USA Web 3.0 Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD4581

November 2024

97

About the Report

USA Web 3.0 Market Overview

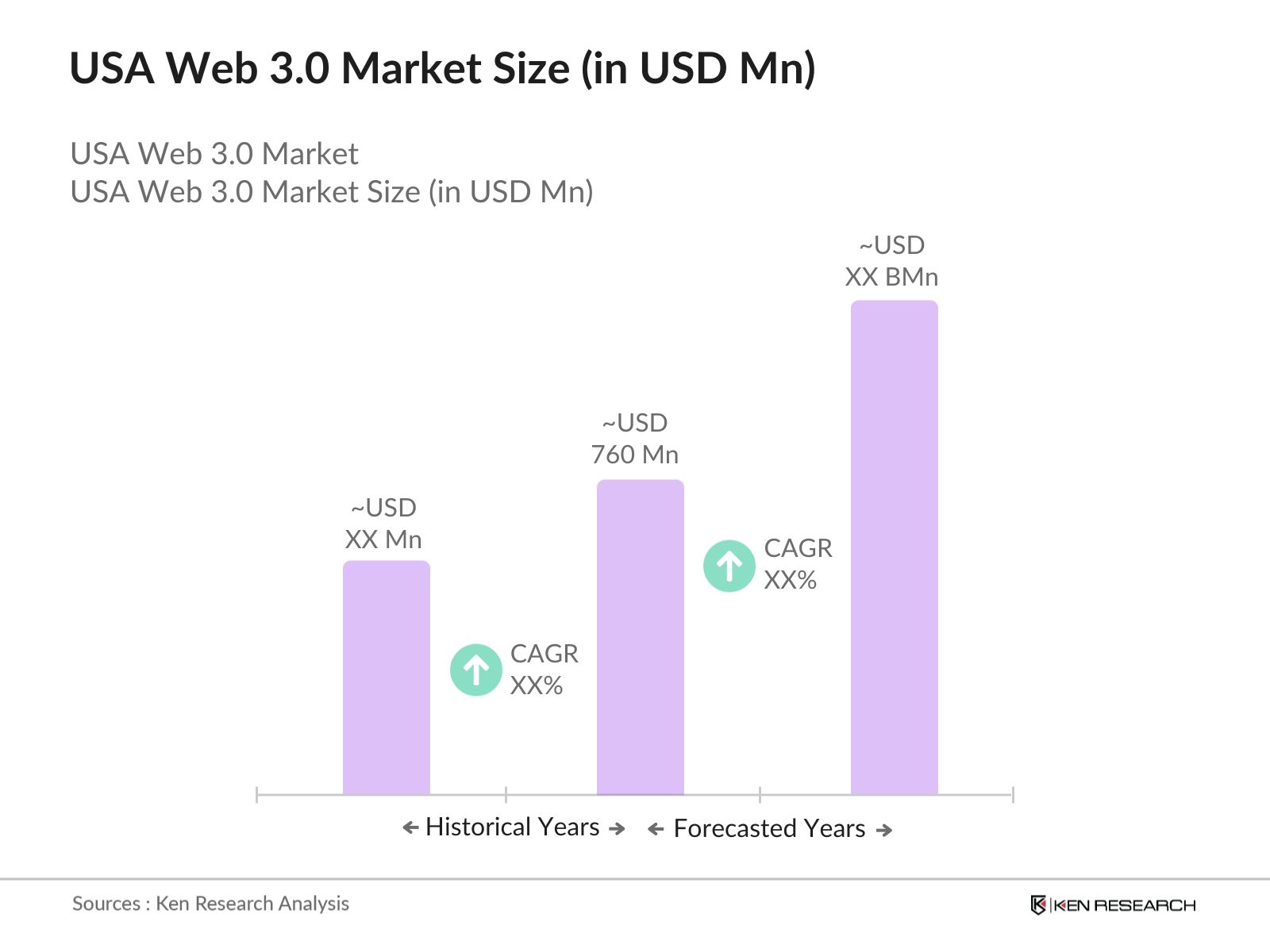

The USA Web 3.0 market, valued at USD 760 Mn, is driven by the rapid adoption of decentralized technologies, blockchain innovations, and increased demand for data ownership and security solutions. The shift from centralized Web 2.0 platforms to decentralized Web 3.0 ecosystems has catalyzed the growth of decentralized applications (DApps) and smart contract platforms. Moreover, expanding institutional interest in decentralized finance (DeFi) and digital asset management contributes significantly to this growth.

