USA Water Treatment Market Outlook to 2030

Region:North America

Author(s):Mukul

Product Code:KROD7802

October 2024

85

About the Report

USA Water Treatment Market Overview

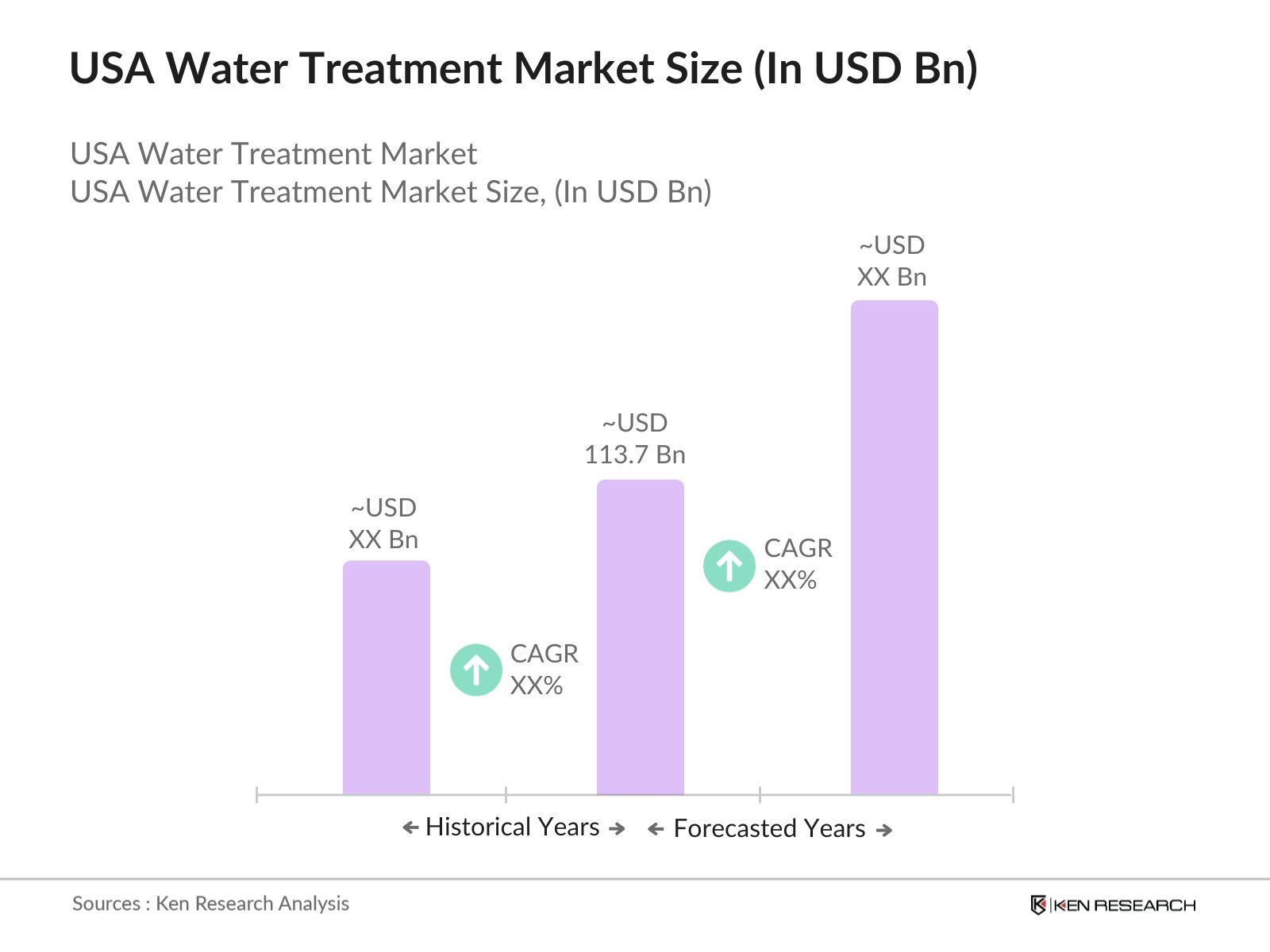

- The USA Water Treatment market is valued at USD 113.7 billion based on a comprehensive five-year historical analysis. The market is driven by increasing industrial activities, urban population growth, and heightened environmental concerns about water pollution and contamination. Growing water scarcity across various regions has led to increased investments in advanced water treatment solutions, including desalination, wastewater treatment, and water reuse technologies, further propelling market demand.

