5. iRobot Corporation

5.1.6. FLIR Systems, Inc.

5.1.7. BAE Systems

5.1.8. AeroVironment, Inc.

5.1.9. Clearpath Robotics

5.1.10. Thales Group

5.1.11. Rheinmetall AG

5.1.12. G-NIUS Unmanned Ground Systems

5.1.13. Oshkosh Corporation

5.1.14. Kongsberg Gruppen

5.1.15. Milrem Robotics

5.2. Cross Comparison Parameters (R&D Spending, Product Portfolio, Defense Contracts, Strategic Alliances)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA UGV Market Regulatory Framework

6.1. Defense Acquisition Standards

6.2. Safety and Compliance Regulations

6.3. Certification Processes

USA UGV Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA UGV Future Market Segmentation

8.1. By Mobility (In Value %)

8.2. By Application (In Value %)

8.3. By Payload Type (In Value %)

8.4. By Operation Mode (In Value %)

8.5. By End-User (In Value %)

USA UGV Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step includes mapping out key stakeholders and identifying the main influencers in the USA UGV market. Extensive desk research and analysis of proprietary databases are employed to understand the core dynamics, including technological advancements and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, historical data related to UGV deployment in sectors such as defense and agriculture is evaluated. Market penetration, key revenue drivers, and operational data are compiled to assess growth trajectories across the sub-segments.

Step 3: Hypothesis Validation and Expert Consultation

Using interviews and consultations with industry experts, the research team validates the hypotheses on market drivers, challenges, and opportunities. These insights contribute to refining the data and ensuring accuracy.

Step 4: Research Synthesis and Final Output

The final output incorporates data from both bottom-up and top-down research approaches, combining direct interviews and secondary data to offer a holistic view of the market.

Frequently Asked Questions

01. How big is the USA Unmanned Ground Vehicle Market?

The USA Unmanned Ground Vehicle market is valued at USD 580 million, driven by rising investments in defense, technological innovation, and expanded applications in industrial and agricultural sectors.

02. What are the challenges in the USA UGV Market?

Key challenges in the USA UGV market include high initial development costs, technical complexities in autonomous navigation, and stringent regulatory requirements for safety and defense contracts.

03. Who are the major players in the USA UGV Market?

Major players in the USA UGV market include Lockheed Martin, Northrop Grumman, General Dynamics, Clearpath Robotics, and FLIR Systems, who dominate due to their defense contracts and innovation capabilities.

04. What are the growth drivers of the USA UGV Market?

The primary drivers include advancements in AI and autonomous navigation technologies, rising defense investments, and growing applications in industrial automation, agriculture, and emergency response.

05. Which cities dominate the USA UGV Market?

California, Virginia, and Texas lead the market due to their technological ecosystems, proximity to military bases, and adoption of UGVs in industrial sectors like agriculture and logistics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.