USA Vegan Food Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD3301

November 2024

82

About the Report

USA Vegan Food Market Overview

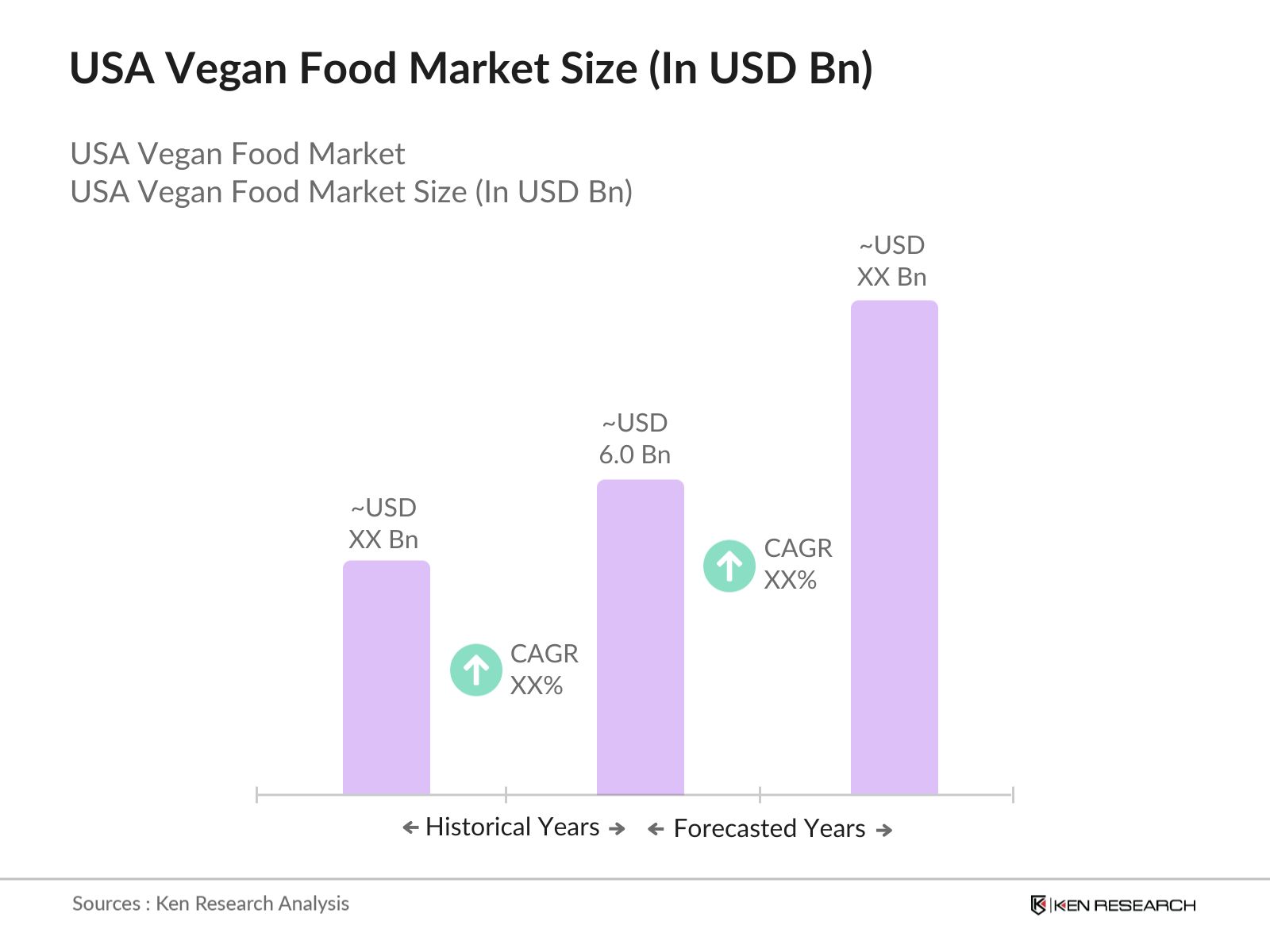

- The USA vegan food market was valued at USD 6.0 billion. The market is experiencing robust growth, driven by increasing consumer awareness regarding health, environmental sustainability, and animal welfare. The shift towards plant-based diets, coupled with growing innovation in vegan food products, is fueling this growth. Major food companies and startups are investing heavily in the development of plant-based alternatives to traditional animal-based foods, such as dairy, meat, and eggs. This transition is largely supported by rising demand from health-conscious consumers and the influence of veganism as a lifestyle choice, particularly among younger demographics.

