USA Veterinary Healthcare Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD5096

December 2024

96

About the Report

USA Veterinary Healthcare Market Overview

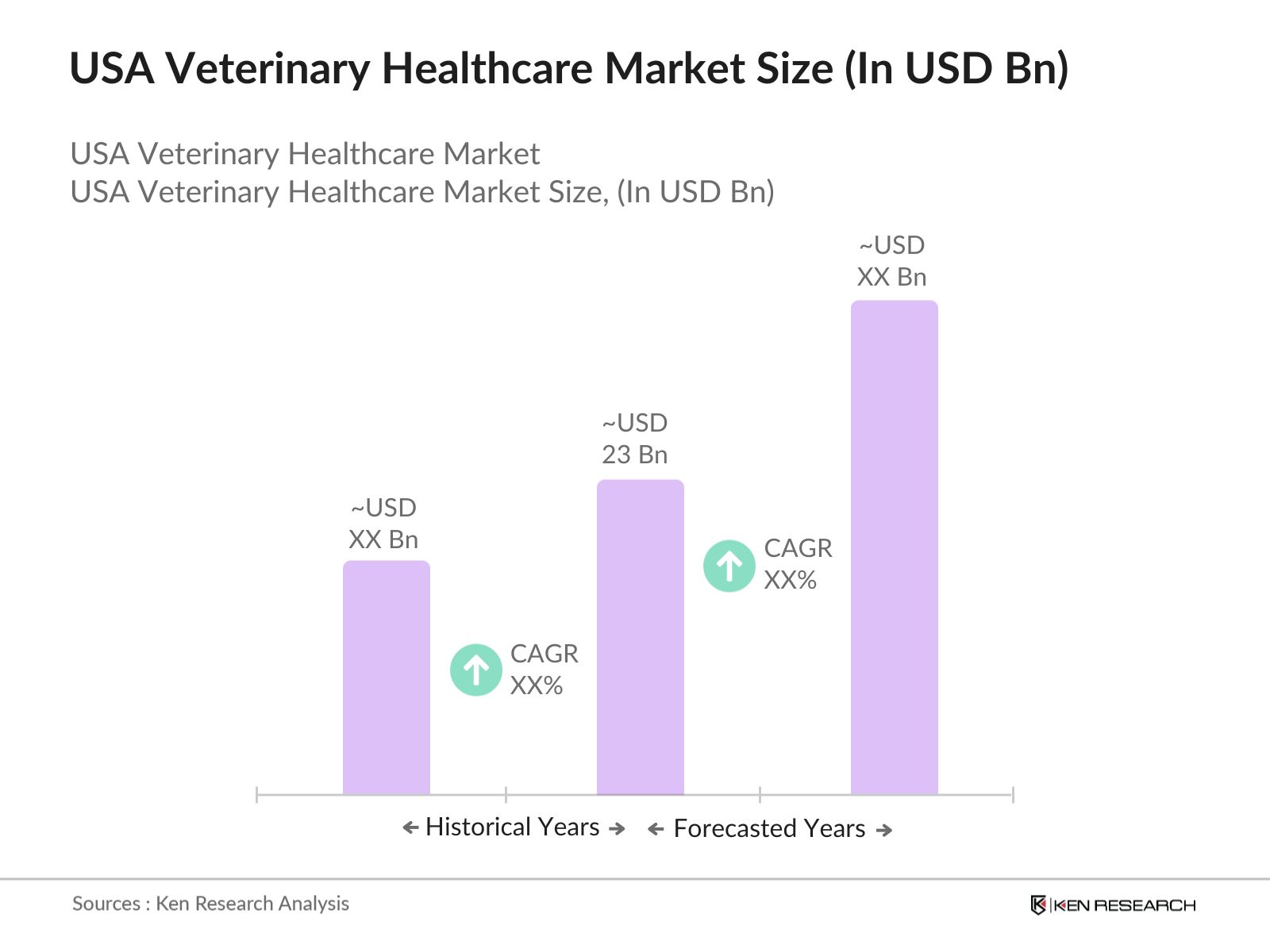

- The USA Veterinary Healthcare market is valued at USD 23 billion, driven by several factors, including the increasing pet ownership and rising disposable incomes. Over the past five years, a growing awareness of pet health, coupled with advances in veterinary diagnostics and treatments, has propelled the market. The demand for advanced care services, including surgeries, diagnostic imaging, and telemedicine, is surging, contributing to the overall market's expansion.

