USA Wearable Medical Devices Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD4569

December 2024

94

About the Report

USA Wearable Medical Devices Market Overview

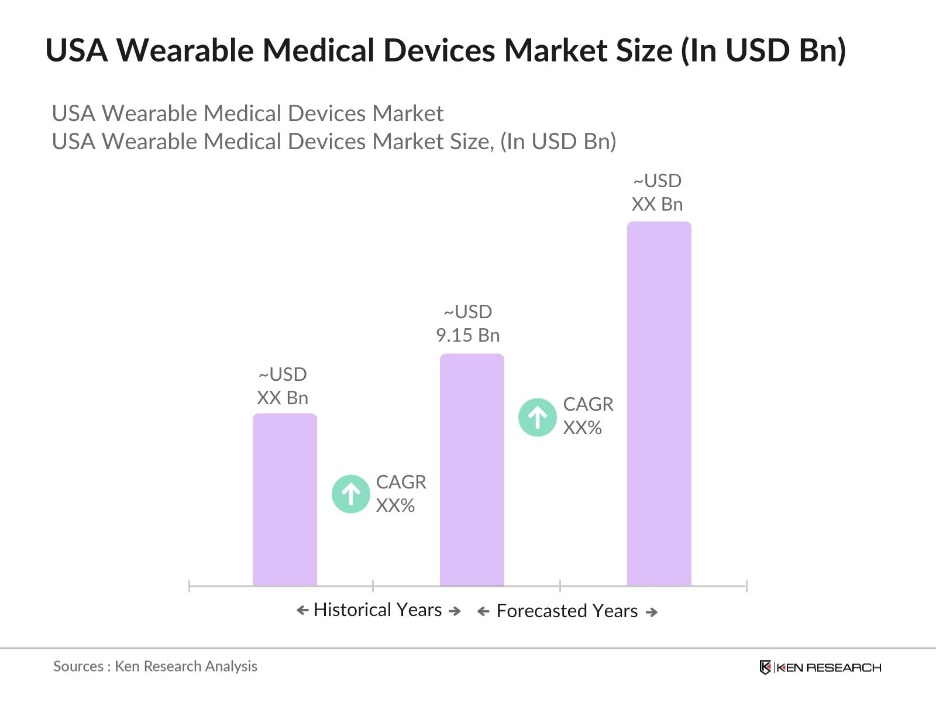

- The USA Wearable Medical Devices Market is valued at USD 9.15 billion in 2023, is primarily driven by rising healthcare costs, growing consumer awareness about preventive care, and technological advancements in the healthcare sector. Devices like smartwatches, biosensors, and fitness trackers have gained widespread popularity due to their ability to monitor vital health metrics such as heart rate, blood pressure, and glucose levels. Additionally, the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions has further fueled the demand for continuous health monitoring solutions provided by wearable devices.

- Dominant regions in the USA wearable medical devices market include large metropolitan cities such as New York, Los Angeles, and Chicago, as well as states like California and Texas. These areas lead the market due to higher disposable incomes, advanced healthcare infrastructure, and greater adoption of innovative healthcare technologies. Urban populations in these cities have shown higher awareness and acceptance of digital healthcare solutions, contributing to their dominance in the market.

- The U.S. Department of Health and Human Services (HHS) has finalized its 2024-2030 Federal Health IT Strategic Plan, aimed at enhancing healthcare delivery and innovation through technology. The plan focuses on improving health data access, promoting health equity, and leveraging AI and broadband infrastructure, especially in underserved areas. It aims to foster better care coordination, lower costs, and ensure data security across the healthcare system, aligning federal resources to support digital health transformation.