- Cities such as Los Angeles, New York, and San Francisco dominate the vegan food market due to their progressive consumer bases, dense population, and the presence of innovative food companies. These cities have seen widespread availability of vegan options in both retail and foodservice sectors, contributing to their dominance. The high level of consumer awareness regarding animal welfare and environmental sustainability also propels these cities as market leaders.

- The regulatory landscape for vegan products in the U.S. is evolving, with government bodies such as the FDA and USDA playing a critical role in setting standards for product labeling and certification. In 2023, the FDA updated its guidelines for plant-based product labeling, requiring clear indications of vegan ingredients and adherence to nutritional standards.

USA Vegan Food Market Segmentation

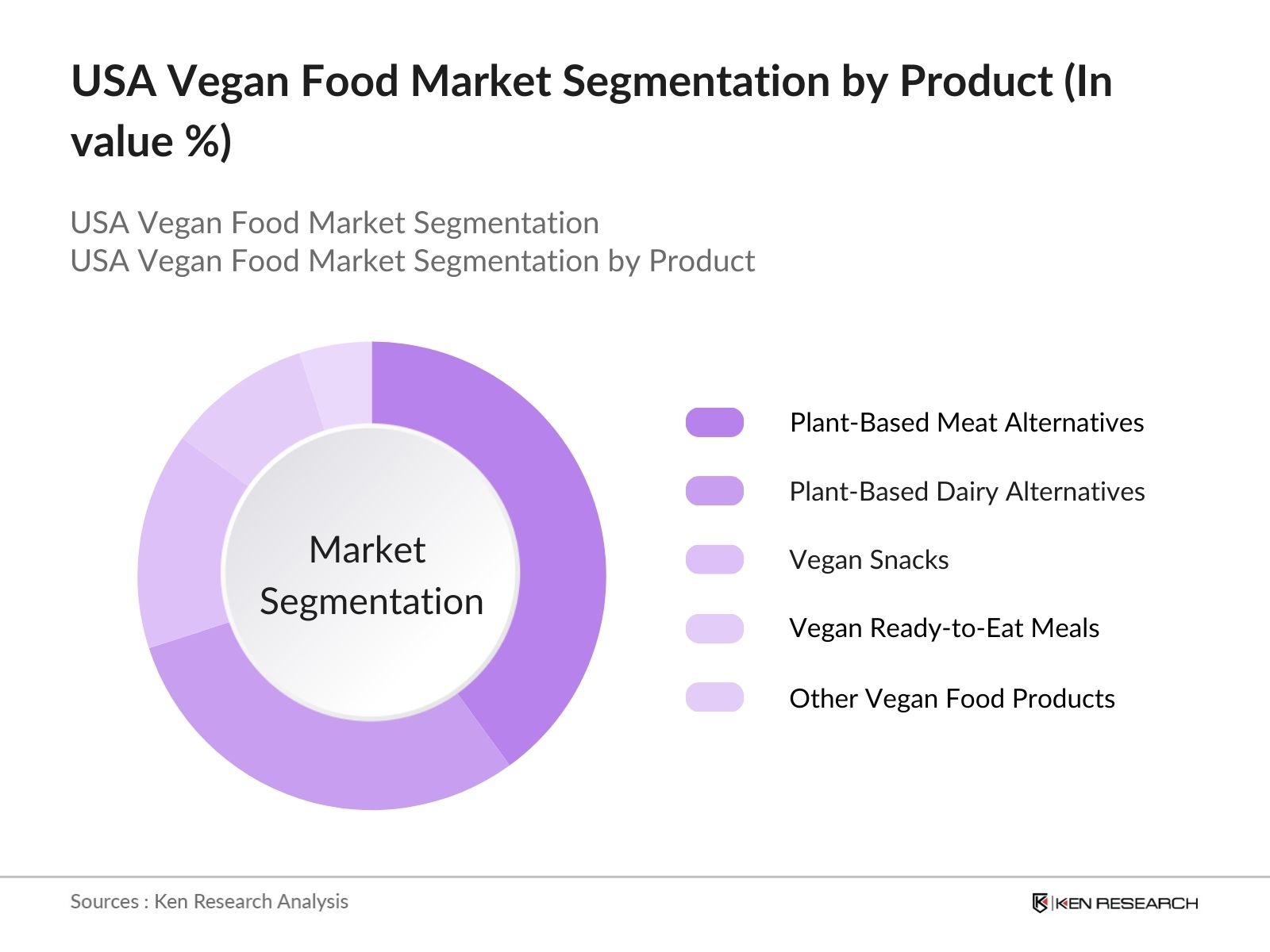

- By Product Type: The market is segmented into plant-based meat alternatives, dairy alternatives, vegan snacks, vegan ready to eat meals and other vegan food products (snacks, beverages, etc.). Plant-based meat alternatives account for the largest market share, driven by the growing popularity of products that closely mimic the taste and texture of traditional meat. Innovations in ingredients, such as pea protein, soy, and mycoprotein, have led to improved taste and functionality, making these products more appealing to mainstream consumers. Dairy alternatives, including almond milk, oat milk, and plant-based cheese, are also experiencing high demand as consumers seek lactose-free and allergen-friendly options. Other vegan food products, such as snacks and ready-to-eat meals, are gaining traction due to their convenience and nutritional value.

