USA Warehouse Management System Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD6551

November 2024

83

About the Report

USA Warehouse Management System (WMS) Market Overview

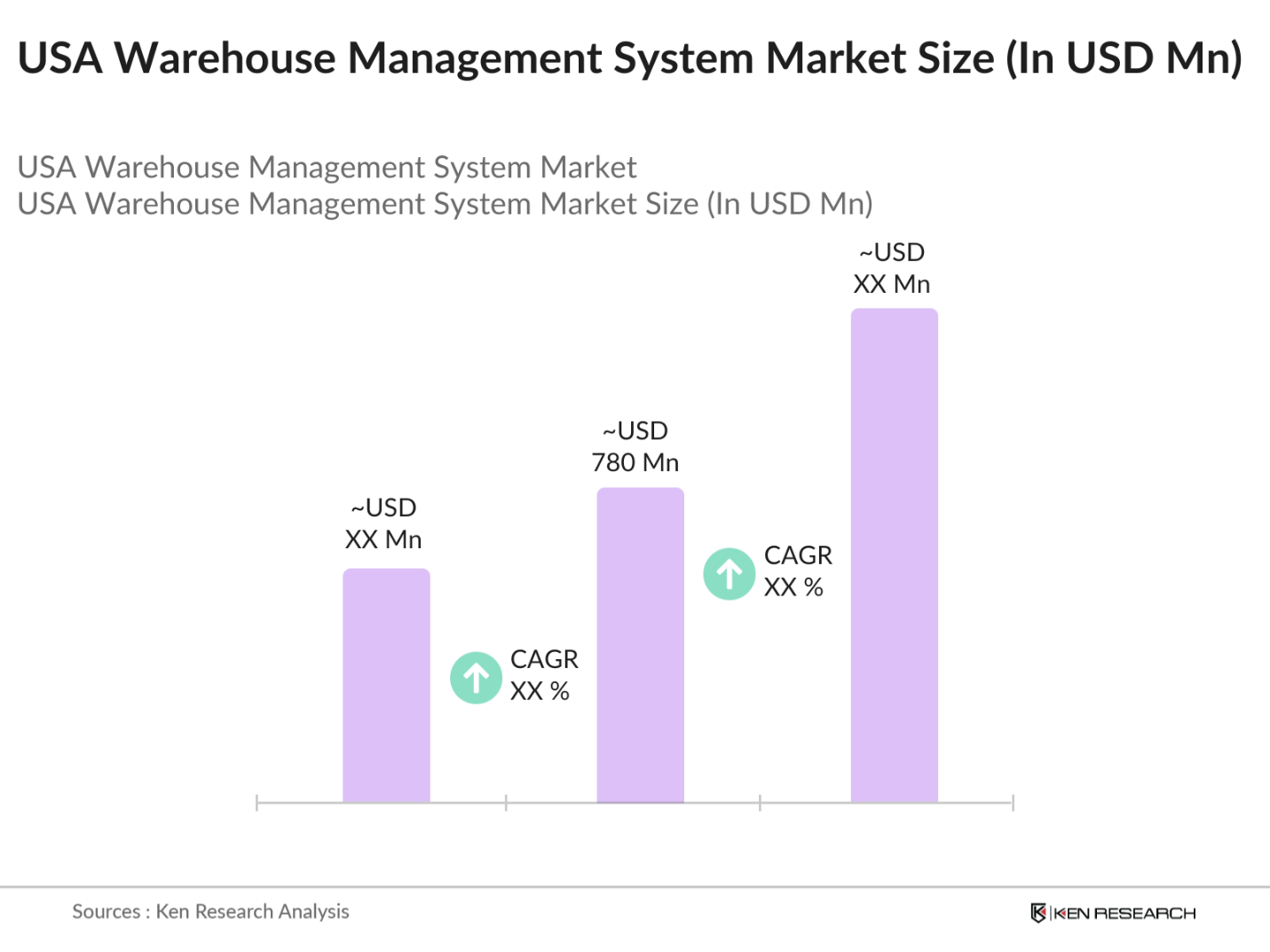

- The USA Warehouse Management System market is valued at USD 780 million, based on a five-year historical analysis. This market is primarily driven by the rapid growth of e-commerce and the increasing complexity of supply chain operations, which demand more efficient and scalable warehouse management solutions. The shift towards omnichannel retail and the need for real-time inventory tracking has further accelerated the adoption of WMS technologies, particularly in industries like retail, manufacturing, and logistics.