- Key regions driving the Web 3.0 market include Silicon Valley and New York in the United States. These areas dominate the market due to their robust technological infrastructure, concentration of tech talent, and access to venture capital. Silicon Valleys role as a hub for blockchain and decentralized projects, combined with New Yorks leadership in fintech and DeFi applications, allows these regions to stay at the forefront of the Web 3.0 revolution. Furthermore, early investments in decentralized technologies by local enterprises continue to fuel their dominance.

- Interoperability between different blockchain platforms is gaining traction in the U.S., as companies and developers push for solutions that enable seamless interaction between various blockchain networks. In 2023, more than 300 U.S.-based blockchain projects were working on cross-chain compatibility, ensuring that decentralized applications could operate across multiple networks. The development of these interoperable platforms enhances the utility of blockchain technology, allowing for more complex decentralized applications and improving user experiences by reducing fragmentation across networks.

USA Web 3.0 Market Segmentation

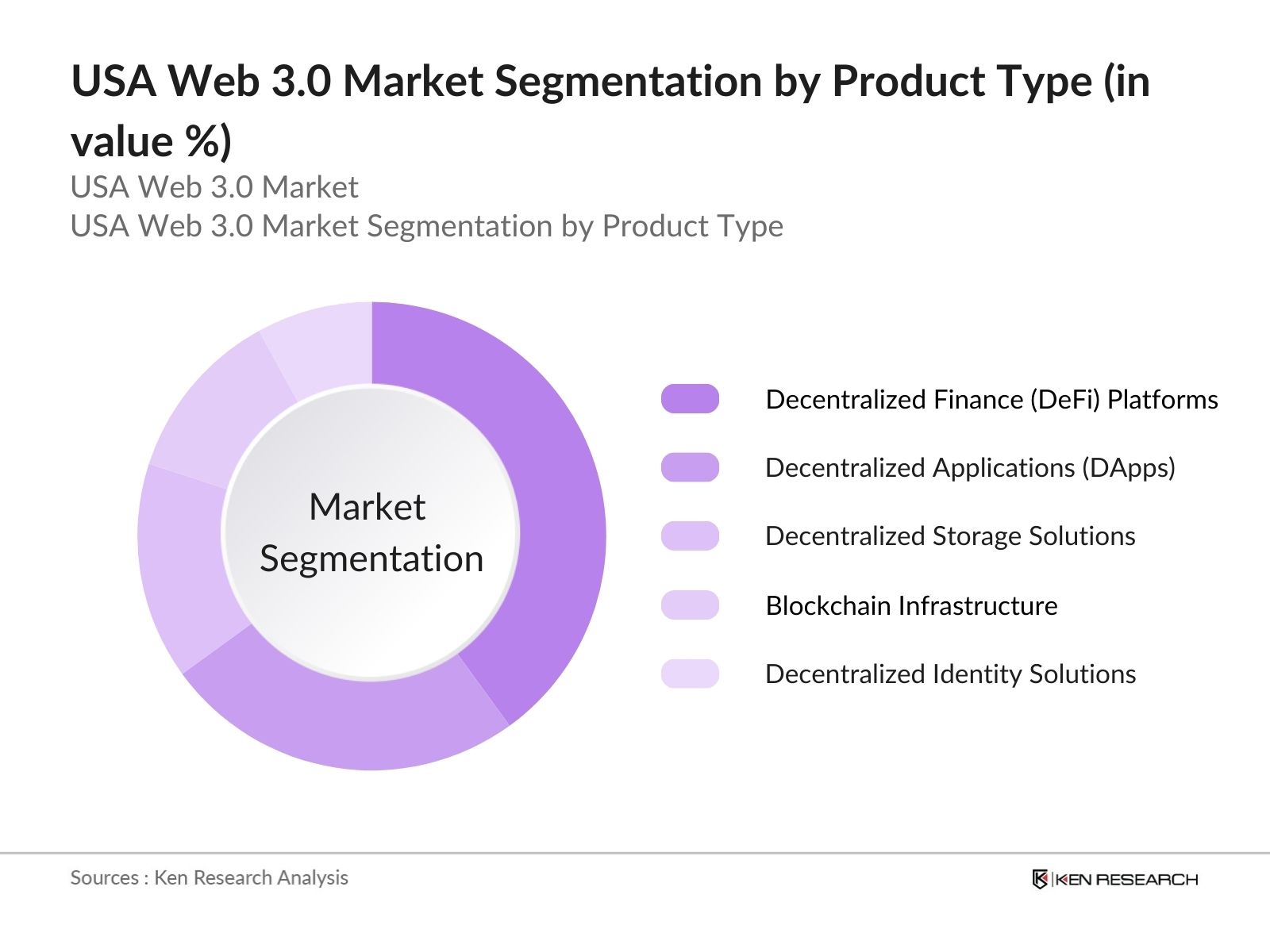

By Product Type: The market is segmented by product type into decentralized applications (DApps), decentralized finance (DeFi) platforms, decentralized storage solutions, blockchain infrastructure, and decentralized identity solutions. Recently, decentralized finance (DeFi) platforms have dominated the market due to their ability to enable peer-to-peer financial transactions without intermediaries, leading to lower transaction costs and greater transparency. DeFi has gained traction because of its potential to revolutionize traditional banking systems, particularly through lending, borrowing, and trading services. The increased institutional and individual investor interest in DeFi protocols such as Uniswap and Aave is a significant growth driver.