- Several cities, particularly New York, Los Angeles, and Chicago, dominate the veterinary healthcare market. These urban hubs boast higher pet ownership rates and a concentration of affluent pet owners willing to invest in advanced veterinary care services. Additionally, the presence of major veterinary clinics and hospitals, alongside research facilities in these regions, drives market dominance.

- In 2024, the U.S. government is investing in veterinary education to address the shortage of professionals. The federal government allocated over $50 million to veterinary schools to expand their capacity and increase enrollment in veterinary programs. Additionally, scholarship programs have been introduced to attract students to rural areas, where the shortage is most severe. These initiatives are expected to alleviate some of the pressure on the veterinary workforce and improve access to care in underserved regions.

USA Veterinary Healthcare Market Segmentation

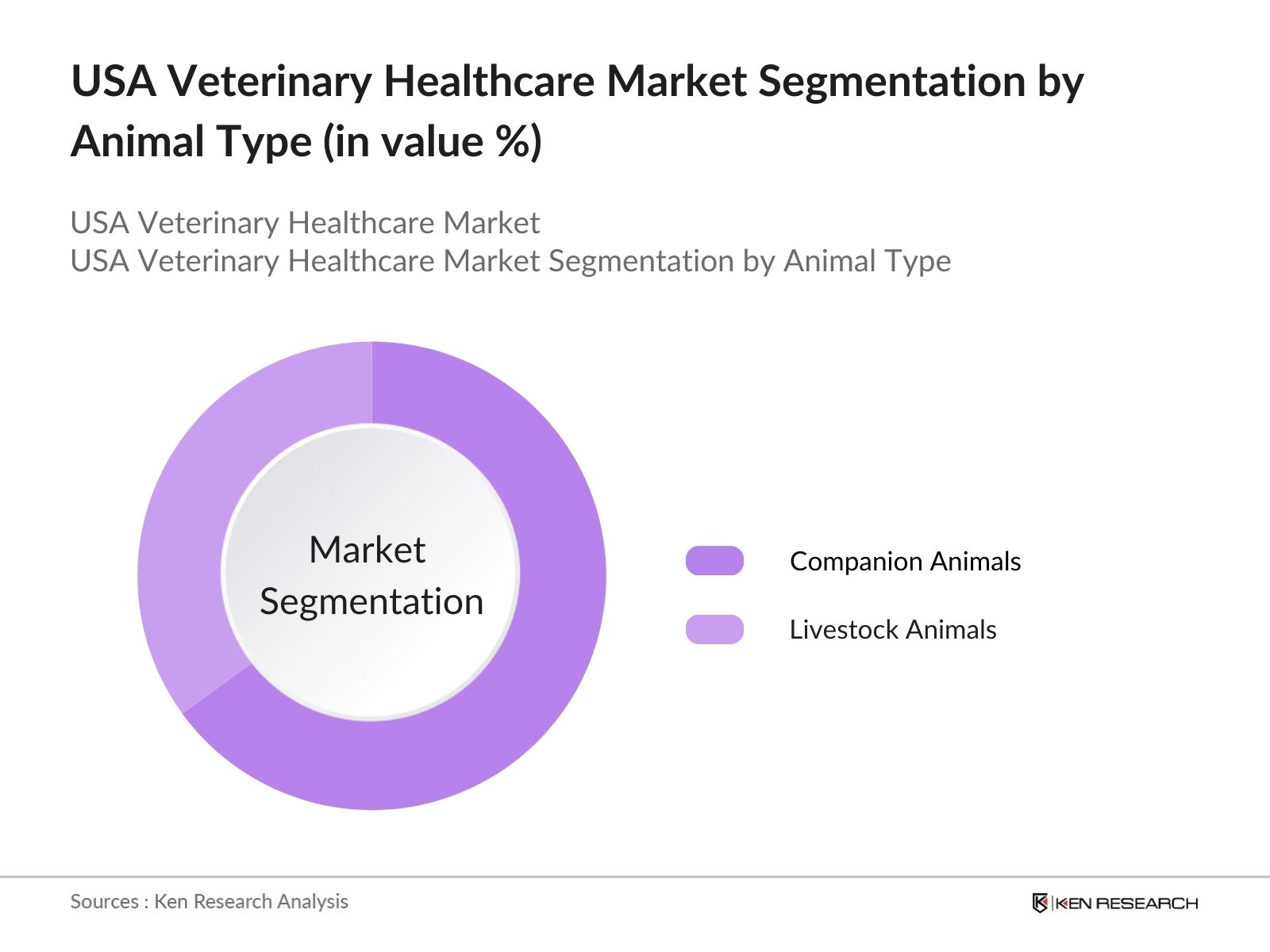

By Animal Type: The USA Veterinary Healthcare market is segmented by animal type into companion animals and livestock animals. Recently, companion animals, particularly dogs and cats, have dominated the market due to their increasing presence in American households. The rise in pet humanization, where pets are seen as family members, has significantly driven this sub-segment. Owners are more likely to invest in comprehensive healthcare, including preventive care, wellness checks, and advanced treatments, leading to sustained growth in this category.

