USA Vaginal Moisturizers And Lubricants Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7812

November 2024

96

About the Report

USA Vaginal Moisturizers and Lubricants Market Overview

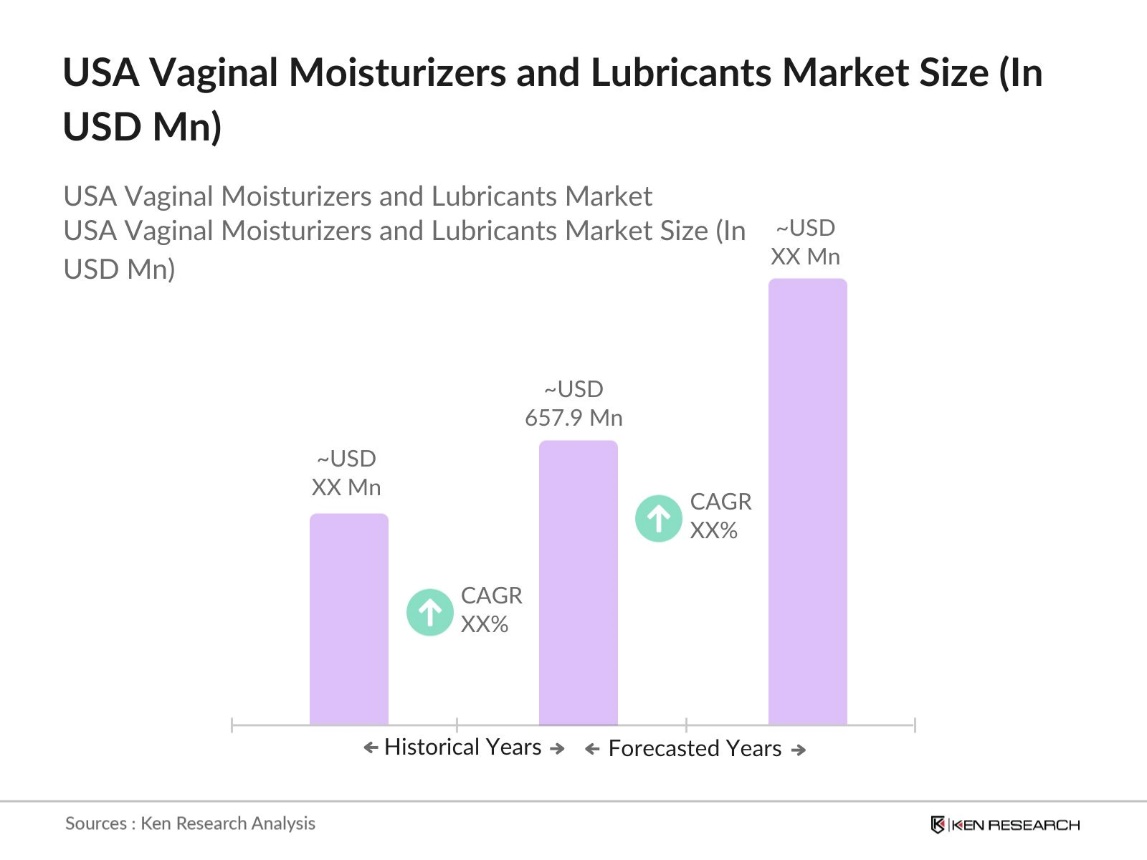

- The U.S. vaginal moisturizers and lubricants market is valued at USD 657.9 million, based on a five-year historical analysis. This growth is driven by increasing awareness of sexual wellness, a rising incidence of vaginal dryness among women, and technological advancements in product formulations. The expanding geriatric population further contributes to market expansion.

- Major urban centers such as New York, Los Angeles, and Chicago dominate the market due to higher consumer awareness, better access to healthcare facilities, and a more open attitude toward sexual health products. These cities also benefit from robust retail and e-commerce infrastructures, facilitating easier product availability.

- The U.S. Food and Drug Administration (FDA) classifies vaginal moisturizers and lubricants as medical devices, subjecting them to specific regulatory standards. In 2023, the FDA updated its guidelines, emphasizing the need for clear labeling of ingredients and intended use. Compliance with these guidelines ensures product safety and efficacy, fostering consumer confidence.