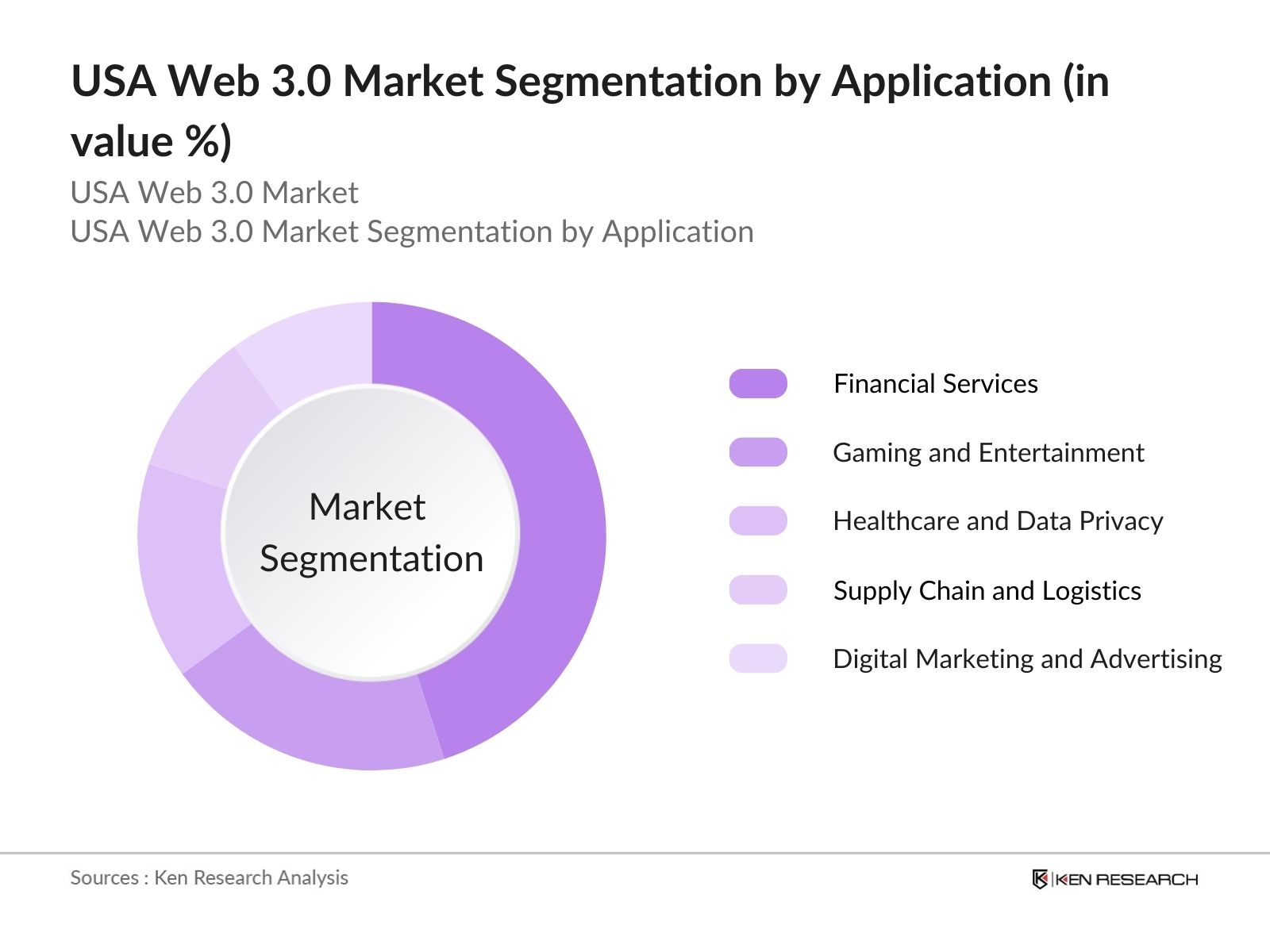

By Application: The market is also segmented by application into financial services, gaming and entertainment, healthcare and data privacy, supply chain and logistics, and digital marketing and advertising. Financial services hold a dominant position due to the widespread adoption of decentralized finance (DeFi) solutions. DeFi allows users to access financial services without relying on centralized institutions, providing them with more control over their assets. Additionally, the transparency and immutability offered by blockchain technology ensure secure transactions, making it a popular choice in finance.

USA Web 3.0 Market Competitive Landscape

The USA Web 3.0 market is dominated by a mix of global giants and rapidly scaling startups, driving innovation in decentralized applications, financial services, and blockchain infrastructure. The market is notably competitive due to high investor interest, technological advancements, and the emergence of new players.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Blockchain Projects |

DeFi Integration |

Developer Support |

Partnerships |

|

ConsenSys |

2014 |

Brooklyn, NY |

||||||

|

Coinbase |

2012 |

San Francisco, CA |

||||||

|

Chainlink Labs |

2017 |

San Francisco, CA |

||||||

|

Dapper Labs |

2018 |

Vancouver, Canada |

||||||

|

Alchemy |

2020 |

San Francisco, CA |

USA Web 3.0 Industry Analysis

Growth Drivers

- Increasing Demand for Decentralization: Decentralization remains at the core of Web 3.0 development in the U.S. As of 2024, the U.S. has over 20 million blockchain wallets, driven by a growing user base interested in decentralized applications (dApps) and services. Government data indicates that by the end of 2023, blockchain-related activities accounted for more than 500,000 new employment opportunities across various sectors in the U.S., contributing to the acceleration of decentralized systems adoption. The focus on decentralization stems from demand for secure, permissionless platforms as an alternative to centralized web infrastructures.

