USA Virtual Power Plant Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD7782

November 2024

94

About the Report

USA Virtual Power Plant Market Overview

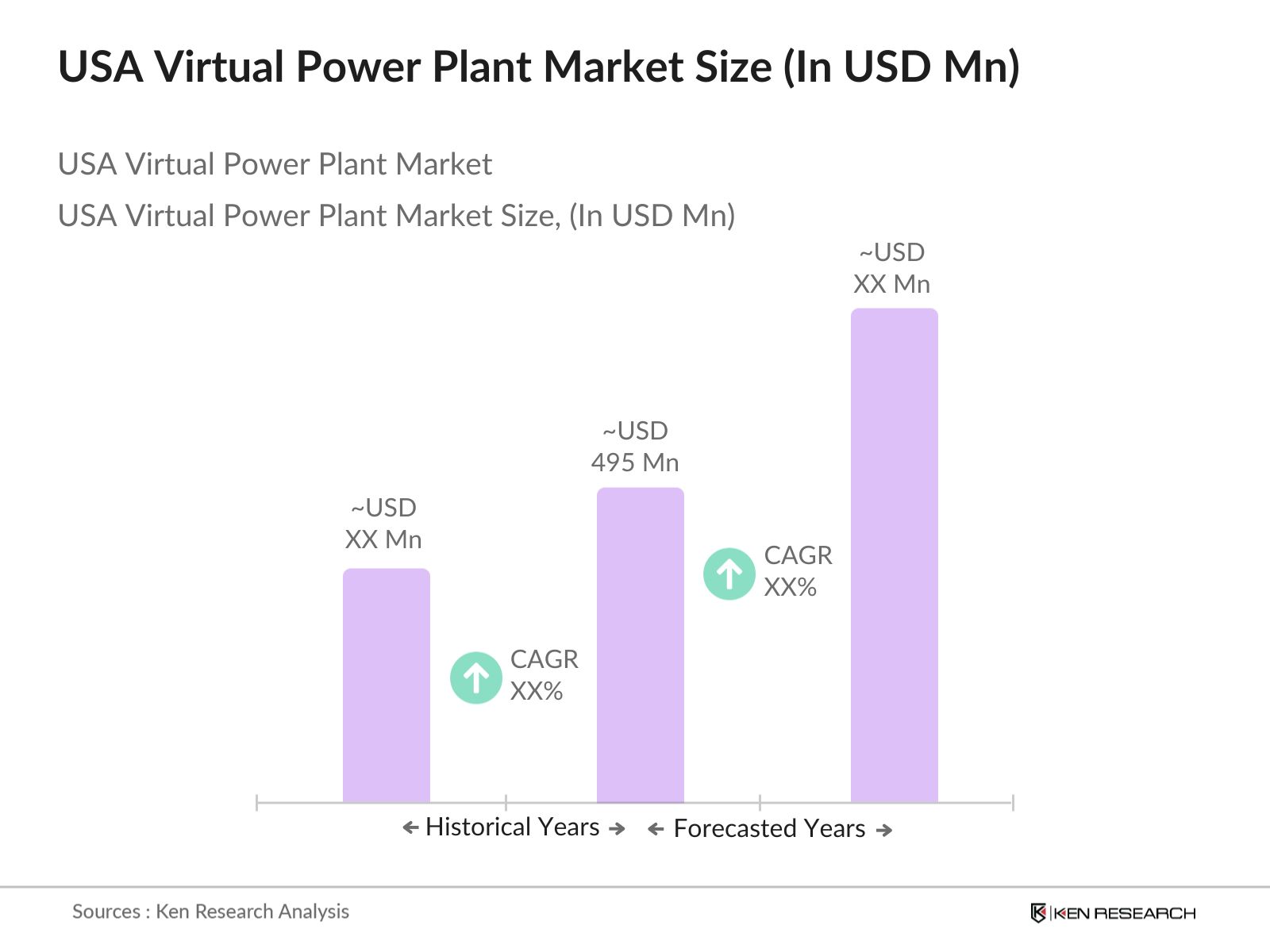

- The USA Virtual Power Plant (VPP) market is valued at USD 495 million, based on a five-year historical analysis. This market is driven by the increasing integration of distributed energy resources (DERs) such as solar and wind, coupled with advancements in energy storage solutions like batteries. The need for enhanced grid flexibility, energy cost reduction, and the Federal Energy Regulatory Commissions (FERC) support for DER participation in wholesale markets further accelerate the markets growth.