USA Vaginal Moisturizers and Lubricants Market Segmentation

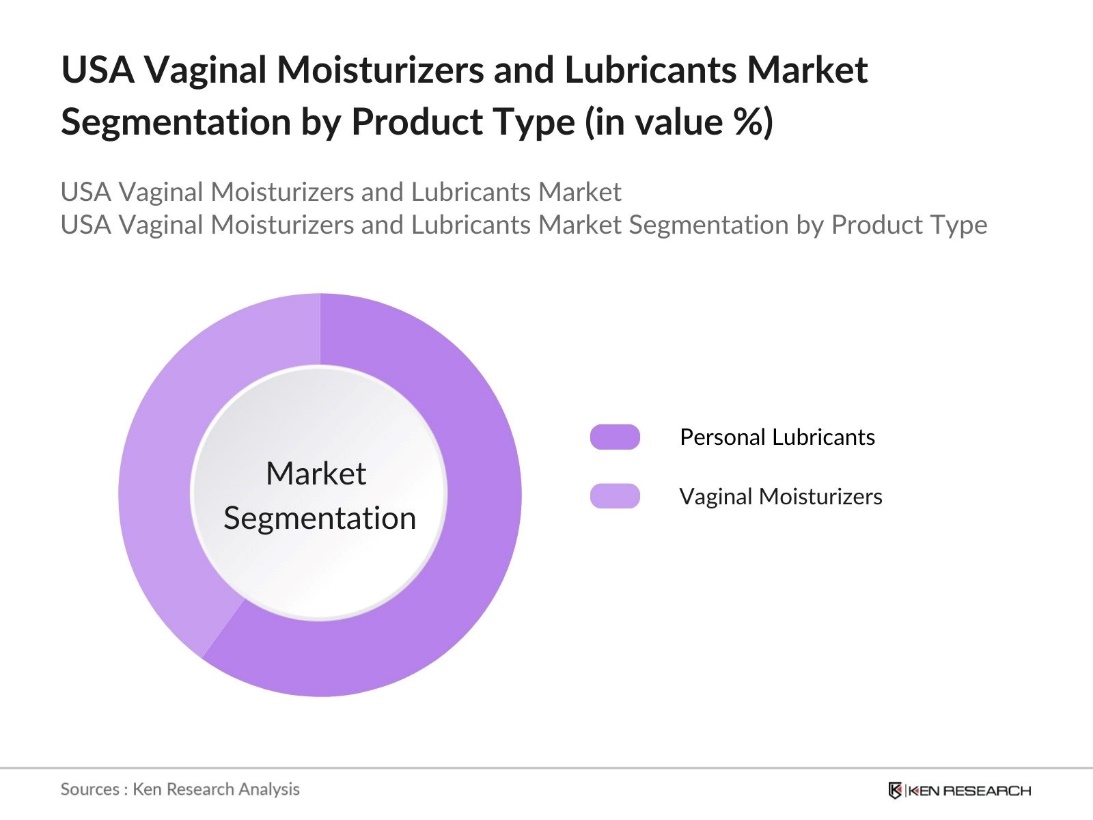

By Product Type: The market is segmented by product type into vaginal moisturizers and personal lubricants. Personal lubricants hold a dominant market share due to their widespread use in enhancing sexual comfort and reducing friction during intercourse. Their versatility and availability in various formulations cater to a broad consumer base, contributing to their leading position in the market.