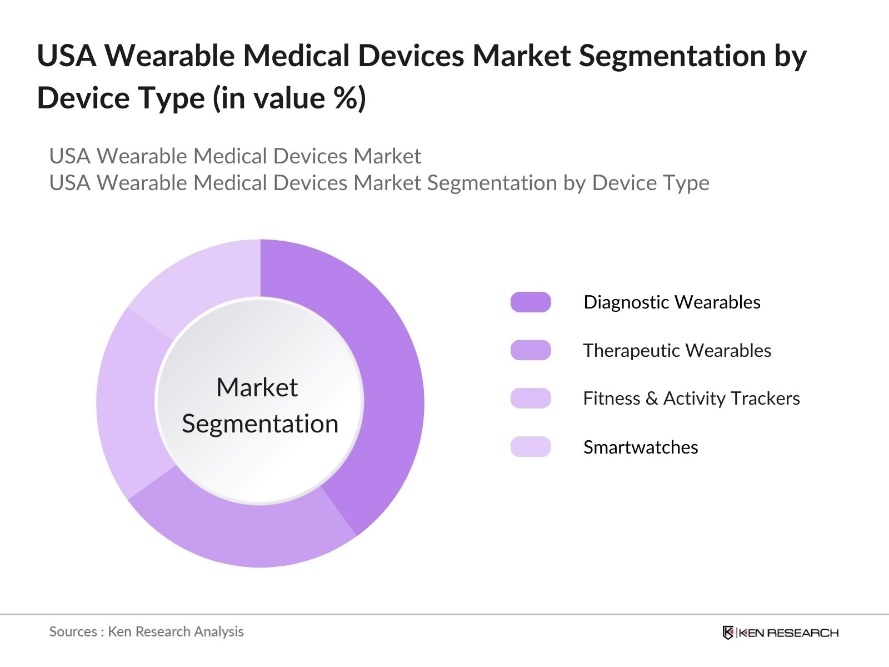

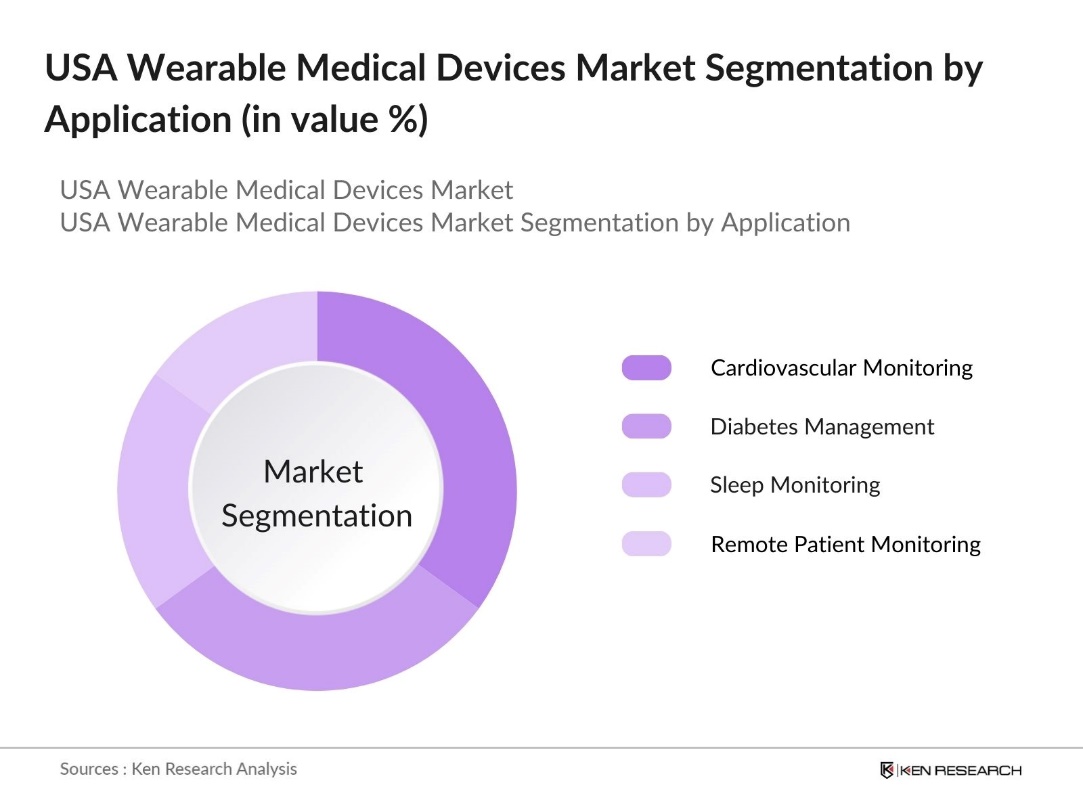

USA Wearable Medical Devices Market Segmentation

By Device Type: The USA wearable medical devices market is segmented by device type into diagnostic wearables, therapeutic wearables, fitness & activity trackers, and smartwatches. Diagnostic wearables, such as blood glucose monitors and heart rate monitors, hold a dominant share due to the rising demand for continuous monitoring among patients with chronic conditions like diabetes and heart disease. These devices provide real-time insights into vital health metrics, enabling early diagnosis and proactive treatment, which has been a significant driver for their adoption in both healthcare settings and at-home care.

