USA Utility Poles Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD5953

November 2024

80

About the Report

USA Utility Poles Market Overview

The USA utility poles market is valued at USD 7.2 billion, according to a five-year historical analysis. The market is primarily driven by the increasing demand for upgrading existing infrastructure, rapid urbanization, and the growing renewable energy sector. The replacement of aging poles in several parts of the country, along with government initiatives to modernize grid infrastructure, is a key growth factor. Additionally, investments in renewable energy transmission are further accelerating the market's expansion.

The market is heavily dominated by states like Texas, California, and Florida. These states have extensive electric grids and telecommunication networks that require constant maintenance and expansion. Texas leads in terms of utility infrastructure due to its vast energy production and industrial activities, while Californias focus on renewable energy integration and wildfire prevention has driven its demand for newer, safer utility poles. Florida, being prone to hurricanes, necessitates regular utility pole replacement and reinforcement, maintaining a high demand in this sector.

The Biden administrations Bipartisan Infrastructure Law, which allocated $65 billion to modernize the nations power grid, has set ambitious targets for the replacement and upgrade of utility poles. In 2023, the U.S. Department of Energy allocated $11 billion specifically for grid modernization, including pole replacements and the integration of renewable energy. This law is expected to drive sustained investment in the utility poles market as part of broader energy infrastructure improvements.

