USA Uterine Fibroid Treatment Devices Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD9388

December 2024

90

About the Report

USA Uterine Fibroid Treatment Devices Market Overview

- The USA Uterine Fibroid Treatment Devices Market is valued at USD 4.4 billion, driven by the increasing prevalence of uterine fibroids among women of reproductive age. The rise in demand for minimally invasive treatments such as ablation, embolization, and robotic-assisted surgeries is a key factor supporting this market. Additionally, advancements in medical technology, along with the growing awareness of treatment options, have further fueled market growth.

- Major cities such as New York, Los Angeles, and Chicago dominate the market due to their robust healthcare infrastructure and higher concentration of specialized hospitals and medical centers. These urban areas benefit from significant investments in cutting-edge medical devices and have access to highly trained healthcare professionals. Additionally, these cities have a high prevalence of fibroid-related conditions, which increases the demand for advanced uterine fibroid treatment devices.

- The FDA plays a critical role in regulating uterine fibroid treatment devices in the U.S., ensuring safety and efficacy. Furthermore, reimbursement policies set by Medicare and Medicaid have become increasingly favorable for minimally invasive fibroid treatments. As of 2023, 85% of uterine fibroid treatment procedures performed in outpatient settings were eligible for partial or full reimbursement under these programs.

USA Uterine Fibroid Treatment Devices Market Segmentation

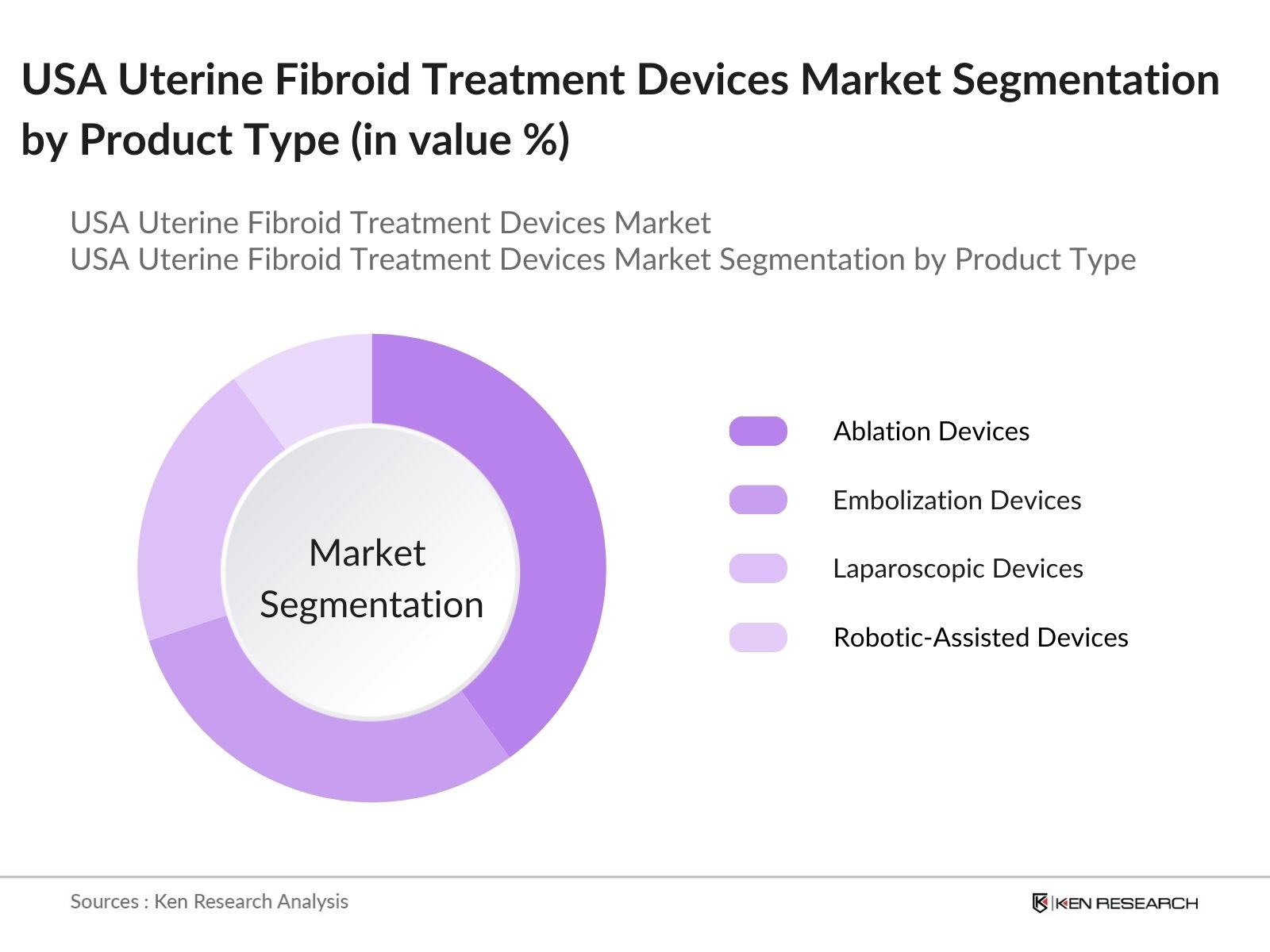

By Product Type: The USA Uterine Fibroid Treatment Devices Market is segmented by product type into ablation devices, embolization devices, laparoscopic devices, and robotic-assisted devices. Among these, ablation devices hold the largest market share due to their non-invasive nature, shorter recovery times, and ability to effectively treat smaller fibroids without the need for major surgery. These devices have become the preferred choice in outpatient settings, where patients seek quicker recovery and reduced hospital stays. Furthermore, the rising adoption of MRI-guided focused ultrasound ablation has further strengthened the segments dominance.