- Growth of Metaverse and Virtual Economies: The metaverse economy is gaining momentum in the U.S. economy, with projections from reputable organizations indicating that virtual worlds and metaverse-related assets to contribute nearly $130 Bn to the U.S. economy by end of 2024. U.S. companies such as Meta and Roblox are investing billions into metaverse technologies and supporting virtual economies where users can exchange digital goods and services. This trend is reinforced by rising demand for digital real estate, virtual experiences, and interoperable digital avatars, which form key components of Web 3.0's framework for virtual economies.

- Demand for Digital Asset Ownership: Tokenization of real-world and digital assets continues to gain traction in the U.S., with non-fungible tokens (NFTs) leading this trend. In 2023, there were more than 15 million unique NFT transactions within the country, with sectors such as art, gaming, and sports collectibles driving adoption. Digital ownership of assets, facilitated through Web 3.0 protocols, offers users the ability to authenticate, trade, and store unique digital content on decentralized platforms, aligning with consumer demand for more secure ownership solutions in an increasingly digital economy.

Market Challenges

- Regulatory Uncertainty: The U.S. regulatory environment surrounding cryptocurrencies and blockchain technologies remains complex and fragmented. The U.S. Securities and Exchange Commission (SEC) has taken enforcement actions against various blockchain-based projects, causing market participants to hesitate in launching new initiatives. By the end of 2023, over 30 federal and state-level legislative proposals relating to blockchain and crypto regulations were introduced, yet clear guidelines remain elusive. This lack of regulatory clarity, particularly around token classification and compliance requirements, acts as a restraint to the growth of Web 3.0 in the U.S.

- Scalability Issues: Blockchain scalability remains a challenge for Web 3.0 development in the U.S., with current infrastructure often struggling to handle large volumes of transactions efficiently. Ethereum, the leading blockchain network for decentralized applications, processed 1.2 million transactions per day in 2023, but network congestion often results in high transaction fees, which can exceed $10 per transaction during peak usage. These scalability issues limit the widespread adoption of Web 3.0, especially for applications requiring fast, low-cost transactions, such as DeFi and micropayments.