USA Utility Poles Market Segmentation

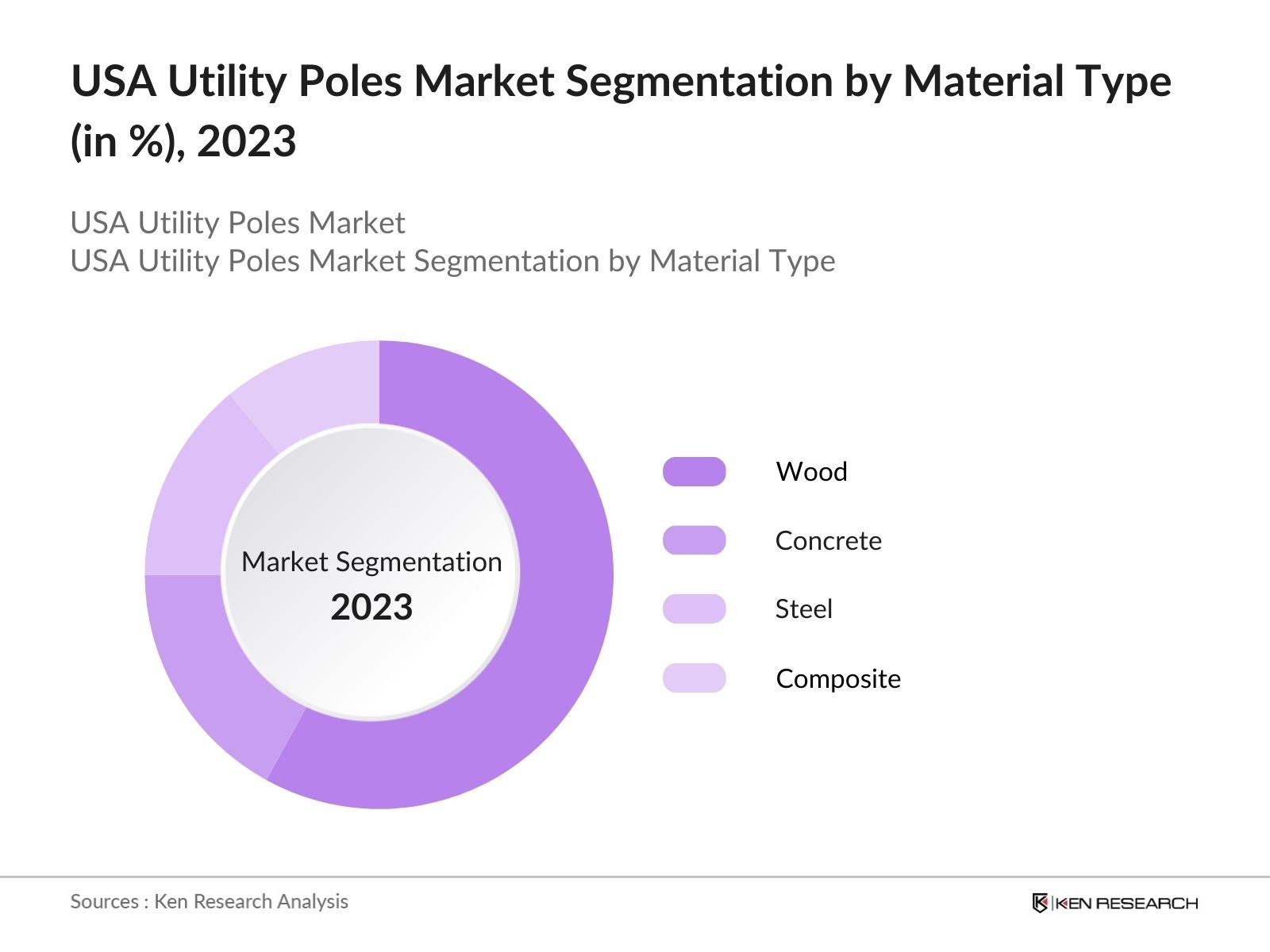

By Material Type: The market is segmented by material type into wood, concrete, steel, and composite poles. Wood poles dominate the market due to their long-standing use, affordability, and ease of installation. Despite environmental concerns, wood poles remain the most preferred material in rural and suburban areas. The dominance of wood is supported by strong supply chains and the ability to replace poles quickly in regions with frequent natural disasters. However, the demand for composite poles is increasing in regions with high risks of fire, as they are more durable and fire-resistant.