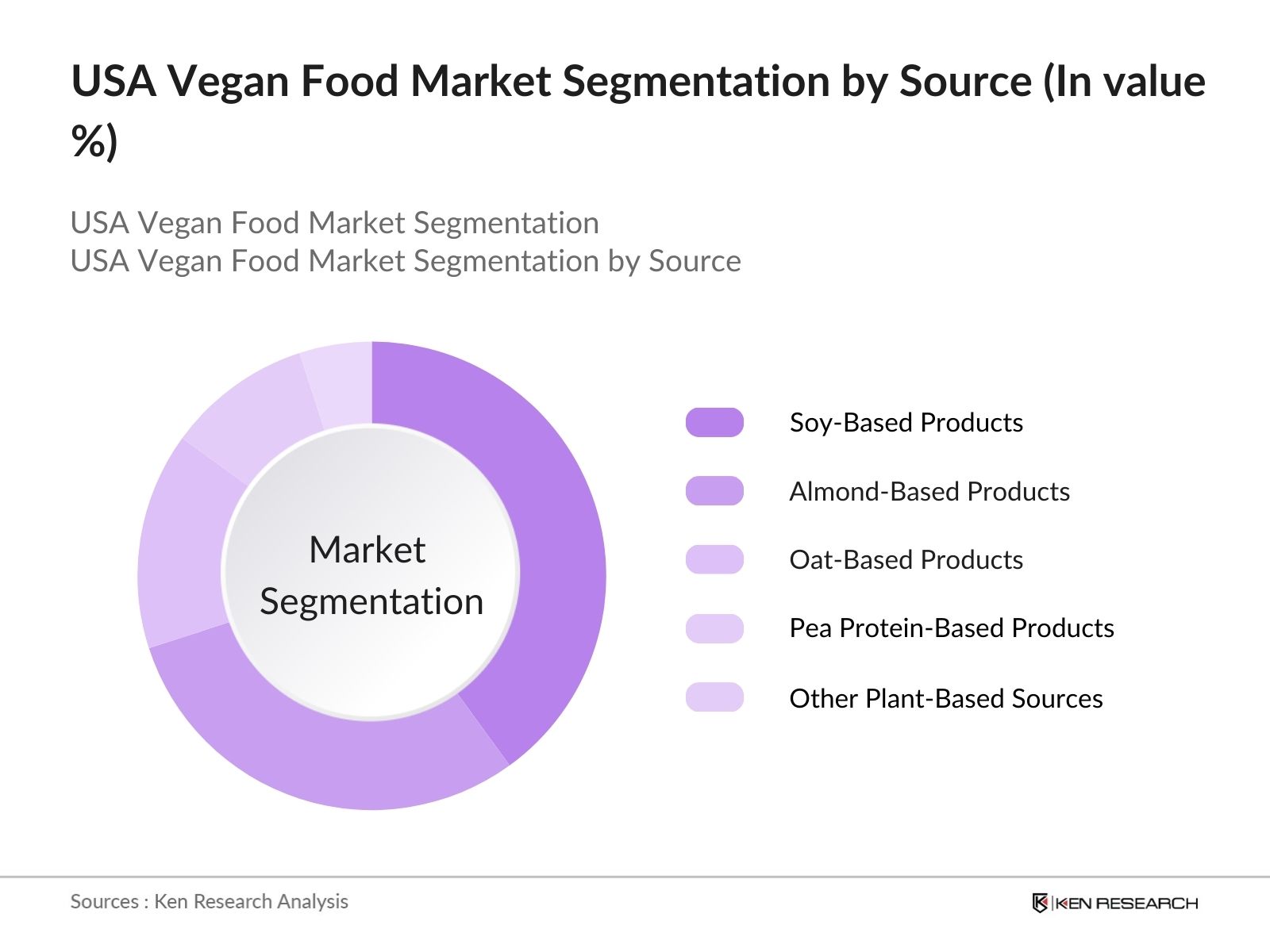

- By Source: The market is also segmented by source into soy-based products, almond-based products, oat-based products, pea protein-based products, and other plant-based sources. Soy-based products dominate the market share due to their high protein content, versatility, and long-standing presence in the market. Soy products, such as tofu and soy milk, have been staples of vegan diets for years and continue to be the most accessible and affordable alternatives for consumers. Additionally, the widespread availability of soy as an ingredient in various processed vegan foods further contributes to its dominant market position.

USA Vegan Food Market Competitive Landscape

The USA vegan food market is highly competitive, with a mix of well-established food manufacturers and innovative startups. Leading companies such as Beyond Meat, Impossible Foods, and Danones Alpro are driving market growth through constant innovation and product development. These companies are focusing on expanding their product lines to meet consumer demands for taste, texture, and nutritional value, while also reducing production costs to make vegan alternatives more accessible. Many players are also leveraging partnerships with restaurants, foodservice companies, and retail chains to increase the visibility and availability of vegan products across the country.

|

Company Name |

Established |

Headquarters |

No. of Employees |

Revenue (2023) |

Key Partners |

Major Product Line |

R&D Investment |

Market Presence |

|

Beyond Meat |

2009 |

USA |

||||||

|

Impossible Foods |

2011 |

USA |

||||||

|

Danone (Alpro) |