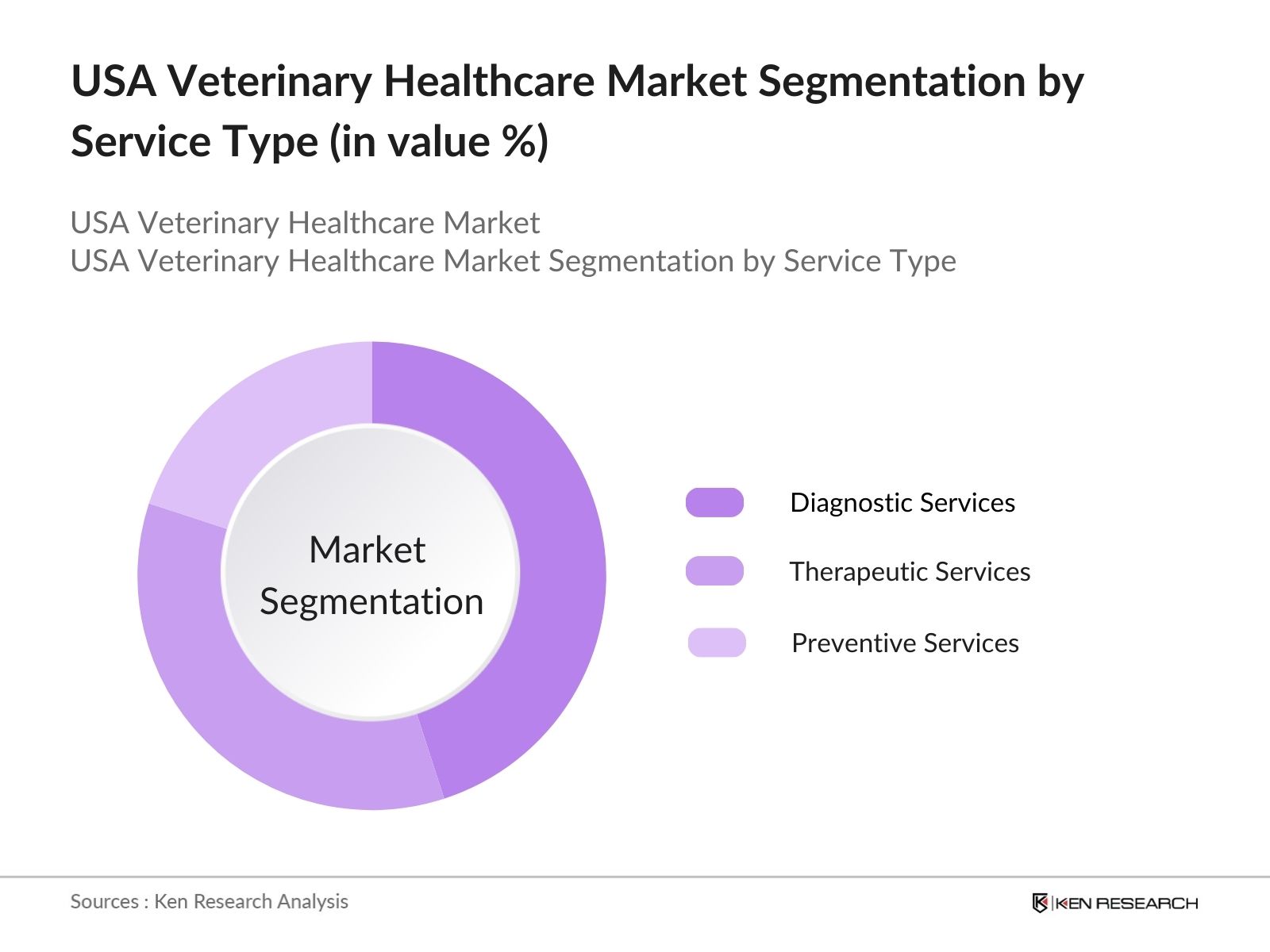

By Service Type: The USA Veterinary Healthcare market is segmented by service type into diagnostic services, therapeutic services, and preventive services. The diagnostic services segment, comprising imaging, laboratory tests, and clinical diagnostics, holds the largest market share. The segment's dominance stems from an increasing focus on early disease detection and advanced diagnostic technologies. As more pet owners seek precise and timely health assessments for their pets, veterinary labs and diagnostic centers have seen substantial demand growth.

USA Veterinary Healthcare Market Competitive Landscape

The USA Veterinary Healthcare market is dominated by several key players, each contributing to market advancements through innovation, service offerings, and geographic expansion. These companies have established a strong market presence, leveraging their wide-ranging product portfolios and strategic partnerships.

|

Company |

Establishment Year |

Headquarters |

Pharmaceuticals |

Diagnostics |

Vaccines |

Companion Animal Care |

Veterinary Equipment |

R&D Investments |

|

Zoetis Inc. |

1952 |

Parsippany, NJ |

- | - | - | - | - | - |

|

Merck Animal Health |

1997 |

Madison, NJ |

- | - | - | - | - | - |

|

IDEXX Laboratories Inc. |

1983 |

Westbrook, ME |

- | - | - | - | - | - |

|

Boehringer Ingelheim Animal Health |

1885 |

Ingelheim, Germany |

- | - | - | - | - | - |

|

Elanco Animal Health |

1954 |

Greenfield, IN |

- | - | - | - | - | - |

USA Veterinary Healthcare Market Analysis

Growth Drivers

- Increased Pet Ownership: In 2024, pet ownership continues to grow as urbanization and rising disposable incomes increase the demand for companion animals. According to global reports, the number of households with pets in the U.S. has surpassed 86.9 million, while India sees a surge with nearly 28 million pets. The growing awareness of animal welfare and the emotional connection between pets and owners is pushing governments to promote responsible pet ownership. This macroeconomic shift, coupled with strong consumer demand, is driving growth in veterinary services as more pets require regular healthcare, vaccines, and specialized treatments.