- Cities like Los Angeles, New York, and Chicago dominate the USA Water Treatment market due to their large populations and significant industrial activities that demand extensive water treatment solutions. These cities also face stringent environmental regulations and higher water usage, creating a demand for robust water management infrastructure. States like California lead the market owing to severe droughts and water shortages, necessitating innovative water treatment technologies.

- The Safe Drinking Water Act (SDWA) plays a pivotal role in ensuring the safety of public drinking water supplies across the U.S. In 2024, the EPA allocated $1.2 billion for state revolving funds under the SDWA to assist local governments in complying with water safety standards. The act mandates regular testing and treatment of public water systems to remove harmful contaminants like lead, arsenic, and pathogens. Compliance with SDWA standards continues to drive the adoption of advanced treatment technologies, particularly in regions with aging water infrastructure.

USA Water Treatment Market Segmentation

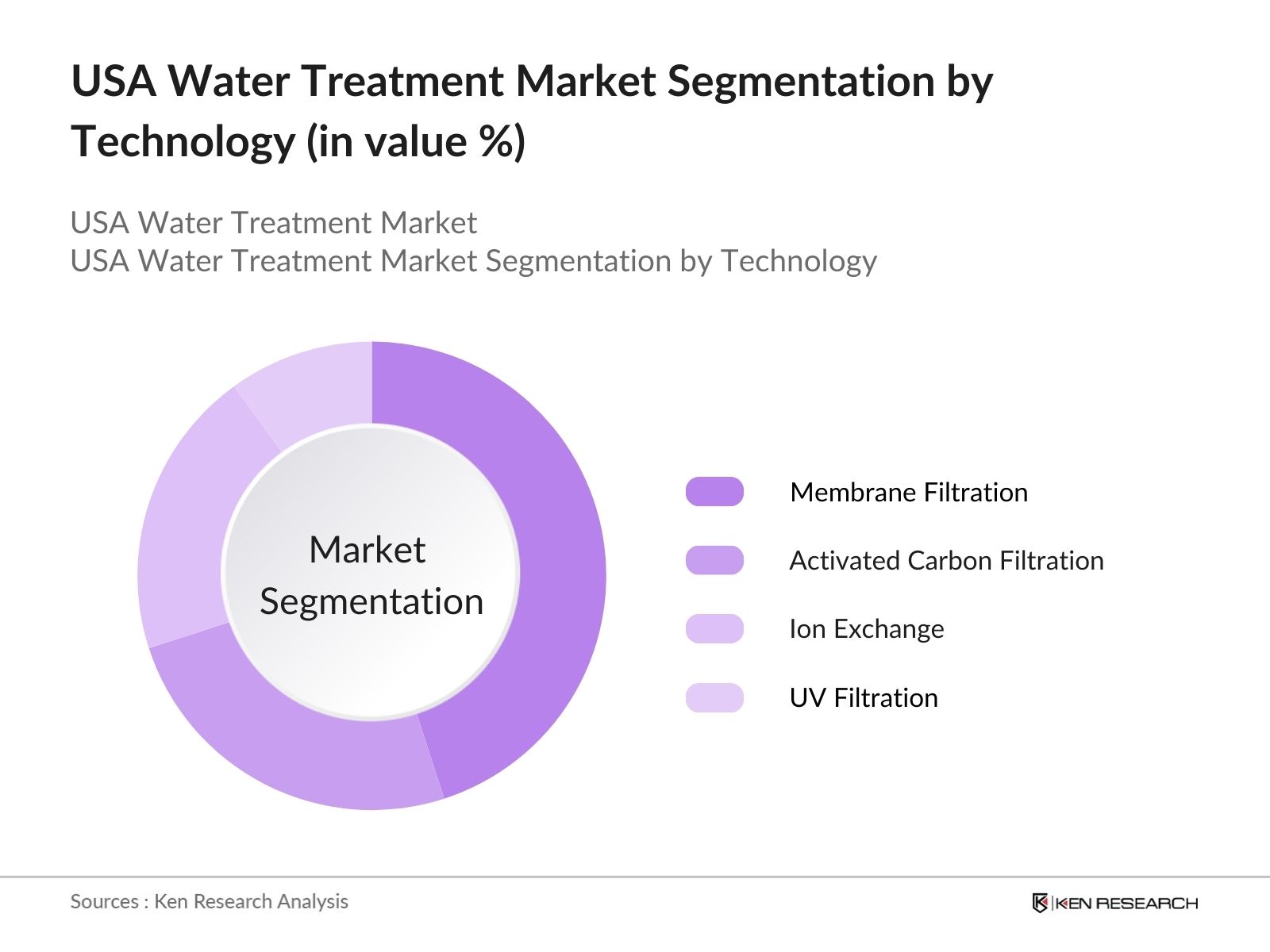

- By Technology: The USA Water Treatment market is segmented by technology into membrane filtration, activated carbon filtration, ion exchange, UV filtration, and reverse osmosis. Recently, membrane filtration has dominated market share in this segment. This dominance is attributed to its superior ability to remove microscopic contaminants, such as bacteria and viruses, while maintaining high efficiency in wastewater and potable water treatment. Its growing adoption in both industrial and municipal sectors is fueled by advancements in membrane technology and the increasing regulatory emphasis on water purity.