1919 |

France |

||||||

|

Oatly |

1994 |

Sweden |

||||||

|

Tofurky |

1980 |

USA |

USA Vegan Food Industry Analysis

Growth Drivers

- Increased Consumer Awareness and Health Trends: Consumer demand for vegan food is primarily driven by health awareness. A 2024 USDA report highlights a significant shift in consumer preferences toward plant-based products, as many are choosing diets that minimize processed and animal-based foods. An estimated 23.5 million Americans, particularly in urban areas, are consciously reducing meat intake to combat lifestyle diseases such as heart disease, high cholesterol, and obesity. This trend is bolstered by the USDA's "MyPlate" initiative, promoting plant-based eating as part of a balanced diet. Moreover, the CDC reports that dietary changes, including a rise in plant-based diets, have contributed to a substantial decline in cholesterol-related health complications over the last five years.

- Rising Environmental Awareness: Environmental consciousness is another major growth driver for the vegan food market in the U.S. Consumers are more aware of the environmental footprint of meat production, and the U.S. Department of Agriculture (USDA) reports that animal agriculture is responsible for 37% of national methane emissions. In contrast, plant-based food production generates fewer emissions and requires significantly less land and water. Studies by the U.S. Environmental Protection Agency (EPA) show that choosing plant-based alternatives reduces individual carbon footprints substantially annually. This awareness has sparked a growing trend toward adopting environmentally sustainable diets.