- Technological Advancements in Diagnostics and Treatment: Technological innovations such as veterinary imaging, AI-powered diagnostic tools, and genomics are revolutionizing animal healthcare. For instance, in 2024, the integration of AI in veterinary imaging is enhancing diagnostic accuracy, helping to detect complex conditions in both pets and livestock. In the U.S., there has been significant investment in veterinary AI tools with funding from federal research programs to develop advanced imaging techniques. Moreover, genetic research is being applied to breed-specific health management in regions such as the EU, where genomic studies for livestock are helping improve animal health.

- Rising Demand for Specialty Services: Veterinary oncology, cardiology, and dermatology are witnessing increased demand as owners seek specialized treatments for their pets. For example, in 2024, veterinary oncology clinics have expanded significantly in North America, with specialized oncology treatments now available in over 1,200 clinics. The demand for advanced veterinary care extends globally, particularly in emerging markets like Southeast Asia, where increasing pet ownership is paired with growing awareness of specialty services. Specialty services, like pet cardiology, are now being integrated into regular veterinary practices, as seen in the U.S. where institutions such as the USDA report enhanced treatment capabilities.

Market Challenges

- High Cost of Veterinary Care: The rising cost of veterinary care remains a significant barrier in 2024. Access to advanced treatments, such as orthopedic surgery or oncology, can cost between $2,000 and $8,000 per treatment, limiting affordability for many pet owners. In developing regions, access to high-cost pharmaceuticals and treatments remains limited due to import duties and regulatory constraints. Countries like India are facing challenges in developing local veterinary pharmaceutical production, increasing dependence on costly imports. The veterinary workforce in many countries also reports challenges in providing affordable care while maintaining service quality.

- Shortage of Veterinary Professionals: A shortage of skilled veterinary professionals continues to constrain the industry in 2024. According to recent workforce studies, the U.S. alone faces a shortfall of around 15,000 veterinarians, while emerging markets like Brazil and India are also grappling with similar shortages. Governments are investing in veterinary education to address this gap, but high demand is outpacing the supply of qualified professionals. This shortage impacts the delivery of quality care and increases wait times for pet owners seeking treatment, limiting overall market expansion. Developing veterinary telehealth solutions can partially address the shortage but require further technological advancements.

USA Veterinary Healthcare Market Future Outlook

Over the next five years, the USA Veterinary Healthcare market is expected to experience sustained growth, driven by several key factors. These include the continuous advancements in veterinary diagnostic technologies, increased pet ownership, and a growing emphasis on preventive care and wellness. Moreover, the rising popularity of pet insurance will encourage more pet owners to seek comprehensive healthcare solutions for their animals, further propelling market growth. The expansion of telemedicine and mobile veterinary services will also play a crucial role in reshaping the market dynamics.

Market Opportunities

- Growth in Pet Insurance Adoption: In 2024, pet insurance adoption is witnessing substantial growth, particularly in developed regions. In the U.S., over 5 million pets are currently insured, and countries like the U.K. report that almost 40% of households with pets have insurance policies. Pet insurance is providing a financial safety net, allowing owners to access advanced treatments and diagnostics that were once financially out of reach. This trend is also gaining traction in emerging markets like China, where the government is introducing policies to expand pet insurance coverage, further enhancing veterinary healthcare access.

- Expansion of Telemedicine and Remote Monitoring: The expansion of veterinary telemedicine and remote monitoring services is an emerging trend in 2024. Telehealth platforms allow pet owners in remote areas to access expert consultations without visiting clinics. In regions like the U.S., veterinary telehealth is being integrated into primary care, with over 10,000 veterinarians offering virtual consultations. The global adoption of telemedicine is also being supported by governmental policies in countries like Australia and Canada, where rural populations often face limited access to veterinary services. This expansion provides immense potential for market growth, particularly as telehealth platforms continue to develop.