USA Web 3.0 Market Future Outlook

Over the next five years, the USA Web 3.0 market is expected to experience exponential growth driven by increasing adoption of decentralized technologies by enterprises and consumers alike. Key factors driving this growth include advancements in blockchain scalability, the integration of Web 3.0 technologies into mainstream applications, and increased institutional interest in decentralized finance (DeFi) solutions. Moreover, growing concerns regarding data privacy and security will further boost the adoption of decentralized identity and storage solutions, ensuring the continued expansion of the Web 3.0 ecosystem.

Future Market Opportunities

- Institutional Investments and Venture Capital Funding: Institutional investors and venture capital firms in the U.S. are increasingly allocating capital to Web 3.0 projects. The U.S. governments recognition of digital assets, along with the involvement of major financial institutions like JPMorgan and Goldman Sachs in blockchain projects, further solidifies Web 3.0 as a growing market. These investments not only foster innovation but also signal strong institutional confidence in the long-term viability of Web 3.0 technologies.

- Integration with Artificial Intelligence (AI) and IoT: The intersection of Web 3.0 with emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT) presents a major growth opportunity. In 2023, the U.S. government allocated more than $2 billion towards AI research and development, emphasizing the integration of AI with decentralized systems. IoT devices, which surpassed 10 billion active connections worldwide in 2023, are increasingly being paired with blockchain technology to create secure, decentralized data exchanges. These integrations facilitate the development of smart contracts and automated systems, driving the next phase of Web 3.0 applications.

Scope of the Report

|

By Product Type |

Decentralized Applications (DApps) Smart Contracts Platforms Tokenized Assets Decentralized Finance (DeFi) Platforms Decentralized Identity Solutions |

|

By Application |

Financial Services Gaming and Entertainment Healthcare and Data Privacy Supply Chain and Logistics Digital Marketing and Advertising |

|

By Technology |

Blockchain Technology Distributed Ledger Technologies (DLT) Peer-to-Peer Protocols Decentralized Storage and Computing |

|

By End-User |

Enterprises SMEs Individual Consumers Developers and Innovators |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Venture Capitalist Firms

Institutional Investors

Government and Regulatory Bodies (SEC, CFTC, IRS)

Decentralized Application (DApp) Developers

Blockchain Infrastructure Providers

Banks and Financial Institutes

DeFi Platform Operators

Digital Asset Exchanges

Enterprise Blockchain Adopters

Companies

Major Players

ConsenSys

Coinbase

Chainlink Labs

Dapper Labs

Alchemy

Protocol Labs

Filecoin Foundation

Avalanche Labs

Solana Labs

Binance Smart Chain

Aave

Arweave

OpenSea

Block.one

Polygon

Table of Contents

1. USA Web 3.0 Market Overview

1.1. Definition and Scope (Blockchain, Decentralized Networks, Edge Computing)

1.2. Market Taxonomy (DeFi, NFTs, DAOs, Metaverse)

1.3. Market Growth Rate (CAGR, Market Value, Expansion Potential)

1.4. Market Segmentation Overview (Product, Application, Technology, End-user, Region)

2. USA Web 3.0 Market Size (In USD Mn)

2.1. Historical Market Size (Previous Market Data, Web 2.0 Transition)

2.2. Year-On-Year Growth Analysis (Annual Growth Comparison)

2.3. Key Market Developments and Milestones (New Protocols, Regulatory Updates, Technological Advancements)

3. USA Web 3.0 Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Decentralization

3.1.2. Growth of Metaverse and Virtual Economies

3.1.3. Demand for Digital Asset Ownership (NFTs, Tokenization)

3.1.4. Growing Privacy Concerns (Data Ownership, Security Protocols)

3.2. Restraints

3.2.1. Regulatory Uncertainty (Compliance, Crypto Regulations)

3.2.2. Scalability Issues (Blockchain Speed, Transaction Costs)

3.2.3. Limited Consumer Understanding

3.3. Opportunities

3.3.1. Expansion of DeFi and DAO Applications

3.3.2. Integration with Artificial Intelligence (AI) and IoT

3.3.3. Institutional Investments and Venture Capital Funding

3.4. Trends

3.4.1. Rise in DAO Governance Models

3.4.2. Development of Interoperable Blockchain Platforms

3.4.3. Increasing Use of Web 3.0 for Social Platforms and Digital Identity

3.5. Government Regulation

3.5.1. Federal Crypto and Blockchain Guidelines

3.5.2. Token Classification and Taxation

3.5.3. Data Protection and Decentralized Identity Standards

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stake Ecosystem (Developers, Infrastructure Providers, End-Users)