- 3.1.3 Innovation in Plant-Based Protein Technologies: Technological advancements in the production of plant-based proteins are revolutionizing the vegan food market. Companies are developing more protein-rich plant-based products, which closely mimic the taste and texture of animal-based foods. The USDA has identified innovations in alternative protein sources like pea and soy proteins, with nearly 45 new patents filed in 2023 alone. These developments are making plant-based foods more appealing to a wider range of consumers, fostering market growth. The National Institute of Food and Agriculture (NIFA) also reports increased federal funding for research in plant-based food technology, with over USD 700 million allocated in 2023.

Market Challenges

- High Costs of Plant-Based Ingredients: The production of plant-based foods continues to face challenges due to the high price of specialized ingredients such as pea and soy proteins. Supply chain disruptions and increased input costs have made these ingredients more expensive, adding to the overall cost of plant-based food production. Additionally, farmers transitioning to organic plant-based crops encounter high certification and maintenance expenses, which further elevate the cost of vegan products. Limited government subsidies for plant-based agriculture also make it difficult for producers to compete with lower-cost animal-based products in the market.

- Taste and Texture Limitations in Plant-Based Alternatives: A significant challenge in the vegan food market is achieving taste and texture parity with animal-based products. Many consumers who try plant-based alternatives find that the taste or texture does not meet their expectations. Despite ongoing innovations, consumer satisfaction with the sensory qualities of plant-based foods remains a concern. Developing technologies like fermentation and protein extrusion are expected to address these issues, but they are still in the early stages of development and require further investment to match the appeal of traditional animal-based foods.

USA Vegan Food Market Future Outlook

The USA vegan food market is expected to continue its upward trajectory through 2028, with increasing product diversification and growing consumer awareness driving market expansion. Advances in food technology, including the development of more realistic meat and dairy substitutes, will help vegan products appeal to a broader audience. Furthermore, as production scales and costs decrease, the price gap between vegan and animal-based products is expected to narrow, making vegan options more accessible to mainstream consumers.

Future Market Opportunities

- Expansion of Product Range to Meet Consumer Preferences: There is a significant opportunity for market players to diversify their product offerings to cater to different dietary preferences and needs. USDA data from 2023 indicates that while there are over 1,200 plant-based products available in the U.S. market, consumers are demanding greater variety in terms of flavour, protein sources, and nutritional profiles. Expanding the product range to include allergen-free options, fortified foods, and culturally diverse vegan cuisines presents a substantial opportunity for growth. The USDA reports that introducing such products could attract new consumer demographics, including those seeking functional health benefits from their food choices.

- Growth of Vegan Fast-Food Chains: The rise of vegan fast-food chains presents a lucrative opportunity for growth in the U.S. market. Chains like Plant Power Fast Food and Veggie Grill have gained popularity in urban areas, with combined revenues worth millions in 2023, according to USDA data. As consumer demand for convenient and healthy plant-based meals increases, vegan fast-food outlets are expanding their footprints. The U.S. Department of Commerce has reported a substantial rise in the number of vegan quick-service restaurants (QSRs) between 2022 and 2023, indicating a growing appetite for plant-based fast-food options.

Scope of the Report

|

By Product |

Plant-Based Meat Alternatives Plant-Based Dairy Alternatives Vegan Snacks Vegan Ready-to-Eat Meals Other Vegan Food Products |

|

By Source |

Soy-Based Products Almond-Based Products Oat-Based Products Pea Protein-Based Products Other Plant-Based Sources |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By End-User |

Residential/Household Foodservice (Restaurants, Cafes) Institutional (Hospitals, Schools |

|

By Meat Processing |

Fresh Frozen Processed |

|

By Region |

Riyadh Jeddah Eastern Province Rest of Saudi Arabia |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Foodservice Providers (Restaurants, Cafes, Fast-Food Chains)

Retailers and Supermarkets (Walmart, Kroger)

Plant-Based Food Manufacturers

Food Technology Innovators

Supply Chain Partners

Environmental and Health NGOs

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Beyond Meat

Impossible Foods

Danone (Alpro)