- Dominant regions in the USA, such as California, Texas, and New York, lead the VPP market due to their large-scale renewable energy projects and progressive regulatory frameworks. California's ambitious Renewable Portfolio Standard (RPS) and New Yorks Reforming the Energy Vision (REV) initiative are key reasons for their dominance. Texas, known for its vast wind energy capacity, has become a hotspot for VPP integration, especially in areas with grid flexibility challenges.

- Renewable Portfolio Standards (RPS) continue to drive VPP adoption by mandating that utilities source a percentage of their energy from renewable resources. As of 2024, 29 states and Washington D.C. have enforceable RPS, which compels utilities to incorporate renewables, boosting the demand for VPPs to manage these decentralized resources efficiently.

USA Virtual Power Plant Market Segmentation

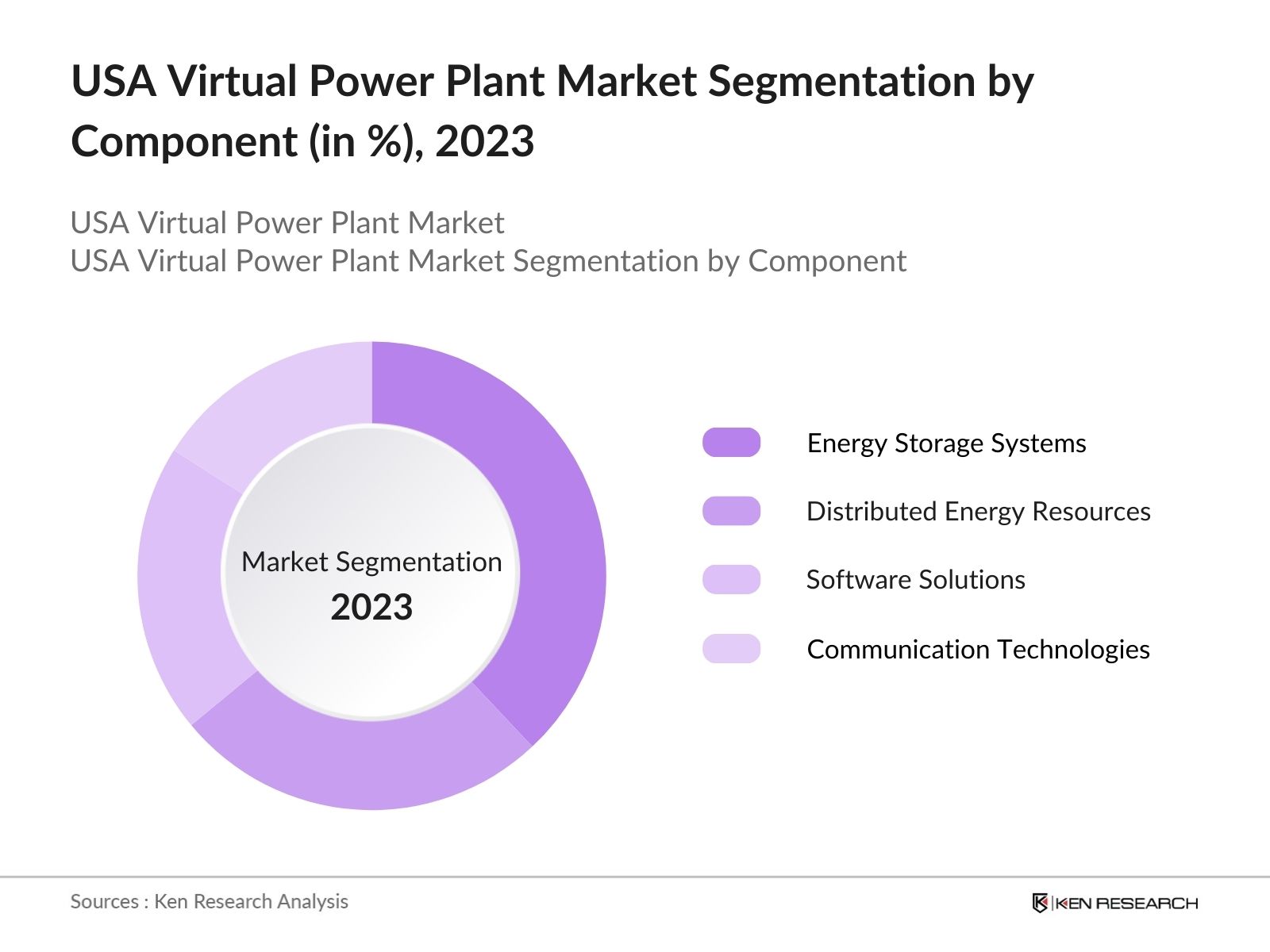

By Component: The USA VPP market is segmented by component into energy storage systems, distributed energy resources (DERs), software solutions, and communication technologies. Energy Storage Systems (Battery, Thermal) Energy storage systems, particularly battery storage, have been the dominant sub-segment in 2023 due to the increasing need for backup power, grid stability, and storage of excess energy generated by renewable sources.