By Application: The USA wearable medical devices market is segmented by application into cardiovascular monitoring, diabetes management, sleep monitoring, and remote patient monitoring. Cardiovascular monitoring dominates the market share, driven by the rising prevalence of cardiovascular diseases in the USA. According to the CDC, heart disease remains a leading cause of death, which has heightened the focus on real-time monitoring of heart activity through wearable devices like ECG monitors. These wearables not only help in tracking heart health but also in reducing hospital readmissions and improving patient outcomes through early intervention.

USA Wearable Medical Devices Market Competitive Landscape

The market is dominated by a few key players with strong brand presence and a solid foothold in the digital health ecosystem. Companies like Apple, Fitbit (Google LLC), Garmin Ltd., and Medtronic are leading in the development of innovative health monitoring solutions. The consolidation of these companies reflects their focus on expanding product portfolios and incorporating advanced technologies like artificial intelligence (AI) and machine learning into their devices to provide more accurate and efficient health data monitoring.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Product Portfolio |

Global Reach |

Innovation Index |

Number of Patents |

Partnerships & Collaborations |

|

Apple Inc. |

1976 |

Cupertino, CA |

||||||

|

Fitbit (Google LLC) |

2007 |

San Francisco, CA |

||||||

|

Garmin Ltd. |

1989 |

Olathe, KS |

||||||

|

Medtronic Plc |

1949 |

Minneapolis, MN |

||||||

|

Abbott Laboratories |

1888 |

Abbott Park, IL |

USA Wearable Medical Devices Industry Analysis

Growth Drivers

- Rise in Geriatric Population: The rising geriatric population in the U.S. is a significant growth driver for wearable medical devices. As of 2022, there were approximately 57.8 million individuals aged 65 and older in the U.S. The aging population is increasingly turning to wearable devices to monitor vital signs and chronic conditions such as diabetes and cardiovascular diseases, as these devices offer real-time monitoring solutions. The demand for wearable devices that can track health metrics is growing as older adults focus on preventive healthcare.

- Increasing Prevalence of Chronic Diseases: Chronic diseases, including diabetes and cardiovascular diseases, are driving the wearable medical device market in the U.S. In 2021, 38.4 million people of all ages or 11.6% of the U.S. population had diabetes. These patients increasingly rely on wearable devices such as glucose monitors and heart rate trackers for continuous health monitoring. As chronic diseases grow in prevalence, the demand for wearable health solutions that can help individuals manage these conditions will continue to expand.

- Advancements in Wearable Technology: Technological advancements in wearable devices are significantly driving the growth of the market. Wearable medical devices have progressed from basic step-counting trackers to sophisticated health monitoring systems equipped with AI and biosensors. Modern devices now offer features like ECG monitoring, oxygen saturation tracking, and blood pressure measurement, providing comprehensive health data in real-time. These innovations have made wearable devices essential for individuals seeking to monitor their health more closely.

Market Challenges

- High Cost of Wearable Devices: The high cost of wearable medical devices presents a significant barrier to their widespread adoption. Advanced wearable devices, especially those with medical-grade features, tend to be expensive, limiting access for a large portion of the population. This financial burden makes it difficult for many consumers, particularly those from lower-income groups, to invest in wearable health technologies. The cost issue poses a challenge to market growth, as affordability plays a critical role in the broader acceptance and use of these devices.

- Data Security and Privacy Concerns: Wearable medical devices collect and store sensitive health data, which raises significant concerns about data security and privacy. These devices are often connected to online platforms, making them susceptible to potential breaches and misuse of personal health information. Consumers remain cautious about adopting wearable technology due to fears of unauthorized access to their medical data. Ensuring robust data protection and addressing privacy concerns are critical challenges that the wearable medical devices market continues to face.