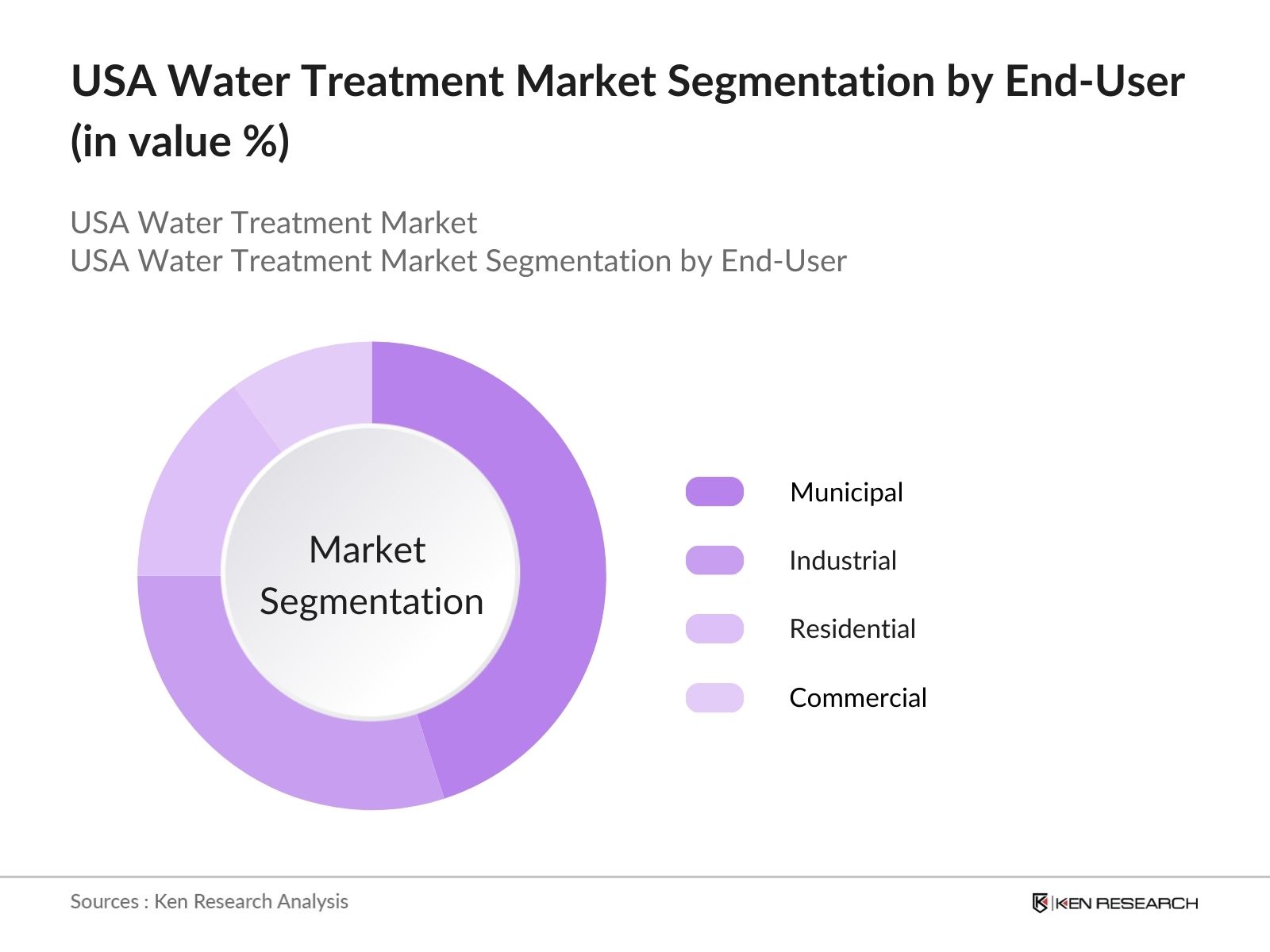

- By End-User: The market is also segmented by end-user into municipal, industrial, residential, and commercial applications. The municipal sector holds a dominant position due to the increasing need for safe drinking water and efficient wastewater management systems. With a growing population and urbanization, municipalities are focusing on upgrading their aging infrastructure and implementing advanced water treatment technologies, making this segment the largest contributor to the market.

USA Water Treatment Market Competitive Landscape

The USA Water Treatment market is dominated by both global and domestic players. Major companies have established strong distribution channels and robust research and development departments to innovate and meet the rising demand for clean water solutions. These players also benefit from strategic collaborations with governments and environmental agencies to meet regulatory standards and increase the efficiency of water treatment processes.

|

Company Name |

Establishment Year |

Headquarters |

Manufacturing Capacity |

No. of Employees |

Revenue |

Geographic Presence |

Technological Innovations |

Market Share |

Export Capability |

|

Veolia North America |

1853 |

Boston, USA |

|||||||

|

Suez Water Technologies |

1834 |

Paris, France |

|||||||

|

Xylem Inc. |

2011 |

Rye Brook, USA |

|||||||

|

Pentair Plc |

1966 |

London, UK |

|||||||

|

Evoqua Water Technologies |

1913 |

Pittsburgh, USA |

USA Water Treatment Industry Analysis

Growth Drivers

- Government Regulations and Environmental Standards: The USAs stringent environmental regulations, such as the Clean Water Act (CWA), continue to push for improved water treatment processes. The Environmental Protection Agency (EPA) enforces strict standards for water discharge, requiring industries and municipalities to maintain high levels of treatment. According to the EPAs 2024 budget proposal, $12 billion was allocated to support clean water programs, including water treatment improvements. These measures have accelerated the adoption of advanced treatment technologies to meet the compliance demands. The Safe Drinking Water Act (SDWA) mandates an additional $3.7 billion in state revolving funds to improve water quality nationwide.