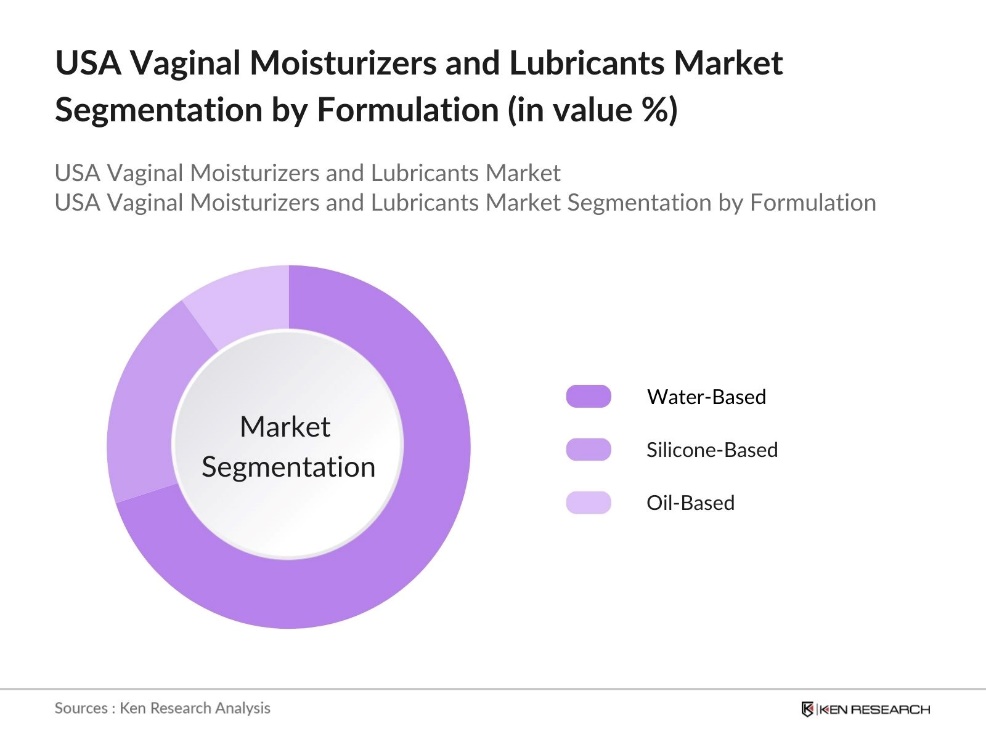

By Formulation: The market is segmented by formulation into water-based, silicone-based, and oil-based products. Water-based formulations dominate the market share due to their compatibility with most condoms and sex toys, ease of cleaning, and minimal risk of irritation. Their non-staining properties and suitability for individuals with sensitive skin make them a preferred choice among consumers.

USA Vaginal Moisturizers and Lubricants Market Competitive Landscape

The U.S. vaginal moisturizers and lubricants market is characterized by the presence of several key players, including Church & Dwight Co., Inc., Bayer AG, Reckitt Benckiser Group plc., The Yes Yes Company Ltd., and Searchlight Pharma. These companies leverage strong brand recognition, extensive distribution networks, and continuous product innovation to maintain their market positions.

USA Vaginal Moisturizers and Lubricants Industry Analysis

Growth Drivers

- Increasing Awareness of Sexual Wellness: In recent years, there has been a notable rise in public awareness regarding sexual wellness in the United States. The Centers for Disease Control and Prevention (CDC) that is about sexual health with healthcare providers, reflecting a growing openness towards addressing sexual wellness issues. This shift is further evidenced by the National Institutes of Health (NIH) allocating $200 million by 2025 towards research on sexual health, underscoring the increasing emphasis on this aspect of well-being. Such heightened awareness is anticipated to drive demand for products like vaginal moisturizers and lubricants.

- Rising Incidence of Vaginal Dryness: Vaginal dryness is a prevalent concern among women, particularly during and after menopause. The North American Menopause Society (NAMS) reported that in 2023, over 50 million women in the U.S. were aged 45 and above, with a significant portion experiencing menopausal symptoms, including vaginal dryness. These statistics underscore the growing need for effective vaginal moisturizers and lubricants.

- Technological Advancements in Product Formulation: Recent innovations in vaginal moisturizers and lubricants have led to more effective and user-friendly options, integrating advanced materials like bioadhesive polymers to improve product efficacy and longevity. Enhanced research on biocompatible materials has also contributed to safer, more comfortable formulations. These advancements are likely to attract consumers looking for modern solutions to manage vaginal dryness with improved comfort and reliability.

Market Challenges

- Social Stigma and Cultural Barriers: Despite growing awareness, social stigma and cultural barriers continue to limit open discussions about sexual health. Many individuals feel uncomfortable addressing vaginal health issues, as conversations about sexual wellness remain taboo in some communities. These societal attitudes can discourage the use of products like vaginal moisturizers and lubricants, slowing their adoption and creating challenges for the market.

- Regulatory Hurdles: The regulatory environment for vaginal moisturizers and lubricants in the U.S. is complex, as these products are classified as medical devices. Manufacturers must navigate rigorous approval processes and comply with strict labeling standards, which can lead to delays and increased costs. These regulatory hurdles often impact market growth, presenting significant challenges for new product launches.

USA Vaginal Moisturizers and Lubricants Market Future Outlook

Over the next five years, the U.S. vaginal moisturizers and lubricants market is expected to show significant growth driven by continuous product innovation, increasing consumer awareness, and expanding distribution channels. The trend toward natural and organic products, coupled with the growing acceptance of sexual wellness products, will further propel market expansion.

Market Opportunities

- Growth in E-commerce Platforms: The expansion of e-commerce has reshaped consumer purchasing behaviors, making online shopping a key channel for health and personal care products. This trend offers manufacturers of vaginal moisturizers and lubricants an opportunity to reach a wider audience, particularly appealing to those who value the convenience and privacy that online shopping provides.

- Product Innovation and Natural Ingredients: Consumer demand is increasingly favoring personal care products formulated with natural ingredients. In response, manufacturers are innovating with organic and plant-based components in vaginal moisturizers and lubricants, aligning with the shift towards products free from synthetic additives. This trend toward natural formulations reflects a growing consumer preference for cleaner, more eco-friendly products.