USA Wearable Medical Devices Market Future Outlook

Over the next few years, the USA wearable medical devices market is expected to experience considerable growth, driven by increased government initiatives to promote digital health, rapid technological advancements, and growing consumer preference for non-invasive health monitoring solutions. The increasing integration of wearables with telemedicine platforms and healthcare systems is expected to revolutionize the remote patient monitoring ecosystem, further propelling the market forward.

Market Opportunities

- Growth of Remote Patient Monitoring Systems: The growing adoption of remote patient monitoring (RPM) systems in healthcare is closely linked to the use of wearable medical devices. These devices enable real-time tracking of various health conditions, allowing for continuous monitoring and better management of chronic diseases. When combined with telemedicine, wearable devices help reduce hospital visits and improve patient outcomes by offering personalized care.

- Adoption in Fitness and Sports Industries: Wearable medical devices are gaining widespread acceptance in the fitness and sports industries. These devices are being used to monitor health metrics during workouts, track physical performance, and prevent injuries. In professional sports, wearable technology has become an essential tool for optimizing athlete training and enhancing recovery. As wearable devices continue to penetrate the fitness market, new opportunities are emerging for their application beyond medical purposes, contributing to broader market growth and innovation within non-medical sectors.

Scope of the Report

|

Device Type |

Diagnostic Wearables (Heart Rate Monitors, Glucose Monitors) Therapeutic Wearables (Insulin Pumps, Neuromodulation Devices) Smartwatches |

|

Application |

Cardiovascular Monitoring Diabetes Management Sleep Monitoring Remote Patient Monitoring |

|

Technology |

Sensors (Biosensors, Accelerometers) Wearable Data Analytics Platforms Cloud Computing Data Integration |

|

End User |

Hospitals & Clinics Home Healthcare Fitness & Sports Organizations Ambulatory Care Centers |

|

Region |

North East West South |

Products

Key Target Audience

Healthcare IT Companies

Wearable Technology Manufacturers

Pharmaceutical Companies

Data Analytics Firms

Telemedicine Companies

Banks and Financial Institutions

Government and Regulatory Bodies (FDA, CMS)

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Apple Inc.

Fitbit (Google LLC)

Garmin Ltd.

Medtronic Plc

Abbott Laboratories

Dexcom, Inc.

Philips Healthcare

Omron Corporation

Biotronik SE & Co. KG

Boston Scientific Corporation

BioTelemetry, Inc.

iRhythm Technologies, Inc.

Masimo Corporation

Livongo Health, Inc.

NeuroMetrix, Inc.

Table of Contents

1. USA Wearable Medical Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Device Types, Use Cases, Technology, End-Users)

1.3. Market Growth Rate (Factors Influencing Adoption: Aging Population, Chronic Disease Prevalence, Healthcare Costs)

1.4. Market Segmentation Overview (Device Types, Applications, Regions)

2. USA Wearable Medical Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Technological Innovation, Regulatory Approvals, Strategic Partnerships)

3. USA Wearable Medical Devices Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Geriatric Population

3.1.2. Increasing Prevalence of Chronic Diseases (Diabetes, Cardiovascular Diseases)

3.1.3. Advancements in Wearable Technology

3.1.4. Increasing Consumer Awareness & Preference for Preventive Healthcare

3.1.5. Integration of AI and IoT in Wearable Devices

3.2. Market Challenges

3.2.1. High Cost of Wearable Devices

3.2.2. Data Security and Privacy Concerns

3.2.3. Regulatory Compliance (FDA Regulations, Data Protection Laws)

3.2.4. Battery Life and Device Durability Issues

3.3. Opportunities

3.3.1. Growth of Remote Patient Monitoring Systems

3.3.2. Adoption in Fitness and Sports Industries

3.3.3. Expansion of Wearable Medical Devices into Emerging Markets

3.3.4. Integration with Telemedicine Solutions

3.4. Trends

3.4.1. Increasing Adoption of Wearable Medical Devices for Home Healthcare

3.4.2. Miniaturization and Design Innovations in Wearable Devices

3.4.3. Wearable Device Integration with Cloud-based Data Platforms

3.4.4. Rising Adoption of Smart Wearable Patches (Glucose Monitoring, ECG Patches)

3.5. Government Regulation

3.5.1. FDA Guidelines on Medical Devices

3.5.2. Medicare Reimbursement Policies for Wearable Devices

3.5.3. U.S. Health Insurance Portability and Accountability Act (HIPAA) Compliance

3.5.4. Initiatives Supporting Digital Health Technologies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. USA Wearable Medical Devices Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Diagnostic Wearables (Heart Rate Monitors, Blood Pressure Monitors, Glucose Monitors)