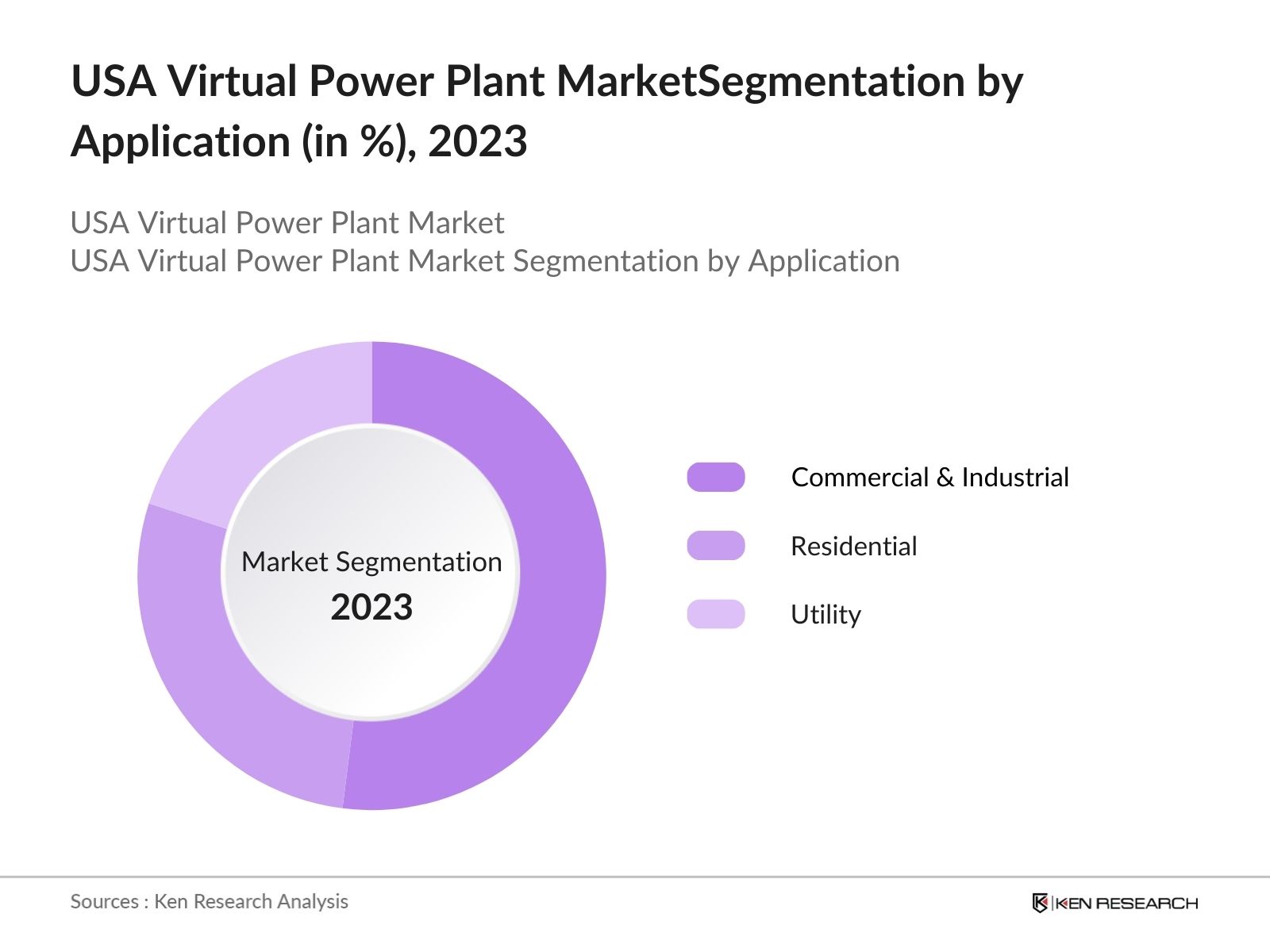

By Application: The market is segmented by application into commercial & industrial, residential, and utility sectors. Commercial & Industrial The commercial and industrial sector has captured a dominant share of the USA VPP market in 2023, driven by large-scale energy consumers adopting VPPs to reduce energy costs, enhance operational efficiency, and meet sustainability goals.

USA Virtual Power Plant Market Competitive Landscape

The USA Virtual Power Plant market is highly competitive, with a mix of established energy companies and technology providers. The market is dominated by key players, including technology innovators and large energy companies focusing on grid solutions. The USA VPP market is led by players such as Tesla, Siemens, and Schneider Electric. These companies are leveraging advanced energy storage solutions, AI-driven energy management platforms, and large-scale grid-interactive software to dominate the space.

USA Virtual Power Plant Industry Analysis

Growth Drivers

- Increasing Renewable Energy Integration: In 2024, the integration of renewable energy sources like wind and solar has become a pivotal driver for the growth of Virtual Power Plants (VPPs). The United States generated 1,051 terawatt-hours (TWh) from renewables in 2023, accounting for 22% of total electricity generation. The rise in renewable energy integration demands more flexible grid systems, and VPPs provide the necessary infrastructure to manage and distribute decentralized energy from diverse sources, enhancing grid reliability.

- Rising Demand for Grid Decentralization: The U.S. power grid is facing increasing decentralization, driven by more distributed energy resources (DERs) like rooftop solar and small-scale wind farms. In 2023, the U.S. had over 12 GW of installed DER capacity, and this decentralized growth is pushing utilities to adopt VPPs to manage energy flows. VPPs help optimize the balance of supply and demand without relying on traditional, centralized power plants, thereby offering more resilience and flexibility for local grids.

- Energy Storage Advancements (Battery, Thermal): Advancements in energy storage technology are critical for VPPs in 2024, enabling efficient energy distribution. The U.S. added 6 GW of battery storage capacity by mid-2023, up from 4.5 GW in 2022, primarily to store intermittent renewable energy. This growing capacity enables VPPs to store surplus energy and dispatch it during peak demand periods, supporting grid stability.