Scope of the Report

|

Product Type |

Vaginal Moisturizers |

|

Formulation |

Water-Based |

|

Distribution Channel |

Retail Stores |

|

End-User |

Personal Use |

|

Region |

Northeast |

Products

Key Target Audience

Personal Care Product Manufacturers

Pharmaceutical Companies

Healthcare Industry

Women's Health Organizations

E-commerce Platforms

Government and Regulatory Bodies (e.g., FDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Church & Dwight Co., Inc.

Bayer AG

Reckitt Benckiser Group plc.

The Yes Yes Company Ltd.

Searchlight Pharma

KESSEL medintim GmbH

BioFilm Inc.

Sliquid LLC

Combe Incorporated

Laclede, Inc.

Table of Contents

1. USA Vaginal Moisturizers and Lubricants Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Vaginal Moisturizers and Lubricants Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Vaginal Moisturizers and Lubricants Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Awareness of Sexual Wellness

3.1.2 Rising Incidence of Vaginal Dryness

3.1.3 Expanding Geriatric Population

3.1.4 Technological Advancements in Product Formulation

3.2 Market Challenges

3.2.1 Social Stigma and Cultural Barriers

3.2.2 Regulatory Hurdles

3.2.3 Competition from Alternative Therapies

3.3 Opportunities

3.3.1 Growth in E-commerce Platforms

3.3.2 Product Innovation and Natural Ingredients

3.3.3 Untapped Markets in Rural Areas

3.4 Trends

3.4.1 Shift Towards Organic and Natural Products

3.4.2 Increased Marketing and Educational Campaigns

3.4.3 Collaboration with Healthcare Professionals

3.5 Government Regulations

3.5.1 FDA Guidelines on Over-the-Counter Products

3.5.2 Advertising and Labeling Standards

3.5.3 Import and Export Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Vaginal Moisturizers and Lubricants Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Vaginal Moisturizers

4.1.2 Personal Lubricants

4.2 By Formulation (Value %)

4.2.1 Water-Based

4.2.2 Silicone-Based

4.2.3 Oil-Based

4.3 By Distribution Channel (Value %)

4.3.1 Retail Stores

4.3.2 Specialty Stores

4.3.3 E-commerce

4.4 By End-User (Value %)

4.4.1 Personal Use

4.4.2 Medical Use

4.5 By Region (Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Vaginal Moisturizers and Lubricants Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Church & Dwight Co., Inc.

5.1.2 Bayer AG

5.1.3 Reckitt Benckiser Group plc.

5.1.4 The Yes Yes Company Ltd.

5.1.5 Searchlight Pharma

5.1.6 KESSEL medintim GmbH

5.1.7 BioFilm Inc.

5.1.8 Sliquid LLC

5.1.9 Combe Incorporated

5.1.10 Laclede, Inc.

5.1.11 Aloe Cadabra

5.1.12 Dr. Anna Cabeca

5.1.13 Damiva Canada

5.1.14 Good Clean Love

5.1.15 Trigg Laboratories, Inc.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Distribution Network, Recent Developments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Vaginal Moisturizers and Lubricants Market Regulatory Framework

6.1 FDA Approval Processes

6.2 Compliance Requirements

6.3 Certification Processes

7. USA Vaginal Moisturizers and Lubricants Future Market Size (USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Vaginal Moisturizers and Lubricants Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By Formulation (Value %)

8.3 By Distribution Channel (Value %)

8.4 By End-User (Value %)

8.5 By Region (Value %)

9. USA Vaginal Moisturizers and Lubricants Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. vaginal moisturizers and lubricants market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. vaginal moisturizers and lubricants market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple product manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. vaginal moisturizers and lubricants market.

Frequently Asked Questions

01 How big is the U.S. vaginal moisturizers and lubricants market?

The U.S. vaginal moisturizers and lubricants market is valued at USD 657.9 million, based on a five-year historical analysis. This market valuation reflects rising consumer awareness and demand for personal wellness products.

02 What are the challenges in the U.S. vaginal moisturizers and lubricants market?

Challenges in U.S. vaginal moisturizers and lubricants market include social stigmas associated with sexual health products, regulatory hurdles surrounding product ingredients, and the presence of counterfeit products. These factors impact market accessibility and consumer trust.

03 Who are the major players in the U.S. vaginal moisturizers and lubricants market?

Major players in U.S. vaginal moisturizers and lubricants market include Church & Dwight Co., Inc., Bayer AG, Reckitt Benckiser Group plc., The Yes Yes Company Ltd., and Searchlight Pharma. Their strong brand presence and extensive distribution networks contribute to their dominance.

04 What drives growth in the U.S. vaginal moisturizers and lubricants market?

The U.S. vaginal moisturizers and lubricants market growth is driven by increasing awareness about sexual wellness, advancements in product formulations, and the rising incidence of vaginal dryness among women, particularly in the aging population. Accessibility via e-commerce further supports expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.