- Dominant regions in the USA WMS market include California, Texas, and New York. These states are industry hubs due to their proximity to major transportation networks, large populations, and high industrial and retail activities. The presence of numerous warehouses, distribution centers, and third-party logistics (3PL) providers in these regions plays a critical role in the growth of the market. These states also house major ports and airports, driving the high demand for robust warehouse management systems to manage inventory and ensure smooth operations.

- Warehouse automation technologies must comply with stringent safety regulations imposed by the U.S. Occupational Safety and Health Administration (OSHA). In 2023, OSHA issued updated guidelines to ensure that automated systems, such as robotics and conveyor systems, meet safety standards to prevent workplace injuries. With over 150,000 warehouse-related injuries reported annually in the U.S., these regulations are critical to ensuring that automation does not compromise worker safety.

USA Warehouse Management System (WMS) Market Segmentation

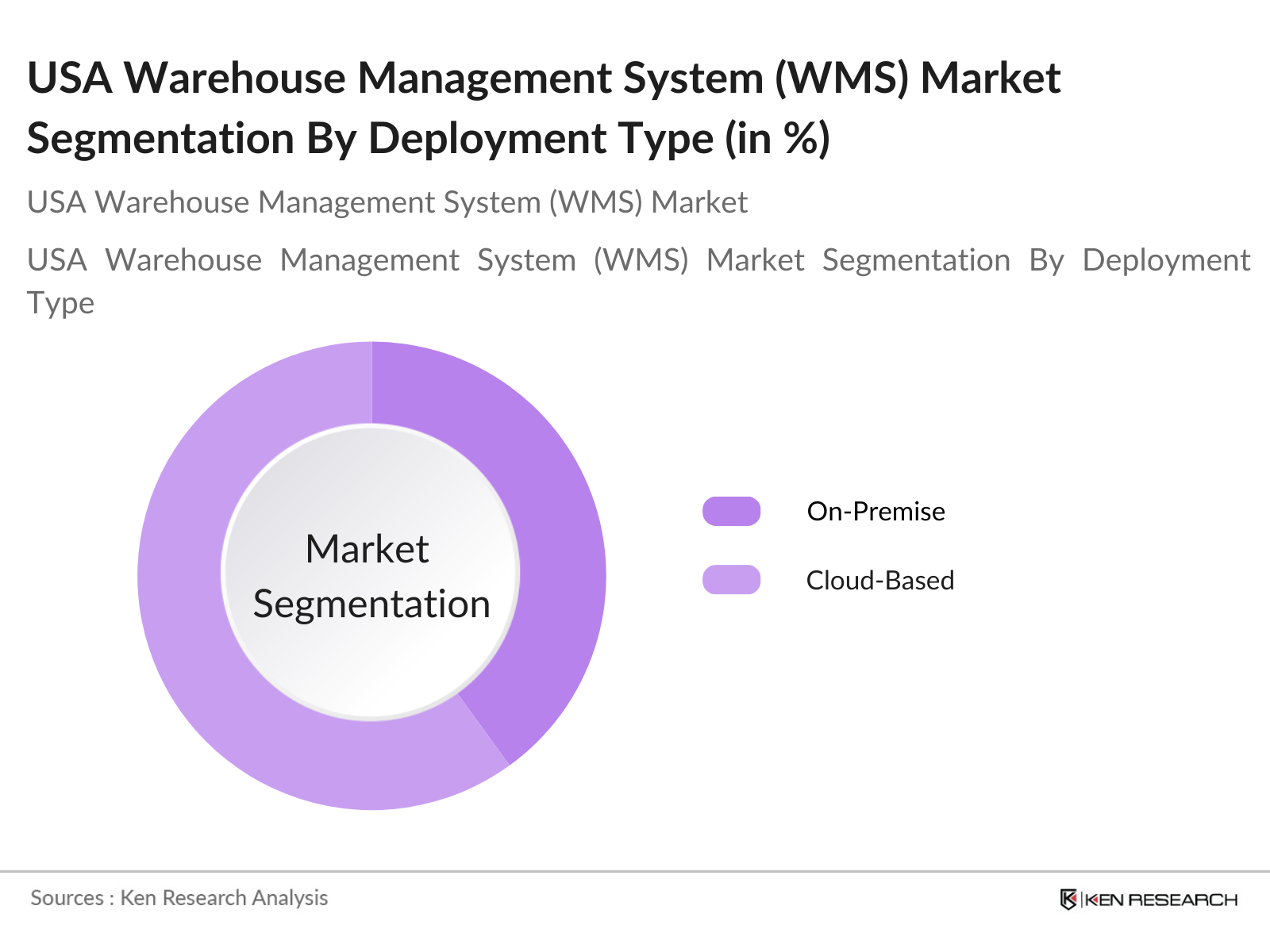

By Deployment Type: The USA Warehouse Management System market is segmented by deployment type into on-premise and cloud-based WMS solutions. Recently, cloud-based solutions dominate the market share due to their scalability, flexibility, and cost-effectiveness. Cloud-based WMS enables real-time data access, which enhances decision-making and enables businesses to respond quickly to supply chain disruptions.