- Increasing Industrial Wastewater: The USA generated over 15 billion gallons of industrial wastewater daily in 2023, contributing to the water treatment market's growth. The energy, chemical, and manufacturing industries are the primary contributors, necessitating advanced treatment technologies to meet discharge standards. Industrial wastewater from manufacturing alone accounted for 35% of the total volume, according to the U.S. Geological Survey. These numbers highlight the growing need for efficient treatment processes to prevent water pollution and ensure regulatory compliance, driving market demand for innovative water treatment solutions.

- Growing Water Scarcity and Reuse Initiatives: Water scarcity continues to be a pressing issue in the U.S., with many regions, particularly the Southwest, facing severe drought conditions. According to the U.S. Drought Monitor, in 2023, nearly 30% of the U.S. experienced moderate to extreme drought. This has driven municipalities and industries to adopt water reuse initiatives. The EPA reported that in 2023, water reuse projects conserved over 2.4 billion gallons daily. These efforts contribute to reducing water stress and promoting the use of treated wastewater, further boosting the water treatment sector

Market Restraints

- Aging Infrastructure and Replacement Costs: The aging water infrastructure in the U.S. is a critical issue, with over 50% of the countrys water treatment systems dating back more than 50 years. According to the American Water Works Association (AWWA), the cost of replacing outdated infrastructure is estimated at $2 trillion by 2040, with immediate repairs and replacements needed for leaking pipes and deteriorating treatment facilities. The 2024 federal infrastructure plan includes $55 billion in funding for water and wastewater treatment improvements, yet this still leaves a large financial gap for necessary upgrades.

- Complexity in Wastewater Treatment: Wastewater treatment has become increasingly complex due to the wide variety of contaminants, including pharmaceuticals, heavy metals, and organic compounds. The EPA reported in 2023 that over 80,000 industrial chemicals may enter U.S. waterways, requiring sophisticated treatment processes to remove these pollutants. Treatment facilities must now handle more diverse waste streams, leading to increased operational complexity and the need for advanced filtration and chemical treatment technologies. This complexity raises operational costs and challenges the ability of older facilities to maintain compliance with stringent water quality standards.