Market Challenges

- Cybersecurity Risks in Virtual Systems: As VPPs rely heavily on digital platforms, the risk of cyberattacks is a growing concern. In 2024, the U.S. power sector reported over 45 significant cyber incidents, many targeting grid infrastructure. VPPs, being digitally integrated systems, are particularly vulnerable to such threats, requiring enhanced cybersecurity protocols.

- Regulatory and Compliance Barriers: State-specific regulations continue to pose challenges for VPP implementation. As of 2024, 30 states have varying degrees of support for DERs, with 10 states lacking clear policies for integrating VPPs. This regulatory inconsistency makes it difficult for energy companies to deploy VPPs uniformly across the country.

USA Virtual Power Plant Market Future Outlook

The USA Virtual Power Plant market is expected to experience rapid growth over the next five years, driven by increased adoption of distributed energy resources, grid modernization initiatives, and government support for renewable energy integration. Growing demand for enhanced grid resilience and decarbonization goals will further accelerate market expansion.

Market Opportunities

- Utility Partnerships and Smart Grid Collaborations: In 2024, VPP operators are increasingly forming partnerships with utilities to expand their capabilities. Utilities are investing in smart grid technologies, which grew by 12 GW of connected DERs in 2023, to enhance the integration of renewable energy. These collaborations allow utilities to leverage VPPs for peak shaving, demand response, and energy balancing services.

- Growth of Distributed Energy Resources (DER): The growth of DERs is a significant opportunity for VPPs in 2024. With over 12 GW of DERs installed by the end of 2023, VPPs are positioned to aggregate these resources to provide grid support. The rising number of rooftop solar installations, electric vehicles, and small-scale wind farms creates a vast pool of energy that VPPs can manage.

Scope of the Report

|

By Component |

Energy Storage Systems (Battery, Thermal) |

|

By Technology |

Demand Response (DR) |

|

By Application |

Commercial & Industrial |

|

By Business Model |

Energy-as-a-Service (EaaS) |

|

By Region |

Northeast |

Products

Key Target Audience

Utilities and Independent System Operators (ISOs)

Energy Service Companies (ESCOs)

Energy Storage Providers

Distributed Energy Resource Aggregators

Commercial & Industrial Energy Consumers

Residential Energy Consumers

Government and Regulatory Bodies (FERC, DOE)

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Tesla, Inc.

Siemens AG

Schneider Electric SE

AutoGrid Systems, Inc.

Generac Power Systems

Enbala Networks

ABB Ltd.

NextEra Energy, Inc.

GE Digital

Sunrun Inc.

Table of Contents

1. USA Virtual Power Plant Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Virtual Power Plant Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Virtual Power Plant Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Renewable Energy Integration

3.1.2. Rising Demand for Grid Decentralization

3.1.3. Energy Storage Advancements (Battery, Thermal)

3.1.4. FERC Orders (Policy Impact)

3.2. Market Challenges

3.2.1. Cybersecurity Risks in Virtual Systems

3.2.2. Regulatory and Compliance Barriers

3.2.3. High Initial Capital Investment

3.2.4. Inconsistent Power Market Regulations (State-by-State Variations)

3.3. Opportunities

3.3.1. Utility Partnerships and Smart Grid Collaborations

3.3.2. Growth of Distributed Energy Resources (DER)

3.3.3. Expanding Demand Response Programs

3.3.4. Integration of AI and Blockchain for VPP Optimization

3.4. Trends

3.4.1. Rise of Prosumers (Prosumer Participation in Energy Markets)

3.4.2. Virtual Power Plants as Energy-as-a-Service (EaaS) Model

3.4.3. Cloud-Based Solutions and IoT Integration in VPPs

3.4.4. Flexibility and Peak Shaving Services by VPPs

3.5. Government Regulation

3.5.1. Federal Energy Regulatory Commission (FERC) Orders on VPPs

3.5.2. Renewable Energy Portfolio Standards (RPS)

3.5.3. State-Level Energy Transition Policies

3.5.4. Incentives for Energy Storage Integration

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Utility Companies

3.7.2. Independent Power Producers (IPPs)

3.7.3. DER Operators

3.7.4. Energy Service Providers

3.7.5. End-Users (Commercial, Industrial, Residential)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Virtual Power Plant Market Segmentation