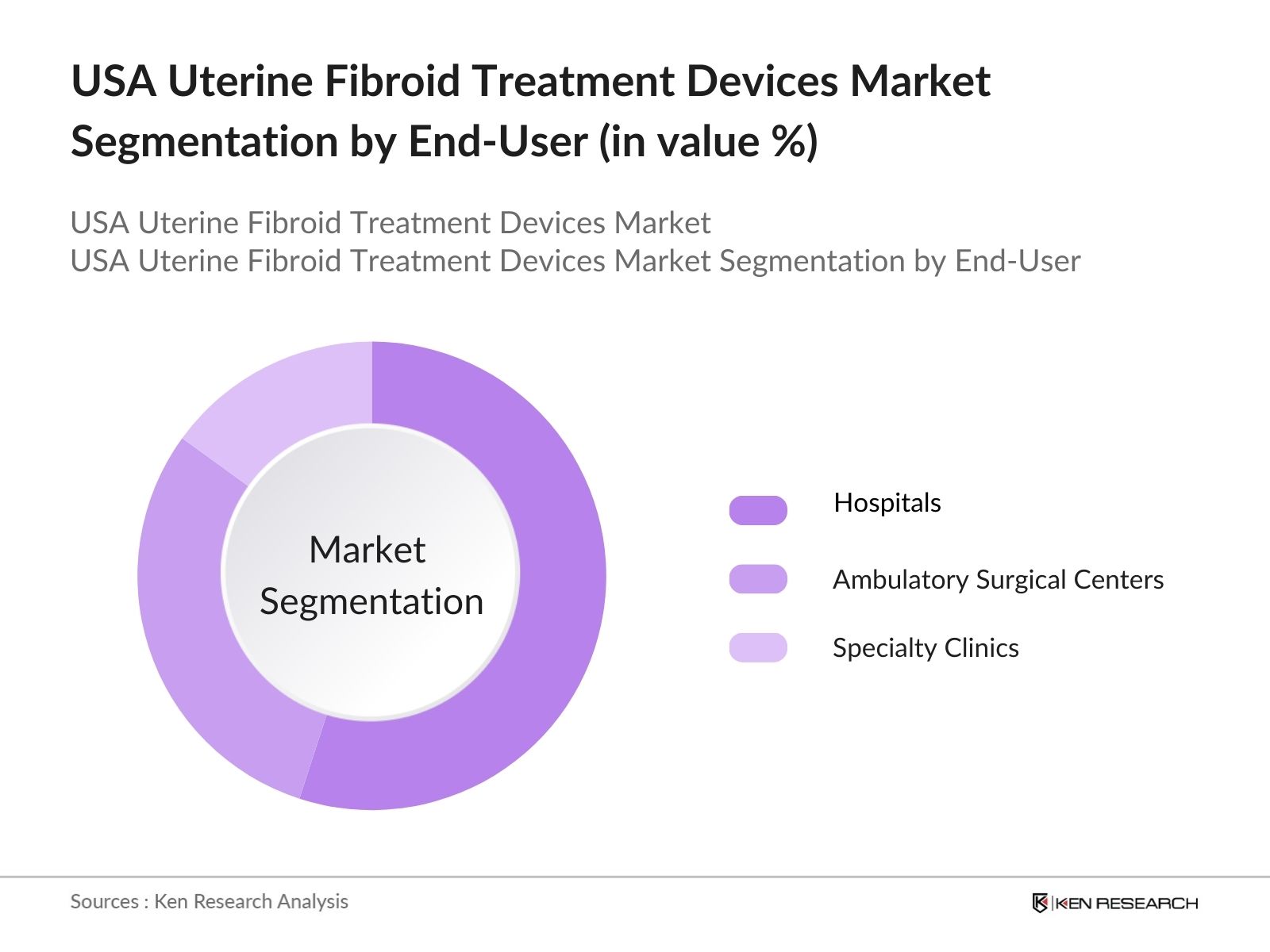

By End-User: The USA Uterine Fibroid Treatment Devices Market is also segmented by end-user into hospitals, ambulatory surgical centers, and specialty clinics. Hospitals hold the dominant market share due to their comprehensive healthcare services and the presence of highly specialized surgical departments. Hospitals are better equipped to handle complex cases, including fibroid treatments requiring advanced imaging and robotic-assisted surgery. The increasing number of minimally invasive procedures being performed in hospitals, coupled with higher patient footfall in urban hospitals, contributes to the significant market share held by this segment.

USA Uterine Fibroid Treatment Devices Market Competitive Landscape

The USA Uterine Fibroid Treatment Devices Market is dominated by a few major players, including Hologic Inc., Boston Scientific Corporation, Medtronic Plc, Siemens Healthineers AG, and General Electric Healthcare. These companies have extensive experience in developing medical devices, a strong global presence, and a diverse product portfolio catering to various treatment needs. Their continued investments in research and development, along with strategic mergers and acquisitions, have cemented their dominance in this space.

USA Uterine Fibroid Treatment Devices Industry Analysis

Growth Drivers

- Rising Prevalence of Uterine Fibroids (Medical condition prevalence rates): Uterine fibroids are one of the most common gynecological conditions affecting women in the U.S. The prevalence of uterine fibroids varies significantly among studies, with estimates ranging from 4.5% to 68.6% depending on factors such as age and ethnicity. With a significant portion of this population needing medical interventions, the demand for uterine fibroid treatment devices is surging, particularly in urban regions where healthcare access is more prevalent.