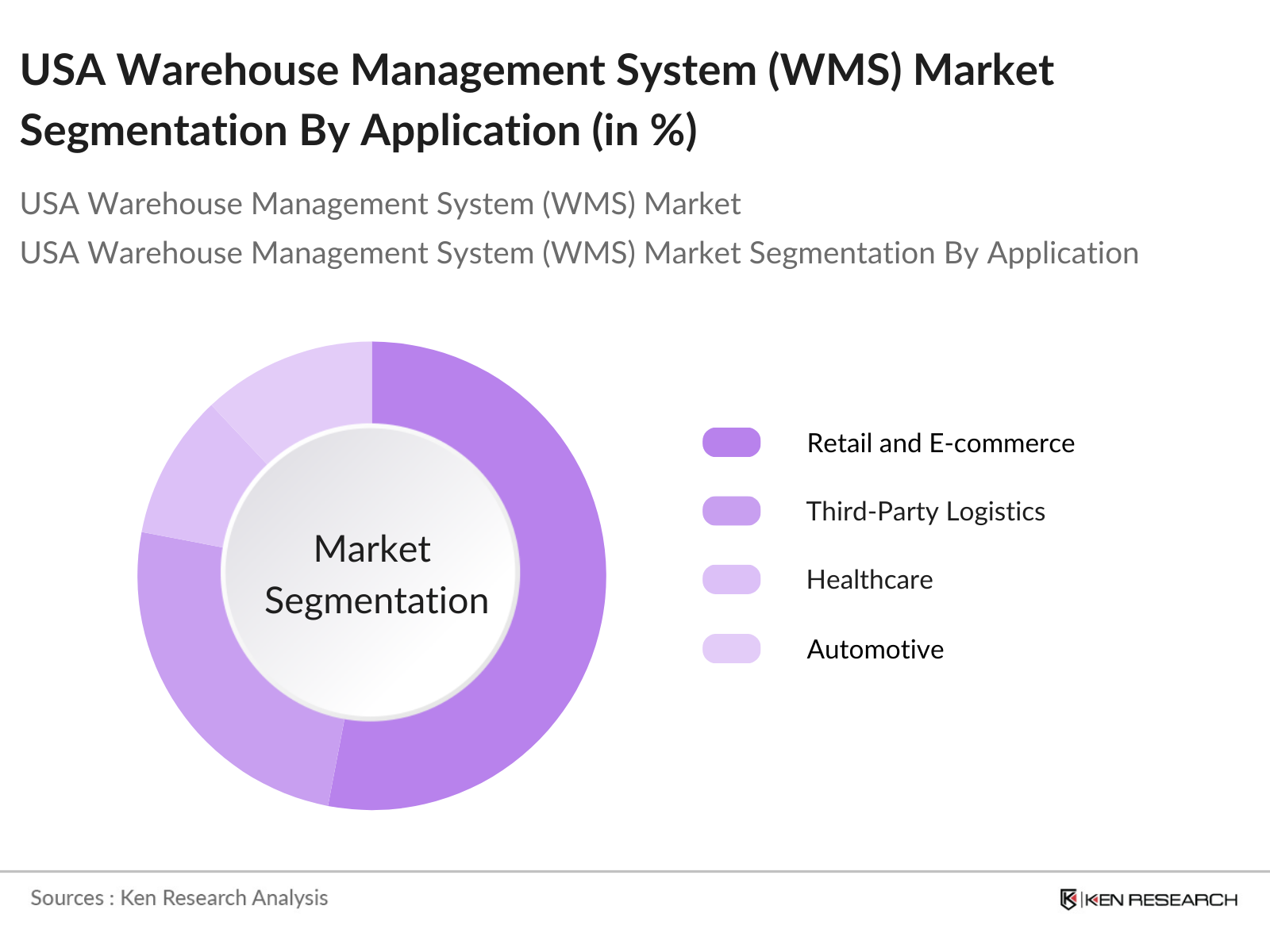

By Application: The USA WMS market is segmented by application into retail and e-commerce, third-party logistics (3PL), healthcare, automotive, and food & beverage. The retail and e-commerce segment has been dominating the market due to the rise in online shopping and omnichannel fulfillment needs. Warehouses dedicated to e-commerce require highly automated systems for managing complex orders, ensuring fast delivery, and maintaining stock accuracy.

USA Warehouse Management System (WMS) Market Competitive Landscape

The USA WMS market is dominated by key players, many of which have long-established market presences and extensive client bases. These companies are involved in continuous technological advancements, focusing on cloud-based solutions, artificial intelligence (AI), and Internet of Things (IoT) integrations. The market is moderately consolidated, with the following companies playing a significant role in shaping its competitive landscape.

USA Warehouse Management System (WMS) Industry Analysis

Growth Drivers

- Rise in E-commerce and Omnichannel Retailing: The growth of e-commerce and omnichannel retailing in the USA has created an increasing demand for warehouse management systems (WMS). In 2023, the U.S. Census Bureau reported that retail e-commerce sales in the U.S. reached approximately $1.2 trillion, marking a significant rise from the $960 billion recorded in 2022. This surge in online shopping requires more sophisticated warehouse management to handle inventory, returns, and delivery speed.

- Increased Adoption of Automation and Robotics: Automation and robotics are rapidly transforming warehouses across the U.S. due to the need for operational efficiency. According to the International Federation of Robotics, the U.S. installed over 38,000 industrial robots in 2022, a significant jump from previous years. The adoption of robotics has improved warehouse throughput and accuracy, reducing human errors and labor dependency. With labor costs rising, companies are increasingly investing in robotics to automate repetitive tasks such as sorting, picking, and packing.

- Growth in 3PL and Logistics Services: The third-party logistics (3PL) market in the U.S. is expanding due to growing outsourcing needs. The Bureau of Transportation Statistics reported that the value of U.S. freight shipments exceeded $21 trillion in 2023, with 3PL providers managing an increasingly larger portion of this volume. This shift has encouraged the adoption of WMS among 3PL providers to manage complex logistics operations efficiently. The growth of e-commerce and global supply chains necessitates real-time data visibility, scalability, and seamless integration with transportation systems, driving WMS adoption in the 3PL sector.