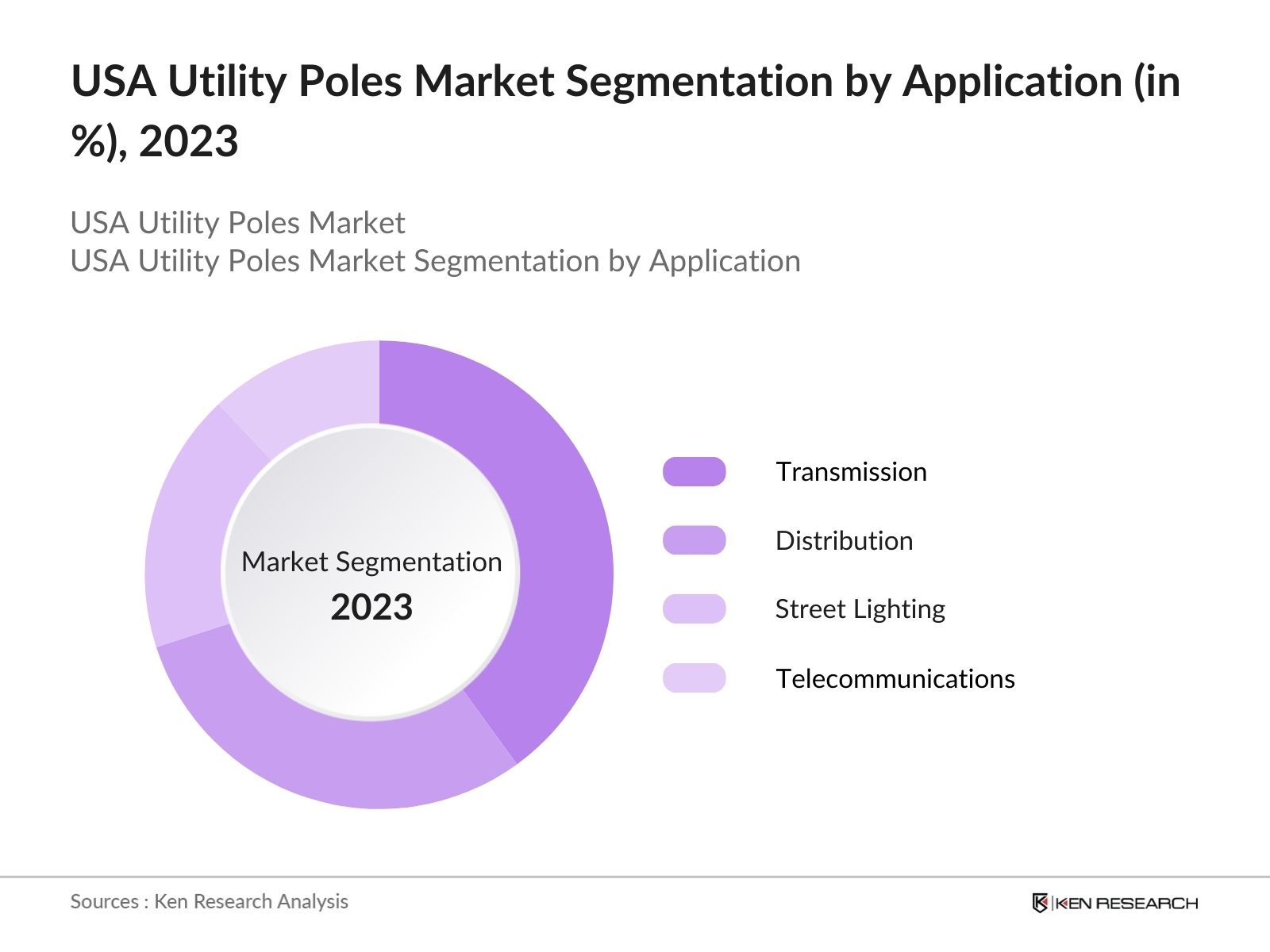

By Application: The market is also segmented by application into transmission, distribution, street lighting, and telecommunications. Transmission utility poles hold the dominant share, primarily because of the significant infrastructure required to transmit high-voltage electricity across long distances. The continuous expansion of electricity transmission networks, especially for renewable energy, contributes to the dominance of this segment. Additionally, transmission poles are subject to more stringent regulations and require sturdier materials, further boosting demand.

USA Utility Poles Market Competitive Landscape

The USA utility poles market is dominated by a mix of well-established companies and emerging players, focusing on innovations in materials, sustainability, and grid modernization. The USA utility poles market is dominated by these key players, who are deeply integrated with utility companies and government projects. They have a strong focus on improving the durability and sustainability of poles, while also exploring advanced materials such as composite and steel for high-risk environments.

|

Company Name |

Year Established |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Sustainability Measures |

Material Innovation |

Product Range |

Global Reach |

Strategic Partnerships |

|

Valmont Industries |

1946 |

Omaha, NE |

|||||||

|

Stella-Jones |

1992 |

Montreal, QC |

|||||||

|

Koppers Holdings Inc. |

1988 |

Pittsburgh, PA |

|||||||

|

American Timber & Steel |

1983 |

Norwalk, OH |

|||||||

|

RS Technologies Inc. |

1993 |

Calgary, AB |

USA Utility Poles Industry Analysis

Growth Drivers

- Increased Demand from the Energy Sector: The USA utility poles market is experiencing heightened demand due to the expansion of the energy sector, particularly with renewable energy projects requiring significant upgrades to the national grid. In 2023, the U.S. Department of Energy reported that over 1.2 million miles of electrical lines are supported by more than 160 million utility poles. This infrastructure is essential for maintaining current power delivery and for connecting new renewable energy sources, such as solar and wind. Additionally, the U.S. Energy Information Administration (EIA) noted that the demand for electricity increased by over 1 billion kilowatt-hours in 2022, driving further investments into utility infrastructure.

- Expansion of Utility Infrastructure: Urbanization and rural electrification efforts are major factors contributing to the growth of the USA utility poles market. According to the U.S. Census Bureau, approximately 83% of the U.S. population resides in urban areas, with projections for continued growth. Expanding utility infrastructure to support the influx of people into urban areas has led to increased installations of utility poles. Additionally, rural electrification programs continue to drive the need for new poles, particularly in underserved areas. As per the U.S. Department of Agriculture (USDA), rural electric cooperatives serve over 42 million people across 56% of the countrys landmass.

- Government Investments and Grid Modernization Initiatives: Government programs such as the Bipartisan Infrastructure Law, which allocated $73 billion for power infrastructure improvements in 2023, are fueling growth in the utility poles market. This funding includes grants for upgrading transmission lines and replacing outdated poles to enhance grid resilience. Moreover, grid modernization initiatives aim to integrate more renewable energy sources and improve energy efficiency. According to the U.S. Department of Energy, $11 billion of these funds were specifically earmarked for transmission expansion, which includes new poles for supporting the grid.

Market Challenges

- High Installation and Maintenance Costs: The installation and maintenance of utility poles represent a significant cost burden for energy companies. According to the American Society of Civil Engineers, the average cost of installing a single utility pole is around $1,200 to $5,600per pole, including materials and labor. Maintenance adds to these expenses, ownership of $3.9 millionfor a specific utility's poles. Utility companies must weigh these costs against other options such as underground cabling, which, while more expensive initially, may be more cost-effective in the long run due to lower maintenance costs.