- Growth in the Aging Population (Demographic data): As the U.S. population ages, the prevalence of uterine fibroids has become more pronounced. By 2050, this demographic is anticipated to increase to around 82 million, accounting for 23% of the population. Since uterine fibroids often become symptomatic as women approach menopause, the aging population directly contributes to an increase in demand for fibroid treatment options. This demographic shift underscores the need for expanded treatment device offerings that cater to older women who are more likely to experience fibroid-related complications.

- Technological Advancements in Fibroid Treatment Devices (Innovation adoption rates): Technological advancements have improved the safety and effectiveness of fibroid treatment devices, with innovations like robotic-assisted surgeries and MRI-guided focused ultrasound (MRgFUS) offering more precise and less invasive treatment options. These advancements are increasing the accessibility of complex procedures, leading to broader adoption of advanced fibroid treatment technologies in healthcare settings, ultimately enhancing patient outcomes and treatment efficiency.

Market Challenges

- High Cost of Advanced Treatment Devices (Cost comparison): The high cost of advanced uterine fibroid treatment devices poses a significant challenge in the U.S. healthcare market. Robotic-assisted surgeries and other advanced treatments are often expensive, limiting accessibility for many patients, especially those without sufficient insurance coverage. The disparity between traditional and advanced treatments results in out-of-pocket expenses that discourage many from opting for these innovative procedures, creating a barrier to widespread adoption.