Scope of the Report

|

By Animal Type |

Companion Animals Livestock Animals |

|

By Service Type |

Diagnostic Services Therapeutic Services Preventive Services |

|

By End-User |

Veterinary Clinics Veterinary Hospitals Mobile Veterinary Services |

|

By Distribution Channel |

Direct Purchase Distributors & Wholesalers Online Sales Platforms |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Veterinary Hospitals and Clinics

Diagnostic Equipment Manufacturers

Pharmaceutical Companies

Pet Insurance Providers

Telemedicine and Remote Monitoring Platforms

Government and Regulatory Bodies (USDA, FDA)

Livestock Management Organizations

Investments and Venture Capital Firms

Companies

Players Mentioned in the Report:

Zoetis Inc.

Merck Animal Health

IDEXX Laboratories Inc.

Boehringer Ingelheim Animal Health

Elanco Animal Health

VCA Inc.

Covetrus Inc.

Patterson Veterinary Supply

Heska Corporation

Dechra Pharmaceuticals

Table of Contents

1. USA Veterinary Healthcare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Types of Veterinary Services, Key Stakeholders, End-Users, Animal Types, etc.)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Veterinary Healthcare Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Veterinary Practice Consolidation, Telemedicine Adoption, AI in Diagnostics)

3. USA Veterinary Healthcare Market Analysis

3.1. Growth Drivers

3.1.1. Increased Pet Ownership (Companion Animal Care)

3.1.2. Technological Advancements in Diagnostics and Treatment (Veterinary Imaging, AI, Genomics)

3.1.3. Rising Demand for Specialty Services (Oncology, Cardiology, Dermatology)

3.1.4. Focus on Preventive Care (Vaccination Programs, Pet Wellness Plans)

3.2. Market Challenges

3.2.1. High Cost of Veterinary Care (Access to Advanced Treatments, Pharmaceuticals)

3.2.2. Shortage of Veterinary Professionals (Veterinary Workforce Dynamics)

3.2.3. Regulatory Hurdles in Drug Approval (FDA Compliance, Veterinary Drug Pipeline)

3.3. Opportunities

3.3.1. Growth in Pet Insurance Adoption

3.3.2. Expansion of Telemedicine and Remote Monitoring (Veterinary Telehealth)

3.3.3. Increasing Demand for Livestock Animal Care (Animal Husbandry, Livestock Health Management)

3.4. Trends

3.4.1. AI-Driven Diagnostic Tools (Automation in Clinical Decision Making)

3.4.2. Mobile Veterinary Clinics (Expanding Rural Access to Veterinary Care)

3.4.3. Sustainability Initiatives (Eco-Friendly Veterinary Practices, Biodegradable Pharmaceuticals)

3.5. Government Regulation

3.5.1. USDA Veterinary Health Guidelines

3.5.2. Federal Drug Administration (FDA) Animal Drug and Device Approvals

3.5.3. Animal Welfare Laws and Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Veterinarians, Pharmaceutical Companies, Diagnostic Equipment Manufacturers, Animal Shelter Organizations)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Veterinary Healthcare Market Segmentation

4.1. By Animal Type (In Value %)

4.1.1. Companion Animals (Dogs, Cats)

4.1.2. Livestock Animals (Cattle, Poultry, Swine, Equine)

4.2. By Service Type (In Value %)

4.2.1. Diagnostic Services (Veterinary Laboratories, Imaging)

4.2.2. Therapeutic Services (Surgery, Rehabilitation)

4.2.3. Preventive Services (Vaccinations, Wellness Exams)

4.3. By End-User (In Value %)

4.3.1. Veterinary Clinics

4.3.2. Veterinary Hospitals

4.3.3. Mobile Veterinary Services

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Purchase

4.4.2. Distributors & Wholesalers

4.4.3. Online Sales Platforms

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Veterinary Healthcare Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Zoetis Inc.