- Risk of Damage from Natural Disasters: Natural disasters such as hurricanes, wildfires, and tornadoes are major threats to utility poles. In 2022 alone, extreme weather events caused over $165 billion in damages across the U.S., with utility poles being among the most vulnerable infrastructure. The National Oceanic and Atmospheric Administration (NOAA) reported that more than 10,000 utility poles were destroyed by Hurricane Ian in 2022, highlighting the vulnerability of above-ground infrastructure. This has spurred investments in pole hardening initiatives but also increased the need for regular replacement and repair.

USA Utility Poles Market Future Outlook

Over the next five years, the USA utility poles market is expected to experience consistent growth driven by the countrys focus on infrastructure modernization, particularly in the energy and telecommunications sectors. Government programs aimed at replacing aging poles and expanding grid capacities for renewable energy will likely continue to boost demand. Additionally, advancements in composite materials and the integration of smart technologies into poles will further reshape the landscape, opening up new opportunities for utility pole manufacturers.

Future Market Opportunities

- Technological Advancements: Smart poles with integrated sensors and IoT technology represent a significant growth opportunity within the utility poles market. According to the U.S. Department of Energy, smart grid initiatives, which include the installation of sensor-equipped poles, received $3.5 billion in funding in 2023. These smart poles can monitor grid performance, detect faults, and even support wireless communication networks, creating new revenue streams for utility companies. Smart pole technology is expected to become increasingly prevalent, especially in urban areas, as cities continue their smart infrastructure projects.

- Expansion of Renewable Energy Projects: Renewable energy projects, such as wind and solar farms, are driving demand for utility poles, especially in remote areas where new transmission lines are required. The U.S. Department of Energy noted that 26% of the countrys electricity generation came from renewable sources in 2023, and connecting these new energy sources to the grid often requires the installation of new utility poles. With 36 gigawatts of new wind capacity and 52 gigawatts of solar capacity expected to come online by the end of 2024, demand for poles will continue to rise.

Scope of the Report

|

Material Type |

Wood Concrete Steel Composite |

|

|

Application |

Transmission Distribution Street Lighting Telecommunications |

|

|

Pole Size |

Below 40 ft 40-70 ft Above 70 ft |

|

|

Installation |

New Installation Replacement |

|

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Utility Companies

Telecommunication Firms

Transmission and Distribution Companies

Government and Regulatory Bodies (EPA, DOE)

Pole Manufacturers

Material Suppliers (Steel, Wood, Composite)

Investor and Venture Capitalist Firms

Renewable Energy Project Developers

Companies

Major Players in the USA Utility Poles Market

Valmont Industries

Stella-Jones

Koppers Holdings Inc.

American Timber & Steel

RS Technologies Inc.

Duratel LLC

McFarland Cascade Holdings

Bell Lumber & Pole Company

StressCrete Group

Sabre Industries

Omega Factory

Strongwell Corporation

Laminated Wood Systems Inc.

Thomasson Company

FUCHS Group

Table of Contents

1. USA Utility Poles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Utility Poles Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Utility Poles Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand from the Energy Sector

3.1.2. Expansion of Utility Infrastructure (urbanization, electrification)

3.1.3. Replacement of Aging Infrastructure

3.1.4. Government Investments and Grid Modernization Initiatives

3.2. Market Challenges

3.2.1. High Installation and Maintenance Costs

3.2.2. Environmental Impact and Sustainability Issues (wood supply, environmental regulations)

3.2.3. Technological Shift to Underground Cabling

3.2.4. Risk of Damage from Natural Disasters

3.3. Opportunities

3.3.1. Technological Advancements (smart poles, pole-mounted sensors)

3.3.2. Expansion of Renewable Energy Projects

3.3.3. Increasing Demand for Transmission and Distribution Lines (urban-rural electrification gap)

3.3.4. Government Grants and Subsidies for Infrastructure Modernization

3.4. Trends

3.4.1. Rising Adoption of Composite Utility Poles

3.4.2. Introduction of Smart Poles and IoT Integration

3.4.3. Shift to Underground Power Lines in High-Risk Areas (climate impact)

3.4.4. Increasing Use of Recycled and Sustainable Materials

3.5. Government Regulation

3.5.1. Federal Infrastructure Acts and Initiatives (Bidens infrastructure bill, renewable energy targets)

3.5.2. Compliance with NESC Standards (National Electric Safety Code)

3.5.3. Local Environmental and Sustainability Standards

3.5.4. Policies Encouraging Renewable Energy Grid Integration

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.7.1. Utility Companies

3.7.2. Government and Regulatory Bodies

3.7.3. Manufacturers and Suppliers

3.7.4. Environmental and Community Organizations

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of Substitutes (underground cabling, alternative structures)