USA Water Treatment Market Future Outlook

Over the next five years, the USA Water Treatment market is expected to show significant growth driven by government mandates on water quality, rising awareness of water conservation, and the need for sustainable treatment technologies. Urbanization and industrial expansion are likely to fuel demand for advanced water treatment solutions across residential, industrial, and municipal sectors. Additionally, technological advancements, such as AI-powered smart water management systems, are poised to optimize water treatment efficiency.

Market Opportunities

- Growth in Residential and Commercial Applications: The demand for water treatment solutions in residential and commercial sectors is growing rapidly due to concerns over drinking water quality. According to the U.S. Census Bureau, nearly 15% of U.S. households were reliant on private water systems in 2023, many of which require filtration and purification systems. The EPA also reported that more than 30,000 public water systems in the U.S. failed to meet federal safety standards in 2023, driving demand for residential and commercial water treatment technologies. This market shift opens up significant growth opportunities for water treatment providers.

- Public-Private Partnerships in Infrastructure Development: Public-private partnerships (PPPs) are emerging as a key solution for funding water treatment infrastructure. In 2023, the U.S. Department of Transportation allocated $2.3 billion in water infrastructure funds through PPPs to address aging systems and expand water treatment capacity. These collaborations enable municipalities to leverage private investments to improve water quality, while sharing operational risks. PPPs are especially crucial for large-scale infrastructure projects, as they provide the financial resources needed to implement advanced treatment technologies and meet growing demand.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Technology |

Membrane Filtration |

|

Activated Carbon Filtration |

|

|

Ion Exchange |

|

|

UV Filtration |

|

|

Reverse Osmosis |

|

|

By End-User |

Municipal |

|

Industrial |

|

|

Residential |

|

|

Commercial |

|

|

By Process |

Primary Treatment |

|

Secondary Treatment |

|

|

Tertiary Treatment |

|

|

By Application |

Potable Water Treatment |

|

Wastewater Treatment |

|

|

Desalination |

|

|

Groundwater Treatment |

|

|

By Region |

North-East |

|

Mid-West |

|

|

South |

|

|

West |

Products

Key Target Audience

Municipal Water Authorities (Environmental Protection Agency - EPA, State Water Resources Control Board)

Industrial Manufacturers (Heavy industries, pharmaceuticals, food and beverage)

Wastewater Management Companies

Residential Building Developers

Commercial Real Estate Investors

Government and Regulatory Bodies (US Environmental Protection Agency - EPA)

Investment and Venture Capitalist Firms (Water technology investment groups)

Public-Private Partnership Entities

Companies

Players Mentioned in the Report:

Veolia North America

Suez Water Technologies

Xylem Inc.

Pentair Plc

Evoqua Water Technologies

Ecolab

Danaher Corporation

A.O. Smith Corporation

Culligan International

General Electric Water

3M Purification

Kemira Oyj

Aquatech International

Kurita Water Industries

American Water

Table of Contents

1. USA Water Treatment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (including key macroeconomic indicators)

1.4 Market Segmentation Overview

2. USA Water Treatment Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis (market expansion metrics and regulatory compliance effects)