5.1.2. Merck Animal Health

5.1.3. Elanco Animal Health

5.1.4. IDEXX Laboratories Inc.

5.1.5. Boehringer Ingelheim Animal Health

5.1.6. VCA Inc. (Mars Petcare)

5.1.7. Covetrus Inc.

5.1.8. Patterson Veterinary Supply

5.1.9. Heska Corporation

5.1.10. Dechra Pharmaceuticals

5.1.11. Nutramax Laboratories

5.1.12. Virbac Corporation

5.1.13. Bayer Animal Health

5.1.14. PetIQ Inc.

5.1.15. Neogen Corporation

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investment, Veterinary Care Solutions)

5.3 Market Share Analysis (Top Competitors and Market Distribution)

5.4 Strategic Initiatives (New Product Launches, Partnerships, Acquisitions)

5.5 Mergers and Acquisitions (Notable Consolidations in Veterinary Healthcare)

5.6 Investment Analysis (Key Market Investments)

5.7 Venture Capital Funding (Notable VC-Backed Startups in Veterinary Tech)

5.8 Government Grants (Funding Initiatives Supporting Animal Health)

5.9 Private Equity Investments (Trends in Private Equity Investments)

6. USA Veterinary Healthcare Market Regulatory Framework

6.1. USDA Veterinary Health Standards

6.2. FDA Animal Drug Compliance

6.3. Animal Welfare Act (AWA) Regulations

6.4. Veterinary Telemedicine Regulations

7. USA Veterinary Healthcare Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Emerging Technologies, Pet Insurance Penetration, Livestock Care Focus)

8. USA Veterinary Healthcare Future Market Segmentation

8.1. By Animal Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. USA Veterinary Healthcare Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Veterinary Services Adoption by Pet Owners, Livestock Farmers)

9.3. Marketing Initiatives (Outreach and Education for Pet Insurance, Livestock Disease Management)

9.4. White Space Opportunity Analysis (Untapped Segments in Pet and Livestock Care)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by identifying essential factors influencing the USA Veterinary Healthcare Market. Through extensive desk research, we examine the dynamics affecting pet ownership rates, the regulatory landscape, and technological advancements in the industry. Proprietary databases and secondary sources form the backbone of this data collection phase.

Step 2: Market Analysis and Construction

This stage involves gathering historical data and market performance statistics to assess current market conditions. A focus on diagnostic service penetration rates, clinic-to-service provider ratios, and regional healthcare variations forms the core of the analysis. We construct models to estimate revenue and market shares based on these metrics.

Step 3: Hypothesis Validation and Expert Consultation

To verify and refine the data, consultations are conducted with industry experts from major veterinary pharmaceutical companies, diagnostic service providers, and healthcare organizations. These discussions provide first-hand insights into operational strategies, technological adoption, and future market potential.

Step 4: Research Synthesis and Final Output

The final synthesis of data is performed through engagement with top veterinary professionals, refining market statistics and projections. Data verification occurs at this stage, ensuring that both top-down and bottom-up methodologies are corroborated for accuracy.

Frequently Asked Questions

01. How big is the USA Veterinary Healthcare Market?

The USA Veterinary Healthcare market is valued at USD 23 billion. The market is supported by increasing pet ownership and advancements in veterinary diagnostic services.

02. What are the challenges in the USA Veterinary Healthcare Market?

Key challenges in the USA Veterinary Healthcare market include the high cost of veterinary services, a shortage of qualified professionals, and stringent regulatory requirements for veterinary drugs and treatments.

03. Who are the major players in the USA Veterinary Healthcare Market?

The major players in the USA Veterinary Healthcare market include Zoetis Inc., Merck Animal Health, IDEXX Laboratories Inc., Boehringer Ingelheim Animal Health, and Elanco Animal Health.

04. What are the growth drivers of the USA Veterinary Healthcare Market?

The USA Veterinary Healthcare market is driven by increased pet ownership, advancements in diagnostic technologies, and the rising adoption of pet insurance, which encourages more comprehensive veterinary care.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.