Market Challenges

- High Initial Implementation Costs: The initial costs associated with implementing WMS solutions remain a significant barrier, especially for small and medium-sized businesses. According to a 2023 report from the National Institute of Standards and Technology (NIST), the average cost of deploying a basic WMS can exceed $500,000, including software, hardware, and training expenses. These costs can rise even further when adding advanced features such as automation or robotics integration.

- Complex Integration with Legacy Systems: Many U.S. warehouses still operate on outdated legacy systems, making the integration of modern WMS a complex and costly endeavor. According to the U.S. Department of Commerce, over 45% of U.S. businesses with warehouses report challenges when attempting to integrate WMS with existing enterprise resource planning (ERP) systems. These integration issues lead to disruptions in operations, requiring extensive customization and configuration.

USA Warehouse Management System (WMS) Market Future Outlook

Over the next five years, the USA Warehouse Management System market is expected to experience significant growth driven by the proliferation of e-commerce, advancements in warehouse automation, and the rising adoption of AI and IoT technologies. The transition to cloud-based WMS is anticipated to accelerate further as more businesses seek scalable and flexible solutions to meet their dynamic warehousing needs.

Market Opportunities

- Expansion of Cloud-Based WMS Solutions: Cloud-based WMS solutions are gaining traction due to their scalability, lower upfront costs, and ease of deployment. According to the U.S. Department of Commerce, over 60% of U.S. businesses transitioned to cloud-based solutions in 2023, reducing their reliance on on-premise infrastructure. This shift is particularly beneficial for small and medium-sized enterprises (SMEs) as cloud-based WMS offers cost-effective solutions without the need for significant capital investments.

- Growth in AI and Machine Learning in Warehousing: Artificial intelligence (AI) and machine learning (ML) are transforming the U.S. warehousing sector by enabling predictive analytics and real-time decision-making. According to the U.S. Chamber of Commerce, the adoption of AI in logistics grew by 30% in 2023, with a significant portion of this growth occurring in warehouse operations. AI-driven WMS can optimize inventory management, forecast demand accurately, and reduce inefficiencies in labor allocation.

Scope of the Report

|

By Deployment Type |

On-Premise Cloud-Based |

|

By Application |

Retail and E-commerce 3PL Healthcare Automotive F&B |

|

By Functionality |

Order Picking Inventory Management Yard/Dock Management |

|

Labor Management Shipping and Receiving |

|

|

By Enterprise Size |

Large Enterprises SMEs |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Warehouse Operators

Third-Party Logistics (3PL) Providers

Retail and E-commerce Companies

Automotive and Manufacturing Industries

Food & Beverage Companies

Healthcare Providers

Government and Regulatory Bodies (e.g., Department of Transportation, OSHA)

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Manhattan Associates

SAP SE

Oracle Corporation

JDA Software (Blue Yonder)

HighJump (Korber)

Infor

IBM Corporation

Tecsys Inc.

PSI Logistics

Epicor Software Corporation

Table of Contents

1. USA Warehouse Management System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Warehouse Management System Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Warehouse Management System Market Analysis

3.1. Growth Drivers

3.1.1. Rise in E-commerce and Omnichannel Retailing

3.1.2. Increased Adoption of Automation and Robotics

3.1.3. Growth in 3PL and Logistics Services

3.1.4. Integration with Supply Chain Solutions

3.2. Market Challenges

3.2.1. High Initial Implementation Costs

3.2.2. Complex Integration with Legacy Systems

3.2.3. Lack of Skilled Workforce for System Management

3.3. Opportunities

3.3.1. Expansion of Cloud-Based WMS Solutions

3.3.2. Growth in AI and Machine Learning in Warehousing

3.3.3. Technological Advancements in IoT Connectivity

3.4. Trends

3.4.1. Adoption of Advanced Analytics and Reporting

3.4.2. Increased Focus on Sustainability and Green Warehousing

3.4.3. Integration with Automated Guided Vehicles (AGVs)

3.5. Government Regulations

3.5.1. Safety Regulations on Warehouse Automation

3.5.2. Data Security and Compliance Requirements for Cloud WMS

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Warehouse Management System Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-Premise