3.8. Porters Five Forces (Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitutes, Barriers to Entry)

3.9. Competition Ecosystem

4. USA Web 3.0 Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Decentralized Applications (DApps)

4.1.2. Smart Contracts Platforms

4.1.3. Tokenized Assets

4.1.4. Decentralized Finance (DeFi) Platforms

4.1.5. Decentralized Identity Solutions

4.2. By Application (In Value %)

4.2.1. Financial Services

4.2.2. Gaming and Entertainment

4.2.3. Healthcare and Data Privacy

4.2.4. Supply Chain and Logistics

4.2.5. Digital Marketing and Advertising

4.3. By Technology (In Value %)

4.3.1. Blockchain Technology (Layer 1, Layer 2 Solutions)

4.3.2. Distributed Ledger Technologies (DLT)

4.3.3. Peer-to-Peer (P2P) Protocols

4.3.4. Decentralized Storage and Computing (IPFS, Filecoin)

4.4. By End-User (In Value %)

4.4.1. Enterprises

4.4.2. SMEs

4.4.3. Individual Consumers

4.4.4. Developers and Innovators

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. USA Web 3.0 Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ConsenSys

5.1.2. Alchemy

5.1.3. Coinbase

5.1.4. Chainlink Labs

5.1.5. Block.one

5.1.6. Dapper Labs

5.1.7. Protocol Labs

5.1.8. Filecoin Foundation

5.1.9. Polygon

5.1.10. Avalanche Labs

5.1.11. Binance Smart Chain

5.1.12. Solana Labs

5.1.13. OpenSea

5.1.14. Arweave

5.1.15. Aave

5.2. Cross Comparison Parameters (Market Capitalization, Total Users, Product Offering, Funding, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, R&D, Decentralization Efforts)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. USA Web 3.0 Market Regulatory Framework

6.1. Crypto and Digital Asset Regulations (SEC, CFTC, IRS)

6.2. Compliance Requirements (AML, KYC, GDPR)

6.3. Certification Processes (ISO, SOC 2 Compliance for Blockchain)

7. USA Web 3.0 Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Decentralized Finance, Web 3.0 Ecosystems)

7.2. Key Factors Driving Future Market Growth (Adoption of Web 3.0 by Enterprises, Consumer Demand)

8. USA Web 3.0 Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Web 3.0 Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (User Adoption Rates, Enterprise Usage)

9.3. Marketing Initiatives (Awareness Campaigns, Developer Incentives)

9.4. White Space Opportunity Analysis (Unexplored Verticals, Niche Opportunities)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the ecosystem of the USA Web 3.0 Market. This includes an extensive desk review to gather data on major stakeholders such as developers, investors, and end-users. Proprietary and secondary databases were utilized to identify key drivers of growth within the market, particularly focusing on blockchain and decentralized application adoption.

Step 2: Market Analysis and Construction

In this phase, historical market data was compiled and analyzed, including the markets adoption rate and blockchain penetration. Market segmentation was developed based on the dominant product and application types, ensuring a detailed breakdown of the market.

Step 3: Hypothesis Validation and Expert Consultation

After developing market hypotheses, a series of in-depth interviews with industry experts were conducted using computer-assisted telephone interviews (CATIs). This step provided real-world insights from Web 3.0 developers, blockchain infrastructure providers, and DeFi platform operators.

Step 4: Research Synthesis and Final Output

In the final step, the gathered data from interviews and databases was synthesized into a comprehensive market report. The analysis was validated through direct engagement with multiple blockchain infrastructure providers and developers, ensuring the accuracy and relevance of the research.

Frequently Asked Questions

01. How big is the USA Web 3.0 market?

The USA Web 3.0 market is valued at USD 760 Mn, driven by the rapid adoption of blockchain technology, decentralized applications (DApps), and the increasing demand for decentralized finance (DeFi) platforms.

02. What are the challenges in the USA Web 3.0 market?

Challenges in the USA Web 3.0 market include regulatory uncertainty, scalability issues with blockchain platforms, and limited consumer understanding of decentralized technologies, which may hinder mainstream adoption.

03. Who are the major players in the USA Web 3.0 market?

Key players in the USA Web 3.0 market include ConsenSys, Coinbase, Chainlink Labs, Dapper Labs, and Alchemy, which dominate the market through strong infrastructure, partnerships, and user bases.

04. What are the growth drivers of the USA Web 3.0 market?

Growth in the USA Web 3.0 market driven by the expanding use of decentralized finance (DeFi), increasing adoption of blockchain for data privacy, and institutional investments in blockchain infrastructure and decentralized platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.