4.1. By Component (In Value %)

4.1.1. Energy Storage Systems (Battery, Thermal)

4.1.2. Distributed Energy Resources (Solar, Wind, CHP)

4.1.3. Software Solutions (Cloud, Edge Computing)

4.1.4. Communication Technologies (IoT, Blockchain)

4.2. By Technology (In Value %)

4.2.1. Demand Response (DR)

4.2.2. Distributed Generation (DG)

4.2.3. Mixed Asset VPPs

4.3. By Application (In Value %)

4.3.1. Commercial & Industrial

4.3.2. Residential

4.3.3. Utility

4.4. By Business Model (In Value %)

4.4.1. Energy-as-a-Service (EaaS)

4.4.2. Aggregator Model

4.4.3. Wholesale Market Participation

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Virtual Power Plant Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla, Inc.

5.1.2. Siemens AG

5.1.3. Generac Power Systems

5.1.4. Enbala Networks

5.1.5. AutoGrid Systems, Inc.

5.1.6. ABB Ltd.

5.1.7. NextEra Energy, Inc.

5.1.8. Schneider Electric SE

5.1.9. Sunrun Inc.

5.1.10. Engie SA

5.1.11. GE Digital

5.1.12. Shell Energy

5.1.13. Orsted A/S

5.1.14. NRG Energy, Inc.

5.1.15. Limejump Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Technology Offerings, Energy Capacity Managed, DER Asset Type, Geographic Reach, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Virtual Power Plant Market Regulatory Framework

6.1. FERC Orders Impacting VPPs

6.2. State Energy Policies (California, New York, Texas)

6.3. Compliance Requirements for DERs

6.4. Grid Modernization Policies

7. USA Virtual Power Plant Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Virtual Power Plant Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Business Model (In Value %)

8.5. By Region (In Value %)

9. USA Virtual Power Plant Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We began by mapping all the stakeholders involved in the USA Virtual Power Plant Market, from utility companies to distributed energy resource aggregators. This stage involved detailed desk research to identify critical drivers and challenges in the market, enabling a thorough understanding of the factors shaping the market landscape.

Step 2: Market Analysis and Construction

Historical data was analyzed to build an accurate representation of the USA VPP market. These included assessments of technology adoption rates, grid flexibility, and the role of government policies. Special attention was paid to energy storage penetration and how virtual power plants contribute to peak load reduction.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through consultations with experts from energy companies, technology vendors, and regulatory bodies. These discussions provided a clearer understanding of market adoption rates, DER capacity growth, and evolving business models.

Step 4: Research Synthesis and Final Output

This phase involved integrating data from both primary and secondary sources. Additional inputs from utilities, distributed resource operators, and regulatory agencies were collected to ensure a well-rounded and accurate report that captures the full market picture.

Frequently Asked Questions

01. How big is the USA Virtual Power Plant Market?

The USA Virtual Power Plant (VPP) market is valued at USD 495 million, based on a five-year historical analysis. This market is driven by the increasing integration of distributed energy resources (DERs) such as solar and wind, coupled with advancements in energy storage solutions like batteries.

02. What are the challenges in the USA Virtual Power Plant Market?

Key challenges include cybersecurity risks, high initial capital investment, and regulatory complexities that vary from state to state, making it difficult for companies to scale VPP operations uniformly.

03. Who are the major players in the USA Virtual Power Plant Market?

Major players include Tesla, Siemens, Schneider Electric, AutoGrid Systems, and Generac Power Systems, with each company offering innovative solutions to enhance grid efficiency and flexibility.

04. What are the growth drivers of the USA Virtual Power Plant Market?

Growth drivers include increasing adoption of renewable energy, advancements in energy storage systems, and favorable government regulations that encourage the use of distributed energy resources (DERs) in grid management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.