Oatly

Tofurky

Kite Hill

Follow Your Heart

Amys Kitchen

The Hain Celestial Group

Lightlife Foods

Miyokos Creamery

Good Catch Foods

Gardein (Conagra Brands)

Sweet Earth Foods (Nestl)

Califia Farms

Table of Contents

01 USA Vegan Food Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

02 USA Vegan Food Market Size (in USD Billion)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

03 USA Vegan Food Market Analysis

Growth Drivers

Rising Health Consciousness

Environmental Sustainability Concerns

Ethical and Animal Welfare Awareness

Technological Advancements in Food Processing

Market Challenges

High Product Costs

Limited Consumer Awareness in Certain Regions

Supply Chain Constraints

Regulatory Hurdles

Opportunities

Expansion into Untapped Markets

Product Diversification and Innovation

Strategic Partnerships and Collaborations

Increasing Investment in Plant-Based Startups

Trends

Surge in Plant-Based Meat Alternatives

Growth of Vegan Dairy Products

Adoption of Clean Label Products

Rise of Direct-to-Consumer Sales Channels

Government Regulations

Labeling Standards for Vegan Products

Subsidies and Incentives for Plant-Based Foods

Import and Export Regulations

Food Safety and Quality Standards

SWOT Analysis

Stakeholder Ecosystem

Porter's Five Forces Analysis

Competitive Landscape

04 Vegan Food Market Segmentation

By Product Type (in Value %)

Dairy Alternatives

Meat Substitutes

Bakery and Confectionery

Beverages

Others

By Source (in Value %)

Soy-Based

Almond-Based

Wheat-Based

Others

By Distribution Channel (in Value %)

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Specialty Stores

Others

By End-User (in Value %)

Household

Food Service Industry

Others

By Region (in Value %)

Northeast

Midwest

South

West

O5 USA Vegan Food Market Competitive Analysis

Detailed Profiles of Major Companies

Beyond Meat

Impossible Foods

Danone North America

The Hain Celestial Group

Tofurky

Amy's Kitchen

Daiya Foods

Kite Hill

Lightlife Foods

Follow Your Heart

Miyoko's Creamery

So Delicious Dairy Free

Sweet Earth Foods

Gardein

MorningStar Farms

Cross Comparison Parameters

Number of Employees

Headquarters Location

Year of Establishment

Revenue

Product Portfolio

Market Share

Recent Developments

Strategic Initiatives

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

Vegan Food Market Regulatory Framework

Food and Drug Administration (FDA) Guidelines

United States Department of Agriculture (USDA) Regulations

Labeling and Packaging Requirements

Compliance and Certification Processes

06 Vegan Food Future Market Size (in USD Billion)

Future Market Size Projections

Key Factors Driving Future Market Growth

07 Vegan Food Future Market Segmentation

By Product Type (in Value %)

By Source (in Value %)

By Distribution Channel (in Value %)

By End-User (in Value %)

By Region (in Value %)

08 Vegan Food Market Analysts’ Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Vegan Food Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Vegan Food Market. This includes assessing market penetration, consumer demand trends, and revenue generation. Furthermore, an evaluation of product quality and consumer preference statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple vegan food manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Vegan Food Market.

Frequently Asked Questions

01. How big is the USA Vegan Food Market?

The USA vegan food market was valued at USD 6.0 billion, driven by rising consumer demand for plant-based alternatives and increasing awareness regarding environmental sustainability and animal welfare.

02. What are the challenges in the USA Vegan Food Market?

Challenges in the USA vegan food market include high production costs, taste and texture limitations in plant-based alternatives, and consumer skepticism regarding the nutritional value of vegan products.

03. Who are the major players in the USA Vegan Food Market?

Key players in the USA vegan food market include Beyond Meat, Impossible Foods, Danone (Alpro), Oatly, and Tofurky. These companies lead the market due to their innovative product offerings and strong partnerships with major retailers and foodservice chains.

04. What are the growth drivers of the USA Vegan Food Market?

The USA vegan food market is driven by increasing health consciousness, advancements in food technology, and growing consumer awareness of environmental and ethical issues. Additionally, the rising demand for plant-based foods in mainstream retail and foodservice is boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.