- Limited Awareness in Certain Regions (Awareness and education levels): Awareness of uterine fibroids and available treatment options remains uneven across different regions in the U.S. In rural areas, healthcare education is often limited, leaving many women unaware of minimally invasive treatment options. This lack of information leads to delayed diagnoses and lower treatment uptake. Improving educational outreach is essential to ensure that more women can access and benefit from modern fibroid treatment technologies.

USA Uterine Fibroid Treatment Devices Market Future Outlook

Over the next five years, the USA Uterine Fibroid Treatment Devices Market is expected to show significant growth, driven by continuous advancements in minimally invasive technologies, increasing patient awareness about alternative treatment options, and rising healthcare expenditures. As more patients and healthcare providers adopt cutting-edge technologies such as MRI-guided ablation and robotic-assisted surgery, the demand for advanced devices is anticipated to rise further.

Market Opportunities

- Emerging Markets for Uterine Fibroid Treatment Devices (Geographical potential analysis): Emerging opportunities for uterine fibroid treatment devices are growing in underserved regions like the South and Midwest in the U.S. These areas have historically had less access to advanced treatment options compared to coastal cities. With the expansion of healthcare infrastructure and supportive government initiatives, the demand for fibroid treatment devices is expected to increase, creating new opportunities for manufacturers to tap into these underserved markets.

- Rising Adoption of Robotic Surgery (Technology utilization metrics): The adoption of robotic surgery for uterine fibroid treatments is on the rise, driven by its precision and the benefits of reduced recovery times. Robotic-assisted surgeries are becoming more prevalent as hospitals and outpatient centers invest in these technologies. This growing trend presents a significant opportunity for manufacturers of robotic surgery devices to capitalize on the increasing demand for advanced fibroid treatment solutions.

Scope of the Report

|

By Product Type |

Ablation Devices Embolization Devices Laparoscopic Devices Robotic-Assisted Devices |

|

By Treatment Type |

Minimally Invasive Treatments Surgical Treatments Non-invasive Treatments |

|

By End-User |

Hospitals Ambulatory Surgical Centers Specialty Clinics |

|

By Technology |

MRI-Guided Technology Ultrasound-Guided Technology Robotic-Assisted Technology |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Hospitals

Ambulatory Surgical Centers

Specialty Clinics

Device Manufacturers

Government and Regulatory Bodies (FDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Medtronic

Stryker Corporation

CooperSurgical Inc.

Hologic Inc.

Boston Scientific Corporation

Ethicon Inc. (Johnson & Johnson)

Minerva Surgical Inc.

Lumenis

Smith & Nephew

KARL STORZ

Olympus Corporation

Gynesonics

INSIGHTEC

Merit Medical Systems

Terumo Corporation

Table of Contents

1. USA Uterine Fibroid Treatment Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Uterine Fibroid Treatment Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Uterine Fibroid Treatment Devices Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Uterine Fibroids (Medical condition prevalence rates)

3.1.2. Increased Demand for Minimally Invasive Procedures (Demand metrics)

3.1.3. Technological Advancements in Fibroid Treatment Devices (Innovation adoption rates)

3.1.4. Growth in the Aging Population (Demographic data)

3.2. Market Challenges

3.2.1. High Cost of Advanced Treatment Devices (Cost comparison)

3.2.2. Limited Awareness in Certain Regions (Awareness and education levels)

3.2.3. Stringent FDA Regulations (Regulatory framework metrics)

3.3. Opportunities

3.3.1. Emerging Markets for Uterine Fibroid Treatment Devices (Geographical potential analysis)

3.3.2. Rising Adoption of Robotic Surgery (Technology utilization metrics)

3.3.3. Expansion of Healthcare Infrastructure (Infrastructure growth rates)

3.4. Trends

3.4.1. Shift Towards Outpatient Settings (Healthcare setting trends)

3.4.2. Increasing Use of MRI-Guided Focused Ultrasound (Technology adoption metrics)

3.4.3. Personalized Treatment Solutions (Customization and patient-specific approaches)

3.5. Government Regulation

3.5.1. FDA Approvals and Reimbursement Policies (Government and insurance data)

3.5.2. Patient Safety Regulations (Healthcare compliance requirements)

3.5.3. Health System Incentives for Minimally Invasive Treatments (Incentive metrics)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. USA Uterine Fibroid Treatment Devices Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ablation Devices