2.3 Key Market Developments and Milestones (key projects, investments, regulatory approvals)

3. USA Water Treatment Market Analysis

3.1 Growth Drivers

3.1.1 Government Regulations and Environmental Standards

3.1.2 Increasing Industrial Wastewater

3.1.3 Growing Water Scarcity and Reuse Initiatives

3.1.4 Technological Advancements (including sustainable technologies)

3.2 Market Challenges

3.2.1 High Initial Capital Investment

3.2.2 Aging Infrastructure and Replacement Costs

3.2.3 Complexity in Wastewater Treatment

3.3 Opportunities

3.3.1 Growth in Residential and Commercial Applications

3.3.2 Public-Private Partnerships in Infrastructure Development

3.3.3 Increasing Adoption of Advanced Filtration Technologies

3.4 Trends

3.4.1 Digitalization and Smart Water Treatment Systems

3.4.2 Increasing Use of Membrane Filtration Technology

3.4.3 Integration with Industrial IoT

3.5 Government Regulation

3.5.1 Safe Drinking Water Act (SDWA) Regulations

3.5.2 National Pollutant Discharge Elimination System (NPDES) Compliance

3.5.3 Clean Water Act (CWA) Requirements

3.5.4 State-Level Water Quality Standards

3.6 SWOT Analysis

Strengths, Weaknesses, Opportunities, and Threats

3.7 Stakeholder Ecosystem

Key Stakeholders and Roles in the Market

3.8 Porters Five Forces

Analysis of Competitive Forces Impacting the Market

3.9 Competition Ecosystem

Overview of Major Competitors and Market Fragmentation

4. USA Water Treatment Market Segmentation

4.1 By Technology (In Value %)

4.1.1 Membrane Filtration

4.1.2 Activated Carbon Filtration

4.1.3 Ion Exchange

4.1.4 UV Filtration

4.1.5 Reverse Osmosis

4.2 By End-User (In Value %)

4.2.1 Municipal

4.2.2 Industrial

4.2.3 Residential

4.2.4 Commercial

4.3 By Process (In Value %)

4.3.1 Primary Treatment

4.3.2 Secondary Treatment

4.3.3 Tertiary Treatment

4.4 By Application (In Value %)

4.4.1 Potable Water Treatment

4.4.2 Wastewater Treatment

4.4.3 Desalination

4.4.4 Groundwater Treatment

4.5 By Region (In Value %)

4.5.1 North-East

4.5.2 Mid-West

4.5.3 South

4.5.4 West

5. USA Water Treatment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Veolia North America

5.1.2 Suez Water Technologies

5.1.3 Xylem Inc.

5.1.4 Pentair Plc

5.1.5 Evoqua Water Technologies

5.1.6 Ecolab

5.1.7 Danaher Corporation

5.1.8 A.O. Smith Corporation

5.1.9 Culligan International

5.1.10 General Electric Water

5.1.11 3M Purification

5.1.12 Kemira Oyj

5.1.13 Aquatech International

5.1.14 Kurita Water Industries

5.1.15 American Water

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Operating Segments, Regional Presence, Key Technologies, Environmental Impact Initiatives, Investment in R&D)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Water Treatment Market Regulatory Framework

6.1 Water Quality Standards

6.2 Compliance with EPA Regulations

6.3 Certification Processes

7. USA Water Treatment Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Water Treatment Future Market Segmentation

8.1 By Technology (In Value %)

8.2 By End-User (In Value %)

8.3 By Process (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. USA Water Treatment Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map for the USA Water Treatment market. This map includes government regulations, key market participants, and critical water usage segments. Extensive desk research, using secondary sources and proprietary databases, helps identify key variables driving the market, such as water scarcity, population growth, and industrial pollution.

Step 2: Market Analysis and Construction

Historical data is compiled from credible sources such as the US Environmental Protection Agency and the World Bank. This data is analyzed to assess market trends, customer segmentation, and revenue generation. Service quality metrics and technological advancements are also evaluated to ensure the accuracy of revenue and demand estimates.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through interviews with industry experts, including representatives from municipal water agencies and water treatment technology providers. These insights provide real-time data on operational challenges and future growth areas.

Step 4: Research Synthesis and Final Output

A bottom-up approach is used to gather detailed insights from water treatment equipment manufacturers, distributors, and service providers. This final phase validates the accuracy of projections, market segmentation, and trends to deliver a comprehensive market report.

Frequently Asked Questions

01. How big is the USA Water Treatment Market?

The USA Water Treatment market is valued at USD 113.7 billion, driven by increasing regulatory requirements for safe drinking water, industrial water reuse initiatives, and technological advancements in water treatment processes.

02. What are the challenges in the USA Water Treatment Market?

Key challenges include aging water infrastructure, high capital costs for implementing advanced treatment technologies, and stringent compliance requirements that drive up operational expenses for both public and private water entities.

03. Who are the major players in the USA Water Treatment Market?

Leading players in the market include Veolia North America, Suez Water Technologies, Xylem Inc., Pentair Plc, and Evoqua Water Technologies. These companies dominate due to their advanced technologies, extensive market presence, and strategic public-private partnerships.

04. What are the growth drivers of the USA Water Treatment Market?

The market is propelled by rising water scarcity, government mandates for clean water, and advancements in membrane filtration and digital water management solutions. Increasing demand for potable water treatment and wastewater recycling also drives market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.