3.8.4. Threat of New Entrants

3.8.5. Industry Rivalry

3.9. Competitive Ecosystem

4. USA Utility Poles Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Wood

4.1.2. Concrete

4.1.3. Steel

4.1.4. Composite

4.2. By Application (In Value %)

4.2.1. Transmission

4.2.2. Distribution

4.2.3. Street Lighting

4.2.4. Telecommunications

4.3. By Pole Size (In Value %)

4.3.1. Below 40 ft

4.3.2. 40-70 ft

4.3.3. Above 70 ft

4.4. By Installation (In Value %)

4.4.1. New Installation

4.4.2. Replacement

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Utility Poles Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Valmont Industries

5.1.2. Stella-Jones

5.1.3. Koppers Holdings Inc.

5.1.4. American Timber & Steel

5.1.5. Omega Factory

5.1.6. FUCHS Group

5.1.7. RS Technologies Inc.

5.1.8. StressCrete Group

5.1.9. Sabre Industries

5.1.10. Thomasson Company

5.1.11. Bell Lumber & Pole Company

5.1.12. Strongwell Corporation

5.1.13. Laminated Wood Systems Inc.

5.1.14. McFarland Cascade Holdings

5.1.15. Duratel LLC

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Production Capacity, Revenue, Technology Adoption, Sustainability Measures, Product Portfolio, Global Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Utility Poles Market Regulatory Framework

6.1. NESC Compliance Requirements

6.2. Environmental and Sustainability Standards (EPA guidelines, wood treatment regulations)

6.3. Certification Processes (ASTM Standards, CSA Certification)

7. USA Utility Poles Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Renewable Energy Integration, Infrastructure Modernization)

8. USA Utility Poles Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By Pole Size (In Value %)

8.4. By Installation (In Value %)

8.5. By Region (In Value %)

9. USA Utility Poles Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all significant stakeholders in the USA Utility Poles Market. Through detailed desk research, we gather information from proprietary databases, reports, and industry publications to identify critical market dynamics and variables, including material preferences, application needs, and regulatory frameworks.

Step 2: Market Analysis and Construction

This step includes collecting historical data on market growth, infrastructure projects, and material usage in utility poles. A thorough analysis of these factors is conducted to understand their impact on market revenue generation, particularly focusing on sustainability trends and technological innovations.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and stakeholders are conducted via interviews and surveys to validate initial findings. These consultations provide firsthand operational and financial insights that help refine the data and ensure its relevance to the current market scenario.

Step 4: Research Synthesis and Final Output

Finally, the data gathered through primary and secondary research is synthesized to produce a comprehensive report. The information is validated and cross-checked with manufacturers and experts in the utility pole industry to ensure accuracy, reliability, and depth of analysis.

Frequently Asked Questions

01. How big is the USA Utility Poles Market?

The USA utility poles market was valued at USD 7.2 billion, driven by infrastructure modernization efforts and the replacement of aging poles across the country.

02. What are the challenges in the USA Utility Poles Market?

Challenges in the USA utility poles market include high costs of installation and maintenance, environmental concerns related to wood usage, and the growing preference for underground cabling in certain regions.

03. Who are the major players in the USA Utility Poles Market?

Key players in the USA utility poles market include Valmont Industries, Stella-Jones, Koppers Holdings Inc., American Timber & Steel, and RS Technologies Inc. These companies dominate due to their wide range of product offerings and strong ties with utility companies.

04. What are the growth drivers of the USA Utility Poles Market?

The in the USA utility poles market is driven by the need to replace aging poles, increasing urbanization, and government investments in grid modernization and renewable energy transmission.

05. What are the trends in the USA Utility Poles Market?

Notable trends in the USA utility poles market include the growing use of composite materials, integration of smart technology into utility poles, and the increasing focus on sustainability and fire-resistant materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.