4.1.2. Cloud-Based

4.2. By Application (In Value %)

4.2.1. Retail and E-commerce

4.2.2. Third-Party Logistics (3PL)

4.2.3. Healthcare

4.2.4. Automotive

4.2.5. Food & Beverage

4.3. By Functionality (In Value %)

4.3.1. Order Picking

4.3.2. Inventory Management

4.3.3. Yard and Dock Management

4.3.4. Labor Management

4.3.5. Shipping and Receiving

4.4. By Enterprise Size (In Value %)

4.4.1. Large Enterprises

4.4.2. Small and Medium Enterprises (SMEs)

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Warehouse Management System Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Manhattan Associates

5.1.2. SAP SE

5.1.3. Oracle Corporation

5.1.4. JDA Software Group (Blue Yonder)

5.1.5. HighJump (Korber)

5.1.6. Infor

5.1.7. IBM Corporation

5.1.8. Epicor Software Corporation

5.1.9. Tecsys Inc.

5.1.10. PSI Logistics

5.1.11. Made4net

5.1.12. Softeon

5.1.13. 3PL Central

5.1.14. Deposco

5.1.15. Vinculum Solutions

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Deployment Type, Key Product Offerings, Customer Base, Geographic Presence, R&D Investments, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Warehouse Management System Market Regulatory Framework

6.1. Industry Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Warehouse Management System Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Warehouse Management System Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Functionality (In Value %)

8.4. By Enterprise Size (In Value %)

8.5. By Region (In Value %)

9. USA Warehouse Management System Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage involved mapping out the entire USA WMS market ecosystem, considering all significant stakeholders. This was achieved through a combination of secondary research using various databases and industry reports. The main aim of this step was to identify and define the market variables, including key growth drivers and constraints.

Step 2: Market Analysis and Construction

In this phase, historical data on the USA WMS market was compiled and analyzed. This included evaluating the growth of major sectors like e-commerce, retail, and 3PL. The market penetration of WMS solutions across these verticals was also assessed, providing a reliable framework for understanding market dynamics and forecasting growth.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses about market growth and drivers were validated through interviews with industry experts, including warehouse managers and software developers. These consultations provided direct insights into operational and financial aspects of the WMS market, enriching the overall research findings.

Step 4: Research Synthesis and Final Output

The final research synthesis involved cross-verifying the data gathered from industry stakeholders and proprietary databases. The consolidated data formed the foundation for the reports insights, ensuring accuracy and reliability.

Frequently Asked Questions

01. How big is the USA Warehouse Management System market?

The USA Warehouse Management System market is valued at USD 780 million, based on a five-year historical analysis. This market is primarily driven by the rapid growth of e-commerce and the increasing complexity of supply chain operations, which demand more efficient and scalable warehouse management solutions.

02. What are the challenges in the USA Warehouse Management System market?

Challenges include the high initial cost of WMS implementation, integration issues with legacy systems, and a shortage of skilled workforce for managing advanced WMS solutions. Additionally, the transition from on-premise to cloud-based systems poses technical and security concerns.

03. Who are the major players in the USA Warehouse Management System market?

Key players include Manhattan Associates, SAP SE, Oracle Corporation, JDA Software (Blue Yonder), and HighJump (Korber). These companies dominate due to their robust software capabilities, cloud-based offerings, and strong market presence.

04. What are the growth drivers of the USA Warehouse Management System market?

Growth is driven by the increasing need for real-time inventory management, e-commerce growth, advancements in warehouse automation, and the rising adoption of cloud-based WMS solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.