4.1.2. Therapeutic Wearables (Insulin Pumps, Pain Management Devices, Neuromodulation Devices)

4.1.3. Fitness & Activity Trackers

4.1.4. Smartwatches

4.2. By Application (In Value %)

4.2.1. Cardiovascular Monitoring

4.2.2. Diabetes Management

4.2.3. Sleep Monitoring

4.2.4. Remote Patient Monitoring

4.3. By Technology (In Value %)

4.3.1. Sensors (Biosensors, Accelerometers, Gyroscopes)

4.3.2. Wearable Data Analytics Platforms

4.3.3. Cloud Computing and Data Integration

4.4. By End User (In Value %)

4.4.1. Hospitals & Clinics

4.4.2. Home Healthcare

4.4.3. Fitness & Sports Organizations

4.4.4. Ambulatory Care Centers

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. USA Wearable Medical Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Fitbit (Google LLC)

5.1.3. Garmin Ltd.

5.1.4. Medtronic Plc

5.1.5. Philips Healthcare

5.1.6. Abbott Laboratories

5.1.7. Omron Corporation

5.1.8. Biotronik SE & Co. KG

5.1.9. Boston Scientific Corporation

5.1.10. BioTelemetry, Inc.

5.1.11. Dexcom, Inc.

5.1.12. iRhythm Technologies, Inc.

5.1.13. Masimo Corporation

5.1.14. Livongo Health, Inc.

5.1.15. NeuroMetrix, Inc.

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Product Portfolio, R&D Investment, Innovation Index, Global Reach, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Wearable Medical Devices Market Regulatory Framework

6.1. FDA Device Classification and Approval Pathways

6.2. Data Privacy & Security Regulations (HIPAA, GDPR Compliance)

6.3. Reimbursement Framework and CPT Codes

6.4. Certification Processes for Wearable Medical Devices

7. USA Wearable Medical Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological Advancements, Increasing Healthcare Spending, Shift Towards Preventive Healthcare)

8. USA Wearable Medical Devices Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. USA Wearable Medical Devices Market Analysts' Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping the ecosystem of the USA wearable medical devices market. This includes stakeholders like device manufacturers, healthcare providers, regulatory bodies, and end-users. Extensive desk research, involving secondary data and proprietary databases, will be used to pinpoint the variables driving the market, such as regulatory policies and healthcare trends.

Step 2: Market Analysis and Construction

This step involves gathering and analyzing historical data related to device sales, healthcare infrastructure, and adoption rates across various segments. By examining revenue streams, user demographics, and adoption patterns, we will construct a comprehensive view of the current state of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on preliminary findings and validated through consultations with industry professionals via interviews and surveys. These experts provide insights into the operational, financial, and technological aspects of the wearable medical devices market.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered data and expert feedback to deliver a detailed, accurate, and validated report. The findings are cross-verified with top-tier manufacturers and healthcare providers to ensure comprehensive coverage and relevance to the market.

Frequently Asked Questions

01. How big is the USA Wearable Medical Devices Market?

The USA Wearable Medical Devices Market is valued at USD 9.15 billion, driven by advancements in technology, increasing healthcare costs, and growing consumer awareness regarding preventive health monitoring.

02. What are the challenges in the USA Wearable Medical Devices Market?

The major challenges in USA Wearable Medical Devices Market include high device costs, data security and privacy concerns, and regulatory hurdles related to device approval and compliance with data protection laws like HIPAA.

03. Who are the major players in the USA Wearable Medical Devices Market?

Key players in the USA Wearable Medical Devices Market include Apple Inc., Fitbit (Google LLC), Garmin Ltd., Medtronic Plc, and Abbott Laboratories. These companies lead the market due to their extensive product portfolios, technological innovation, and strong partnerships within the healthcare ecosystem.

04. What are the growth drivers of the USA Wearable Medical Devices Market?

The USA Wearable Medical Devices Market is driven by rising healthcare costs, the increasing prevalence of chronic diseases, technological advancements in wearable health solutions, and growing consumer awareness of the benefits of preventive healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.