4.1.2. Embolization Devices

4.1.3. Laparoscopic Devices

4.1.4. Robotic-Assisted Devices

4.2. By Treatment Type (In Value %)

4.2.1. Minimally Invasive Treatments

4.2.2. Surgical Treatments

4.2.3. Non-invasive Treatments

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Ambulatory Surgical Centers

4.3.3. Specialty Clinics

4.4. By Technology (In Value %)

4.4.1. MRI-Guided Technology

4.4.2. Ultrasound-Guided Technology

4.4.3. Robotic-Assisted Technology

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Uterine Fibroid Treatment Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hologic Inc.

5.1.2. Boston Scientific Corporation

5.1.3. Medtronic Plc

5.1.4. Siemens Healthineers AG

5.1.5. General Electric Healthcare

5.1.6. Stryker Corporation

5.1.7. Johnson & Johnson

5.1.8. CooperSurgical Inc.

5.1.9. Merit Medical Systems

5.1.10. Olympus Corporation

5.1.11. AbbVie Inc.

5.1.12. Smith & Nephew

5.1.13. KARL STORZ SE & Co. KG

5.1.14. Zimmer Biomet Holdings Inc.

5.1.15. Intuitive Surgical Inc.

5.2. Cross Comparison Parameters (Market Capitalization, Product Portfolio, Recent Innovations, Partnerships & Collaborations, Regulatory Approvals, Number of Employees, Revenue Growth, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Uterine Fibroid Treatment Devices Market Regulatory Framework

6.1. FDA Regulations for Uterine Fibroid Devices

6.2. Medicare and Medicaid Reimbursement Policies

6.3. Certification Processes for Minimally Invasive Devices

7. USA Uterine Fibroid Treatment Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Uterine Fibroid Treatment Devices Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Treatment Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. USA Uterine Fibroid Treatment Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all stakeholders in the USA Uterine Fibroid Treatment Devices Market. Extensive desk research, using secondary and proprietary databases, is conducted to gather industry-level insights. The objective is to define the critical variables influencing the market, including technological advancements and regulatory changes.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data and trends in the Uterine Fibroid Treatment Devices Market, evaluating the adoption rates of new technologies, and assessing patient preferences. Additionally, revenue generation models and service delivery structures will be examined.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions will be tested through interviews with industry experts, including medical professionals and device manufacturers. Insights from these consultations will help refine market estimates and ensure data reliability.

Step 4: Research Synthesis and Final Output

The final step involves integrating data from manufacturers and healthcare providers to validate the market analysis. This bottom-up approach ensures an accurate and comprehensive view of the USA Uterine Fibroid Treatment Devices Market.

Frequently Asked Questions

01. How big is the USA Uterine Fibroid Treatment Devices Market?

The USA Uterine Fibroid Treatment Devices Market is valued at USD 4.4 billion, driven by the increasing prevalence of uterine fibroids and the growing demand for minimally invasive treatments.

02. What are the challenges in the USA Uterine Fibroid Treatment Devices Market?

Challenges in USA Uterine Fibroid Treatment Devices Market include the high cost of advanced devices, limited awareness in rural areas, and the stringent FDA regulatory approval process, which can slow down product launches.

03. Who are the major players in the USA Uterine Fibroid Treatment Devices Market?

Key players in USA Uterine Fibroid Treatment Devices Market include Hologic Inc., Boston Scientific Corporation, Medtronic Plc, Siemens Healthineers AG, and General Electric Healthcare. These companies dominate the market due to their innovative product offerings and global presence.

04. What are the growth drivers of the USA Uterine Fibroid Treatment Devices Market?

The USA Uterine Fibroid Treatment Devices Market growth drivers include rising awareness about minimally invasive treatments, advancements in medical technology, and increased healthcare spending in urban areas with advanced medical infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.